0001261654FALSE00012616542024-02-072024-02-07

____________________________________________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 7, 2024

UNIVERSAL TECHNICAL INSTITUTE, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 1-31923 | 86-0226984 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | |

4225 E. Windrose Drive, Suite 200 Phoenix, AZ (Address of principal executive offices) | 85032 (Zip Code) |

(623) 445-9500

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | UTI | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

☐ Emerging growth company

☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial Condition.

On February 7, 2024, Universal Technical Institute, Inc. (the "Company") issued a press release reporting first quarter results for fiscal 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated into this Item 2.02 by reference.

The information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits | | | | | | | | | | | |

| | | | |

| Exhibit No. | | Description | |

| | | |

| 99.1 | | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | | | | | | | |

| | | | | |

| | | UNIVERSAL TECHNICAL INSTITUTE, INC. |

| | | | | |

| February 7, 2024 | | By: | | /s/ Troy R. Anderson |

| | | Name: | | Troy R. Anderson |

| | | Title: | | Executive Vice President and Chief Financial Officer |

Exhibit 99.1

Universal Technical Institute Reports Fiscal Year 2024 First Quarter Results

PHOENIX, ARIZ. - February 7, 2024 - Universal Technical Institute, Inc. (NYSE: UTI), a leading workforce solutions provider of transportation, skilled trades and healthcare education programs, reported financial results for the fiscal 2024 first quarter ended December 31, 2023. Universal Technical Institute, Inc. operates in two reportable segments, Universal Technical Institute (UTI) and Concorde Career Colleges (Concorde), and together with its segments and subsidiaries is referred to as the “Company,” “we,” “us” or “our.”

•Revenue of $174.7 million with UTI contributing $115.4 million representing 9.3% growth versus the prior year period, and Concorde contributing $59.3 million.

•Net income of $10.4 million and adjusted EBITDA(1) of $24.5 million, both increasing considerably versus the prior year period.

•Total new student starts of 4,346 with UTI contributing 2,314 representing 17.2% growth versus the prior year period, and Concorde contributing 2,032.

•Full year guidance raised for revenue, net income, diluted earnings per share (EPS) and adjusted EBITDA(1).

“In the first quarter of 2024, we continued to outperform our financial expectations and advance our growth, diversification, and optimization strategy,” said Jerome Grant, CEO of Universal Technical Institute, Inc. “Across both divisions, we generated year-over-year new student start growth and made progress with launching and ramping new programs. We also strengthened our divisional and corporate leadership teams, with the respective appointments of Kevin Prehn as the president of the Concorde division and Carolyn Frank as our corporate chief human resource officer. With our track record in robust strategic execution and superior student outcomes, we are entering 2024 with our multi-divisional company foundation solidly in place, and proven ability to deliver on our expectations.

“Over the coming quarters, we are focused on increasing enrollment, revenue, and profit growth from our most recent program launches; enhancing the yield of our marketing and admissions investments; and optimizing our workforce and facilities utilization to drive improved margin expansion and operating leverage. Through our program expansions, and as we progress towards the next phases of our growth trajectory, we intend to continuously expand the depth and breadth of opportunities we provide for our students across the in-demand industries we serve. We believe our current optimization work and long-term strategic initiatives will take the company to its fullest potential.”

Financial Results for the Three-Month Period Ended December 31, 2023 Compared to 2022(2)

•Revenues increased 45.6% to $174.7 million compared to $120.0 million primarily due to the growth in UTI new student starts and the inclusion of Concorde for a full quarter(2).

•Operating expenses rose by 38.9% to $160.5 million, compared to $115.6 million primarily due to inclusion of Concorde for a full quarter(2).

•Operating income was $14.2 million compared to $4.4 million.

•Net income was $10.4 million compared to $2.6 million.

•Basic and diluted EPS were $0.18 and $0.17 compared to $0.03 and $0.02, respectively.

•Adjusted EBITDA(1) was $24.5 million compared to $14.4 million.

UTI

•UTI had revenues of $115.4 million, a $9.8 million and 9.3% increase from the prior year quarter revenues of $105.6 million, due to higher student starts.

•Operating expenses for UTI were $100.3 million compared to $92.2 million. The increase was primarily due to expenses incurred during the current year for new program launches during the last two fiscal quarters and planned for fiscal 2024.

•Adjusted EBITDA(1) was $21.6 million compared to $20.2 million.

•New student starts increased from prior year by 17.2%, and average undergraduate full-time active students increased 6.0%.

Concorde(2)

•Revenues of $59.3 million, a $44.9 million increase from the prior year quarter revenues of $14.4 million due to the inclusion of a full quarter in the current year and only December in the prior year, along with growth in new student starts.

