AtlasClear, Inc. (“AtlasClear”) and Quantum FinTech Acquisition

Corporation (“Quantum”) (NYSE: QFTA), a publicly traded special

purpose acquisition company, today announced the filing on May 4,

2023 with the U.S. Securities and Exchange Commission (the “SEC”)

of a registration statement on Form S-4 by Calculator New Pubco,

Inc. (“New Pubco”) (to be renamed AtlasClear Holdings, Inc.

(“AtlasClear Holdings”)) in relation to its previously announced

business combination.

In November 2022, Quantum entered into a definitive business

combination agreement that is expected to result in Atlas FinTech

Holdings Corp. transferring its trading technology assets to

AtlasClear and the acquisition by AtlasClear of Wilson Davis &

Co., Inc., a correspondent clearing broker-dealer (“Wilson-Davis”),

pending required regulatory approvals. AtlasClear has also entered

into a definitive agreement to acquire Commercial Bancorp of

Wyoming, a federal reserve member (“Commercial Bancorp”), following

consummation of the initial business combination, which is expected

to close in the second or third quarter of 2023, pending required

regulatory approvals.

About AtlasClear Holdings

AtlasClear Holdings plans to build a cutting-edge technology

enabled financial services firm that would create a more efficient

platform for trading, clearing, settlement and banking of evolving

and innovative financial products with a focus on the small and

middle market financial services firms. The team that will lead

AtlasClear Holdings consists of respected financial services

industry veterans that have founded and led other companies in the

industry including Penson Clearing, Southwest Securities, NexTrade

and Anderen Bank.

The nature of the combined entity is expected to be supported by

robust, proven, financial technologies with a full suite that will

enable the flow of business and success of the enterprise. The

combined entity is expected to have a full exchange platform for a

spectrum of financial products. In addition, the combined entity is

expected to have a full prime brokerage and, following the

Commercial Bancorp acquisition, a prime banking platform with

complete front-end delivery. The enterprise is anticipated to offer

a fixed income risk management platform which can be expanded to a

diverse application on financial products.

The combined entity is expected to be run by a new digital suite

of technologies that will be part of the transaction at

closing.

About Quantum FinTech Acquisition Corporation

Quantum FinTech Acquisition Corporation is a blank check

company, also commonly referred to as a special purpose acquisition

company, or SPAC, that was formed for the purpose of entering into

a merger, share exchange, asset acquisition, stock purchase,

recapitalization, reorganization or other similar business

combination with one or more businesses, with a principal focus on

identifying high-growth financial services and fintech businesses

as targets.

About Wilson-Davis & Co., Inc.

Wilson-Davis is a full-service correspondent securities

broker-dealer. The company is registered with the SEC, the

Financial Industry Regulatory Authority and the Securities Investor

Protection Organization. In addition, Wilson-Davis is a member of

DTCC as well as the National Securities Clearing Corporation.

Headquartered in Salt Lake City, Utah and Dallas, Texas.

Wilson-Davis has been servicing the investment community since

1968, with satellite offices in California, Arizona, Colorado, New

York, New Jersey and Florida.

About Commercial Bancorp of Wyoming

Commercial Bancorp is a bank holding company operating through

its wholly-owned subsidiary, Farmers State Bank (“FSB”) and has

been servicing the local community in Pine Bluffs, WY since 1915.

It has focused the majority of its services on private and

corporate banking. A member of the Federal Reserve, FSB is expected

to be a strategic asset for the combined company’s long-term

business model.

Additional Information and Where to Find It

In connection with the proposed business combination and related

transactions contemplated in connection therewith (the “Proposed

Transaction”), New Pubco has publicly filed with the SEC a

registration statement on Form S-4 containing a preliminary proxy

statement of Quantum and prospectus of New Pubco, and after the

registration statement is declared effective, Quantum will mail a

definitive proxy statement/prospectus relating to the Proposed

Transaction to its stockholders. This press release does not

contain any information that should be considered by Quantum’s

stockholders concerning the Proposed Transaction and is not

intended to constitute the basis of any voting or investment

decision in respect of the Proposed Transaction or the securities

of New Pubco. Quantum’s stockholders and other interested persons

are advised to read the preliminary proxy statement/prospectus and

the amendments thereto and, when available, the definitive proxy

statement/prospectus and other documents filed in connection with

the Proposed Transaction, as these materials will contain important

information about New Pubco, Quantum, AtlasClear, WDCO, Commercial

Bancorp and its subsidiary bank, FSB, and the Proposed Transaction.

When available, the definitive proxy statement/prospectus will be

mailed to stockholders of Quantum as of a record date to be

established for voting on the Proposed Transaction. Stockholders

will also be able to obtain copies of the preliminary proxy

statement/prospectus, the definitive proxy statement/ prospectus

and other documents filed with the SEC, without charge, once

available, at the SEC’s website at www.sec.gov, or by directing a

request to: Quantum FinTech Acquisition Corporation, 4221 W Boy

Scout Blvd., Suite 300, Tampa, FL 33607, Attention: Investor

Relations or by email at atlasclearir@icrinc.com.

No Offer or Solicitation

This press release shall not constitute a “solicitation” as

defined in Section 14 of the Securities Exchange Act of 1934, as

amended. This press release does not constitute an offer, or a

solicitation of an offer, to buy or sell any securities, investment

or other specific product, or a solicitation of any vote or

approval, nor shall there be any offer, solicitation or sale of

securities, investment or other specific product in any

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offer of securities

shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as

amended, or an exemption therefrom.

Participants in Solicitation

Quantum, AtlasClear and their respective directors and executive

officers may be deemed participants in the solicitation of proxies

from Quantum stockholders with respect to the Proposed Transaction.

