UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

|

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2024

OR

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period to

Commission File Number: 1-8424

SABINE ROYALTY TRUST

(Exact name of registrant as specified in its charter)

|

|

Texas |

75-6297143 |

( State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer

Identification No.) |

Argent Trust Company 3838 Oak Lawn Ave, Suite 1720 Dallas, Texas 75219-4518 |

(Address of principal executive offices) (Zip Code) |

Registrant’s telephone number, including area code: (855) 588-7839

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Title of each class |

|

Units of Beneficial Interest |

|

SBR |

|

New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☐ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

Large accelerated filer |

☒ |

Accelerated filer |

☐ |

Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes☐ No ☒

Number of units of beneficial interest outstanding at August 8, 2024: 14,579,345

SABINE ROYALTY TRUST

PART I — FINANCIAL INFORMATION

Item 1. Financial Statements.

The condensed financial statements included herein have been prepared by Argent Trust Company, as Trustee (the “Trustee”) of Sabine Royalty Trust (the “Trust”), pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and footnote disclosures normally included in annual financial statements have been condensed or omitted pursuant to such rules and regulations, although the Trustee believes that the disclosures are adequate to make the information presented not misleading. The condensed financial statements of the Trust presented herein are unaudited. It is suggested that these condensed financial statements and notes thereto be read in conjunction with the financial statements and notes thereto included in the Trust’s latest annual report on Form 10-K. The December 31, 2023 condensed statement of assets, liabilities and trust corpus is derived from the audited statement of assets, liabilities and trust corpus as of that date. In the opinion of the Trustee, all adjustments necessary to present fairly the assets, liabilities and trust corpus of the Trust as of June 30, 2024, and the distributable income and the changes in trust corpus for the three-month and six-month periods ended June 30, 2024 and 2023, have been included. The distributable income for such interim periods is not necessarily indicative of the distributable income for the full year. Unless specified otherwise, all amounts included herein are presented in US dollars.

The condensed financial statements as of June 30, 2024, and for the three-month and six-month periods ended June 30, 2024 and 2023, included herein, have been reviewed by Weaver and Tidwell, L.L.P., an independent registered public accounting firm, as stated in their report appearing herein.

|

|

|

Page |

Report of Independent Registered Public Accounting Firm (PCAOB ID Number 410) |

4 |

Condensed Statements of Assets, Liabilities, and Trust Corpus |

5 |

Condensed Statements of Distributable Income (Unaudited) |

6 |

Condensed Statements of Changes in Trust Corpus (Unaudited) |

7 |

|

|

All financial statement schedules are omitted as they are inapplicable or the required information has been included in the consolidated financial statements or notes thereto. |

|

Report of Independent Registered Public Accounting Firm

To the Holders of Sabine Royalty Trust

and Argent Trust Company, Trustee

Dallas, Texas

Results of Review of Interim Financial Statements

We have reviewed the accompanying condensed statements of assets, liabilities and trust corpus of Sabine Royalty Trust (the Trust) as of June 30, 2024 and the related condensed statements of distributable income and changes in trust corpus for the three-month and six-month periods ended June 30, 2024 and 2023, and the related notes (collectively referred to as the “condensed interim financial statements” or “interim financial information”). Based on our reviews, we are not aware of any material modifications that should be made to the accompanying condensed interim financial statements for them to be in conformity with the modified cash basis of accounting, which is a comprehensive basis of accounting other than accounting principles generally accepted in the United States of America.

As described in Note 2 to the condensed interim financial statements, these condensed interim financial statements were prepared on a modified cash basis of accounting, which is a comprehensive basis of accounting other than accounting principles generally accepted in the United States of America.

We have previously audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (“PCAOB”), the statement of assets, liabilities, and trust corpus as of December 31, 2023, and the related statements of distributable income and changes in trust corpus for the year then ended (not presented herein); and in our report dated February 29, 2024 we expressed an unqualified opinion on those financial statements. In our opinion, the information set forth in the accompanying condensed statement of assets, liabilities and trust corpus as of December 31, 2023, is fairly stated, in all material respects, in relation to the statement of assets, liabilities, and trust corpus from which it has been derived.

Basis for Review Results

These condensed interim financial statements are the responsibility of the Trustee. We conducted our reviews in accordance with the standards of the PCAOB. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Trust in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

A review of interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with the standards of the PCAOB, the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an opinion.

WEAVER AND TIDWELL, L.L.P.

Dallas, Texas

August 8, 2024

SABINE ROYALTY TRUST

CONDENSED STATEMENTS OF ASSETS, LIABILITIES, AND TRUST CORPUS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30,

2024 |

|

|

December 31, |

|

|

|

Note |

|

|

(UNAUDITED) |

|

|

2023 |

|

Assets |

|

|

|

|

|

|

|

|

|

Cash and short-term investments |

|

|

|

|

$ |

8,362,564 |

|

|

$ |

9,342,423 |

|

Royalty interests in oil and gas properties (less accumulated amortization of $22,310,118