•Operating expenses were $52.2 million compared to $15.2 million. The increase was due to the inclusion of a full quarter in the current year and only December in the prior year.

•Adjusted EBITDA(1) was $8.8 million compared to $(64.0) thousand.

•New student starts of 2,032 and 8,244 average undergraduate full-time active students.

(1) See the "Use of Non-GAAP Financial Information" below. For a detailed reconciliation of the non-GAAP measures, see the tables following the earnings release.

(2) First quarter fiscal 2023 reflects UTI results for the full quarter and Concorde results beginning December 1, 2022. Total company quarter-over-quarter comparisons are shown on an "as-reported basis."

“Our first quarter results exceeded our expectations on both the top and bottom line,” said Troy Anderson, CFO of Universal Technical Institute, Inc. “This performance reflects the benefit of having the full quarter of contribution from Concorde, along with meaningful start growth and ramping new program launches in both divisions. Importantly, in December 2023, we also satisfied the conditions that allowed us to fully convert our outstanding Series A preferred stock into common stock, representing a key milestone for the company and an important step in optimizing our capital structure.

“With our current momentum as well as our visibility into the remainder of the year, we are announcing positive adjustments to our fiscal 2024 guidance ranges for several key financial metrics. We are raising our expected revenue range and raising and tightening our adjusted EBITDA range. In addition, we are raising our GAAP net income and diluted EPS expectations, the latter including the benefits from the conversion of the outstanding preferred shares. This updated outlook reflects our continued confidence in our ability to execute and drive strong results, along with additional operating efficiencies and positive returns on our growth investments. In the year ahead, we intend to maintain our strategic progress and enhance the high-quality training and employment experiences we offer students across our platform.”

Balance Sheet and Liquidity

At December 31, 2023, the Company’s total available cash liquidity was $143.6 million, with an additional $8.2 million available from its revolving credit facility. Capital expenditures (“capex”) for the quarter were $3.8 million. The primary drivers of capex for the quarter were the UTI and Concorde program expansions.

For the Company’s most recent investor presentation and quarterly financial supplement, please see its investor relations website at https://investor.uti.edu.

Updated Fiscal 2024 Financial Outlook

| | | | | | | | |

| | Updated |

| | FY 2024 |

| ($ in millions, except EPS) | | Guidance |

| New student starts | No change | 24,500 - 25,500 |

| Revenue | Raised range and midpoint | $710 - 720 |

| Net Income | Raised range and midpoint | $36 - 40 |

| Diluted EPS | Raised range and midpoint | $0.67 - 0.72 |

Adjusted EBITDA(3) | Raised range and midpoint | $100 - 103 |

Adjusted free cash flow(3)(4) | No change | $62 - 66 |

(3) See the "Use of Non-GAAP Financial Information" below. For a detailed reconciliation of the non-GAAP measures, see the tables following the earnings release.

(4) For FY 2024, assumes $28 million to $31 million of total capex, including incremental investments for program expansions and maintenance capex equal to approximately 2% of revenue.

Conference Call

Management will hold a conference call to discuss the financial results for the fiscal 2024 first quarter ended December 31, 2023, on Wednesday, February 7, 2024, at 4:30 p.m. ET.

To participate in the live call, investors are invited to dial (844) 881-0138 (domestic) or (412) 317-6790 (international). A live webcast of the call will be available via the Universal Technical Institute, Inc. investor relations website at https://investor.uti.edu. Please go to the website at least 10 minutes early to register, download and install any necessary audio software. The conference call webcast will be archived for fourteen days at https://investor.uti.edu. Alternatively, the telephone replay can be accessed through February 21, 2024, by dialing (877) 344-7529 (domestic) or (412) 317-0088 (international) and entering passcode 9867059.

Use of Non-GAAP Financial Information

In addition to disclosing financial results that are determined in accordance with U.S. generally accepted accounting principles ("GAAP"), the Company also discloses certain non-GAAP financial information in this press release and may similarly disclose non-GAAP financial information on the related conference call. These financial measures are not recognized measures under GAAP and are not intended to be and should not be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. The Company discloses these non-GAAP financial measures because it believes that they provide investors an additional analytical tool to clarify its results of operations and identify underlying trends. Additionally, the Company believes that these measures may also help investors compare its performance on a consistent basis across time periods. Additional details on our non-GAAP measures and the tables reconciling these measures to the most directly comparable GAAP measure are provided below.

Adjusted EBITDA

The Company defines adjusted EBITDA as net income (loss) before interest expense, interest income, income taxes, depreciation and amortization, adjusted for stock-based compensation expense and items not considered normal recurring operations.

