Credit Markets: Pace of Ratings Reductions Speeds Up -- WSJ

April 03 2020 - 3:02AM

Dow Jones News

By Sebastian Pellejero

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 3, 2020).

U.S. corporate bonds are being downgraded at breakneck speeds,

highlighting the threat posed to companies' balance sheets by the

coronavirus crisis.

The pace of downgrades over the last two weeks was the fastest

on record in one major corporate-bond index going back to 2002,

according to BofA Global Research.

The index, known as the ICE BofAML U.S. Corporate Index, has

suffered $569 billion in downgrades since March 16, said Bank of

America.

Credit-ratings firms downgraded a net $560 billion of

investment-grade corporate bonds in the index last month, the bank

added. While total downgrades remained lower than at the same point

during the financial crisis, the pace accelerated in recent weeks

as ratings firms and investors reassessed the ability of borrowers

to repay their debts.

Fears that the crisis will spur bankruptcies and a prolonged

recession have helped drive the Bloomberg Barclays U.S. corporate

investment grade index down 3.9% in the first quarter of 2020, the

worst performance since the end 2016. Analysts said there is still

room for more companies to fall down the ratings ladder, with

businesses closed and consumers stuck at home, despite the Federal

Reserve's recent extraordinary efforts to support the corporate

debt market.

"The Fed programs cannot stem the negative actions that credit

rating agencies have already taken and will continue to take," said

UBS senior credit strategist Barry McAlinden. "Downgrades are a

normal part of an economic down cycle, and the anticipation for

negative rating actions is a reason why [investment-grade bond]

spreads are where they currently stand."

Investors are being compensated more to hold corporate bonds.

Adjusted for options, the spread, or extra yield investors demanded

to hold investment-grade U.S. corporate bonds in the Bloomberg

Barclays index over Treasury bonds increased by 1.79 percentage

points during the first quarter -- a record, according to Dow Jones

Market Data.

Investors watch downgrades because it is one sign of

deteriorating conditions in the corporate sector. Many funds also

can't hold debt below investment-grade, so downgrades could put

added pressure on the debt market in an already difficult trading

environment.

"A wave of downgrades would unquestionably cause disruption

given the swell of new names into the high-yield market," said Mike

Terwilliger, portfolio manager at Resource America. "The market

would absorb the paper, but it would definitely bring a temporary

downdraft."

Downgrades haven't stopped a deluge of new bonds being sold by

investment-grade companies. A record amount was issued last week,

and in recent days, some speculative-grade companies have joined

in. After Yum Brands Inc. completed the first high-yield bond sale

in nearly a month on Monday, more have followed. Sales by aerospace

manufacturer TransDigm Group Inc., fast-food operator Restaurant

Brands International Inc. and Tenet Healthcare Corp. were expected

to close on Thursday.

U.S. Treasury yields were down on Thursday. The benchmark

10-year yield fell to 0.624%, according to Tradeweb, from 0.630% at

Wednesday's close. The intraday yield of the 30-year bond fell to

1.268%, from 1.285%.

As downgrades from ratings firms like S&P and Moody's

accelerate, more companies at the lower rungs of the

investment-grade bond market are at risk of having their ratings

pushed into junk territory, becoming what is known on Wall Street

as fallen angels. More than $97 billion in debt tied to 13

companies including Ford Motor Co., Occidental Petroleum Corp., and

Western Midstream Partners LP lost investment-grade status in

March.

Wall Street analysts say more fallen angels are likely, with

many triple-B bond investors demanding larger spreads compared with

their speculative-grade counterparts. Around $343 billion of

triple-B rated bonds issued in developed markets trade at a higher

premium over U.S. Treasurys than double-B rated bonds, says Bank of

America.

Cruise operator Carnival Corp., which is under review for

downgrades, sold $4 billion of new triple-B bonds Wednesday at an

initial yield of 11.9%. T-Mobile Inc. was set to sell triple-B

bonds to pay down a bridge loan used to fund its purchase of Sprint

Corp.

--Sam Goldfarb contributed to this article.

Write to Sebastian Pellejero at sebastian.pellejero@wsj.com

(END) Dow Jones Newswires

April 03, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

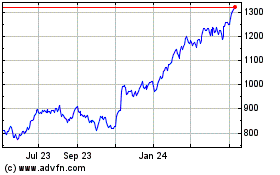

Transdigm (NYSE:TDG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Transdigm (NYSE:TDG)

Historical Stock Chart

From Nov 2023 to Nov 2024