and $22,299,783 at June 30, 2024 and December 31, 2023) |

|

|

|

|

|

85,067 |

|

|

|

95,402 |

|

Total |

|

|

|

|

$ |

8,447,631 |

|

|

$ |

9,437,825 |

|

Liabilities and Trust Corpus |

|

|

|

|

|

|

|

|

|

Trust expenses payable |

|

|

4 |

|

|

$ |

207,851 |

|

|

$ |

508,489 |

|

Other payables |

|

|

4 |

|

|

|

538,607 |

|

|

|

370,430 |

|

Total liabilities |

|

|

|

|

|

746,458 |

|

|

|

878,919 |

|

Contingencies |

|

|

6 |

|

|

|

|

|

|

|

Trust corpus — 14,579,345 units of beneficial interest authorized and outstanding |

|

|

|

|

|

7,701,173 |

|

|

|

8,558,906 |

|

Total |

|

|

|

|

$ |

8,447,631 |

|

|

$ |

9,437,825 |

|

The accompanying notes are an integral part of these condensed financial statements.

SABINE ROYALTY TRUST

CONDENSED STATEMENTS OF DISTRIBUTABLE INCOME (UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

|

Notes |

|

2024 |

|

|

2023 |

|

Royalty Income |

|

|

|

$ |

22,607,108 |

|

|

$ |

17,433,846 |

|

Interest Income |

|

|

|

|

175,353 |

|

|

|

154,709 |

|

Total |

|

|

|

|

22,782,461 |

|

|

|

17,588,555 |

|

General and administrative expenses |

|

|

|

|

(703,464 |

) |

|

|

(889,719 |

) |

Distributable Income |

|

|

|

$ |

22,078,997 |

|

|

$ |

16,698,836 |

|

Distributable Income per unit (14,579,345 units) |

|

1,3,5 |

|

$ |

1.51 |

|

|

$ |

1.15 |

|

The accompanying notes are an integral part of these condensed financial statements.

SABINE ROYALTY TRUST

CONDENSED STATEMENTS OF DISTRIBUTABLE INCOME (UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended

June 30, |

|

|

|

Notes |

|

2024 |

|

|

2023 |

|

Royalty Income |

|

|

|

$ |

43,365,913 |

|

|

$ |

44,569,132 |

|

Interest Income |

|

|

|

|

327,279 |

|

|

|

401,725 |

|

Total |

|

|

|

|

43,693,192 |

|

|

|

44,970,857 |

|

General and administrative expenses |

|

|

|

|

(1,692,768 |

) |

|

|

(1,995,521 |

) |

Distributable Income |

|

|

|

$ |

42,000,424 |

|

|

$ |

42,975,336 |

|

Distributable Income per unit (14,579,345 units) |

|

1,3,5 |

|

$ |

2.88 |

|

|

$ |

2.95 |

|

The accompanying notes are an integral part of these condensed financial statements.

SABINE ROYALTY TRUST CONDENSED

STATEMENTS OF CHANGES IN TRUST CORPUS (UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

|

Note |

|

|

2024 |

|

|

2023 |

|

Trust corpus, beginning of period |

|

|

|

|

$ |

9,987,642 |

|

|

$ |

12,395,493 |

|

Amortization of royalty interests |

|

|

|

|

|

(5,276 |

) |

|

|

(4,916 |

) |

Distributable income |

|

|

|

|

|

22,078,997 |

|

|

|

16,698,836 |

|

Distributions |

|

|

3 |

|

|

|

(24,360,190 |

) |

|

|

(22,225,483 |

) |

Trust corpus, end of period |

|

|

|

|

$ |

7,701,173 |

|

|

$ |

6,863,930 |

|

Distributions per unit (14,579,345 units) |

|

|

3 |

|

|

$ |

1.67 |

|

|

$ |

1.52 |

|

The accompanying notes are an integral part of these condensed financial statements.

SABINE ROYALTY TRUST CONDENSED

STATEMENTS OF CHANGES IN TRUST CORPUS (UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended

June 30, |

|

|

|

Note |

|

|

2024 |

|

|

2023 |

|

Trust corpus, beginning of period |

|

|

|

|

$ |

8,558,906 |

|

|

$ |

11,409,506 |

|

Amortization of royalty interests |

|

|

|

|

|

(10,335 |

) |

|

|

(10,762 |

) |

Distributable income |

|

|

|

|

|

42,000,424 |

|

|

|

42,975,336 |

|

Distributions |

|

|

3 |

|

|

|

(42,847,822 |

) |

|

|

(47,510,150 |

) |

Trust corpus, end of period |

|

|

|

|

$ |

7,701,173 |

|

|

$ |

6,863,930 |

|

Distributions per unit (14,579,345 units) |

|

|

3 |

|

|

$ |

2.94 |

|

|

$ |

3.26 |

|

The accompanying notes are an integral part of these condensed financial statements.

NOTES TO CONDENSED FINANCIAL STATEMENTS (UNAUDITED)

1. TRUST ORGANIZATION AND PROVISIONS

Sabine Royalty Trust (the “Trust”) was established by the Sabine Corporation Royalty Trust Agreement (the “Trust Agreement”), made and entered into effective as of December 31, 1982, to receive a distribution from Sabine Corporation (“Sabine”) of royalty and mineral interests, including landowner’s royalties, overriding royalty interests, minerals (other than executive rights, bonuses and delay rentals), production payments and any other similar, nonparticipator interests (the "Royalties"), in certain producing and proved undeveloped oil and gas properties located in Florida, Louisiana, Mississippi, New Mexico, Oklahoma and Texas (the “Royalty Properties”).