Adjusted Free Cash Flow

The Company defines adjusted free cash flow as net cash provided by (used in) operating activities less capital expenditures, adjusted for items not considered normal recurring operations.

We disclose any campus adjustments as direct costs (net of any corporate allocations). Management utilizes adjusted figures as performance measures internally for operating decisions, strategic planning, annual budgeting

and forecasting. For the periods presented, this includes acquisition-related costs for both announced and potential acquisitions, integration costs for completed acquisitions, costs related to the purchase of our campuses, start-up costs associated with the Austin, TX and Miramar, FL campus openings and other program expansions, and restructuring charges. To obtain a complete understanding of our performance, these measures should be examined in connection with net income (loss) and net cash provided by (used in) operating activities, determined in accordance with GAAP, as presented in the financial statements and notes thereto included in the annual and quarterly filings with the Securities and Exchange Commission (“SEC”). Because the items excluded from these non-GAAP measures are significant components in understanding and assessing our financial performance under GAAP, these measures should not be considered to be an alternative to net income (loss) or net cash provided by (used in) operating activities as a measure of our operating performance or liquidity. Exclusion of items in the non-GAAP presentation should not be construed as an inference that these items are unusual, infrequent or non-recurring. Other companies, including other companies in the education industry, may define and calculate non-GAAP financial measures differently than we do, limiting their usefulness as a comparative measure across similarly titled performance measures presented by other companies. A reconciliation of the historical non-GAAP financial measures to the most directly comparable GAAP measures is provided below and investors are encouraged to review the reconciliations.

Forward Looking Statements

All statements contained in this press release and the related conference call, other than statements of historical fact, are "forward-looking" statements within the meaning of the safe harbor from civil liability provided for such statements by the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended). These forward-looking statements which address our expected future business and financial performance, may contain words such as "goal," "target," "future," "estimate," "expect," "anticipate," "intend," "plan," "believe," "seek," "project," "may," "should," "will," the negative form of these expressions or similar expressions. Examples of forward-looking statements include, among others, statements regarding (1) the Company’s expectation that it will meet its fiscal year 2024 guidance for new student start growth (decline), revenue growth, net income, diluted earnings per share, Adjusted EBITDA and Adjusted Free Cash Flow; (2) the Company’s expectation that it will continue to expand its value proposition and build a business that can grow in low-to-mid single digits with potential upside, regardless of the economic environment; and (3) the Company’s expectation that it will succeed in new program launches next year. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on the Company’s current beliefs, expectations and assumptions regarding the future of its business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could affect our actual results include, among other things, failure of our schools to comply with the extensive regulatory requirements for school operations; our failure to maintain eligibility for federal student financial assistance funds; the effect of current and future Title IV Program regulations arising out of negotiated rulemakings, including any potential reductions in funding or restrictions on the use of funds received through Title IV Programs; the effect of future legislative or regulatory initiatives related to veterans’ benefit programs; continued Congressional examination of the for-profit education sector; our failure to maintain eligibility for or the ability to process federal student financial assistance; regulatory investigations of, or actions commenced against, us or other companies in our industry; changes in the state regulatory environment or budgetary constraints; our failure to execute on our growth and diversification strategy; our failure to realize the expected benefits of our acquisitions, or our failure to successfully integrate our acquisitions, including, without limitation, Concorde Career Colleges, Inc.; our failure to improve underutilized capacity at certain of our campuses; enrollment declines or challenges in our students’ ability to find employment as a result of macroeconomic conditions; our failure to maintain and expand existing industry relationships and develop new industry relationships; our ability to update and expand the content of existing programs and develop and integrate new programs in a timely and cost-effective manner while maintaining positive student outcomes; a loss of our senior management or other key employees; failure to comply with the restrictive covenants and our ability to pay the amounts when due under the Credit Agreement; the effect of our principal stockholder owning a significant percentage of our capital stock, and thus being able to influence certain corporate matters and the potential in the future to gain substantial control over our company; the impact of certain holders of our Series A Preferred Stock owning a significant percentage

of our capital stock, their ability to influence and control certain corporate matters and the potential for future dilution to holders of our common stock; the effect of public health pandemics, epidemics or outbreak, including COVID-19, and other risks that are described from time to time in our public filings. Further information on these and other potential factors that could affect the financial results or condition may be found in the company's filings with the SEC. Any forward-looking statements made by us in this press release and the related conference call are based only on information currently available to us and speak only as of the date on which it is made. We expressly disclaim any obligation to publicly update any forward-looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future developments, changes in expectations, any changes in events, conditions or circumstances, or otherwise.

