false

0001581091

0001581091

2023-11-13

2023-11-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): November 13, 2023

RE/MAX

Holdings, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-36101 |

|

80-0937145 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

5075

South Syracuse Street

Denver,

Colorado 80237

(Address of principal executive offices, including

Zip code)

(303)

770-5531

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

| Class

A Common Stock $0.0001 par value per share |

|

RMAX |

|

New

York Stock Exchange |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangement of Certain Officers.

Appointment of Chief Executive Officer

On November 7, 2023, the Board of Directors

of RE/MAX Holdings, Inc. (the “Company”) appointed Erik Carlson as the Company’s Chief Executive Officer, effective

November 13, 2023 (the “Start Date”). The Board of Directors also appointed Mr. Carlson to the Company’s Board

of Directors, effective as of the Start Date. Mr. Carlson will serve as a Class II director, with a term through the Company’s

2024 annual meeting of stockholders. Mr. Carlson was not appointed to any committees of the Board of Directors.

Mr. Carlson, age 53, previously served as

the President and Chief Executive Officer of DISH Network Corporation from 2017 through November 12, 2023. He continues to serve

on the Board of Directors of DISH Network Corporation, which he joined in December 2021.

On November 10, 2023, the Company entered

into an Executive Agreement with Mr. Carlson (the “Executive Agreement”). Pursuant to the Executive Agreement, Mr. Carlson

will receive an annual base salary of $825,000, a bonus for the remainder of 2023 equal to 100% of his annual base salary, pro-rated for

the portion of the year that he serves as Chief Executive Officer, and an annual target bonus of 125% of his base salary for subsequent

years. In the event that the Company terminates Mr. Carlson’s employment without Cause or Mr. Carlson terminates his employment

for Good Reason (as such terms are defined in the Executive Agreement), Mr. Carlson would be entitled to a pro-rated bonus based

on actual performance and salary continuation and benefits for 12 months if he was employed by the Company for less than two years and

salary continuation and benefits for 18 months if he was employed for two years or more. If Mr. Carlson’s employment is terminated

without Cause or by Mr. Carlson with Good Reason within two years following a Change in Control (as defined in the Executive Agreement),

in lieu of the compensation and benefits described in the preceding sentence, Mr. Carlson would be entitled to a lump sum equal to

two-and-one-half times the sum of his then current base salary and target annual bonus, and Mr. Carlson would be entitled to benefits

continuation for 30 months. Mr. Carlson will not receive any additional compensation for his service on the Company’s Board

of Directors.

In addition, pursuant to the inducement award

exception under New York Stock Exchange Rule 303A.08, to induce Mr. Carlson to accept employment with the Company, he will be

granted on the Start Date equity awards with a total intended value at grant of $5,500,000, which will consist of restricted stock units

(“RSUs”) that are scheduled to vest as follows:

| · | $1,000,000: time-based RSUs scheduled to vest one year after the Start Date. |

| · | $1,800,000: time-based RSUs scheduled to vest in equal installments on March 1, 2025, March 1,

2026, and March 1, 2027. |

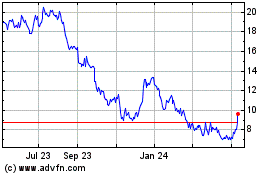

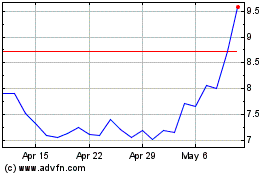

| · | $2,700,000: performance-based RSUs that vest based on the price of the Company’s class A common

stock during the performance period that runs from the Start Date through December 31, 2027 (the “Performance Period”).

For the performance-based awards, the actual number of RSUs that vest will range from 0-200% of the target (for a potential maximum intended

value at grant of $5,400,000), based on the table below. |

60-Day VWAP Stock

Price Level | |

Percent of RSUs That Vest | |

| $20 | |

| 25 | % |

| $25 | |

| 50 | % |

| $30 | |

| 75 | % |

| $35 (Target level) | |

| 100 | % |

| $40 | |

| 125 | % |

| $45 | |

| 150 | % |

| $50 | |

| 175 | % |

| $55 | |

| 200 | % |

For purposes of meeting any stock price level

with respect to the performance-based RSUs, the “60-Day VWAP” means the volume-weighted average trading price per share of

the Company’s Class A common stock measured over any rolling 60 calendar day period (i.e., any 60 consecutive calendar days)

occurring after the date of the award and within the Performance Period. With respect to the performance-based RSUs, in the event of a

Change in Control (as defined in the Executive Agreement) during the Performance Period, then, subject to Mr. Carlson’s continuous

service to the Company through the date of such Change in Control, the unvested portion of the award shall vest as follows: if the price

per share of Class A common stock of the Company paid by an acquiror in connection with a Change of Control equals or exceeds a stock

price target level set forth in the table above with respect to any unvested portion of the award, then the award will vest at the percentage

for the applicable stock price target level immediately prior to the date of such Change in Control and the remainder of the unvested

award shall be forfeited. With respect to the time-based RSUs, in the event of a Change in Control in connection with which the award

is assumed or converted into an equivalent award by the acquiring entity, if Mr. Carlson’s continuous service with the Company

is terminated by such entity without Cause or by Mr. Carlson with Good Reason following such Change in Control, the assumed or converted

award shall automatically become fully vested on the date of such termination.

Mr. Carlson will be entitled to receive a

future equity award in 2025 based on a compensation analysis performed by a third-party compensation consultant in the aggregate value

of at least $4,500,000, subject to the Company’s standard governance approval process.

The foregoing summary of the Executive Agreement

and equity awards does not purport to be complete and is qualified in its entirety by reference to the Executive Agreement and equity

award forms, which are filed as Exhibits 10.1, 10.2, and 10.3 and are incorporated herein by reference.

There are no related party transactions between

Mr. Carlson and the Company as defined in Item 404(a) of Regulation S-K. There are no family relationships between Mr. Carlson

and any other director, executive officer, or person nominated or

chosen to be a director or executive officer of

the Company.

Departure of Chief Executive Officer

In connection with Mr. Carlson’s appointment

as Chief Executive Officer, Stephen Joyce, who has served as the Company’s Chief Executive Officer on an interim basis, resigned

as the Company’s Chief Executive Officer, effective November 13, 2023. Mr. Joyce continues to serve on the Company’s

Board of Directors.

Approval of Retention Agreements

On November 10, 2023, the Compensation Committee

of the Board (the “Committee”) approved Retention Agreements (the “Retention Agreements”), which provide for special

cash awards to certain of the Company’s Named Executive Officers: Nicholas R. Bailey, President and Chief Executive Officer of RE/MAX,

LLC; Karri R. Callahan, the Company’s Chief Financial Officer; Ward M. Morrison, President and Chief Executive Officer of Motto

Mortgage and wemlo; and Serene M. Smith, the Company’s Chief Operating Officer and Chief of Staff. The Committee approved the Retention

Agreements to encourage retention of the Company’s management team given the transition of the Company’s Chief Executive Officer

and amidst the highly competitive market for talent, both within the real estate and mortgage industries and, more generally, for seasoned

top leadership with the specific expertise possessed by these Named Executive Officers.