Certificates evidencing units of beneficial interest (the “Units”) in the Trust were mailed on December 31, 1982, to Sabine’s shareholders of record on December 23, 1982, on the basis of one Unit for each share of Sabine’s outstanding common stock.

In May 1988, Sabine was acquired by Pacific Enterprises. Through a series of mergers, Sabine was merged into Pacific Enterprises Oil Company (USA) (“Pacific (USA)”), which in turn was merged and consolidated into Sempra Energy, effective January 1, 1993. As of August 1, 2006, Sempra Energy sold its various interests and rights to Providence Energy Corporation (“PEC”). PEC in turn transferred its interests and rights to RJ Holdings, Inc. (“RJ Holdings”) as of June 1, 2021. These transactions had no effect on the Units. RJ Holdings, as successor to Sabine, has assumed by operation of law all of Sabine’s rights and obligations with respect to the Trust. The Units are listed and traded on the New York Stock Exchange.

In connection with the transfer of the Royalties to the Trust upon its formation, Sabine had reserved to itself all executive rights, including rights to execute leases and to receive bonuses and delay rentals. Through a series of mergers, Sabine was merged into Pacific (USA), which in turn was merged and consolidated into Sempra Energy, effective January 1, 1993. In January 1993, Pacific (USA) completed the sale of substantially all of Pacific (USA)’s producing oil and gas assets to Hunt Oil Company. The sale did not include executive rights relating to the Royalty Properties, and Pacific (USA)’s ownership of such rights was not affected by the sale. The Trustee currently reviews all leases executed on the Trust’s behalf.

The wells on the properties conveyed to the Trust are operated by many companies including large, established companies such as BP Amoco, Chevron, ConocoPhillips and ExxonMobil. The Trustee believes these operators utilize the recovery methods best suited for the particular formations on which the properties are located.

Argent Trust Company (the “Trustee”), acts as trustee of the Trust. The terms of the Trust Agreement provide, among other things, that:

•The Trust shall not engage in any business or commercial activity of any kind or acquire assets other than those initially transferred to the Trust.

•The Trustee may not sell all or any part of its assets unless approved by the holders of a majority of the outstanding Units in which case the sale must be for cash and the proceeds, after satisfying all existing liabilities, promptly distributed to Unit holders.

•The Trustee may establish a cash reserve for the payment of any liability that is contingent or uncertain in amount or that otherwise is not currently due or payable.

•The Trustee will use reasonable efforts to cause the Trust and the Unit holders to recognize income and expenses on monthly record dates.

•The Trustee is authorized to borrow funds to pay liabilities of the Trust provided that such borrowings are repaid in full before any further distributions are made to Unit holders.

•The Trustee will make monthly cash distributions to Unit holders of record on the monthly record date (see Note 3).

Effective October 19, 2017, Simmons First National Corporation (“SFNC”) completed its acquisition of First Texas BHC, Inc., the parent company of Southwest Bank. SFNC is the parent of Simmons Bank. SFNC merged Southwest Bank with Simmons Bank effective February 20, 2018.

On November 4, 2021, Simmons Bank, as trustee, announced that it had entered into an agreement with Argent Trust Company, a Tennessee chartered trust company (“Argent”), pursuant to which Simmons Bank would be resigning as trustee of the Trust and would nominate Argent as successor trustee of the Trust. Simmons Bank’s resignation as trustee, and Argent’s appointment as successor trustee, became effective December 30, 2022.

The defined term “Trustee” as used herein shall refer to Southwest Bank for periods from May 30, 2014 through February 19, 2018, shall refer to Simmons Bank for periods on and after February 20, 2018 through December 29, 2022, and shall refer to Argent for periods on and after December 30, 2022.

Because of the passive nature of the Trust and the restrictions and limitations on the powers and activities of the Trustee contained in the Trust Agreement, the Trustee does not consider any of the officers and employees of the Trustee to be “officers” or “executive officers” of the Trust as such terms are defined under applicable rules and regulations adopted under the Securities Exchange Act of 1934.

The proceeds of production from the Royalty Properties are receivable from hundreds of separate payors. In order to facilitate creation of the Trust and to avoid the administrative expense and inconvenience of daily reporting to Unit holders, the conveyances by Sabine of the Royalties

located in five of the six states provided for the execution of an escrow agreement by Sabine and the initial trustee of the Trust, in its capacities as trustee of the Trust and as escrow agent. The conveyances by Sabine of the Royalties located in Louisiana provided for the execution of a substantially identical escrow agreement by Sabine and a Louisiana bank in the capacities of escrow agent and of trustee under the name of Sabine Louisiana Royalty Trust. Sabine Louisiana Royalty Trust, the sole beneficiary of which is the Trust, was established in order to avoid uncertainty under Louisiana law as to the legality of the Trustee’s holding record title to the Royalties located in Louisiana. The Trust now only has one escrow agent, which is the Trustee, and a single escrow agreement.

