First-Quarter Results

- First-quarter earnings of $748 million or $1.73 per share;

adjusted earnings of $822 million or $1.90 per share

- $1.6 billion returned to shareholders through dividends and

share repurchases

- Refining operated at 92% crude utilization

- Recently announced 10% increase to the quarterly dividend to

$1.15 per common share

- Earned industry recognition for 2023 exemplary safety

performance in Midstream, Refining and Chemicals

Strategic Priorities Highlights

- Returned $9.9 billion to shareholders through dividends and

share repurchases since July 2022

- On track to achieve $1.4 billion of business transformation

cost and sustaining capital savings by year-end 2024

- Launched process to divest retail marketing assets in Germany

and Austria

- Commenced operations at Rodeo Renewable Energy Complex

Phillips 66 (NYSE: PSX), a leading diversified and integrated

downstream energy company, announced first-quarter earnings of $748

million, compared with earnings of $1.3 billion in the fourth

quarter. Excluding special items of $74 million, the company had

adjusted earnings of $822 million in the first quarter, compared

with fourth-quarter adjusted earnings of $1.4 billion.

“In the first quarter, we progressed our strategic priorities

and returned $1.6 billion to shareholders,” said Mark Lashier,

president and CEO of Phillips 66. “While our crude utilization

rates were strong, our results were affected by maintenance that

limited our ability to make higher-value products. We were also

impacted by the renewable fuels conversion at Rodeo, as well as the

effect of rising commodity prices on our inventory hedge positions.

The maintenance is behind us, our assets are currently running near

historical highs and we are ready to meet peak summer demand.

“We recently launched a process to sell our retail marketing

business in Germany and Austria, consistent with our plan to divest

non-core assets. A major milestone was achieved with the startup of

our Rodeo Renewable Energy Complex, positioning Phillips 66 as a

world leader in renewable fuels.

“We remain committed to delivering increased value to our

shareholders. We have returned $9.9 billion to shareholders through

share repurchases and dividends since July 2022, on pace to meet

our target of $13 billion to $15 billion by year-end 2024. Our

strategic priorities put us on a clear path to achieve our $14

billion mid-cycle adjusted EBITDA target by 2025 and return over

50% of operating cash flows to shareholders.”

Midstream

Millions of Dollars

Pre-Tax Income

Adjusted Pre-Tax

Income

1Q 2024

4Q 2023

1Q 2024

4Q 2023

Transportation

$

243

334

302

334

NGL and Other

306

425

306

423

NOVONIX

5

(3)

5

(3)

Midstream

$

554

756

613

754

Midstream first-quarter 2024 pre-tax income was $554 million,

compared with $756 million in the fourth quarter of 2023. Results

in the first quarter included a $59 million asset impairment.

Fourth-quarter results included a $2 million tax benefit.

Transportation first-quarter adjusted pre-tax income was $302

million, compared with adjusted pre-tax income of $334 million in

the fourth quarter. The decline mainly reflects a decrease in

throughput and deficiency revenues, partially offset by seasonally

lower maintenance costs.

NGL and Other adjusted pre-tax income was $306 million in the

first quarter, compared with adjusted pre-tax income of $423

million in the fourth quarter. The decrease was mainly due to a

decline in margins, as well as lower volumes reflecting impacts

from winter storms.

In the first quarter, the fair value of the company’s investment

in NOVONIX, Ltd. increased by $5 million, compared with a $3

million decrease in the fourth quarter.

Chemicals

Millions of Dollars

Pre-Tax Income

Adjusted Pre-Tax

Income

1Q 2024

4Q 2023

1Q 2024

4Q 2023

Chemicals

$

205

106

205

106

The Chemicals segment reflects Phillips 66’s equity investment

in Chevron Phillips Chemical Company LLC (CPChem). Chemicals

first-quarter 2024 reported and adjusted pre-tax income was $205

million, compared with fourth-quarter 2023 reported and adjusted

pre-tax income of $106 million. The increase was mainly due to

higher polyethylene margins driven by improved sales prices and a

decline in feedstock costs, as well as lower turnaround costs.