Under

the Retention Agreements, certain of the Company’s Named Executive Officers will be eligible for special cash bonus awards in the

following amounts: $478,931 for Mr. Bailey; $712,500 for Ms. Callahan; $430,363 for Mr. Morrison; and $391,230 for Ms. Smith.

These cash retention awards will be payable on the first anniversary of Mr. Carlson’s Start Date, other than Ms. Callahan’s

award, which will be payable on February 28, 2025, subject in each case to the grantee’s employment through the applicable

date. The awards also require the grantees to agree to certain restrictive covenants, including non-disparagement, and confidentiality

provisions. The foregoing description of the Retention Agreements does not purport to be complete and is qualified in its entirety by

reference to the form of Retention Agreement, which is filed hereto as Exhibit 10.4 and incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.*

The Company issued a

press release announcing Mr. Carlson’s appointment on November 13, 2023. A copy of the press release is furnished as Exhibit 99.1

to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.*

Footnotes:

* The information contained in Items 7.01 and

9.01 and Exhibit 99.1 of this Current Report on Form 8-K is being “furnished” and shall not be deemed “filed”

for purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that section, nor shall it be deemed incorporated by reference into any registration statement or other filings

of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be set forth by specific reference in

such filing.

** Certain exhibits and schedules have been omitted

pursuant to Item 601(b)(2) of Regulation S-K. The Registrant hereby undertakes to furnish supplemental copies of any omitted exhibits

and schedules upon request by the SEC.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

RE/MAX HOLDINGS, INC. |

| |

|

|

| Date: November 13, 2023 |

By: |

/s/ Karri Callahan |

| |

|

Karri Callahan |

| |

|

Chief Financial Officer |

Exhibit 10.1

EXECUTIVE AGREEMENT

This Executive Agreement (“Agreement”)

is entered into November 9, 2023 (the “Effective Date”) by and between RE/MAX, LLC, a Delaware limited

liability company (the “Company”), RE/MAX Holdings, Inc. (“Holdings”) and W.

Erik Carlson (“Executive”). The Company, Holdings and Executive are collectively referred to herein as the “parties”.

WHEREAS, Executive

acknowledges and agrees that Executive is not currently employed by the Company, Executive has been provided this Agreement prior to accepting

an offer for employment, and Executive has received, under separate cover, a clear and conspicuous notice describing the restrictions

contained herein;

WHEREAS, the Company

desires to employ Executive and, in connection therewith, to compensate Executive for Executive’s personal services to the Company;

and

WHEREAS, Executive

wishes to be employed by the Company and provide personal services to the Company in return for certain compensation.

NOW THEREFORE, in consideration

of the mutual promises and covenants contained herein, the parties agree to the following:

1. EMPLOYMENT

BY THE COMPANY.

1.1 Position.

Subject to the terms set forth herein, the Company agrees to employ Executive in the position of Chief Executive Officer of Holdings (“CEO”),

and Executive hereby accepts such employment. Executive will report to the Board of Directors of Holdings (the “Board”).

Executive will perform such duties as are normally associated with Executive’s position or as reasonably assigned by the Board from

time to time. While Executive serves as CEO, Executive shall also serve as a Director of the Board, for no additional consideration. During

the term of Executive’s employment with the Company, and excluding periods of vacation, disability and sick or other lawful leave

to which Executive is entitled, Executive will devote Executive’s best efforts and substantially all of Executive’s business

time and attention to the business of the Company, Holdings, RMCO, LLC and their respective direct and indirect wholly-owned subsidiaries

(collectively, the Company, Holdings and their respective direct and indirect subsidiaries are referred to as the “Company

Group”). Executive owes the Company, Holdings and other members of the Company Group fiduciary duties (including (a) duties

of loyalty and disclosure and (b) such fiduciary duties applicable to officers of the Company Group), and the obligations described

in this Agreement are in addition to, and not in lieu of, the obligations Executive owes each member of the Company and Holdings under

statutory and common law. For the avoidance of doubt, franchisees and sub-franchisors of the Company Group, and their respective representatives,

agents and employees, are not within the “Company Group”, are not owed fiduciary duties under this Agreement or law, and are

not third-party beneficiaries of this Agreement, including pursuant to Section 26.

1.2 Employment

Commencement Date. Executive’s employment pursuant to this Agreement will commence on November 13, 2023, or such other

date as may be agreed to by the parties (the “Employment Commencement Date”). If Executive does not commence

employment with the Company prior to December 31, 2023, the Agreement will automatically become null and void.

1.3 Location.

Executive shall perform Executive’s duties under this Agreement principally out of the Company’s Denver, Colorado office.

Executive shall spend sufficient time on business travel to fulfill his duties and responsibilities as CEO of the Company.

1.4 Company

Policies. The employment relationship between the parties shall also be subject to the Company’s personnel policies and procedures

as they may be interpreted, adopted, revised or deleted from time to time in the Company’s sole discretion, including but not limited

to codes of ethics and conduct, insider trading policies, and clawback policies. Notwithstanding the foregoing, in the event of a conflict

between an express term or condition of this Agreement and such policies and procedures this Agreement shall control.

2. COMPENSATION.

2.1 Base

Salary. While employed by the Company, the Company shall pay to Executive a base salary of $825,000 per year (the “Base

Salary”) in consideration for Executive’s services under this Agreement, payable in substantially equal installments

in conformity with the Company’s customary payroll practices for similarly situated employees as may exist from time to time.

2.2 Bonus.

While employed by the Company, Executive shall be eligible to earn an annual bonus (the “Annual Bonus”), which

will be paid approximately half in cash and approximately half in immediately vested Holdings common stock. Executive’s target opportunity

for the Annual Bonus shall be equal to one hundred twenty-five percent (125%) of the Base Salary (the “Target Annual Bonus”),

with a maximum target opportunity of two hundred percent (200%) of the Base Salary, based on the Company’s and Executive’s

achievement of performance goals, as reasonably established by the Compensation Committee of the Board (the “Compensation

Committee”) each year in its sole discretion. The Board or the Compensation Committee will determine in its sole discretion

the extent to which the performance goals have been achieved. The annual period over which performance is measured for purposes of this

Section 2.2 is January 1 through December 31. The Annual Bonus, if earned, will be paid no later than March 15

of the year following the calendar year to which the Annual Bonus relates and shall be subject to applicable deductions and withholdings.

In order to be eligible to earn an Annual Bonus, except as provided otherwise in Sections 6.4 and 6.5, Employee must be employed

by the Company through the date any Annual Bonus is paid. For the 2023 year, subject to Executive’s continued employment through

the applicable payment date of the 2023 Annual Bonus (except as provided otherwise in Sections 6.4 and 6.5), Executive shall receive

a prorated Annual Bonus at a level equal to one hundred percent (100%) of the Base Salary (calculated by multiplying the Base Salary by

a fraction, the numerator of which is equal to the number of days from and including the Employment Commencement Date through December 31,

2023, and the denominator of which is 365), which will be paid no later than March 15, 2024, subject to applicable deductions and

withholdings.

2.3 Equity

Awards.

