false000108499100010849912022-11-142022-11-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): October 9, 2023 NATURAL GAS SERVICES GROUP, INC.

(Exact Name of Registrant as Specified in Charter) | | | | | | | | | | | | | | |

Colorado | | 1-31398 | | 75-2811855 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

404 Veterans Airpark Lane, Suite 300

Midland, TX 79705

(Address of Principal Executive Offices)

(432) 262-2700

(Registrant's Telephone Number, Including Area Code)

N/A

(Former Name or Former Address if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)).

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-14(c)).

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, Par Value $0.01 | | NGS | | NYSE |

| | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Employment of Brian Tucker as Chief Operating Officer

On October 9, 2023, the Company entered into an entered into an employment agreement (the “Employment Agreement”) with Brian L. Tucker, age 49, pursuant to which Mr. Tucker was appointed President and Chief Operating Officer of the Company.

The following is a summary of the material features of the Employment Agreement and is qualified in its entirety by reference to the full text of it, a copy of which is filed as Exhibit 10.1 to this Report.

Base Salary. Mr. Tucker’s initial annual base salary is $400,000 (“Base Salary”) and will be reviewed at least annually by the Company’s Board of Directors (“Board”). The Company does not have any obligation to increase or decrease the Base Salary.

Bonus. In addition, Mr. Tucker will have the opportunity to earn incentive compensation in the form of an annual cash bonus based on performance thresholds and metrics established by the Board or Compensation Committee of the Board. For 2023, the target amount is 75% of his Base Salary, pro-rated for the number of days employed in 2023.

Equity Compensation. Upon his employment, Mr. Tucker was granted a restricted stock unit of 6,361 shares of the Company’s common stock based on $14.30 per share which was the fair market value of one share of the Company’s stock on the date of grant. The RSU vests in three equal annual installments beginning on the first anniversary of the effective date of the Employment Agreement, subject to Mr. Tucker’s continuous employment with the Company and other customary provisions to be set forth in an award agreement under the Company’s 2019 Equity Incentive Plan.

Benefits. The Company will provide Mr. Tucker retirement and other employee benefits as are customarily provided to similarly situated executives of the Company, including paid vacation, coverage under the Company’s medical plan and reimbursement for all reasonable business expenses in accordance with the Company’s expense reimbursement policy.

Term and Termination. The initial term of the Employment Agreement is for one year (October 9, 2023 to October 8, 2024). The initial term automatically extends for additional one-year periods unless either party gives notice not to renew at least 60 days prior to the end of the initial or any renewal term. The Company or Mr. Tucker may terminate the Agreement at any time upon written notice.

Effect of Termination; Severance.

If Mr. Tucker’s employment is terminated by the Company (A) without cause (as defined in the Employment Agreement) or (B) failure by the Company to renew the agreement upon the expiration of any given one-year term, or if the Mr. Tucker terminates his employment without good reason (as defined in the Employment Agreement), the Employment Agreement provides that he will receive (i) payment in a lump sum of accrued but unpaid salary and vacation time, (ii) any earned but unpaid bonus, (iii) unreimbursed business expenses and (iv) any such other benefits (including equity compensation) to which he may be entitled to under any employee benefit plan as of the date of termination (collectively, the “Accrued Amounts”). In addition, he will receive a severance payment of one (1) times his Base Salary payable over 12 month and the Company will pay COBRA continuation coverage for up to twelve (12) months following his termination.

In the event of a termination of employment (i) by the Company for cause, (ii) by Mr. Tucker without good reason, or (iii) in the case of death or disability, Mr. Tucker will be entitled to the Accrued Amounts but will not be entitled to any severance.

Clawbacks. Mr. Tucker’s incentive compensation will be subject to clawback regulations in effect under applicable law or applicable stock exchange listing standards.

Non-Compete and Other Agreements.

In connection with the Employment Agreement, Mr. Tucker also executed a Non-Compete Agreement and Proprietary Rights Agreement that contain customary non-compete, confidentiality and non-solicitation provisions, along with proprietary rights ownership of work product in favor of the Company.

The non-compete provision prohibit Mr. Tucker from engaging in competitive activity in a defined geographic area for a period of either (i) 12 months immediately following the termination of his employment connection with a termination by Mr. Tucker for Good Reason or by the Company without Cause or on account of the Company’s failure to renew the Employment Agreement, or (ii) 24 months immediately following the termination of employment with the Company in connection with a termination by Mr. Tucker without Good Reason or by the Company with Cause. The non-solicitation provisions prohibit Mr. Tucker from soliciting for employment any employee of the Company or any person who was an employee of the Company. This prohibition applies while Mr. Tucker is employed by the Company and for the same applicable period of time as the non-compete provision after termination of his employment.

Prior to Mr. Tucker’s employment with the Company, most recently he served as a Senior Vice President Operations for Patterson UTI Energy. Immediately before his time at Patterson, he held the role of Chief Operating Officer of Pioneer Energy Services. During his time at Pioneer, Mr. Tucker also held the roles of Senior Vice President Operations and Drilling/Well Services President before being named the COO in 2019. Prior to joining Pioneer, Mr. Tucker was a Vice President for Helmerich and Payne (H&P) serving as the South Texas Vice President of Operations from 2010 to 2012. From 2004 to 2010, Mr. Tucker served as drilling engineer and operations manager for the Barnett Shale, South Texas, and West Texas operations for H&P. Originally from Odessa TX, Mr. Tucker served eight years as an officer in the U.S. Army, is a West Point graduate with a Bachelor of Science in Systems Engineering and completed the Harvard Business School Advanced Management Program in 2014. He currently serves as a board member of Catholic Charities Archdiocese of San Antonio.

Appointment of John Bittner as Interim Chief Financial Officer

The Company also announced the appointment of John Bittner, age 56, to the position of Interim Chief Financial Officer effective October 9, 2023. In his position with the Company, Mr. Bittner will have oversight of finance, accounting functions, public company reporting obligations and other customary functions consistent with the position of chief financial officer. He will report to Stephen C. Taylor, the Company’s Interim Chief Executive Officer. Mr. Bittner will also serve as the Company’s Interim Principal Financial Officer. Mr. Bittner’s services as Interim Chief Financial Officer and the compensation therefor are provided for pursuant to an addendum to engagement agreement between the Company and Accordion Partners LLC (“Accordion”) a copy of which is filed herewith as Exhibit 10.2. The Company has previously engaged Accordion as financial consultant. Accordingly, Mr. Bittner will not be eligible to participate in the Company’s incentive equity, bonus or employee benefit plans. Accordion is a financial consulting firm with an emphasis on serving the office of the CFO and spanning the entire CFO function – including financial and accounting responsibilities, strategic financial planning and analysis, debt and banking transactions and interim leadership.

