false

0000056873

0000056873

2024-12-05

2024-12-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report : December

5, 2024

(Date of earliest event

reported)

The Kroger Co.

(Exact

name of registrant as specified in its charter)

| Ohio |

|

No. 1-303 |

|

31-0345740 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

1014 Vine Street

Cincinnati, OH 45202

(Address

of principal executive offices, including zip code)

Registrant’s telephone number, including

area code: (513) 762-4000

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on

which registered |

| Common

Stock $1 par value |

|

KR |

|

NYSE |

Indicate by

check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition. |

On December 5, 2024, The Kroger Co. (NYSE:KR) issued a press release

announcing its third quarter 2024 results. Attached hereto as Exhibit 99.1, and furnished herewith, is a copy of that release.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

The Kroger Co. |

| |

|

|

| December 5, 2024 |

By: |

/s/ Christine S. Wheatley |

| |

|

Christine S. Wheatley |

| |

|

Senior Vice President, General Counsel and Secretary |

Exhibit 99.1

Kroger

Reports Third Quarter 2024 Results and

Narrows

Guidance Range

Third Quarter Highlights

| · | Identical

Sales without fuel increased 2.3% |

| · | Operating

Profit of $828 million; EPS of $0.84 |

| · | Adjusted

FIFO Operating Profit of $1,017 million and Adjusted EPS of $0.98 |

| · | Achieved

strong Adjusted Free Cash Flow |

| · | Executed

its go-to-market strategy to deliver value for customers |

| o | Our Brands sales growth outpaced total grocery sales growth |

| o | Increased total households and loyal households |

CINCINNATI, December 5, 2024 – The

Kroger Co. (NYSE: KR) today reported its third quarter 2024 results, narrowed its guidance range and updated investors on how Kroger

is positioned for long-term sustainable growth.

Comments from Chairman and CEO Rodney McMullen

“Kroger achieved strong sales results in the third quarter led

by our pharmacy and digital performance, which reflects the strength and diversity of our model.

We continued to grow total households this quarter by delivering exceptional

value for customers, with low prices, personalized offers and great quality Our Brands products, all through a seamless shopping

experience. We appreciate our associates for their continued efforts to elevate the customer experience, delivering on our key priorities

of full, fresh and friendly.

While we expect the macroeconomic environment to remain uncertain

near-term, the strength of our model gives us confidence in our ability to deliver value for customers and invest in our associates,

while generating attractive and sustainable returns for shareholders.”

Comments from Chairman and CEO Rodney McMullen on the pending merger

with Albertsons

“As we await the courts’ rulings in the regulatory challenge

to the merger, we remain confident in the facts and the strength of our position. The food industry has always been competitive and will

continue to be after this merger. We are committed to closing this merger because bringing Kroger and Albertsons together will provide

meaningful and measurable benefits – lower prices, secure jobs and expanded access to fresh, affordable food – for customers,

associates, and communities across the country.”

Sale of

Kroger Specialty Pharmacy

Kroger closed the sale of its specialty pharmacy business on October 4,

2024, for $464 million. The sale reduced total company sales in the third quarter by approximately $340 million, compared to the same

period last year, and annualized sales will be approximately $3 billion lower going forward. KSP was a low margin business. As a result,

the sale of the business increased both Kroger’s gross margin and operating, general and administrative costs as a rate of sales.

It had no material effect on operating profit.

Third Quarter Financial Results

| |

3Q24

($ in millions; except EPS) |

3Q23

($ in millions; except EPS) |

| ID

Sales* (Table 4) |

2.3% |

(0.6%) |

| Earnings

Per Share |

$0.84 |

$0.88 |

| Adjusted

EPS (Table 6) |

$0.98 |

$0.95 |

| Operating

Profit |

$828 |

$912 |

| Adjusted

FIFO Operating Profit (Table 7) |

$1,017 |

$1,022 |

| FIFO

Gross Margin Rate* |

Increased

51 basis points |

| OG&A

Rate* |

Increased

22 basis points |

* Without fuel and adjustment items, if applicable.

Total company sales were $33.6 billion in the third quarter, compared

to $34.0 billion for the same period last year. The decrease in sales was attributable to the sale of Kroger Specialty Pharmacy during

the quarter and to lower fuel sales, which was primarily the result of a lower average retail price per gallon compared to last year.

Excluding fuel and Kroger Specialty Pharmacy, sales increased 2.7% compared to the same period last year.

Gross margin was 22.9% of sales for the third quarter. The FIFO gross

margin rate, excluding fuel, increased 51 basis points compared to the same period last year. This result reflected Kroger’s ability

to improve margin, while maintaining competitive pricing and helping customers manage their budgets. The increase in rate was primarily

attributable to the sale of Kroger Specialty Pharmacy, Our Brands performance and lower shrink, partially offset by lower pharmacy

margins.

The LIFO charge for the quarter was $4 million, compared to a LIFO

charge of $29 million for the same period last year. The decreased charge was due to lower expected year over year inflation.

The Operating, General & Administrative rate increased 22

basis points, excluding fuel and adjustment items, compared to the same period last year. This increase in rate was driven by the sale

of Kroger Specialty Pharmacy and increased incentive plan costs, partially offset by continued execution of cost savings initiatives.

