FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the

month of February 2024

Commission

File Number: 001-10306

NatWest

Group plc

Gogarburn,

PO Box 1000

Edinburgh

EH12 1HQ

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form

20-F X Form 40-F

___

Indicate

by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities

Exchange Act of 1934.

Yes ___

No X

If

"Yes" is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b): 82-

________

The following information was issued as Company announcements

in London, England and is furnished pursuant to General Instruction

B to the General Instructions to Form

6-K:

|

Exhibit

No. 1

|

Holding(s)

in Company dated 5 February 2024

|

|

Exhibit

No. 2

|

Directorate

Change dated Day 6 February 2024

|

|

Exhibit

No. 3

|

Paul

Thwaite appointed as NatWest Group CEO dated 16 February

2024

|

|

Exhibit

No. 4

|

Publication

of Supplementary Prospectus dated 16 February 2024

|

|

Exhibit

No. 5

|

Commencement

of On Market Share Buyback Programme dated 19 February

2024

|

|

Exhibit

No. 6

|

Holding(s)

in Company dated 19 February 2024

|

|

Exhibit

No. 7

|

Notice

of Redemption dated 22 February 2024

|

|

Exhibit

No. 8

|

Holding(s)

in Company – HMT shareholding dated 26 February

2024

|

|

Exhibit

No. 9

|

Total

Voting Rights dated 29 February 2024

|

Exhibit

No. 1

TR-1: Standard form for notification of major holdings

|

NOTIFICATION OF MAJOR HOLDINGS (to

be sent to the relevant issuer and to the FCA in

Microsoft Word format if possible)i

|

|

|

|

1a. Identity of the issuer or the underlying issuer of existing

shares to which voting rights are attachedii:

|

NatWest Group plc

|

|

1b. Please indicate if the issuer is a non-UK

issuer (please

mark with an "X" if appropriate)

|

|

Non-UK issuer

|

|

|

2. Reason for the notification (please

mark the appropriate box or boxes with an "X")

|

|

An acquisition or disposal of voting rights

|

x

|

|

An acquisition or disposal of financial instruments

|

|

|

An event changing the breakdown of voting rights

|

|

|

Other (please specify)iii:

|

|

|

3. Details of person subject to the notification

obligationiv

|

|

Name

|

The Commissioners of His Majesty's Treasury

|

|

City and country of registered office (if applicable)

|

London, England

|

|

4. Full name of shareholder(s) (if

different from 3.)v

|

|

Name

|

The Solicitor for the Affairs of His Majesty's

Treasury

|

|

City and country of registered office (if applicable)

|

London, England

|

|

5. Date on which the threshold was crossed or

reachedvi:

|

2 February 2024

|

|

6. Date on which issuer notified (DD/MM/YYYY):

|

2 February 2024

|

|

7. Total positions of person(s) subject to the notification

obligation

|

|

|

% of voting rights attached to shares (total of 8. A)

|

% of voting

rights through financial

instruments(total of 8.B 1 + 8.B 2)

|

Total of both in % (8.A + 8.B)

|

Total number of voting rights of issuervii

|

|

Resulting situation on the date on which threshold was crossed or

reached

|

34.96%

|

|

34.96%

|

35,093,417,576

|

|

Position of previous notification (if

applicable)

|

35.94%

|

|

35.94%

|

|

|

8. Notified details of the resulting situation on the date on which

the threshold was crossed or reachedviii

|

|

A: Voting rights attached to shares

|

|

Class/type ofshares

ISIN code (if possible)

|

Number of voting rightsix

|

% of voting rights

|

|

Direct

(Art 9 of Directive 2004/109/EC) (DTR5.1)

|

Indirect

(Art 10 of Directive 2004/109/EC) (DTR5.2.1)

|

Direct

(Art 9 of Directive 2004/109/EC) (DTR5.1)

|

Indirect

(Art 10 of Directive 2004/109/EC) (DTR5.2.1)

|

|

Ordinary Shares of £1.0769 each GB00BM8PJY71

|

12,267,836,404

|

|

34.96%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUBTOTAL 8. A

|

12,267,836,404

|

34.96%

|

|

|

|

B 1: Financial Instruments according to Art. 13(1)(a) of Directive

2004/109/EC (DTR5.3.1.1 (a))

|

|

Type of financial instrument

|

Expirationdatex

|

Exercise/Conversion Periodxi

|

Number of voting rights that may be acquired if the instrument

is

exercised/converted.

