As filed with the Securities and Exchange Commission on December 6, 2022

Registration No. 333-

| | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Lemonade, Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

Delaware

(State or other jurisdiction of

incorporation or organization) | 32-0469673

(I.R.S. Employer

Identification No.) |

5 Crosby Street, 3rd Floor

New York, NY 10013

(844) 733-8666

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Daniel Schreiber

Chief Executive Officer

5 Crosby Street, 3rd Floor

New York, NY 10013

(844) 733-8666

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | |

Marc D. Jaffe, Esq.

Robert M. Katz, Esq.

Rachel W. Sheridan, Esq.

Latham & Watkins LLP

1271 Avenue of the Americas

New York, NY 10020

(212) 906-1200 |

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| | | | | |

Large accelerated filer ☒ | Accelerated filer ☐ |

Non-accelerated filer ☐ | Smaller reporting company ☐ |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

This registration statement on Form S-3ASR is being filed to correct a clerical error made in a previously filed registration statement on Form S-3 (file number 333-268615) related to the form type used for such filing. The contents of this registration statement on Form S-3ASR are identical to those of the previously filed registration statement on Form S-3, except for certain changes required to be made to update the date of the filing.

PROSPECTUS

Lemonade, Inc.

7,846,646 Warrants to Purchase Shares of Common Stock

Up to 412,969 Shares of Common Stock Issuable Upon Exercise of Warrants to be Sold by Selling Shareholders

This prospectus relates to the offer and sale from time to time by certain selling stockholders identified in an accompanying prospectus supplement (the “Selling Stockholders”) of warrants originally issued by INSU Acquisition Corp. II (subsequently assumed by Metromile, Inc. in connection with its business combination with INSU Acquisition Corp. II) and assumed by us in connection with our acquisition of Metromile, Inc. and converted automatically into warrants denominated in shares of our common stock on the same terms and conditions (including vesting terms) as applied to such warrant immediately prior to the consummation of the acquisition (with the number of common stock subject to such warrants and exercise price being adjusted based on the exchange ratio).

In connection with this prospectus, (i) the Selling Stockholders may offer and sell from time to time 7,846,646 warrants to purchase shares of our common stock, $0.00001 par value per share (“common stock”), and (ii) we may issue, and the Selling Stockholders may subsequently offer and sell, from time to time, up to 412,969 shares of common stock that are issuable upon the exercise of the warrants.

Our registration of the securities covered by this prospectus does not mean that the Selling Stockholders will offer or sell any of the warrants or shares covered by this prospectus. The Selling Stockholders may sell the warrants and/or shares of common stock covered by this prospectus in a number of different ways and at varying prices. We provide more information about how the Selling Stockholders may sell the shares in the section entitled “Plan of Distribution.”

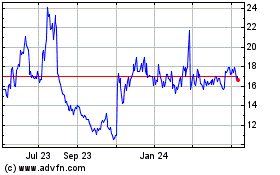

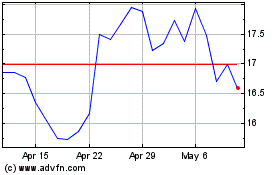

Our common stock is listed on the New York Stock Exchange (the “NYSE”), under the symbol “LMND.” On December 5, 2022, the closing price of our common stock was $18.22. We have applied to list the Public Warrants (defined below) on the NYSE under the symbol “LMNDW.”

Investing in our securities involves a high degree of risk. Please carefully read the information under the heading “Risk Factors” beginning on page 3 of this prospectus before you invest in our securities. This information may also be included in any supplement, any related free writing prospectus and/or any other future filings we make with the Securities and Exchange Commission that are incorporated by reference into this prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Selling Stockholders may offer and sell these securities to or through one or more underwriters, dealers and agents, or directly to purchasers, on a continuous or delayed basis. We will provide specific information about any Selling Stockholders in one or more supplements to this prospectus. If any underwriters, dealers or agents are involved in the sale of any of the securities, their names, and any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement. See the sections entitled “Plan of Distribution” and “About This Prospectus” for more information. The price to the public of those securities and the net proceeds any Selling Stockholders expect to receive from that sale will also be set forth in a prospectus supplement.

The date of this prospectus is December 6, 2022.

TABLE OF CONTENTS

| | | | | |

| |

| |

| |

| |

| |

| Unaudited Pro Forma Condensed Combined Financial Information | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Selected Historical Consolidated Financial Data of Metromile | |

You should rely only on the information provided in this prospectus, as well as the information incorporated by reference into this prospectus and any applicable prospectus supplement. Neither we nor the Selling Stockholders have authorized anyone to provide you with different information. Neither we nor the Selling Stockholders are making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus or any applicable prospectus supplement is accurate as of any date other than the date of the applicable document. Since the date of this prospectus and the documents incorporated by reference into this prospectus, our business, financial condition, results of operations and prospects may have changed.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”) using the “shelf” registration process. Under this shelf registration process, the Selling Stockholders may, from time to time, sell the securities offered by them described in this prospectus. We will not receive any proceeds from the sale by such Selling Stockholders of the securities offered by them described in this prospectus. This prospectus also relates to the issuance by us of the shares of common stock issuable upon the exercise of any warrants. We may receive in cash the proceeds from any exercise of warrants and issuance of such shares underlying the warrants pursuant to this prospectus.

Neither we nor the Selling Stockholders have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus or any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. Neither we nor the Selling Stockholders take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we nor the Selling Stockholders will make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

We may also provide a prospectus supplement or, if appropriate, a post-effective amendment, to the registration statement to add information to, or update or change information contained in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement together with the additional information to which we refer you in the sections of this prospectus entitled “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference.”

Unless the context indicates otherwise, references in this prospectus to the “Company,” “Lemonade,” “we,” “us,” “our” and similar terms refer to Lemonade, Inc. and its consolidated subsidiaries, including Lemonade Insurance Company and Lemonade Insurance Agency, LLC. References in this prospectus to “Metromile” refer to Metromile, Inc. and its wholly owned subsidiaries. Prior to February 9, 2021, Metromile was known as INSU Acquisition Corp. II. On February 9, 2021, INSU Acquisition Corp. II completed the acquisition of 100% of the outstanding shares of Metromile.

FORWARD-LOOKING STATEMENTS

This prospectus and any accompanying prospectus supplement contain forward-looking statements. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. All statements other than statements of historical fact contained in this prospectus and any accompanying prospectus supplement, including without limitation statements regarding our future results of operations and financial position, our ability to attract, retain and expand our customer base, our ability to operate under and maintain our business model, our ability to maintain and enhance our brand and reputation, our ability to effectively manage the growth of our business, the effects of seasonal trends on our results of operations, our ability to attain greater value from each customer, our ability to compete effectively in our industry, the future performance of the markets in which we operate, and our ability to maintain reinsurance contracts, and the plans and objectives of management for future operations and capital expenditures are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential”, or “continue” or the negative of these terms or other similar expressions. The forward-looking statements in this prospectus and any accompanying prospectus supplement are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements are subject to a number of important factors that could cause actual results to differ materially from those in the forward-looking statements, including:

•We have a history of losses and we may not achieve or maintain profitability in the future.

•Our success and ability to grow our business depend on retaining and expanding our customer base. If we fail to add new customers or retain current customers, our business, revenue, operating results and financial condition could be harmed.