Capital Allocation Strategy

Kroger expects to continue to generate strong

free cash flow and remains committed to investing in the business to drive long-term sustainable net earnings growth, as well as maintaining

its current investment grade debt rating. The Company expects to continue to pay its quarterly dividend and expects this to increase

over time, subject to board approval. Kroger has paused its share repurchase program to prioritize de-leveraging following the proposed

merger with Albertsons.

Kroger’s net total debt to adjusted

EBITDA ratio is 1.21 compared to 1.40 a year ago (Table 5). The company’s net total debt to adjusted EBITDA ratio target range

is 2.30 to 2.50. Kroger’s strong balance sheet provides ample opportunities for the Company to pursue growth and enhance shareholder

value.

Full-Year 2024 Guidance*

Comments from Interim CFO Todd Foley

“Kroger delivered another quarter of strong results that reflect

the resilience of our value creation model. As we head into the final quarter of the year, we are narrowing the ranges of identical sales

without fuel, adjusted FIFO Operating Profit and adjusted EPS guidance.

Our business is more diverse than ever and our model gives us confidence

in our ability to deliver on our guidance, and continue to generate attractive and sustainable returns for shareholders.”

| |

Guidance

as of

September 12, 2024 |

Guidance

as of

December 5, 2024 |

| Identical

Sales without fuel |

0.75%

– 1.75% |

1.20%

– 1.50% |

| Adjusted

FIFO Operating Profit |

$4.6

– $4.8 billion |

$4.6

– $4.7 billion |

| Adjusted

net earnings per diluted share |

$4.30

– $4.50 |

$4.35

– $4.45 |

| Adjusted

Free Cash Flow** |

$2.5

– $2.7 billion |

$2.5

– $2.7 billion |

| Capital

expenditures |

$3.6

– $3.8 billion |

$3.6

– $3.8 billion |

| Adjusted

effective tax rate*** |

23% |

22.5% |

* Without adjusted items, if applicable. Kroger is unable to provide

a full reconciliation of the GAAP and non-GAAP measures used in 2024 guidance without unreasonable effort because it is not possible

to predict certain of our adjustment items with a reasonable degree of certainty. This information is dependent upon future events and

may be outside of our control and its unavailability could have a significant impact on 2024 GAAP financial results.

** Adjusted free cash flow excludes planned payments related to the

restructuring of multi-employer pension plans, payments related to opioid settlements and merger-related expenses.

*** The adjusted tax rate reflects typical tax adjustments and does

not reflect changes to the rate from the completion of income tax audit examinations and changes in tax laws and policies, which cannot

be predicted.

Third Quarter 2024 Highlights

Leading with Fresh

| · | Introduced

226 new Our Brands items |

| · | Announced

the top five food trends for 2025 |

| · | Released

12 Days of Murray’s Cheese advent calendar featuring a curated collection of cheeses,

jams and crackers |

Accelerating with Digital

| · | Increased

delivery sales by 18% over last year led by Customer Fulfillment Centers |

| · | Improved

Pickup productivity to a record low cost per order supported by the addition of order batching

and routing technology in all stores |

| · | Enhanced

the Boost by Kroger Plus Membership by including Disney streaming options with an

annual membership |

Associate Experience

| · | Celebrated

32 company leaders named 2024 Progressive Grocer GenNext Honorees |

| · | Donated

nearly $1 million in associate and company contributions as part of annual giving campaign

for charitable causes |

| · | Celebrated

the third year of Kroger’s Game Changers program, bringing together female business

leaders, entrepreneurs and key community members as part of the LPGA Queen City Championship |

Live Our Purpose

| · | Supported

disaster response efforts for those impacted by Hurricane Helene |

| · | Enhanced

innovative nutrition scoring system to incorporate more nutritional attributes, making

it easier for customers to make healthier food choices |

| · | Celebrated

Hunger Action Month with Kroger’s annual campaign to support food banks in our

communities |

About Kroger

At

The Kroger Co. (NYSE: KR), we are dedicated to our Purpose: To Feed the Human Spirit™. We are, across our family

of companies nearly 420,000 associates who serve over 11 million customers daily through a seamless digital shopping experience and retail

food stores under a variety of banner names, serving America through food inspiration and uplift, and creating #ZeroHungerZeroWaste

communities. To learn more about us, visit our newsroom and investor relations site.

Kroger's third quarter 2024 ended on November 9,

2024.

Note: Fuel sales have historically had a

low gross margin rate and operating expense rate as compared to corresponding rates on non-fuel sales. As a result, Kroger discusses

the changes in these rates excluding the effect of fuel.

Please refer to the supplemental information

presented in the tables for reconciliations of the non-GAAP financial measures used in this press release to the most comparable GAAP

financial measure and related disclosure. As noted above, Kroger is unable to provide a full reconciliation of the GAAP and non-GAAP

measures used in its guidance without unreasonable effort because it is not possible to predict certain of our adjustment items with

a reasonable degree of certainty. This information is dependent upon future events and may be outside of our control and its unavailability

could have a significant impact on GAAP financial results.

This press release contains certain statements

that constitute “forward-looking statements” about Kroger’s financial position and the future performance of the company.

These statements are based on management’s assumptions and beliefs in light of the information currently available to it. Such

statements are indicated by words or phrases such as “achieve,” “committed,” “confident,” “continue,”

“deliver,” “expect,” “future,” “guidance,” “model,” “outlook,”

“strategy,” “target,” “trends,” “will,” and variations of such words and similar phrases.

Various uncertainties and other factors could cause actual results to differ materially from those contained in the forward-looking statements.

These include the specific risk factors identified in “Risk Factors” in our annual report on Form 10-K for our last

fiscal year and any subsequent filings, as well as the following:

Kroger's ability to achieve sales, earnings,

incremental FIFO operating profit, and adjusted free cash flow goals may be affected by: our proposed transaction with Albertsons, including,

among other things, our ability to consummate the proposed transaction and related divestiture plan, including on the terms of the merger

agreement and divestiture plan, on the anticipated timeline, with the required regulatory approvals, and/or resolution of pending litigation

challenging the merger; labor negotiations; potential work stoppages; changes in the unemployment rate; pressures in the labor market;

changes in government-funded benefit programs; changes in the types and numbers of businesses that compete with Kroger; pricing and promotional

activities of existing and new competitors, and the aggressiveness of that competition; Kroger's response to these actions; the state

of the economy, including interest rates, the inflationary, disinflationary and/or deflationary trends and such trends in certain commodities,

products and/or operating costs; the geopolitical environment including wars and conflicts; unstable political situations and social

unrest; changes in tariffs; the effect that fuel costs have on consumer spending; volatility of fuel margins; manufacturing commodity

costs; supply constraints; diesel fuel costs related to Kroger’s logistics operations; trends in consumer spending; the extent

to which Kroger’s customers exercise caution in their purchasing in response to economic conditions; the uncertainty of economic

growth or recession; stock repurchases; changes in the regulatory environment in which Kroger operates, along with changes in federal

policy and at regulatory agencies; Kroger’s ability to retain pharmacy sales from third party payors; consolidation in the healthcare

industry, including pharmacy benefit managers; Kroger’s ability to negotiate modifications to multi-employer pension plans; natural

disasters or adverse weather conditions; the effect of public health crises or other significant catastrophic events; the potential costs

and risks associated with potential cyber-attacks or data security breaches; the success of Kroger's future growth plans; the ability

to execute our growth strategy and value creation model, including continued cost savings, growth of our alternative profit businesses,

and our ability to better serve our customers and to generate customer loyalty and sustainable growth through our strategic pillars of

fresh, our brands, personalization, and seamless; and the successful integration of merged companies and new strategic collaborations;

and the risks relating to or arising from our proposed nationwide opioid litigation settlement, including our ability to finalize and

effectuate the settlement, the scope and coverage of the ultimate settlement and the expected financial or other impacts that could result

from the settlement. Our ability to achieve these goals may also be affected by our ability to manage the factors identified above. Our

ability to execute our financial strategy may be affected by our ability to generate cash flow.

Kroger’s adjusted effective tax rate

may differ from the expected rate due to changes in tax laws and policies, the status of pending items with various taxing authorities,

and the deductibility of certain expenses.

Kroger assumes no obligation to update the

information contained herein unless required by applicable law. Please refer to Kroger's reports and filings with the Securities and

Exchange Commission for a further discussion of these risks and uncertainties.

Note: Kroger's quarterly conference call

with investors will broadcast live at 10 a.m. (ET) on December 5, 2024 at ir.kroger.com. An on-demand replay of

the webcast will be available at approximately 1 p.m. (ET) on Thursday, December 5, 2024.

3rd Quarter 2024 Tables Include:

| 1. | Consolidated Statements of Operations |

| 2. | Consolidated Balance Sheets |

| 3. | Consolidated Statements of Cash Flows |

| 4. | Supplemental Sales Information |

| 5. | Reconciliation of Net Total Debt and Net Earnings Attributable to

The Kroger Co. to Adjusted EBITDA |

| 6. | Net Earnings Per Diluted Share Excluding the Adjustment Items |

| 7. | Operating Profit Excluding the Adjustment Items |

--30--

Contacts: Media: Erin Rolfes (513) 762-1080; Investors: Rob Quast

(513) 762-4969

Table

1.

THE

KROGER CO.

CONSOLIDATED

STATEMENTS OF OPERATIONS

(in

millions, except per share amounts)

(unaudited)

| | |

THIRD QUARTER | |

YEAR-TO-DATE |

| | |

2024 | |

2023 | |

2024 | |

2023 |

| SALES | |

$ | 33,634 | | |

| 100.0 | % | |

$ | 33,957 | | |

| 100.0 | % | |

$ | 112,815 | | |

| 100.0 | % | |

$ | 112,975 | | |

| 100.0 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| OPERATING EXPENSES | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| MERCHANDISE

COSTS, INCLUDING ADVERTISING, WAREHOUSING AND TRANSPORTATION (a), AND LIFO CHARGE (b) | |

| 25,948 | | |

| 77.2 | | |

| 26,477 | | |

| 78.0 | | |

| 87,332 | | |

| 77.4 | | |

| 88,032 | | |

| 77.9 | |

| OPERATING,

GENERAL AND ADMINISTRATIVE (a) | |

| 5,898 | | |

| 17.5 | | |

| 5,646 | | |

| 16.6 | | |

| 19,388 | | |

| 17.2 | | |

| 19,974 | | |

| 17.7 | |

| RENT | |

| 203 | | |

| 0.6 | | |

| 201 | | |

| 0.6 | | |

| 672 | | |

| 0.6 | | |

| 671 | | |

| 0.6 | |

| DEPRECIATION

AND AMORTIZATION | |

| 757 | | |

| 2.3 | | |

| 721 | | |

| 2.1 | | |

| 2,486 | | |

| 2.2 | | |

| 2,396 | | |

| 2.1 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| OPERATING

PROFIT | |

| 828 | | |

| 2.5 | | |

| 912 | | |

| 2.7 | | |

| 2,937 | | |

| 2.6 | | |

| 1,902 | | |

| 1.7 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| OTHER INCOME (EXPENSE) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| NET INTEREST

EXPENSE | |

| (86 | ) | |

| (0.3 | ) | |

| (94 | ) | |

| (0.3 | ) | |

| (294 | ) | |

| (0.3 | ) | |

| (341 | ) | |

| (0.3 | ) |

| NON-SERVICE COMPONENT

OF COMPANY-SPONSORED PENSION PLAN BENEFITS | |

| 3 | | |

| - | | |

| 7 | | |

| - | | |

| 9 | | |

| - | | |

| 24 | | |

| - | |

| (LOSS)

GAIN ON INVESTMENTS | |

| (20 | ) | |

| (0.1 | ) | |

| 26 | | |

| 0.1 | | |

| (125 | ) | |

| (0.1 | ) | |

| 317 | | |

| 0.3 | |

| GAIN

ON SALE OF BUSINESS | |

| 79 | | |

| 0.2 | | |

| - | | |

| - | | |

| 79 | | |

| 0.1 | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| NET EARNINGS

BEFORE INCOME TAX EXPENSE | |

| 804 | | |

| 2.4 | | |

| 851 | | |

| 2.5 | | |

| 2,606 | | |

| 2.3 | | |

| 1,902 | | |

| 1.7 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| INCOME

TAX EXPENSE | |

| 187 | | |

| 0.6 | | |

| 204 | | |

| 0.6 | | |

| 568 | | |

| 0.5 | | |

| 472 | | |

| 0.4 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| NET

EARNINGS INCLUDING NONCONTROLLING INTERESTS | |

| 617 | | |

| 1.8 | | |

| 647 | | |

| 1.9 | | |

| 2,038 | | |

| 1.8 | | |

| 1,430 | | |

| 1.3 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| NET

(LOSS) INCOME ATTRIBUTABLE TO NONCONTROLLING INTERESTS | |

| (1 | ) | |

| - | | |

| 1 | | |

| - | | |

| 7 | | |

| - | | |

| 2 | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| NET

EARNINGS ATTRIBUTABLE TO THE KROGER CO. | |

$ | 618 | | |

| 1.8 | % | |

$ | 646 | | |

| 1.9 | % | |

$ | 2,031 | | |

| 1.8 | % | |

$ | 1,428 | | |

| 1.3 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| NET

EARNINGS ATTRIBUTABLE TO THE KROGER CO. PER BASIC COMMON SHARE | |

$ | 0.85 | | |

| | | |

$ | 0.89 | | |

| | | |

$ | 2.79 | | |

| | | |

$ | 1.97 | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| AVERAGE NUMBER

OF COMMON SHARES USED IN BASIC CALCULATION | |

| 723 | | |

| | | |

| 719 | | |

| | | |

| 722 | | |

| | | |

| 718 | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| NET EARNINGS

ATTRIBUTABLE TO THE KROGER CO. PER DILUTED COMMON SHARE | |

$ | 0.84 | | |

| | | |

$ | 0.88 | | |

| | | |

$ | 2.77 | | |

| | | |

$ | 1.95 | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| AVERAGE NUMBER

OF COMMON SHARES USED IN DILUTED CALCULATION | |

| 728 | | |

| | | |

| 725 | | |

| | | |

| 728 | | |

| | | |

| 725 | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| DIVIDENDS

DECLARED PER COMMON SHARE | |

$ | 0.32 | | |

| | | |

$ | 0.29 | | |

| | | |

$ | 0.93 | | |

| | | |

$ | 0.84 | | |

| | |

| Note: |

Certain percentages may not sum due to rounding. |

| Note: |

The Company defines First-In First-Out (FIFO) gross profit

as sales minus merchandise costs, including advertising, warehousing and transportation, but excluding the Last-In First-Out (LIFO)

charge. |

| |

The Company defines FIFO gross margin as FIFO gross profit

divided by sales. |

| |

|

| |

The Company defines FIFO operating profit as operating

profit excluding the LIFO charge. |

| |

|

| |

The Company defines FIFO operating margin as FIFO operating

profit divided by sales. |

| |

|

| |

The above FIFO financial metrics are important measures

used by management to evaluate operational effectiveness. Management believes these FIFO financial metrics are useful to investors

and analysts because they measure our day-to-day operational effectiveness. |

| (a) |

Merchandise costs ("COGS") and operating, general

and administrative expenses ("OG&A") exclude depreciation and amortization expense and rent expense which are included

in separate expense lines. |

| (b) |

LIFO charges of $4 and $29 were recorded in the third

quarters of 2024 and 2023, respectively. For the year-to-date period, LIFO charges of $66 and $131 were recorded for 2024

and 2023, respectively. |

Table

2.

THE

KROGER CO.

CONSOLIDATED

BALANCE SHEETS

(in

millions)

(unaudited)

| | |

November 9, | | |

November 4, | |

| | |

2024 | | |

2023 | |

| ASSETS | |

| | |

| |

| Current Assets | |

| | | |

| | |

| Cash | |

$ | 235 | | |

$ | 254 | |

| Temporary cash investments | |

| 13,123 | | |

| 1,471 | |

| Store deposits in-transit | |

| 1,082 | | |

| 1,197 | |

| Receivables | |

| 2,193 | | |

| 1,938 | |

| Inventories | |

| 7,585 | | |

| 7,931 | |

| Prepaid and other current assets | |

| 807 | | |

| 648 | |

| | |

| | | |

| | |

| Total current assets | |

| 25,025 | | |

| 13,439 | |

| | |

| | | |

| | |

| Property, plant and equipment, net | |

| 25,698 | | |

| 24,882 | |

| Operating lease assets | |

| 6,829 | | |

| 6,752 | |

| Intangibles, net | |

| 865 | | |

| 890 | |

| Goodwill | |

| 2,674 | | |

| 2,916 | |

| Other assets | |

| 1,327 | | |

| 2,142 | |

| | |

| | | |

| | |

| Total Assets | |

$ | 62,418 | | |

$ | 51,021 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREOWNERS' EQUITY | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Current portion of long-term debt including

obligations under finance leases | |

$ | 187 | | |

$ | 724 | |

| Current portion of operating lease

liabilities | |

| 667 | | |

| 668 | |

| Accounts payable | |

| 10,521 | | |

| 10,748 | |

| Accrued salaries and wages | |

| 1,185 | | |

| 1,177 | |

| Other current liabilities | |

| 3,714 | | |

| 3,468 | |

| | |

| | | |

| | |

| Total current liabilities | |

| 16,274 | | |

| 16,785 | |

| | |

| | | |

| | |

| Long-term debt including obligations under finance leases | |

| 22,414 | | |

| 12,039 | |

| Noncurrent operating lease liabilities | |

| 6,512 | | |

| 6,408 | |

| Deferred income taxes | |

| 1,556 | | |

| 1,506 | |

| Pension and postretirement benefit obligations | |

| 371 | | |

| 387 | |

| Other long-term liabilities | |

| 2,397 | | |

| 2,705 | |

| | |

| | | |

| | |

| Total Liabilities | |

| 49,524 | | |

| 39,830 | |

| | |

| | | |

| | |

| Shareowners' equity | |

| 12,894 | | |

| 11,191 | |

| | |

| | | |

| | |

| Total Liabilities and Shareowners' Equity | |

$ | 62,418 | | |

$ | 51,021 | |

| | |

| | | |

| | |

| Total common shares outstanding at end of period | |

| 724 | | |

| 719 | |

| Total diluted shares year-to-date | |

| 728 | | |

| 725 | |

| Note: |

The Company reclassified $2.6 billion of liabilities

from other current liabilities to accounts payable on the Consolidated Balance Sheet for the quarter ended November 4, 2023 to

conform to the current year presentation. This reclassification was made to the Consolidated Balance Sheet to more accurately present

these current liabilities. A similar reclassification was made to the Consolidated Statement of Cash Flows resulting in a change to

accounts payable and accrued expenses within net cash provided by operating activities for the quarter ended November 4, 2023.

|

Table

3.

THE

KROGER CO.

CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in

millions)

(unaudited)

| | |

YEAR-TO-DATE | |

| | |

2024 | | |

2023 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net earnings including noncontrolling interests | |

$ | 2,038 | | |

$ | 1,430 | |

| Adjustments to reconcile net earnings

including noncontrolling interests to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 2,486 | | |

| 2,396 | |

| Operating lease asset amortization | |

| 465 | | |

| 472 | |

| LIFO charge | |

| 66 | | |

| 131 | |

| Stock-based employee compensation | |

| 133 | | |

| 124 | |

| Deferred income taxes | |

| 9 | | |

| (261 | ) |

| Gain on the sale of assets | |

| (8 | ) | |

| (45 | ) |

| Gain on sale of business | |

| (79 | ) | |

| - | |

| Loss (gain) on investments | |

| 125 | | |

| (317 | ) |

| Other | |

| 29 | | |

| 120 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Store deposits in-transit | |

| 134 | | |

| (70 | ) |

| Receivables | |

| (238 | ) | |

| 133 | |

| Inventories | |

| (662 | ) | |

| (502 | ) |

| Prepaid and other current assets | |

| (204 | ) | |

| 45 | |

| Accounts payable | |

| 578 | | |

| 991 | |

| Accrued expenses | |

| 77 | | |

| (387 | ) |

| Income taxes receivable and payable | |

| 28 | | |

| 148 | |

| Operating lease liabilities | |

| (451 | ) | |

| (539 | ) |

| Other | |

| (136 | ) | |

| 999 | |

| | |

| | | |

| | |

| Net cash provided by operating activities | |

| 4,390 | | |

| 4,868 | |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Payments for property and equipment, including payments for

lease buyouts | |

| (3,133 | ) | |

| (2,907 | ) |

| Proceeds from sale of assets | |

| 310 | | |

| 94 | |

| Net proceeds from sale of business | |

| 464 | | |

| - | |

| Other | |

| (43 | ) | |

| 68 | |

| | |

| | | |

| | |

| Net cash used by investing activities | |

| (2,402 | ) | |

| (2,745 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Proceeds from issuance of long-term debt | |

| 10,499 | | |

| - | |

| Payments on long-term debt including obligations under finance

leases | |

| (145 | ) | |

| (755 | ) |

| Dividends paid | |

| (651 | ) | |

| (586 | ) |

| Financing fees paid | |

| (116 | ) | |

| - | |

| Proceeds from issuance of capital stock | |

| 106 | | |

| 42 | |

| Treasury stock purchases | |

| (125 | ) | |

| (54 | ) |

| Other | |

| (81 | ) | |

| (60 | ) |

| | |

| | | |

| | |

| Net cash provided (used) by financing

activities | |

| 9,487 | | |

| (1,413 | ) |

| | |

| | | |

| | |

| NET INCREASE IN CASH AND TEMPORARY CASH INVESTMENTS | |

| 11,475 | | |

| 710 | |

| | |

| | | |

| | |

| CASH AND TEMPORARY CASH INVESTMENTS: | |

| | | |

| | |

| BEGINNING OF YEAR | |

| 1,883 | | |

| 1,015 | |

| END OF PERIOD | |

$ | 13,358 | | |

$ | 1,725 | |

| | |

| | | |

| | |

| Reconciliation of capital investments: | |

| | | |

| | |

| Payments for property and equipment, including payments for

lease buyouts | |

$ | (3,133 | ) | |

$ | (2,907 | ) |

| Payments for lease buyouts | |

| 46 | | |

| - | |

| Changes in construction-in-progress payables | |

| 271 | | |

| 421 | |

| Total capital investments, excluding lease

buyouts | |

$ | (2,816 | ) | |

$ | (2,486 | ) |

| | |

| | | |

| | |

| Disclosure of cash flow information: | |

| | | |

| | |

| Cash paid during the year for net interest | |

$ | 168 | | |

$ | 380 | |

| Cash paid during the year for income taxes | |

$ | 526 | | |

$ | 579 | |

Table

4. Supplemental Sales Information

(in

millions, except percentages)

(unaudited)

Items identified below should not be considered

as alternatives to sales or any other GAAP measure of performance. Identical sales is an industry-specific measure, and it

is important to review it in conjunction with Kroger's financial results reported in accordance with GAAP. Other companies

in our industry may calculate identical sales differently than Kroger does, limiting the comparability of the measure.

IDENTICAL

SALES (a)

| | |

THIRD QUARTER | |

YEAR-TO-DATE |

| | |

2024 | |

2023 | |

2024 | |

2023 |

| EXCLUDING FUEL | |

$ | 29,470 | | |

$ | 28,818 | | |

$ | 97,595 | | |

$ | 96,397 | |

| | |

| | | |

| | | |

| | | |

| | |

| EXCLUDING FUEL | |

| 2.3 | % | |

| (0.6 | )% | |

| 1.2 | % | |

| 1.5 | % |

| (a) |

Kroger defines identical sales, excluding fuel, as sales

to retail customers, including sales from all departments at identical supermarket locations, Kroger Specialty Pharmacy businesses,

jewelry and ship-to-home solutions. Kroger defines a supermarket as identical when it has been in operation without expansion

or relocation for five full quarters. Kroger defines Kroger Specialty Pharmacy businesses as identical when physical locations

have been in operation continuously for five full quarters and discontinued patient therapies are excluded from the identical sales

calculation starting in the quarter of transfer or termination. We include Kroger Delivery sales powered by Ocado as identical

if the delivery occurs in an existing Kroger Supermarket geography or when the location has been in operation for five full quarters.

Starting in the first quarter of 2024, Kroger Specialty Pharmacy businesses were not included in identical sales due to being classified

as held for sale, while they were included in identical sales in the third quarter and year-to-date periods of 2023. |

Table

5. Reconciliation of Net Total Debt and

Net

Earnings Attributable to The Kroger Co. to Adjusted EBITDA

(in

millions, except for ratio)

(unaudited)

The

items identified below should not be considered an alternative to any GAAP measure of performance or access to liquidity. Net

total debt to adjusted EBITDA is an important measure used by management to evaluate the Company's access to liquidity. The

items below should be reviewed in conjunction with Kroger's financial results reported in accordance with GAAP.

The

following table provides a reconciliation of net total debt.

| | |

November 9, | | |

November 4, | | |

| |

| | |

2024 | | |

2023 | | |

Change | |

| Current portion of long-term debt including obligations

under finance leases | |

$ | 187 | | |

$ | 724 | | |

$ | (537 | ) |

| Long-term debt including obligations

under finance leases (a) | |

| 22,414 | | |

| 12,039 | | |

| 10,375 | |

| | |

| | | |

| | | |

| | |

| Total debt | |

| 22,601 | | |

| 12,763 | | |

| 9,838 | |

| | |

| | | |

| | | |

| | |

| Less: Temporary cash investments (a) | |

| 13,123 | | |

| 1,471 | | |

| 11,652 | |

| | |

| | | |

| | | |

| | |

| Net total debt | |

$ | 9,478 | | |

$ | 11,292 | | |

$ | (1,814 | ) |

The following table provides a reconciliation

from net earnings attributable to The Kroger Co. to adjusted EBITDA, as defined in the Company's credit agreement, on a rolling four

quarter 52-week basis.

| | |

ROLLING FOUR

QUARTERS ENDED | |

| | |

November 9, | | |

November 4, | |

| | |

2024 | | |

2023 | |

| Net earnings attributable to The Kroger Co. | |

$ | 2,767 | | |

$ | 1,878 | |

| LIFO charge | |

| 48 | | |

| 365 | |

| Depreciation and amortization | |

| 3,215 | | |

| 3,102 | |

| Net Interest expense | |

| 394 | | |

| 454 | |

| Income tax expense | |

| 763 | | |

| 643 | |

| Adjustment for pension plan withdrawal liabilities | |

| - | | |

| 25 | |

| Adjustment for loss (gain) on investments | |

| 290 | | |

| (225 | ) |

| Adjustment for Home Chef contingent consideration | |

| - | | |

| 2 | |

| Adjustment for merger related costs (b) | |

| 646 | | |

| 203 | |

| Adjustment for opioid settlement charges | |

| - | | |

| 1,475 | |

| Adjustment for gain on sale of Kroger Specialty Pharmacy | |

| (79 | ) | |

| - | |

| Adjustment for goodwill and fixed asset impairment charges

related to Vitacost.com | |

| - | | |

| 164 | |

| 53rd week EBITDA adjustment | |

| (187 | ) | |

| - | |

| Other | |

| (12 | ) | |

| (8 | ) |

| | |

| | | |

| | |

| Adjusted EBITDA | |

$ | 7,845 | | |

$ | 8,078 | |

| | |

| | | |

| | |

| Net total debt to adjusted EBITDA ratio

on a 52-week basis | |

| 1.21 | | |

| 1.40 | |

| (a) |

$4.7 billion of debt subject to a special mandatory redemption issued in the third quarter of 2024 is included in long-term debt including

obligations under finance leases and temporary cash investments. |

| |

|

| (b) |

Merger related costs primarily include third party professional

fees and credit facility fees associated with the proposed merger with Albertsons Companies, Inc. |

Table

6. Net Earnings Per Diluted Share Excluding the Adjustment Items

(in

millions, except per share amounts)

(unaudited)

The purpose of this table is to better

illustrate comparable operating results from our ongoing business, after removing the effects on net earnings per diluted common share

for certain items described below. Adjusted net earnings and adjusted net earnings per diluted share are useful metrics to

investors and analysts because they present more accurately year-over-year comparisons for net earnings and net earnings per diluted

share because adjusted items are not the result of normal operations. Items identified in this table should not be considered

alternatives to net earnings attributable to The Kroger Co. or any other GAAP measure of performance. These items should not

be reviewed in isolation or considered substitutes for the Company's financial results as reported in accordance with GAAP. Due

to the nature of these items, as further described below, it is important to identify these items and to review them in conjunction with

the Company's financial results reported in accordance with GAAP.

The

following table summarizes items that affected the Company's financial results during the periods presented.

| | |

THIRD QUARTER | | |

YEAR-TO-DATE | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net earnings attributable to The Kroger Co. | |

$ | 618 | | |

$ | 646 | | |

$ | 2,031 | | |

$ | 1,428 | |

| | |

| | | |

| | | |

| | | |

| | |

| Adjustment for loss (gain) on investments (a)(b) | |

| 16 | | |

| (21 | ) | |

| 96 | | |

| (244 | ) |

| Adjustment for merger related costs (a)(c) | |

| 145 | | |

| 73 | | |

| 411 | | |

| 153 | |

| Adjustment for opioid settlement charges (a)(d) | |

| - | | |

| - | | |

| - | | |

| 1,163 | |

| Adjustment for gain on sale of Kroger Specialty Pharmacy (a)(e) | |

| (60 | ) | |

| - | | |

| (60 | ) | |

| - | |

| Held for sale income tax adjustment | |

| - | | |

| - | | |

| (31 | ) | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| 2024 and 2023 Adjustment Items | |

| 101 | | |

| 52 | | |

| 416 | | |

| 1,072 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net earnings attributable to The Kroger Co. excluding the adjustment

items above | |

$ | 719 | | |

$ | 698 | | |

$ | 2,447 | | |

$ | 2,500 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net earnings attributable to The Kroger Co. per diluted common share | |

$ | 0.84 | | |

$ | 0.88 | | |

$ | 2.77 | | |

$ | 1.95 | |

| | |

| | | |

| | | |

| | | |

| | |

| Adjustment for loss (gain) on investments (f) | |

| 0.02 | | |

| (0.03 | ) | |

| 0.13 | | |

| (0.34 | ) |

| Adjustment for merger related costs (f) | |

| 0.20 | | |

| 0.10 | | |

| 0.56 | | |

| 0.21 | |

| Adjustment for opioid settlement charges (f) | |

| - | | |

| - | | |

| - | | |

| 1.60 | |

| Adjustment for gain on sale of Kroger Specialty Pharmacy (f) | |

| (0.08 | ) | |

| - | | |

| (0.08 | ) | |

| - | |

| Held for sale income tax adjustment (f) | |

| - | | |

| - | | |

| (0.04 | ) | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| 2024 and 2023 Adjustment Items | |

| 0.14 | | |

| 0.07 | | |

| 0.57 | | |

| 1.47 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net earnings attributable

to The Kroger Co. per diluted common share excluding the adjustment items above | |