Global olefins and polyolefins utilization was 96% for the

quarter.

Refining

Millions of Dollars

Pre-Tax Income

Adjusted Pre-Tax

Income

1Q 2024

4Q 2023

1Q 2024

4Q 2023

Refining

$

131

814

228

797

Refining first-quarter 2024 reported pre-tax income was $131

million, compared with pre-tax income of $814 million in the fourth

quarter of 2023. Results in the first quarter included a $104

million asset impairment and a $7 million benefit related to a

legal settlement. Fourth-quarter results included a $17 million tax

benefit.

Adjusted pre-tax income for Refining was $228 million in the

first quarter, compared with adjusted pre-tax income of $797

million in the fourth quarter. The decrease was primarily due to a

decline in realized margins driven by less favorable commercial

results, inventory hedging impacts and lower Gulf Coast clean

product realizations.

Refining pre-tax turnaround expense for the first quarter was

$160 million, including $36 million related to the Rodeo Renewable

Energy Complex. The crude utilization rate was 92%, clean product

yield was 84% and market capture was 69%.

Marketing and Specialties

Millions of Dollars

Pre-Tax Income

Adjusted Pre-Tax

Income

1Q 2024

4Q 2023

1Q 2024

4Q 2023

Marketing and Specialties

$

404

432

345

432

Marketing and Specialties first-quarter 2024 pre-tax income was

$404 million, compared with $432 million in the fourth quarter of

2023. Results in the first quarter included a $59 million benefit

related to a legal settlement.

Adjusted pre-tax income for Marketing and Specialties was $345

million in the first quarter, compared with $432 million in the

fourth quarter. The decrease in the first quarter was mainly due to

lower domestic marketing and lubricant margins.

Corporate and Other

Millions of Dollars

Pre-Tax Loss

Adjusted Pre-Tax Loss

1Q 2024

4Q 2023

1Q 2024

4Q 2023

Corporate and Other

$

(330)

(347)

(330)

(297)

Corporate and Other first-quarter 2024 pre-tax costs were $330

million, compared with pre-tax costs of $347 million in the fourth

quarter of 2023. Results in the fourth quarter included

restructuring costs of $50 million.

Adjusted pre-tax costs were $330 million in the first quarter of

2024, compared with $297 million in the fourth quarter. Increased

costs in the first quarter were mainly due to higher net interest

expense.

Financial Position, Liquidity and Return of Capital

Cash used in operations was $236 million in the first quarter.

Operating cash flow was $1.2 billion, excluding $1.4 billion of

working capital impacts mainly due to inventory builds. The company

had net debt issuances of $802 million.

During the first quarter, Phillips 66 funded $1.2 billion of

share repurchases, $448 million in dividends and $628 million of

capital expenditures and investments.

As of March 31, 2024, the company had $1.6 billion of cash and

cash equivalents and $3.5 billion of committed capacity available

under its credit facility. The company’s consolidated

debt-to-capital ratio was 40% and its net debt-to-capital ratio was

38%. The company ended the quarter with 424 million shares

outstanding.

Strategic Priorities and Business Update

Phillips 66 is executing its strategic priorities to increase

mid-cycle adjusted EBITDA to $14 billion by 2025 and return over

50% of operating cash flow to shareholders. Since July 2022, the

company has distributed $9.9 billion through share repurchases and

dividends and is on pace to achieve its $13 billion to $15 billion

target by year-end 2024.

Phillips 66 plans to monetize assets that no longer fit its

long-term strategy. The company is progressing the potential

divestiture of its retail marketing business in Germany and

Austria. Completion of dispositions is subject to market and other

conditions, including customary approvals.

The company achieved $1.24 billion in run-rate cost and

sustaining capital savings through business transformation as of

March 31, 2024. The company is targeting $1.4 billion in run-rate

savings by the end of 2024.