•The “Lemonade” brand may not become as widely known as incumbents' brands or the brand may become tarnished.

•Denial of claims or our failure to accurately and timely pay claims could materially and adversely affect our business, financial condition, results of operations, and prospects.

•Our future revenue growth and prospects depend on attaining greater value from each user.

•The novelty of our business model makes its efficacy unpredictable and susceptible to unintended consequences.

•We could be forced to modify or eliminate our Giveback, which could undermine our business model and have a material adverse effect on our results of operations and financial condition.

•Our limited operating history makes it difficult to evaluate our current business performance, implementation of our business model, and our future prospects.

•We may not be able to manage our growth effectively.

•Intense competition in the segments of the insurance industry in which we operate could negatively affect our ability to attain or increase profitability.

•Reinsurance may be unavailable at current levels and prices, which may limit our ability to write new business. Furthermore, reinsurance subjects us to counterparty risk and may not be adequate to protect us against losses, which could have a material effect on our results of operations and financial condition.

•Failure to maintain our risk-based capital at the required levels could adversely affect the ability of our insurance subsidiary to maintain regulatory authority to conduct our business.

•If we are unable to expand our product offerings, our prospects for future growth may be adversely affected.

•Our proprietary artificial intelligence algorithms may not operate properly or as we expect them to, which could cause us to write policies we should not write, price those policies inappropriately or overpay claims that are made by our customers. Moreover, our proprietary artificial intelligence algorithms may lead to unintentional bias and discrimination.

•Regulators may limit our ability to develop or implement our proprietary artificial intelligence algorithms and/or may eliminate or restrict the confidentiality of our proprietary technology, which could have a material adverse effect on our financial condition and results of operations.

•New legislation or legal requirements may affect how we communicate with our customers, which could have a material adverse effect on our business model, financial condition, and results of operations.

•We rely on artificial intelligence and our digital platform to collect data points that we evaluate in pricing and underwriting our insurance policies, managing claims and customer support, and improving business processes, and any legal or regulatory requirements that restrict our ability to collect this data could thus materially and adversely affect our business, financial condition, results of operations and prospects.

•We depend on search engines, social media platforms, digital app stores, content-based online advertising and other online sources to attract consumers to our website and our online app, which may be affected by third-party interference beyond our control and as we grow our customer acquisition costs will continue to rise.

•We may require additional capital to grow our business, which may not be available on terms acceptable to us or at all.

•Security incidents or real or perceived errors, failures or bugs in our systems, website or app could impair our operations, result in loss of personal customer information, damage our reputation and brand, and harm our business and operating results.

•We are periodically subject to examinations by our primary state insurance regulator, which could result in adverse examination findings and necessitate remedial actions. In addition, insurance regulators of other states in which we are licensed to operate may also conduct examinations or other targeted investigations, which may also result in adverse examination findings and necessitate remedial actions.

•We collect, process, store, share, disclose and use customer information and other data, and our actual or perceived failure to protect such information and data, respect customers' privacy or comply with data privacy and security laws and regulations could damage our reputation and brand and harm our business and operating results.

•We may be unable to prevent or address the misappropriation of our data.

•If we are unable to underwrite risks accurately and charge competitive yet profitable rates to our customers, our business, results of operations and financial condition will be adversely affected.

•Our product development cycles are complex and subject to regulatory approval, and we may incur significant expenses before we generate revenues, if any, from new products.

•Our expansion within the United States and any future international expansion strategy will subject us to additional costs and risks and our plans may not be successful.

•Combining the businesses of Lemonade and Metromile may be more difficult, costly or time-consuming than expected and the combined company may fail to realize the anticipated benefits of the mergers, which may adversely affect the combined company’s business results and negatively affect the value of the company’s common stock.

•The combined company may not be able to retain customers, which could have an adverse effect on the combined company’s business and operations. Third parties may terminate or alter existing contracts or relationships with Lemonade or Metromile.

•The combined company may be exposed to increased litigation, which could have an adverse effect on the combined company’s business and operations.

•The insurance business, including the market for renters and homeowners insurance, is historically cyclical in nature, and we may experience periods with excess underwriting capacity and unfavorable premium rates, which could adversely affect our business.

•We are subject to extensive insurance industry regulations.

•State insurance regulators impose additional reporting requirements regarding enterprise risk on insurance holding company systems, with which we must comply as an insurance holding company.

•Severe weather events and other catastrophes, including the effects of climate change and global pandemics, are inherently unpredictable and may have a material adverse effect on our financial results and financial condition.

•We expect our results of operations to fluctuate on a quarterly and annual basis. In addition, our operating results and operating metrics are subject to seasonality and volatility, which could result in fluctuations in our quarterly revenues and operating results or in perceptions of our business prospects.

•We rely on data from our customers and third parties for pricing and underwriting our insurance policies, handling claims and maximizing automation, the unavailability or inaccuracy of which could limit the functionality of our products and disrupt our business.

•Our results of operations and financial condition may be adversely affected due to limitations in the analytical models used to assess and predict our exposure to catastrophe losses.

•Our actual incurred losses may be greater than our loss and loss adjustment expense reserves, which could have a material adverse effect on our financial condition and results of operations.

•Our insurance subsidiary is subject to minimum capital and surplus requirements, and our failure to meet these requirements could subject us to regulatory action.

•We are subject to assessments and other surcharges from state guaranty funds, and mandatory state insurance facilities, which may reduce our profitability.

•As a public benefit corporation, our focus on a specific public benefit purpose and producing a positive effect for society may negatively impact our financial performance.

•Our directors have a fiduciary duty to consider not only our stockholders' interests, but also our specific public benefit and the interests of other stakeholders affected by our actions. If a conflict between such interests arises, there is no guarantee such a conflict would be resolved in favor of our stockholders.

•A joint investment committee consisting of our Co-Founders and a former executive of SoftBank will have sole voting and dispositive control over the shares owned by the entities affiliated with SoftBank Group Corp. This joint investment committee further concentrates voting power with our Co-Founders, which could limit your ability to influence the outcome of important transactions, including a change in control.

•We conduct certain of our operations in Israel and therefore our results may be adversely affected by political, economic and military instability in Israel and the region.

•The factors described under the section titled “Risk Factors” in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K filed with the Commission.

Given these risks and uncertainties, you should not place undue reliance on these forward-looking statements. Additional cautionary statements or discussions of risks and uncertainties that could affect our results or the achievement of the expectations described in forward-looking statements may also be contained in any accompanying prospectus supplement. There can be no assurance that future developments affecting us will be those that we have anticipated. Should one or more of these risks or uncertainties materialize, or should any of the assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

These forward-looking statements made by us in this prospectus and any accompanying prospectus supplement speak only as of the date of this prospectus and the accompanying prospectus supplement. Except as required under the federal securities laws and rules and regulations of the Commission, we expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. You should, however, review additional disclosures we make in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K filed with the Commission.

You should read this prospectus and any accompanying prospectus supplement completely and with the understanding that our actual future results, levels of activity and performance as well as other events and circumstances may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

SUMMARY

This summary highlights selected information appearing elsewhere in this prospectus. Because it is a summary, it may not contain all of the information that may be important to you. To understand this offering fully, you should read this entire prospectus carefully, including the information set forth under the heading “Risk Factors” and our financial statements and related notes included in this prospectus or incorporated by reference into this prospectus, any applicable prospectus supplement and the documents to which we have referred to in the “Incorporation of Certain Documents by Reference” section below.

