false

0001518621

0001518621

2024-10-24

2024-10-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 24, 2024

Orchid Island Capital, Inc.

(Exact Name of Registrant as Specified in Charter)

|

Maryland

|

001-35236

|

27-3269228

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

3305 Flamingo Drive, Vero Beach, Florida 32963

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code (772) 231-1400

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class:

|

Trading symbol:

|

Name of each exchange on which registered:

|

|

Common Stock, par value $0.01 per share

|

ORC

|

NYSE

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On October 24, 2024, Orchid Island Capital, Inc. (the “Company”) issued the press release attached hereto as Exhibit 99.1 announcing the Company’s results of operations for the three and nine month periods ended September 30, 2024. In addition, the Company posted supplemental financial information on the investor relations section of its website (https://ir.orchidislandcapital.com). The press release, attached as Exhibit 99.1, is being furnished under this “Item 2.02 Results of Operations and Financial Condition,” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any disclosure document of the Company, except as shall be expressly set forth by specific reference in such document.

Caution About Forward-Looking Statements.

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws, including, but not limited to, statements regarding interest rates, inflation, liquidity, pledging of our structured RMBS, funding levels and spreads, prepayment speeds, portfolio composition, positioning and repositioning, hedging levels, leverage ratio, dividends, investment and return opportunities, the supply and demand for Agency RMBS and the performance of the Agency RMBS sector generally, the effect of actual or expected actions of the U.S. government, including the Federal Reserve, market expectations, capital raising, future opportunities and prospects of the Company and general economic conditions. These forward-looking statements are based upon the Company’s present expectations, but the Company cannot assure investors that actual results will not vary from the expectations contained in the forward-looking statements. Investors should not place undue reliance upon forward-looking statements. For further discussion of the factors that could affect outcomes, please refer to the “Risk Factors” section of the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which has been filed with the Securities and Exchange Commission ("SEC"), and other documents that the Company files with the SEC. All forward-looking statements speak only as of the date on which they are made. New risks and uncertainties arise over time, and it is not possible to predict those events or how they may affect the Company. Except as required by law, the Company is not obligated to, and does not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: October 24, 2024

|

|

ORCHID ISLAND CAPITAL, INC. |

| |

|

| |

|

| |

By:

|

/s/ Robert E. Cauley

|

| |

|

Robert E. Cauley

|

| |

|

Chairman and Chief Executive Officer

|

Exhibit 99.1

ORCHID ISLAND CAPITAL ANNOUNCES Third QUARTER 2024 RESULTS

VERO BEACH, Fla. (October 24, 2024) – Orchid Island Capital, Inc. (NYSE:ORC) ("Orchid” or the "Company"), a real estate investment trust ("REIT"), today announced results of operations for the three month period ended September 30, 2024.

Third Quarter 2024 Results

| |

●

|

Net realized and unrealized gains of $21.2 million, or $0.29 per common share, on RMBS and derivative instruments, including net interest income on interest rate swaps

|

| |

●

|

Third quarter dividends declared and paid of $0.36 per common share

|

| |

●

|

Total return of 2.10%, comprised of $0.36 dividend per common share and $0.18 decrease in book value per common share, divided by beginning book value per common share

|

Other Financial Highlights

| |

●

|

Company to discuss results on Friday, October 25, 2024, at 10:00 AM ET

|

| |

●

|

Supplemental materials to be discussed on the call can be downloaded from the investor relations section of the Company’s website at https://ir.orchidislandcapital.com

|

Management Commentary

Commenting on the third quarter results, Robert E. Cauley, Chairman and Chief Executive Officer, said, “The long-awaited impacts of tight monetary policy orchestrated by the Federal Reserve appear to have finally had the desired impacts on inflation and the imbalances in the labor market. Inflation is closing in on the Fed’s 2% target and hiring and wage growth are slowing while the unemployment rate has steadily risen. In contrast, growth in the economy and consumer spending have remained robust throughout. In late September the Fed reduced the overnight funding rate by 50 basis points, and the market anticipated it was the first of many such cuts. Unfortunately, the non-farm payroll report for September 2024, released in early October, as well as the latest readings on inflation and spending, imply the magnitude and urgency of additional rate cuts by the Fed may differ with those market expectations.

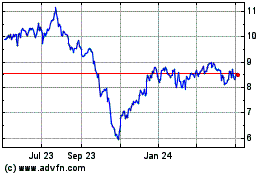

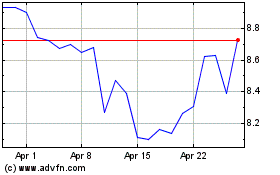

“For the third quarter of 2024 Orchid Island generated an economic return of 2.1%, not annualized. We have maintained the dividend rate at $0.12 per month which, based on yesterday’s closing price of $7.80, represents a dividend yield of approximately 18.5%. Our portfolio positioning continues to be predominantly focused on a barbell strategy with 30-year, fixed rate Agency RMBS, while our hedges are more focused and have a longer duration bias to protect the portfolio against an unanticipated rise in longer term rates. This positioning was not optimal during the current quarter, as interest rates decreased significantly, leading to a modest decline in our book value, but we made modest changes to our positioning since quarter end to better balance the anticipated outcomes for different rate movements. However, we continue to view a bear-steepening of the yield curve as the greatest risk to the portfolio.

“We were able to raise additional capital at attractive levels via our ATM program and increase the size of the portfolio while maintaining leverage levels. Looking forward, we anticipate investment opportunities to remain attractive with potential total returns that could improve if the Fed were to continue easing monetary policy. Absent such a development, total returns available today are still quite attractive and hedged net-interest spreads are ample in relation to the current dividend level.”