Social Media Disclosure

Universal Technical Institute, Inc uses its websites (https://www.uti.edu/, https://concorde.edu, and https://investor.uti.edu/) and LinkedIn pages (https://www.linkedin.com/school/universal-technical-institute/ and https://www.linkedin.com/school/concorde-career-colleges/) as channels of distribution of information about its programs, its planned financial and other announcements, its attendance at upcoming investor and industry conferences, and other matters. Such information may be deemed material information, and the Company may use these channels to comply with its disclosure obligations under Regulation FD. Therefore, investors should monitor the company's website and its social media accounts in addition to following the company's press releases, SEC filings, public conference calls, and webcasts.

About Universal Technical Institute, Inc.

Universal Technical Institute, Inc. (NYSE: UTI) was founded in 1965 and is a leading workforce solutions provider of transportation, skilled trades and healthcare education programs, whose mission is to serve students, partners, and communities by providing quality education and support services for in-demand careers across a number of highly-skilled fields. The Company is comprised of two divisions: Universal Technical Institute ("UTI") and Concorde Career Colleges ("Concorde"). UTI operates 16 campuses located in 9 states and offers a wide range of transportation and skilled trades technical training programs under brands such as UTI, MIAT College of Technology, Motorcycle Mechanics Institute, Marine Mechanics Institute and NASCAR Technical Institute. Concorde operates across 17 campuses in 8 states and online, offering programs in the Allied Health, Dental, Nursing, Patient Care and Diagnostic fields. For more information, visit www.uti.edu or www.concorde.edu, or visit us on LinkedIn at @UniversalTechnicalInstitute and @Concorde Career Colleges or on X (formerly Twitter) @news_UTI or @ConcordeCareer.

Company Contact:

Troy R. Anderson

Chief Financial Officer

Universal Technical Institute, Inc.

(623) 445-9365

Media Contact:

Susan Aspey

Vice President, Corporate Affairs & External Communications

Universal Technical Institute, Inc.

(202) 549-0534

saspey@uti.edu

Investor Relations Contact:

Matt Glover or Jackie Keshner

Gateway Group, Inc.

(949) 574-3860

UTI@gateway-grp.com

(Tables Follow)

UNIVERSAL TECHNICAL INSTITUTE, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | |

| | 2023 | | 2022 | | | | |

| Revenues | $ | 174,695 | | | $ | 120,004 | | | | | |

| Operating expenses: | | | | | | | |

| Educational services and facilities | 92,409 | | | 61,408 | | | | | |

| Selling, general and administrative | 68,055 | | | 54,148 | | | | | |

| Total operating expenses | 160,464 | | | 115,556 | | | | | |

| Income from operations | 14,231 | | | 4,448 | | | | | |

| Other (expense) income: | | | | | | | |

| Interest income | 1,975 | | | 823 | | | | | |

| Interest expense | (2,871) | | | (1,423) | | | | | |

| Other income (expense), net | 214 | | | 325 | | | | | |

| Total other expense, net | (682) | | | (275) | | | | | |

| Income before income taxes | 13,549 | | | 4,173 | | | | | |

| Income tax expense | (3,160) | | | (1,525) | | | | | |

| Net income | $ | 10,389 | | | $ | 2,648 | | | | | |

| Preferred stock dividends | (1,097) | | | (1,277) | | | | | |

| Income available for distribution | 9,292 | | | 1,371 | | | | | |

| Income allocated to participating securities | (2,855) | | | (514) | | | | | |

| Net income available to common shareholders | $ | 6,437 | | | $ | 857 | | | | | |

| | | | | | | |

| Earnings per share: | | | | | | | |

| Net income per share - basic | $ | 0.18 | | | $ | 0.03 | | | | | |

| Net income per share - diluted | $ | 0.17 | | | $ | 0.02 | | | | | |

| | | | | | | |

Weighted average number of shares outstanding(1): | | | | | | |

| Basic | 36,434 | | | 33,805 | | | | | |

| Diluted | 37,439 | | | 34,408 | | | | | |

(1) On December 18, 2023, the Company exercised in full its right of conversion of the Company’s Series A Preferred Stock which resulted in the conversion of all outstanding Series A Preferred shares into 19,296,843 shares of Common Stock. As of December 31, 2023 there were 53,732,017 shares of Common Stock outstanding.