Overview

Lemonade is rebuilding insurance from the ground up on a digital substrate and an innovative business model. By leveraging technology, data, artificial intelligence, contemporary design, and behavioral economics, we believe we are making insurance more delightful, more affordable, more precise, and more socially impactful. To that end, we have built a vertically-integrated company with wholly-owned insurance carriers in the United States and Europe, and the full technology stack to power them.

A brief chat with our bot, AI Maya, is all it takes to get covered with renters, homeowners, pet, car or life insurance, and we expect to offer a similar experience for other insurance products over time. Claims are filed by chatting with another bot, AI Jim, who pays claims in as little as three seconds. This breezy experience belies the extraordinary technology that enables it: a state-of-the-art platform that spans marketing to underwriting, customer care to claims processing, finance to regulation. Our architecture melds artificial intelligence with the human kind, and learns from the prodigious data it generates to become ever better at delighting customers and quantifying risk.

In addition to digitizing insurance end-to-end, we also reimagined the underlying business model to minimize volatility while maximizing trust and social impact. In a departure from the traditional insurance model, where profits can literally depend on the weather, we typically retain a fixed fee, currently 25% of premiums, and our gross margin is expected to change little in good years and in bad. At Lemonade, excess claims are generally offloaded to reinsurers, while excess premiums are usually donated to nonprofits selected by our customers as part of our annual “Giveback.” These two ballasts, reinsurance and Giveback, reduce volatility, while creating an aligned, trustful, and values-rich relationship with our customers.

Lemonade’s cocktail of delightful experience, aligned values, and great prices enjoys broad appeal, while over indexing on younger and first time buyers of insurance. As these customers progress through predictable lifecycle events, their insurance needs typically grow to encompass more and higher-value products: renters regularly acquire more property and frequently upgrade to successively larger homes; home buying often coincides with a growing household and a corresponding need for life or pet insurance, and so forth. These progressions can trigger orders-of-magnitude increases in insurance premiums.

The result is a business with highly-recurring and naturally-growing revenue streams; a level of automation that we believe delights consumers while collapsing costs; and an architecture that generates and employs data to price and underwrite risk with ever-greater precision to the benefit of our company, our customers and their chosen nonprofits.

Warrants Assumed in the Metromile Acquisition

On November 8, 2021, Lemonade entered into a definitive agreement to acquire Metromile, pursuant to which the Company acquired 100% of the equity of Metromile, through an all-stock transaction based upon the exchange ratio of 0.05263 shares of Lemonade for each outstanding share of Metromile (the “Merger”). In connection with the Merger, each outstanding warrant of Metromile was assumed by us and converted automatically into warrants denominated in shares of our common stock on the same terms and conditions (including vesting terms) as applied to such warrant immediately prior to the consummation of the acquisition (with the number of common stock subject to such warrants and exercise price being adjusted based on the exchange ratio).

Metromile was incorporated in the State of Delaware on January 14, 2011. In February 2021, Metromile completed a business combination with INSU Acquisition Corp. II, where it merged with a wholly-owned subsidiary of INSU Acquisition Corp. II, with Metromile surviving the merger as a wholly-owned subsidiary of INSU Acquisition Corp. II.

The shares offered in this prospectus relate to the warrants assumed in connection with the Merger and the resale by Selling Shareholders of an aggregate of 412,969 common stock issuable upon the exercise of the assumed warrants, which were purchased (1) pursuant to certain Warrant Agreement, dated September 2, 2020, by and among INSU Acquisition Corp. II and each of the signatories thereto (the "Public Warrants") and (2) in a private placement in connection with the initial public offering of INSU Acquisition Corp. II (the"Placement Warrants").

Corporate Information

Lemonade, Inc. was incorporated as a Delaware corporation on June 17, 2015. Our corporate headquarters is located at 5 Crosby Street, 3rd Floor, New York, New York 10013. Our telephone number is (844) 733-8666. Our principal website address is www.lemonade.com. Information contained on our website or connected thereto does not constitute part of, and is not incorporated by reference into, this prospectus or the registration statement of which it forms a part.

RISK FACTORS

An investment in our securities involves risks. Our business, financial condition or results of operations could be materially and adversely affected by any of these risks. If any of these risks occur, the value of our common stock and our other securities may decline. You should carefully consider the risk factors set forth in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 and our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2022, June 30, 2022 and September 30, 2022, as well as other information contained or incorporated by reference herein or any applicable prospectus supplement hereto, before making a decision to invest in our securities. See “Incorporation of Certain Documents by Reference.”

USE OF PROCEEDS

All of the shares of common stock and warrants offered by the Selling Stockholders will be sold by them for their respective accounts. We will not receive any of the proceeds from these sales.

The Selling Stockholders will pay any underwriting fees, discounts, selling commissions, stock transfer taxes and certain legal expenses incurred by such Selling Stockholders in disposing of their shares of common stock and warrants, and we will bear all other costs, fees and expenses incurred in effecting the registration of such securities covered by this prospectus, including, without limitation, all registration and filing fees, NYSE listing fees and fees and expenses of our counsel and our independent registered public accountants.

We may receive proceeds from the exercise of the warrants for cash, but not from the sale of the shares of common stock issuable upon such exercise.

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

The following unaudited pro forma condensed combined financial statements combine the separate historical financial information of Lemonade, Inc. ("Lemonade") and Metromile, Inc. ("Metromile") after giving effect to the Mergers (as described in Note 1 below), and the pro forma effects of certain assumptions and adjustments described in “Notes to the Unaudited Pro Forma Condensed Combined Financial Statements” below. The unaudited pro forma condensed combined financial statements give effect to the Mergers, as if they had been completed as of January 1, 2021 for the purposes of the unaudited pro forma condensed combined statements of operations and comprehensive loss.

The preparation of the unaudited pro forma condensed combined financial statements and related adjustments required management to make certain assumptions and estimates. The unaudited pro forma condensed combined financial statements should be read together with:

•the accompanying notes to the unaudited pro forma condensed combined financial statements;

•Lemonade’s separate audited historical consolidated financial statements and accompanying notes as of and for the year ended December 31, 2021, included in Lemonade’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, filed with the SEC on March 1, 2022;

•Metromile’s separate audited historical consolidated financial statements and accompanying notes as of and for the year ended December 31, 2021, included in Metromile’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, filed with the SEC on February 28, 2022;

•Lemonade’s separate unaudited historical consolidated financial statements and accompanying notes as of and for nine months ended September 30, 2022, included in Lemonade’s Quarterly Reports on Form 10-Q for the fiscal quarter ended September 30, 2022 filed with the SEC on November 9, 2022; and

•Metromile’s separate unaudited historical condensed consolidated financial statements and accompanying notes as of and for the six months ended June 30, 2022 included herein.

In connection with the plan to integrate the operations of Lemonade and Metromile following the completion of the Mergers, Lemonade anticipates that nonrecurring charges will be incurred. Lemonade is not able to determine the timing, nature, and amount of these charges as of the date of this prospectus. However, these charges will affect the results of operations of Lemonade and Metromile, as well as those of the combined company following the completion of the mergers, in the period in which they are incurred. The unaudited pro forma condensed combined financial statements do not include the effects of costs associated with any restructuring or integration activities resulting from the transaction, as such costs cannot be determined at this time.