Details of Third Quarter 2024 Results of Operations

The Company reported net income of $17.3 million for the three month period ended September 30, 2024, compared with a net loss of $80.1 million for the three month period ended September 30, 2023. Interest income on the portfolio in the third quarter was up approximately $14.6 million from the second quarter of 2024. The yield on our average Agency RMBS increased from 5.05% in the second quarter of 2024 to 5.43% for the third quarter of 2024, and our repurchase agreement borrowing costs increased from 5.34% for the second quarter of 2024 to 5.62% for the third quarter of 2024. Book value decreased by $0.18 per share in the third quarter of 2024. The decrease in book value reflects our net income of $0.24 per share and the dividend distribution of $0.36 per share. The Company recorded net realized and unrealized gains of $21.2 million on Agency RMBS assets and derivative instruments, including net interest income on interest rate swaps.

Prepayments

For the quarter ended September 30, 2024, Orchid received $137.7 million in scheduled and unscheduled principal repayments and prepayments, which equated to a 3-month constant prepayment rate (“CPR”) of approximately 8.8%. Prepayment rates on the two RMBS sub-portfolios were as follows (in CPR):

| |

|

|

|

|

|

Structured

|

|

|

|

|

|

| |

|

PT RMBS

|

|

|

RMBS

|

|

|

Total

|

|

|

Three Months Ended

|

|

Portfolio (%)

|

|

|

Portfolio (%)

|

|

|

Portfolio (%)

|

|

|

September 30, 2024

|

|

|

8.8 |

|

|

|

6.4 |

|

|

|

8.8 |

|

|

June 30, 2024

|

|

|

7.6 |

|

|

|

7.1 |

|

|

|

7.6 |

|

|

March 31, 2024

|

|

|

6.0 |

|

|

|

5.9 |

|

|

|

6.0 |

|

|

December 31, 2023

|

|

|

5.4 |

|

|

|

7.9 |

|

|

|

5.5 |

|

|

September 30, 2023

|

|

|

6.1 |

|

|

|

5.7 |

|

|

|

6.0 |

|

|

June 30, 2023

|

|

|

5.6 |

|

|

|

7.0 |

|

|

|

5.6 |

|

|

March 31, 2023

|

|

|

3.9 |

|

|

|

5.7 |

|

|

|

4.0 |

|

Portfolio

The following tables summarize certain characteristics of Orchid’s PT RMBS (as defined below) and structured RMBS as of September 30, 2024 and December 31, 2023:

|

($ in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted

|

|

|

| |

|

|

|

|

|

Percentage

|

|

|

|

|

|

|

Average

|

|

|

| |

|

|

|

|

|

of

|

|

|

Weighted

|

|

|

Maturity

|

|

|

| |

|

Fair

|

|

|

Entire

|

|

|

Average

|

|

|

in

|

|

Longest

|

|

Asset Category

|

|

Value

|

|

|

Portfolio

|

|

|

Coupon

|

|

|

Months

|

|

Maturity

|

|

September 30, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed Rate RMBS

|

|

$ |

5,427,069 |

|

|

|

99.7 |

% |

|

|

4.94 |

% |

|

|

327 |

|

1-Oct-54

|

|

Interest-Only Securities

|

|

|

15,382 |

|

|

|

0.3 |

% |

|

|

4.01 |

% |

|

|

214 |

|

25-Jul-48

|

|

Inverse Interest-Only Securities

|

|

|

353 |

|

|

|

0.0 |

% |

|

|

0.00 |

% |

|

|

264 |

|

15-Jun-42

|

|

Total Mortgage Assets

|

|

$ |

5,442,804 |

|

|

|

100.0 |

% |

|

|

4.90 |

% |

|

|

325 |

|

1-Oct-54

|

|

December 31, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed Rate RMBS

|

|

$ |

3,877,082 |

|

|

|

99.6 |

% |

|

|

4.33 |

% |

|

|

334 |

|

1-Nov-53

|

|

Interest-Only Securities

|

|

|

16,572 |

|

|

|

0.4 |

% |

|

|

4.01 |

% |

|

|

223 |

|

25-Jul-48

|

|

Inverse Interest-Only Securities

|

|

|

358 |

|

|

|

0.0 |

% |

|

|

0.00 |

% |

|

|

274 |

|

15-Jun-42

|

|

Total Mortgage Assets

|

|

$ |

3,894,012 |

|

|

|

100.0 |

% |

|

|

4.30 |

% |

|

|

331 |

|

1-Nov-53

|

|

($ in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

September 30, 2024

|

|

|

December 31, 2023

|

|

| |

|

|

|

|

|

Percentage of

|

|

|

|

|

|

|

Percentage of

|

|

|

Agency

|

|

Fair Value

|

|

|

Entire Portfolio

|

|

|

Fair Value

|

|

|

Entire Portfolio

|

|

|

Fannie Mae

|

|

$ |

3,692,047 |

|

|

|

67.8 |

% |

|

$ |

2,714,192 |

|

|

|

69.7 |

% |

|

Freddie Mac

|

|

|

1,750,757 |

|

|

|

32.2 |

% |

|

|

1,179,820 |

|

|

|

30.3 |

% |

|

Total Portfolio

|

|

$ |

5,442,804 |

|

|

|

100.0 |

% |

|

$ |

3,894,012 |

|

|

|

100.0 |

% |

| |

|

September 30, 2024

|

|

|

December 31, 2023

|

|

|

Weighted Average Pass-through Purchase Price

|

|

$ |

102.72 |

|

|

$ |

104.10 |

|

|

Weighted Average Structured Purchase Price

|

|

$ |

18.74 |

|

|

$ |

18.74 |

|

|

Weighted Average Pass-through Current Price

|

|

$ |

98.89 |

|

|

$ |

95.70 |

|

|

Weighted Average Structured Current Price

|

|

$ |

14.02 |

|

|

$ |

13.51 |

|

|

Effective Duration (1)

|

|

|

3.490 |

|

|

|

4.400 |

|

|

(1)

|

Effective duration is the approximate percentage change in price for a 100 basis point change in rates. An effective duration of 3.490 indicates that an interest rate increase of 1.0% would be expected to cause a 3.490% decrease in the value of the RMBS in the Company’s investment portfolio at September 30, 2024. An effective duration of 4.400 indicates that an interest rate increase of 1.0% would be expected to cause a 4.400% decrease in the value of the RMBS in the Company’s investment portfolio at December 31, 2023. These figures include the structured securities in the portfolio, but do not include the effect of the Company’s funding cost hedges. Effective duration quotes for individual investments are obtained from The Yield Book, Inc.

