Gannett Announces Expiration of Exchange Offer and Consent Solicitation

October 28 2024 - 4:15PM

Business Wire

Gannett Co., Inc. (“Gannett”, “we”, “our”, or the “Company”)

(NYSE: GCI) announced today that its previously announced (a) offer

to exchange (the “Exchange Offer”) any and all outstanding 6.000%

Senior Secured Notes due 2026 (the “Notes”) of its wholly-owned

subsidiary, Gannett Holdings LLC (“Gannett Holdings”), and (b) the

related consent solicitation made by Gannett and Gannett Holdings

(the “Consent Solicitation”) to adopt certain amendments to the

indenture governing the Notes (the “Proposed Amendments”), expired

at 5:00 p.m., New York City time, on October 25, 2024.

The initial settlement for the Notes that were validly tendered

(and not validly withdrawn) at or prior to 5:00 p.m., New York City

time, on October 10, 2024 (the “Early Tender Time”), and accepted

for exchange occurred on October 15, 2024. Gannett and Gannett

Holdings did not accept for exchange any Notes tendered after the

Early Tender Time. Any Notes tendered and not accepted for exchange

will be returned to holders promptly.

In addition, as previously disclosed, Gannett and Gannett

Holdings received the requisite consents to the Proposed

Amendments. A supplemental indenture effecting the Proposed

Amendments was executed on October 15, 2024.

About Gannett

Gannett Co., Inc. (NYSE: GCI) is a diversified media company

with expansive reach at the national and local level dedicated to

empowering and enriching communities. We seek to inspire, inform,

and connect audiences as a sustainable, growth focused media and

digital marketing solutions company. We endeavor to deliver

essential content, marketing solutions, and experiences for curated

audiences, advertisers, consumers, and stakeholders by leveraging

our diverse teams and suite of products to enrich the local

communities and businesses we serve. Our current portfolio of

trusted media brands includes the USA TODAY NETWORK, comprised of

the national publication, USA TODAY, and local media organizations

in the United States, and Newsquest, a wholly-owned subsidiary

operating in the United Kingdom. Our digital marketing solutions

brand, LocaliQ, uses innovation and software to enable small and

medium-sized businesses to grow, and USA TODAY NETWORK Ventures,

our events division, creates impactful consumer engagements,

promotions, and races.

Our website address is www.gannett.com. We use our website as a

channel of distribution for important company information,

including press releases and other news and presentations, which is

accessible on the Investor Relations and News and Events subpages

of our website.

This press release does not constitute an offer to sell or

purchase, or a solicitation of an offer to sell or purchase, or the

solicitation of tenders or consents with respect to, any security.

No offer, solicitation, purchase or sale will be made in any

jurisdiction in which such an offer, solicitation, or sale would be

unlawful.

Cautionary Statement Regarding

Forward-Looking Statements

Certain items in this press release may constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, including, among others,

statements regarding note repurchases, exchanges and redemptions

and expectations (including timing) with respect to the Exchange

Offer and Consent Solicitation. Words and phrases such as “may”,

“will”, and similar expressions are intended to identify such

forward-looking statements. These statements are based on

management’s current expectations and beliefs and are subject to a

number of risks and uncertainties. These and other risks and

uncertainties could cause actual results to differ materially from

those described in the forward-looking statements, many of which

are beyond our control. The Company can give no assurance its

expectations regarding the Exchange Offer and Consent Solicitation

or any other proposed financing or liability management

transactions, or otherwise, will be attained. Accordingly, you

should not place undue reliance on any forward-looking statements

contained in this press release. For a discussion of some of the

risks and important factors that could cause actual results to

differ from such forward-looking statements, see the section

entitled “Risk Factors” in the confidential offer to exchange and

consent solicitation statement dated September 26, 2024 and the

risks and other factors detailed in the Company’s 2023 Annual

Report on Form 10-K and from time to time in other filings with the

Securities and Exchange Commission. Furthermore, new risks and

uncertainties emerge from time to time, and it is not possible for

the Company to predict or assess the impact of every factor that

may cause its actual results to differ from those contained in any

forward-looking statements. Such forward-looking statements speak

only as of the date of this press release. Except to the extent

required by law, the Company expressly disclaims any obligation to

release publicly any updates or revisions to any forward-looking

statements contained herein to reflect any change in the Company’s

expectations with regard thereto or change in events, conditions or

circumstances on which any statement is based.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241028826613/en/

For investor inquiries, contact: Matt Esposito Investor

Relations 703-854-3000 investors@gannett.com

For media inquiries, contact: Lark-Marie Anton Corporate

Communications 646-906-4087 lark@gannett.com

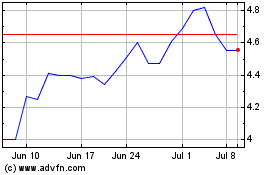

New Gannett (NYSE:GCI)

Historical Stock Chart

From Nov 2024 to Dec 2024

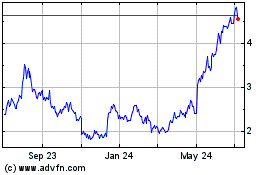

New Gannett (NYSE:GCI)

Historical Stock Chart

From Dec 2023 to Dec 2024