Phillips 66 is capturing value from its Midstream NGL

wellhead-to-market strategy. The company’s increased ownership of

DCP Midstream has provided an incremental $1.25 billion toward its

2025 mid-cycle adjusted EBITDA target, including approximately $250

million of synergies. The company remains focused on capturing over

$400 million of run-rate commercial and operating synergies by the

end of 2024.

In Chemicals, CPChem is building world-scale petrochemical

facilities with a joint-venture partner on the U.S. Gulf Coast and

in Ras Laffan, Qatar. Both projects are expected to start up in

2026.

In Refining, the company continues to invest in high-return,

low-capital projects to improve asset reliability and market

capture. Since 2022, completed projects have added over 3% to

market capture based on mid-cycle pricing.

During the first quarter, Phillips 66 achieved a significant

milestone with the startup of the Rodeo Renewed project. The Rodeo

Renewable Energy Complex is now producing 30,000 barrels per day of

renewable fuels. The facility is on track to produce approximately

50,000 barrels per day (800 million gallons per year) of renewable

fuels by the end of the second quarter, positioning Phillips 66 as

a leader in renewable fuels.

The American Fuel and Petrochemical Manufacturers (AFPM)

recognized four Phillips 66 refineries and two CPChem facilities

for exemplary safety performance in 2023. The Rodeo and Sweeny

facilities both received the Distinguished Safety Award, the

highest annual safety award in the industry. This was Sweeny

Refinery’s third consecutive year to receive the honor. The Ponca

City Refinery earned the Elite Platinum Award, and the Lake Charles

Refinery secured the Elite Gold Award. In Midstream, the company

received the first-place Division I 2023 GPA Midstream Safety Award

for its gathering and processing operations.

Investor Webcast

Members of Phillips 66 executive management will host a webcast

at noon ET to provide an update on the company’s strategic

initiatives and discuss the company’s first-quarter performance. To

access the webcast and view related presentation materials, go to

phillips66.com/investors and click on “Events & Presentations.”

For detailed supplemental information, go to

phillips66.com/supplemental.

Earnings

Millions of Dollars

2024

2023

1Q

4Q

1Q

Midstream

$

554

756

702

Chemicals

205

106

198

Refining

131

814

1,608

Marketing and Specialties

404

432

426

Corporate and Other

(330)

(347)

(283)

Pre-Tax Income

964

1,761

2,651

Less: Income tax expense

203

476

574

Less: Noncontrolling interests

13

25

116

Phillips 66

$

748

1,260

1,961

Adjusted

Earnings

Millions of Dollars

2024

2023

1Q

4Q

1Q

Midstream

$

613

754

678

Chemicals

205

106

198

Refining

228

797

1,608

Marketing and Specialties

345

432

426

Corporate and Other

(330)

(297)

(248)

Pre-Tax Income

1,061

1,792

2,662

Less: Income tax expense

226

405

576

Less: Noncontrolling interests

13

25

121

Phillips 66

$

822

1,362

1,965

About Phillips 66

Phillips 66 (NYSE: PSX) is a leading diversified and integrated

downstream energy provider that manufactures, transports and

markets products that drive the global economy. The company’s

portfolio includes Midstream, Chemicals, Refining, and Marketing

and Specialties businesses. Headquartered in Houston, Phillips 66

has employees around the globe who are committed to safely and

reliably providing energy and improving lives while pursuing a

lower-carbon future. For more information, visit phillips66.com or

follow @Phillips66Co on LinkedIn.

CAUTIONARY STATEMENT FOR THE PURPOSES OF THE

“SAFE HARBOR” PROVISIONS OF THE PRIVATE SECURITIES

LITIGATION REFORM ACT OF 1995

This news release contains forward-looking statements within the

meaning of the federal securities laws. Words such as “adjusted

EBITDA,” “anticipated,” “estimated,” “expected,” “planned,”

“scheduled,” “targeted,” “believe,” “continue,” “intend,” “will,”

“would,” “objective,” “goal,” “project,” “efforts,” “strategies”

and similar expressions that convey the prospective nature of

events or outcomes generally indicate forward-looking statements.