|

Financing, Leverage and Liquidity

As of September 30, 2024, the Company had outstanding repurchase obligations of approximately $5,230.9 million with a net weighted average borrowing rate of 5.24%. These agreements were collateralized by RMBS with a fair value, including accrued interest, of approximately $5,461.0 million and cash pledged to counterparties of approximately $9.2 million. The Company’s adjusted leverage ratio, defined as the balance of repurchase agreement liabilities divided by stockholders' equity, at September 30, 2024 was 8.0 to 1. At September 30, 2024, the Company’s liquidity was approximately $326.7 million consisting of cash and cash equivalents and unpledged RMBS. To enhance our liquidity even further, we may pledge more of our structured RMBS as part of a repurchase agreement funding, but retain the cash in lieu of acquiring additional assets. In this way we can, at a modest cost, retain higher levels of cash on hand and decrease the likelihood we will have to sell assets in a distressed market in order to raise cash. Below is a list of our outstanding borrowings under repurchase obligations at September 30, 2024.

|

($ in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Weighted

|

|

|

Weighted

|

|

| |

|

Total

|

|

|

|

|

|

|

Average

|

|

|

Average

|

|

| |

|

Outstanding

|

|

|

% of

|

|

|

Borrowing

|

|

|

Maturity

|

|

|

Counterparty

|

|

Balances

|

|

|

Total

|

|

|

Rate

|

|

|

in Days

|

|

|

ABN AMRO Bank N.V.

|

|

$ |

381,192 |

|

|

|

7.29 |

% |

|

|

5.37 |

% |

|

|

15 |

|

|

Merrill Lynch, Pierce, Fenner & Smith

|

|

|

379,748 |

|

|

|

7.26 |

% |

|

|

5.20 |

% |

|

|

35 |

|

|

ASL Capital Markets Inc.

|

|

|

346,397 |

|

|

|

6.62 |

% |

|

|

5.35 |

% |

|

|

31 |

|

|

Cantor Fitzgerald & Co

|

|

|

289,468 |

|

|

|

5.53 |

% |

|

|

5.30 |

% |

|

|

11 |

|

|

DV Securities, LLC Repo

|

|

|

274,284 |

|

|

|

5.24 |

% |

|

|

5.24 |

% |

|

|

19 |

|

|

Mitsubishi UFJ Securities (USA), Inc

|

|

|

263,580 |

|

|

|

5.04 |

% |

|

|

5.35 |

% |

|

|

23 |

|

|

J.P. Morgan Securities LLC

|

|

|

254,798 |

|

|

|

4.87 |

% |

|

|

5.33 |

% |

|

|

9 |

|

|

Banco Santander SA

|

|

|

248,472 |

|

|

|

4.75 |

% |

|

|

5.33 |

% |

|

|

49 |

|

|

Daiwa Securities America Inc.

|

|

|

247,191 |

|

|

|

4.73 |

% |

|

|

5.04 |

% |

|

|

28 |

|

|

Citigroup Global Markets Inc

|

|

|

244,746 |

|

|

|

4.68 |

% |

|

|

5.04 |

% |

|

|

25 |

|

|

Wells Fargo Bank, N.A.

|

|

|

241,641 |

|

|

|

4.62 |

% |

|

|

5.29 |

% |

|

|

16 |

|

|

ING Financial Markets LLC

|

|

|

225,593 |

|

|

|

4.31 |

% |

|

|

5.01 |

% |

|

|

39 |

|

|

Marex Capital Markets Inc.

|

|

|

223,192 |

|

|

|

4.27 |

% |

|

|

5.00 |

% |

|

|

21 |

|

|

Goldman, Sachs & Co

|

|

|

208,485 |

|

|

|

3.99 |

% |

|

|

5.32 |

% |

|

|

16 |

|

|

Bank of Montreal

|

|

|

204,522 |

|

|

|

3.91 |

% |

|

|

5.31 |

% |

|

|

15 |

|

|

South Street Securities, LLC

|

|

|

194,516 |

|

|

|

3.72 |

% |

|

|

5.20 |

% |

|

|

19 |

|

|

Clear Street LLC

|

|

|

193,535 |

|

|

|

3.70 |

% |

|

|

5.21 |

% |

|

|

48 |

|

|

Mirae Asset Securities (USA) Inc.

|

|

|

193,120 |

|

|

|

3.69 |

% |

|

|

5.26 |

% |

|

|

26 |

|

|

StoneX Financial Inc.

|

|

|

159,098 |

|

|

|

3.04 |

% |

|

|

5.03 |

% |

|

|

21 |

|

|

The Bank of Nova Scotia

|

|

|

149,958 |

|

|

|

2.87 |

% |

|

|

5.29 |

% |

|

|

15 |

|

|

RBC Capital Markets, LLC

|

|

|

143,225 |

|

|

|

2.74 |

% |

|

|

5.31 |

% |

|

|

45 |

|

|

Nomura Securities International, Inc.

|

|

|

75,278 |

|

|

|

1.44 |

% |

|

|

5.31 |

% |

|

|

15 |

|

|

Lucid Prime Fund, LLC

|

|

|

48,322 |

|

|

|

0.92 |

% |

|

|

5.29 |

% |

|

|

17 |

|

|

Wells Fargo Securities, LLC

|

|

|

23,004 |

|

|

|

0.44 |

% |

|

|

5.06 |

% |

|

|

25 |

|

|

Lucid Cash Fund USG LLC

|

|

|

17,506 |

|

|

|

0.33 |

% |

|

|

5.31 |

% |

|

|

17 |

|

|

Total / Weighted Average

|

|

$ |

5,230,871 |

|

|

|

100.00 |

% |

|

|

5.24 |

% |

|

|

25 |

|

Hedging

In connection with its interest rate risk management strategy, the Company economically hedges a portion of the cost of its repurchase agreement funding against a rise in interest rates by entering into derivative financial instrument contracts. The Company has not elected hedging treatment under U.S. generally accepted accounting principles (“GAAP”) in order to align the accounting treatment of its derivative instruments with the treatment of its portfolio assets under the fair value option election. As such, all gains or losses on these instruments are reflected in earnings for all periods presented. At September 30, 2024, such instruments were comprised of U.S. Treasury note (“T-Note”) and Secured Overnight Financing Rate ("SOFR") futures contracts, interest rate swap agreements and contracts to sell to-be-announced ("TBA") securities.

