UPDATE: Report Of Iran Oil Cut To Europe Lifts Oil Prices

February 15 2012 - 4:48PM

Dow Jones News

A report Wednesday from an Iranian state television

broadcaster--later denied by the Iranian government--saying Tehran

had cut its oil exports to six European nations lifted European oil

prices Wednesday, exposing oil markets' nervousness over any abrupt

Iranian oil disruption.

The report was the latest from Iran to shock oil markets after

the country's threats to close the Strait of Hormuz had sent oil

prices higher in recent weeks. The strait is a strategic Persian

Gulf shipping artery through which a fifth of world oil supplies

are transported.

The Iranian broadcaster Press TV said on its website: "In

response to the latest sanctions imposed by the EU against Iran's

energy and banking sectors, the Islamic Republic has cut oil

exports to six European countries," naming France, the Netherlands,

Spain, Italy, Portugal and Greece as targets of the measure.

Although Portugal buys no oil from Tehran, the five other

countries have been among the EU's largest importers of Iranian

oil, together receiving 659,000 barrels a day in September,

according to data from Eurostat, the EU statistics service.

Some companies, such as France's largest oil company, Total SA

(TOT, FP.FR), have since stopped buying or shipping oil from

Tehran. Royal Dutch Shell PLC (RDSA.LN, RDSA, RDSB.LN, RDSB)

declined to comment on the report and BP PLC (BP, BP.LN) couldn't

immediately be reached for comment.

The International Energy Agency, which coordinates energy policy

for industrialized nations in the Organization for Economic

Cooperation and Development, declined to comment on the Iranian

reports and oil-price moves.

The Press TV report lifted the European benchmark Brent crude

price on ICE Futures Europe as high as $119.99 a barrel during the

session to a six-month intraday high.

Oil prices eased somewhat after an Iranian oil-ministry

spokesman and an Iranian diplomat in charge of Western Europe

denied the Press TV report to separate news agencies. Still, the

Brent contract ended the session at $118.93, an eight-month settle

high.

Italy's foreign minister, Giulio Terzi, denied that Iranian oil

exports to Italy have been halted.

Iranian oil officials and an Iranian diplomat in one of the six

European countries Wednesday also told Dow Jones Newswires they

hadn't received any official notification about a decision to cut

oil exports.

"If there had been a decision, we would have been aware," the

diplomat said.

Despite the denials, subsequent reports suggested a preemptive

embargo still could be in the cards. The Mehr agency quoted an

unnamed Iranian oil official as saying Italy, Spain, Portugal and

Greece were given an ultimatum to extend their long-term contracts

or get their supply cut.

So far, Iran has reacted defiantly to Europe's planned embargo,

saying it could easily find new customers. The National Iranian Oil

Co. has raised the price of its oil for European customers, even as

stronger sanctions make it increasingly difficult to purchase its

crude, a person who had seen the Iranian oil official selling

prices told Dow Jones Newswires Wednesday.

Iranian lawmakers and the country's oil minister have previously

threatened to abruptly interrupt oil exports to some European Union

countries in response to a full EU embargo, which is due to come

into force July 1.

A top Iranian lawmaker had said Tuesday on the Iranian

parliament's website the preemptive ban was still under

consideration, though there was a consensus to implement it.

Even though it has been denied, the Iranian Press TV report

comes during increasing tensions in the Middle East.

Iran's President Mahmoud Ahmadinejad Wednesday unveiled further

progress on its nuclear reactor, though Iran has denied western

claims that it is building atomic weapons and has said the program

is peaceful.

Iran has been accused of bomb blasts this week in Bangkok and

New Delhi, while Israel has warned it could seek to destroy Iran's

nuclear facilities.

Elsewhere, some unrest in large oil-producing nations such as

Saudi Arabia and Nigeria also unsettled oil markets.

"There is little doubt that the increase in tensions in these

regions accompanies an increase in the risk of disruption to oil

supplies," U.S. bank J.P. Morgan said Wednesday in a note.

-By Benoit Faucon, Dow Jones Newswires; +44 77 601 777 36;

benoit.faucon@dowjones.com

--James Herron, Alexis Flynn, Sarah Kent and Selina Williams in

London, Patricia Kowsmann in Lisbon and Liam Moloney in Rome

contributed to this article.

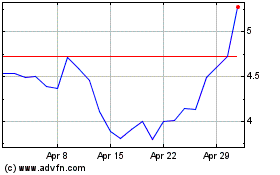

NIO (NYSE:NIO)

Historical Stock Chart

From Jun 2024 to Jul 2024

NIO (NYSE:NIO)

Historical Stock Chart

From Jul 2023 to Jul 2024