CONSHOHOCKEN, Pa., May 1 /PRNewswire-FirstCall/ -- Quaker Chemical

Corporation (NYSE:KWR) today announced record quarterly sales for

the first quarter 2007 of $124.9 million and net income of $3.5

million, a sales increase of 13.7%, and a net income increase of

39%, compared to the first quarter 2006. Earnings per share

increased to $0.35 per diluted share from $0.26 per diluted share

for the first quarter 2006. First Quarter 2007 Summary Net sales

for the first quarter were $124.9 million, compared to $109.8 for

the first quarter of 2006. The increase in net sales was primarily

attributable to a combination of higher sales prices and volume

growth. Volume growth was mainly attributable to double digit sales

growth in China and higher revenue related to the Company's CMS

channel. Foreign exchange rate translation also increased revenues

by approximately 4% for the first quarter of 2007, compared to the

same period in 2006. Selling price increases were realized across

all regions and market segments, in part, as an ongoing effort to

offset higher raw material costs. CMS revenues were higher due to

additional CMS accounts and the renewal and restructuring of

several of the Company's CMS contracts. Gross margin as a

percentage of sales was 30.9% for the first quarter of 2007,

compared to 29.6% for the first quarter of 2006. Higher selling

prices and additional contribution from the Company's CMS channel

helped improve margins. On a sequential basis, however, the first

quarter 2007 gross margin percentage was below the fourth quarter

2006 gross margin percentage of 32.3%, as higher CMS service

revenues, which include revenues from third-party product sales to

CMS accounts, have lower gross margin percentages than traditional

product sales. This change in sales mix decreased gross margin as a

percentage of sales by approximately 1.5 percentage points compared

to the fourth quarter of 2006. Selling, general and administrative

expenses for the quarter increased $4.6 million, as compared to the

first quarter of 2006. Foreign exchange rate translation accounted

for approximately $1.0 million of the increase over the first

quarter of 2006. Also negatively affecting the comparison with the

prior year is a pension gain of $0.9 million recorded in the first

quarter of 2006 due to a legislative change. The remainder of the

increase was due to continued planned spending in higher growth

areas, primarily China, higher commissions as a result of higher

sales, and increased incentive compensation as a result of higher

earnings. The increase in other income was the result of higher

foreign exchange rate losses recorded in the prior year. The

increase in net interest expense is attributable to higher average

borrowings and higher interest rates. The Company's effective tax

rate was 32.9% for the first quarter of 2007, compared to 36.2% for

the first quarter of 2006. The decrease in the effective tax rate

was primarily attributable to a shifting of income to lower rate

tax jurisdictions, which was offset in part by the Company's first

quarter 2007 adoption of FASB Interpretation No. 48, "Accounting

for Uncertainty in Income Taxes" ("FIN 48"). Balance Sheet and Cash

Flow Items The Company's net debt has increased from December 31,

2006, primarily to fund working capital needs driven by higher

sales late in the quarter and the start-up of a new operation in

China. The Company's net debt-to-total capital ratio was 43% at

March 31, 2007, compared to 40% at December 31, 2006. In connection

with the adoption of FIN 48, the Company recorded a non-cash charge

to shareholders' equity of $5.5 million, which negatively impacted

the Company's net debt-to-total capital ratio by approximately 1

percentage point. Ronald J. Naples, Chairman and Chief Executive

Officer, commented, "We had a fine first quarter resulting from

increased contributions from strategic initiatives such as

Asia/Pacific growth and CMS, as well as our continued actions on

the pricing front. Virtually worldwide, we had solid results in the

first quarter. Even though sequential quarterly gross margin

percentage slipped a bit, due primarily to sales mix, we were able

to achieve higher gross margin in dollar terms even as raw material

costs ran considerably ahead of last year. This flowed from

business expansion efforts and, importantly, from our work with

customers to recognize the value we deliver as well as our cost

realities. We continue to invest where we think we can get growth

and feel good about our long-term future and the prospects of

continuing earnings improvement in 2007." Quaker Chemical

Corporation is a leading global provider of process chemicals,

chemical specialties, services, and technical expertise to a wide

range of industries - including steel, automotive, mining,

aerospace, tube and pipe, coatings, and construction materials. Our

products, technical solutions, and chemical management services

enhance our customers' processes, improve their product quality,

and lower their costs. Quaker's headquarters is located near

Philadelphia in Conshohocken, Pennsylvania. This release contains

forward-looking statements that are subject to certain risks and

uncertainties that could cause actual results to differ materially

from those projected in such statements. A major risk is that the

Company's demand is largely derived from the demand for its

customers' products, which subjects the Company to downturns in a

customer's business and unanticipated customer production

shutdowns. Other major risks and uncertainties include, but are not

limited to, significant increases in raw material costs, customer

financial stability, worldwide economic and political conditions,

foreign currency fluctuations, and future terrorist attacks such as

those that occurred on September 11, 2001. Other factors could also

adversely affect us. Therefore, we caution you not to place undue

reliance on our forward-looking statements. This discussion is

provided as permitted by the Private Securities Litigation Reform

Act of 1995. As previously announced, Quaker Chemical's investor

conference call to discuss first quarter results is scheduled for

May 2, 2007 at 2:30 p.m. (ET). Access the conference by calling

877-269-7756 or visit Quaker's Web site at

http://www.quakerchem.com/ for a live webcast. Quaker Chemical

Corporation Condensed Consolidated Statement of Income (Dollars in

thousands, except per share data and share amounts) (Unaudited)