However, the absence of these words does not mean that a statement

is not forward-looking. Forward-looking statements included in this

news release are based on management’s expectations, estimates and

projections as of the date they are made. These statements are not

guarantees of future performance and you should not unduly rely on

them as they involve certain risks, uncertainties and assumptions

that are difficult to predict. Therefore, actual outcomes and

results may differ materially from what is expressed or forecast in

such forward-looking statements. Factors that could cause actual

results or events to differ materially from those described in the

forward-looking statements include: fluctuations in NGL, crude oil,

refined petroleum product and natural gas prices, and refining,

marketing and petrochemical margins; changes in governmental

policies or laws that relate to NGL, crude oil, natural gas,

refined petroleum products, or renewable fuels that regulate

profits, pricing, or taxation, or other regulations that limit or

restrict refining, marketing and midstream operations or restrict

exports; the effects of any widespread public health crisis and its

negative impact on commercial activity and demand for refined

petroleum products; our ability to timely obtain or maintain

permits necessary for capital projects; changes to worldwide

government policies relating to renewable fuels and greenhouse gas

emissions that adversely affect programs including the renewable

fuel standards program, low carbon fuel standards and tax credits

for biofuels; our ability to achieve the expected benefits of the

integration of DCP Midstream, LP, including the realization of

synergies; the success of the company’s business transformation

initiatives and the realization of savings and cost reductions from

actions taken in connection therewith; unexpected changes in costs

for constructing, modifying or operating our facilities; our

ability to successfully complete, or any material delay in the

completion of, asset dispositions or acquisitions that we may

pursue; unexpected difficulties in manufacturing, refining or

transporting our products; the level and success of drilling and

production volumes around our midstream assets; risks and

uncertainties with respect to the actions of actual or potential

competitive suppliers and transporters of refined petroleum

products, renewable fuels or specialty products; lack of, or

disruptions in, adequate and reliable transportation for our NGL,

crude oil, natural gas, and refined products; potential liability

from litigation or for remedial actions, including removal and

reclamation obligations under environmental regulations; failure to

complete construction of capital projects on time and within

budget; our ability to comply with governmental regulations or make

capital expenditures to maintain compliance with laws; limited

access to capital or significantly higher cost of capital related

to illiquidity or uncertainty in the domestic or international

financial markets, which may also impact our ability to repurchase

shares and declare and pay dividends; potential disruption of our

operations due to accidents, weather events, including as a result

of climate change, acts of terrorism or cyberattacks; general

domestic and international economic and political developments,

including armed hostilities (such as the Russia-Ukraine war),

expropriation of assets, and other political, economic or

diplomatic developments; international monetary conditions and

exchange controls; changes in estimates or projections used to

assess fair value of intangible assets, goodwill and property and

equipment and/or strategic decisions with respect to our asset

portfolio that cause impairment charges; investments required, or

reduced demand for products, as a result of environmental rules and

regulations; changes in tax, environmental and other laws and

regulations (including alternative energy mandates); political and

societal concerns about climate change that could result in changes

to our business or increase expenditures, including

litigation-related expenses; the operation, financing and

distribution decisions of equity affiliates we do not control; and

other economic, business, competitive and/or regulatory factors

affecting Phillips 66’s businesses generally as set forth in our

filings with the Securities and Exchange Commission. Phillips 66 is

under no obligation (and expressly disclaims any such obligation)

to update or alter its forward-looking statements, whether as a

result of new information, future events or otherwise.

Use of Non-GAAP Financial Information—This news release

includes the terms “adjusted earnings,” “adjusted pre-tax income

(loss),” “adjusted pre-tax costs,” “adjusted earnings per share,”

“operating cash flow, excluding working capital,” and “net

debt-to-capital ratio.” These are non-GAAP financial measures that

are included to help facilitate comparisons of operating

performance across periods and to help facilitate comparisons with

other companies in our industry. Where applicable, these measures

exclude items that do not reflect the core operating results of our

businesses in the current period or other adjustments to reflect

how management analyzes results. Reconciliations of these non-GAAP

financial measures to the most comparable GAAP financial measure

are included within this release.