|

% of voting rights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUBTOTAL 8. B 1

|

|

|

|

|

|

B 2: Financial Instruments with similar economic effect according

to Art. 13(1)(b) of Directive 2004/109/EC (DTR5.3.1.1

(b))

|

|

Type of financial instrument

|

Expirationdatex

|

Exercise/Conversion Period xi

|

Physical or cash

settlementxii

|

Number of voting rights

|

% of voting rights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUBTOTAL 8.B.2

|

|

|

|

|

|

9. Information in relation to the person subject to the

notification obligation (please mark

the

applicable

box with an "X")

|

|

Person

subject to the notification obligation is not controlled by any

natural person or legal entity and does not control any other

undertaking(s) holding directly or indirectly an interest in the

(underlying) issuerxiii

|

|

|

Full chain of controlled undertakings through which

the voting rights and/or thefinancial instruments are effectively

held starting with the ultimate controlling natural person or legal

entityxiv (please add additional rows as

necessary)

|

x

|

|

Namexv

|

% of voting rights if it equals or is higher than the notifiable

threshold

|

% of voting rights through financial instruments if it equals or is

higher than the notifiable threshold

|

Total of both if it equals or is higher than the notifiable

threshold

|

|

UK

Government Investments Limited, a company wholly-owned by His

Majesty's Treasury, is entitled to exercise control over the voting

rights which are the subject of this notification (pursuant to

certain management arrangements agreed with His Majesty's

Treasury).

The

Solicitor for the Affairs of His Majesty's Treasury is acting as

nominee for The Commissioners of His Majesty's

Treasury.

|

|

The

Commissioners of His Majesty's Treasury

|

34.96%

|

|

34.96%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. In case of proxy voting, please

identify:

|

|

Name of

the proxy holder

|

|

|

The

number and % of voting rights held

|

|

|

The

date until which the voting rights will be held

|

|

|

|

|

11. Additional informationxvi

|

|

The

Solicitor for the Affairs of His Majesty's Treasury is acting as

nominee for The Commissioners of His Majesty's Treasury

(HMT).

The

percentage of voting rights held by HMT in NatWest Group plc (NWG),

as shown on this form (34.96%), has been calculated following the

disposal by HMT of 97,917,196 ordinary shares in NWG since its last

TR-1 notification on 22 January 2024.

The

percentage of voting rights held by HMT could move up or down going

forward depending on the number of shares repurchased by NWG and

the progress of sales under HMT's trading plan announced on 22 July

2021 and most recently extended on 3 April 2023.

|

|

Place of completion

|

London,

England

|

|

Date of completion

|

2

February 2024

|

Legal Entity Identifier: 2138005O9XJIJN4JPN90

Exhibit

No. 2

6 February 2024

NatWest Group plc

Directorate Change

NatWest Group plc ('NWG') announces the appointment of Geeta

Gopalan as an independent non-executive director with effect from 1

July 2024.

Howard Davies, Chairman of NWG, said:

"I am delighted to welcome Geeta to NatWest Group. Geeta will

be a valuable addition to the board, bringing substantial financial

and banking expertise, combined with a strong track record as a plc

non-executive director."

Geeta currently serves as a non-executive director of Virgin

Money UK PLC*, Funding Circle plc, Intrum S.A., and as a Trustee of

The Old Vic Theatre. She previously served as a non-executive

director of Dechra Pharmaceuticals Ltd, Ultra Electronics Plc,

Wizink Bank SA, and Vocalink. Geeta's biography is set out

below.

*Stepping down on 30 June 2024.

There are no further matters requiring disclosure under Listing

Rule 9.6.13.

For further information contact:

NatWest Group Investor Relations:

Claire Kane

Director, Investor Relations

+44 (0) 20 7672 1758

NatWest Group Media Relations:

+44 (0) 131 523 4205

LEI: 2138005O9XJIJN4JPN90

-------------------------------------------------

Geeta Gopalan Biography

Geeta Gopalan is currently a non-executive director of Virgin Money

UK PLC*, serving as Risk Committee Chair; Intrum S.A, Europe's

largest credit investment and collections company; Funding Circle

plc - the largest fintech platform for SME lending in the UK,

serving as Senior Independent Director and Audit Committee Chair;

and as Trustee and Finance Committee Chair at The Old Vic

Theatre.

