- Operating Revenues $1.3 billion; $1.3 billion in

2023

- Income from Operations $51.0 million; $103.8 million in

2023

- Diluted Earnings per Share $0.20; Adjusted Diluted Earnings

Per Share $0.21

- Updated full year Adjusted Diluted Earnings per Share

guidance to $0.80 - $0.90

- Updated full year Net Capital Expenditures guidance of

$300.0 - $350.0 million

Schneider National, Inc. (NYSE: SNDR, “Schneider” or the

“Company”), a leading transportation and logistics services

company, today announced results for the three months ended June

30, 2024.

“The second quarter showed continued progress toward market

equilibrium as evidenced by moderate seasonality and a tightening

spot market,” said Mark Rourke, President and Chief Executive

Officer of Schneider. “Enterprise results benefited from our

continued emphasis on cost containment and asset efficiency,

contributing to sequentially improved performance across our

multimodal platform of Truckload, Intermodal and Logistics.”

“We have maintained pricing discipline in a highly competitive

bid season, and while certain elements of our portfolio achieved

positive contract pricing during the second quarter renewals, the

rate and pace of the change to date are below our expectations,”

Rourke continued. “For the second half of the year, we anticipate

movement towards more typical freight replenishment and seasonality

trends, contributing to continued improvement in margin performance

across our operating segments.”

Results of Operations (unaudited)

The following table summarizes the Company’s results of

operations for the periods indicated.

Three Months Ended

Six Months Ended

June 30,

June 30,

(in millions, except ratios & per

share amounts)

2024

2023

Change

2024

2023

Change

Operating revenues

$

1,316.7

$

1,346.5

(2)%

$

2,635.7

$

2,775.2

(5)%

Revenues (excluding fuel

surcharge)

1,167.9

1,190.9

(2)%

2,331.0

2,440.4

(4)%

Income from operations

51.0

103.8

(51)%

79.7

218.4

(64)%

Adjusted income from

operations

52.3

106.7

(51)%

82.3

221.3

(63)%

Operating ratio

96.1

%

92.3

%

(380) bps

97.0

%

92.1

%

(490) bps

Adjusted operating ratio

95.5

%

91.0

%

(450) bps

96.5

%

90.9

%

(560) bps

Net income

$

35.3

$

77.5

(54)%

$

53.8

$

175.5

(69)%

Adjusted net income

36.3

79.7

(54)%

55.8

177.7

(69)%

Adjusted EBITDA

152.9

199.1

(23)%

283.6

422.5

(33)%

Diluted earnings per share

0.20

0.43

(53)%

0.31

0.98

(68)%

Adjusted diluted earnings per

share

0.21

0.45

(53)%

0.32

0.99

(68)%

Weighted average diluted shares

outstanding

175.8

178.7

(2.9)

176.2

178.9

(2.7)

Enterprise Results

Enterprise income from operations for the second quarter of 2024

was $51.0 million, a decrease of $52.8 million, or 51%, compared to

the same quarter in 2023. Diluted earnings per share in the second

quarter of 2024 was $0.20 compared to $0.43 in the prior year.

Gains on the sales of transportation equipment were $9.9 million

lower compared to the same quarter in 2023.

Cash Flow and Capitalization

At June 30, 2024, the Company had $265.0 million outstanding on

total debt and finance lease obligations compared to $302.1 million

as of December 31, 2023. The Company had cash and cash equivalents

of $103.2 million and $102.4 million as of June 30, 2024 and

December 31, 2023, respectively.

The Company’s cash provided by operating activities for the

second quarter of 2024 increased year over year, while net capital

expenditures were lower year over year largely due to reduced

purchases of transportation equipment. As of June 30, 2024, year to

date free cash flow increased $93.5 million compared to the same

period in 2023.

In February 2023, the Company announced the approval of a $150.0

million stock repurchase program. As of June 30, 2024, the Company

had repurchased 3.6 million Class B shares for a total of $91.9

million under the program to date. In April 2024, the Company’s

Board of Directors declared a $0.095 dividend payable to

shareholders of record as of June 7, 2024, which was paid on July

9, 2024. On July 29, 2024, the Company’s Board of Directors

declared a $0.095 dividend payable to shareholders of record as of

September 13, 2024, expected to be paid on October 8, 2024. As of

June 30, 2024, the Company had returned $33.3 million in the form

of dividends to shareholders year to date.