Pursuant to the terms of the escrow agreement and the conveyances of the properties by Sabine, the proceeds of production from the Royalty Properties for each calendar month, and interest thereon, are collected by the Trustee, as escrow agent, and are paid to and received by the Trust only on the next monthly record date. The Trustee, as escrow agent, has agreed to endeavor to assure that it incurs and pays expenses and fees for each calendar month only on the next monthly record date. The Trust Agreement also provides that the Trustee is to endeavor to assure that income of the Trust will be accrued and received and expenses of the Trust will be incurred and paid only on each monthly record date. Assuming that the escrow agreement is recognized for federal income tax purposes and that the Trustee is able to control the timing of income and expenses, as stated above, cash and accrual basis Unit holders should be treated as realizing income only on each monthly record date. The Trustee is treating the escrow agreement as effective for federal income tax purposes. However, for financial reporting purposes, royalty and interest income are recorded in the calendar month in which the amounts are received by either the escrow agent or the Trust.

Distributable income as determined for financial reporting purposes for a given quarter will not usually equal the sum of distributions made during that quarter. Distributable income for a given quarter will approximate the sum of the distributions made during the last two months of such quarter and the first month of the next quarter.

2. ACCOUNTING POLICIES

Basis of Accounting

The financial statements of the Trust are prepared on the following basis and are not intended to present financial position and results of operations in conformity with accounting principles generally accepted in the United States of America (“GAAP”):

•Royalty income, net of severance and ad valorem taxes, and interest income are recognized in the month in which amounts are received by the Trust, pending verification of ownership and title.

•Trust expenses, consisting principally of routine general and administrative costs, include payments made during the accounting period. Expenses are accrued to the extent of amounts that become payable on the next monthly record date following the end of an accounting period. Reserves for liabilities that are contingent or uncertain in amount may also be established if considered necessary.

•Royalties that are producing properties are amortized using the unit-of-production method. This amortization is shown as a reduction of Trust corpus.

•Distributions to Unit holders are recognized when declared by the Trustee (see Note 3).

The financial statements of the Trust differ from financial statements prepared in conformity with accounting principles generally accepted in the United States of America because of the following:

•Royalty income is recognized in the month received, pending verification of ownership and title, rather than in the month of production.

•Expenses other than those expected to be paid on the following monthly record date are not accrued.

•Amortization of the Royalties is shown as a reduction to Trust corpus and not as a charge to operating results.

•Reserves may be established for contingencies that would not be recorded under accounting principles generally accepted in the United States of America.

This comprehensive basis of accounting other than GAAP corresponds to the accounting permitted for royalty trusts by the U.S. Securities and Exchange Commission, as specified by Staff Accounting Bulletin Topic 12:E, Financial Statements of Royalty Trusts.

Use of Estimates

The preparation of financial statements in conformity with the basis of accounting described above requires the Trustee to make estimates and assumptions that affect reported amounts of certain assets, liabilities, revenues and expenses as of and for the reporting periods. Actual results may differ from such estimates.

Distributable Income per Unit

Basic distributable income per Unit is computed by dividing distributable income by the weighted average number of Units outstanding. Distributable income per Unit assuming dilution is computed by dividing distributable income by the weighted average number of Units and equivalent Units outstanding. The Trust had no equivalent Units outstanding for any period presented. Therefore, basic distributable income per Unit and distributable income per Unit assuming dilution are the same.

New Accounting Pronouncements

There are no new pronouncements that are expected to have a significant impact on the Trust’s financial statements.

Federal Tax Considerations

The Internal Revenue Service has ruled that the Trust is classified as a grantor trust for federal income tax purposes and therefore is not subject to federal income tax at the trust level. The Unit holders are considered, for federal income tax purposes, to own the Trust’s income and principal as though no trust were in existence. Accordingly, no provision for federal income tax expense has been made in these financial statements. The income of the Trust will be deemed to have been received or accrued by each Unit holder at the time such income is received or accrued by the Trust (on the applicable monthly record date) if the escrow arrangement discussed in Note 1 to these financial statements is respected by the Internal Revenue Service. In the absence of the escrow arrangement, Unit holders would be deemed to receive or accrue income from production from the Royalty Properties (and interest income) on a daily basis, in accordance with their method of accounting, as the proceeds from production and interest thereon were received or accrued by the Trust. The Trustee is treating the escrow arrangement as effective for federal income tax purposes and furnishes tax information to Unit holders on that basis.

State Tax Considerations

The Trust holds properties located in Florida, Louisiana, Mississippi, New Mexico, Oklahoma, and Texas. Unit holders should consult the Trust’s latest annual report on Form 10-K for a summary of tax matters.

Florida does not impose an individual income tax. Florida imposes an income tax on resident and nonresident corporations (except for S corporations not subject to the built-in-gains tax or passive investment income tax), which will apply to royalty income allocable to a corporate Unit holder from properties located within Florida.