Mr. Bittner is Senior Managing Director of Accordion Partners, LLC with over 25 years of strategic, financial and operational advisory experience. Mr. Bittner has been employed by Accordion and predecessor companies since 2017. Prior to this, Mr. Bittner served as a senior executive for several leading consulting practices, most recently serving as a Partner in the Business Recovery Services practice of PwC and as a Partner in the Corporate Advisory and Restructuring Services practice of Grant Thornton LLP. Throughout his career, Mr. Bittner has had a wide range of experience in various industries including the energy and manufacturing sectors. Mr. Bittner earned an M.B.A. from the University of Michigan, Ann Arbor and a B.B.A. in Business Administration from Texas A&M University. He is a Certified Public Accountant, licensed in Texas.

Departure of JD Faircloth as Interim Chief Financial Officer

In connection with Mr. Bittner’s appointment, J.D. Faircloth, who had been employed as the Company’s Interim Chief Financial Officer since February 8, 2023, will depart to resume his retirement.

Item 8.01 Other Events

On October 9, 2023, the Company issued a press release announcing the appointments of Mr. Tucker as its President and Chief Operating Officer and John Bittner as Interim Chief Financial Officer. A copy of this press release is filed herewith as Exhibit 99.1 and is hereby incorporated by reference.

The press release filed herewith as Exhibit 99.1 is being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liability under that section, and it shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are included with this Current Report on Form 8-K:

| | | | | |

| Exhibit No. | Description |

| Addendum to Engagement Agreement between Accordion Partners LLC and Natural Gas Services Group, Inc. dated October 9, 2023. |

| Addendum to Engagement Agreement between Accordion Partners LLC and Natural Gas Services Group, Inc. dated October 9, 2023. |

| Press Release dated October 10, 2023. |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | NATURAL GAS SERVICES GROUP, INC. |

| | | | | |

| | | | | |

| Date: | | By: | | /s/ Stephen C. Taylor |

| October 10, 2023 | | | | Stephen C. Taylor |

| | | | | Interim President & Chief Executive Officer |

Exhibit 10.1

EMPLOYMENT AGREEMENT

This Employment Agreement (the “Agreement”) is made and entered into as of October 9, 2023 (the “Effective Date”), by and between Brian L. Tucker (the “Executive”) and Natural Gas Services Group, Inc., a Colorado corporation (the “Company”).

RECITALS

WHEREAS, the Company desires to employ the Executive on the terms and conditions set forth herein; and

WHEREAS, the Executive desires to be employed by the Company on such terms and conditions.

NOW, THEREFORE, in consideration of the mutual covenants, promises, and obligations set forth herein, the parties agree as follows:

1.Term. Subject to Section 5 of this Agreement: 1.1The Executive's initial term of employment hereunder shall be from the period beginning on the Effective Date through the one (1) year anniversary of the Effective Date (the “Initial Term”).

1.2Thereafter, the Agreement shall be deemed to be automatically extended, upon the same terms and conditions, for successive periods of one year, unless either party provides written notice of its intention not to extend the term at least 60 days prior to the end of the Initial Term or one-year extension thereof. The period during which the Executive is employed by the Company hereunder is hereinafter referred to as the “Employment Term.”

2.Position and Duties.

2.1Position. During the Employment Term, the Executive shall serve as the President and Chief Operating Officer of the Company, reporting to the Chief Executive Officer, or such other person as the Board of Directors of the Company (the “Board”) may determine in its discretion. In such position, the Executive shall have such duties, authority, and responsibilities as are consistent with the Executive's position.

2.2Duties. During the Employment Term, the Executive shall devote substantially all of the Executive's business time and attention to the performance of the Executive's duties hereunder and will not engage in any other business, profession, or occupation for compensation or otherwise which would conflict or interfere with the performance of such services either directly or indirectly without the prior written consent of the Board. Prior to execution of this Agreement, Executive has disclosed in writing to the Company any such conflicts that exist at the time of execution.

3.Place of Performance. The principal place of Executive's employment shall be the Company's principal executive office currently located in Midland, Texas (the “Midland Office”) provided that, the Executive may be required to travel on Company business during the Employment Term. Notwithstanding the foregoing, for up to 24 months following the Effective Date, Executive may maintain his place of residence outside of the Odessa-Midland area so long as he is available to work from the Midland Office at least 4 days per week (except when traveling on Company business.) Executive shall not be entitled to any Company-paid or reimbursement for commuting or living expenses.

4.Compensation.

4.1Base Salary. The Company shall pay the Executive an annual rate of base salary of $400,000 in periodic installments in accordance with the Company's customary payroll practices and applicable wage payment laws, but no less frequently than monthly. The Executive's base salary shall be reviewed at least annually by the Board during the Employment Term. The Executive's annual base salary, as in effect from time to time, is hereinafter referred to as “Base Salary.”

4.2Annual Bonus.

(a)For each calendar year ending during the Employment Term, the Executive shall be eligible to receive an annual bonus (the “Annual Bonus”) in accordance with the Company’s Annual Incentive Bonus Plan, or any successor plan applicable to the Company’s executive officers. The decision to provide any Annual Bonus and the amount and terms of any Annual Bonus shall be in the sole and absolute discretion of the Board or the Compensation Committee of the Board (the “Compensation Committee”).