Results of Operations – Reportable Segments

Truckload

Truckload revenues (excluding fuel surcharge) for the second

quarter of 2024 were $540.3 million, an increase of $7.6 million,

compared to the same quarter in 2023. Results were driven by

organic and acquisitive growth in dedicated, partially offset by

lower network pricing and volumes year over year. Truckload revenue

per truck per week was $3,933, a decrease of 2% compared to the

same quarter in 2023. Network revenue per truck per week increased

3% from the prior quarter, while Dedicated revenue per truck per

week improved 2%.

Truckload income from operations was $30.7 million in the second

quarter of 2024, a decrease of $34.1 million, or 53%, compared to

the same quarter in 2023 primarily due to lower network pricing and

volumes, as well as decreased gains on the sale of transportation

equipment. Truckload operating ratio was 94.3% in the second

quarter of 2024 compared to 87.8% in the second quarter of 2023. A

level of seasonal freight volumes as well as targeted productivity

actions favorably impacted operating ratio, which improved 290

basis points from the first quarter of 2024.

Intermodal

Intermodal revenues (excluding fuel surcharge) for the second

quarter of 2024 were $253.1 million, a decrease of $7.9 million, or

3%, compared to the same quarter in 2023, largely due to lower

revenue per order compared to the same quarter in 2023. Volumes

were up slightly compared to the same period a year ago.

Intermodal income from operations for the second quarter of 2024

was $14.6 million, a decrease of $9.1 million, or 38%, compared to

the same quarter in 2023. Results were primarily due to lower

revenue per order, partially offset by network management,

operational and dray cost improvements. Intermodal operating ratio

was 94.2% in the second quarter of 2024, compared to 90.9% in the

second quarter of 2023. Volume growth and productivity actions

favorably impacted operating ratio, which improved 300 basis points

from the first quarter of 2024.

Logistics

Logistics revenues (excluding fuel surcharge) for the second

quarter of 2024 were $318.8 million, a decrease of $24.6 million,

or 7%, compared to the same quarter in 2023, driven by decreased

revenue per order and 4% lower brokerage volume compared to the

same quarter in the prior year. Power Only continued to recognize

volume growth year over year as well as momentum from the prior

quarter.

Logistics income from operations for the second quarter of 2024

was $11.2 million, a decrease of $1.6 million, or 13%, compared to

the same quarter in 2023 primarily due to lower brokerage volumes

and decreased net revenue per order. Logistics operating ratio was

96.5% in the second quarter of 2024, compared to 96.3% in the

second quarter of 2023. Effective gross margin management

contributed to the 180 basis point improvement in operating ratio

compared to the first quarter of 2024.

Business Outlook

(in millions, except per share

data)

Current Guidance

Prior Guidance

Adjusted diluted earnings per

share

$0.80 - $0.90

$0.85 - $1.00

Net capital expenditures

$300.0 - $350.0

$350.0 - $400.0

“Our results for the second quarter reflected progress in both

external market dynamics and our continued internal efforts to

restore margins,” said Darrell Campbell, Executive Vice President

and Chief Financial Officer of Schneider. “We are approximately

three quarters of the way through the freight allocation season in

our network businesses and those outcomes have shifted the timing

of achieving the level of pricing improvements that we previously

anticipated. As a result, we are updating our full year 2024

adjusted diluted earnings per share guidance to a range of $0.80 -

$0.90, as well as net capital expenditures guidance to a range of

$300 - $350 million.”

Non-GAAP Financial Measure

The Company has presented certain non-GAAP financial measures,

including revenues (excluding fuel surcharge), adjusted income from

operations, adjusted operating ratio, adjusted net income, adjusted

EBITDA, free cash flow, and adjusted diluted earnings per share.

Management believes the use of non-GAAP measures assists investors

in understanding the business, as further described below. The

non-GAAP information provided is used by Company management and may

not be comparable to similar measures disclosed by other companies.

