UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or

15d-16

of the Securities Exchange Act of 1934

For

the month of March 2023

Commission

File Number: 001-39928

Sendas

Distribuidora S.A.

(Exact

Name as Specified in its Charter)

Sendas

Distributor S.A.

(Translation

of registrant’s name into English)

Avenida

Ayrton Senna, No. 6,000, Lote 2, Pal 48959, Anexo A

Jacarepaguá

22775-005

Rio de Janeiro, RJ, Brazil

(Address

of principal executive offices)

(Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form

20-F: ☒ Form 40-F: ☐

SENDAS

ANNOUNCES THE PRICING OF THE PUBLIC OFFERING OF COMMON SHARES BY THE CASINO GROUP

March

16, 2023 – Sendas Distribuidora S.A. (“Company” or “Sendas”) (B3: ASAI3; NYSE: ASAI)

informs its shareholders and the market that, further to the Form 6-K furnished by the Company to the U.S. Securities and Exchange Commission

(“SEC”) on March 14, 2023, the offering by Wilkes Participações S.A., a Casino Group company (the “Selling

Shareholder”), of 254,000,000 common shares of the Company (“Shares”), including 2,340,957 American Depositary

Shares (“ADSs”), each of which represents five Shares, was priced on the date hereof.

The

price per Share to the public was set at R$16.00, resulting in an aggregate offering price of R$4,064,000,000.00. The ADSs were offered

and sold to the public at a price of U.S.$15.13 per ADS. The price per Share in the form of ADSs corresponds to the price per Share translated

into U.S. dollars, based on the selling exchange rate for U.S. dollars (PTAX) of R$5.2892 per US$1.00, as published by the Central Bank

of Brazil on March 16, 2023.

The

global offering consists of an international offering outside Brazil (the “International Offering”) and a concurrent

public offering in Brazil (the “Brazilian Offering” and, together with the International Offering, the “Global

Offering”). The International Offering includes a registered offering of ADSs in the United States with the SEC under the U.S.

Securities Act of 1933, as amended. The International Offering and the Brazilian Offering are being conducted concurrently, and the closing

of each is conditioned upon the closing of the other.

The

International Offering is being conducted pursuant to a registration statement on Form F-3 filed on November 28, 2022 with the SEC, which

automatically became effective upon filing, and a preliminary prospectus supplement filed on March 14, 2023. The registration

statement on Form F-3 and the preliminary prospectus supplement may be accessed through the SEC’s website at www.sec.gov.

BTG

Pactual, Bradesco BBI, Itaú BBA and J.P. Morgan are acting as Global Coordinators, and Goldman Sachs, UBS, Citigroup, Credit Suisse,

Safra and Santander are acting as Joint Bookrunners, in each case with respect to the Global Offering.

Banco

BTG Pactual S.A. – Cayman Branch, Banco Bradesco BBI S.A., Itau BBA USA Securities, Inc., J.P. Morgan Securities LLC, Goldman Sachs

& Co. LLC, UBS Securities LLC, Citigroup Global Markets, Inc., Credit Suisse Securities (USA) LLC and Santander US Capital Markets

LLC are serving as international underwriters with respect to the International Offering of the ADSs.

BTG

Pactual US Capital, LLC, Bradesco Securities, Inc., Itau BBA USA Securities, Inc., J.P. Morgan Securities LLC, Goldman Sachs & Co.

LLC, UBS Securities LLC, Citigroup Global Markets, Inc., Credit Suisse Securities (USA) LLC, Safra Securities LLC and Santander US Capital

Markets LLC are collectively acting as international placement agents with respect to the International Offering of Shares (not in the

form of ADSs) sold outside Brazil on behalf of the Brazilian placement agents.

You

should read the registration statement (including the preliminary prospectus supplement) and other documents filed with the SEC for

more complete information about the Company, the Selling Shareholder and the Global Offering. Please refer to our annual report on Form 20-F as of and for the year ended December 31, 2022 filed with the SEC, as well as any further updates in our current

reports on Form 6-K, which may be amended, supplemented or superseded, from time to time, by other reports that we file with the

SEC.