(b)Except as otherwise provided in Section 5, (i) the Annual Bonus will be subject to the terms of the Company annual bonus plan under which it is granted and (ii) in order to be eligible to receive an Annual Bonus, the Executive must be employed by the Company on the last day of the applicable calendar year. For calendar year 2023, Executive’s cash bonus at “Target” as established by the Compensation Committee, shall be 75% of Base Salary and shall be prorated for the number of days employed in 2023. 4.3Equity Awards. During the Employment Term, the Executive shall be eligible to participate in the Company’s 2019 Equity Incentive Plan, or any successor plan (the “Equity Plan”), subject to the terms of such Equity Plan and as determined by the Board or the Compensation Committee, in its discretion. For calendar year 2023, Executive will receive a restricted stock unit (“RSU”) award valued at 100% of Base Salary, but prorated for the number of days remaining in 2023 from the Effective Date. The number of RSUs awarded will be determined by dividing the value by the closing sale price of one share of the Company’s common stock as reported on the New York Stock Exchange (“NYSE”) on the Effective Date and then prorated by multiplying the number of days remaining in 2023 from the Effective Date divided by 365 (the “2023 Award”). The 2023 Award will vest in one-third annual installments beginning on the first anniversary of the Effective Date.

4.4Fringe Benefits and Perquisites. During the Employment Term, the Executive shall be entitled to fringe benefits and perquisites consistent with those provided to similarly situated executives of the Company.

4.5Employee Benefits. During the Employment Term, the Executive shall be entitled to participate in all employee benefit plans, practices, and programs maintained by the Company, as in effect from time to time (collectively, “Employee Benefit Plans”), on a basis which is no less favorable than is provided to other similarly situated executives of the Company, to the extent consistent with applicable law and the terms of the applicable Employee Benefit Plans. The Company reserves the right to amend or terminate any Employee Benefit Plans at any time in its sole discretion, subject to the terms of such Employee Benefit Plan and applicable law.

4.6Vacation; Paid Time Off. During the Employment Term, the Executive shall be entitled to four weeks of paid vacation days per calendar year (prorated for partial years) in accordance with the Company's vacation policies, as in effect from time to time. The Executive shall receive other paid time off in accordance with the Company's policies for executive officers as such policies may exist from time to time and as required by applicable law. In compliance with Company policy, vacation shall be taken during the year that it is awarded and shall not be carried-over or accrued beyond the current year.

4.7Business Expenses. The Executive shall be entitled to reimbursement for all reasonable and necessary out-of-pocket business, entertainment, and travel expenses incurred by the Executive in connection with the performance of the Executive's duties hereunder in accordance with the Company's expense reimbursement policies and procedures.

4.8Indemnification. The Company shall indemnify and hold the Executive harmless to the fullest extent applicable to any other officer or director of the Company subject to applicable law and the Company's Bylaws for acts and omissions in the Executive's capacity as an officer and employee of the Company.

4.9Clawback Provisions. Any amounts payable under this Agreement are subject to any policy (whether in existence as of the Effective Date or later adopted) established by the Company providing for clawback or recovery of amounts that were paid to the Executive. The Company will make any determination for clawback or recovery in its sole discretion and in accordance with any applicable law or regulation.

5.Termination of Employment. In addition to the rights of the parties set forth herein, the Employment Term and the Executive's employment hereunder may be terminated by either the Company or the Executive at any time and for any reason or for no particular reason in accordance with Section 1.2 or this Section 5. Upon termination of the Executive's employment during the Employment Term, the Executive shall be entitled to the compensation and benefits described in this Section 5 and shall have no further rights to any compensation or any other benefits from the Company or any of its affiliates.

5.1By Company For Cause or By Executive Without Good Reason.

(a)The Executive's employment hereunder may be terminated by the Company for Cause or by the Executive without Good Reason and the Executive shall be entitled to receive:

(i)any accrued but unpaid Base Salary and accrued but unused vacation/paid time off which shall be paid within six calendar days following the date of the Executive's termination, or at the next regular pay period following the date of the Executive’s resignation;

(ii)any earned but unpaid Annual Bonus with respect to any completed calendar year immediately preceding the date of the Executive's termination, which shall be paid on the otherwise applicable payment date except to the extent payment is otherwise deferred pursuant to any applicable deferred compensation arrangement; provided that, if the Executive's employment is terminated by the Company for Cause, then the Executive understands and acknowledges that any such earned but unpaid Annual Bonus shall be forfeited;

(iii)reimbursement for unreimbursed business expenses properly incurred by the Executive, which shall be subject to and paid in accordance with the Company's expense reimbursement policy; and

(iv)such employee benefits (including equity compensation), if any, to which the Executive may be entitled under the Company's employee benefit plans as of the date of the Executive's termination; provided that, in no event shall the Executive be entitled to any payments in the nature of severance or termination payments except as specifically provided herein.

Items 5.1(a)(i) through 5.1(a)(iv) are referred to herein collectively as the “Accrued Amounts.”

(b)For purposes of this Agreement, “Cause” shall mean:

(i)the Executive's willful failure to perform the Executive's duties (other than any such failure resulting from incapacity due to physical or mental illness);

(ii)the Executive's willful failure to comply with any valid and legal directive of the Board or the person to whom Executive reports;

(iii)the Executive's engagement in dishonesty, illegal conduct, or misconduct, which is, in each case, injurious to the Company or its affiliates, as reasonably determined by the Board;

(iv)the Executive's embezzlement, misappropriation, or fraud, whether or not related to the Executive's employment with the Company;

(v)the Executive's conviction of or plea of guilty or nolo contendere to a crime that constitutes a felony (or state law equivalent) or a crime that constitutes a misdemeanor involving moral turpitude;

(vi)the Executive's material violation of the Company's written policies or codes of conduct, including written policies related to discrimination, harassment, performance of illegal or unethical activities, and ethical misconduct;

(vii)the Executive's material breach of any material obligation under this Agreement or any other written agreement between the Executive and the Company; or

(viii)the Executive's engagement in conduct that brings or is reasonably likely to bring the Company negative publicity or into public disgrace, embarrassment, or disrepute.

For purposes of this provision, none of the Executive's acts or failures to act shall be considered “willful” unless the Executive acts, or fails to act, in bad faith or without reasonable belief that the action or failure to act was in the best interests of the Company. The Executive's actions, or failures to act, based upon authority given pursuant to a resolution duly adopted by the Board or upon the advice of counsel for the Company shall be conclusively presumed to be in good faith and in the best interests of the Company.

Except for a failure, breach, or refusal which, by its nature, cannot reasonably be expected to be cured, the Executive shall have 10 business days from the delivery of written notice by the Company within which to cure any acts constituting Cause.