Geeta's previous non-executive directorships include Dechra

Pharmaceuticals Ltd, a leading FTSE 150 veterinary pharmaceuticals

company, serving as Remuneration Committee Chair; Ultra Electronics

Plc, a highly specialised software company that supply solutions

for defence, transport and aerospace; Wizink Bank SA, a private

equity owned digital bank in Spain; Vocalink, the operator for the

UK national payments infrastructure; Trustee Pilotlight, an

enterprise focused on bringing business skills to the third sector;

and as Vice-Chair and Member of the England Committee Big Lottery

Fund, which is the largest non-government funder of community

development in the UK and one of the largest globally.

Geeta has spent over 20 years in various executive roles across

banking and fintechs. Geeta is also a Qualified Chartered

Accountant (Chartered Accountants Institute, India).

Exhibit

No. 3

Paul Thwaite appointed as NatWest Group CEO

The

Board of NatWest Group plc has appointed Paul Thwaite as Group

Chief Executive Officer and Executive Director with immediate

effect. This follows his appointment on an initial 12-month basis

in July 2023.

Led

by Chair Designate Rick Haythornthwaite, the NatWest Group Board

has undertaken a rigorous and competitive search process, with

support from a leading external search firm.

Rick Haythornthwaite, Chair Designate of NatWest Group

said: "Paul

has shown an unrivalled understanding of this business, our

customers, and the opportunities for growth. We are both ambitious

for this organisation and I fully expect his potent blend of

NatWest knowledge and thoughtful, imaginative approach to

leadership to prove key to forging success in the rapidly changing

landscape of banking.

The Board agreed that he was the outstanding candidate and the

right person to shape the future of NatWest".

Paul Thwaite, NatWest Group CEO said: "I want to thank the Board for their support and

the opportunity they have given me. It's an honour to lead what, I

believe, is a great business, which plays a vital role in the lives

of the 19 million customers we serve. With that, comes a

great sense of responsibility to succeed for our customers,

colleagues, and shareholders.

Our customers' needs and expectations are changing at pace, as they

engage with emerging technology, adapt to new social trends, and

build ever more resilience to a fast-evolving

world. I

believe that NatWest, with its heritage, leading customer

businesses, deep regional connections and financial strength, can

be a trusted partner to customers during a period of

change.

It is an exciting time for our sector and our bank. I am confident

we can shape the future of NatWest to deliver its full

potential."

Howard Davies, NatWest Group

Chairman said: "I

am very pleased with the outcome of the process Rick ran. I have

worked closely with Paul over the last seven months and am

confident that he has all the skills needed to lead the bank

forward."

Paul

has also been appointed as CEO and Executive Director of NatWest

Holdings Limited, The Royal Bank of Scotland plc and National

Westminster Bank Plc.

Paul

previously served as a director of Motability Operations Group plc

from 30 September 2016 to 1 March 2021.

There

are no other matters to disclose under Listing Rule

9.6.13

Remuneration arrangements for Paul Thwaite

Paul Thwaite's remuneration arrangements have been set in

accordance with the Directors' Remuneration Policy approved by

shareholders. The remuneration package includes a base salary

of £1,155,660 per

annum, a

fixed share allowance set at 100% of salary, standard benefit

funding of £26,250 per annum and a pension allowance of 10% of

salary on the same basis as the wider

workforce.

Variable pay will consist of an annual bonus subject to

performance, with a maximum opportunity of

100% of salary delivered equally in cash and shares and a

Restricted Share Plan award with a maximum

opportunity of

150% of salary delivered in shares. Paul will be required to build

up and maintain a minimum shareholding equal to 500% of

salary.

The remuneration package for the NatWest Group CEO continues to

represent pay restraint in comparison to the

market. Any

further increases will be reviewed annually, subject to

satisfactory performance and development in

role.

Further details of Paul's remuneration arrangements are set out in

the 2023 Directors' Remuneration Report.