UNIVERSAL TECHNICAL INSTITUTE, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except par value and per share amounts)

(Unaudited)

| | | | | | | | | | | |

| December 31, 2023 | | September 30, 2023 |

| Assets | |

| Cash and cash equivalents | $ | 143,590 | | | $ | 151,547 | |

| Restricted cash | 5,233 | | | 5,377 | |

| | | |

| Receivables, net | 22,722 | | | 25,161 | |

| Notes receivable, current portion | 6,001 | | | 5,991 | |

| Prepaid expenses | 12,117 | | | 9,412 | |

| Other current assets | 7,779 | | | 7,497 | |

| Total current assets | 197,442 | | | 204,985 | |

| Property and equipment, net | 263,922 | | | 266,346 | |

| Goodwill | 28,459 | | | 28,459 | |

| Intangible assets, net | 18,801 | | | 18,975 | |

| Notes receivable, less current portion | 33,393 | | | 30,672 | |

| Right-of-use assets for operating leases | 174,973 | | | 176,657 | |

| Deferred tax asset, net | 4,855 | | | 3,768 | |

| Other assets | 10,568 | | | 10,823 | |

| Total assets | $ | 732,413 | | | $ | 740,685 | |

| Liabilities and Shareholders’ Equity | | | |

| Accounts payable and accrued expenses | $ | 68,498 | | | $ | 69,941 | |

| | | |

| Deferred revenue | 81,474 | | | 85,738 | |

| | | |

| Operating lease liability, current portion | 22,521 | | | 22,481 | |

| Long-term debt, current portion | 2,560 | | | 2,517 | |

| Other current liabilities | 6,882 | | | 4,023 | |

| Total current liabilities | 181,935 | | | 184,700 | |

| Deferred tax liabilities, net | 663 | | | 663 | |

| Operating lease liability | 164,125 | | | 165,026 | |

| Long-term debt | 158,962 | | | 159,600 | |

| Other liabilities | 4,543 | | | 4,729 | |

| Total liabilities | 510,228 | | | 514,718 | |

| Commitments and contingencies | | | |

| Shareholders’ equity: | | | |

Common stock, $0.0001 par value, 100,000 shares authorized, 53,814 and 34,157 shares issued | 5 | | | 3 | |

| Preferred stock, $0.0001 par value, 10,000 shares authorized; 0 and 676 shares of Series A Convertible Preferred Stock issued and outstanding, liquidation preference of $100 per share | — | | | — | |

| Paid-in capital - common | 214,071 | | | 151,439 | |

| Paid-in capital - preferred | — | | | 66,481 | |

Treasury stock, at cost, 82 shares | (365) | | | (365) | |

| Retained earnings | 6,897 | | | 5,946 | |

| Accumulated other comprehensive income | 1,577 | | | 2,463 | |

| Total shareholders’ equity | 222,185 | | | 225,967 | |

| Total liabilities and shareholders’ equity | $ | 732,413 | | | $ | 740,685 | |

UNIVERSAL TECHNICAL INSTITUTE, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | |

| | Three Months Ended December 31, |

| | | 2023 | | 2022 |

| Cash flows from operating activities: | | | | |

| Net income | | $ | 10,389 | | | $ | 2,648 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation and amortization | | 6,984 | | | 5,248 | |

| | | | |

| Amortization of right-of-use assets for operating leases | | 5,531 | | | 4,120 | |

| | | | |

| | | | |

| Bad debt expense | | 1,486 | | | 535 | |

| Stock-based compensation | | 1,482 | | | 1,169 | |

| Deferred income taxes | | (730) | | | 1,068 | |

| | | | |

| | | | |

| Training equipment credits earned, net | | 529 | | | (83) | |

| Unrealized loss on interest rate swap | | (886) | | | (126) | |

| Other losses (gains), net | | 245 | | | (143) | |

| Changes in assets and liabilities: | | | | |

| Receivables | | 1,029 | | | 4,657 | |

| Prepaid expenses | | (4,060) | | | (1,438) | |

| Other assets | | 408 | | | 2,079 | |

| Notes receivable | | (2,731) | | | (622) | |

| Accounts payable, accrued expenses and other current liabilities | | 330 | | | (15,925) | |

| Deferred revenue | | (4,264) | | | 4,634 | |

| | | | |

| | | | |

| Operating lease liability | | (4,708) | | | (4,963) | |

| Other liabilities | | (198) | | | (46) | |

| Net cash provided by operating activities | | 10,836 | | | 2,812 | |

| Cash flows from investing activities: | | | | |

| Cash paid for acquisitions, net of cash acquired | | — | | | (16,973) | |

| Purchase of property and equipment | | (3,848) | | | (6,782) | |

| | | | |

| | | | |

| Proceeds from maturities of held-to-maturity securities | | — | | | 29,000 | |

| | | | |

| | | | |

| Net cash (used in) provided by investing activities | | (3,848) | | | 5,245 | |