The non-GAAP measures used herein have limitations as analytical

tools and should not be considered in isolation or as substitutes

for analysis of results as reported under GAAP.

A reconciliation of net income per share to adjusted diluted

earnings per share as projected for 2024 is not provided. Schneider

does not forecast net income per share as the Company cannot,

without unreasonable effort, estimate or predict with certainty

various components of net income. The components of net income that

cannot be predicted include expenses for items that do not relate

to core operating performance, such as costs related to potential

future acquisitions, as well as the related tax impact of these

items. Further, in the future, other items with similar

characteristics to those currently included in adjusted net income,

that have a similar impact on the comparability of periods, and

which are not known at this time may exist and impact adjusted net

income.

About Schneider National, Inc.

Schneider National, Inc. and its subsidiaries (together

“Schneider,” the “Company,” “we,” “us,” or “our”) are among the

largest providers of surface transportation and logistics solutions

in North America. We offer a multimodal portfolio of services and

an array of capabilities and resources that leverage artificial

intelligence, data science, and analytics to provide innovative

solutions that coordinate the timely, safe, and effective movement

of customer products. The Company offers truckload, intermodal, and

logistics services to a diverse customer base throughout the

continental United States, Canada, and Mexico. We were founded in

1935 and have been a publicly held holding company since our IPO in

2017. Our stock is publicly traded on the NYSE under the ticker

symbol SNDR.

Our diversified portfolio of complementary service offerings

enables us to serve the varied needs of our customers and to

allocate capital that maximizes returns across all market cycles

and economic conditions. Our service offerings include

transportation of full-truckload freight, which we directly

transport utilizing either our company-owned transportation

equipment and company drivers, owner-operators, or third-party

carriers under contract with us. We have arrangements with most of

the major North American rail carriers to transport freight in

containers. We also provide customized freight movement,

transportation equipment, labor, systems, and delivery services

tailored to meet individual customer requirements, which typically

involve long-term contracts. These arrangements are generally

referred to as dedicated services and may include multiple pickups

and drops, local deliveries, freight handling, specialized

equipment, and freight network design. In addition, we provide

comprehensive logistics services with a network of thousands of

qualified third-party carriers. We also lease equipment to third

parties through our wholly owned subsidiary Schneider Finance,

Inc., which is primarily engaged in leasing trucks to

owner-operators, including, but not limited to, owner-operators

with whom we contract, and we provide insurance for both company

drivers and owner-operators through our wholly owned insurance

subsidiary.

Conference Call and Webcast Information

The Company will host an earnings conference call today at 10:30

a.m. Eastern Time. The conference call can be accessed by dialing

888-660-6621 toll-free or 646-960-0589 (conference ID: 7923455). A

live webcast of the conference call can also be accessed on the

Investor Relations section of the Company’s website, Schneider.com,

along with the current quarterly investor presentation.

SCHNEIDER NATIONAL, INC. CONSOLIDATED

STATEMENTS OF INCOME (Unaudited) (in millions, except per share

data)

Three Months Ended

Six Months

Ended

June 30,

June 30,

2024

2023

2024

2023

Operating revenues

$

1,316.7

$

1,346.5

$

2,635.7

$

2,775.2

Operating expenses:

Purchased transportation

493.3

531.8

1,002.0

1,094.9

Salaries, wages, and benefits

352.3

325.5

707.4

663.3

Fuel and fuel taxes

100.7

96.8

208.4

209.8

Depreciation and amortization

102.5

93.2

205.3

185.0

Operating supplies and

expenses—net

157.2

140.6

310.8

288.5

Insurance and related

expenses

33.2

25.7

64.3

50.4

Other general expenses

26.5

29.1

57.8

64.9

Total operating expenses

1,265.7

1,242.7

2,556.0

2,556.8

Income from operations

51.0

103.8

79.7

218.4

Other expenses (income):

Interest income

(0.9

)

(2.6

)

(1.7

)

(4.7

)

Interest expense

4.3

2.4

8.3

6.8

Other expense (income)—net

0.6

0.8

1.4

(16.2

)

Total other expenses

(income)—net

4.0

0.6

8.0

(14.1

)