For further information contact:

NatWest Group Investor Relations:

Claire Kane

Director, Investor Relations

+44 (0) 20 7672 1758

NatWest Group Media Relations:

+44 (0) 131 523 4205

LEI: 2138005O9XJIJN4JPN90

Exhibit

No. 4

NatWest Group plc

Publication of Supplementary Prospectus

The following supplementary prospectus has been approved by the

Financial Conduct Authority and is available for

viewing:

Supplementary Prospectus dated 16 February 2024 to the NatWest

Group plc £40,000,000,000 Euro Medium Term Note Programme of 7

December 2023.

To view the full document, please paste the following URL into the

address bar of your browser:

http://www.rns-pdf.londonstockexchange.com/rns/4873D_1-2024-2-16.pdf

A copy of the above Supplementary Prospectus has been submitted to

the National Storage Mechanism and will shortly be available for

inspection at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

For further information, please contact:

Scott Forrest

Head of NatWest Treasury DCM

Tel: +44 (0) 7747 455

969

DISCLAIMER - INTENDED ADDRESSEES

Please note that the information contained in the Supplementary

Prospectus (and the Prospectus to which it relates) may be

addressed to and/or targeted at persons who are residents of

particular countries (specified in the Prospectus) only and is not

intended for use and should not be relied upon by any person

outside of these countries and/or to whom the offer contained in

the Prospectus and the Supplementary Prospectus is not addressed.

Prior to relying on the information contained in the Prospectus and

the Supplementary Prospectus you must ascertain from the Prospectus

whether or not you are part of the intended addressees of the

information contained therein.

Your right to access this service is conditional upon complying

with the above requirement.

Legal Entity Identifier

|

|

|

|

NatWest Group plc

|

2138005O9XJIJN4JPN90

|

Exhibit No. 5

NatWest Group plc

19 February 2024

Commencement of On

Market Share Buyback Programme

NatWest Group plc (the "Company") announces the commencement of its

programme to buy back ordinary shares in the Company with a nominal

value of £1.0769* each

("Ordinary Shares").

On 16 February 2024, the Company announced its full year results

and a share buyback programme (the "2024 Programme") of up to

£300 million. The 2024 Programme will commence on 19

February 2024 and will end no later than 18 July 2024, provided

that the term of the 2024 Programme may be extended to end no later

than 15 August 2024 to account for any days where usual trading has

not been possible because of market events during the term of the

2024 Programme.

The 2024 Programme, the purpose of which is to reduce the Company's

issued share capital, will take place within the limitations of the

authority granted by shareholders to the Board of the Company at

its Annual General Meeting, held on 25 April 2023 (the "2023

Authority").

The maximum number of Ordinary Shares that can be purchased by NWG

under the 2024 Programme is 696,743,990**.

The Company has entered into non-discretionary instructions with

UBS AG, London Branch to conduct the Programme on its behalf and to

make trading decisions under the Programme independently of the

Company.

The Company intends to cancel the repurchased Ordinary

Shares.

* The

nominal value of Ordinary Shares without rounding is

£1.076923076923077 per share.

** This number reflects the impact on the 2023 Authority of the

reduction in issued share capital following the off-market buyback

announced on 22 May 2023. It is further reduced by the number of

shares purchased to date by the Company under the ongoing share

buyback programme announced on 31 July 2023 (the

"2023 Programme").This

number does not take into account further purchases of

Ordinary Shares which (i) may have taken place but have not, at the

date of this announcement, settled under the 2023 Programme or (ii)

may take place under the 2023 Programme between the date of this

announcement and the conclusion of the 2023

Programme. These

remaining purchases under the 2023 Programme may occur whilst

purchases are taking place under the

2024 Programme.

Further information:

Investor Relations

+ 44 (0)207 672 1758

Media Relations

+44 (0)131 523 4205

Legal Entity Identifier: 2138005O9XJIJN4JPN90

Disclaimer

This announcement is for information purposes only and does not

constitute or form a part of an offer to sell or a solicitation of

an offer to purchase, or the solicitation to sell, any securities

of the Company.