Louisiana, Mississippi, New Mexico and Oklahoma each impose an income tax applicable to both resident and nonresident individuals and/or corporations (subject to certain exceptions for S corporations and limited liability companies, depending on their treatment for federal tax purposes), which will apply to royalty income allocable to a Unit holder from properties located within these states. New Mexico and Oklahoma impose a withholding tax on payments to nonresidents of oil and gas proceeds derived from royalty interests. To reduce the administrative burden imposed by these rules, the Trustee has opted to allow the payors of oil and gas proceeds to withhold on royalty payments made to the Trust. The Trust files New Mexico and Oklahoma tax returns, obtains a refund, and distributes that refund to Unit holders. Unit holders who transfer their Units before either the New Mexico or Oklahoma tax refunds are received by the Trust or after the refunds are received but before the next monthly record date will not receive any portion of the refund. As a result, such Unit holders may effectively incur a double tax — first, through the reduced distribution received from the Trust (as withholding at the Trust level reduces the amount of cash available for distribution) and second, by the tax payment made directly to New Mexico or Oklahoma taxing authorities with the filing of their New Mexico or Oklahoma income tax returns.

Texas does not impose an individual income tax. Texas imposes a franchise tax at a rate of 0.75% on gross revenues less certain deductions, as specifically set forth in the Texas franchise tax statutes. Entities subject to the Texas franchise tax generally include trusts and most other types of entities that provide limited liability protection, unless otherwise exempt. Trusts that receive at least 90% of their federal gross income from certain passive sources, including royalties from mineral properties and other non-operated mineral interest income, and do not receive more than 10% of their income from operating an active trade or business generally are exempt from the Texas franchise tax as “passive entities.” The Trust has been and expects to continue to be exempt from Texas franchise tax as a passive entity. Because the Trust should be exempt from Texas franchise tax at the Trust level as a passive entity, each Unit holder that is a taxable entity under the Texas franchise tax generally will be required to include its portion of Trust revenues in its own Texas franchise tax computation. This revenue is sourced to Texas under provisions of the Texas Administrative Code providing that such income is sourced according to the principal place of business of the Trust, which is Texas.

Unit holders should consult their tax advisor regarding the possible state tax implications of owning Trust Units.

3. DISTRIBUTION TO UNIT HOLDERS

The amount to be distributed to Unit holders (“Monthly Income Amount”) is determined on a monthly basis. The Monthly Income Amount is an amount equal to the sum of cash received by the Trust during a monthly period (the period commencing on the day after a monthly record date and continuing through and including the next succeeding monthly record date) attributable to the Royalties, any reduction in cash reserves and any other cash receipts of the Trust, including interest, reduced by the sum of liabilities paid and any increase in cash reserves. Due to the fact that oil and natural gas prices have been unusually volatile in recent history, the Trustee maintains an expense reserve. The expense reserve was established to allow the Trustee to pay general and administrative expenses even if there were not sufficient funds generated from monthly royalty income to pay such expenses. Unit holders of record as of the monthly record date (the 15th day of each calendar month except in limited circumstances) are entitled to have distributed to them the calculated Monthly Income Amount for such month on or before 10 business days after the monthly record date. The Monthly Income Amount per Unit is declared by the Trust no later than 10 days prior to the monthly record date.

The cash received by the Trust from purchasers of the Trust’s oil and gas production consists of gross sales of production less applicable severance taxes.

4. PAYABLES

Payables consist primarily of royalty receipts suspended pending verification of ownership interest or title, as well as amounts the Trustee has reserved for payments of other expenses.

The Trustee believes that these payables represent an ordinary operating condition of the Trust and that such payables will be paid or released in the normal course of business with the exception of amounts reserved for payment of expenses.

5. SUBSEQUENT EVENTS

Subsequent to June 30, 2024, the Trust declared the following distributions:

|

|

|

|

|

|

|

|

|

Notification

Date |

|

Monthly Record

Date |

|

Payment

Date |

|

Distribution

per Unit |

|

July 5, 2024 |

|

July 15, 2024 |

|

July 29, 2024 |

|

$ |

0.379040 |

|

August 5, 2024 |

|

August 15, 2024 |

|

August 29, 2024 |

|

$ |

0.450890 |

|

6. CONTINGENCIES

Contingencies related to the Royalty Properties that are unfavorably resolved would generally be reflected by the Trust as reductions to future royalty income payments to the Trust with corresponding reductions to cash distributions to Unit holders. The Trustee is not aware of any such items as of June 30, 2024.

* * * * *

Item 2. Trustee’s Discussion and Analysis of Financial Condition and Results of Operations.

Liquidity and Capital Resources

The Trust makes monthly distributions to the holders of Units of the excess of the preceding month’s royalty income received over expenses incurred. Upon receipt, royalty income is invested in short-term investments until its subsequent distribution. In accordance with the Trust Agreement, the Trust’s only long-term assets consist of royalty interests in producing and proved undeveloped oil and gas properties. Although the Trust is permitted to borrow funds if necessary to continue its operations, borrowings are not anticipated in the foreseeable future.