You

may access these documents for free by visiting EDGAR on the SEC’s website at www.sec.gov. Alternatively, a copy of the registration

statement (including the preliminary prospectus supplement) may be obtained by contacting: (i) Banco BTG Pactual S.A. —Cayman

Branch, 601 Lexington Avenue, 57th Floor, New York, NY, 10022, Attention: Equity Syndicate Desk, telephone: +1 212 293-4600 or by emailing

OL-BTGPactual-ProspectusDepartment@btgpactual.com; (ii) Bradesco Securities Inc. at 450 Park Avenue, 32nd Floor, New York, NY, 10022,

Attn: Isabela Behar, telephone: +1 (646) 468 3400 or by emailing isabela.behar@bradescobbi.com; (iii) Itau BBA USA Securities, Inc.,

540 Madison Avenue 24th Floor, New York, NY, 10022, Attention: Equity Sales or by emailing ibba-ibdsalesagendas@itau-unibanco.com.br;

(iv) J.P. Morgan Securities LLC, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, New York, NY, 11717, telephone:

+1 (866) 803-9204 or by emailing prospectus-eq_fi@jpmchase.com; (v) Goldman Sachs & Co. LLC, 200 West Street, New York, NY, 10282,

Attention: Prospectus Department, telephone: +1 (866) 471-2526 or by emailing prospectus-ny@gs.com; (vi) UBS Securities LLC, 1285 Avenue

of the Americas, New York, NY, 10019, Attention: Syndicate; (vii) Citigroup Global Markets Inc., c/o Broadridge Financial Solutions,

1155 Long Island Avenue, Edgewood, New York, NY, 11717, telephone: +1 (800) 831-9146 or by emailing prospectus@citi.com; (viii) Credit

Suisse Securities (USA) LLC, 6933 Louis Stephens Drive, Morrisville, North Carolina, 27560, Attention Prospectus Department, telephone:

+1 (800) 221-1037 or by emailing usa.prospectus@credit-suisse.com; (ix) Safra Securities LLC, 546 Fifth Avenue, New York, NY, 10036,

Attention: Gerard McCarthy, with a courtesy copy, which shall not constitute notice, to legal@safra.com; and (x) Santander US Capital

Markets LLC, 437 Madison Avenue, New York, NY, 10022, Attention: US Equity Capital Markets or by emailing ecm-us@santander.us.

This

press release is for informative purposes only under the current applicable laws and regulations, and is neither an offer to sell nor

a solicitation of an offer to buy the securities described herein, nor shall there be any sale of these securities in any jurisdiction

in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any

such jurisdiction.

The

Company will inform its shareholders and the market about any further developments with respect to the Global Offering in accordance

with applicable regulations.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

Date:

March 17, 2023

| |

Sendas Distribuidora S.A. |

| |

|

| |

By: |

/s/ Daniela Sabbag Papa |

| |

Name: |

Daniela Sabbag Papa |

| |

Title: |

Chief Financial Officer |

| |

|

| |

By: |

/s/ Gabrielle Helú |

| |

Name: |

Gabrielle Helú |

| |

Title: |

Investor Relations Officer |

FORWARD-LOOKING

STATEMENTS

This

press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on

management’s current view and estimates of future economic circumstances, industry conditions, company performance and financial results.

The words “anticipates”, “believes”, “estimates”, “expects”, “plans” and similar expressions,

as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of

dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future

operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking

statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is

no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors,

including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors

could cause actual results to differ materially from current expectations.

3

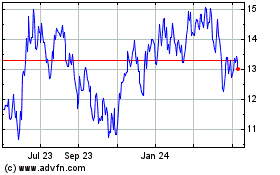

Sendas Distribuidora (NYSE:ASAI)

Historical Stock Chart

From Aug 2024 to Sep 2024

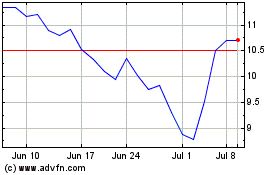

Sendas Distribuidora (NYSE:ASAI)

Historical Stock Chart

From Sep 2023 to Sep 2024