Forward-looking statements

This announcement may include forward-looking statements within the

meaning of the United States Private Securities Litigation Reform

Act of 1995, such as statements that include, without limitation,

the words 'expect', 'estimate', 'project', 'anticipate', 'commit',

'believe', 'should', 'intend', 'will', 'plan', 'could',

'probability', 'risk', 'Value-at-Risk (VaR)', 'target', 'goal',

'objective', 'may', 'endeavour', 'outlook', 'optimistic',

'prospects' and similar expressions or variations on these

expressions. These statements concern or may affect future matters,

such as NatWest Group's future economic results, business plans and

strategies. In

particular, this announcement may include forward-looking

statements relating to NatWest Group plc in respect of, but not

limited to: its economic and political risks, its financial

position, profitability and financial performance (including

financial, capital, cost savings and operational targets), the

implementation of its strategy, its climate and

sustainability-related targets, increasing competition from

incumbents, challengers and new entrants and disruptive

technologies, its access to adequate sources of liquidity and

funding, its regulatory capital position and related requirements,

its exposure to third party risks, its ongoing compliance with the

UK ring-fencing regime and ensuring operational continuity in

resolution, its impairment losses and credit exposures under

certain specified scenarios, substantial regulation and oversight,

ongoing legal, regulatory and governmental actions and

investigations, and NatWest Group's exposure to operational risk,

conduct risk, cyber, data and IT risk, financial crime risk, key

person risk and credit rating risk. Forward-looking

statements are subject to a number of risks and uncertainties that

might cause actual results and performance to differ materially

from any expected future results or performance expressed or

implied by the forward-looking statements. Factors that could cause

or contribute to differences in current expectations include, but

are not limited to, future growth initiatives (including

acquisitions, joint ventures and strategic partnerships), the

outcome of legal, regulatory and governmental actions and

investigations, the level and extent of future impairments and

write-downs, legislative, political, fiscal and regulatory

developments, accounting standards, competitive conditions,

technological developments, interest and exchange rate

fluctuations, general economic and political conditions and the

impact of climate-related risks and the transitioning to a net zero

economy. These and other factors, risks and uncertainties that may

impact any forward-looking statement or NatWest Group plc's actual

results are discussed in NatWest Group plc's 2023 Annual Report on

Form 20-F, and

its other public filings. The forward-looking statements contained

in this announcement speak only as of the date of this announcement

and NatWest Group plc does not assume or undertake any obligation

or responsibility to update any of the forward-looking statements

contained in this announcement, whether as a result of new

information, future events or otherwise, except to the extent

legally required.

No Purchases in the United States and No Purchases of American

Depositary Receipts ("ADRs")

Purchases of Ordinary Shares under the Programme will be made

outside the United States only. There will be no purchases of

Ordinary Shares from within the United States or from persons known

to be located in the United States, and there will be no purchases

of the Company's ADRs under the Programme.

Exhibit

No. 6

TR-1: Standard form for notification of major holdings

|

NOTIFICATION OF MAJOR HOLDINGS (to

be sent to the relevant issuer and to the FCA in

Microsoft Word format if possible)i

|

|

|

|

1a. Identity of the issuer or the underlying issuer of existing

shares to which voting rights are attachedii:

|

NatWest Group plc

|

|

1b. Please indicate if the issuer is a non-UK

issuer (please

mark with an "X" if appropriate)

|

|

Non-UK issuer

|

|

|

2. Reason for the notification (please

mark the appropriate box or boxes with an "X")

|

|

An acquisition or disposal of voting rights

|

x

|

|

An acquisition or disposal of financial instruments

|

|

|

An event changing the breakdown of voting rights

|

|

|

Other (please specify)iii:

|

|

|

3. Details of person subject to the notification

obligationiv

|

|

Name

|

The Commissioners of His Majesty's Treasury

|

|

City and country of registered office (if applicable)

|

London, England

|

|

4. Full name of shareholder(s) (if

different from 3.)v

|

|

Name

|

The Solicitor for the Affairs of His Majesty's

Treasury

|

|

City and country of registered office (if applicable)

|

London, England

|

|

5. Date on which the threshold was crossed or

reachedvi:

|

16 February 2024

|

|

6. Date on which issuer notified (DD/MM/YYYY):

|

16 February 2024

|

|

7. Total positions of person(s) subject to the notification

obligation

|

|

|

% of voting rights attached to shares (total of 8. A)

|

% of voting

rights through financial

instruments(total of 8.B 1 + 8.B 2)

|

Total of both in % (8.A + 8.B)

|

Total number of voting rights of issuervii

|

|

Resulting situation on the date on which threshold was crossed or

reached

|

33.56%

|

|

33.56%

|

35,093,417,576

|

|

Position of previous notification (if

applicable)