| Cash flows from financing activities: | | | | |

| Proceeds from revolving credit facility | | — | | | 90,000 | |

| | | | |

| Debt issuance costs for long-term debt | | — | | | (484) | |

| | | | |

| Payment of preferred stock cash dividend | | (1,097) | | | — | |

| Payments on term loans and finance leases | | (618) | | | (273) | |

| Payment of payroll taxes on stock-based compensation through shares withheld | | (2,054) | | | (525) | |

| Preferred share repurchase | | (11,320) | | | — | |

| | | | |

| Net cash (used in) provided by financing activities | | (15,089) | | | 88,718 | |

| Change in cash, cash equivalents and restricted cash | | (8,101) | | | 96,775 | |

| Cash and cash equivalents, beginning of period | | 151,547 | | | 66,452 | |

| Restricted cash, beginning of period | | 5,377 | | | 3,544 | |

| Cash, cash equivalents and restricted cash, beginning of period | | 156,924 | | | 69,996 | |

| Cash and cash equivalents, end of period | | 143,590 | | | 162,229 | |

| Restricted cash, end of period | | 5,233 | | | 4,542 | |

| Cash, cash equivalents and restricted cash, end of period | | $ | 148,823 | | | $ | 166,771 | |

UNIVERSAL TECHNICAL INSTITUTE, INC. AND SUBSIDIARIES

SELECTED SUPPLEMENTAL NON-FINANCIAL AND FINANCIAL INFORMATION BY SEGMENT

(In thousands, except for Student Metrics)

(Unaudited)

Student Metrics

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 | | | Three Months Ended December 31, 2022 |

| UTI | | Concorde | | Total | | | UTI | | Concorde(2) | | Total |

| Total new student starts | 2,314 | | | 2,032 | | | 4,346 | | | | 1,974 | | | 321 | | | 2,295 | |

| Year-over-year growth (decline) | 17.2 | % | | 533.0 | % | | 89.4 | % | | | 0.1 | % | | — | | | — | |

| Average undergraduate full-time active students | 14,321 | | | 8,244 | | | 22,565 | | | | 13,511 | | | 7,737 | | | 21,248 | |

| Year-over-year growth (decline) | 6.0 | % | | 6.6 | % | | 6.2 | % | | | (1.6) | % | | — | | | — | |

| End of period undergraduate full-time active students | 13,682 | | | 8,150 | | | 21,832 | | | | 12,657 | | | 7,630 | | | 20,287 | |

| Year-over-year growth (decline) | 8.1 | % | | 6.8 | % | | 7.6 | % | | | (3.6) | % | | — | | | — | |

Financial Summary by Segment and Consolidated

During fiscal 2023, in coordination with the integration of Concorde, we began to reassess our operating model to determine the organizational structure that would best help the Company achieve future growth goals and optimally support the business. Beginning in fiscal 2024, we have executed an internal reorganization to fully transition our operating and reporting model to support a multi-divisional business. As part of the internal reorganization, each of the reportable segments now have dedicated accounting, finance, information technology, and human resources teams. Additionally, human resources and information technology costs that benefit the entire organization are now allocated across UTI, Concorde and Corporate each period based upon relative headcount. As a result, additional costs have moved from Corporate into the UTI segment and to a lesser extent the Concorde segment as resources were redirected to support the segment’s objectives. Due to these changes in allocation methodology, the prior year segment amounts have been recast for comparability to the current year presentation.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2023 | | | Three Months Ended December 31, 2022 |

| | UTI | | Concorde | | Corporate | | Consolidated | | | UTI | | Concorde | | Corporate | | Consolidated |

| Revenue | | $ | 115,373 | | | $ | 59,322 | | | $ | — | | | $ | 174,695 | | | | $ | 105,573 | | | $ | 14,431 | | | $ | — | | | $ | 120,004 | |

| Educational services and facilities | | 57,368 | | | 35,041 | | | — | | | 92,409 | | | | 50,877 | | | 10,531 | | | — | | | 61,408 | |

| Selling, general and administrative | | 42,915 | | | 17,153 | | | 7,987 | | | 68,055 | | | | 41,274 | | | 4,626 | | | 8,248 | | | 54,148 | |

| Total operating expenses | | 100,283 | | | 52,194 | | | 7,987 | | | 160,464 | | | | 92,151 | | | 15,157 | | | 8,248 | | | 115,556 | |

| Net income (loss) | | 13,597 | | | 7,173 | | | (10,381) | | | 10,389 | | | | 12,732 | | | (734) | | | (9,350) | | | 2,648 | |

UNIVERSAL TECHNICAL INSTITUTE, INC. AND SUBSIDIARIES

SELECTED SUPPLEMENTAL NON-FINANCIAL AND FINANCIAL INFORMATION BY SEGMENT

(In thousands)