(c)For purposes of this Agreement, “Good Reason” shall mean the occurrence of any of the following, in each case during the Employment Term without the Executive's prior written consent:

(i)a material reduction in the Executive's Base Salary other than a general reduction in Base Salary that affects all similarly situated executives in substantially the same proportions;

(ii)a relocation of the Executive's principal place of employment by more than 100 miles; or

(iii)any material breach by the Company of any material provision of this Agreement.

To terminate the Executive's employment for Good Reason, the Executive must provide written notice to the Company of the existence of the circumstances providing grounds for termination for Good Reason within 30 days of the initial existence of such grounds and the Company must have at least 30 days from the date on which such notice is provided to cure such circumstances. If the Executive does not terminate the Executive's employment for Good Reason within 60 days after the first occurrence of the applicable grounds, then the Executive will be

deemed to have waived the Executive's right to terminate for Good Reason with respect to such grounds.

5.2Expiration of Term, Termination by Company Without Cause or Termination by Executive for Good Reason. The Employment Term and the Executive's employment hereunder may be terminated by the Executive for Good Reason or by the Company without Cause or on account of the Company’s failure to renew the Agreement in accordance with Section 1. In the event of such termination, the Executive shall be entitled to receive the Accrued Amounts and subject to the Executive's compliance with Section 6 of this Agreement and the Executive's execution, within 21 days following receipt, of a release of claims in favor of the Company, its affiliates and their respective officers and directors in a form provided by the Company (the “Release”), the Executive shall be entitled to receive the following: (a)equal installment payments payable in accordance with the Company's normal payroll practices, but no less frequently than monthly, which are in the aggregate equal to 12 months of the Executive's Base Salary for the year in which the date of the Executive's termination occurs, which shall begin upon the lapse of any and all legal revocation period relating to the Release and continue until the 1st anniversary of the Executive's date of termination; and

(b)If the Executive timely and properly elects health continuation coverage under the Consolidated Omnibus Budget Reconciliation Act of 1985 (“COBRA”), the Company shall reimburse the Executive for the monthly COBRA premium paid by the Executive for the Executive and the Executive's dependents. Such reimbursement shall be paid to the Executive no later than the 15th day of the month immediately following the month in which the Executive timely remits the premium payment and proof thereof. The Executive shall be eligible to receive such reimbursement until the earliest of: (i) the 12-month anniversary of the date of the Executive's termination; (ii) the date the Executive is no longer eligible to receive COBRA continuation coverage; or (iii) the date on which the Executive becomes eligible to receive health insurance coverage from another employer or other source. Notwithstanding the foregoing, if the Company's making payments under this Section 5.2(c) would violate the nondiscrimination rules applicable to non-grandfathered, insured group health plans under the Affordable Care Act (the “ACA”), or result in the imposition of penalties under the ACA and the related regulations and guidance promulgated thereunder, the parties agree to reform this Section 5.2(c) in a manner as is necessary to comply with the ACA.

5.3Death or Disability.

(a)The Executive's employment hereunder shall terminate automatically upon the Executive's death during the Employment Term, and the Company may terminate the Executive's employment on account of the Executive's Disability.

(b)If the Executive's employment is terminated during the Employment Term on account of the Executive's death or Disability, the Executive (or the Executive's estate and/or

beneficiaries, as the case may be) shall be entitled to receive the Accrued Amounts in accordance with Section 5.1.

(c)For purposes of this Agreement, “Disability” shall mean the Executive's inability, due to physical or mental incapacity, to perform the essential functions of the Executive's job, with or without reasonable accommodation, for one hundred twenty (120) consecutive days. Any question as to the existence of the Executive's Disability as to which the Executive and the Company cannot agree shall be determined in writing by a qualified independent physician mutually acceptable to the Executive and the Company. The determination of Disability made in writing to the Company and the Executive shall be final and conclusive for all purposes of this Agreement.

5.4Notice of Termination. Any termination of the Executive's employment hereunder by the Company or by the Executive during the Employment Term (other than termination pursuant to Section 5.3(a) on account of the Executive's death) shall be communicated by written notice of termination (“Notice of Termination”) to the other party hereto in accordance with Section 17. The Notice of Termination shall specify: (a)the termination provision of this Agreement relied upon;

(b)if notice of termination is provided by the Company, then a written notice of termination is to be sent to the Executive at any time and with or without reason; and

(c)if notice of termination is provided by the Executive, then the Executive understands and agrees as a courtesy to send a 30-day written termination notice prior to his intended last day of employment to the Company’s Board of Directors.

5.5Resignation of All Other Positions. Upon termination of the Executive's employment hereunder for any reason, the Executive shall be deemed to have resigned from all positions that the Executive holds as an officer or member of the Board (or a committee thereof) of the Company or any of its affiliates.

6.Confidential Information and Restrictive Covenants. As a condition of the Executive's employment with the Company, the Executive shall enter into and abide by the Company's Employee Non-Compete Agreement and Proprietary Rights Agreement.

7.Arbitration/Prevailing Party Recovery of Attorney’s Fees. Any dispute, controversy, or claim arising out of or related to the Executive's employment by the Company, or termination of employment, including but not limited to claims arising under or related to this Agreement or any breach of this Agreement, and any alleged violation of federal, state, or local statute, regulation, common law, or public policy, shall be submitted to and decided by binding arbitration. Arbitration shall be administered exclusively by the American Arbitration Association and shall be conducted in the County of Midland, Texas consistent with the rules of the American Arbitration Association in effect at the time the arbitration is commenced. Any

arbitral award determination shall be final and binding upon the parties. The Parties agree that the prevailing party of the Arbitration shall recover its or his attorney’s fees.

8.Governing Law, Jurisdiction, and Venue. This Agreement, for all purposes, shall be construed in accordance with the laws of Texas without regard to conflicts of law principles. Any action or proceeding by either of the parties to enforce this Agreement shall be brought only in a state or federal court located in the state of Texas, county of Midland. The parties hereby irrevocably submit to the exclusive jurisdiction of such courts and waive the defense of inconvenient forum to the maintenance of any such action or proceeding in such venue.

9.Stock Ownership Requirements. During the Employment Term, the Executive shall be expected to comply with the Company’s stock ownership guidelines, as same may be amended from time to time by the Company.