|

34.96%

|

|

34.96%

|

|

|

8. Notified details of the resulting situation on the date on which

the threshold was crossed or reachedviii

|

|

A: Voting rights attached to shares

|

|

Class/type ofshares

ISIN code (if possible)

|

Number of voting rightsix

|

% of voting rights

|

|

Direct

(Art 9 of Directive 2004/109/EC) (DTR5.1)

|

Indirect

(Art 10 of Directive 2004/109/EC) (DTR5.2.1)

|

Direct

(Art 9 of Directive 2004/109/EC) (DTR5.1)

|

Indirect

(Art 10 of Directive 2004/109/EC) (DTR5.2.1)

|

|

Ordinary Shares of £1.0769 each GB00BM8PJY71

|

11,776,787,296

|

|

33.56%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUBTOTAL 8. A

|

11,776,787,296

|

33.56%

|

|

|

|

B 1: Financial Instruments according to Art. 13(1)(a) of Directive

2004/109/EC (DTR5.3.1.1 (a))

|

|

Type of financial instrument

|

Expirationdatex

|

Exercise/Conversion Periodxi

|

Number of voting rights that may be acquired if the instrument

is

exercised/converted.

|

% of voting rights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUBTOTAL 8. B 1

|

|

|

|

|

|

B 2: Financial Instruments with similar economic effect according

to Art. 13(1)(b) of Directive 2004/109/EC (DTR5.3.1.1

(b))

|

|

Type of financial instrument

|

Expirationdatex

|

Exercise/Conversion Period xi

|

Physical or cash

settlementxii

|

Number of voting rights

|

% of voting rights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUBTOTAL 8.B.2

|

|

|

|

|

|

9. Information in relation to the person subject to the

notification obligation (please mark

the

applicable

box with an "X")

|

|

Person

subject to the notification obligation is not controlled by any

natural person or legal entity and does not control any other

undertaking(s) holding directly or indirectly an interest in the

(underlying) issuerxiii

|

|

|

Full chain of controlled undertakings through which

the voting rights and/or thefinancial instruments are effectively

held starting with the ultimate controlling natural person or legal

entityxiv (please add additional rows as

necessary)

|

x

|

|

Namexv

|

% of voting rights if it equals or is higher than the notifiable

threshold

|

% of voting rights through financial instruments if it equals or is

higher than the notifiable threshold

|

Total of both if it equals or is higher than the notifiable

threshold

|

|

UK

Government Investments Limited, a company wholly-owned by His

Majesty's Treasury, is entitled to exercise control over the voting

rights which are the subject of this notification (pursuant to

certain management arrangements agreed with His Majesty's

Treasury).

The

Solicitor for the Affairs of His Majesty's Treasury is acting as

nominee for The Commissioners of His Majesty's

Treasury.

|

|

The

Commissioners of His Majesty's Treasury

|

33.56%

|

|

33.56%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. In case of proxy voting, please

identify:

|

|

Name of

the proxy holder

|

|

|

The

number and % of voting rights held

|

|

|

The

date until which the voting rights will be held

|

|

|

|

|

11. Additional informationxvi

|

|

The

Solicitor for the Affairs of His Majesty's Treasury is acting as

nominee for The Commissioners of His Majesty's Treasury

(HMT).

The

percentage of voting rights held by HMT in NatWest Group plc (NWG),

as shown on this form (33.56%), has been calculated following the

disposal by HMT of 122,762,277 ordinary shares in NWG since its

last TR-1 notification on 5 February 2024.

The

percentage of voting rights held by HMT could move up or down going

forward depending on the number of shares repurchased by NWG and

the progress of sales under HMT's trading plan announced on 22 July

2021 and most recently extended on 3 April 2023.

|

|

Place of completion

|

London,

England

|

|

Date of completion

|

16

February 2024

|

Legal Entity Identifier: 2138005O9XJIJN4JPN90

Exhibit

No. 7

NatWest Group plc

22 February 2024

Notice of Redemption

NatWest Group

plc (the

"Issuer")

The Issuer hereby gives notice to holders of the

€750,000,000 Fixed to Floating Rate Notes due 4 March

2025 (ISIN: XS1875275205 (the "Notes")) of the upcoming redemption of the Notes on 4

March 2024. The amount of the Notes currently outstanding is

€750,000,000.