The table below presents information related to the Company’s T-Note and SOFR futures contracts at September 30, 2024.

|

($ in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

September 30, 2024

|

|

| |

|

Average

|

|

|

Weighted

|

|

|

Weighted

|

|

|

|

|

|

| |

|

Contract

|

|

|

Average

|

|

|

Average

|

|

|

|

|

|

| |

|

Notional

|

|

|

Entry

|

|

|

Effective

|

|

|

Open

|

|

|

Expiration Year

|

|

Amount

|

|

|

Rate

|

|

|

Rate

|

|

|

Equity(1)

|

|

|

T-Note Futures Contracts (Short Positions)(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 2024 10-year T-Note futures (Dec 2024 - Dec 2034 Hedge Period)

|

|

$ |

12,500 |

|

|

|

3.73 |

% |

|

|

3.62 |

% |

|

$ |

(88 |

) |

|

SOFR Futures Contracts (Short Positions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 2024 3-Month SOFR futures (Sep 2024 - Dec 2024 Hedge Period)

|

|

$ |

241,250 |

|

|

|

4.78 |

% |

|

|

4.73 |

% |

|

$ |

(110 |

) |

|

March 2025 3-Month SOFR futures (Dec 2024 - Mar 2025 Hedge Period)

|

|

|

129,250 |

|

|

|

4.23 |

% |

|

|

4.04 |

% |

|

|

(242 |

) |

|

June 2025 3-Month SOFR futures (Mar 2025 - Jun 2025 Hedge Period)

|

|

|

129,000 |

|

|

|

3.77 |

% |

|

|

3.52 |

% |

|

|

(333 |

) |

|

September 2025 3-Month SOFR futures (Jun 2025 - Sep 2025 Hedge Period)

|

|

|

129,000 |

|

|

|

3.49 |

% |

|

|

3.21 |

% |

|

|

(356 |

) |

|

December 2025 3-Month SOFR futures (Sep 2025 - Dec 2025 Hedge Period)

|

|

|

129,000 |

|

|

|

3.31 |

% |

|

|

3.07 |

% |

|

|

(320 |

) |

|

March 2026 3-Month SOFR futures (Dec 2025 - Mar 2026 Hedge Period)

|

|

|

129,000 |

|

|

|

3.21 |

% |

|

|

3.00 |

% |

|

|

(275 |

) |

|

June 2026 3-Month SOFR futures (Mar 2026 - Jun 2026 Hedge Period)

|

|

|

104,000 |

|

|

|

3.15 |

% |

|

|

2.97 |

% |

|

|

(178 |

) |

|

September 2026 3-Month SOFR futures (Jun 2026 - Sep 2026 Hedge Period)

|

|

|

104,000 |

|

|

|

3.11 |

% |

|

|

2.98 |

% |

|

|

(137 |

) |

|

December 2026 3-Month SOFR futures (Sep 2026 - Dec 2026 Hedge Period)

|

|

|

29,000 |

|

|

|

3.34 |

% |

|

|

3.01 |

% |

|

|

(96 |

) |

|

March 2027 3-Month SOFR futures (Dec 2026 - Mar 2027 Hedge Period)

|

|

|

16,250 |

|

|

|

3.10 |

% |

|

|

3.04 |

% |

|

|

(10 |

) |

|

(1)

|

Open equity represents the cumulative gains (losses) recorded on open futures positions from inception.

|

|

(2)

|

10-Year T-Note futures contracts were valued at a price of $114.28. The contract values of the short positions were $14.3 million. |

The table below presents information related to the Company’s interest rate swap positions at September 30, 2024.

|

($ in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Average

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Fixed

|

|

|

Average

|

|

|

Average

|

|

| |

|

Notional

|

|

|

Pay

|

|

|

Receive

|

|

|

Maturity

|

|

| |

|

Amount

|

|

|

Rate

|

|

|

Rate

|

|

|

(Years)

|

|

|

Expiration > 1 to ≤ 5 years

|

|

$ |

1,450,000 |

|

|

|

1.69 |

% |

|

|

5.41 |

% |

|

|

3.6 |

|

|

Expiration > 5 years

|

|

|

2,036,800 |

|

|

|

3.55 |

% |

|

|

5.35 |

% |

|

|

7.2 |

|

| |

|

$ |

3,486,800 |

|

|

|

2.78 |

% |

|

|

5.37 |

% |

|

|

5.7 |

|

The following table summarizes our contracts to sell TBA securities as of September 30, 2024.

|

($ in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Notional |

|

|

|

|

|

|

|

|

|

| |

Amount

|

|

|

|

|

|

|

|

Net

|

|

| |

Long

|

|

Cost

|

|

Market

|

|

Carrying

|

|

| |

(Short)(1)

|

|

Basis(2)

|

|

Value(3)

|

|

Value(4)

|

|

|

September 30, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30-Year TBA securities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.0%

|

$ |

(300,000 |

) |

$ |

(271,195 |

) |

$ |

(269,027 |

) |

$ |

2,168 |

|

| |

$ |

(300,000 |

) |

$ |

(271,195 |

) |

$ |

(269,027 |

) |

$ |

2,168 |

|

|

(1)

|

Notional amount represents the par value (or principal balance) of the underlying Agency RMBS.

|

|

(2)

|

Cost basis represents the forward price to be paid (received) for the underlying Agency RMBS.

|

|

(3)

|

Market value represents the current market value of the TBA securities (or of the underlying Agency RMBS) as of period-end.