This news release also includes the term “mid-cycle adjusted

EBITDA,” which is a forward-looking non-GAAP financial measure.

EBITDA is defined as estimated net income plus estimated net

interest expense, income taxes, and depreciation and amortization.

Adjusted EBITDA is defined as estimated EBITDA plus the

proportional share of selected equity affiliates’ estimated net

interest expense, income taxes, and depreciation and amortization

less the portion of estimated adjusted EBITDA attributable to

noncontrolling interests. Net income is the most directly

comparable GAAP financial measure for the consolidated company and

income before income taxes is the most directly comparable GAAP

financial measure for operating segments. Mid-cycle adjusted EBITDA

is defined as the average adjusted EBITDA generated over a complete

economic cycle. Mid-cycle adjusted EBITDA estimates or targets

depend on future levels of revenues and expenses, including amounts

that will be attributable to noncontrolling interests, which are

not reasonably estimable at this time. Accordingly, we cannot

provide a reconciliation of projected mid-cycle adjusted EBITDA to

consolidated net income or segment income before income taxes

without unreasonable effort.

References in the release to earnings refer to net income

attributable to Phillips 66. References in the release to

shareholder distributions refers to the sum of dividends paid to

Phillips 66 stockholders and proceeds used by Phillips 66 to

repurchase shares of its common stock. References to run-rate cost

savings includes cost savings and references to run-rate synergies

include costs savings and other benefits that will be reflected in

the sales and other operating revenues, purchased crude oil and

products costs, operating expenses, selling, general and

administrative expenses and equity in earnings of affiliates lines

on our consolidated statement of income when realized. References

to run-rate sustaining capital savings includes savings that will

be reflected in the capital expenditures and investments on our

consolidated statement of cash flows when realized. References to

run-rate savings represent the sum of run-rate cost savings and

run-rate sustaining capital savings.

Millions of Dollars

Except as Indicated

2024

2023

1Q

4Q

1Q

Reconciliation of Consolidated Earnings

to Adjusted Earnings

Consolidated Earnings

$

748

1,260

1,961

Pre-tax adjustments:

Impairments

163

—

—

Certain tax impacts

—

(19)

—

Net gain on asset disposition

—

—

(36)

Legal settlement

(66)

—

—

Business transformation restructuring

costs1

—

50

35

DCP integration restructuring costs2

—

—

12

Tax impact of adjustments3

(23)

(12)

(2)

Other tax impacts

—

83

—

Noncontrolling interests

—

—

(5)

Adjusted earnings

$

822

1,362

1,965

Earnings per share of common stock

(dollars)

$

1.73

2.86

4.20

Adjusted earnings per share of common

stock (dollars)4

$

1.90

3.09

4.21

Reconciliation of Segment Pre-Tax

Income (Loss) to Adjusted Pre-Tax Income (Loss)

Midstream Pre-Tax Income

$

554

756

702

Pre-tax adjustments:

Impairments

59

—

—

Certain tax impacts

—

(2)

—

Net gain on asset disposition

—

—

(36)

DCP integration restructuring costs2

—

—

12

Adjusted pre-tax income

$

613

754

678

Chemicals Pre-Tax Income

$

205

106

198

Pre-tax adjustments:

None

—

—

—

Adjusted pre-tax income

$

205

106

198

Refining Pre-Tax Income

$

131

814

1,608

Pre-tax adjustments:

Impairments

104

—

—

Certain tax impacts

—

(17)

—

Legal accrual

—

—

—

Legal settlement

(7)

—

—

Adjusted pre-tax income

$

228

797

1,608

Marketing and Specialties Pre-Tax

Income

$

404

432

426

Pre-tax adjustments:

Legal settlement

(59)

—

—

Adjusted pre-tax income

$

345

432

426

Corporate and Other Pre-Tax

Loss

$

(330)

(347)

(283)

Pre-tax adjustments:

Business transformation restructuring

costs1

—

50

35

Loss on early redemption of DCP debt

—

—

—

Adjusted pre-tax loss

$

(330)

(297)

(248)

1 Restructuring costs, related to Phillips

66’s multi-year business transformation efforts, are primarily due

to consulting fees and severance costs.