Terms used but not defined herein shall have the meaning given to

them in the notice of redemption. The Notes are being redeemed

pursuant to Condition 5(d) (Call Option - Redemption at

the Option of the Issuer) of the Notes at par, together with interest

accrued to but excluding the Redemption Date. The Issuer has

notified the holders pursuant to the terms of the

Notes.

To view the notice, please click on the link below.

http://www.rns-pdf.londonstockexchange.com/rns/1227E_1-2024-2-22.pdf

For further information, please contact:

Scott Forrest

Head of NatWest Treasury DCM

Tel: +44 (0)7747 455969

|

Legal Entity Identifiers

|

|

|

NatWest Group plc

|

2138005O9XJIJN4JPN90

|

Exhibit

No. 8

TR-1: Standard form for notification of major holdings

|

NOTIFICATION OF MAJOR HOLDINGS (to

be sent to the relevant issuer and to the FCA in

Microsoft Word format if possible)i

|

|

|

|

1a. Identity of the issuer or the underlying issuer of existing

shares to which voting rights are attachedii:

|

NatWest Group plc

|

|

1b. Please indicate if the issuer is a non-UK

issuer (please

mark with an "X" if appropriate)

|

|

Non-UK issuer

|

|

|

2. Reason for the notification (please

mark the appropriate box or boxes with an "X")

|

|

An acquisition or disposal of voting rights

|

x

|

|

An acquisition or disposal of financial instruments

|

|

|

An event changing the breakdown of voting rights

|

|

|

Other (please specify)iii:

|

|

|

3. Details of person subject to the notification

obligationiv

|

|

Name

|

The Commissioners of His Majesty's Treasury

|

|

City and country of registered office (if applicable)

|

London, England

|

|

4. Full name of shareholder(s) (if

different from 3.)v

|

|

Name

|

The Solicitor for the Affairs of His Majesty's

Treasury

|

|

City and country of registered office (if applicable)

|

London, England

|

|

5. Date on which the threshold was crossed or

reachedvi:

|

23 February 2024

|

|

6. Date on which issuer notified (DD/MM/YYYY):

|

23 February 2024

|

|

7. Total positions of person(s) subject to the notification

obligation

|

|

|

% of voting rights attached to shares (total of 8. A)

|

% of voting

rights through financial

instruments(total of 8.B 1 + 8.B 2)

|

Total of both in % (8.A + 8.B)

|

Total number of voting rights of issuervii

|

|

Resulting situation on the date on which threshold was crossed or

reached

|

32.88%

|

|

32.88%

|

35,093,417,576

|

|

Position of previous notification (if

applicable)

|

33.56%

|

|

33.56%

|

|

|

8. Notified details of the resulting situation on the date on which

the threshold was crossed or reachedviii

|

|

A: Voting rights attached to shares

|

|

Class/type ofshares

ISIN code (if possible)

|

Number of voting rightsix

|

% of voting rights

|

|

Direct

(Art 9 of Directive 2004/109/EC) (DTR5.1)

|

Indirect

(Art 10 of Directive 2004/109/EC) (DTR5.2.1)

|

Direct

(Art 9 of Directive 2004/109/EC) (DTR5.1)

|

Indirect

(Art 10 of Directive 2004/109/EC) (DTR5.2.1)

|

|

Ordinary Shares of £1.0769 each GB00BM8PJY71

|

11,537,714,952

|

|

32.88%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUBTOTAL 8. A

|

11,537,714,952

|

32.88%

|

|

|

|

B 1: Financial Instruments according to Art. 13(1)(a) of Directive

2004/109/EC (DTR5.3.1.1 (a))

|

|

Type of financial instrument

|

Expirationdatex

|

Exercise/Conversion Periodxi

|

Number of voting rights that may be acquired if the instrument

is

exercised/converted.