Income before income taxes

47.0

103.2

71.7

232.5

Provision for income taxes

11.7

25.7

17.9

57.0

Net income

$

35.3

$

77.5

$

53.8

$

175.5

Weighted average shares

outstanding

175.5

178.1

175.7

178.1

Basic earnings per share

$

0.20

$

0.44

$

0.31

$

0.99

Weighted average diluted shares

outstanding

175.8

178.7

176.2

178.9

Diluted earnings per share

$

0.20

$

0.43

$

0.31

$

0.98

SCHNEIDER NATIONAL, INC. CONDENSED

CONSOLIDATED BALANCE SHEETS (Unaudited) (in millions)

June 30,

December 31,

2024

2023

Assets

Cash and cash equivalents

$

103.2

$

102.4

Trade accounts receivable—net

551.7

575.7

Other current assets

395.5

432.8

Net property and equipment

2,590.7

2,581.7

Other noncurrent assets

906.8

864.6

Total Assets

$

4,547.9

$

4,557.2

Liabilities and Shareholders’

Equity

Trade accounts payable

$

218.0

$

241.3

Current maturities of debt and

finance lease obligations

139.2

104.5

Other current liabilities

302.1

260.4

Long-term debt and finance lease

obligations

125.8

197.6

Deferred income taxes

577.3

595.7

Other noncurrent liabilities

233.9

200.9

Shareholders’ Equity

2,951.6

2,956.8

Total Liabilities and

Shareholders’ Equity

$

4,547.9

$

4,557.2

SCHNEIDER NATIONAL, INC. CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) (in

millions)

Six Months

Ended

June 30,

2024

2023

Net cash provided by operating

activities

$

280.2

$

303.2

Net cash used in investing

activities

(178.1

)

(364.1

)

Net cash used in financing

activities

(101.3

)

(75.6

)

Net increase (decrease) in cash

and cash equivalents

$

0.8

$

(136.5

)

Net capital expenditures

$

(181.6

)

$

(298.1

)

Schneider National, Inc.

Revenues and Income (Loss) from Operations by Segment

(unaudited)

Revenues by Segment

Three Months Ended

Six Months Ended

June 30,

June 30,

(in millions)

2024

2023

2024

2023

Truckload

$

540.3

$

532.7

$

1,078.4

$

1,069.7

Intermodal

253.1

261.0

500.3

527.1

Logistics

318.8

343.4

643.7

725.6

Other

95.6

78.9

189.9

171.1

Fuel surcharge

148.8

155.6

304.7

334.8

Inter-segment eliminations

(39.9

)

(25.1

)

(81.3

)

(53.1

)

Operating revenues

$

1,316.7

$

1,346.5

$

2,635.7

$

2,775.2

Income (Loss) from Operations by

Segment

Three Months Ended

Six Months Ended

June 30,

June 30,

(in millions)

2024

2023

2024

2023

Truckload

$

30.7

$

64.8

$

45.6

$

127.4

Intermodal

14.6

23.7

21.6

53.7

Logistics

11.2

12.8

16.6

31.3

Other

(5.5

)

2.5

(4.1

)

6.0

Income from operations

$

51.0

$

103.8

$

79.7

$

218.4

Schneider National, Inc. Key

Performance Indicators by Segment (unaudited)

We monitor and analyze a number of KPIs in order to manage our

business and evaluate our financial and operating performance.

Truckload

The following table presents our Truckload segment KPIs for the

periods indicated, consistent with how revenues and expenses are

reported internally for segment purposes.

The two operations that make up our Truckload segment are as

follows:

- Dedicated - Transportation services with equipment

devoted to customers under long-term contracts.

- Network - Transportation services of one-way

shipments.

