UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 11-K

Annual report pursuant to Section 15(d) of the Securities and Exchange

Act of 1934 for the fiscal year ended December 31, 2023

Transition report pursuant to Section 15(d) of the Securities

Exchange Act of 1934 for the transition period from ___ to ___

Commission file number: 001-12297

A. Full title of the plan and the address of the plan, if different from

that of the issuer named below:

Penske Automotive Group 401(k) Savings and Retirement Plan

B. Name of the issuer of the securities held pursuant to the plan and the

address of its principal executive office:

Penske Automotive Group, Inc.

2555 Telegraph Road

Bloomfield Hills, MI 48302-0954

Penske Automotive Group 401(k) Savings and Retirement Plan

Table of Contents

| | | | | |

| | Page |

| | |

| |

| |

Financial Statements and Supplemental Schedules | |

| |

| |

| |

| |

Supplemental Schedules* | |

| |

| |

| |

*All other schedules required by Section 2520 103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 have been omitted because they are not applicable. | |

| |

| |

| |

| |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Plan Participants and Plan Administrator of

Penske Automotive Group 401(k) Savings and Retirement Plan

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of Penske Automotive Group 401(k) Savings and Retirement Plan (the "Plan") as of December 31, 2023 and 2022, the related statement of changes in net assets available for benefits for the year ended December 31, 2023, and the related notes (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2023 and 2022, and the changes in net assets available for benefits for the year ended December 31, 2023, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on the Plan's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Report on Supplemental Schedules

The supplemental schedule of assets (held at end of year) as of December 31, 2023, and the schedule of delinquent participant contributions for the year ended December 31, 2023, have been subjected to audit procedures performed in conjunction with the audit of the Plan's financial statements. The supplemental schedules are the responsibility of the Plan's management. Our audit procedures included determining whether the supplemental schedules reconcile to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedules. In forming our opinion on the supplemental schedules, we evaluated whether the supplemental schedules, including their form and content, are presented in compliance with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, such schedules are fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Deloitte & Touche LLP

Detroit, Michigan

June 18, 2024

We have served as the auditor of the Plan since 1999.

Penske Automotive Group 401(k) Savings and Retirement Plan

Statements of Net Assets Available for Benefits

December 31, 2023 and 2022

| | | | | | | | | | | |

| December 31, |

| 2023 | | 2022 |

| | | |

| Assets: | | | |

| Investments at fair value | $ | 910,927,123 | | | $ | 757,683,033 | |

| Receivables: | | | |

| Participant contributions | 2,972,837 | | | 2,855,883 | |

| Employer contributions | 4,687,245 | | | 4,370,968 | |

| Due from broker | — | | | 1,386 | |

| Notes receivable from participants | 22,215,943 | | | 18,892,289 | |

| Total receivables | 29,876,025 | | | 26,120,526 | |

| Total assets | 940,803,148 | | | 783,803,559 | |

| | | |

| Liabilities: | | | |

| Participant refunds payable | 34,316 | | | 36,442 | |

| | | |

| Total liabilities | 34,316 | | | 36,442 | |

| Net assets available for benefits | $ | 940,768,832 | | | $ | 783,767,117 | |

See accompanying notes to the financial statements.

Penske Automotive Group 401(k) Savings and Retirement Plan

Statement of Changes in Net Assets Available for Benefits

Year Ended December 31, 2023

| | | | | |

| Investment income: | |

| Net appreciation in fair value of investments | $ | 134,947,406 | |

| Interest and dividends | 4,836,751 | |

| Net investment gain | 139,784,157 | |

| | |

| Contributions: | |

| Participant contributions | 67,043,069 | |

| Employer contributions | 22,781,261 | |

| Participant rollover contributions | 4,582,924 | |

| Total contributions | 94,407,254 | |

| | |

| Distributions to participants | (76,546,852) | |

| Administration fees | (642,844) | |

| |

| |

| |

| Increase in net assets | 157,001,715 | |

| | |

| Net assets available for benefits, beginning of year | 783,767,117 | |

| Net assets available for benefits, end of year | $ | 940,768,832 | |

See accompanying notes to the financial statements.