|

|

(4)

|

Net carrying value represents the difference between the market value and the cost basis of the TBA securities as of period-end and is reported in derivative assets (liabilities) at fair value in our balance sheets.

|

Dividends

In addition to other requirements that must be satisfied to qualify as a REIT, we must pay annual dividends to our stockholders of at least 90% of our REIT taxable income, determined without regard to the deduction for dividends paid and excluding any net capital gains. We intend to pay regular monthly dividends to our stockholders and have declared the following dividends since our February 2013 IPO.

|

(in thousands, except per share data)

|

|

|

Year

|

|

Per Share Amount

|

|

|

Total

|

|

|

2013

|

|

$ |

6.975 |

|

|

$ |

4,662 |

|

|

2014

|

|

|

10.800 |

|

|

|

22,643 |

|

|

2015

|

|

|

9.600 |

|

|

|

38,748 |

|

|

2016

|

|

|

8.400 |

|

|

|

41,388 |

|

|

2017

|

|

|

8.400 |

|

|

|

70,717 |

|

|

2018

|

|

|

5.350 |

|

|

|

55,814 |

|

|

2019

|

|

|

4.800 |

|

|

|

54,421 |

|

|

2020

|

|

|

3.950 |

|

|

|

53,570 |

|

|

2021

|

|

|

3.900 |

|

|

|

97,601 |

|

|

2022

|

|

|

2.475 |

|

|

|

87,906 |

|

|

2023

|

|

|

1.800 |

|

|

|

81,127 |

|

|

2024 - YTD(1)

|

|

|

1.200 |

|

|

|

76,738 |

|

|

Totals

|

|

$ |

67.650 |

|

|

$ |

685,335 |

|

Book Value Per Share

The Company's book value per share at September 30, 2024 was $8.40. The Company computes book value per share by dividing total stockholders' equity by the total number of shares outstanding of the Company's common stock. At September 30, 2024, the Company's stockholders' equity was $656.0 million with 78,082,645 shares of common stock outstanding.

Capital Allocation and Return on Invested Capital

The Company allocates capital to two RMBS sub-portfolios, the pass-through RMBS portfolio, consisting of mortgage pass-through certificates issued by Fannie Mae, Freddie Mac or Ginnie Mae (the “GSEs”) and collateralized mortgage obligations (“CMOs”) issued by the GSEs (“PT RMBS”), and the structured RMBS portfolio, consisting of interest-only (“IO”) and inverse interest-only (“IIO”) securities. As of September 30, 2024, approximately 97.1% of the Company’s investable capital (which consists of equity in pledged PT RMBS, available cash and unencumbered assets) was deployed in the PT RMBS portfolio. At June 30, 2024, the allocation to the PT RMBS portfolio was approximately 96.2%.

The table below details the changes to the respective sub-portfolios during the quarter.

|

(in thousands)

|

|

|

Portfolio Activity for the Quarter

|

|

| |

|

|

|

|

|

Structured Security Portfolio

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Inverse |

|

|

|

|

|

|

|

|

|

| |

|

Pass- |

|

|

Interest |

|

|

Interest |

|

|

|

|

|

|

|

|

|

| |

|

Through

|

|

|

Only

|

|

|

Only

|

|

|

|

|

|

|

|

|

|

| |

|

Portfolio

|

|

|

Securities

|

|

|

Securities

|

|

|

Sub-total

|

|

|

Total

|

|

|

Market value - June 30, 2024

|

|

$ |

4,509,084 |

|

|

$ |

16,447 |

|

|

$ |

224 |

|

|

$ |

16,671 |

|

|

$ |

4,525,755 |

|

|

Securities purchased

|

|

|

959,202 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

959,202 |

|

|

Securities sold

|

|

|

(66,509 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(66,509 |

) |

|

Gains on sales

|

|

|

510 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

510 |

|

|

Return of investment

|

|

|

n/a |

|

|

|

(581 |

) |

|

|

- |

|

|

|

(581 |

) |

|

|

(581 |

) |

|

Pay-downs

|

|

|

(137,137 |

) |

|

|

n/a |

|

|

|

n/a |

|

|

|

n/a |

|

|

|

(137,137 |

) |

|

Discount accretion due to pay-downs

|

|

|

5,048 |

|

|

|

n/a |

|

|

|

n/a |

|

|

|

n/a |

|

|

|

5,048 |

|

|

Mark to market gains (losses)

|

|

|

156,871 |

|

|

|

(484 |

) |

|

|

129 |

|

|

|

(355 |

) |

|

|

156,516 |

|

|

Market value - September 30, 2024

|

|

$ |

5,427,069 |

|

|

$ |

15,382 |

|

|

$ |

353 |

|

|

$ |

15,735 |

|

|

$ |

5,442,804 |

|

The tables below present the allocation of capital between the respective portfolios at September 30, 2024 and June 30, 2024, and the return on invested capital for each sub-portfolio for the three month period ended September 30, 2024.

|

($ in thousands)

|

|

|

Capital Allocation

|

|

| |

|

|

|

|

|

Structured Security Portfolio

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Inverse |

|

|

|

|

|

|

|

|

|

| |

|

Pass- |

|

|

Interest |

|

|

Interest |

|

|

|

|

|

|

|

|

|

| |

|

Through

|

|

|

Only

|

|

|

Only

|

|

|

|

|

|

|

|

|

|

| |

|

Portfolio

|

|

|

Securities

|

|

|

Securities

|

|

|

Sub-total

|

|

|

Total

|

|

|

September 30, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Market value

|

|

$ |

5,427,069 |

|

|

$ |

15,382 |

|

|

$ |

353 |

|

|

$ |

15,735 |

|

|

$ |

5,442,804 |

|

|

Cash

|

|

|

333,717 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

333,717 |

|

|

Borrowings(1)