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Dedicated

Revenues (excluding fuel

surcharge) (1)

$

346.4

$

302.8

$

687.8

$

605.8

Average trucks (2) (3)

6,683

5,973

6,697

5,961

Revenue per truck per week

(4)

$

4,025

$

3,948

$

3,997

$

3,963

Network

Revenues (excluding fuel

surcharge) (1)

$

193.8

$

230.2

$

390.0

$

464.3

Average trucks (2) (3)

3,982

4,390

4,080

4,429

Revenue per truck per week

(4)

$

3,778

$

4,083

$

3,719

$

4,089

Total Truckload

Revenues (excluding fuel

surcharge) (5)

$

540.3

$

532.7

$

1,078.4

$

1,069.7

Average trucks (2) (3)

10,665

10,363

10,777

10,390

Revenue per truck per week

(4)

$

3,933

$

4,005

$

3,892

$

4,017

Average company trucks (3)

9,077

8,400

9,124

8,437

Average owner-operator trucks

(3)

1,588

1,963

1,653

1,953

Trailers (6)

47,154

44,714

47,154

44,714

Operating ratio (7)

94.3

%

87.8

%

95.8

%

88.1

%

(1)

Revenues (excluding fuel surcharge), in millions, exclude

revenue in transit.

(2)

Includes company and owner-operator trucks.

(3)

Calculated based on beginning and end of month counts and

represents the average number of trucks available to haul freight

over the specified timeframe.

(4)

Calculated excluding fuel surcharge and revenue in transit,

consistent with how revenue is reported internally for segment

purposes, using weighted workdays.

(5)

Revenues (excluding fuel surcharge), in millions, include

revenue in transit at the operating segment level and, therefore

does not sum with amounts presented above.

(6)

Includes entire fleet of owned trailers, including trailers with

leasing arrangements between Truckload and Logistics.

(7)

Calculated as segment operating expenses divided by segment

revenues (excluding fuel surcharge) including revenue in transit

and related expenses at the operating segment level.

Intermodal

The following table presents the KPIs for

our Intermodal segment for the periods indicated.

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Orders (1)

103,088

102,622

203,582

203,367

Containers

26,695

27,419

26,695

27,419

Trucks

1,408

1,568

1,408

1,568

Revenue per order (2)

$

2,446

$

2,572

$

2,443

$

2,600

Operating ratio (3)

94.2

%

90.9

%

95.7

%

89.8

%

(1)

Based on delivered rail orders.

(2)

Calculated using rail revenues excluding

fuel surcharge and revenue in transit, consistent with how revenue

is reported internally for segment purposes.

(3)

Calculated as segment operating expenses

divided by segment revenues (excluding fuel surcharge) including

revenue in transit and related expenses at the operating segment

level.

Logistics

The following table presents the KPI for

our Logistics segment for the periods indicated.

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Operating ratio (1)

96.5

%

96.3

%

97.4

%

95.7

%

(1)

Calculated as segment operating expenses

divided by segment revenues (excluding fuel surcharge) including

revenue in transit and related expenses at the operating segment

level.

Schneider National, Inc.

Reconciliation of Non-GAAP Financial Measures

(unaudited)

In this earnings release, we present the following non-GAAP

financial measures: (1) revenues (excluding fuel surcharge), (2)

adjusted income from operations, (3) adjusted operating ratio, (4)

adjusted net income, (5) adjusted EBITDA, (6) free cash flow, and

(7) adjusted diluted earnings per share. We also provide

reconciliations of these measures to the most directly comparable

financial measures calculated and presented in accordance with

GAAP.

Management believes the use of each of these non-GAAP measures

assists investors in understanding our business by (1) removing the

impact of items from our operating results that, in our opinion, do

not reflect our core operating performance, (2) providing investors

with the same information our management uses internally to assess

our core operating performance, and (3) presenting comparable

financial results between periods. In addition, in the case of

revenues (excluding fuel surcharge), we believe the measure is

useful to investors because it isolates volume, price, and cost

changes directly related to industry demand and the way we operate

our business from the external factor of fluctuating fuel prices

and the programs we have in place to manage such fluctuations.

Fuel-related costs and their impact on our industry are important

to our results of operations, but they are often independent of

other, more relevant factors affecting our results of operations

and our industry. Free cash flow is used as a measure to assess

overall liquidity and does not represent residual cash flow

available for discretionary expenditures as it excludes certain

mandatory expenditures such as repayment of maturing debt.

Although we believe these non-GAAP measures are useful to

investors, they have limitations as analytical tools and may not be

comparable to similar measures disclosed by other companies. You

should not consider the non-GAAP measures in this report in

isolation or as substitutes for, or alternatives to, analysis of

our results as reported under GAAP. The exclusion of unusual or

infrequent items or other adjustments reflected in the non-GAAP

measures should not be construed as an inference that our future

results will not be affected by unusual or infrequent items or by

other items similar to such adjustments. Our management compensates

for these limitations by relying primarily on our GAAP results in

addition to using the non-GAAP measures.

