UPDATE: Posco, Kepco Bid For Anglo American Coal Assets -Sources

July 01 2010 - 2:19AM

Dow Jones News

A South Korean consortium of Posco (005490.SE) and Korea

Electric Power Corp. (015760.SE), known as Kepco, is bidding for

two Australian coal assets being sold by Anglo American PLC

(AAL.LN), people familiar with the matter said.

Posco, the world's fourth-largest steelmaker by output, and

state-run Kepco are bidding for the Bylong and Sutton Forest

exploration assets in the Sydney Basin of New South Wales state,

said the people, declining to be named.

The move shows that North Asian steelmakers and power generators

are continuing to bid aggressively for overseas coal assets that

have access to infrastructure such as ports, from where mined

volumes can be shipped home to meet booming demand.

It also demonstrates that neither a 40% mining profits tax

proposed by Australia's governing Labor Party nor a sharp increase

in the valuations of local coal assets over the past year are

deterring interest from buyers.

"A consortium of Kepco and Posco is bidding for the coal assets"

but the outcome of the auction isn't known yet, said a Seoul-based

Kepco official, declining to be named.

Choi Doo-jin, a spokesman for Posco, said, "We are looking at

several opportunities for a stable supply of raw materials and this

is one of them.

A spokesman for Anglo American declined to comment.

Bylong has total resources of 420 million metric tons of low-ash

thermal coal--used for power generation--that could be extracted

via open-cut and underground mines, according to a flyer for the

sale issued by Anglo American earlier this year.

Sutton Forest is a smaller asset with an estimated 115 million

tons of coal, but is attractive because it could produce both

thermal coal and metallurgical coal, used in steelmaking.

Both assets are relatively close to railways leading to export

terminals on the coast--Sutton Forest is near Port Kembla and

Bylong is within reach of the port of Newcastle.

Anglo American is selling the assets because they do not form

part of its growth plans in the short-to-medium term. The company's

existing Australian coal mining operations are not affected by its

decision to sell exploration projects.

Goldman Sachs JBWere is advising Anglo American on the sales

process. It wasn't known how much Posco and Kepco are bidding for

each asset, or other financial terms.

State-owned Korean energy companies including Kepco have

invested a combined $4.5 billion last year in overseas resources

companies and energy development projects, bringing total spending

over the past 10 years to $9.48 billion, South Korea's Ministry of

Strategy and Finance said June 28.

These companies plan to expand investment this year to enhance

the country's energy self-sufficiency, the ministry said, without

providing a precise target.

On Thursday, Korea's SK Group said it would spend $14 billion on

the expansion of its operations by 2020, including acquisitions of

natural resources overseas.

Korean companies often form consortiums to bid for exploration

assets in order to pool finances and share risk.

Posco's self-sufficiency ratio for key raw materials including

coal currently stands around 20%, well below its bigger rival

ArcelorMittal's (MT) 46%. It aims to raise the ratio to more than

50% by 2014.

-By David Winning, Dow Jones Newswires; +61-2-82724688;

david.winning@dowjones.com

(Kyong-Ae Choi in Seoul contributed to this article)

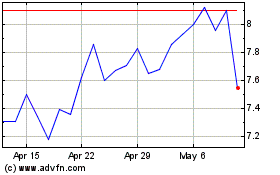

Korea Electric Power (NYSE:KEP)

Historical Stock Chart

From Oct 2024 to Nov 2024

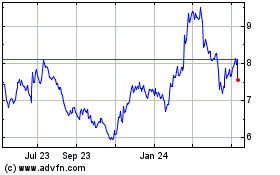

Korea Electric Power (NYSE:KEP)

Historical Stock Chart

From Nov 2023 to Nov 2024