Penske Automotive Group 401(k) Savings and Retirement Plan

Notes to Financial Statements

1. Description of the Plan

(a) General

The following description of the Penske Automotive Group 401(k) Savings and Retirement Plan, as amended through December 31, 2023, (the “Plan”), is provided for general information purposes only. Participants should refer to the Plan document for a more complete description of the Plan.

The Plan is a defined contribution savings plan (401(k) plan) covering all eligible employees of Penske Automotive Group, Inc. (the “Company” or “Plan Sponsor”) and its subsidiaries, including eligible employees of Premier Truck Group (“PTG”), in the United States who elect to participate in the Plan. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”). The 401(k) Savings and Retirement Plan Committee (the “Committee”) is the designated administrator of the Plan and has responsibility for reviewing the performance of the Plan’s investments. Certain asset-based fees are paid by the Plan participants. Principal Financial Group ("Principal") serves as the trustee and recordkeeper of the Plan. Participants with balances from plans merged into the Plan due to acquisitions by the Plan Sponsor may retain certain rights of such merged plans.

(b) Recent Legislation

The SECURE 2.0 Act of 2022 (“SECURE 2.0”), signed into law on December 29, 2022, makes significant changes to existing law for retirement plans by building upon provisions in the SECURE Act of 2019. SECURE 2.0 introduces new requirements and considerations for plan sponsors that are intended to expand coverage, increase savings, preserve income, and simplify plan rules and administrative procedures. Each of the provisions in SECURE 2.0 has its own effective date ranging from the date of enactment to 2028 and beyond, with the bulk of the provisions taking effect in 2023 and 2024. The plan has adopted the required minimum distribution at age 73 effective January 1, 2023, and is in the process of evaluating other voluntary provisions. The Plan is required to be amended in regard to other requirements of SECURE 2.0 by December 31, 2025.

(c) Eligibility

Full-time employees in the United States, and part-time or temporary employees in the United States who are scheduled to complete 1,000 hours of service in a twelve consecutive month period beginning with their date of hire, are eligible to participate in the Plan on the first day of the calendar month following the date they have completed sixty days of service.

(d) Participant Accounts

Individual accounts are maintained by the Recordkeeper for each of the Plan’s participants. Such accounts include the participant’s contributions and related Employer Match Contributions (as defined below), as adjusted by the net investment return on the participant’s holdings. Participant accounts are also charged with recordkeeping administrative fees.

(e) Contributions

Under the provisions of the Plan, new employees are automatically enrolled in the Plan at a deferral rate of 2% of eligible employee compensation. Participants may elect to defer, through payroll deductions, a portion of their compensation to the Plan in an amount generally from 1% to 75% of gross earnings. Participants may adjust their deferral percentage at any time. Highly compensated employees (“HCEs”) are limited to deferring up to 10% of gross earnings. The Plan provides for both pre-tax contributions and after-tax (Roth) contributions. Such contributions may not exceed Internal Revenue Code (“IRC”) 402(g) limitations ($22,500 in 2023). The Plan also permits participants who are 50 or older to make additional contributions (up to $7,500 in 2023). A participant’s elective contributions and any related Employer Match Contributions, as defined below, are invested at the direction of the participant. If a participant does not

make such an election, he or she is deemed to have elected to invest in an age-appropriate target retirement fund (“Default Investment”).

In addition to any pre-tax or Roth contributions, the Plan allows participants to make voluntary after-tax contributions and in-plan Roth conversions, allowing participants to convert voluntary after-tax contributions and earnings to a Roth account. Participants may contribute up to 100% of eligible pay, and the Plan was amended on November 1, 2023, to increase the percentage HCEs may contribute from 4% to 6% of eligible pay. These voluntary after-tax contributions can be withdrawn any time prior to an in-plan Roth conversion with up to two withdrawals allowed in a 12-month period.

The Plan Sponsor funds discretionary matching contributions at a level of 62.5% of the first 4% of eligible salary deferrals for most participants and at a level of 50% of the first 6% of eligible salary deferrals for participants of PTG (“Employer Match Contributions”). Eligible salary deferrals used to determine discretionary matching contributions may not exceed IRC 401(a)(17) limitations ($330,000 in 2023). Employer Match Contributions are invested based on participant investment elections or in the Default Investment if the participant did not make an election.