The pro forma financial information reflects adjustments that management believes are necessary to present fairly, the combined pro forma results of operations following the closing of the transaction as of and for the periods indicated. The adjustments are based on currently available information and assumptions that management believes are, under the circumstances and given the information available at this time, reasonable. These adjustments are based on preliminary estimates and will be finalized within the measurement period that will not extend beyond 12 months from the close of the transaction. Differences between these preliminary estimates and the final acquisition accounting may arise, and these differences could have a material impact on the accompanying unaudited pro forma condensed combined consolidated financial information and the combined entity’s future results of operations and financial position.

The unaudited pro forma condensed combined financial information has been prepared to illustrate the effect of the Mergers. It has been prepared for informational purposes only and is subject to a number of uncertainties and assumptions. The pro forma financial information has been prepared by Lemonade in accordance with Regulation S-X Article 11, Pro Forma Financial information (“Article 11”). Additionally, the unaudited pro forma condensed combined financial statements are not necessarily, and should not be assumed to be, an indication of the results that would have been achieved had the transaction been completed as of the dates indicated or that may be achieved in the future.

Unaudited Pro Forma Condensed Combined Statement of Operations and Comprehensive Loss

For the Nine Months Ended September 30, 2022

(in millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Transaction Accounting Adjustments | | Pro Forma Combined |

| | Lemonade

Historical | | Metromile

Historical | | Reclassification

Adjustments

- Note 4 | | Pro Forma Adjustments

- Note 7 | |

| Revenue | | | | | | | | | | |

Net earned premium |

| $ | 109.2 | | $ | 46.1 | | $ | — | | $ | — | | $ | 155.3 |

Ceding commission income |

| 46.4 | | — | | 0.2 | | — | | 46.6 |

Net investment income |

| 4.7 | | 0.3 | | — | | — | | 5.0 |

Commission and other income |

| 8.0 | | — | | 2.9 | | — | | 10.9 |

Other revenue |

| — | | 3.1 | | (3.1) | | — | | — |

| Total revenue | | 168.3 | | 49.5 | | — | | — | | 217.8 |

| Expense | | | | | | | | | | |

Loss and loss adjustment expense, net |

| 105.8 | | | 51.9 | | | — | | | (0.2) | | (A) | 157.5 | |

Other insurance expense |

| 30.9 | | | 12.1 | | | 3.8 | | | (0.6) | | (B) | 46.2 | |

Sales and marketing |

| 111.1 | | | — | | | 9.6 | | | — | | | 120.7 | |

Sales, marketing and other acquisition costs |

| — | | | 10.4 | | | (10.4) | | | — | | | — | |

Technology development |

| 56.1 | | | 10.7 | | | — | | | — | | | 66.8 | |

Amortization of capitalized software |

| — | | | 7.9 | | | (7.9) | | | — | | | — | |

Other operating expenses |

| — | | | 33.5 | | | (33.5) | | | — | | | — | |

General and administrative |

| 91.1 | | | — | | | 38.4 | | | (0.9) | | (C) | 128.6 | |

| Interest expense | | — | | | — | | | — | | | — | | | — | |

| Impairment on digital assets | | — | | | 0.2 | | | — | | | — | | | 0.2 | |

Decrease in fair value of stock warrant liability |

| — | | | (0.6) | | | — | | | — | | | (0.6) | |

| Total expenses | | 395.0 | | 126.1 | | — | | (1.7) | | 519.4 |

| Loss before income taxes | | (226.7) | | (76.6) | | — | | 1.7 | | (301.6) |

Income tax expense |

| 7.4 | | — | | — | | — | (E) | 7.4 |

| Net loss | | $ | (234.1) | | $ | (76.6) | | $ | — | | $ | 1.7 | | $ | (309.0) |

| | | | | | | | | | |

| Other comprehensive income, net of tax | | | | | | | | | | |

Unrealized loss on investments |

| (23.8) | | (0.4) | | — | | — | | (24.2) |

Foreign currency translation adjustment |

| (8.1) | | — | | — | | — | | (8.1) |

| Comprehensive loss | | $ | (266.0) | | $ | (77.0) | | — | | $ | 1.7 | | $ | (341.3) |

| Per share data: | | | | | | | | | | |

Net loss per share attributable to common stockholders - basic and diluted | $ | (3.69) | | | | | | | (F) | $ | (4.87) |

Weighted average common shares outstanding-basic and diluted |

| 63,482,945 | | | | | | | (F) | 63,482,945 |

See accompanying notes to the unaudited pro forma condensed combined financial statements.

Unaudited Pro Forma Condensed Combined Statement of Operations and Comprehensive Loss

For the Year Ended December 31, 2021

(in millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Transaction Accounting Adjustments | | Pro Forma Combined |

| | Lemonade

Historical | | Metromile

Historical | | Reclassification

Adjustments

- Note 4 | | Pro Forma Adjustments

- Note 7 | |

| Revenue | | | | | | | | | | |

| Net earned premium |

| $ | 77.0 | | $ | 75.6 | | $ | — | | $ | — | | $ | 152.6 |

| Ceding commission income |

| 44.9 | | — | | 24.4 | | — | | 69.3 |

| Net investment income |

| 1.9 | | 0.1 | | — | | — | | 2.0 |

| Commission and other income |

| 4.6 | | — | | 4.8 | | — | | 9.4 |

| Other revenue |

| — | | 29.2 | | (29.2) | | — | | — |

| Total revenue | | 128.4 | | 104.9 | | — | | — | | 233.3 |

| Expense | | | | | | | | | | |

| Loss and loss adjustment expense, net |

| 71.9 | | | 88.5 | | | — | | | (0.6) | | (A) | 159.8 | |

| Other insurance expense |

| 24.1 | | | 20.3 | | | 64.3 | | | 0.4 | | (B) | 109.1 | |

| Sales and marketing |

| 141.6 | | | — | | | 43.4 | | | — | | | 185.0 | |

| Sales and marketing and other acquisition costs |

| — | | | 103.0 | | | (103.0) | | | — | | | — | |

| Technology development |

| 51.8 | | | 16.0 | | | — | | | — | | | 67.8 | |

| Amortization of capitalized software |

| — | | | 11.3 | | | (11.3) | | | — | | | — | |

| Other operating expenses |

| — | | | 63.5 | | | (63.5) | | | — | | | — | |

| General and administrative |

| 72.6 | | | — | | | 70.1 | | | (2.0) | | (C) | 149.6 | |

| | | | | | | | 8.9 | | (D) | |

| Interest expense | | — | | | 16.0 | | | — | | | — | | | 16.0 | |

| Impairment on digital assets | | — | | | 0.2 | | | — | | | — | | | 0.2 | |

| Increase in fair value of stock warrant liability |

| — | | | 2.6 | | | — | | | — | | | 2.6 | |

| Total expense | | 362.0 | | | 321.4 | | | — | | | 6.7 | | | 690.1 | |

| Loss before income taxes | | (233.6) | | | (216.5) | | | — | | | (6.7) | | | (456.8) | |

| Income tax expense |

| 7.7 | | | — | | | — | | | — | | (E) | 7.7 | |

| Net loss | | $ | (241.3) | | | $ | (216.5) | | | $ | — | | | $ | (6.7) | | | $ | (464.5) | |

| | | | | | | | | | |

| Other comprehensive income, net of tax | | | | | | | | | | |

Unrealized loss on investments |

| (5.7) | | (0.1) | | — | | — | | (5.8) |

Foreign currency translation adjustment |

| 0.5 | | — | | — | | — | | 0.5 |

| Comprehensive loss | | $ | (246.5) | | $ | (216.6) | | — | | $ | (6.7) | | $ | (469.8) |

| Per share data: | | | | | | | | | | |

Net loss per share attributable to common stockholders - basic and diluted | $ | (3.94) | | $ | (1.89) | | | | | (F) | $ | (6.82) |

Weighted average common shares outstanding-basic and diluted |

| 61,224,433 | | 114,609,563 | | | | | (F) | 68,107,457 |

See accompanying notes to the unaudited pro forma condensed combined financial statements.

