MFS Investment Management® (MFS®) released today the

distribution income sources for five of its closed-end funds for

September 2024: MFS® Charter Income Trust (NYSE: MCR), MFS®

Government Markets Income Trust (NYSE: MGF), MFS® Intermediate

High-Income Fund (NYSE: CIF), MFS® Intermediate Income Trust (NYSE:

MIN) and MFS® Multimarket Income Trust (NYSE: MMT). This

information also can be obtained by visiting MFS.com by clicking on

Products & Strategies > Closed End Funds > Dividend

Source Information.

MFS Charter Income Trust

Distribution period: September 2024 Distribution amount per share:

$ 0.04601

The following table sets forth the

estimated amounts of the current distribution and the cumulative

distributions paid this fiscal year to date from the following

sources: net investment income, net realized short-term capital

gains, net realized long-term capital gains and return of capital

or other capital source. The fund’s fiscal year begins each

December 1st. All amounts are expressed per common share.

Current

distribution

% Breakdown of

current distribution

Total cumulative

distributions for the

fiscal year to date

% Breakdown of

the total

cumulative

distributions for

the fiscal year to

date

Net Investment Income

$ 0.00000

0%

$ 0.28620

63%

Net Realized ST Cap Gains

0.00000

0%

0.00000

0%

Net Realized LT Cap Gains

0.00000

0%

0.00000

0%

Return of Capital or Other Capital

Source

0.04601

100%

0.16809

37%

Total (per common share)

$ 0.04601

100%

$ 0.45429

100%

Average annual total return (in relation

to NAV) for the five years ended 8-31-2024

3.06%

Annualized current distribution rate

expressed as a percentage of month end NAV as of 8-31-2024

7.97%

Cumulative total return (in relation to

NAV) for the fiscal year through 8-31-2024

10.26%

Cumulative fiscal year distributions as a

percentage of NAV as of 8-31-2024

6.56%

MFS Government Markets Income

Trust Distribution period: September 2024 Distribution

amount per share: $ 0.02021

The following table sets forth the

estimated amounts of the current distribution and the cumulative

distributions paid this fiscal year to date from the following

sources: net investment income, net realized short-term capital

gains, net realized long-term capital gains and return of capital

or other capital source. The fund’s fiscal year begins each

December 1st. All amounts are expressed per common share.

Current

distribution

% Breakdown of

current distribution

Total cumulative

distributions for the

fiscal year to date

% Breakdown of

the total

cumulative

distributions for

the fiscal year to

date

Net Investment Income

$ 0.01112

55%

$ 0.09779

49%

Net Realized ST Cap Gains

0.00000

0%

0.00000

0%

Net Realized LT Cap Gains

0.00000

0%

0.00000

0%

Return of Capital or Other Capital

Source

0.00909

45%

0.10179

51%

Total (per common share)

$ 0.02021

100%

$ 0.19958

100%

Average annual total return (in relation

to NAV) for the five years ended 8-31-2024

0.05%

Annualized current distribution rate

expressed as a percentage of month end NAV as of 8-31-2024

7.26%

Cumulative total return (in relation to

NAV) for the fiscal year through 8-31-2024

7.13%

Cumulative fiscal year distributions as a

percentage of NAV as of 8-31-2024

5.98%

MFS Intermediate High-Income

Fund Distribution period: September 2024 Distribution

amount per share: $ 0.01480

The following table sets forth the

estimated amounts of the current distribution and the cumulative

distributions paid this fiscal year to date from the following

sources: net investment income, net realized short-term capital

gains, net realized long-term capital gains and return of capital

or other capital source. The fund’s fiscal year begins each

December 1st. All amounts are expressed per common share.

Current

distribution

% Breakdown of

current distribution

Total cumulative

distributions for the

fiscal year to date

% Breakdown of

the total

cumulative

distributions for

the fiscal year to

date

Net Investment Income

$ 0.00710

48%

$ 0.08198

56%

Net Realized ST Cap Gains

0.00000

0%

0.00000

0%

Net Realized LT Cap Gains

0.00000

0%

0.00000

0%

Return of Capital or Other Capital

Source

0.00770

52%

0.06442

44%

Total (per common share)

$ 0.01480

100%

$ 0.14640

100%

Average annual total return (in relation

to NAV) for the five years ended 8-31-2024

3.44%

Annualized current distribution rate

expressed as a percentage of month end NAV as of 8-31-2024

9.40%

Cumulative total return (in relation to

NAV) for the fiscal year through 8-31-2024

12.06%

Cumulative fiscal year distributions as a

percentage of NAV as of 8-31-2024

7.75%

MFS Intermediate Income

Trust Distribution period: September 2024 Distribution

amount per share: $ 0.02029

The following table sets forth the

estimated amounts of the current distribution and the cumulative

distributions paid this fiscal year to date from the following

sources: net investment income, net realized short-term capital

gains, net realized long-term capital gains and return of capital

or other capital source. The fund’s fiscal year begins each

November 1st. All amounts are expressed per common share.

Current

distribution

% Breakdown of

current distribution

Total cumulative

distributions for

the fiscal year to date

% Breakdown of

the total

cumulative

distributions for

the fiscal year to

date

Net Investment Income

$ 0.00812

40%

$ 0.08447

38%

Net Realized ST Cap Gains

0.00000

0%

0.00000

0%

Net Realized LT Cap Gains

0.00000

0%

0.00000

0%

Return of Capital or Other Capital

Source

0.01217

60%

0.13781

62%

Total (per common share)

$ 0.02029

100%

$ 0.22228

100%

Average annual total return (in relation

to NAV) for the five years ended 8-31-2024

1.84%

Annualized current distribution rate

expressed as a percentage of month end NAV as of 8-31-2024

8.51%

Cumulative total return (in relation to

NAV) for the fiscal year through 8-31-2024

9.67%

Cumulative fiscal year distributions as a

percentage of NAV as of 8-31-2024

7.77%

MFS Multimarket Income Trust

Distribution period: September 2024 Distribution amount per share:

$ 0.03411

The following table sets forth the

estimated amounts of the current distribution and the cumulative

distributions paid this fiscal year to date from the following

sources: net investment income, net realized short-term capital

gains, net realized long-term capital gains and return of capital

or other capital source. The fund’s fiscal year begins each

November 1st. All amounts are expressed per common share.

Current

distribution

% Breakdown of

current distribution

Total cumulative

distributions for

the fiscal year to date

% Breakdown of

the total

cumulative

distributions for

the fiscal year to

date

Net Investment Income

$ 0.00000

0%

$ 0.17223

47%

Net Realized ST Cap Gains

0.00000

0%

0.00000

0%

Net Realized LT Cap Gains

0.00000

0%

0.00000

0%

Return of Capital or Other Capital

Source

0.03411

100%

0.19421

53%

Total (per common share)

$ 0.03411

100%

$ 0.36644

100%

Average annual total return (in relation

to NAV) for the five years ended 8-31-2024

4.13%

Annualized current distribution rate

expressed as a percentage of month end NAV as of 8-31-2024

7.96%

Cumulative total return (in relation to

NAV) for the fiscal year through 8-31-2024

18.44%

Cumulative fiscal year distributions as a

percentage of NAV as of 8-31-2024

7.13%

The above funds have adopted a managed distribution plan. Under

a managed distribution plan, to the extent that sufficient

investment income is not available monthly, the fund will

distribute long-term capital gains and/or return of capital to

maintain its managed distribution level. Investors should not draw

any conclusions about the fund’s investment performance from the

amount of the fund’s distributions or from the terms of the fund’s

managed distribution plan.

The Board of the fund may amend the terms of the plan or

terminate the plan at any time without prior notice to the fund's

shareholders. The amendment or termination of a plan could have an

adverse effect on the market price of the fund’s common shares. The

plan will be subject to periodic review by the Board. With each

distribution that does not consist solely of net investment income,

the fund will issue a notice to shareholders and an accompanying

press release which will provide detailed information regarding the

amount and estimated composition of the distribution and other

related information.

The amounts and sources of distributions reported above are only

estimates and are not being provided for tax reporting purposes.

The actual amounts and sources of the amounts for tax reporting

purposes will depend upon the fund’s investment experience during

its full fiscal year and may be subject to changes based on tax

regulations. The fund will send shareholders a Form 1099-DIV for

the calendar year that will tell them how to report these

distributions for federal income tax purposes. The fund may at

times distribute more than its net investment income and net

realized capital gains; therefore, a portion of the distribution

may result in a return of capital. A return of capital may occur,

for example, when some or all the money that shareholders invested

in the fund is paid back to them. A return of capital does not

necessarily reflect a fund’s investment performance and should not

be confused with ‘yield’ or ‘income’. Any such returns of capital

will decrease the fund's total assets and, therefore, could have

the effect of increasing the fund's expense ratio. In addition, to

make the level of distributions called for under its plan, the fund

may have to sell portfolio securities at a less than opportune

time.

About MFS Investment

Management In 1924, MFS launched the first US open-end

mutual fund, opening the door to the markets for millions of

everyday investors. Today, as a full-service global investment

manager serving financial advisors, intermediaries and

institutional clients, MFS still serves a single purpose: to create

long-term value for clients by allocating capital responsibly. That

takes our powerful investment approach combining collective

expertise, thoughtful risk management and long-term discipline.

Supported by our culture of shared values and collaboration, our

teams of diverse thinkers actively debate ideas and assess material

risks to uncover what we believe are the best investment

opportunities in the market. As of August 31, 2024, MFS manages

US$638.6 billion in assets on behalf of individual and

institutional investors worldwide. Please visit mfs.com for

more information.

The Funds are closed-end Funds. Common shares of the Funds

are only available for purchase/sale on the NYSE at the current

market price. Shares may trade at a discount to NAV.

MFS Investment Management 111

Huntington Ave., Boston, MA 02199

15668.174

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240923642414/en/

Computershare Shareholders Services: Shareholders

(account information, quotes): 800-637-2304

MFS Investment Management: Shareholders or Advisors

(investment product information): Jeffrey Schwarz, 800-343-2829,

ext. 55872

Media Only: Dan Flaherty, 617-954-4256

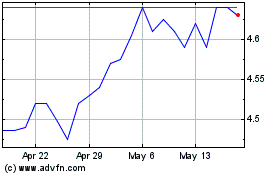

MFS Multimarket Income (NYSE:MMT)

Historical Stock Chart

From Nov 2024 to Dec 2024

MFS Multimarket Income (NYSE:MMT)

Historical Stock Chart

From Dec 2023 to Dec 2024