|

|

|

(5,230,871 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(5,230,871 |

) |

|

Total

|

|

$ |

529,915 |

|

|

$ |

15,382 |

|

|

$ |

353 |

|

|

$ |

15,735 |

|

|

$ |

545,650 |

|

|

% of Total

|

|

|

97.1 |

% |

|

|

2.8 |

% |

|

|

0.1 |

% |

|

|

2.9 |

% |

|

|

100.0 |

% |

|

June 30, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Market value

|

|

$ |

4,509,084 |

|

|

$ |

16,447 |

|

|

$ |

224 |

|

|

$ |

16,671 |

|

|

$ |

4,525,755 |

|

|

Cash

|

|

|

257,011 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

257,011 |

|

|

Borrowings(2)

|

|

|

(4,345,704 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(4,345,704 |

) |

|

Total

|

|

$ |

420,391 |

|

|

$ |

16,447 |

|

|

$ |

224 |

|

|

$ |

16,671 |

|

|

$ |

437,062 |

|

|

% of Total

|

|

|

96.2 |

% |

|

|

3.8 |

% |

|

|

0.1 |

% |

|

|

3.8 |

% |

|

|

100.0 |

% |

|

(1)

|

At September 30, 2024, there were outstanding repurchase agreement balances of $12.7 million secured by IO securities and $0.3 million secured by IIO securities. We entered into these arrangements to generate additional cash available to meet margin calls on PT RMBS; therefore, we have not considered these balances to be allocated to the structured securities strategy.

|

|

(2)

|

At June 30, 2024, there were outstanding repurchase agreement balances of $13.5 million secured by IO securities and $0.2 million secured by IIO securities. We entered into these arrangements to generate additional cash available to meet margin calls on PT RMBS; therefore, we have not considered these balances to be allocated to the structured securities strategy.

|

The return on invested capital in the PT RMBS and structured RMBS portfolios was approximately 5.1% and (0.2)%, respectively, for the third quarter of 2024. The combined portfolio generated a return on invested capital of approximately 4.9%.

|

($ in thousands)

|

|

|

Returns for the Quarter Ended September 30, 2024

|

|

| |

|

|

|

|

|

Structured Security Portfolio

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Inverse |

|

|

|

|

|

|

|

|

|

| |

|

Pass- |

|

|

Interest |

|

|

Interest |

|

|

|

|

|

|

|

|

|

| |

|

Through

|

|

|

Only

|

|

|

Only

|

|

|

|

|

|

|

|

|

|

| |

|

Portfolio

|

|

|

Securities

|

|

|

Securities

|

|

|

Sub-total

|

|

|

Total

|

|

|

Income (net of borrowing cost)

|

|

$ |

21 |

|

|

$ |

319 |

|

|

$ |

- |

|

|

$ |

319 |

|

|

$ |

340 |

|

|

Realized and unrealized gains (losses)

|

|

|

162,429 |

|

|

|

(484 |

) |

|

|

129 |

|

|

|

(355 |

) |

|

|

162,074 |

|

|

Derivative losses

|

|

|

(140,825 |

) |

|

|

n/a |

|

|

|

n/a |

|

|

|

n/a |

|

|

|

(140,825 |

) |

|

Total Return

|

|

$ |

21,625 |

|

|

$ |

(165 |

) |

|

$ |

129 |

|

|

$ |

(36 |

) |

|

$ |

21,589 |

|

|

Beginning Capital Allocation

|

|

$ |

420,391 |

|

|

$ |

16,447 |

|

|

$ |

224 |

|

|

$ |

16,671 |

|

|

$ |

437,062 |

|

|

Return on Invested Capital for the Quarter(1)

|

|

|

5.1 |

% |

|

|

(1.0 |

)% |

|

|

57.6 |

% |

|

|

(0.2 |

)% |

|

|

4.9 |

% |

|

Average Capital Allocation(2)

|

|

$ |

475,153 |

|

|

$ |

15,915 |

|

|

$ |

289 |

|

|

$ |

16,204 |

|

|

$ |

491,357 |

|

|

Return on Average Invested Capital for the Quarter(3)

|

|

|

4.6 |

% |

|

|

(1.0 |

)% |

|

|

44.6 |

% |

|

|

(0.2 |

)% |

|

|

4.4 |

% |

|

(1)

|

Calculated by dividing the Total Return by the Beginning Capital Allocation, expressed as a percentage.

|

|

(2)

|

Calculated using two data points, the Beginning and Ending Capital Allocation balances.

|

|

(3)

|

Calculated by dividing the Total Return by the Average Capital Allocation, expressed as a percentage.

|

Stock Offerings

On October 29, 2021, we entered into an equity distribution agreement (the “October 2021 Equity Distribution Agreement”) with four sales agents pursuant to which we could offer and sell, from time to time, up to an aggregate amount of $250,000,000 of shares of our common stock in transactions that were deemed to be “at the market” offerings and privately negotiated transactions. We issued a total of 9,742,188 shares under the October 2021 Equity Distribution Agreement for aggregate gross proceeds of approximately $151.8 million, and net proceeds of approximately $149.3 million, after commissions and fees, prior to its termination in March 2023.

On March 7, 2023, we entered into an equity distribution agreement (the “March 2023 Equity Distribution Agreement”) with three sales agents pursuant to which we could offer and sell, from time to time, up to an aggregate amount of $250,000,000 of shares of our common stock in transactions that were deemed to be “at the market” offerings and privately negotiated transactions. We issued a total of 24,675,497 shares under the March 2023 Equity Distribution Agreement for aggregate gross proceeds of approximately $228.8 million and net proceeds of approximately $225.0 million, after commissions and fees, prior to its termination in June 2024.

On June 11, 2024, we entered into an equity distribution agreement (the “June 2024 Equity Distribution Agreement”) with three sales agents pursuant to which we may offer and sell, from time to time, up to an aggregate amount of $250,000,000 of shares of our common stock in transactions that are deemed to be “at the market” offerings and privately negotiated transactions. Through September 30, 2024, we issued a total of 15,309,022 shares under the June 2024 Equity Distribution Agreement for aggregate gross proceeds of approximately $128.6 million, and net proceeds of approximately $126.5 million, after commissions and fees. Subsequent to September 30, 2024, we issued a total of 332,000 shares under the June 2024 Equity Distribution Agreement for aggregate gross proceeds of approximately $2.7 million, and net proceeds of approximately $2.7 million, after commissions and fees.