Commodity Prices

The Trust’s income and monthly distributions are heavily influenced by commodity prices. Commodity prices may fluctuate widely in response to (i) relatively minor changes in the supply of and demand for oil and natural gas, (ii) market uncertainty and (iii) a variety of additional factors that are beyond the Trustee’s control. The price of oil and natural gas continued to remain soft from the first quarter through the beginning of the third quarter in 2023 due to continued lower demand resulting from higher-than-normal inflation and an oversupply of the commodities. In the latter part of the third quarter of 2023, the price of oil and gas began to increase, due mainly to OPEC cutting oil production and colder weather during the winter. Oil prices have continued to fluctuate during the first six months of 2024, due mainly to weather conditions and geopolitical conditions in Eastern Europe and the Middle East. Factors which may affect commodity prices are discussed below and under “Item 1A—Risk Factors” in the Trust’s Form 10-K for the year ended December 31, 2023. Factors that may impact future commodity prices, including the price of oil and natural gas, include but are not limited to:

•political conditions in major oil producing regions, especially in the Middle East and Eastern Europe, including the conflicts between Russia and Ukraine and Israel and Hamas and Israel and Iran;

•worldwide economic and geopolitical conditions;

•public health concerns, such as COVID-19;

•the supply and price of domestic and foreign crude oil or natural gas;

•the level of consumer demand;

•the price and availability of alternative fuels;

•the proximity to, and capacity of, transportation facilities;

•the effect of worldwide energy conservation measures and governmental policies and regulatory incentives for investment in non-fossil fuel energy sources; and

•the nature and extent of governmental regulation and taxation.

Although we cannot predict the occurrence of events that may affect future commodity prices or the degree to which these prices will be affected, gas royalty income for a given period generally relates to production three months prior to the period and crude oil royalty income for a given period generally relates to production two months prior to the period and will generally approximate current market prices in the geographic region of the production at the time of production. When crude oil and natural gas prices decline, the Trust is affected in two ways. First, distributable income from the Royalty Properties is reduced. Second, exploration and development activity by operators on the Royalty Properties may decline as some projects may become uneconomic and are either delayed or eliminated. It is impossible to predict future crude oil and natural gas price movements, and this reduces the predictability of future cash distributions to Unit holders.

Results of Operations

Distributable income consists of royalty income plus interest income plus any decrease in cash reserves established by the Trustee less general and administrative expenses of the Trust less any increase in cash reserves established by the Trustee. Distributable income for the three months ended June 30, 2024, was $22,078,997, or $1.51 per unit. Royalty income for the three months ended June 30, 2024, amounted to $22,607,108 while interest income was $175,353. General and administrative expenses totaled $703,464 for the three months ended June 30, 2024.

Distributions during the period were $0.535500, $0.597730, and $0.537640 per Unit payable to Unit holders of record on April 15, May 15, and June 17, 2024, respectively.

Royalty income for the quarter ended June 30, 2024, increased approximately $5,173,000 or 30%, compared with the second quarter of 2023. This increase was primarily the result of an increase in both oil and natural gas production ($7.2 million) and in oil prices ($1.3 million), offset by a decrease in natural gas prices ($2.7 million) and increased production taxes, operating expenses, and ad valorem taxes ($0.6 million).

Compared to the preceding quarter ended March 31, 2024 royalty income increased approximately $1,848,000, or 9%, due mainly to increased oil production ($3.7 million), offset by lower oil and natural gas prices ($1.7 million), and lower gas production ($0.1 million). Production taxes, operating expenses, and ad valorem taxes were relatively flat.

Royalty income for the six months ended June 30, 2024, decreased approximately $1,203,000 or 3% compared to the same time period in 2023. This decrease was due mainly to lower natural gas prices ($11.6 million). This decrease was tempered somewhat by an increase in the production of both oil and natural gas ($9.8 million) and lower ad valorem taxes and operating expenses ($0.6 million).

The following tables illustrate average prices received for the periods discussed above and the related oil and gas production volume:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

|

|

|

|

|

June 30, |

|

|

June 30, |

|

|

March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

Production |

|

|

|

|

|

|

|

|

|

Oil (Bbls) |

|

|

220,438 |

|

|

|

159,548 |

|

|

|

174,002 |

|

Gas (Mcfs) |

|

|

3,869,375 |

|

|

|

2,676,099 |

|

|

|

3,934,950 |

|

Average Price |

|

|

|

|

|

|

|

|

|

Oil (per Bbl) |

|

$ |

78.89 |

|

|

$ |

70.83 |

|

|

$ |

80.20 |

|

Gas (per Mcf) |

|

$ |

1.99 |

|

|

$ |

2.98 |

|

|

$ |

2.37 |

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended |

|

|

|

June 30, 2024 |

|

|

June 30, 2023 |

|

Production |

|

|

|

|

|

|

Oil (Bbls) |

|

|

394,440 |

|

|

|

320,351 |

|

Gas (Mcfs) |

|

|

7,804,325 |

|

|

|

6,032,173 |

|

Average Price |

|

|

|

|

|

|

Oil (Bbls) |

|

$ |

79.47 |

|

|

$ |

75.61 |

|

Gas (Mcfs) |

|

$ |

2.18 |

|

|

$ |

4.10 |

|

Gas royalty income received for the three months ended June 30, 2024, related primarily to production for January through March 2024. The average price of gas reported by the Henry Hub for the same time period was $1.93 per Mcf. The average price of gas for the Henry Hub was $1.90 per Mcf for January through June 2024. Oil royalty income for the three months ended June 30, 2024, related primarily to production for February through April 2024. The average price of oil as reported by NYMEX for that time period was $81.42 per barrel. The average price of oil was $79.69 per barrel for January through June 2024. As of July 29, 2024, the average price of gas for the Henry Hub was $1.71 per Mcf and the average price of oil reported by NYMEX was $77.27 per barrel. It is difficult to estimate future prices of oil and gas, and any assumptions concerning future prices may prove to be incorrect.