10.Entire Agreement. Unless specifically provided herein, this Agreement, together with the Employee Non-Compete Agreement and Proprietary Rights Agreement, contains all of the understandings and representations between the Executive and the Company pertaining to the subject matter hereof and supersedes all prior and contemporaneous understandings, agreements, representations and warranties, both written and oral, with respect to such subject matter.

11.Modification and Waiver. No provision of this Agreement may be amended or modified unless such amendment or modification is agreed to in writing and signed by the Executive and by the Chief Executive Officer or the Chairperson of the Compensation Committee of the Board. No waiver by either of the parties of any breach by the other party hereto of any condition or provision of this Agreement to be performed by the other party hereto shall be deemed a waiver of any similar or dissimilar provision or condition at the same or any prior or subsequent time.

12.Severability. Should any provisions of this Agreement be held to be invalid, illegal, or unenforceable in any respect, such invalidity, illegality, or unenforceability shall not affect any other provisions hereof, and if such provision or provisions are not modified as provided above, this Agreement shall be construed as if such invalid, illegal, or unenforceable provisions had not been set forth herein.

13.Captions. Captions and headings of the sections and paragraphs of this Agreement are intended solely for convenience and no provision of this Agreement is to be construed by reference to the caption or heading of any section or paragraph.

14.Counterparts. This Agreement may be executed in separate counterparts, each of which shall be deemed an original, but all of which taken together shall constitute one and the same instrument.

15.Section 409A.

15.1General Compliance. This Agreement is intended to comply with Section 409A of the Code and the treasury regulations promulgated thereunder (“Section 409A”) or an exemption thereunder and shall be construed and administered in accordance with such intent.

Notwithstanding any other provision of this Agreement, payments provided under this Agreement may only be made upon an event and in a manner that complies with Section 409A or an applicable exemption. Any nonqualified deferred compensation payments under this Agreement that may be excluded from Section 409A either as “separation pay” due to an involuntary separation from service or as a “short-term deferral” shall be excluded from Section 409A to the maximum extent possible. For purposes of Section 409A, each installment payment provided under this Agreement shall be treated as a separate payment and any right to a series of installment payments under this Agreement shall be treated as a right to a series of separate payments. Any payments to be made under this Agreement upon a termination of employment shall only be made upon a “separation from service” under Section 409A. Notwithstanding any provision of this Agreement to the contrary, in no event shall the timing of Executive’s execution of a release, directly or indirectly, result in Executive designating the calendar year of payment of any deferred compensation subject to Section 409A, and if a payment subject to Section 409A is subject to execution of a release and could be made in more than one taxable year, payment of such an amount shall be made in the later taxable year. Notwithstanding the foregoing, the Company makes no representations that the payments and benefits provided under this Agreement comply with Section 409A, and in no event shall the Company be liable for all or any portion of any taxes, penalties, interest, or other expenses that may be incurred by the Executive on account of non-compliance with Section 409A.

15.2Specified Employees. Notwithstanding any other provision of this Agreement, if any payment or benefit provided to the Executive in connection with the Executive's termination of employment is determined to constitute “nonqualified deferred compensation” within the meaning of Section 409A and the Executive is determined to be a “specified employee” as defined in Section 409A(a)(2)(b)(i), then such payment or benefit shall not be paid until the first payroll date to occur following the six-month anniversary of the date of the Executive's termination or, if earlier, on the Executive's death (the “Specified Employee Payment Date”). The aggregate of any payments that would otherwise have been paid before the Specified Employee Payment Date shall be paid to the Executive in a lump sum on the Specified Employee Payment Date and thereafter, any remaining payments shall be paid without delay in accordance with their original schedule.

15.3Reimbursements. To the extent required by Section 409A, each reimbursement or in-kind benefit provided under this Agreement shall be provided in accordance with the following, subject to proof thereof:

(a)the amount of expenses eligible for reimbursement, or in-kind benefits provided, during each calendar year cannot affect the expenses eligible for reimbursement, or in-kind benefits to be provided, in any other calendar year;

(b)any reimbursement of an eligible expense shall be paid to the Executive on or before the last day of the calendar year following the calendar year in which the expense was incurred; and

(c)any right to reimbursements or in-kind benefits under this Agreement shall not be subject to liquidation or exchange for another benefit.

16.Cooperation. The parties agree that certain matters in which the Executive will be involved during the Employment Term may necessitate the Executive's cooperation in the future. Accordingly, following the termination of the Executive's employment for any reason, to the extent reasonably requested by the Board, the Executive shall cooperate with the Company in connection with matters arising out of the Executive's service to the Company; provided that, the Company shall make reasonable efforts to minimize disruption of the Executive's other activities. The Company shall reimburse the Executive for reasonable expenses incurred in connection with such cooperation and, to the extent that the Executive is required to spend substantial time on such matters, the Company shall compensate the Executive at an hourly rate based on the Executive's Base Salary on the Termination Date.

17.Successors and Assigns. This Agreement is personal to the Executive and shall not be assigned by the Executive. Any purported assignment by the Executive shall be null and void from the initial date of the purported assignment. The Company may assign this Agreement to any successor or assign (whether direct or indirect, by purchase, merger, consolidation, or otherwise) to all or substantially all of the business or assets of the Company. This Agreement shall inure to the benefit of the Company and permitted successors and assigns.

18.Notice. Notices and all other communications provided for in this Agreement shall be given in writing by personal delivery, electronic delivery, or by registered mail to the parties at the addresses set forth below (or such other addresses as specified by the parties by like notice):

If to the Company:

Natural Gas Services Group, Inc.

404 Veterans Airpark Lane, Suite 300

Midland, TX 79705

Attention: Chief Executive Officer

Email: steve.taylor@ngsgi.com

with a copy (which will not constitute notice hereunder) to:

Jones & Keller, P.C.

1675 Broadway, 26th Floor

Denver, CO 80202

Attention: David Thayer, Esq.

If to the Executive:

Brian L. Tucker

134 E. Agarita Avenue

San Antonio, TX 78212

19.Representations of the Executive. The Executive represents and warrants to the Company that:

The Executive's acceptance of employment with the Company and the performance of the Executive's duties hereunder will not conflict with or result in a violation of, a breach of, or a default under any contract, agreement, or understanding to which the Executive is a party or is otherwise bound.

