Report of Foreign Issuer (6-k)

July 24 2020 - 8:18AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of July, 2020

Commission File Number 1-15106

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

(Exact name of registrant as specified in its charter)

Brazilian Petroleum Corporation – PETROBRAS

(Translation of Registrant's name into English)

Avenida República do Chile, 65

20031-912 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras moves forward in the development of the Búzios field

—

Rio de Janeiro, July 24, 2020 – Petróleo Brasileiro S.A. – Petrobras informs that its Executive Board approved today the beginning of the contracting processes for three new Floating Production Storage and Offloading (FPSOs) platforms for the Búzios field, in the Santos Basin pre-salt.

The three new units are part of the Asset Development Plan, which envisages a total of twelve units installed by the end of the decade. At the end of the development phase, the Búzios field is expected to produce more than 2 million barrels of oil equivalent per day (boed), becoming Petrobras' largest production asset.

Currently, there are four units operating in Búzios, which account for over 20% of Petrobras' total production.

The fifth platform, the FPSO Almirante Barroso, is under construction and is scheduled to start production in the second half of 2022.

New units

The first of the three new units will be the FPSO Almirante Tamandaré with startup schedule for the second half of 2024. The FPSO will be chartered with a daily processing capacity of 225 thousand barrels of oil and 12 million m3 of gas, and will be the largest oil production unit operating in Brazil and one of the largest in the world.

The other two units, P-78 and P-79, will be contracted under the Engineering, Procurement and Construction (EPC) model and will have the capacity to process daily 180,000 barrels of oil and 7.2 million m3 of gas, each one. The platforms are expected to start operating in 2025.

Petrobras will contract wet Christmas trees (WCTs), drilling rigs, well services and collection systems.

The FPSOs and WCTs are expected to be contracted in 2021, and the others will start in the next 18 months.

All contracts will meet the local content levels required for the Búzios field.

Petrobras has consolidated its learnings in FPSO projects, which are used as a reference for future contracts, incorporating standardization of specifications and market approach model. Innovations will also be implemented in the FPSOs, such as: mechanism for treatment and reinjection of the water produced in the reservoir; technologies to reduce the need for diving for hull inspection; in addition to items to reduce pollutant gas emissions, with emphasis on the closed flare, equipment that allows the reuse of the gas produced at the plant, without burning.

www.petrobras.com.br/ir

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS | Investor Relations

e-mail: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. República do Chile, 65 – 1002 – 20031-912 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes", "expects", "predicts", "intends", "plans", "projects", "aims", "should," and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore, future results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information included herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: July 24, 2020

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Andrea Marques de Almeida

______________________________

Andrea Marques de Almeida

Chief Financial Officer and Investor Relations Officer

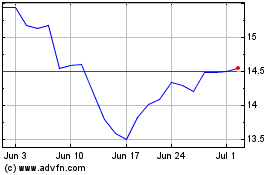

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Aug 2024 to Sep 2024

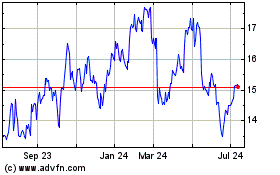

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Sep 2023 to Sep 2024