0001315257false00013152572024-12-052024-12-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 05, 2024 |

KOPPERS HOLDINGS INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Pennsylvania |

1-32737 |

20-1878963 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

436 Seventh Avenue |

|

Pittsburgh, Pennsylvania |

|

15219 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (412) 227-2001 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock |

|

KOP |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.05 Costs Associated with Exit or Disposal Activities.

On December 5, 2024, Koppers Inc. (the “Company”), a wholly owned subsidiary of Koppers Holdings Inc., decided to discontinue phthalic anhydride production at the Company’s facility in Stickney, Illinois. The decision, affecting approximately 25 employees, was driven by significant near-term capital spending requirements that could not be economically justified by end-market projections and will substantially reduce annual emissions of certain regulated air contaminants. The Company has targeted a date of mid-2025 for shutdown and expects to ramp down production of phthalic anhydride over the next six months as it builds inventory to supply existing contracts through 2025, as necessary. The closure of the phthalic anhydride plant will not impact the Stickney facility’s coal tar distillation operations.

The Company expects this action to result in pre-tax charges to earnings of $51 to $55 million through the end of 2026, approximately $28 million of which constitutes non-cash charges and approximately $23 to $27 million of which constitutes cash expenditures. Estimates of the total pre-tax amount for each major type of cost associated with the discontinuation plan are: (i) retention and severance costs of approximately $1 million, (ii) accelerated depreciation and asset write-down costs of approximately $28 million, and (iii) plant cleaning, waste disposal and demolition costs of approximately $22 million to $26 million.

In connection with the foregoing, the Company issued a press release on December 5, 2024, a copy of which is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Safe Harbor Statement

The statements made in this Form 8-K regarding the amount and timing of the charge to earnings the Company expects to record, the estimates of the total costs expected for each major type of cost and the expected cash outlays constitute forward looking statements for purposes of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995. Actual results could differ materially from those expressed by these forward-looking statements as a result of various important factors, including, but not limited to, finalization of employee retention and severance arrangements; finalization of the accounting impact of the closure; higher than expected demolition, site clearing, environmental remediation or asset retirement costs; and other factors and risks discussed in the Company’s latest annual report on Form 10-K. In addition, the forward-looking statements represent estimates only as of today and should not be relied upon as representing estimates as of any subsequent date. The Company disclaims any obligation to update publicly any forward-looking statements, whether in response to new information, future events or otherwise, except as required by applicable law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: December 5, 2024

|

|

|

KOPPERS HOLDINGS INC. |

|

|

By: |

|

/s/ Jimmi Sue Smith |

|

|

Jimmi Sue Smith |

|

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

Koppers Holdings Inc. 436 Seventh Avenue

Pittsburgh, PA 15219-1800

Tel 412 227 2001

www.koppers.com |

News Release

FOR IMMEDIATE RELEASE

|

|

|

|

|

|

For Information: |

|

Quynh McGuire, Vice President, Investor Relations |

|

|

412 227 2049 |

|

|

McGuireQT@koppers.com |

Koppers Ceasing Phthalic Anhydride Operations at Stickney Facility

Consistent with Strategy to Optimize Business Portfolio and Enhance Free Cash Flow

PITTSBURGH, December 5, 2024 – Koppers Inc., a wholly-owned subsidiary of Koppers Holdings Inc. (NYSE: KOP), today announced that the company will discontinue phthalic anhydride production at its facility in Stickney, Illinois, in 2025.

The decision, affecting approximately 25 employees, was driven by significant near-term capital spending requirements that could not be economically justified by end-market projections. An ancillary benefit is an improvement in the site’s environmental footprint as annual emissions of certain regulated air contaminants are expected to be reduced by 50 to 70 percent.

Koppers has targeted mid-2025 for the shutdown and expects to ramp down production of phthalic anhydride over the next six months as the company builds inventory to supply existing contracts through 2025, as necessary. The closure of the phthalic anhydride plant will not impact Stickney’s coal tar distillation operations, which manufacture products including creosote, carbon pitch and pavement sealer base.

The phthalic anhydride plant at Stickney was constructed to consume naphthalene, a byproduct of the coal tar distillation process, as a feedstock to produce the chemical intermediate used to manufacture plasticizers, polyester resins, and alkyd paints. As availability of coal tar has declined, phthalic anhydride has become less profitable as lower naphthalene production resulted in a need to supplement production with a greater proportion of higher-cost third-party feedstock.

This action is expected to result in pre-tax charges to earnings of $51 million to $55 million through the end of 2026. Approximately $28 million constitutes non-cash charges anticipated to be recorded in 2024 and 2025 with approximately $23 million to $27 million over the next two years going toward cash expenditures, primarily for plant cleaning, waste disposal, and demolition costs. Ongoing operational and capital

expenditure savings have been incorporated into the company’s current 2025 goals of $300 million of adjusted EBITDA and $65 million to $75 million of capital expenditures.