Interest income for the quarter ended June 30, 2024, increased $20,644 compared with the second quarter of 2023. Compared to the preceding quarter ended March 31, 2024, interest income increased $23,427. Interest income for the six months ended June 30, 2024 decreased approximately $74,446 compared to the same period in 2023. Changes in interest income are the result of changes in interest rates and funds available for investment.

General and administrative expenses for the quarter ended June 30, 2024 decreased approximately $186,300 compared to the same quarter of 2023 due primarily to a decrease in Escrow Agent/Trustee fees of approximately $88,700, unitholder services of $69,500, printing services of $24,200, and professional services of $18,500. These were partially offset by an increases in CDEX services of $11,000, and audit services of $4,200.

Compared to the previous quarter ended March 31, 2024, general and administrative expenses decreased approximately $285,800 primarily due to a decrease related to timing of payment of legal and professional services of approximately $216,000, unitholder services of $57,800, and CDEX account and transfer agent services of $12,000.

General and administrative expenses decreased approximately $302,800 for the six months ended June 30, 2024, compared to the same time period in 2023 due primarily to a decrease in Escrow Agent/Trustee fees of approximately $267,100 and a decrease in professional services of $35,900.

The financial statements of the Trust differ from financial statements prepared in conformity with accounting principles generally accepted in the United States of America because of the following:

•Royalty income is recognized in the month received, pending verification of ownership and title, rather than in the month of production.

•Expenses other than those expected to be paid on the following monthly record date are not accrued.

•Amortization of the Royalties is shown as a reduction to Trust corpus and not as a charge to operating results.

•Reserves may be established for contingencies that would not be recorded under accounting principles generally accepted in the United States of America.

This comprehensive basis of accounting other than GAAP corresponds to the accounting permitted for royalty trusts by the U.S. Securities and Exchange Commission, as specified by Staff Accounting Bulletin Topic 12:E, Financial Statements of Royalty Trusts.

Critical Accounting Policies and Estimates

A disclosure of critical accounting policies and the more significant judgments and estimates used in the preparation of the Trust’s financial statements is included in Item 7 of the Trust’s Annual Report on Form 10-K for the year ended December 31, 2023. There have been no significant changes to the critical accounting policies during the three months ended June 30, 2024.

Distributable Income per Unit

Basic distributable income per Unit is computed by dividing distributable income by the weighted average number of Units outstanding. Distributable income per Unit assuming dilution is computed by dividing distributable income by the weighted average number of Units and equivalent Units outstanding. The Trust had no equivalent Units outstanding for any period presented. Therefore, basic distributable income per Unit and distributable income per Unit assuming dilution are the same.

New Accounting Pronouncements

There are no new pronouncements that are expected to have a significant impact on the Trust’s financial statements.

Forward Looking Statements

This Report includes “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, which are intended to be covered by the safe harbor created thereby. All statements other than statements of historical fact included in this Report are forward-looking statements. Although the Trustee believes that the expectations reflected in such forward-looking statements are reasonable, such expectations are subject to numerous risks and uncertainties and the Trustee can give no assurance that they will prove correct. There are many factors, none of which are within the Trustee’s control, that may cause such expectations not to be realized, including, among other things, factors identified in the Trust’s most recent Annual Report on Form 10-K affecting oil and gas prices and the recoverability of reserves, general economic conditions, actions and policies of petroleum-producing nations and other changes in the domestic and international energy markets.

The Trust has an Internet website and has made available its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to such reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act at http://www.sbr-sabine.com as soon as reasonably practicable after such information is electronically filed with or furnished to the SEC.

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

The Trust invests in no derivative financial instruments and has no foreign operations or long-term debt instruments. Other than the Trust’s ability to periodically borrow money as necessary to pay expenses, liabilities and obligations of the Trust that cannot be paid out of cash held by the Trust, the Trust is prohibited from engaging in borrowing transactions. The amount of any such borrowings is unlikely to be material to the Trust. The Trust periodically holds short-term investments acquired with funds held by the Trust pending distribution to Unit holders and funds held in reserve for the payment of Trust expenses and liabilities. Because of the short-term nature of these borrowings and investments and certain limitations upon the types of such investments which may be held by the Trust, the Trustee believes that the Trust is not subject to any material interest rate risk.

Item 4. Controls and Procedures.

As of the end of the period covered by this report, the Trustee carried out an evaluation of the effectiveness of the design and operation of the Trust’s disclosure controls and procedures pursuant to Exchange Act Rules 13a-15 and 15d-15. Based upon that evaluation, the Trustee concluded that the Trust’s disclosure controls and procedures are effective in recording, processing, summarizing and reporting, on a timely basis, information required to be disclosed by the Trust in the reports that it files or submits under the Securities Exchange Act of 1934 and are effective in ensuring that information required to be disclosed by the Trust in the reports that it files or submits under the Securities Exchange Act of 1934 is accumulated and communicated to the Trustee to allow timely decisions regarding required disclosure. There has not been any change in the Trust’s internal control over financial reporting during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Trust’s internal control over financial reporting.