(Unaudited)

Major Expense Categories by Segment and Consolidated

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 |

| UTI | | Concorde | | Corporate | | Consolidated |

| Salaries, benefits and tax expense | $ | 45,367 | | | $ | 28,192 | | | $ | 3,563 | | | $ | 77,122 | |

| Bonus expense | 3,494 | | | 857 | | | 1,022 | | | 5,373 | |

| Stock-based compensation | 470 | | | 8 | | | 1,003 | | | 1,481 | |

| Total compensation and related costs | $ | 49,331 | | | $ | 29,057 | | | $ | 5,588 | | | $ | 83,976 | |

| | | | | | | |

| Advertising expense | $ | 13,353 | | | $ | 6,092 | | | $ | — | | | $ | 19,445 | |

| Occupancy expense, net of subleases | 7,607 | | | 5,798 | | | 150 | | | 13,555 | |

| Depreciation and amortization | 5,494 | | | 1,154 | | | 336 | | | 6,984 | |

| Professional and contract services expense | 2,587 | | | 1,870 | | | 2,507 | | | 6,964 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2022 |

| UTI | | Concorde | | Corporate | | Consolidated |

| Salaries, benefits and tax expense | $ | 43,482 | | | $ | 8,476 | | | $ | 3,875 | | | $ | 55,833 | |

| Bonus expense | 3,543 | | | 188 | | | 1,134 | | | 4,865 | |

| Stock-based compensation | 252 | | | — | | | 917 | | | 1,169 | |

| Total compensation and related costs | $ | 47,277 | | | $ | 8,664 | | | $ | 5,926 | | | $ | 61,867 | |

| | | | | | | |

| Advertising expense | $ | 13,349 | | | $ | 1,280 | | | $ | — | | | $ | 14,629 | |

| Occupancy expense, net of subleases | 8,026 | | | 1,764 | | | 125 | | | 9,915 | |

| Depreciation and amortization | 4,775 | | | 457 | | | 16 | | | 5,248 | |

| Professional and contract services expense | 3,065 | | | 97 | | | 2,175 | | | 5,337 | |

UNIVERSAL TECHNICAL INSTITUTE, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP FINANCIAL INFORMATION TO NON-GAAP FINANCIAL INFORMATION

(In thousands)

(Unaudited)

Reconciliation of Net Income (Loss) to EBITDA and Adjusted EBITDA

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2023 |

| | UTI | | Concorde | | Corporate | | Consolidated |

| Net income (loss) | $ | 13,597 | | | $ | 7,173 | | | $ | (10,381) | | | $ | 10,389 | |

| Interest income | (6) | | | (128) | | | (1,841) | | | (1,975) | |

| Interest expense | 1,512 | | | 83 | | | 1,276 | | | 2,871 | |

| Income tax expense | — | | | — | | | 3,160 | | | 3,160 | |

| Depreciation and amortization | 5,494 | | | 1,154 | | | 336 | | | 6,984 | |

| EBITDA | 20,597 | | | 8,282 | | | (7,450) | | | 21,429 | |

| | | | | | | |

| Integration related costs for acquisitions | — | | | 294 | | | 612 | | | 906 | |

| Stock-based compensation expense | 471 | | | 8 | | | 1,003 | | | 1,482 | |

| Start-up costs for program expansion | 500 | | | 168 | | | — | | | 668 | |

| Restructuring costs | 43 | | | — | | | — | | | 43 | |

| Adjusted EBITDA, non-GAAP | $ | 21,611 | | | $ | 8,752 | | | $ | (5,835) | | | $ | 24,528 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2022 |

| | UTI | | Concorde | | Corporate | | Consolidated |

| Net income (loss) | $ | 12,732 | | | $ | (734) | | | $ | (9,350) | | | $ | 2,648 | |

| Interest income | (3) | | | (36) | | | (784) | | | (823) | |

| Interest expense | 881 | | | 44 | | | 498 | | | 1,423 | |

| Income tax expense | — | | | — | | | 1,525 | | | 1,525 | |

| Depreciation and amortization | 4,775 | | | 457 | | | 16 | | | 5,248 | |

| EBITDA | 18,385 | | | (269) | | | (8,095) | | | 10,021 | |

| Acquisition related costs | — | | | — | | | 775 | | | 775 | |

| Integration related costs for acquisitions | 219 | | | 150 | | | 726 | | | 1,095 | |

| Stock-based compensation expense | 252 | | | — | | | 917 | | | 1,169 | |

| Start-up costs for new campuses and program expansion | 1,324 | | | 55 | | | — | | | 1,379 | |

| | | | | | | |

| Adjusted EBITDA, non-GAAP | $ | 20,180 | | | $ | (64) | | | $ | (5,677) | | | $ | 14,439 | |