|

% of voting rights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUBTOTAL 8. B 1

|

|

|

|

|

|

B 2: Financial Instruments with similar economic effect according

to Art. 13(1)(b) of Directive 2004/109/EC (DTR5.3.1.1

(b))

|

|

Type of financial instrument

|

Expirationdatex

|

Exercise/Conversion Period xi

|

Physical or cash

settlementxii

|

Number of voting rights

|

% of voting rights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUBTOTAL 8.B.2

|

|

|

|

|

|

9. Information in relation to the person subject to the

notification obligation (please mark

the

applicable

box with an "X")

|

|

|

Person

subject to the notification obligation is not controlled by any

natural person or legal entity and does not control any other

undertaking(s) holding directly or indirectly an interest in the

(underlying) issuerxiii

|

|

|

Full chain of controlled undertakings through which

the voting rights and/or thefinancial instruments are effectively

held starting with the ultimate controlling natural person or legal

entityxiv (please add additional rows as

necessary)

|

x

|

|

Namexv

|

% of voting rights if it equals or is higher than the notifiable

threshold

|

% of voting rights through financial instruments if it equals or is

higher than the notifiable threshold

|

Total

of both if it equals or is higher than the notifiable

threshold

|

|

UK

Government Investments Limited, a company wholly-owned by His

Majesty's Treasury, is entitled to exercise control over the voting

rights which are the subject of this notification (pursuant to

certain management arrangements agreed with His Majesty's

Treasury).

The

Solicitor for the Affairs of His Majesty's Treasury is acting as

nominee for The Commissioners of His Majesty's Treasury.

|

|

The

Commissioners of His Majesty's Treasury

|

32.88%

|

|

32.88%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. In

case of proxy voting, please identify:

|

|

Name of

the proxy holder

|

|

|

The

number and % of voting rights held

|

|

|

The

date until which the voting rights will be held

|

|

|

|

|

11. Additional informationxvi

|

|

The

Solicitor for the Affairs of His Majesty's Treasury is acting as

nominee for The Commissioners of His Majesty's Treasury

(HMT).

The

percentage of voting rights held by HMT in NatWest Group plc (NWG),

as shown on this form (32.88%), has been calculated following the

disposal by HMT of 59,768,086 ordinary shares in NWG since its last

TR-1 notification on 19 February 2024.

The

percentage of voting rights held by HMT could move up or down going

forward depending on the number of shares repurchased by NWG and

the progress of sales under HMT's trading plan announced on 22 July

2021 and most recently extended on 3 April 2023.

|

|

Place of completion

|

London,

England

|

|

Date of completion

|

23

February 2024

|

Legal Entity Identifier: 2138005O9XJIJN4JPN90

Exhibit

No. 9

NatWest

Group plc

Total Voting Rights and Capital

In conformity with the Disclosure

Guidance and Transparency Rules, NatWest Group plc ("NWG") hereby

notifies the following in respect of its issued share capital with

voting rights as at 29 February 2024.

|

Share Class and nominal value

|

Number of Shares issued

|

Voting rights per share

|

Total Voting rights -

|

|

29 February 2024

|

|

Ordinary Shares of £1.0769* (excluding ordinary shares held in

treasury)

|

8,750,233,496

|

4

|

35,000,933,984

|

|

Ordinary Shares of £1.0769* held in treasury

|

174,599,613

|

4

|

Voting rights not exercisable

|

|

11% Cumulative Preference Shares of £1

|

240,686

|

4

|

962,744

|

|

5.5% Cumulative Preference Shares of £1

|

242,454

|

4

|

969,816

|

|

Total:

|

8,925,316,249

|

|

35,002,866,544

|

*Note:

the nominal value of Ordinary Shares without

rounding is £1.076923076923077 per share

Shareholders may use the above figure of

35,002,866,544 for their calculations to determine whether they are

required to notify their interest in, or a change to their interest

in, NWG under the FCA's Disclosure Guidance and Transparency

Rules.

Legal Entity

Identifier:2138005O9XJIJN4JPN90

Date: 29

February 2024

|

|

NATWEST

GROUP plc (Registrant)

|

|

|

|

|

|

By: /s/

Jan Cargill

|

|

|

|

|

|

Name:

Jan Cargill

|

|

|

Title:

Chief Governance Officer and Company Secretary

|

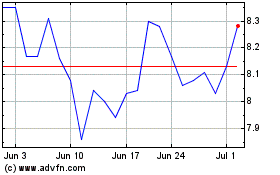

NatWest (NYSE:NWG)

Historical Stock Chart

From Apr 2024 to May 2024

NatWest (NYSE:NWG)

Historical Stock Chart

From May 2023 to May 2024