Stock Repurchase Program

On July 29, 2015, the Company’s Board of Directors authorized the repurchase of up to 400,000 shares of our common stock. The timing, manner, price and amount of any repurchases is determined by the Company in its discretion and is subject to economic and market conditions, stock price, applicable legal requirements and other factors. The authorization does not obligate the Company to acquire any particular amount of common stock and the program may be suspended or discontinued at the Company’s discretion without prior notice. On February 8, 2018, the Board of Directors approved an increase in the stock repurchase program for up to an additional 904,564 shares of the Company’s common stock. Coupled with the 156,751 shares remaining from the original 400,000 share authorization, the increased authorization brought the total authorization to 1,061,316 shares, representing 10% of the Company’s then outstanding share count. On December 9, 2021, the Board of Directors approved an increase in the number of shares of the Company’s common stock available in the stock repurchase program for up to an additional 3,372,399 shares, bringing the remaining authorization under the stock repurchase program to 3,539,861 shares, representing approximately 10% of the Company’s then outstanding shares of common stock. On October 12, 2022, the Board of Directors approved an increase in the number of shares of the Company’s common stock available in the stock repurchase program for up to an additional 4,300,000 shares, bringing the remaining authorization under the stock repurchase program to 6,183,601 shares, representing approximately 18% of the Company’s then outstanding shares of common stock. This stock repurchase program has no termination date.

From the inception of the stock repurchase program through September 30, 2024, the Company repurchased a total of 5,144,602 shares at an aggregate cost of approximately $77.5 million, including commissions and fees, for a weighted average price of $15.07 per share. During the nine months ended September 30, 2024, the Company repurchased a total of 396,241 shares at an aggregate cost of approximately $3.3 million, including commissions and fees, for a weighted average price of $8.30 per share.

Earnings Conference Call Details

An earnings conference call and live audio webcast will be hosted Friday, October 25, 2024, at 10:00 AM ET. Participants can register and receive dial-in information at https://register.vevent.com/register/BI631347493dd04b38aa589f3e4b9f5a6d. A live audio webcast of the conference call can be accessed at https://edge.media-server.com/mmc/p/9wgzmhx7 or via the investor relations section of the Company's website at https://ir.orchidislandcapital.com. An audio archive of the webcast will be available for 30 days after the call.

About Orchid Island Capital, Inc.

Orchid Island Capital, Inc. is a specialty finance company that invests on a leveraged basis in Agency RMBS. Our investment strategy focuses on, and our portfolio consists of, two categories of Agency RMBS: (i) traditional pass-through Agency RMBS, such as mortgage pass-through certificates, and CMOs issued by the GSEs, and (ii) structured Agency RMBS, such as IOs, IIOs and principal only securities, among other types of structured Agency RMBS. Orchid is managed by Bimini Advisors, LLC, a registered investment adviser with the Securities and Exchange Commission.

Forward Looking Statements

Statements herein relating to matters that are not historical facts, including, but not limited to statements regarding interest rates, inflation, liquidity, pledging of our structured RMBS, funding levels and spreads, prepayment speeds, portfolio composition, positioning and repositioning, hedging levels, leverage ratio, dividends, investment and return opportunities, the supply and demand for Agency RMBS and the performance of the Agency RMBS sector generally, the effect of actual or expected actions of the U.S. government, including the Fed, market expectations, capital raising, future opportunities and prospects of the Company and general economic conditions, are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. The reader is cautioned that such forward-looking statements are based on information available at the time and on management's good faith belief with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in such forward-looking statements. Important factors that could cause such differences are described in Orchid Island Capital, Inc.'s filings with the Securities and Exchange Commission, including its most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Orchid Island Capital, Inc. assumes no obligation to update forward-looking statements to reflect subsequent results, changes in assumptions or changes in other factors affecting forward-looking statements.

CONTACT:

Orchid Island Capital, Inc.

Robert E. Cauley, 772-231-1400

Chairman and Chief Executive Officer

https://ir.orchidislandcapital.com

Summarized Financial Statements

The following is a summarized presentation of the unaudited balance sheets as of September 30, 2024, and December 31, 2023, and the unaudited quarterly statements of operations for the nine and three months ended September 30, 2024 and 2023. Amounts presented are subject to change.

|

ORCHID ISLAND CAPITAL, INC.

|

|

BALANCE SHEETS

|

|

($ in thousands, except per share data)

|

|

(Unaudited - Amounts Subject to Change)

|

| |

|

September 30, 2024

|

|

|

December 31, 2023

|

|

|

ASSETS:

|

|

|

|

|

|

|

|

|

|

Mortgage-backed securities, at fair value

|

|

$ |

5,442,804 |

|

|

$ |

3,894,012 |

|

|

U.S. Treasury securities, available-for-sale

|

|

|

99,467 |

|

|

|

148,820 |

|

|

Cash, cash equivalents and restricted cash

|

|

|

333,717 |

|

|

|

200,289 |

|

|

Accrued interest receivable

|

|

|

22,868 |

|

|

|

14,951 |

|

|

Derivative assets, at fair value

|

|

|

16,846 |

|

|

|

6,420 |

|

|

Receivable for investment securities and TBA transactions

|

|

|

177 |

|

|

|

- |

|

|

Other assets

|

|

|

614 |

|

|

|

455 |

|

|

Total Assets

|

|

$ |

5,916,493 |

|

|

$ |

4,264,947 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

Repurchase agreements

|

|

$ |

5,230,871 |

|

|

$ |

3,705,649 |

|

|

Payable for investment securities and TBA transactions

|

|

|

68 |

|

|

|

60,454 |

|

|

Dividends payable

|

|

|

9,396 |

|

|

|

6,222 |

|

|

Derivative liabilities, at fair value

|

|

|

- |

|

|

|

12,694 |

|

|

Accrued interest payable

|

|

|

16,372 |

|

|

|

7,939 |

|

|

Due to affiliates

|

|

|

1,177 |

|

|

|

1,013 |

|

|

Other liabilities

|

|

|

2,585 |

|

|

|

1,031 |

|

|

Total Liabilities

|

|

|

5,260,469 |

|

|

|

3,795,002 |

|

|

Total Stockholders' Equity

|

|

|

656,024 |

|

|

|

469,945 |

|

|

Total Liabilities and Stockholders' Equity

|

|

$ |

5,916,493 |

|

|

$ |

4,264,947 |

|

|

Common shares outstanding

|

|

|

78,082,645 |

|

|

|

51,636,074 |

|

|

Book value per share

|

|

$ |

8.40 |

|

|

$ |

9.10 |

|

|

ORCHID ISLAND CAPITAL, INC.