Three Months ended March 31, 2007 2006 Net sales $124,891 $109,816

Cost of goods sold 86,345 77,331 Gross margin 38,546 32,485 % 30.9%

29.6% Selling, general and administrative 31,919 27,362 Operating

income 6,627 5,123 % 5.3% 4.7% Other income, net 327 128 Interest

expense, net (1,350) (965) Income before taxes 5,604 4,286 Taxes on

income 1,844 1,553 3,760 2,733 Equity in net income of associated

companies 125 113 Minority interest in net income of subsidiaries

(348) (304) Net income (loss) $3,537 $2,542 % 2.8% 2.3% Per share

data: Net income - basic $0.36 $0.26 Net income - diluted $0.35

$0.26 Shares Outstanding: Basic 9,907,683 9,723,432 Diluted

10,024,905 9,816,149 Quaker Chemical Corporation Condensed

Consolidated Balance Sheet (Dollars in thousands, except par value

and share amounts) (Unaudited) March 31, December 31, 2007 2006

ASSETS Current assets Cash and cash equivalents $10,787 $16,062

Accounts receivable, net 118,834 107,340 Inventories, net 55,420

51,984 Prepaid expenses and other current assets 12,213 10,855

Total current assets 197,254 186,241 Property, plant and equipment,

net 61,464 60,927 Goodwill 40,235 38,740 Other intangible assets,

net 8,046 8,330 Investments in associated companies 6,840 7,044

Deferred income taxes 33,197 28,573 Other assets 27,083 27,527

Total assets $374,119 $357,382 LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities Short-term borrowings and current portion of

long-term debt $3,702 $4,950 Accounts and other payables 64,404

56,345 Accrued compensation 8,987 15,225 Other current liabilities

15,480 13,659 Total current liabilities 92,573 90,179 Long-term

debt 90,535 85,237 Deferred income taxes 5,493 5,317 Other

non-current liabilities 71,139 61,783 Total liabilities 259,740

242,516 Minority interest in equity of subsidiaries 4,154 4,035

Shareholders' equity Common stock, $1 par value; authorized

30,000,000 shares; issued 10,083,434 shares 10,083 9,926 Capital in

excess of par value 7,380 5,466 Retained earnings 110,365 114,498

Accumulated other comprehensive loss (17,603) (19,059) Total

shareholders' equity 110,225 110,831 Total liabilities and

shareholders' equity $374,119 $357,382 Quaker Chemical Corporation

Condensed Consolidated Statement of Cash Flows For the Three Months

ended March 31, (Dollars in thousands) (Unaudited) 2007 2006 Cash

flows from operating activities Net income $3,537 2,542 Adjustments

to reconcile net income to net cash used in operating activities:

Depreciation 2,719 2,495 Amortization 339 351 Equity in net income

of associated companies, net of dividends 44 92 Minority interest

in earnings of subsidiaries 348 304 Deferred income tax 361 (361)

Deferred compensation and other, net 267 (184) Stock-based

compensation 262 171 (Gain) Loss on disposal of property, plant and

equipment 5 - Insurance settlement realized (265) (72) Pension and

other postretirement benefits (869) (1,865) Increase (decrease) in

cash from changes in current assets and current liabilities, net of

acquisitions: Accounts receivable (10,633) (6,425) Inventories

(3,019) (3,696) Prepaid expenses and other current assets (873)

(2,330) Accounts payable and accrued liabilities 2,749 245 Change

in restructuring liabilities - (2,912) Net cash used in operating

activities (5,028) (11,645) Cash flows from investing activities

Capital expenditures (2,721) (1,655) Payments related to

acquisitions (1,000) (1,000) Insurance settlement received and

interest earned 143 75 Change in restricted cash, net 122 (3) Net

cash used in investing activities (3,456) (2,583) Cash flows from

financing activities Net (decrease) increase in short-term

borrowings (1,262) (2,504) Proceeds from long-term debt 5,277

12,340 Repayments of long-term debt (225) (233) Dividends paid

(2,137) (2,090) Stock options exercised, other 1,809 101

Distributions to minority shareholders (270) (350) Net cash

provided by financing activities 3,192 7,264 Effect of exchange

rate changes on cash 17 448 Net decrease in cash and cash

equivalents (5,275) (6,516) Cash and cash equivalents at the

beginning of the period 16,062 16,121 Cash and cash equivalents at

the end of the period $10,787 $9,605 DATASOURCE: Quaker Chemical

Corporation CONTACT: Mark A. Featherstone, Vice President and Chief

Financial Officer of Quaker Chemical Corporation, +1-610-832-4160

Web site: http://www.quakerchem.com/

Copyright

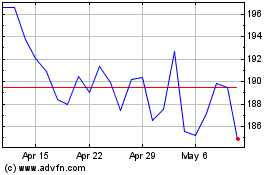

Quaker Houghton (NYSE:KWR)

Historical Stock Chart

From Jun 2024 to Jul 2024

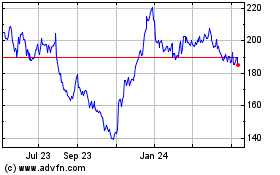

Quaker Houghton (NYSE:KWR)

Historical Stock Chart

From Jul 2023 to Jul 2024