The Executive's acceptance of employment with the Company and the performance of the Executive's duties hereunder will not violate any non-solicitation, non-competition, or other similar covenant or agreement of a prior employer or third-party.

20.Withholding. The Company shall have the right to withhold from any amount payable hereunder any Federal, state, and local taxes in order for the Company to satisfy any withholding tax obligation it may have under any applicable law or regulation.

21.Survival. Upon the expiration or other termination of this Agreement, the respective rights and obligations of the parties hereto shall survive such expiration or other termination to the extent necessary to carry out the intentions of the parties under this Agreement.

22.Acknowledgement of Full Understanding. THE EXECUTIVE ACKNOWLEDGES AND AGREES THAT THE EXECUTIVE HAS FULLY READ, UNDERSTANDS AND VOLUNTARILY ENTERS INTO THIS AGREEMENT. THE EXECUTIVE ACKNOWLEDGES AND AGREES THAT THE EXECUTIVE HAS HAD AN OPPORTUNITY TO ASK QUESTIONS AND CONSULT WITH AN ATTORNEY OF THE EXECUTIVE'S CHOICE BEFORE SIGNING THIS AGREEMENT.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, the parties hereto have executed this Employment Agreement as of the date first above written.

NATURAL GAS SERVICES GROUP, INC.

By: /s/ Stephen C. Tyalor

Name: Stephen C. Taylor

Title: Interim Chief Executive Officer

EXECUTIVE

/s/ Brian L. Tucker

Brian L. Tucker

Exhibit 10.2

ADDENDUM TO

ENGAGEMENT LETTER among

ACCORDION PARTNERS LLC and NATURAL GAS SERVICES GROUP, INC.

dated as of July 18, 2023

(the “Addendum”)

Natural Gas Services Group, Inc. (the “Company”) retained Accordion Partners, LLC as a financial services consultant effective July 18, 2023 (such retention, the “Engagement”) pursuant to an agreement, dated as of July 18, 2023 (the “Engagement Agreement”) to provide services (the “Advisory Services”). The Company and Accordion further agree to amend the Agreement as follows.

The Agreement provides that any additional services (“Additional Advisory Services”) be agreed upon in writing by both the Company and Accordion. In that regard, the Agreement is hereby amended as follows and will become effective October 9, 2023 (the “Effective Date”).

Introductory Paragraph

The opening paragraph of the Engagement Agreement is hereby amended and restated in its entirety as follows:

•On behalf of Accordion Partners LLC (“Accordion”), we are pleased to submit the following for the continued retention of Accordion to provide financial consulting services to Natural Gas Services Group, Inc. (the “Company”). Subject to the conditions noted herein, Accordion will provide John Bittner as the interim Chief Financial Officer, reporting to the Interim Chief Executive Officer of the Company. We view this opportunity to work with the Company as the continued steps in a partnership, and are focused on delivering high-impact results in a cost and time-efficient manner. This letter, together with Exhibit A attached hereto and incorporated herein by reference, constitutes the entire agreement (the “Agreement”and such retention, the “Engagement”) of the parties hereto and will become effective when agreed and acknowledged by the Company (the “Effective Date”).

Project Scope

This section of the Engagement Agreement is hereby amended and restated in its entirety as follows:

•John Bittner will serve as the Company’s interim Chief Financial Officer, reporting to the Interim Chief Executive Officer of the Company and, in his individual capacity, have the powers and authority that would normally be given to a Chief Financial Officer.

•Accordion shall provide the following Advisory Services as the interim Chief Financial Officer in addition to continuing to perform its existing services, key work streams and deliverables for the Company pursuant to this Agreement (collectively, the “Advisory Services”):

oProvide executive leadership to the finance function of the Company;

oReview and analyze the Company and its financial results, projections, and operational data;

oAssist with the preparation and review of quarterly and annual financial statements pursuant to GAAP and rules and regulations promulgated by the Securities and Exchange Commission;

oAssist with the preparation and filing of financial statements, documents, reports and registration statements (if any) with the Securities and Exchange Commission, including but not limited to, Current Reports on Form 8-K, Quarterly Reports on form 10-Q and the Annual Report on Form 10-K pursuant to the Securities Exchange Act of 1934 (the “Exchange Act”) and related rules and regulations and registration statements under the Securities Act of 1933 (collectively, the “ SEC Documents”);

oTo the extent necessary pursuant to federal or state securities laws, the New York Stock Exchange or agreements or contracts relating to the Company, sign in his capacity as the Chief Financial Officer or Principal Financial Officer the SEC Documents or other documents or agreements referred to herein;

oAssist, if and as requested, with financial disclosure in the Company’s proxy statements pursuant to the Securities Exchange Act of 1934 (the “Exchange Act”) and related rules and regulations;

oExecute the certifications required under Sections 302 and 906 of the Sarbanes-Oxley Act of 2002 and perform the underlying evaluations and work necessary to execute such certifications;

oGain an understanding of the existing contractual arrangements and obligations with customers, advisors/consultants, and suppliers;

oAssist the Company in the preparation of cash flow projections and updating those projections as required;

oAssist the Company in the preparation of short-, medium- and long-term projections and updating those projections as required;

oAssess and advise the Company with regards to the adequacy of the Company’s capital and the nature and extent of its debt obligations and sources of bank and debt financing;

oAssist the Company to manage key constituents, including communications and meetings with, and requests for information made by, creditor constituents, including secured lenders, vendors, customers, and employees; and

oProvide such advisory services consistent with his role as interim Chief Financial Officer of a public company as requested and agreed upon by Consultant and the Chief Executive Officer.

Engagement Assumptions

The following additions regarding the primary contact for the interim Chief Financial Officer role shall be added to the Engagement Agreement:

•The Company will designate Stephen C. Taylor, or persons designated thereby in writing, as the Primary Contact for supervision of the interim Chief Financial Officer and central point of contact for all updates (the “Primary Contact”) related to the Advisory Services provided in this capacity.