Adjustments to arrive at non-GAAP measures are made at the

enterprise level, with the exception of fuel surcharge revenues,

which are not included in segment revenues.

Revenues (excluding fuel surcharge)

We define “revenues (excluding fuel surcharge)” as operating

revenues less fuel surcharge revenues, which are excluded from

revenues at the segment level. Included below is a reconciliation

of operating revenues, the most closely comparable GAAP financial

measure, to revenues (excluding fuel surcharge).

Three Months Ended

Six Months Ended

June 30,

June 30,

(in millions)

2024

2023

2024

2023

Operating revenues

$

1,316.7

$

1,346.5

$

2,635.7

$

2,775.2

Less: Fuel surcharge revenues

148.8

155.6

304.7

334.8

Revenues (excluding fuel

surcharge)

$

1,167.9

$

1,190.9

$

2,331.0

$

2,440.4

Adjusted income from operations

We define “adjusted income from operations” as income from

operations, adjusted to exclude material items that do not reflect

our core operating performance. Included below is a reconciliation

of income from operations, which is the most directly comparable

GAAP measure, to adjusted income from operations. Excluded items

for the periods shown are explained in the table and notes

below.

Three Months Ended

Six Months Ended

June 30,

June 30,

(in millions)

2024

2023

2024

2023

Income from operations

$

51.0

$

103.8

$

79.7

$

218.4

Litigation and audit assessments

(1)

—

2.9

—

2.9

Amortization of intangible assets

(2)

1.3

—

2.6

—

Adjusted income from

operations

$

52.3

$

106.7

$

82.3

$

221.3

(1)

Includes $2.9 million for the three and

six months ended June 30, 2023 for charges related to adverse audit

assessments for prior period state sales tax on rolling stock

equipment used within that state. Refer to Note 12, Commitments and

Contingencies, for additional details.

(2)

Amortization expense related to intangible

assets acquired through recent business acquisitions. As we

finalized our purchase accounting adjustments related to intangible

assets, we made the decision to exclude the related amortization

expense from adjusted income from operations and adjusted net

income beginning in the fourth quarter of 2023. Although intangible

assets contribute to our revenue generation, the amortization of

intangible assets does not directly relate to transportation

services provided to our customers.

Adjusted operating ratio

We define “adjusted operating ratio” as operating expenses,

adjusted to exclude material items that do not reflect our core

operating performance, divided by revenues (excluding fuel

surcharge). Included below is a reconciliation of operating ratio,

which is the most directly comparable GAAP measure, to adjusted

operating ratio.

Three Months Ended

Six Months Ended

June 30,

June 30,

(in millions, except ratios)

2024

2023

2024

2023

Total operating expenses

$

1,265.7

$

1,242.7

$

2,556.0

$

2,556.8

Divide by: Operating revenues

1,316.7

1,346.5

2,635.7

2,775.2

Operating ratio

96.1

%

92.3

%

97.0

%

92.1

%

Total operating expenses

$

1,265.7

$

1,242.7

$

2,556.0

$

2,556.8

Adjusted for:

Fuel surcharge revenues

(148.8

)

(155.6

)

(304.7

)

(334.8

)

Litigation and audit

assessments

—

(2.9

)

—

(2.9

)

Amortization of intangible

assets

(1.3

)

—

(2.6

)

—

Adjusted total operating

expenses

$

1,115.6

$

1,084.2

$

2,248.7

$

2,219.1

Operating revenues

$

1,316.7

$

1,346.5

$

2,635.7

$

2,775.2

Less: Fuel surcharge revenues

148.8

155.6

304.7

334.8

Revenues (excluding fuel

surcharge)

$

1,167.9

$

1,190.9

$

2,331.0

$

2,440.4

Adjusted operating ratio

95.5

%

91.0

%

96.5

%

90.9

%

Adjusted net income

We define “adjusted net income” as net income, adjusted to

exclude material items that do not reflect our core operating

performance. Included below is a reconciliation of net income,

which is the most directly comparable GAAP measure, to adjusted net

income.