Koppers CEO Leroy Ball said, “The decision to close the phthalic anhydride plant demonstrates our ongoing willingness to critically assess our portfolio and pivot from underperforming businesses when it is clear that improvement is not on the horizon. By focusing on our core strengths, we can continue to enhance our competitive position in healthier markets to drive better long-term returns. Ceasing operations at any plant is never easy, however, this will improve the performance, efficiency, and emissions profile at Stickney. I want to thank our dedicated employees who have worked hard over the years to serve our customers with quality products. I am mindful of the impact this decision has on them and am committed to ensuring that they are supported through this transition.”

###

About Koppers

Koppers (NYSE: KOP) is an integrated global provider of essential treated wood products, wood preservation technologies and carbon compounds. Our team of 2,200 employees create, protect and preserve key elements of our global infrastructure – including railroad crossties, utility poles, outdoor wooden structures, and production feedstocks for steel, aluminum and construction materials, among others – applying decades of industry-leading expertise while constantly innovating to anticipate the needs of tomorrow. Together we are providing safe and sustainable solutions to enable rail transportation, keep power flowing, and create spaces of enjoyment for people everywhere. Protecting What Matters, Preserving The Future. Learn more at Koppers.com.

Inquiries from the media should be directed to Ms. Jessica Franklin Black at BlackJF@koppers.com or 412-227-2025. Inquiries from the investment community should be directed to Ms. Quynh McGuire at McGuireQT@koppers.com or 412-227-2049.

Safe Harbor Statement

Certain statements in this press release are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and may include, but are not limited to, statements about sales levels, acquisitions, restructuring, declines in the value of Koppers assets and the effect of any resulting impairment charges, profitability and anticipated expenses and cash outflows. All forward-looking statements involve risks and uncertainties.

All statements contained herein that are not clearly historical in nature are forward-looking, and words such as “outlook,” “guidance,” “forecast,” “believe,” “anticipate,” “expect,” “estimate,” “may,” “will,” “should,” “continue,” “plan,” “potential,” “intend,” “likely,” or other similar words or phrases are generally intended to identify forward-looking statements. Any forward-looking statement contained herein, in other press releases, written statements or other documents filed with the Securities and Exchange Commission, or in Koppers communications and discussions with investors and analysts in the normal course of business through meetings, phone calls and conference calls, regarding future dividends, expectations with respect to sales, earnings, cash flows, operating efficiencies, restructurings, cost reduction efforts, the amount and timing of the charge to earnings Koppers expects to record, including the estimates of the total costs expected for each major type of cost and the expected cash outlays, the benefits of acquisitions, divestitures, joint ventures or other matters as well as financings and debt reduction, are subject to known and unknown risks, uncertainties and contingencies.

Many of these risks, uncertainties and contingencies are beyond our control, and may cause actual results, performance or achievements to differ materially from anticipated results, performance or achievements. Factors that might affect such forward-looking statements include, among other things, the impact of changes in commodity prices, such as oil and copper, on product margins; general economic and business conditions; potential difficulties in protecting our intellectual property; the ratings on our debt and our ability to repay or refinance our outstanding indebtedness as it matures; our ability to operate within the limitations of our debt covenants; unexpected business disruptions; potential delays in timing or changes to expected

benefits from cost reduction efforts; finalization of employee retention and severance arrangements; finalization of the accounting impact of the closure; higher than expected demolition, site clearing, environmental remediation or asset retirement costs; potential impairment of our goodwill and/or long-lived assets; demand for Koppers goods and services; competitive conditions; capital market conditions, including interest rates, borrowing costs and foreign currency rate fluctuations; availability and fluctuations in the prices of key raw materials; disruptions and inefficiencies in the supply chain; economic, political and environmental conditions in international markets; changes in laws; the impact of environmental laws and regulations; unfavorable resolution of claims against us, as well as those discussed more fully elsewhere in this release and in documents filed with the Securities and Exchange Commission by Koppers, particularly our latest annual report on Form 10-K and any subsequent filings by Koppers with the Securities and Exchange Commission. Any forward-looking statements in this release speak only as of the date of this release, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after that date or to reflect the occurrence of unanticipated events.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

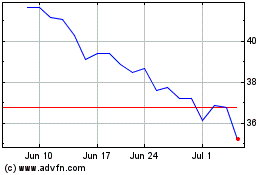

Koppers (NYSE:KOP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Koppers (NYSE:KOP)

Historical Stock Chart

From Dec 2023 to Dec 2024