US Foods Announces Private Offering of $1.0 Billion of Senior Unsecured Notes

September 11 2023 - 8:22AM

Business Wire

US Foods Holding Corp. (NYSE: USFD) today announced the

commencement of a private offering (the “Offering”) of $1.0 billion

aggregate principal amount of notes, consisting of senior unsecured

notes due 2028 and senior unsecured notes due 2032 (collectively,

the “Notes”), by its direct, wholly-owned subsidiary, US Foods,

Inc. (“US Foods”), subject to market and other conditions.

US Foods intends to use the net proceeds of the Offering,

together with cash on hand, to fund the redemption of its

outstanding 6.250% senior secured notes due 2025 and to pay related

fees and expenses.

The Notes and the guarantees thereof will be offered in a

private offering exempt from the registration requirements of the

Securities Act of 1933, as amended (the “Securities Act”). The

Notes and the guarantees thereof will be offered only to persons

reasonably believed to be qualified institutional buyers pursuant

to Rule 144A under the Securities Act and to non-U.S. persons

outside the United States in reliance on Regulation S under the

Securities Act.

The Notes and the guarantees thereof have not been registered

under the Securities Act and may not be offered or sold in the

United States absent registration or an applicable exemption from

the registration requirements of the Securities Act and applicable

state laws.

This press release does not constitute an offer to sell, or the

solicitation of an offer to buy, the Notes, nor shall there be any

sale of the Notes in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction. No assurance can be made that the Offering will be

consummated on its proposed terms or at all.

About US Foods

With a promise to help its customers Make It, US Foods is one of

America’s great food companies and a leading foodservice

distributor, partnering with approximately 250,000 restaurants and

foodservice operators to help their businesses succeed. With 70

broadline locations and more than 85 cash and carry stores, US

Foods and its 29,000 associates provides its customers with a broad

and innovative food offering and a comprehensive suite of

e-commerce, technology and business solutions. US Foods is

headquartered in Rosemont, Ill.

Forward-Looking Statements

Statements in this press release which are not historical in

nature are “forward-looking statements” within the meaning of the

federal securities laws, including statements regarding the

Offering and the intended use of the proceeds thereof. These

statements often include words such as “believe,” “expect,”

“project,” “anticipate,” “intend,” “plan,” “outlook,” “estimate,”

“target,” “seek,” “will,” “may,” “would,” “should,” “could,”

“forecast,” “mission,” “strive,” “more,” “goal,” or similar

expressions (although not all forward-looking statements may

contain such words) and are based upon various assumptions and our

experience in the industry, as well as historical trends, current

conditions, and expected future developments. However, you should

understand that these statements are not guarantees of performance

or results, and there are a number of risks, uncertainties and

other important factors that could cause our actual results to

differ materially from those expressed in the forward-looking

statements, including, among others: economic factors affecting

consumer confidence and discretionary spending and reducing the

consumption of food prepared away from home; cost

inflation/deflation, rising interest rates and volatile commodity

costs; competition; reliance on third-party suppliers and

interruption of product supply or increases in product costs;

changes in our relationships with customers and group purchasing

organizations; our ability to increase or maintain the highest

margin portions of our business; achievement of expected benefits

from cost savings initiatives; fluctuations in fuel costs; changes

in consumer eating habits; cost and pricing structures; the impact

of climate change or measures implemented to address climate

change; impairment charges for goodwill, indefinite-lived

intangible assets or other long-lived assets; changes to or failure

to comply with applicable governmental regulations; product recalls

and product liability claims; our reputation in the industry; labor

relations and increased labor costs and continued access to

qualified and diverse labor; our level of indebtedness and

restrictions under agreements governing our indebtedness; interest

rate increases; the replacement of London Interbank Offered Rate

(“LIBOR”) with an alternative reference rate and the relative

immaturity of any such replacement standard; disruption of existing

technologies and implementation of new technologies; cybersecurity

incidents and other technology disruptions; risks associated with

intellectual property, including potential infringement; effective

integration of acquired businesses; the impact of activist

shareholders; changes in tax laws and regulations and resolution of

tax disputes; limitations related to our governing documents; risks

to the health and safety of our associates and others; adverse

judgments or settlements resulting from litigation; extreme weather

conditions, natural disasters and other catastrophic events,

including pandemics and the rapid spread of contagious illnesses;

and management of retirement benefits and pension obligations. For

a detailed discussion of these risks, uncertainties and other

factors, see the section entitled “Risk Factors” in our Annual

Report on Form 10-K for the fiscal year ended December 31, 2022,

which was filed with the SEC on February 16, 2023, our Quarterly

Report on Form 10-Q for the fiscal quarter ended April 1, 2023,

which was filed with the SEC on May 11, 2023 and our Quarterly

Report on Form 10-Q for the fiscal quarter ended July 1, 2023,

which was filed with the SEC on August 10, 2023. The

forward-looking statements contained in this press release speak

only as of the date of this press release. We undertake no

obligation to update or revise any forward-looking statements,

except as may be required by law. We may not consummate the

Offering and, if the Offering is consummated, we cannot provide any

assurances regarding the final terms of the Offering or our ability

to effectively apply the net proceeds as described above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230910087223/en/

INVESTOR CONTACT: Michael Neese 847-720-1688

Michael.neese@usfoods.com

MEDIA CONTACT: Sara Matheu 773-580-3775

Sara.Matheu@usfoods.com

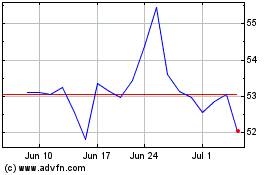

US Foods (NYSE:USFD)

Historical Stock Chart

From Jan 2025 to Feb 2025

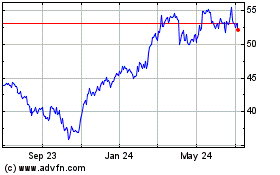

US Foods (NYSE:USFD)

Historical Stock Chart

From Feb 2024 to Feb 2025