Three Months Ended

Six Months Ended

June 30,

June 30,

(in millions)

2024

2023

2024

2023

Net income

$

35.3

$

77.5

$

53.8

$

175.5

Litigation and audit

assessments

—

2.9

—

2.9

Amortization of intangible

assets

1.3

—

2.6

—

Income tax effect of non-GAAP

adjustments (1)

(0.3

)

(0.7

)

(0.6

)

(0.7

)

Adjusted net income

$

36.3

$

79.7

$

55.8

$

177.7

(1)

Our estimated tax rate on non-GAAP items

is determined annually using the applicable consolidated federal

and state effective tax rate, modified to remove the impact of tax

credits and adjustments that are not applicable to the specific

items. Due to the differences in the tax treatment of items

excluded from non-GAAP income, as well as the methodology applied

to our estimated annual tax rates as described above, our estimated

tax rate on non-GAAP items may differ from our GAAP tax rate and

from our actual tax liabilities.

Adjusted EBITDA

We define “adjusted EBITDA” as net income, adjusted to exclude

net interest expense, our provision for income taxes, depreciation

and amortization, and certain items that do not reflect our core

operating performance. Included below is a reconciliation of net

income, which is the most directly comparable GAAP measure, to

adjusted EBITDA.

Three Months Ended

Six Months Ended

June 30,

June 30,

(in millions)

2024

2023

2024

2023

Net income

$

35.3

$

77.5

$

53.8

$

175.5

Interest expense (income),

net

3.4

(0.2

)

6.6

2.1

Provision for income taxes

11.7

25.7

17.9

57.0

Depreciation and amortization

102.5

93.2

205.3

185.0

Litigation and audit

assessments

—

2.9

—

2.9

Adjusted EBITDA

$

152.9

$

199.1

$

283.6

$

422.5

Free cash flow

We define “free cash flow” as net cash provided by operating

activities less net cash used for capital expenditures.

Three Months Ended

June 30,

June 30,

(in millions)

2024

2023

2024

2023

Net cash provided by operating

activities

$

182.6

$

120.1

$

280.2

$

303.2

Purchases of transportation

equipment

(97.1

)

(201.3

)

(220.4

)

(344.4

)

Purchases of other property and

equipment

(7.4

)

(12.9

)

(19.4

)

(25.3

)

Proceeds from sale of property

and equipment

34.8

37.0

58.2

71.6

Net capital expenditures

(69.7

)

(177.2

)

(181.6

)

(298.1

)

Free cash flow

$

112.9

$

(57.1

)

$

98.6

$

5.1

Adjusted diluted earnings per share

(1)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Diluted earnings per share

$

0.20

$

0.43

$

0.31

$

0.98

Non-GAAP adjustments, tax

effected

0.01

0.01

0.01

0.01

Adjusted diluted earnings per

share

$

0.21

$

0.45

$

0.32

$

0.99

(1)

Table may not sum due to rounding.

Special Note Regarding Forward-Looking Statements

This earnings release contains forward-looking statements,

within the meaning of the safe harbor provisions of the United

States Private Securities Litigation Reform Act of 1995. These

forward-looking statements reflect the Company’s current

expectations, beliefs, plans, or forecasts with respect to, among

other things, future events and financial performance and trends in

the business and industry. The words “may,” “will,” “could,”

“should,” “would,” “anticipate,” “estimate,” “expect,” “project,”

“intend,” “plan,” “believe,” “prospects,” “potential,” “budget,”

“forecast,” “continue,” “predict,” “seek,” “objective,” “goal,”

“guidance,” “outlook,” “effort,” “target,” and similar words,

expressions, terms, and phrases among others, generally identify

forward-looking statements, which speak only as of the date the

statements were made. Forward-looking statements involve estimates,

expectations, projections, goals, forecasts, assumptions, risks,

and uncertainties. Readers are cautioned that a forward-looking

statement is not a guarantee of future performance and that actual

results could differ materially from those contained in the

forward-looking statement.

