KKR Names Todd Builione Global Head of Private Wealth

January 26 2022 - 7:00AM

Business Wire

Augments commitment to expanding access to

KKR’s investment strategies for individual investors

KKR today announced the appointment of Todd Builione as Global

Head of Private Wealth. In this newly created role, Mr. Builione

will oversee the firm’s strategic priority of building its private

wealth distribution platform to expand access to KKR’s alternative

investment strategies for individual investors globally.

As Global Head of Private Wealth, Mr. Builione will oversee

KKR’s regional private wealth leads Dan Parant and Doug Krupa in

the United States, Markus Egloff in APAC and Mark Tucker in EMEA,

as well as the newly created Global Private Wealth Product

Strategies effort led by Mr. Krupa. KKR’s private wealth team is an

integral part of the firm’s Client & Partner Group, led by Eric

Mogelof, and focuses on building high-quality, democratized

investment solutions to meet the needs of individual investors, as

well as growing the firm’s relationships with leading wirehouses,

private banks, independent/regional broker-dealers, registered

investment advisers (RIAs) and fintech platforms. The appointment

reinforces KKR’s commitment to serving the approximately $175

trillion global private wealth market by delivering customized

products and increased access to KKR’s investment strategies.i

Joe Bae and Scott Nuttall, Co-Chief Executive Officers of KKR,

said: “Over the past decade, Todd has led a number of KKR’s

important business priorities, including launching our strategic

partnership with Marshall Wace and being instrumental in the growth

of our Credit and Capital Markets businesses. We believe the

addition of a senior leader with a global focus will be additive to

the success of our global private wealth effort, a critical

component of our growth strategy and a big opportunity for the

firm.”

KKR currently manages approximately $50 billion in private

wealth assets through relationships with distribution partners and

a large network of Financial Advisors and RIAs. In recent years,

between 10 and 20 percent of new capital raised annually by KKR has

come from private wealth. This is expected to grow to 30 to 50

percent of annual fundraising over the next several years, driven

by investments the firm is making across sales and marketing,

distribution, technology, product creation and education, as well

as the continuation of KKR’s long history of investment success.

Today, KKR’s private equity, credit and real estate investment

strategies are accessible for individual investors through a suite

of KKR-sponsored and third-party continuously offered registered

funds.

“The combination of a low yield environment, new technology and

innovative investment structures is creating an inflection point in

the industry and we see individual investors poised to

significantly increase their allocations to alternatives in the

coming years,” said Eric Mogelof, Global Head of KKR’s Client &

Partner Group. “Todd’s extensive knowledge of KKR’s investment

strategies and embodiment of our culture make him the ideal partner

to lead our global private wealth effort, ensuring that all of our

investors continue to receive the best of what KKR has to

offer.”

Todd Builione joined KKR in 2013 and is a Partner who most

recently served as President of KKR Credit and Markets. In this

role, he helped lead the development of the firm’s credit business

and capital markets franchise. He also serves on the firm's

Distribution Heads Committee, Risk & Operations Committee and

Inclusion & Diversity Council. Mr. Builione serves on the Board

of Directors of Marshall Wace, a liquid alternatives provider in

which KKR is a strategic partner, and the Board of Directors of FS

KKR Capital Corp., a business development company which trades on

the NYSE. Prior to joining KKR, Mr. Builione served as President of

Highbridge Capital Management and CEO of Highbridge's hedge fund

business.

“I am excited to be a part of our global team focused on making

KKR’s investment strategies available to a broader group of

investors,” Mr. Builione said. “Alternative investments are an

important part of a diversified portfolio and individual investors

have historically been under allocated to private markets due to

the structural barriers to entry. As we continue to build our

private wealth platform we will continue to maintain the same

commitment to thoughtful product development and exceptional client

service that has been critical to KKR’s success for more than four

decades.”

About KKR

KKR is a leading global investment firm that offers alternative

asset management as well as capital markets and insurance

solutions. KKR aims to generate attractive investment returns by

following a patient and disciplined investment approach, employing

world-class people, and supporting growth in its portfolio

companies and communities. KKR sponsors investment funds that

invest in private equity, credit and real assets and has strategic

partners that manage hedge funds. KKR’s insurance subsidiaries

offer retirement, life and reinsurance products under the

management of The Global Atlantic Financial Group. References to

KKR’s investments may include the activities of its sponsored funds

and insurance subsidiaries. For additional information about KKR

& Co. Inc. (NYSE: KKR), please visit KKR’s website at

www.kkr.com and on Twitter @KKR_Co.

i Source: PwC Asset & Wealth Management Revolution:

Embracing Exponential Change

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220125006274/en/

Media Miles Radcliffe-Trenner 212-750-8300

media@kkr.com

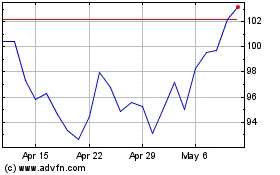

KKR (NYSE:KKR)

Historical Stock Chart

From Oct 2024 to Nov 2024

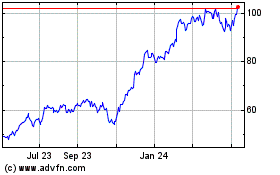

KKR (NYSE:KKR)

Historical Stock Chart

From Nov 2023 to Nov 2024