Quantum stockholders and other interested persons may obtain,

without charge, more detailed information regarding the directors

and officers of Quantum in its Annual Report on Form 10-K, filed

with the SEC on March 31, 2023 (the “2022 Form 10-K”), which is

available free of charge at the SEC’s website at www.sec.gov.

Information regarding the persons who may, under SEC rules, be

deemed participants in the solicitation of proxies to Quantum

stockholders in connection with the Proposed Transaction and other

matters to be voted upon at Quantum’s special meeting of

stockholders will be set forth in the proxy statement/prospectus

for the Proposed Transaction when available. Additional information

regarding the interests of the participants in the solicitation of

proxies from Quantum’s stockholders with respect to the Proposed

Transaction will be contained in the proxy statement/prospectus for

the Proposed Transaction when available.

Cautionary Statement Regarding Forward-Looking

Statements

This communication contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, as amended, that reflect AtlasClear’s and Quantum’s current

views with respect to, among other things, the future operations

and financial performance of AtlasClear, Quantum and the combined

company. Forward-looking statements in this communication may be

identified by the use of words such as “anticipate,” “assume,”

“believe,” “continue,” “could,” “estimate,” “expect,”

“foreseeable,” “future,” “intend,” “may,” “outlook,” “plan,”

“potential,” “proposed” “predict,” “project,” “seek,” “should,”

“target,” “trends,” “will,” “would” and similar terms and phrases.

Forward-looking statements contained in this communication include,

but are not limited to, statements as to (i) expectations regarding

the Proposed Transaction, including timing for its consummation,

(ii) anticipated use of proceeds from the transaction, (iii)

AtlasClear and Quantum’s expectations as to various operational

results and market conditions, (iv) AtlasClear’s anticipated growth

strategy, including the proposed acquisitions, (v) anticipated

benefits of the Proposed Transaction and proposed acquisitions,

(vi) the financial technology of the combined entity, and (vii)

expected listing of the combined company.

The forward-looking statements contained in this communication

are based on the current expectations of AtlasClear, Quantum and

their respective management and are subject to risks and

uncertainties. No assurance can be given that future developments

affecting AtlasClear, Quantum or the combined company will be those

that are anticipated. Actual results may differ materially from

current expectations due to changes in global, regional or local

economic, business, competitive, market, regulatory and other

factors, many of which are beyond the control of AtlasClear and

Quantum. Should one or more of these risks or uncertainties

materialize, or should any of the assumptions prove incorrect,

actual results may vary in material respects from those projected

in these forward-looking statements. Factors that could cause

actual results to differ may emerge from time to time, and it is

not possible to predict all of them.

Such factors include, but are not limited to: the risk that the

transaction may not be completed in a timely manner or at all; the

risk that the transaction closes but AtlasClear’s acquisition of

Commercial Bancorp and its subsidiary bank, FSB, does not close as

a result of the failure to satisfy the conditions to closing such

acquisition (including, without limitation, the receipt of approval

of Commercial Bancorp’s stockholders and receipt of required

regulatory approvals); the failure to obtain requisite approval for

the transaction or meet other closing conditions; the occurrence of

any event, change or other circumstances that could give rise to

the termination of the definitive agreement in respect of the

transaction; failure to achieve sufficient cash available (taking

into account all available financing sources) following any

redemptions of Quantum’s public stockholders; failure to obtain the

requisite approval of Quantum’s stockholders; failure to meet

relevant listing standards in connection with the consummation of

the transaction; failure to recognize the anticipated benefits of

the transaction, which may be affected by, among other things,

competition, the ability of the combined entity to maintain

relationships with customers and suppliers and strategic alliance

third parties, and to retain its management and key employees;

potential litigation relating to the proposed transaction; changes

to the proposed structure of the transaction that may be required

or appropriate as a result of the announcement and execution of the

transaction; unexpected costs and expenses related to the

transaction; estimates of AtlasClear and the combined company’s

financial performance being materially incorrect predictions;

AtlasClear’s failure to complete the proposed acquisitions on

favorable terms to AtlasClear or at all; AtlasClear’s inability to

integrate, and to realize the benefits of, the proposed

acquisitions; changes in general economic or political conditions;

changes in the markets that AtlasClear targets or the combined

company will target; slowdowns in securities or cryptocurrency

trading or shifting demand for trading, clearing and settling

financial products; the impact of the ongoing COVID-19 pandemic;

any change in laws applicable to Quantum or AtlasClear or any

regulatory or judicial interpretation thereof; and other factors,

risks and uncertainties, including those to be included under the

heading “Risk Factors” in the proxy statement/prospectus filed or

to be later filed with the SEC, and those included under the

heading “Risk Factors” in Quantum’s 2022 Form 10-K and its

subsequent filings with the SEC. AtlasClear and Quantum caution

that the foregoing list of factors is not exhaustive. Any

forward-looking statement made in this communication speaks only as

of the date hereof. Plans, intentions or expectations disclosed in

forward-looking statements may not be achieved and no one should

place undue reliance on such forward-looking statements. Neither

AtlasClear nor Quantum undertake any obligation to update, revise

or review any forward-looking statement, whether as a result of new

information, future developments or otherwise, except as may be

required by any applicable securities laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230505005206/en/

Quantum FinTech Acquisition Corporation Investors

atlasclearir@icrinc.com Media AtlasClearPR@icrinc.com

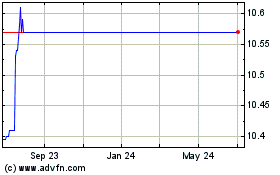

Quantum FinTech Acquisit... (NYSE:QFTA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Quantum FinTech Acquisit... (NYSE:QFTA)

Historical Stock Chart

From Jan 2024 to Jan 2025