(a) Sign-On

Inducement Award. Executive shall be granted a restricted stock unit award with the number of restricted stock units calculated by

dividing one million dollars ($1,000,000) by the average of the closing price of a share of Holdings class A common stock on each of the

fifteen (15) NYSE trading days prior to the date that Executive’s employment is first publicly announced by the Company or by Holdings

(the “Sign-On Inducement Award”). The Sign-On Inducement Award will be granted as an inducement award under

NYSE listing standard 303A.08, and will be subject to the terms of the RE/MAX Holdings, Inc. 2023 Omnibus Incentive Plan (as amended

from time to time, the “Plan”), an award agreement in a form approved by the Board and/or the Compensation Committee

and reflecting the terms described herein, and this Agreement. The Sign-On Inducement Award will vest on the 1st anniversary

of the Employment Commencement Date, subject (except as set forth in the Plan, the award agreement and this Agreement) to Executive’s

Continuous Service (as that term is defined in the Plan) through such date.

(b) Additional

Inducement Award. Executive shall be granted an additional restricted stock unit award with an aggregate value (as determined below)

of $4,500,000 (the “Additional Inducement Award”), with 40% of the Additional Inducement Award vesting in equal

amounts on each of March 1, 2025, 2026, and 2027, based solely on Executive’s Continuous Service (as that term is defined in

the Plan) and 60% of the Additional Inducement Award eligible for vesting over a measurement period between the date of grant and December 31,

2027, based upon Executive’s Continuous Service, the achievement of stock price performance metrics, and other terms as set forth

in Exhibit A to this Agreement. The number of restricted stock units subject to the time-based portion of the Additional Inducement

Award will be determined by dividing $1,800,000 by the closing price of a share of Holding’s common stock on the last Business Day

prior to the Employment Commencement Date and the “target” number of restricted stock units subject to the performance-based

portion of the Additional Inducement Award will be determined by dividing $2,700,000 by the closing price of a share of Holding’s

common stock on the last Business Day before the Employment Commencement Date. The Additional Inducement Award will be granted as an inducement

award under NYSE listing standard 303A.08 and will be subject to the terms and conditions of the Plan, an award agreement in a form approved

by the Board and/or the Compensation Committee and reflecting the terms described herein, and this Agreement.

(c) Future

Annual Equity Awards. Subject to the Company’s standard governance approval process, while employed by the Company, Executive

will be entitled to receive a future equity award in 2025 based on a compensation analysis performed by a third-party compensation consultant

in the aggregate value of at least $4,500,000. Beginning in 2026, Executive will be eligible to receive future equity awards as part of

the Company’s annual grant process, with vesting and other terms as determined by the Compensation Committee consistent with

those applicable to equity incentive grants awarded to other executive officers of the Company. While award types, vesting terms and weighting

between time-based and performance-based vesting will be subject to Compensation Committee discretion, it is initially anticipated that

future annual equity awards would be 40% time based, with vesting over a three- or four-year period in equal amounts on the annual grant

date anniversaries, and 60% performance based, with vesting over a period of three or four calendar years.

2.4 Vacation

and Standard Company Benefits. Executive shall receive other paid time-off in accordance with the Company’s policies for executive

officers as such policies may exist from time to time. While employed by the Company, Executive shall be eligible to participate in the

same benefit plans and programs in which other similarly situated Company employees are eligible to participate, subject to the terms

and conditions of the applicable plans and programs in effect from time to time; provided, however, that Executive will not be eligible

to participate in Holding’s change in control or other severance plans or policies or otherwise receive severance payments or benefits

other than pursuant to this Agreement. Subject to the prior sentence, all matters of eligibility for coverage or benefits under any benefit

plan shall be determined in accordance with the provisions of such plan. The Company Group reserves the right to change, alter, or terminate

any benefit plan in its sole discretion. Notwithstanding the foregoing, in the event that the terms of this Agreement differ from or are

in conflict with the Company’s general employment policies or practices, this Agreement shall control.

2.5 Expenses

for Negotiation of Agreement. The Company shall reimburse Executive for all reasonable attorneys’ fees incurred in connection

with the negotiation and execution of this Agreement, up to a maximum of $20,000, which reimbursement shall be provided as soon as practicable

following the receipt by the Company of documentation from Executive detailing the amount of such fees (but in any event not later than

the close of Executive’s taxable year following the taxable year in which such fees are incurred by Executive).

3. BUSINESS

EXPENSES. Subject to Section 23, the Company shall reimburse Executive for Executive’s reasonable out-of-pocket

business-related expenses actually incurred in the performance of Executive’s duties under this Agreement in accordance with the

Company’s Reimbursement of Business Travel and Expenses Policy and The Executive Addendum thereto (but in any event not later than

the close of Executive’s taxable year following the taxable year in which the expense is incurred by Executive).

4. OUTSIDE

ACTIVITIES. Except with the prior written consent of the Board, Executive will not, while employed by the Company, undertake or

engage in any other employment, occupation or business enterprise, such as service on another company’s board. This restriction

shall not, however, preclude Executive from serving on the board of Denver Downtown Partnership and one additional for profit or non-profit

company’s board (provided pre-approval is given by the Board), or from owning a passive investment in less than two percent (2%)

of the total outstanding shares of a publicly traded company. Executive has listed all boards on which Executive currently serves on Schedule

1 (other than boards Executive will resign from prior to the Employment Commencement Date). Executive agrees to resign from any boards

Executive is serving on that could present a conflict of interest with the Company Group or as reasonably requested by the Board.

5. NO

CONFLICT WITH EXISTING OBLIGATIONS. Executive hereby represents and warrants that other than his restrictive covenants imposed

in his former employment with DISH Network Corporation (which do not prohibit or restrict his work as CEO of Holdings and do not restrict

his performance under this Agreement), Executive is not the subject of, or a party to, any employment agreement, non-competition, non-solicitation,

restrictive covenant, non-disclosure agreement, or any other agreement, obligation, restriction or understanding that would prohibit Executive

from executing this Agreement or fully performing each of Executive’s duties and responsibilities hereunder, or would in any manner,

directly or indirectly, limit or affect any of the duties and responsibilities that may now or in the future be assigned to Executive

hereunder. Executive expressly acknowledges and agrees that Executive is strictly prohibited from using or disclosing any confidential

information belonging to any prior employer in the course of performing services for any member of the Company Group, and Executive promises

that Executive shall not do so. Executive shall not introduce documents or other materials containing confidential information of any

such prior employer to the premises or property (including computers and computer systems) of the Company, Holdings, or any other member

of the Company Group. Executive shall not use any intellectual property of any prior employer or any other person or entity in any way

that infringes upon any intellectual property rights, misappropriates any third-party trade secrets, or violates any other rights.

6. TERMINATION

OF EMPLOYMENT. The parties acknowledge that Executive’s employment relationship with the Company is at-will. Either Executive

or the Company may terminate the employment relationship at any time, with or without Cause. The provisions in this Section govern

the amount of compensation, if any, to be provided to Executive upon termination of employment and do not alter this at-will status.

6.1 Termination

by the Company with Cause.