Ownership and Use

This section of the Engagement Agreement is hereby amended and restated in its entirety as follows:

The Company will own all tangible written materials, working papers, accounting records, financial statements and other work product customarily produced in connection with the Chief Financial Officer services and the position of a chief financial officer of a public company and prepared for and delivered to the Company under this Addendum. Prior to completion of this Engagement, Consultant will transition Company materials and documented processes prepared in connection with the Advisory Services relating to John Bittner’s service as Interim Chief Financial Officer during the course of this engagement to the Chief Executive Officer. Such materials and documented processes will remain the intellectual property of the Company. John Bittner is providing these Interim Chief Financial Officer services solely for the Company’s benefit and, pursuant to a client relationship with the Company. Accordion disclaims any contractual or other responsibility or duty of care to others or upon any deliverables or advice that Consultant provides. Notwithstanding the above, Accordion will own its existing working papers, pre-existing materials and any general skills and know-how, processes, or other intellectual property (including a non-client specific version of any deliverables), which we may have discovered or created as a result of the Advisory Services. Company has a non-exclusive, non-transferable license to use such materials included in our deliverables for its own use as part of such deliverables. In addition to the deliverables, we may develop software or electronic materials (including models, spreadsheets, databases, documents, and other tools) to assist us with the engagement. These will be available to you, and they are provided on an as-is basis and Company’s use is at its own risk.

Professionals and Fee Structure

This section of the Engagement Agreement shall be amended to reflect the following related to the interim Chief Financial Officer:

Accordion will continue be paid for Advisory Services at the fee rates and terms set forth under the Professionals and Fee Structure section in the existing Engagement Agreement provided that Accordion’s average monthly fees will not exceed $150,000 of which $35,000 will be allocated to Interim Chief Financial Officer services. The Company and Accordion agree to re-evaluate the Compensation at the end of the three (3) month timeframe for any adjustments or modifications. Any modifications to the compensation will require agreement in writing by both parties. To the extent the Interim Chief Financial Officer services are terminated pursuant to Section 4 of the Engagement Agreement, this Professionals and Fee Structure Section shall lapse and expire, and compensation for any Advisory Services shall be governed by the “Term” paragraph set forth in Section 4 of the Engagement Agreement.

Exhibit A, Section 2: Service Provider

This section of the Engagement Agreement shall be replaced to reflect the addition related to the interim Chief Financial Officer:

•For all purposes, Accordion will operate as a service provider to the Company. To this end, the parties acknowledge Accordion are not employees, agents, co-venturer, partners, or representatives of the Company. Accordion has been retained under this Agreement as independent contractors. Nothing is the Agreement shall be interpreted or construed as creating or establishing an employer-employee relationship between the Company and Accordion. Except as described in this Addendum, John Bittner and Accordion shall use its own discretion in determining the means, methods, and hours of work by which John Bittner provides the interim Chief Financial Officer Advisory Services. In

addition, Accordion shall be responsible for providing, at Accordion’s own expense, all disability, unemployment, and other insurance, worker’s compensation, training, permits, and licenses required for John Bittner, Accordion and Accordion’s other employees. John Bittner and Consultant will not participate in any Company sponsored insurance, health, pension, stock, or any other benefit program and will be responsible for all taxes payable with respect to the fees payable hereunder, and Company shall not be responsible for withholding any such taxes from the fees paid to John Bittner or Accordion.

In his capacity as interim Chief Financial Officer pursuant to this Agreement, John Bittner shall have the fiduciary, regulatory and reporting duties consistent with the role of Chief Financial Officer of a public company and shall be an agent of the Company with the authority expressly delegated by the Company’s Board of Directors and Chief Executive Officer or as otherwise provided by law. Therefore, to the extent that the terms of the Engagement Agreement are inconsistent with the legal requirements of a public company under the federal and state securities laws and rules and regulations of the Securities and Exchange Commission and the NYSE, along with applicable state corporate law and the Company’s Bylaws and policies applicable to the Company’s executive officers, such terms shall be considered inapplicable or modified with respect to the Advisory Services provided by Bittner pursuant to this Addendum Agreement. This Agreement will inure to the sole and exclusive benefit of Accordion, John Bittner, the Company, and their respective successors.

Exhibit A, Section 3: Prohibition Against Insider Trading

This section of the Engagement Agreement shall be replaced to reflect the following related to the interim Chief Financial Officer:

Accordion and John Bittner hereby acknowledge that the Company is a public company registered under Section 12(b) of the Exchange Act, is traded on the New York Stock Exchange (“NYSE”) and that John Bittner will be deemed to be an executive officer of the Company. Considering the foregoing, Accordion and John Bittner agree to abide by federal and state securities laws and rules and regulations of the Securities and Exchange Commission and the NYSE, along with Company policies applicable to the Company’s executive officers. Accordion and Bittner further acknowledge that it and he are aware, and further agree that they will advise those of its directors, officers, and employees who may have access to confidential and sensitive information in the possession of the Company, that United States securities laws prohibit any person who has material, non-public information about a company from purchasing or selling securities of such a company or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities.

John Bittner and Accordion, both individually, represent to the Company that they have not been convicted of any felony or misdemeanor in connection with the purchase or sale of any security, involved in the making of any false filing with the Securities and Exchange Commission, or the conduct of the business of an underwriter, broker, dealer or paid solicitor of purchasers of securities, and is not subject to any order in connection with the foregoing, or subject to any order the restricts him/it from being engaged in the banking, insurance, savings business, suspends or revokes registration as a broker-dealer or being associated with a person or entity involved in securities offerings, or is subject to an order based on anti-fraud provisions of the United States securities laws or similar Blue Sky laws of the States, or is subject to

any suspension or expulsion from a securities exchange or securities association or a Unites States postal service false representation order.