The statements in this news release are based on currently

available information and the current expectations, forecasts, and

assumptions of the Company’s management concerning risks and

uncertainties that could cause actual outcomes or results to differ

materially from those outcomes or results that are projected,

anticipated, or implied in these statements. Such risks and

uncertainties include, among others, those discussed in Part I,

Item 1A, “Risk Factors,” of the Company’s Annual Report on Form

10-K filed on February 23, 2024, subsequent Reports on Form 10-Q

and 8-K, and other filings we make with the U.S. Securities and

Exchange Commission. In addition to any such risks, uncertainties,

and other factors discussed elsewhere herein, risks, uncertainties,

and other factors that could cause or contribute to actual results

differing materially from those expressed or implied by the

forward-looking statements include, but are not limited to:

inflation, both in the U.S. and globally; our ability to

successfully manage operational challenges and disruptions, as well

as related federal, state, and local government responses arising

from future pandemics; economic and business risks inherent in the

truckload and transportation industry, including inflation, freight

cycles, and competitive pressures pertaining to pricing, capacity,

and service; our ability to effectively manage truck capacity

brought about by cyclical driver shortages and successfully execute

our yield management strategies; our ability to maintain key

customer and supply arrangements (including dedicated arrangements)

and to manage disruption of our business due to factors outside of

our control, such as natural disasters, acts of war or terrorism,

disease outbreaks, or pandemics; volatility in the market valuation

of our investments in strategic partners and technologies; our

ability to manage and effectively implement our growth and

diversification strategies and cost saving initiatives; our

dependence on our reputation and the Schneider brand and the

potential for adverse publicity, damage to our reputation, and the

loss of brand equity; risks related to demand for our service

offerings; risks associated with the loss of a significant customer

or customers; capital investments that fail to match customer

demand or for which we cannot obtain adequate funding; fluctuations

in the price or availability of fuel, the volume and terms of

diesel fuel purchase agreements, our ability to recover fuel costs

through our fuel surcharge programs, and potential changes in

customer preferences (e.g. truckload vs. intermodal services)

driven by diesel fuel prices; fluctuations in the value and demand

for our used Class 8 heavy-duty tractors and trailers; our ability

to attract and retain qualified drivers and owner-operators; our

reliance on owner-operators to provide a portion of our truck

fleet; our dependence on railroads in the operation of our

intermodal business; service instability, availability, and/or

increased costs from third-party capacity providers used by our

business; changes in the outsourcing practices of our third-party

logistics customers; difficulty in obtaining material, equipment,

goods, and services from our vendors and suppliers; variability in

insurance and claims expenses and the risks of insuring claims

through our captive insurance company; the impact of laws and

regulations that apply to our business, including those that relate

to the environment, taxes, associates, owner-operators, and our

captive insurance company; changes to those laws and regulations

and the increased costs of compliance with existing or future

federal, state, and local regulations; political, economic, and

other risks from cross-border operations and operations in multiple

countries; risks associated with financial, credit, and equity

markets, including our ability to service indebtedness and fund

capital expenditures and strategic initiatives; negative seasonal

patterns generally experienced in the trucking industry during

traditionally slower shipping periods and winter months; risks

associated with severe weather and similar events; significant

systems disruptions, including those caused by cybersecurity events

and firmware defects; exposure to claims and lawsuits in the

ordinary course of business; our ability to adapt to new

technologies and new participants in the truckload and

transportation industry.

The Company undertakes no obligation to publicly release any

revision to its forward looking statements to reflect events or

circumstances after the date of this earnings release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731923548/en/

Steve Bindas, Director of Investor Relations 920-357-SNDR

investor@schneider.com

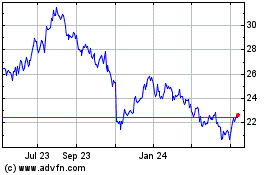

Schneider National (NYSE:SNDR)

Historical Stock Chart

From Nov 2024 to Dec 2024

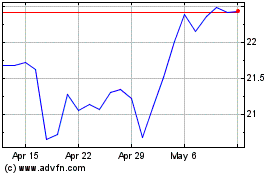

Schneider National (NYSE:SNDR)

Historical Stock Chart

From Dec 2023 to Dec 2024