(a) The

Company shall have the right to terminate Executive’s employment with the Company at any time for Cause (as defined below). Notwithstanding

any of the language within Section 6, Cause under Sections 6.1 (b)(i), (ii), (iii), (vi) and/or (vii) shall

only arise if the Board gives Executive written notice (pursuant to this Agreement) describing in detail such Cause and Executive fails

to cure said Cause within thirty (30) days of receipt of the notice. If Executive’s employment hereunder is terminated by the Company

for Cause, then Executive shall be: (i) paid any previously earned but unpaid Base Salary through the date of termination, if any,

which shall be paid in conformity with the Company’s customary payroll practice, (ii) reimbursed for any business expenses

incurred by but not yet paid to Executive, pursuant to Section 3 above, (iii) entitled to any vested benefits under any

benefit plans and programs described in Section 2.4, above (except for equity), and (iv) paid or provided with any other

amounts or benefits, as required by applicable law, which shall be paid in the time period required by applicable law (the “Accrued

Obligations”). In the event Executive’s employment is terminated by the Company for Cause, all of Executive’s

unvested equity awards shall be immediately forfeited and canceled and Executive shall not receive the Severance Benefits, or any other

severance compensation or benefit, except that, pursuant to the Company’s standard payroll policies, the Company shall provide Executive

only the Accrued Obligations.

(b) For

purposes of this Agreement, “Cause” means the following on the part of Executive:

(i) Violation

of any of the material terms of any member of the Company Group’s written policies of which Executive has been advised in writing;

(ii) Material

breach of this Agreement or any other written Agreement between Executive and any member of the Company Group;

(iii) Obtaining

a material personal profit not thoroughly disclosed to and approved by the Board in connection with any transaction entered into by, or

on behalf of, or in relation to, any member of the Company Group;

(iv) The

commission of a felony or other crime involving moral turpitude which is reasonably likely to cause any member of the Company Group material

and lasting public disgrace or demonstrable economic harm;

(v) Fraud

or embezzlement against any member of the Company Group or theft or misappropriation of property belonging to any member of the Company

Group;

(vi) Breach

of a fiduciary duty against any member of the Company Group; or

(vii) Repeated

failure to obey lawful and reasonable instructions from the Board consistent with his position and this Agreement.

The Board may also place Executive on paid leave

for up to thirty (30) days while it is determining whether there is a basis to terminate Executive’s employment for Cause, should

the Board believe in good faith that there are grounds for termination of Executive’s employment for Cause. In such an instance,

the Board will be required to notify Executive in writing at the time of his suspension of the specific factual grounds that it believes

may support termination of his employment for Cause and allow Executive to respond to said allegations. Any such action by the Board will

not constitute Good Reason.

6.2 Resignation

by Executive. Executive shall have the right to terminate employment with the Company at any time and for any reason, or no reason

at all, upon providing thirty (30) days’ advance written notice to the Company; provided, however, that if Executive

has provided notice to the Company of Executive’s resignation of employment, the Board may determine, in its sole discretion, that

such resignation shall be effective on any date prior to the effective date of resignation provided in such notice (and, if such earlier

date is so required by the Board, then such earlier date shall not change the nature of Executive’s resignation of employment nor

be construed or interpreted as a termination of employment without Cause pursuant to Section 6.4). If Executive resigns Executive’s

employment with the Company as described in this Section 6.2 (other than for Good Reason pursuant to Section 6.4),

then Executive shall not receive the Severance Benefits, or any other severance compensation or benefit, except that, pursuant to the

Company’s standard payroll policies, the Company shall provide to Executive only the Accrued Obligations.

6.3 Termination

by Virtue of Death or Disability of Executive.

(a) In

the event of Executive’s death while employed pursuant to this Agreement, all obligations of the parties hereunder shall terminate

immediately, and Executive will not receive the Severance Benefits, or any other severance compensation or benefit, except that, the Company

shall, pursuant to the Company’s standard payroll policies, provide to Executive’s legal representatives Executive’s

Accrued Obligations. Notwithstanding the foregoing, treatment of any unvested equity awards shall be governed by the terms of the applicable

equity plans and award agreements.

(b) The

Company shall at all times have the right, upon written notice to Executive from the Board, to terminate Executive’s employment

due to Executive’s Disability (as defined below). Upon written notice to Executive of termination due to Disability, Executive’s

employment with the Company shall automatically (and without any further action by any person or entity) terminate. For purposes of this

Agreement, termination by the Company of Executive’s employment based on a “Disability” shall mean termination

because Executive is unable due to a physical or mental condition to perform the essential functions of his position with or without reasonable

accommodation for ninety (90) days consecutively or one hundred eighty (180) days in the aggregate during any twelve (12) month period

or the Board makes such determination (at its sole discretion) based on the written certification by two (2) licensed physicians

of the likely continuation of such condition for such periods. The determination of whether Executive has incurred a Disability shall

be interpreted and applied consistent with the Americans with Disabilities Act, the Family and Medical Leave Act, and other applicable

law. In the event Executive’s employment is terminated based on Executive’s Disability, Executive will not receive the Severance

Benefits, or any other severance compensation or benefit, except that, pursuant to the Company’s standard payroll policies, the

Company shall provide to Executive the Accrued Obligations. Notwithstanding the foregoing, treatment of any unvested equity awards shall

be governed by the terms of the applicable equity plans and award agreements.

6.4 Termination

by the Company without Cause or by Executive with Good Reason.

(a) The

Board (in its sole discretion) shall have the right to terminate Executive’s employment with the Company immediately without Cause

by providing Executive written notice of such termination. If Executive’s employment is terminated without Cause or Executive resigns

for Good Reason (defined in Section 6.4(c)), then Executive shall be paid the Accrued Obligations and, if Executive complies

with all of the obligations in Section 6.4(b) below and, in the case of resignation by the Executive with Good Reason,

Executive has served as the Company’s Chief Executive Officer for a minimum of one year, Executive shall also be eligible to receive

the following severance benefits in Sections 6.4(a)(i)-(iv) (the “Severance Benefits”). Notwithstanding

anything to the contrary, in the event Executive is entitled to Change in Control Severance Benefits under Section 6.5, Executive

shall not be entitled to Severance Benefits under this Section 6.4.

(i) The

Company will pay Executive an amount equal to (x) twelve (12) months if Executive was employed by the Company for less than two (2) years

and (y) eighteen (18) months if Executive was employed by the Company for two (2) years or more of Executive’s then current

Base Salary, less all applicable withholdings and deductions (“Severance”), to be paid in equal installments

over a period of the number of months of Base Salary Executive is receiving, in accordance with the Company’s regular payroll practices

beginning on the Company’s first regularly scheduled payroll date following the Release Effective Date (as defined in Section 6.4(b) of

this Agreement), with the first installment including any amount of the Severance that would otherwise have been due prior to the Release

Effective Date.

(ii) The

Company will pay Executive the prior year’s Annual Bonus if the termination occurs after such calendar year but prior to payment

of any Annual Bonus relating to such prior calendar year, provided such Annual Bonus would have otherwise been payable to Executive had

Executive remained employed by the Company, which will be paid to Executive less applicable deductions and withholdings when such prior

year Annual Bonuses are otherwise paid.

(iii) The

Company will pay Executive a pro-rata amount of the Annual Bonus relating to the year of termination that Executive would have received

had Executive remained employed through the date such Annual Bonus is paid, which payment shall be equal to (i) the Annual Bonus,

if any, that Executive would have earned for the calendar year in which Executive’s termination occurs based on achievement of the

applicable performance goals for the Annual Bonus; and (ii) a fraction, the numerator of which is the number of days Executive was

employed by the Company during the year of termination and the denominator of which is the number of days in such year (the “Pro-Rata

Bonus”). The Pro-Rata Bonus shall be paid on or around the date that the Annual Bonus is paid to other employes and shall

be subject to standard payroll deductions and withholdings.