|

|

STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

|

|

($ in thousands, except per share data)

|

|

(Unaudited - Amounts Subject to Change)

|

| |

|

Nine Months Ended September 30,

|

|

|

Three Months Ended September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Interest income

|

|

$ |

169,581 |

|

|

$ |

128,030 |

|

|

$ |

67,646 |

|

|

$ |

50,107 |

|

|

Interest expense

|

|

|

(172,428 |

) |

|

|

(149,593 |

) |

|

|

(67,306 |

) |

|

|

(58,705 |

) |

|

Net interest (expense) income

|

|

|

(2,847 |

) |

|

|

(21,563 |

) |

|

|

340 |

|

|

|

(8,598 |

) |

|

Gains (losses) on RMBS and derivative contracts

|

|

|

47,351 |

|

|

|

(30,323 |

) |

|

|

21,249 |

|

|

|

(66,890 |

) |

|

Net portfolio income (loss)

|

|

|

44,504 |

|

|

|

(51,886 |

) |

|

|

21,589 |

|

|

|

(75,488 |

) |

|

Expenses

|

|

|

12,387 |

|

|

|

14,467 |

|

|

|

4,269 |

|

|

|

4,644 |

|

|

Net income (loss)

|

|

$ |

32,117 |

|

|

$ |

(66,353 |

) |

|

$ |

17,320 |

|

|

$ |

(80,132 |

) |

|

Other comprehensive income

|

|

|

38 |

|

|

|

16 |

|

|

|

48 |

|

|

|

16 |

|

|

Comprehensive net income (loss)

|

|

$ |

32,155 |

|

|

$ |

(66,337 |

) |

|

$ |

17,368 |

|

|

$ |

(80,116 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net income (loss) per share

|

|

$ |

0.53 |

|

|

$ |

(1.58 |

) |

|

$ |

0.24 |

|

|

$ |

(1.68 |

) |

|

Weighted Average Shares Outstanding

|

|

|

60,700,959 |

|

|

|

42,103,532 |

|

|

|

72,377,373 |

|

|

|

47,773,409 |

|

|

Dividends Declared Per Common Share:

|

|

$ |

1.080 |

|

|

$ |

0.960 |

|

|

$ |

0.360 |

|

|

$ |

0.480 |

|

| |

|

Three Months Ended September 30,

|

|

|

Key Balance Sheet Metrics

|

|

2024

|

|

|

2023

|

|

|

Average RMBS(1)

|

|

$ |

4,984,279 |

|

|

$ |

4,447,098 |

|

|

Average repurchase agreements(1)

|

|

|

4,788,287 |

|

|

|

4,314,332 |

|

|

Average stockholders' equity(1)

|

|

|

605,978 |

|

|

|

478,463 |

|

|

Adjusted leverage ratio - as of period end(2)

|

|

8.0:1

|

|

|

9.5:1

|

|

|

Economic leverage ratio - as of period end(3)

|

|

7.6:1 |

|

|

8.5:1 |

|

| |

|

|

|

|

|

|

|

|

|

Key Performance Metrics

|

|

|

|

|

|

|

|

|

|

Average yield on RMBS(4)

|

|

|

5.43 |

% |

|

|

4.51 |

% |

|

Average cost of funds(4)

|

|

|

5.62 |

% |

|

|

5.44 |

% |

|

Average economic cost of funds(5)

|

|

|

2.96 |

% |

|

|

3.18 |

% |

|

Average interest rate spread(6)

|

|

|

(0.19 |

)% |

|

|

(0.93 |

)% |

|

Average economic interest rate spread(7)

|

|

|

2.47 |

% |

|

|

1.33 |

% |

| |

(1)

|

Average RMBS, borrowings and stockholders’ equity balances are calculated using two data points, the beginning and ending balances.

|

| |

(2)

|

The adjusted leverage ratio is calculated by dividing ending repurchase agreement liabilities by ending stockholders’ equity.

|

| |

(3) |

The economic leverage ratio is calculated by dividing ending total liabilities adjusted for net notional TBA positions by ending stockholders' equity. |

| |

(4)

|

Portfolio yields and costs of funds are calculated based on the average balances of the underlying investment portfolio/borrowings balances and are annualized for the quarterly periods presented.

|

| |

(5)

|

Represents the interest cost of our borrowings and the effect of derivative agreements attributed to the period related to hedging activities, divided by average borrowings.

|

| |

(6)

|

Average interest rate spread is calculated by subtracting average cost of funds from average yield on RMBS.

|

| |

(7)

|

Average economic interest rate spread is calculated by subtracting average economic cost of funds from average yield on RMBS.

|

v3.24.3

Document And Entity Information

|

Oct. 24, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Orchid Island Capital, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 24, 2024

|

| Entity, Incorporation, State or Country Code |

MD

|

| Entity, File Number |

001-35236

|

| Entity, Tax Identification Number |

27-3269228

|

| Entity, Address, Address Line One |

3305 Flamingo Drive

|

| Entity, Address, City or Town |

Vero Beach

|

| Entity, Address, State or Province |

FL

|

| Entity, Address, Postal Zip Code |

32963

|

| City Area Code |

772

|

| Local Phone Number |

231-1400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

ORC

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001518621

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |