Einhorn: Apple Is Great Company With Great Balance Sheet

May 16 2012 - 5:43PM

Dow Jones News

Greenlight Capital's David Einhorn vouched for Apple Inc. (APPL)

in his speech at the Ira Sohn conference in New York on Wednesday,

saying the company is a "great company with great balance

sheet."

He said some investors' concern that Apple can't maintain its

hyper growth was based on the "misunderstanding" that Apple, like

other hardware manufacturers, may suffer from a one-hit wonder. But

the hedge-fund manager said Apple is a software company that can

get consumers hooked onto its products through its various hardware

products.

The value investor said Apple's current value "isn't demanding,"

as "most cellphones aren't smartphones and tablets are still young

and immature."

On Apple's huge cash holdings, Einhorn said Apple doesn't need

to give out dividends. Rather, he said the company should issued

preferred shares, as it doesn't demand an immediate use of cash and

poses no maturity or refinancing risk.

In his over-100-page slide presentation, Einhorn commented on an

eclectic range of stocks and topics, including his dislike of

Martin Marietta Materials Inc. (MLM), saying the company "has a lot

of problems"; and China, cautioning the nation's credit tightening

may stifle economic growth. He also criticized United States Steel

Corp. (X) for generating a loss despite its iron ore cost being

just over a third of what its competitors had paid.

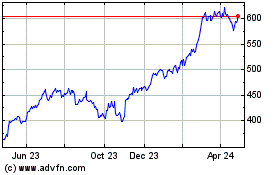

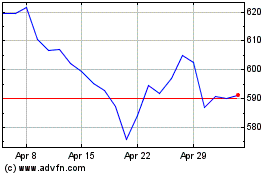

Martin Marietta Materials (NYSE:MLM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Martin Marietta Materials (NYSE:MLM)

Historical Stock Chart

From Jul 2023 to Jul 2024