(iv) During

the Benefit Continuation Period (as defined below), the Company will provide (or cause to be provided) continued participation by Executive

and his eligible dependents in the health, dental and vision benefit plans in which Executive participated immediately prior to the termination

on the same basis (and cost) as Grantee and his eligible dependents were participating immediately prior to the termination if possible

under the terms of such benefit plans; provided, that if the provision of such continued benefits is not possible under the terms of such

benefit plans or if the Company determines that the provision of such continued benefits would result in a violation of the nondiscrimination

rules of Section 105(h)(2) of the Internal Revenue Code of 1986 (the “Code”), or otherwise result

in adverse tax consequences or violate applicable law (including but not limited to the 2010 Patient Protection and Affordable Care Act,

as amended by the 2010 Health Care and Education Reconciliation Act), then, in lieu of providing the coverage described above, the Company

will instead pay fully taxable cash payments in substantially equal installments for the remaining Benefit Continuation Period in accordance

with the Company’s normal payroll schedule in an amount equal to the product of (A) the applicable premium for such health,

dental and/or vision benefit (less any amount Grantee would have paid as an active employee for such coverage) and (B) the number

of months in the Benefit Continuation Period. Benefit Continuation shall be provided concurrently with any health care benefit required

under COBRA. The “Benefit Continuation Period” shall be twelve (12) months if Executive was employed with the

Company for less two (2) years and shall be eighteen (18) months if Executive was employed by the Company for two (2) years

or more.

(b) Notwithstanding

anything to the contrary, Executive shall only be entitled to receive the Severance Benefits pursuant to Section 6.4(a) of

this Agreement if: (i) by the 60th day following the date of Executive’s termination of employment from the Company,

Executive has signed, returned to the Company and not revoked a general release of claims in favor of the Company and its affiliates and

representatives, in a form presented by the Company, a release which includes only language necessary to effectuate a global release of

claims (the “Release”); (ii) if Executive holds any other positions with the Company or any affiliate,

including a position on the Board, Executive resigns such position(s) to be effective no later than the date of Executive’s

termination date (or such other date as requested by the Board); and (iii) Executive complies with Executive’s post-termination

obligations under this Agreement.

(c) For

the purposes of Sections 6.4 and 6.5, “Good Reason” shall mean the occurrence of any of the following

events without Employee’s consent:

(i) material

breach by the Company of the material terms of this Agreement;

(ii) a

material reduction in Executive’s duties, authority, responsibilities, or title relative to Executive’s duties, authority,

responsibilities, and title in effect immediately prior to such reduction, provided, however, that the acquisition of Holdings

and subsequent conversion of Holdings to a division or unit of the acquiring company will not by itself result in a diminution of Executive’s

duties, authority, or responsibilities;

(iii) Executive’s

reporting structure changing to Executive no longer reporting directly to the Board;

(iv) a

reduction in Employee’s Base Salary or Target Annual Bonus of at least fifteen percent (15%), other than a general reduction in

base salary or target bonus opportunities that affects all senior executives of the Company in substantially the same proportions; or

(v) the

Company requires Executive to relocate to any office or location more than 30 miles from the Company’s current headquarters in Denver,

Colorado, provided that any request or directive from the Company to not work in such office pursuant to any stay-at-home or work

from home or similar law, order, directive, request or recommendation from a governmental entity shall not give rise to Good Reason under

this Agreement.

Notwithstanding the foregoing, Executive’s

resignation shall not constitute a resignation for “Good Reason” as a result of any event described above unless: (1) Executive

gives the Board written notice of Executive’s intent to resign for Good Reason within one hundred eighty (180) days following the

first occurrence of the condition(s) that Executive believes constitute(s) Good Reason, which notice shall describe such condition(s);

(2) the Company fails to remedy such condition(s) within thirty (30) days following receipt of such written notice (the “Cure

Period”); (3) the Company or the Board have not, prior to receiving such notice from Executive, already provided notice

to Executive that his employment with the Company is being terminated for Cause (and those grounds, if subsequently challenged, are determined

by the fact finder to meet the definition herein of “Cause”); and (4) Executive voluntarily resigns Executive’s

employment no later than five (5) days after the end of the Cure Period. For the avoidance of doubt, if Holdings ceases to be a publicly-traded

company, Executive will not have Good Reason due to any reduction in Executive’s duties, authority, responsibilities resulting directly

or indirectly from Holdings no longer being a publicly-traded company such as if Executive is reporting to an officer of the acquiring

company versus to the Board.

6.5 Termination

by the Company without Cause or Resignation by the Executive for Good Reason following a Change in Control.

(a) If

Executive’s employment hereunder is terminated by the Company without Cause (other than on account of Executive’s death or

Disability) or Executive resigns for Good Reason (defined in Section 6.4(c)), in each case within two (2) years immediately

following the date a Change in Control (as defined below) occurs, Executive shall be eligible to receive the Accrued Obligations and subject

to Executive’s timely and complete compliance with all requirements in Section 6.4(b), including (without limitation)

execution and non-revocation of the Release, Executive shall be eligible to receive the following change in control severance under Sections

6.5(a)(i)-(iv) (the “Change in Control Severance Benefits”) in lieu of (and not in addition to) the

Severance Benefits. For avoidance of doubt, if Executive’s employment terminates before or more than two years after the date of

a Change in Control, Executive shall not be eligible for the Change in Control Severance Benefits.

(i) The

Company will pay Executive an amount equal to two-and-one-half times (2.5x) the sum of Executive’s then current Base Salary and

Target Annual Bonus, to be paid in a lump sum, less applicable deductions and withholdings, on the Company’s first, regular payroll

date after the Release Effective Date.

(ii) The

Company will pay Executive the prior year’s Annual Bonus if the termination occurs after such calendar year but prior to payment

of any Annual Bonus relating to such prior calendar year, provided such Annual Bonus would have otherwise been payable to Executive had

Executive remained employed by the Company through the date of payment, which will be paid to Executive less applicable deductions and

withholdings when such prior year Annual Bonuses are otherwise paid.

(iii) The

benefits provided under Section 6.4(a)(iv), except that the Benefit Continuation Period shall be thirty (30) months.

(iv) All

of Executive’s then outstanding and unvested equity awards shall be governed by the terms of the applicable equity plans and award

agreements.

(b) For

purposes of this Agreement, “Change in Control” shall mean the occurrence of any of the following after the

Employment Commencement Date:

(i) any

person (as defined in Section 3(a)(9) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

as modified and used in Sections 13(d) and 14(d) thereof, a “Person”), other than (x) a trustee

or other fiduciary holding securities under an employee benefit plan of Holdings or (y) an affiliate as of the Employment Commencement

Date, is or becomes the “beneficial owner” (as defined in Rule 13d-3 under the Exchange Act),

directly or indirectly, of securities of Holdings representing 50% or more of the combined voting power of Holding’s then outstanding

securities;

(ii) during

any period of two consecutive years after the Employment Commencement Date, individuals who at the beginning of such period constitute

the Board and any new director (other than a director designated by a Person who has entered into an agreement with Holdings to effect

a transaction described in clauses (i), (iii) or (iv) of this definition) whose election by the Board or nomination for election

by Holding’s shareholders was approved by a vote of at least two-thirds of the directors then still in office who either were directors

at the beginning of the period or whose election or nomination for election was previously so approved, cease for any reason to constitute

a majority of the Board;

(iii) the

consummation of a merger, share exchange or consolidation of Holdings with any other entity, other than a merger, share exchange or consolidation

that would result in the voting securities of Holdings outstanding immediately prior thereto continuing to represent (either by remaining

outstanding or by being converted into voting securities of the surviving entity) at least 50% of the combined voting power of the voting

securities of Holdings or such surviving entity outstanding immediately after such merger, share exchange or consolidation; or

(iv) the

complete liquidation of Holdings and/or the Company or consummation of the sale or disposition by Holdings or an Affiliate of all or substantially

all of Holdings’ and/or the Company’s assets.

(c) Notwithstanding

the foregoing, (i) a Change in Control shall not be deemed to have occurred by virtue of the consummation of any transaction or series

of integrated transactions immediately following which the holders of common shares of Holdings immediately prior to such transaction

or series of transactions continue to have substantially the same proportionate ownership in an entity which owns, directly or indirectly,

all or substantially all of the assets of Holdings and/or the Company immediately following such transaction or series of transactions

such as a reincorporation of Holdings; and (ii) to the extent necessary to avoid the imposition of adverse taxation under Section 409A

of the Code, in no event will a Change in Control be deemed to have occurred if such transaction is not also a “change in the ownership

or effective control” or “a change in the ownership of a substantial portion of the assets” of Holdings and/or the Company,

as determined under Treasury Regulation Section 1.409A-3(i)(5).

6.6 Deemed

Resignations. Except as otherwise determined by the Board or as otherwise agreed to in writing by Executive and any authorized member

of the Company Group prior to the termination of Executive’s employment with the Company or any member of the Company Group, any

termination of Executive’s employment shall constitute, as applicable, an automatic resignation of Executive: (a) as an officer

of the Company and each member of the Company Group; and (b) from the Board and from the Board of Directors or Board of Managers

(or similar governing body) of any member of the Company Group and of any corporation, limited liability entity, unlimited liability entity

or other entity in which any member of the Company Group holds an equity interest and with respect to which Board of Directors or Board

of Managers (or similar governing body) Executive serves as such Company Group member’s designee or other representative.

7. DISCLOSURES.

Promptly (and in any event, within three (3) Business Days) upon becoming aware of any actual or potential Conflict of Interest Executive

shall disclose such actual or potential Conflict of Interest or such lawsuit, claim or arbitration to the Board. A “Conflict

of Interest” shall exist when Executive engages in, or plans to engage in, any activities, associations, or interests that

Executive reasonably believes will conflict with Executive’s duties, responsibilities, authorities, or obligations for and to Company

Group as required in accordance with the terms of this Agreement. As used herein, the term “Business Day” means

any day except a Saturday, Sunday or other day on which commercial banks in Denver, Colorado, are authorized or required by law to be

closed.

8. CONFIDENTIALITY.

In the course of Executive’s employment with the Company and the performance of Executive’s duties on behalf of the Company

Group hereunder, Executive will be provided with, and will have access to Confidential Information (as defined below) of the Company and

other members of the Company Group. In consideration of Executive’s receipt and access to such Confidential Information and in exchange

for other valuable consideration provided hereunder, and as a condition of Executive’s employment, Executive shall comply with this

Section 8.

8.1 Subject

to Section 8.2, both while employed by the Company and thereafter, except as expressly permitted by this Agreement, including

in the performance of his duties hereunder, or by directive of the Board, Executive shall not disclose any Confidential Information to

any person or entity and shall not use any Confidential Information obtained in connection with Executive’s employment pursuant

to this Agreement or affiliation with the Company Group as a Board member except for the benefit of the Company or the Company Group.

Executive shall follow all Company and Company Group policies and protocols of which he is advised regarding the security of all documents

and other materials containing Confidential Information (regardless of the medium on which Confidential Information is stored). The covenants

of this Section 8.1 shall apply to all Confidential Information, whether now known or later to become known to Executive during

the period that Executive is employed by the Company or any other member of the Company Group.

8.2 Notwithstanding

any provision of Section 8.1 to the contrary, while employed by the Company, Executive may make the following disclosures

and uses of Confidential Information:

(a) disclosures

to other employees of the Company Group who have a need to know the information in connection with the businesses of the Company Group;

(b) disclosures

to customers and suppliers when, in the reasonable and good faith belief of Executive, such disclosure is in connection with Executive’s

performance of Executive’s duties under this Agreement and is in the best interests of the Company Group;

(c) disclosures

and uses that are approved in writing by the Board; or

(d) disclosures

to a person or entity that has (x) been retained by a member of the Company Group to provide services to one or more members of the

Company Group and (y) agreed in writing to abide by the terms of a confidentiality agreement or has a similar obligation of confidentiality

to the Company Group.

8.3 Following

the termination of Executive’s employment with the Company or at any time upon request of the Company or the Board, Executive shall

promptly surrender and deliver to the Company all documents (including electronically stored information) and all copies thereof and all

other materials of any nature containing or pertaining to all Confidential Information and any other Company Group property (including

any Company Group-issued computer, mobile device or other equipment) in Executive’s possession, custody or control and Executive

shall not retain any such documents or other materials or property of the Company Group following the termination of Executive’s

employment with the Company or upon such request. Executive shall be entitled to retain any Confidential Information within his possession

to the extent needed to comply with any reporting obligations to a governmental agency and/or in any legal proceedings between the Parties.

For avoidance of doubt, Executive’s eligibility to receive the Severance Benefits shall cease should the Company or the Board establish

the same factual grounds as meets the definition of “Cause” above.

8.4 For

purposes of this Agreement, “Confidential Information” shall mean all non-public information and materials of

or pertaining to the Company that is valuable, proprietary and/or unique to the Company or any member of the Company Group in any form

or medium, including (without limitation) all notes, analyses, compilations, copies, documents, recordings, summaries, reproductions,

copies, translations, electronic copies or versions (in any medium including video, email, audio, video, MP3, or voicemail), regardless

of where the same may have been stored (including on any personal devices of Executive and information and materials generated by Executive

or third parties, received by a member of the Company Group from third parties). By way of example, “Confidential Information”

includes any and all of the following types of information: as to any Company Group member’s business practices, operations, prospects,

franchisees and franchisee agreements, or legal information and advice; protected by any and all non-disclosure agreements signed by Executive

during employment; concerning claims against or by any member of the Company Group; acquired by Executive in Executive’s capacity

as an employee of any member of the Company Group; education or training programs and materials developed by the Company Group or acquired

from a third party; contained in a Company Group member’s financial records; concerning regional, agent and franchise agreements,

prospects, events, information technology techniques and arrangements, processes and procedures for creating IT related resources, contemplated

products and services and agreement terms; concerning past acquisitions (closed or not closed) and acquisitions being planned or considered,

concerning data and issues related to public filings, and/or concerning purchasing information and other business, marketing, sales, strategic

and operational data of the Company Group and its franchisees. Confidential Information includes all other Company Group information and

materials which are of a propriety or confidential nature, even if they are not marked as such. Moreover, all documents, videotapes, written

presentations, brochures, drawings, memoranda, notes, records, files, correspondence, manuals, models, specifications, computer programs,

e-mail, voice mail, electronic databases, maps, drawings, architectural renditions, models and all other writings or materials of any

type including or embodying any of such information, ideas, concepts, improvements, discoveries, inventions and other similar forms of

expression are and shall be the sole and exclusive property of the Company Group and be subject to the same restrictions on disclosure

applicable to all Confidential Information pursuant to this Agreement. For purposes of this Agreement, Confidential Information shall

not include any information that (i) is or becomes generally available or is readily ascertainable to the public other than as a

result of a disclosure or wrongful act of Executive or any of Executive’s agents; (ii) arises from Executive’s general

training, knowledge, skill, or experience, whether gained on the job or otherwise, (iii) was available to Executive on a non-confidential

basis before its disclosure by a member of the Company Group; or (iii) becomes available to Executive on a non-confidential basis

from a source other than a member of the Company Group; provided, however, that, to the knowledge of Executive, such source

is not bound by a confidentiality agreement with, or other obligation with respect to confidentiality to, a member of the Company Group.

8.5 Notwithstanding

the foregoing, nothing in this Agreement shall prohibit or restrict Executive from lawfully: (a) initiating communications directly

with, cooperating with, providing information to, causing information to be provided to, or otherwise assisting in an investigation by,

any governmental authority regarding a possible violation of any law; (b) responding to any inquiry or legal process directed to

Executive from any such governmental authority; (c) testifying, participating or otherwise assisting in any action or proceeding

by any such governmental authority relating to a possible violation of law; (d) making any other disclosures that are protected under

the whistleblower provisions of any applicable law; or (e) discussing or disclosing underlying facts of any alleged discriminatory

or unfair employment practice, such as sexual harassment or sexual abuse, discriminatory or unfair employment practices, or any other

conduct that Executive has reason to believe is unlawful. Additionally, pursuant to the federal Defend Trade Secrets Act of 2016, an individual

shall not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret that:

(A) is made (1) in confidence to a federal, state or local government official, either directly or indirectly, or to an attorney

and (2) solely for the purpose of reporting or investigating a suspected violation of law; or (B) is made to the individual’s

attorney in relation to a lawsuit for retaliation against the individual for reporting a suspected violation of law or (C) is made

in a complaint or other document filed in a lawsuit or proceeding, if such filing is made under seal or other protected status. Nothing

in this Agreement requires Executive to obtain prior authorization before engaging in any conduct described in this paragraph, or to notify

the Company that Executive has engaged in any such conduct.

9. NON-COMPETITION;

NON-SOLICITATION.

9.1 The

Company and other members of the Company Group shall provide Executive access to trade secrets, as defined in C.R.S. § 7-74-101,

et seq., while employed by the Company, and Executive acknowledges and agrees that the Company and other members of the Company Group

will be entrusting Executive, based on Executive’s unique and special capacity as a senior executive and board member, with: (a) trade

secrets, proprietary rights and Confidential Information concerning the Company and other members of the Company Group and (b) access

to relationships and building goodwill with clients, employees, vendors, consultants, distributors, sales representatives or other business

counterparts of the Company and other members of the Company Group. In consideration of the Company and other members of the Company Group

providing Executive with access to such information and contacts and as an express incentive for the Company to enter into this Agreement

and employ Executive, Executive has voluntarily agreed to the covenants set forth in this Section 9. Executive agrees and

acknowledges that the limitations and restrictions set forth herein, including geographical and temporal restrictions on certain competitive

activities, are reasonable in all respects, will not cause Executive undue hardship or affect Executive’s ability to earn a livelihood,

and are material and substantial parts of this Agreement intended and necessary to protect the trade secrets and legitimate business interests

of the Company and other members of the Company Group. Executive agrees and acknowledges that at the time Executive first received this

Agreement, Executive was provided with the notice entitled “Notice of Covenant Not to Compete,” which Executive acknowledges

fully complies with the requirements of Colorado law, including C.R.S. § 8-2-113, et seq.

9.2 During

the Prohibited Period (as defined below), Executive shall not, without the prior written approval of the Board, directly or indirectly,

for Executive or on behalf of or in conjunction with any other person or entity of any nature:

(a) Provide

any services or engage in any activity that competes against the Company or any member of the Company Group in the Business in the Market

Area; provided that this Section 9.2(a) will only restrict Executive from providing services or engaging in activities

that are the same as or similar to the duties or responsibilities that Executive had on behalf of the Company or any member of the Company

Group or that require Executive to use or disclose the Company Group’s trade secrets;

(b) appropriate

any Business Opportunity located in the Market Area where such Business Opportunity relates to the Company or any member of the Company

Group;

(c) solicit,

encourage, entice or induce any Restricted Business Relationship: (i) to end their franchise or contract (or reduce their business)

with the Company or any member of the Company Group; or (ii) to enter into any service to Executive or any other business, organization,

program or activity, in each case (with respect to this clause (ii)) that competes with the Business; or

(d) solicit,

encourage, entice or induce any Restricted Service Provider to terminate his, her or its employment or engagement with the Company or

any member of the Company Group in any manner that is competitive to the Company or any member of the Company Group.

Notwithstanding the foregoing, nothing in this

Section 9 shall restrict Executive from engaging or participating in any activity permitted pursuant to Section 4.

9.3 Because

of the difficulty of measuring economic losses to the Company and other members of the Company Group as a result of a breach or threatened

breach of the covenants set forth in this Section 9, and because of the immediate and irreparable damage that would be caused

to the Company and other members of the Company Group for which they would have no other adequate remedy, the Company and each other member

of the Company Group shall be entitled to enforce the foregoing covenants, in the event of a breach or threatened breach, by preliminary

and permanent injunctions and restraining orders from any court of competent jurisdiction, without the necessity of showing any actual

damages, and without the necessity of posting any bond or other security. The aforementioned equitable relief shall not be the Company’s

or any other member of the Company Group’s exclusive remedy for a breach but instead shall be in addition to all other rights and

remedies available to the Company and each other member of the Company Group at law and equity.

9.4 The

covenants in this Section 9, and each provision and portion hereof, are severable and separate, and the unenforceability of

any specific covenant (or portion thereof) shall not affect the provisions of any other covenant (or portion thereof). Moreover, in the

event any court of competent jurisdiction shall determine that the scope, time or territorial restrictions set forth are unreasonable,

then it is the intention of the parties that such restrictions be enforced to the fullest extent which such court deems reasonable, and

this Agreement shall thereby be reformed.

9.5 The

following terms shall have the following meanings:

(a) “Business”

shall mean the business, operations, products, or services that are the same or substantially similar to those performed by the Company

and any other member of the Company Group while Executive was employed by the Company or that are the same or substantially similar to

the business, operations, products, or services which the Company or any member of the Company Group had active plans to provide while

Executive was employed by the Company; provided that “Business” shall not include any Company Group member: (i) for which

Executive did not perform services while employed by the Company; or (ii) Executive did not obtain trade secrets about such Company

Group member. The parties agree that as of the Employment Commencement Date, the Company Group’s business and operations include:

(A) franchising real estate brokerages, franchising mortgage brokerages, real estate brokerages, mortgage lending, or mortgage brokerages;

or (B) website or mobile applications designed for the display of real estate listing data, or lead generation or business development

for franchising real estate brokerages, franchising mortgage brokerages, real estate brokerages, or mortgage brokerages.

(b) “Business

Opportunity” shall mean any commercial, investment or other business opportunity of the Company or any member of the Company

relating to the Business that Executive learned about while employed by the Company due to Executive’s employment with the Company

or Executive’s services to any member of the Company Group.

(c) “Market

Area” shall mean any of the following locations: (i) during Executive’s employment or engagement with the Company,

every state, city, county, territory or other locale in which the Company (including franchisees of the Company Group) operates or has

taken recent and significant preparatory steps to enter, and (ii) after the termination of Executive’s employment or engagement

with the Company, any of the following locations: (A) the fifty (50) mile radius around any Company business location at which Executive

has worked on a regular basis during Executive’s employment with the Company; (B) the fifty (50) mile radius around Executive’s

home if Executive worked from home on a regular or occasional basis; or (C) any state, city, county, or similar political subdivision

in the United States or internationally in which: (x) the Company or any member of the Company Group regularly conducted Business

during Executive’s last twelve (12) months of employment with the Company; and (y) where Executive conducted business on behalf

of the Company during the last twelve (12) months prior to Executive’s termination of employment with the Company.

(d) “Prohibited

Period” shall mean the period during which Executive is employed by the Company and continuing for a period of (i) twelve

(12) months if Executive was employed by the Company for less than two (2) years and (ii) eighteen (18) months if Executive

was employed by the Company for two (2) years or more following the date that Executive is no longer employed by the Company, regardless

of whether Executive’s employment with the Company was voluntarily or involuntarily terminated. The Prohibited Period may not be

tolled or extended except by mutual agreement of the parties.

(e) “Restricted

Business Relationship” shall mean: (i) during Executive’s employment or engagement with the Company, any customer,

franchisee, real estate sales associate, loan originator, or regional owner of a franchise of the Company or any member of the Company

Group for which Executive provides services or about which Executive learned trade secrets; and (ii) after the termination of Executive’s

employment with the Company, any customer, franchisee, real estate sales associate, loan originator, or regional owner of a franchise

of the Company or any member of the Company Group which, during Executive’s last twelve (12) months of employment with the Company,

Executive: (a) solicited, serviced or had established a business-relationship; (b) was introduced to directly or through Executive’s

direct or indirect reports, or (c) about which Executive learned trade secrets.

(f) “Restricted

Service Provider” shall mean: (i) during Executive’s employment or engagement with the Company, any employee,

consultant, agent, representative, or independent contractor of the Company or any member of the Company Group for which Executive provides

services or about which Executive learned trade secrets; and (ii) after the termination of Executive’s employment or engagement

with the Company, any employee, consultant, agent, representative, or independent contractor of the Company or any member of the Company

Group which, during Executive’s last twelve (12) months of employment with the Company, Executive: (A) Executive had direct

business-related contacts with through Executive’s employment or services to the Company or any member of the Company Group; (B) was

responsible for and directed the operations of (directly or through Executive’s direct or indirect reports) through Executive’s

employment or services to the Company or any member of the Company Group; or (C) about which Executive learned trade secrets. Notwithstanding

the foregoing, Restricted Service Provider shall not include any person or entity who has not had any business-related contact with the

Company or any member of the Company Group within the twelve (12) months immediately preceding Executive’s last date of employment

with the Company.

10. NONDISPARAGEMENT.

10.1 Subject

to Section 8.5 above, Executive agrees that from and after the Employment Commencement Date, Executive will not, directly

or indirectly, make, publish, or communicate any disparaging or defamatory comments regarding the Company or any of its current or former

directors, officers, or executives. The foregoing shall not be violated by truthful statements in response to legal process, required

governmental testimony or filings or administrative or arbitral proceedings (including, without limitation, depositions in connection

with such proceedings). This provision shall not be interpreted to require or encourage Executive to make any misrepresentations. Further,

nothing in this Section prevents Executive from discussing or disclosing information including the underlying facts of any alleged

discriminatory or unfair employment practice, such as sexual harassment or sexual abuse, or any other conduct that Executive has reason

to believe is unlawful or violative of the Company’s policies or procedures. The parties agree that disclosure of the underlying

facts of any alleged discriminatory or unfair employment practice does not constitute disparagement.

10.2 Company

agrees that Company’s and Holding’s executive officers (the “Covered Individuals”) will not disparage

Executive. This provision shall not prohibit Company and the Covered Individuals from making any statements or taking any actions required

by law, reporting any actions or inactions to a governmental agency that Company or the Covered Individuals believe to be unlawful, or

participating in or cooperating with a governmental investigation. This provision shall not be interpreted to require or encourage Company

or the Covered Individuals to make any misrepresentations. If the Covered Individuals disparage Executive to a third party, Company will

not seek to enforce the non-disparagement provisions of this Agreement or seek damages against Executive or any other party to this Agreement

for violating those provisions, but all other remaining terms of this Agreement remain enforceable.

10.3 At

the same time that this Agreement is signed, Company and Executive will sign the addendum attached hereto as Exhibit B attesting

to compliance with C.R.S. § 24-34-407(b).

11. OWNERSHIP

OF INTELLECTUAL PROPERTY.

11.1 Executive

agrees that the Company shall own, and Executive shall (and hereby does) assign, all right, title and interest (including patent rights,

copyrights, trade secret rights, mask work rights, trademark rights, and all other intellectual and industrial property rights of any

sort throughout the world) relating to any and all inventions (whether or not patentable), works of authorship, mask works, designs, know-how,

ideas and information authored, created, contributed to, made or conceived or reduced to practice, in whole or in part, by Executive during

the period in which Executive is or has been employed by or affiliated with the Company or any other member of the Company Group that

either (a) relate, at the time of conception, reduction to practice, creation, derivation or development, to any member of the Company

Group’s businesses or actual or anticipated research or development, or (b) were developed on any amount of the Company’s

or any other member of the Company Group’s time or with the use of any member of the Company Group’s equipment, supplies,

facilities or trade secret information (all of the foregoing collectively referred to herein as “Company Intellectual Property”),

and Executive shall promptly disclose all Company Intellectual Property to the Company. All of Executive’s works of authorship and

associated copyrights created during the period in which Executive is employed by or affiliated with the Company or any other member of

the Company Group and in the scope of Executive’s employment or engagement (the “Works”) shall be deemed

to be “works made for hire” within the meaning of the Copyright Act and shall belong exclusively to Company, without Company

having the obligation of paying additional compensation to Executive. To the extent that the foregoing does not apply, Executive hereby

irrevocably assigns to the Company, for no additional consideration, Executive’s entire right, title, and interest in and to all

Works and all intellectual property rights therein, including the right to sue, counterclaim, and recover for all past, present, and future

infringement, misappropriation, or dilution thereof, and all rights corresponding thereto throughout the world. Executive shall perform,

during and after the period in which Executive is or has been employed by or affiliated with the Company or any other member of the Company

Group, all reasonable acts deemed necessary by the Company to assist each member of the Company Group, at the Company’s expense,

in obtaining and enforcing its rights throughout the world in the Company Intellectual Property. Such acts may include execution of documents