During 2023, rollover contributions by employees hired as a result of acquisitions totaled $365,738.

(f) Notes Receivable from Participants

Participants may take loans from their accounts from a minimum of $1,000 up to the lesser of a defined amount or $50,000. Loan terms range from one to five years, or up to ten years for the purchase of a primary residence. The loans are collateralized by the balance in the participant’s account and bear interest at a rate commensurate with prevailing rates. Principal and interest are paid ratably through payroll deductions. Repayment of the entire balance is permitted at any time. Participants are limited to having only one loan outstanding at any point in time, and participants are restricted to initiating only one loan in any consecutive twelve-month period.

(g) Vesting

Employee contributions to the Plan vest immediately. Employer Match Contributions vest upon the attainment by the participant of three years of credited service.

(h) Investments

As of December 31, 2023 and 2022 participant investment options consisted primarily of common collective trust funds, employer securities, and mutual funds. Participants are generally permitted to change investment options daily.

(i) Payment of Benefits

Upon retirement, death, disability, termination of employment, or attainment of age 59 1/2, the participant or beneficiary may elect to receive a benefit payment in the form of a lump sum distribution. Participants may also make a hardship withdrawal in certain cases of financial need as established by Internal Revenue Service (“IRS”) regulations.

(j) Forfeited Accounts

At December 31, 2023 and 2022, forfeited non-vested assets totaled $159,491 and $280,900, respectively, which may be used to pay Employer Match Contributions. During 2023, approximately $1,058,232 of matching contributions were paid by the Plan Sponsor using forfeited amounts.

2. Significant Accounting Policies

(a) Basis of Accounting

The accompanying financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

(b) Investment Valuation and Income Recognition

The Plan’s investments in Company common stock and mutual funds are stated at fair value as determined by quoted market prices. The Plan’s investments in common collective trust funds are stated using the net asset value of the investment as a practical expedient as determined by the issuer of the funds and based on the fair value of the underlying investments held by the funds, discussed further below. The Plan’s investment in the Galliard Stable Return Fund (the “Fund”) is a common collective trust fund stated at net asset value and is valued based on the underlying investments in the Fund. The Fund holds synthetic and other fully benefit-responsive guaranteed investment contracts.

The Plan’s investments in common collective trust funds are divided into units of participation, as determined daily by the Trustee. The daily value of each unit of participation, or net asset value, is determined by dividing the total fair market value of all assets in the fund by the total number of fund units. Under the provisions of the Plan, interest and dividend income and net appreciation or depreciation of the fair value of each investment option are allocated to each Participant’s account based on the change in unit value. There are no restrictions on redemptions or unfunded commitments as of December 31, 2023 and 2022.

Purchases and sales of investments are recorded on a trade date basis. Dividends are recorded on the ex-dividend date.

(c) Contributions Receivable

Employee contributions and employer matching contributions that are earned during the Plan year but not yet paid until after the Plan year ended are accrued and recorded as contributions receivable on the statements of net assets available for benefits. Net appreciation includes the Plan’s gains and losses on investments bought and sold as well as held during the year.

(d) Notes Receivable from Participants

Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest.

(e) Payment of Benefits

Benefit payments are recorded upon distribution. Amounts allocated to accounts of persons who had elected to withdraw from the Plan, but had not yet been paid, were $91,123 and $108,451 as of December 31, 2023, and 2022, respectively.

(f) Excess Contributions

Amounts payable to participants for contributions in excess of amounts allowed by the IRS are recorded as a liability with a corresponding increase in distributions. Excess contributions are distributed to the applicable participants in the subsequent plan years. During 2023 and 2022, certain HCEs deferred a portion of their compensation in excess of the Plan limit, and a participant refund payable of $34,316 and $36,442 at December 31, 2023 and 2022, respectively, has been recorded relating to excess contributions.

