Oppenheimer To Pay Boston Market Co-Founder $1.1 Million - Finra Panel

August 30 2011 - 3:13PM

Dow Jones News

Oppenheimer & Co. Inc. must pay more than $1.1 million for

personal losses suffered by a co-founder of Boston Market Corp. who

accused the firm of excessive trading in his account, among other

things.

A Financial Industry Regulatory Authority arbitration panel in

Denver ordered Oppenheimer, an investment firm subsidiary of

Oppenheimer Holdings Inc. (OPY), to pay more than $1.1 million to

investor Steven Kolow, who co-founded Boston Chicken, a restaurant

in Newtown, Mass., in 1985. It would later expand to a restaurant

chain, becoming Boston Market Corp. in 1995.

The ruling was a partial victory for Kolow, who requested more

than $4 million in damages, according to a ruling dated Aug. 26. He

also asked that Oppenheimer be required to repay profits it earned

through "alleged excessive trading" in his account.

Kolow filed the case in July 2010, alleging breach of fiduciary

duty, negligence and other wrongdoing. The claim involved purchases

of certain stocks, including Alcoa Inc. (AA) and General Electric

Co. (GE) and call options for those securities, according to the

ruling.

An Oppenheimer spokesman said the firm "strongly disagrees" with

the outcome. Kolow is an "experienced active investor," he

said.

As is typical of most arbitration rulings, the panel didn't

explain the reasons for its decision.

Lawyers for Kolow declined to comment, and efforts to locate

Kolow weren't successful.

-By Suzanne Barlyn, Dow Jones Newswires; 212-416-2230;

suzanne.barlyn@dowjones.com

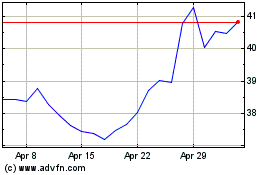

Oppenheimer (NYSE:OPY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Oppenheimer (NYSE:OPY)

Historical Stock Chart

From Jul 2023 to Jul 2024