Notes to Unaudited Pro Forma Condensed Combined Financial Statements

1. Description of Transaction

On July 28, 2022, Lemonade, Inc., a Delaware corporation (the “Company,”) completed the acquisition of Metromile, Inc. (“Metromile”), a Delaware corporation (“Metromile”) pursuant to the Agreement and Plan of Merger, dated as of November 8, 2021 (the “Merger Agreement”), by and among the Company, Citrus Merger Sub A, Inc., a Delaware corporation and a direct, wholly owned subsidiary of the Company (“Acquisition Sub I”), Citrus Merger Sub B, LLC, a Delaware limited liability company and a direct, wholly owned subsidiary of the Company (“Acquisition Sub II”) and Metromile. Pursuant to the Merger Agreement, Acquisition Sub I merged with and into Metromile, with Metromile surviving as a wholly-owned subsidiary of the Company (the “First Merger”) and following the First Merger, Metromile merged with and into Acquisition Sub II, with Acquisition Sub II surviving as “Metromile, LLC” (the “Second Merger,” and together with the First Merger, the “Mergers”). Pursuant to the Merger Agreement, on the closing date, the former shareholders of Metromile exchanged all of the issued and outstanding shares for a total of 6,901,934 shares of Lemonade common stock. On July 28, 2022, Metromile delisted the Metromile common stock and warrants from Nasdaq.

2. Basis of Presentation

The above unaudited pro forma condensed combined statements of operations and comprehensive loss for the nine months ended September 30, 2022, and for the year ended December 31, 2021 are derived from the historical financial statements of Lemonade and Metromile after giving effect to the Mergers. The unaudited pro forma condensed combined statements operations and comprehensive loss for the nine months ended September 30, 2022 and the year ended December 31, 2021 give pro forma effect to these transactions as if they had been completed on January 1, 2021. Certain amounts may not foot due to rounding to millions.

The transaction is accounted for under the acquisition method of accounting in accordance with Accounting Standards Codification (“ASC”) Topic 805, Business Combinations (“ASC 805”), with Lemonade considered the acquirer for accounting purposes. In business combination transactions in which the consideration given is not in the form of cash (that is, in the form of non-cash assets, liabilities incurred, or equity interests issued), measurement of the merger consideration is based on the fair value of the consideration given or the fair value of the assets (or net assets) acquired, whichever is more evident and, thus more reliably measurable.

Under ASC 805, all of the Metromile assets acquired and liabilities assumed in this business combination are recognized at their acquisition-date fair value, while transaction costs and integration costs associated with the business combination are expensed as incurred. The excess of estimated fair value of the purchase price over the net assets acquired is recorded as goodwill. Subsequent to the completion of the Mergers, Lemonade and Metromile implemented an integration plan which may affect how the assets acquired, including intangible assets, will be utilized by the combined company

The purchase price consideration and estimated fair values of assets acquired and liabilities assumed from Metromile will be updated and finalized within the measurement period that will not extend beyond 12 months from the close of the transaction. Estimated fair value adjustments could change significantly from those allocations used in the unaudited pro forma condensed combined financial statements as presented below.

The estimated identifiable finite lived intangible assets include internally developed technology and value of business acquired ("VOBA"). The weighted average useful life of the internally developed technology intangible is estimated to be 3 years. VOBA is expected to be fully amortized in less than a year. Identifiable intangible assets also include insurance licenses which are estimated to have an indefinite life, and are therefore not amortized, but will be subject to periodic impairment testing and are subject to the same risks and uncertainties noted for the identifiable finite lived assets.

Management has recorded reclassifications of Metromile’s financial information to conform to Lemonade’s financial statement presentation. In addition, Lemonade management reviewed Metromile’s accounting policies and determined that no significant differences in accounting policies require adjustment to conform to Lemonade’s accounting policies. Management however, may identify further differences that, when conformed, could have a material impact on these unaudited pro forma condensed combined financial statements.

3. Metromile Acquisition

As discussed and described above, Lemonade obtained unilateral control over Metromile on July 28, 2022. For the purposes of the unaudited pro forma condensed combined statements of operations for the nine months ended September 30, 2022, the Metromile historical unaudited condensed statement of operation for the six months ended June 30, 2022, as included in this prospectus, was adjusted to include the results of operations for the month ended July 31, 2022.

“Metromile As Adjusted” for unaudited pro forma condensed combined statements of operations for the nine months ended September 30, 2022 was determined as follows:

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Metromile As Adjusted |

| | For the Six Months Ended | | For the Month Ended | | For the Seven Months Ended |

| | June 30, 2022 | | July 31, 2022 | | July 31, 2022 |

| Revenue | | | | | | |

| Premium earned, net | | $ | 39.4 | | | $ | 6.7 | | | $ | 46.1 | |

| Investment income | | 0.2 | | | 0.1 | | | 0.3 | |

| Other revenue | | 2.6 | | | 0.5 | | | 3.1 | |

| Total revenue | | 42.2 | | | 7.3 | | | 49.5 | |

| Costs and expenses | | | | | | |

| Losses and loss adjustment expenses | | 44.1 | | | 7.8 | | | 51.9 | |

| Policy servicing expense and other | | 10.4 | | | 1.7 | | | 12.1 | |

| Sales, marketing, and other acquisition costs | | 10.1 | | | 0.3 | | | 10.4 | |

| Research and development | | 9.6 | | | 1.1 | | | 10.7 | |

| Amortization of capitalized software | | 6.7 | | | 1.2 | | | 7.9 | |

| Other operating expenses | | 26.4 | | | 7.1 | | | 33.5 | |

| Total costs and expenses | | 107.3 | | | 19.2 | | | 126.5 | |

| Loss from operations | | (65.1) | | | (11.9) | | | (77.0) | |

| Other expense | | | | | | |

| | | | | | |

| Impairment on digital assets | | 0.4 | | | (0.2) | | | 0.2 | |

| Decrease in fair value of stock warrant liability | | — | | | (0.6) | | | (0.6) | |

| Total other expense | | 0.4 | | | (0.8) | | | (0.4) | |

| Loss before taxes | | (65.5) | | | (11.1) | | | (76.6) | |

| Income tax expense | | — | | | — | | | — | |

| Net loss | | $ | (65.5) | | | $ | (11.1) | | | $ | (76.6) | |

| | | | | | |

| Net loss | | (65.5) | | | (11.1) | | | (76.6) | |

| Unrealized (loss) gain on marketable securities | | (0.5) | | | 0.1 | | | (0.4) | |

| Total comprehensive loss | | $ | (66.0) | | | $ | (11.0) | | | $ | (77.0) | |

4. Reclassification Adjustments

The Pro Forma Financial Statements have been adjusted to reflect reclassifications of Metromile’s historical financial statements to conform to Lemonade’s financial statement presentation, which is summarized below:

Pro Forma Statement of Operations and Comprehensive Loss for the nine months ended September 30, 2022:

•Reclassification of $3.1 million from Other revenue to Ceding commission income and Commission and other income;

•Reclassification of $10.4 million from Sales, marketing and other acquisition costs to Sales and marketing and Other insurance expense;

•Reclassification of $33.5 million from Other operating expenses to General and administrative and Other insurance expense; and

•Reclassification of $7.9 million from Amortization of capitalized software to General and administrative.