(g) Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, additions, deductions, and the disclosure of contingent assets and liabilities in the accompanying financial statements. Actual results could differ from those estimates.

(h) Risks and Uncertainties

The Plan provides for various investment options. The underlying investment securities are exposed to various risks, such as interest rate risk, market risk (including the impact of macro-economic and geo-political conditions and events), and credit risk. Due to the level of risk associated with certain investment securities and the level of uncertainty related to changes in the value of investment securities, it is at least reasonably possible that changes in risk factors in the near term could materially affect participants’ account balances and the amounts reported in the statements of net assets available for benefits and the statement of changes in net assets available for benefits.

3. Fair Value Measurements

The Financial Accounting Standards Board has established a single authoritative definition of fair value and has established the following three-tier hierarchy that requires an entity to maximize the use of observable inputs when measuring fair value:

Level 1: Inputs are unadjusted quoted prices in active markets for identical assets or liabilities that the reporting entity has the ability to access at the measurement date.

Level 2: Inputs are observable inputs other than quoted (Level 1) prices for similar assets or liabilities, quoted prices in markets that are not active, or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

Level 3: Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

The availability of observable market data is monitored by the Plan’s management to assess the appropriate classification of financial instruments within the fair value hierarchy. Changes in economic conditions or model-based valuation techniques may require the transfer of financial instruments from one fair value level to another.

Categorization within the valuation hierarchy is based upon the lowest level of input that is significant to the fair value measurement. Below is a summary of assets measured at fair value on a recurring basis and assets measured at net asset value:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Fair Value Measurement |

| Total Investments | | December 31, 2023 | | Level 1 | | Level 2 | | Level 3 |

| Common Collective Trust Funds (1) | | $ | 721,175,065 | | | $ | — | | | $ | — | | | $ | — | |

| Employer Securities | | 72,138,172 | | | 72,138,172 | | | — | | | — | |

| Mutual Funds | | 117,613,886 | | | 117,613,886 | | | — | | | — | |

| Total | | $ | 910,927,123 | | | $ | 189,752,058 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Fair Value Measurement |

| Total Investments | | December 31, 2022 | | Level 1 | | Level 2 | | Level 3 |

| Common Collective Trust Funds (1) | | $ | 598,438,081 | | | $ | — | | | $ | — | | | $ | — | |

| Employer Securities | | 56,174,248 | | | 56,174,248 | | | — | | | — | |

| Mutual Funds | | 103,070,704 | | | 103,070,704 | | | — | | | — | |

| Total | | $ | 757,683,033 | | | $ | 159,244,952 | | | $ | — | | | $ | — | |

(1)The fair value of each common collective trust fund has been estimated using the net asset value of the investment as a practical expedient.

4. Exempt Party-in-Interest Transactions

As of December 31, 2023 and 2022, the Plan (through investments in Penske Automotive Group, Inc. Common Stock) held 449,431 and 488,769 shares, respectively, of Penske Automotive Group, Inc. Common Stock with a cost basis of $33,830,051 and $33,305,059, respectively. The fair value of Penske Automotive Group, Inc. Common Stock held by the Plan was $72,138,172 and $56,174,248 at December 31, 2023 and 2022, respectively. The Plan also issues loans to participants, which are secured by the vested balances in the participants' accounts.

5. Plan Termination

Although it has not expressed any intention to do so, the Company retains the right, if necessary, to terminate the Plan. Any such termination of the Plan would be subject to the provisions of ERISA. In the event of plan termination, participants would become 100% vested in their account balances.

6. Federal Income Tax Status

The Plan uses a prototype plan document sponsored by Principal. Principal received an opinion letter from the IRS, dated June 30, 2020, which states that the prototype document satisfies the applicable provisions of the IRC. The Plan itself has not received a determination letter from the IRS since adopting the prototype plan document effective July 1, 2022. However, the Plan’s management believes that the Plan is currently designed and being operated in compliance with the applicable requirements of the IRC. Therefore, no provision for income tax has been included in the Plan’s financial statements.