$ | 0.98 | | |

$ | 0.95 | | |

$ | 3.34 | | |

$ | 3.42 | |

| | |

| | | |

| | | |

| | | |

| | |

| Average number of common shares used in diluted calculation | |

| 728 | | |

| 725 | | |

| 728 | | |

| 725 | |

Table

6. Net Earnings Per Diluted Share Excluding the Adjustment Items (continued)

(in

millions, except per share amounts)

(unaudited)

| (a) |

The amounts presented represent the after-tax effect

of each adjustment. |

| |

|

| (b) |

The pre-tax adjustments for loss (gain) on investments

were $20 and ($27) in the third quarters of 2024 and 2023, respectively. The year-to-date pre-tax adjustments for loss (gain) on investments

were $125 and ($317) in the first three quarters of 2024 and 2023, respectively. |

| |

|

| (c) |

The pre-tax adjustments to OG&A expenses for merger-related

costs were $186 and $84 in the third quarters of 2024 and 2023, respectively. The year-to-date pre-tax adjustments to OG&A expenses

for merger-related costs were $509 and $178 in the first three quarters of 2024 and 2023, respectively. |

| |

|

| (d) |

The year-to-date pre-tax adjustments to OG&A expenses

for opioid settlement charges was $1,475 in the first three quarters of 2023. |

| |

|

| (e) |

The pre-tax adjustment for gain on sale of Kroger Specialty

Pharmacy was ($79). |

| |

|

| (f) |

The amounts presented represent the net earnings (loss)

per diluted common share effect of each adjustment. |

| |

|

| Note: |

2024 Third Quarter Adjustment Items include adjustments

for the loss on investments, merger related costs and the gain on sale of Kroger Specialty Pharmacy. |

| |

|

| |

2024 Adjustment Items include the Third Quarter Ajustment

Items plus the adjustments that occurred in the first two quarters of 2024 for loss on investments, merger related costs and held for

sale income tax. |

| |

|

| |

2023 Third Quarter Adjustment Items include adjustments

for the gain on investments and merger related costs. |

| |

|

| |

2023 Adjustment Items include the Third Quarter Adjustment

Items plus the adjustments that occurred in the first two quarters of 2023 for gain on investments, merger related costs and opioid

settlement charges. |

Table

7. Operating Profit Excluding the Adjustment Items

(in

millions)

(unaudited)

The

purpose of this table is to better illustrate comparable operating results from our ongoing business, after removing the effects on operating

profit for certain items described below. Adjusted FIFO operating profit is a useful metric to investors and analysts because

it presents more accurately year-over-year comparisons for operating profit because adjusted items are not the result of normal operations. Items

identified in this table should not be considered alternatives to operating profit or any other GAAP measure of performance. These

items should not be reviewed in isolation or considered substitutes for the Company's financial results as reported in accordance with

GAAP. Due to the nature of these items, as further described below, it is important to identify these items and to review

them in conjunction with the Company's financial results reported in accordance with GAAP.

The

following table summarizes items that affected the Company's financial results during the periods presented.

| | |

THIRD QUARTER | | |

YEAR-TO-DATE | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Operating profit | |

$ | 828 | | |

$ | 912 | | |

$ | 2,937 | | |

$ | 1,902 | |

| LIFO charge | |

| 4 | | |

| 29 | | |

| 66 | | |

| 131 | |

| | |

| | | |

| | | |

| | | |

| | |

| FIFO Operating profit | |

| 832 | | |

| 941 | | |

| 3,003 | | |

| 2,033 | |

| | |

| | | |

| | | |

| | | |

| | |

| Adjustment for merger related costs (a) | |

| 186 | | |

| 84 | | |

| 509 | | |

| 178 | |

| Adjustment for opioid settlement charges | |

| - | | |

| - | | |

| - | | |

| 1,475 | |

| Other | |

| (1 | ) | |

| (3 | ) | |

| (12 | ) | |

| (6 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| 2024 and 2023 Adjustment items | |

| 185 | | |

| 81 | | |

| 497 | | |

| 1,647 | |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted FIFO operating profit excluding the adjustment items

above | |

$ | 1,017 | | |

$ | 1,022 | | |

$ | 3,500 | | |

$ | 3,680 | |

| (a) |

Merger related costs primarily include third party professional

fees and credit facility fees associated with the proposed merger with Albertsons Companies, Inc. |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

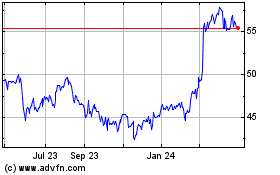

Kroger (NYSE:KR)

Historical Stock Chart

From Dec 2024 to Jan 2025

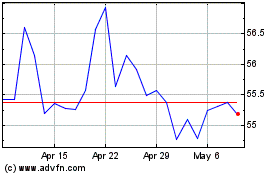

Kroger (NYSE:KR)

Historical Stock Chart

From Jan 2024 to Jan 2025