2 Restructuring costs, related to the

integration of DCP Midstream, primarily reflect severance costs and

consulting fees. A portion of these costs are attributable to

noncontrolling interests.

3 We generally tax effect taxable

U.S.-based special items using a combined federal and state

statutory income tax rate of approximately 24%. Taxable special

items attributable to foreign locations likewise use a local

statutory income tax rate. Nontaxable events reflect zero income

tax. These events include, but are not limited to, most goodwill

impairments, transactions legislatively exempt from income tax,

transactions related to entities for which we have made an

assertion that the undistributed earnings are permanently

reinvested, or transactions occurring in jurisdictions with a

valuation allowance.

4 Q1 2024 and Q4 2023 are based on

adjusted weighted-average diluted shares of 432,158 thousand and

440,582 thousand, respectively. Other periods are based on the same

weighted-average diluted shares outstanding as that used in the

GAAP diluted earnings per share calculation. Income allocated to

participating securities, if applicable, in the adjusted earnings

per share calculation is the same as that used in the GAAP diluted

earnings per share calculation.

Millions of Dollars

Except as Indicated

March 31, 2024

Debt-to-Capital Ratio

Total Debt

$

20,154

Total Equity

30,793

Debt-to-Capital Ratio

40

%

Total Cash

1,570

Net Debt-to-Capital Ratio

38

%

Millions of Dollars

March 31, 2024

Reconciliation of Net Cash Used in

Operating Activities to Operating Cash Flow, Excluding Working

Capital

Net Cash Used in Operating Activities

$

(236)

Less: Net Working Capital Changes

(1,447)

Operating Cash Flow, Excluding Working

Capital

$

1,211

Millions of Dollars

Except as Indicated

2024

2023

1Q

4Q

Reconciliation of Refining Income

Before Income Taxes to Realized Refining

Margins

Income before income taxes

$

131

814

Plus:

Taxes other than income taxes

86

87

Depreciation, amortization and

impairments

321

227

Selling, general and

administrative expenses

47

48

Operating expenses

1,021

1,086

Equity in (earnings) loss of

affiliates

(108)

85

Other segment expense, net

1

5

Proportional share of refining

gross margins contributed by equity affiliates

331

167

Special items:

Certain tax impacts

—

(15)

Legal settlement

(7)

—

Realized refining

margins

$

1,823

2,504

Total processed inputs (thousands

of barrels)

144,730

156,720

Adjusted total processed inputs

(thousands of barrels)*

166,984

173,786

Income before income taxes

(dollars per barrel)**

$

0.91

5.19

Realized refining margins

(dollars per barrel)***

$

10.91

14.41

*Adjusted total processed inputs include

our proportional share of processed inputs of an equity

affiliate.

**Income before income taxes divided by

total processed inputs.

***Realized refining margins per barrel,

as presented, are calculated using the underlying realized refining

margin amounts, in dollars, divided by adjusted total processed

inputs, in barrels. As such, recalculated per barrel amounts using

the rounded margins and barrels presented may differ from the

presented per barrel amounts.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240426235628/en/

Jeff Dietert (investors) 832-765-2297 jeff.dietert@p66.com

Owen Simpson (investors) 832-765-2297 owen.simpson@p66.com

Thaddeus Herrick (media) 855-841-2368

thaddeus.f.herrick@p66.com

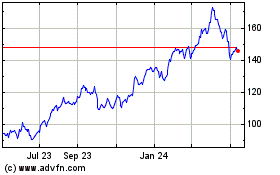

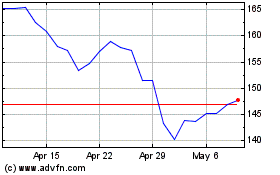

Phillips 66 (NYSE:PSX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Phillips 66 (NYSE:PSX)

Historical Stock Chart

From Nov 2023 to Nov 2024