Reconciliation of Net Cash (Used in) Provided by Operating Activities to Adjusted Free Cash Flow

| | | | | | | | | | | |

| | Three Months Ended December 31, |

| | 2023 | | 2022 |

| Net cash provided by operating activities, as reported | $ | 10,836 | | | $ | 2,812 | |

| Purchase of property and equipment | (3,848) | | | (6,782) | |

| Free cash flow, non-GAAP | 6,988 | | | (3,970) | |

| Adjustments: | | | |

| | | |

| | | |

| | | |

| Acquisition related costs paid | — | | | 594 | |

| Integration related costs paid | 984 | | | 980 | |

| Cash outflow for acquisition integration property and equipment | 9 | | | — | |

| Cash outflow for start-up costs for new campuses and program expansion | 668 | | | 1,379 | |

| Cash outflow for property and equipment for new campuses and program expansion | 1,583 | | | 3,605 | |

| | | |

| Cash payments for restructuring costs | 5 | | | — | |

| | | |

| Adjusted free cash flow, non-GAAP | $ | 10,237 | | | $ | 2,588 | |

UNIVERSAL TECHNICAL INSTITUTE, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP FINANCIAL INFORMATION TO NON-GAAP FINANCIAL

INFORMATION FOR FISCAL 2024 GUIDANCE

(In thousands)

(Unaudited)

For each of the non-GAAP reconciliations provided for fiscal 2024 guidance, we are reconciling to the midpoint of the guidance range. The adjustments reflected below for fiscal 2024 are illustrative only and may change throughout the year, both in amount or the adjustments themselves.

Reconciliation of Net Income to EBITDA and Adjusted EBITDA for Fiscal 2024 Guidance

| | | | | |

| Updated |

| Twelve Months Ended |

| | September 30, |

| | 2024 |

| Net income | ~ $38,000 |

| Interest (income) expense, net | ~ 3,700 |

| Income tax (benefit) expense | ~ 14,100 |

| Depreciation and amortization | ~ 30,000 |

| |

| EBITDA | ~ $85,800 |

| Integration related costs for acquisitions | ~ 5,500 |

| Start-up costs for program expansion | ~ 1,500 |

| Stock-based compensation | ~ 8,000 |

| Restructuring costs | ~700 |

| Adjusted EBITDA, non-GAAP | ~ $101,500 |

| FY 2024 Guidance Range | $100,000 - $103,000 |

Reconciliation of Net Cash Provided by Operating Activities to Adjusted Free Cash Flow for Fiscal 2024 Guidance

| | | | | |

| Updated |

| | Twelve Months Ended |

| September 30, |

| | 2024 |

| Net cash provided by operating activities | ~ $84,000 |

| Purchase of property and equipment | ~ (30,500) |

| Free cash flow, non-GAAP | ~ $(53,500) |

| Adjustments: | |

| Integration related costs for acquisitions | ~ 5,500 |

| Cash outflow for acquisition integration property and equipment | ~ 200 |

| Cash paid for start-up costs for program expansion | ~ 1,500 |

| Cash outflow for program expansion property and equipment | ~ 2,300 |

| Cash payments for restructuring costs | ~700 |

| Cash outflow for restructuring property and equipment | ~300 |

| Adjusted free cash flow, non-GAAP | ~ $64,000 |

| FY 2024 Guidance Range | $62,000 - $66,000 |

v3.24.0.1

Cover Page

|

Feb. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 07, 2024

|

| Entity Registrant Name |

UNIVERSAL TECHNICAL INSTITUTE, INC

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-31923

|

| Entity Tax Identification Number |

86-0226984

|

| Entity Central Index Key |

0001261654

|

| Amendment Flag |

false

|

| Entity Address, Address Line One |

4225 E. Windrose Drive

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

Phoenix

|

| Entity Address, State or Province |

AZ

|

| Entity Address, Postal Zip Code |

85032

|

| City Area Code |

623

|

| Local Phone Number |

445-9500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

UTI

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

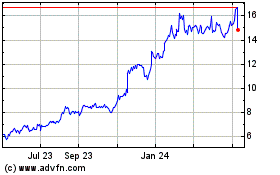

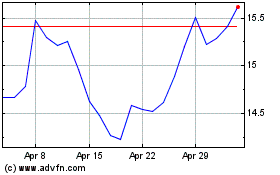

Universal Technical Inst... (NYSE:UTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Universal Technical Inst... (NYSE:UTI)

Historical Stock Chart

From Apr 2023 to Apr 2024