On May 14, 2013, the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) issued an updated version of its Internal Control – Integrated Framework (the “2013 Framework”). Originally, issued in 1992 (the “1992 Framework”), the framework helps organizations design, implement and evaluate the effectiveness of internal control concepts and simplify their use and application. The Trustee has transitioned fully to the Internal Control — Integrated Framework 2013 and is utilizing this framework in its evaluation of the Trust’s internal control over financial reporting.

PART II — OTHER INFORMATION

Item 1. Legal Proceedings.

Not applicable.

Item 1A. Risk Factors.

Risk factors relating to the Trust are contained in Item 1A of the Trust’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023. No material change to such risk factors has occurred during the three and six months ended June 30, 2024. Items 2-4 not applicable.

Item 5. Other Information.

(c) The Trust does not have any directors or officers, and as a result, no such persons adopted or terminated any Rule 10b5-1 trading arrangement or any non-Rule 10b5-1 trading arrangement, as defined in Item 408(a) of Regulation S-K.

Item 6. Exhibits.

Exhibit Number and Description

|

|

4(a)* |

Sabine Corporation Amended and Restated Royalty Trust Agreement effective as of May 22, 2014 |

|

|

(b)** |

Amendment No. 1 to the Amended and Restated Royalty Trust Agreement of Sabine Royalty Trust, dated May 2, 2022 |

|

|

(c)*** |

Sabine Corporation Louisiana Royalty Trust Agreement effective as of December 31, 1982, by and between Sabine Corporation and Hibernia National Bank in New Orleans, as trustee, and joined by InterFirst Bank Dallas, N.A., as trustee. (P) |

|

|

31 |

Trustee Certification pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

|

|

32 |

Trustee Certification pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

* Exhibit 4(a) is incorporated herein by reference to Exhibit 4(a) of the Registrant’s Quarterly Report on Form 10-Q for the quarter ended June 30,

2014.

** Exhibit 4(b) is incorporated herein by reference to Exhibit 4.1 to the Registrant’s Current Report on Form 8-K, filed May 6, 2022.

*** Exhibit 4(c) is incorporated herein by reference to Exhibit 4(b) of the Registrant’s Annual Report on Form 10-K for the year ended December 31, 1993.

(P) Paper exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

SABINE ROYALTY TRUST |

|

|

|

By: |

|

Argent Trust Company, Trustee |

|

|

|

By: |

|

/s/ Nancy Willis |

|

|

Nancy Willis |

|

|

Director of Royalty Trust Services |

Date: August 8, 2024

(The Trust has no directors or executive officers.)

Exhibit 31

CERTIFICATIONS

I, Nancy Willis, certify that:

1.I have reviewed this quarterly report on Form 10-Q of Sabine Royalty Trust, for which Argent Trust Company acts as Trustee;

2.Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3.Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, distributable income and changes in trust corpus of the registrant as of, and for, the periods presented in this report;

4.I am responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(c) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)), or for causing such controls and procedures to be established and maintained, for the registrant and I have:

a)Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under my supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to me by others within those entities, particularly during the period in which this report is being prepared;

b)Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under my supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes;

c)Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report my conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

d)Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5.I have disclosed, based on my most recent evaluation of internal control over financial reporting, to the registrant’s auditors:

a)All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

b)Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

|

|

|

By: |

|

|

/s/ Nancy Willis |

|

|

Nancy Willis |

|

|

Director of Royalty Trust Services |

|

|

Argent Trust Company |

Date: August 8, 2024

Exhibit 32

CERTIFICATION PURSUANT TO 18 U.S.C. SECTION 1350, AS ADOPTED PURSUANT

TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Quarterly Report of Sabine Royalty Trust (the “Trust”) on Form 10-Q for the quarterly period ended June 30, 2024 as filed with the Securities and Exchange Commission on the date hereof (the “Report”), the undersigned, not in its individual capacity but solely as the trustee of the Trust, certifies pursuant to 18 U.S.C. 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that to its knowledge:

(1)The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended; and

(2)The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Trust.

|

|

ARGENT TRUST COMPANY, TRUSTEE |

FOR SABINE ROYALTY TRUST |

|

|

By: |

/s/ Nancy Willis |

Nancy Willis |

Director of Royalty Trust Services |

Date: August 8, 2024

A signed original of this written statement required by Section 906 has been provided to Sabine Royalty Trust and will be retained by Sabine Royalty Trust and furnished to the Securities and Exchange Commission or its staff upon request.

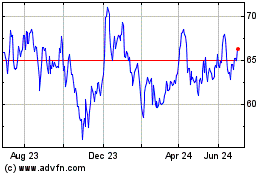

Sabine Royalty (NYSE:SBR)

Historical Stock Chart

From Nov 2024 to Dec 2024

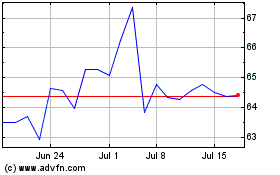

Sabine Royalty (NYSE:SBR)

Historical Stock Chart

From Dec 2023 to Dec 2024