Exhibit A, Section 12 (a): Indemnification

This section of the Engagement Agreement shall be amended to reflect the following additional language related to the interim Chief Financial Officer:

•Neither Accordion nor any Indemnified Person will have any liability to the Company, its owners, parents, creditors, or security holders or any other person for or in connection with its engagement, except such liability for third-party Losses incurred by the Company which are judicially determined to have resulted primarily and directly from such party’s bad faith, willful misconduct, gross negligence, or results from John Bittner’s breach of their fiduciary duty. In addition, the Company hereby represents to Accordion and John Bittner that, upon the appointment of John Bittner as interim Chief Financial Officer of the Company, all indemnification and/or exculpation provisions under the Company’s or any of its direct or indirect subsidiaries’ articles of incorporation, by-laws, operating agreement and/or other constitutional documents shall apply to protect and indemnify John Bittner as interim Chief Financial Officer of the Company, to the same extent they would customarily apply to protect and indemnify the chief executive officer, chief operating officer, and other executives of the Company and its direct and indirect subsidiaries. The Company hereby agrees that it shall ensure that all such provisions will continue at all times to apply to protect and indemnify John Bittner as interim Chief Financial Officer of the Company, to the same extent they would customarily apply to protect and indemnify the chief executive officer, chief operating officer, and other executives of the Company and its direct and indirect subsidiaries, with respect to all facts, events, circumstances and matters existing or occurring at any time during the Engagement. John Bittner will be a third-party beneficiary of and have the right to rely on and enforce the terms and conditions of this paragraph. Additionally, the Company agrees that John Bittner will be covered under the Company’s director and officer liability (“D&O Insurance”) policy which shall be primary to any insurance policy that Accordion may have pertaining to director and officer liability. Prior to Accordion accepting any officer position, the Company shall provide Accordion a copy of its current D&O Insurance policy, a certificate(s) of insurance evidencing the policy is in full force and effect, and a copy of the signed board resolutions and any other documents as Accordion may reasonably request evidencing the appointment and coverage of the indemnitees. The Company will maintain such D&O Insurance coverage for the period through which claims can be made against such persons.

All other terms and provisions of the Engagement Agreement shall remain in full force and effect.

IN WITNESS WHEREOF, the parties hereto have caused this Addendum to be fully executed.

| | | | | | | | | | | |

| Natural Gas Services Group, Inc. | | Accordion Partners, LLC | |

| | | |

| /s/ Stephen C. Taylor | | /s/ John Bittner | |

| Stephen C. Taylor | | John Bittner | |

| Interim President and Chief Executive Officer | | Senior Managing Director | |

| (Principal Executive Officer) | | (Principal Accounting Officer) | |

| | | |

| October 9, 2023 | | October 9, 2023 | |

Natural Gas Services Group, Inc. Announces Appointment of

Brian L. Tucker as President and Chief Operating Officer

Also Appoints New Interim CFO to Support Company Growth

Midland, Texas, October 10, 2023 (GLOBE NEWSWIRE) – Natural Gas Services Group, Inc. (NYSE:NGS) (the “Company” or “NGS”), a leading provider of gas compression equipment, technology and services to the energy industry, announced today that it has appointed industry veteran Brian L. Tucker to the position of President and Chief Operating Officer of the Company.

Current Interim President and Chief Executive Officer Stephen C. Taylor resigned as President to allow Mr. Tucker to assume the position. Mr. Taylor remains Chairman of Board and Interim Chief Executive Officer.

Mr. Tucker, most recently Senior Vice President, Operations at Patterson-UTI Energy Inc., brings nearly 20 years of oil field services experience to NGS. Prior to his position at Patterson-UTI, he was Executive Vice President and Chief Operating Officer of Pioneer Energy Services, Inc., which was acquired by Patterson-UTI in October 2021.

“We are happy to welcome Brian to NGS as an integral part of the team”, Mr. Taylor said. “His background and contributions will be valuable as we continue to build on the momentum of the Company.”

“I am excited to join NGS and anxious to contribute to the growth of the Company”, noted Mr. Tucker. “We have a lot of opportunities ahead of us and I look forward to being a part of that.”

The Company also announced that John Bittner, Senior Managing Director of Accordion Partners, LLC, will succeed J.D. Faircloth as Interim Chief Financial Officer. Accordion is a financial consulting firm that provides “Office of the CFO” services, as well as other financial analysis and technology capabilities. Mr. Bittner has over 25 years of experience in a variety of senior level finance positions in several industries, including oil field services. He holds a BBA in Finance and Accounting from Texas A&M University and an MBA from the University of Michigan.

Mr. Taylor noted, “I want to thank J.D. for his service to the Company over the past few months and we all wish him well as he resumes his retirement. We are fortunate to have a man of John’s caliber available to help support our accounting and finance team during this period of extremely high activity and growth. His leadership ability, financial acumen and significant experience working with financing providers will contribute to the Company’s success.”

“NGS is growing significantly and has a very exciting future ahead of it”, Taylor emphasized. “The addition of Brian and John to the team will enhance our ability to continue our present growth and strengthen our position in the market. We are glad to have them with us.”

About Natural Gas Services Group, Inc. (NGS)

NGS is a leading provider of gas compression equipment, technology and services to the energy industry. The Company manufactures, fabricates, rents, sells and maintains natural gas compressors for oil and natural gas production and plant facilities. NGS is headquartered in Midland, Texas, with fabrication facilities located in Tulsa, Oklahoma and Midland, Texas, and

service facilities located in major oil and natural gas producing basins in the U.S. Additional information can be found at www.ngsgi.com.

Cautionary Statements

This news release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that do not relate strictly to historical or current facts, including those relating to expectations regarding the Company's COO hiring and CFO transition, are forward-looking and are subject to known and unknown risks and uncertainties that may cause actual results to differ materially from those expressed in such forward-looking statements. Any forward-looking statement speaks only as of the date on which

such statement is made, and the Company does not intend to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.

For Additional Information

Anna Delgado-Investor Relations

(432) 262-2700

ir@ngsgi.com

www.ngsgi.com

v3.23.3

Cover Page

|

Nov. 14, 2022 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 09, 2023

|

| Entity Registrant Name |

NATURAL GAS SERVICES GROUP, INC.

|

| Entity Incorporation, State or Country Code |

CO

|

| Entity File Number |

1-31398

|

| Entity Tax Identification Number |

75-2811855

|

| Entity Address, Address Line One |

404 Veterans Airpark Lane, Suite 300

|

| Entity Address, City or Town |

Midland

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

79705

|

| City Area Code |

432

|

| Local Phone Number |

262-2700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, Par Value $0.01

|

| Trading Symbol |

NGS

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001084991

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

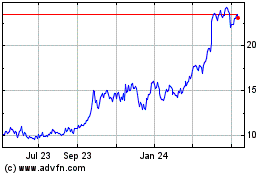

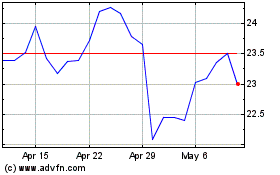

Natural Gas Services (NYSE:NGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Natural Gas Services (NYSE:NGS)

Historical Stock Chart

From Apr 2023 to Apr 2024