7. Nonexempt Party-in-Interest Transactions

During the year ended December 31, 2023, the Company failed to remit $3,418 of certain participant contributions to the trustee in a timely manner as required by Department of Labor (“DOL”) Regulation 2510.3-102. The Company will file Form 5330 with the IRS and pay the required excise tax on the transaction. Participant accounts have been credited with the amount of investment income that would have been earned had the participant contributions been remitted on a timely basis as required by the DOL guidelines.

During the year ended December 31, 2022, the Company failed to remit $223,991 of certain participant contributions to the trustee in a timely manner as required by Department of Labor (“DOL”) Regulation 2510.3-102. In 2023, the Company filed Form 5330 with the IRS and paid the required excise tax on the transaction. Participant accounts were credited with the amount of investment income that would have been earned had the participant contributions been remitted on a timely basis as required by the DOL guidelines.

8. Reconciliation of Financial Statements to Form 5500

The following is a reconciliation of net assets available for benefits per the financial statements as of December 31, 2023 and 2022 to the Form 5500:

| | | | | | | | | | | | | | |

| | 2023 | | 2022 |

Net assets available for benefits per the financial statements | | $ | 940,768,832 | | | $ | 783,767,117 | |

Less: | | | | |

Participant contributions receivable | | 2,972,837 | | | 2,855,883 | |

Employer contributions receivable | | 4,687,245 | | | 4,370,968 | |

Plus: | | | | |

Participant refunds payable | | 34,316 | | | 36,442 | |

Net assets available for benefits per the Form 5500 | | $ | 933,143,066 | | | $ | 776,576,708 | |

The following is a reconciliation of total contributions per the financial statements for the year ended December 31, 2023, to the Form 5500:

| | | | | | | | |

| Total contributions per the financial statements | | $ | 94,407,254 | |

| Add: | | |

Contributions receivable - December 31, 2022 | | 7,226,851 | |

| Less: | | |

Contributions receivable - December 31, 2023 | | 7,660,082 | |

| Total contributions per the Form 5500 | | $ | 93,974,023 | |

The following is a reconciliation of total distributions per the financial statements for the year ended December 31, 2023, to the Form 5500:

| | | | | | | | |

| Total distributions per the financial statements | | $ | 76,546,852 | |

| Add: | | |

Participant refunds payable - December 31, 2022 | | 36,442 | |

| Less: | | |

Participant refunds payable - December 31, 2023 | | 34,316 | |

| Total distributions per the Form 5500 | | $ | 76,548,978 | |

* * *

Penske Automotive Group 401(k) Savings and Retirement Plan

Form 5500, Schedule H, Part IV, Line 4i - Schedule of Assets (Held at End of Year)

As of December 31, 2023

Name of Plan Sponsor: Penske Automotive Group, Inc.