Pro Forma Statement of Operations and Comprehensive Loss for the year ended December 31, 2021:

•Reclassification of $29.2 million of Other revenue to Ceding commission income and Commission and other income;

•Reclassification of $103.0 million from Sales, marketing and other acquisition costs to Sales and marketing and Other insurance expense;

•Reclassification of $63.5 million from Other operating expenses to General and administrative and Other insurance expense; and

•Reclassification of $11.3 million from Amortization of capitalized software to General and administrative.

5. Merger Consideration

Merger Consideration

The fair value of merger consideration, or the purchase price, in the unaudited pro forma financial information is approximately $137.7 million. This amount was derived based on the 131,140,667 issued and outstanding common stock of Metromile on July 28, 2022, and applying the exchange ratio of 0.05263 and closing price of Lemonade common stock of $19.84 per share as of closing date.

Replacement Equity Awards

The fair value of assumed Metromile equity awards which includes stock options and and restricted stock units which are attributable to pre combination service amounted to $0.8 million at the completion of the Merger, and is considered part of the purchase price.

Additional Shares

Additional Shares are considered to be contingent consideration which requires recognition of this consideration at fair value under ASC 805. Management has determined that the Additional Shares are equity-classified instruments. Given that the contingencies are not probable of being met within the contingency period, the fair value was assessed to be zero for these Additional Shares.

For purposes of the pro forma financial information, the following table presents the components of the merger consideration (in millions, except for number of shares and per share amount):

| | | | | | | | |

| Lemonade common stock issued to existing Metromile common stockholders | | 6,901,934 | |

Lemonade common stock closing price at July 28, 2022 | | $ | 19.84 | |

| Merger consideration exchange of Metromile common stock to Lemonade common stock | | $ | 136.9 | |

| Fair value of Metromile assumed equity awards | | 0.8 | |

| Total Merger Consideration | | $ | 137.7 | |

6. Preliminary Fair Value Estimate of Assets Acquired and Liabilities Assumed

The table below represents an initial allocation of the merger consideration to Metromile’s tangible and intangible assets acquired and liabilities assumed based on Lemonade’s initial estimate of their respective fair values and the working capital balances that existed as of the acquisition date. The pro forma financial information do not give effect to normal course changes in our cash and other working capital balances through the closing date. Due to the pro forma financial statements being prepared based on preliminary estimates of fair value of the net assets acquired as of closing date, the final purchase allocation and the effect on our financial position and results of operations may differ significantly from the pro forma amounts included herein.

| | | | | | | | |

| Assets acquired | | |

| Fixed maturities, available for sale, at fair value | | $ | 1.8 | |

| Short-term investments | | 64.2 | |

| Cash, cash equivalents and restricted cash | | 98.8 | |

| Premiums receivable | | 17.4 | |

| Reinsurance recoverable | | 14.5 | |

| Property and equipment | | 4.6 | |

| Value of Business Acquired (VOBA) | | 1.7 | |

| Intangible assets, technology | | 28.0 | |

| Intangible assets, insurance licenses | | 7.5 | |

| Other Assets | | 14.7 | |

| Total assets acquired | | $ | 253.2 | |

| Liabilities assumed | | |

| Unpaid loss and loss adjustment expenses | | $ | 76.3 | |

| Unearned premium | | 15.1 | |

| Ceded premium payable | | 12.0 | |

| Trade payables | | 0.8 | |

| Other liabilities and accrued expenses | | 22.2 | |

| Total liabilities assumed | | 126.4 | |

| Total identifiable net assets acquired | | $ | 126.8 | |

| | |

| Total purchase consideration | | $ | 137.7 | |

| Goodwill | | $ | 10.9 | |

The preliminary purchase price allocation has been used to prepare the pro forma adjustments in the pro forma condensed combined financial information. Final purchase price allocation is subject to change as more detailed analyses are completed and additional information about the fair value of assets acquired and liabilities assumed from Metromile becomes available, and finalized within the measurement period that will not extend beyond 12 months from the close of the transaction. The final allocation could differ materially from the preliminary allocation used in the pro forma adjustments which may include changes in valuation of assets acquired and liabilities assumed, including but not limited to intangible assets, fixed assets, and the residual goodwill.

7. Adjustments to Unaudited Pro Forma Condensed Combined Statement of Operations and Comprehensive Loss

Explanations of the adjustments to the unaudited pro forma condensed combined statement of operations and comprehensive loss are as follows:

A. Represents the amortization on the adjustment of the reserves to fair value.

B. Represents the removal of historical DAC amortization, offset by the amortization related to the newly established VOBA asset.

C. Represents the amortization of newly established intangible assets. Subsequent to the Mergers, the expected amortization expense relating to the preliminary fair value of the acquired intangible assets (excluding VOBA) is reflected in the table below. The pro forma amortization adjustment is $7.0 million and $9.3 million for the nine months ended September 30, 2022 and the year ended December 31, 2021, respectively. The pro forma amortization adjustments include the removal of historical amortization expense of $7.9 million and $11.3 million for the nine months ended September 30, 2022 and the year ended December 31, 2021, respectively.

| | | | | | | | | | | | | | | | | | | | |

| | Estimated fair value ($ in millions) | | Estimated average useful life

(in years) | | Estimated Annual Amortization Expense

($ in millions) |

| Technology Assets | | $ | 28.0 | | | 3 | | $ | 9.3 | |

| Insurance Licenses | | 7.5 | | | Indefinite | | — | |

| Total | | $ | 35.5 | | | | | $ | 9.3 | |

D. Reflects the impact of the estimated severance payment and transaction costs of $8.9 million. These costs are not expected to recur beyond 12 months following the close of the transaction.

E. After the acquisition, Lemonade will file a consolidated tax return that will include Metromile. Lemonade is expected to continue maintaining a full valuation allowance against net deferred tax assets. Metromile is also expected to have net deferred tax assets offset by a full valuation at acquisition date. As such, there were no pro forma adjustments related to taxes as tax effects of pro forma adjustments are fully offset by the valuation allowance.

F. The pro forma basic and diluted net loss per share amounts presented in the unaudited pro forma condensed combined statements of operations are based upon the number of Lemonade’s shares outstanding as if the transaction occurred on January 1, 2021. The calculation of weighted average shares outstanding for pro forma basic and diluted net loss per share assumes that the shares issuable in connection with the transaction have been outstanding for the entirety of the period presented. Since Lemonade is in a net loss position in both the historical and pro forma results of operations, any dilutive shares that were identified in calculating the historical EPS would stay as anti-dilutive for the pro forma calculations. The following table

sets forth the calculation of basic and diluted loss per share (in millions, except for number of shares and per share amounts):

| | | | | | | | | | | | | | |

| | Nine Months Ended September 30, 2022 | | Year Ended

December 31, 2021 |

| Numerator: | | | | |

| Net loss attributable to common shareholders - Lemonade | | $ | (234.1) | | | $ | (241.3) | |

| Net loss attributable to common shareholders - Metromile | | (76.6) | | | (216.5) | |

| Pro forma transaction adjustments | | 1.7 | | | (6.7) | |

| Pro forma net loss attributable to common shareholders | | $ | (309.0) | | | $ | (464.5) | |

| Denominator: | | | | |

| Pro forma weighted average common shares - basic and diluted | | 63,482,945 | | | 68,107,457 | |

| Pro forma loss per share - basic and diluted | | $ | (4.87) | | | $ | (6.82) | |

DETERMINATION OF OFFERING PRICE

The offering price of the shares of common stock underlying the warrants offered hereby is determined by reference to the exercise price of the warrants of $218.51 per share.

We cannot currently determine the price or prices at which shares of our common stock may be sold by the Selling Stockholders under this prospectus.

SELLING STOCKHOLDERS

Information about selling stockholders, when applicable, will be set forth in a prospectus supplement, in a post-effective amendment or in filings we make with the Commission under the Exchange Act which are incorporated by reference into this prospectus.

DESCRIPTION OF OUR CAPITAL STOCK

The description of our capital stock is incorporated by reference to Exhibit 4.3 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, filed with the SEC on March 1, 2022.

DESCRIPTION OF WARRANTS

The following summary of the material terms of our warrants is not intended to be a complete summary of the rights and preferences of such securities, and is qualified by reference to our Certificate of Incorporation, our Bylaws and the Warrant Agreement, dated September 2, 2020, by and among INSU Acquisition Corp. II and each of the signatories thereto (the “Warrant Agreement”). For a complete description, you should refer to the Certificate of Incorporation, Bylaws and Warrant Agreement, copies of which have been filed as exhibits to our Annual Report on Form 10-K or this registration statement, as well as the relevant provisions of the Delaware General Corporation Law.

Public Warrants

Each whole Public Warrant entitles the registered holder to purchase .05263 share of our common stock at a price of $218.51 per share, subject to adjustment as discussed below, at any time commencing on July 28, 2022. Pursuant to the Warrant Agreement, a warrantholder may exercise his, her or its Public Warrants only for a whole number of shares of common stock. The warrants will expire five years after the closing of Metromile’s initial business combination on February 9, 2021 (the “Business Combination”), at 5:00 p.m., New York time, or earlier upon redemption or liquidation.

We will not be obligated to deliver any shares of common stock pursuant to the exercise for cash of a warrant and will have no obligation to settle such Public Warrant exercise unless a registration statement under the Securities Act of 1933, as amended (the “Securities Act”), with respect to the shares of common stock underlying the Public Warrants is then effective and a prospectus relating thereto is current, subject to our satisfying our obligations with respect to registration. No Public Warrant will be exercisable and we will not be obligated to issue shares of common stock upon exercise of a Public Warrant unless common stock issuable upon such Public Warrant exercise has been registered, qualified or deemed to be exempt from the registration or qualifications requirements of the securities laws of the state of residence of the registered holder of the Public Warrants.

If a registration statement covering the shares of common stock issuable upon exercise of the Public Warrants has not been declared effective by the 60th business day following the closing of the Business Combination, warrantholders may, until such time as there is an effective registration statement and during any period when we have failed to maintain an effective registration statement, exercise warrants on a cashless basis pursuant to the exemption provided by Section 3(a)(9) of the Securities Act or another available exemption. Notwithstanding the above, if our common stock is at the time of any exercise of a warrant not listed on a national securities exchange such that it satisfies the definition of a “covered security” under Section 18(b)(1) of the Securities Act, we may, at our option, require holders of Public Warrants who exercise their warrants to do so on a “cashless basis” in accordance with Section 3(a)(9) of the Securities Act and, in the event we so elect, we will not be required to file or maintain in effect a registration statement, and in the event we do not so elect, we will use our best efforts to register or qualify the shares under applicable blue sky laws to the extent an exemption is not available.

Once the Public Warrants become exercisable, we may, except as otherwise provided in the Warrant Agreement, call the Public Warrants for redemption:

•in whole and not in part;

•at a price of $0.01 per Public Warrant;

•upon not less than 30 days’ prior written notice of redemption to each warrantholder; and

•if, and only if, the reported last sale price of the common stock (or the closing bid price of our common stock in the event shares of our common stock are not traded on any specific day) equals or exceeds $342.01 per share (as adjusted for stock splits, stock dividends, reorganizations and the like) for any 20 trading days within a 30 trading-day period ending on the third business day prior to the date on which we send proper notice of such redemption to the warrantholders.

If and when the Public Warrants become redeemable by us, we may exercise our redemption right even if we are unable to register or qualify the underlying securities for sale under all applicable state securities laws.

We have established the last of the redemption criterion discussed above to prevent a redemption call unless there is at the time of the call a significant premium to the Public Warrant exercise price. If the foregoing conditions are satisfied and we issue a notice of redemption of the Public Warrants, each warrantholder will be entitled to exercise his, her or its Public Warrant prior to the scheduled redemption date. However, the price of the common stock may fall below the $342.01 redemption trigger price (as adjusted for stock splits, stock dividends, reorganizations, recapitalizations and the like) as well as the $218.51 (for whole shares) Public Warrant exercise price after the redemption notice is issued.

If we call the Public Warrants for redemption as described above, our management will have the option to require any holder that wishes to exercise its Public Warrant to do so on a “cashless basis.” In determining whether to require all holders to exercise their Public Warrants on a “cashless basis,” our management will consider, among other factors, our cash position, the number of Public Warrants that are outstanding and the dilutive effect on our stockholders of issuing the maximum number of shares of common stock issuable upon the exercise of our Public Warrants. If our management takes advantage of this option, all holders of Public Warrants would pay the exercise price by surrendering their Public Warrants for that number of shares of common stock equal to the quotient obtained by dividing (x) the product of the number of shares of common stock underlying the Public Warrants, multiplied by the difference between the exercise price of the Public Warrants and the “fair market value” (defined below) by (y) the fair market value. The “fair market value” shall mean the average last reported sale price of the common stock for the 10 trading days ending on the third trading day prior to the date on which the notice of redemption is sent to the holders of the Public Warrants. If our management takes advantage of this option, the notice of redemption will contain the information necessary to calculate the number of shares of common stock to be received upon exercise of the Public Warrants, including the “fair market value” in such case. Requiring a cashless exercise in this manner will reduce the number of shares to be issued and thereby lessen the dilutive effect of a warrant redemption.

A holder of a Public Warrant may notify us in writing if it elects to be subject to a requirement that such holder will not have the right to exercise such Public Warrant, to the extent that after giving effect to such exercise, such person (together with such person’s affiliates), to the Public Warrant agent’s actual knowledge, would beneficially own in excess of 4.9% or 9.8% (or such other amount as a holder may specify) of the shares of common stock outstanding immediately after giving effect to such exercise.

If the number of outstanding shares of common stock is increased by a stock dividend payable in shares of common stock, or by a split-up of shares of common stock or other similar event, then, on the effective date of such stock dividend, split-up or similar event, the number of shares of common stock issuable on exercise of each Public Warrant will be increased in proportion to such increase in the outstanding shares of common stock. A rights offering to holders of common stock entitling holders to purchase shares of common stock at a price less than the fair market value will be deemed a stock dividend of a number of shares of common stock equal to the product of (i) the number of shares of common stock actually sold in such rights offering (or issuable under any other equity securities sold in such rights offering that are convertible into or exercisable for common stock) and (ii) one (1) minus the quotient of (x) the price per share of common stock paid in such rights offering divided by (y) the fair market value. For these purposes (i) if the rights offering is for securities convertible into or exercisable for common stock, in determining the price payable for common stock, there will be taken into account any consideration received for such rights, as well as any additional amount payable upon exercise or conversion and (ii) fair market value means the volume weighted average price of common stock as reported during the ten (10) trading day period ending on the trading day prior to the first date on which the shares of common stock trade on the applicable exchange or in the applicable market, regular way, without the right to receive such rights.

In addition, if we, at any time while the Public Warrants are outstanding and unexpired, pay a dividend or make a distribution in cash, securities or other assets to the holders of common stock on account of such shares of common stock (or other shares of our capital stock into which the Public Warrants are convertible), other than (a) as described above or (b) by certain ordinary cash dividends, then the Public Warrant exercise price will be decreased, effective immediately after the effective date of such event, by the amount of cash and/or the fair market value of any securities or other assets paid on each share of common stock in respect of such event.

If the number of outstanding shares of our common stock is decreased by a consolidation, combination, reverse stock split or reclassification of shares of common stock or other similar event, then, on the effective date of such consolidation, combination, reverse stock split, reclassification or similar event, the number of shares of common stock issuable on exercise of each Public Warrant will be decreased in proportion to such decrease in outstanding shares of common stock.

Whenever the number of shares of common stock purchasable upon the exercise of the Public Warrants is adjusted, as described above, the Public Warrant exercise price will be adjusted by multiplying the Public Warrant exercise price immediately prior to such adjustment by a fraction (x) the numerator of which will be the number of shares of common stock purchasable upon the exercise of the Public Warrants immediately prior to such adjustment, and (y) the denominator of which will be the number of shares of common stock so purchasable immediately thereafter.

In case of any reclassification or reorganization of the outstanding shares of common stock (other than those described above or that solely affects the par value of such shares of common stock), or in the case of any merger or consolidation of us with or into another corporation (other than a consolidation or merger in which we are the continuing corporation and that does not result in any reclassification or reorganization of our outstanding shares of common stock), or in the case of any sale or conveyance to another corporation or entity of the assets or other property of us as an entirety or substantially as an entirety in connection with which we are dissolved, the holders of the Public Warrants will thereafter have the right to purchase and receive, upon the basis and upon the terms and conditions specified in the Public Warrants and in lieu of the shares of our common stock immediately theretofore purchasable and receivable upon the exercise of the rights represented thereby, the kind and amount of shares of stock or other securities or property (including cash) receivable upon such event, that the holder of the warrants would have received if such holder had exercised his, her or its Public Warrants immediately before the event. If less than 70% of the consideration receivable by the holders of common stock in such a transaction is payable in the form of common stock in the successor entity that is listed for trading on a national securities exchange or is quoted in an established over-the-counter market, or is to be so listed for trading or quoted immediately following such event, and if the registered holder of the Public Warrant properly exercises the Public Warrant within thirty (30) days following public disclosure of such transaction, the Public Warrant exercise price will be reduced as specified in the Warrant Agreement based on the Black-Scholes value (as defined in the Warrant Agreement) of the Public Warrant.

The Warrant Agreement provides that the terms of the Public Warrants may be amended without the consent of any holder to cure any ambiguity or correct any defective provision, but requires the approval by the holders of at least 65% of the then outstanding Public Warrants to make any change that adversely affects the interests of the registered holders of Public Warrants.

The Public Warrants may be exercised upon surrender of the warrant certificate on or prior to the expiration date at the offices of the warrant agent, with the exercise form on the reverse side of the warrant certificate completed and executed as indicated, accompanied by full payment of the exercise price (or on a cashless basis, if applicable), by certified or official bank check payable to us, for the number of Public Warrants being exercised. The warrantholders do not have the rights or privileges of holders of common stock and any voting rights until they exercise their Public Warrants and receive shares of common stock. After the issuance of shares of common stock upon exercise of the Public Warrants, each holder will be entitled to one vote for each share held of record on all matters to be voted on by stockholders.

Public Warrants may be exercised only for a whole number of shares of common stock. No fractional shares will be issued upon exercise of the warrants. If, upon exercise of the warrants, a holder would be entitled to receive a fractional interest in a share, we will, upon exercise, round down to the nearest whole number of shares of common stock to be issued to the warrantholder.

Placement Warrants

The Placement Warrants are identical to the Public Warrants, except that if held by the initial holders or their permitted transferees, they (a) may be exercised for cash or on a cashless basis, (b) are not subject to being called for redemption and (c) they (including our common stock issuable upon exercise of these warrants) may not, subject to certain limited exceptions, be transferred, assigned or sold by the holders until 30 days after the consummation of the business combination. In addition, for as long as the placement warrants are held by Cantor Fitzgerald & Co. and/or its designees or affiliates, such placement warrants may not be exercised after September 2, 2025.

PLAN OF DISTRIBUTION

The Selling Stockholders, which as used herein includes donees, pledgees, transferees, distributees or other successors-in-interest selling shares of our common stock or warrants or interests in our common stock or warrants received after the date of this prospectus from the Selling Stockholders as a gift, pledge, partnership distribution or other transfer, may, from time to time, sell, transfer, distribute or otherwise dispose of certain of their shares of common stock or warrants or interests in our common stock or warrants on any stock exchange, market or trading facility on which shares of our common stock or warrants, as applicable, are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

We are required to pay all fees and expenses incident to the registration of the shares of our common stock to be offered and sold pursuant to this prospectus.

We will not receive any of the proceeds from the sale of the securities by the Selling Stockholders. We will receive proceeds from warrants exercised in the event that such warrants are exercised for cash. The aggregate proceeds to the Selling Stockholders will be the purchase price of the securities less any discounts and commissions borne by the Selling Stockholders. The shares of common stock beneficially owned by the Selling Stockholders covered by this prospectus may be offered and sold from time to time by the Selling Stockholders. The term “Selling Stockholders” includes donees, pledgees, transferees or other successors in interest selling securities received after the date of this prospectus from a Selling Stockholder as a gift, pledge, partnership distribution or other transfer. The Selling Stockholders will act independently of us in making decisions with respect to the timing, manner and size of each sale. Such sales may be made on one or more exchanges or in the over-the-counter market or otherwise, at prices and under terms then prevailing or at prices related to the then current market price or in negotiated transactions. The Selling Stockholders may sell their shares by one or more of, or a combination of, the following methods:

•purchases by a broker-dealer as principal and resale by such broker-dealer for its own account pursuant to this prospectus;

•ordinary brokerage transactions and transactions in which the broker solicits purchasers;

•block trades in which the broker-dealer so engaged will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;