Employer Identification Number: 22-3086739

Plan number: 005

| | | | | |

Description of Investment Including Maturity Date, Rate of Interest,

Collateral, Par, or Maturity Value** | Current Value |

| |

| COMMON COLLECTIVE TRUST FUNDS | |

| GALLIARD STABLE RETURN FUND | $ | 100,585,557 | |

| NORTHERN TRUST S&P 500 INDEX NON-LENDING FUND | 150,402,220 | |

| SSGA TARGET RETIREMENT 2065 NON-LENDING FUND | 7,578,649 | |

| SSGA TARGET RETIREMENT 2060 NON-LENDING FUND | 19,249,950 | |

| SSGA TARGET RETIREMENT 2055 NON-LENDING FUND | 36,863,613 | |

| SSGA TARGET RETIREMENT 2050 NON-LENDING FUND | 64,702,903 | |

| SSGA TARGET RETIREMENT 2045 NON-LENDING FUND | 64,023,600 | |

| SSGA TARGET RETIREMENT 2040 NON-LENDING FUND | 63,008,527 | |

| SSGA TARGET RETIREMENT 2035 NON-LENDING FUND | 66,267,834 | |

| SSGA TARGET RETIREMENT 2030 NON-LENDING FUND | 60,865,470 | |

| SSGA TARGET RETIREMENT 2025 NON-LENDING FUND | 45,719,390 | |

| SSGA TARGET RETIREMENT 2020 NON-LENDING FUND | 19,575,981 | |

| SSGA TARGET RETIREMENT INCOME NON-LENDING FUND | 9,795,385 | |

| SSGA U.S. BOND INDEX NON-LENDING SERIES FUND | 7,128,219 | |

| SSGA GLOBAL CAP EQUITY EX-US NON-LENDING FUND | 5,407,767 | |

| TOTAL COMMON COLLECTIVE TRUST FUNDS | 721,175,065 | |

| |

| EMPLOYER SECURITIES | |

| *PENSKE AUTOMOTIVE GROUP, INC. COMMON STOCK | 72,138,172 | |

| |

| MUTUAL FUNDS | |

| DODGE & COX INTERNATIONAL STOCK FUND | 22,812,154 | |

| COHEN & STEERS REAL ESTATE SECURITIES FUND | 160,633 | |

| FULLER & THALER BEHAVIORAL SMALL-CAP EQUITY FUND | 1,389,857 | |

| VANGUARD SMALL-CAP INDEX FUND | 967,518 | |

| VANGUARD MID-CAP INDEX FUND | 26,332,180 | |

| VANGUARD STRATEGIC EQUITY FUND | 52,764,556 | |

| PIMCO TOTAL RETURN FUND | 13,186,988 | |

| TOTAL MUTUAL FUNDS | 117,613,886 | |

| |

| *PARTICIPANT LOANS (MATURING 2024 TO 2043 AT INTEREST RATES OF 4.25% - 9.50%) | 22,215,943 | |

| TOTAL | $ | 933,143,066 | |

* Represents a party-in-interest to the plan

** Cost information is not required for participant-directed investments and therefore is not included

Penske Automotive Group 401(k) Savings and Retirement Plan

Form 5500, Schedule H, Part IV, Line 4a - Schedule of Delinquent Participant Contributions

For the Year Ended December 31, 2023

Name of Plan Sponsor: Penske Automotive Group, Inc.

Employer Identification Number: 22-3086739

Plan number: 005

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Participant Contributions Transferred Late to Plan |

| | | | | | | | | | |

| | | | Total that Constitutes Nonexempt Prohibited Transactions | | |

| Plan Year | | Check here if Late Participant

Loan Repayments are included: | | Contributions Not Corrected (1) | | Contributions Corrected Outside VFCP | | Contributions Pending Correction in VFCP | | Total Fully Corrected Under VFCP and PTE 2002-51 |

2022 | | (ü) | | $ | — | | | $ | 223,991 | | | $ | — | | | $ | — | |

2023 | | (ü) | | $ | 1,672 | | | $ | 1,746 | | | $ | — | | | $ | — | |

| | | | | | | | | | |

(1) 2023 plan year participant contributions were corrected during the 2024 plan year. |

EXHIBIT INDEX

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

|

| Penske Automotive Group 401(k) Savings and Retirement Plan |

| | |

| By: | /s/ Anthony Pordon |

|

|

|

|

| Anthony Pordon |

Date: June 18, 2024 |

|

|

| | Chair, 401(k) Savings and Retirement Plan Committee |

Exhibit 23

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in Registration Statement No. 333-177855 on Form S-8 of our report dated June 18, 2024, relating to the financial statements and supplemental schedules of Penske Automotive Group 401(k) Savings and Retirement Plan, appearing in this Annual Report on Form 11-K of Penske Automotive Group 401(k) Savings and Retirement Plan, for the year ended December 31, 2023.

/s/ Deloitte & Touche LLP

Detroit, Michigan

June 18, 2024

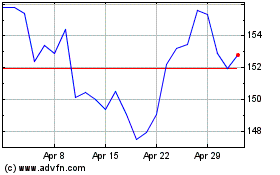

Penske Automotive (NYSE:PAG)

Historical Stock Chart

From May 2024 to Jun 2024

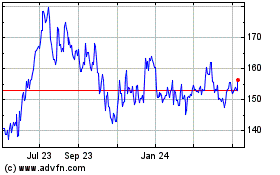

Penske Automotive (NYSE:PAG)

Historical Stock Chart

From Jun 2023 to Jun 2024