KKR Enhances Focus on Renewables Investing with Appointments to Global Infrastructure Team

April 12 2021 - 7:00AM

Business Wire

KKR, a leading global investment firm, today announced three

appointments to the firm’s Global Infrastructure team. Energy

transition industry veterans Tim Short and Benoit Allehaut joined

the firm as Managing Directors and Benjamin Droz as a Principal.

Based in New York, Messrs. Short, Allehaut and Droz will focus on

sourcing renewable energy and energy transition investments in

North America.

“KKR is committed to investing in the energy transition, an

initiative only made possible by increasing renewable energy

sources. We are eager to continue investing behind this effort and

thrilled to add three experienced and talented executives to our

team,” said Raj Agrawal, KKR Partner and Global Head of

Infrastructure.

Messrs. Short, Allehaut, and Droz join KKR from Capital

Dynamics, where Mr. Short and Mr. Allehaut served as Managing

Directors of the firm’s dedicated Clean Energy Infrastructure team,

and where Mr. Droz served as a Vice President. At Capital Dynamics,

Mr. Short and Mr. Allehaut played instrumental roles in building

and leading a vertically-integrated clean energy investment

platform, executing approximately $14.5 billion in investments and

building one of the largest private portfolios of solar energy

generation in the U.S.

“Tim, Benoit and Ben’s deep expertise and experience in

renewables, storage and electrification will greatly contribute to

our investments in support of a clean energy future,” said Brandon

Freiman, KKR Partner and Head of North American Infrastructure.

KKR has been an active investor in renewables investing over the

last ten years, executing approximately $19.5 billion in

investments in renewable assets with a power generation capacity of

12.5 GW. Over the past 12 months, KKR’s infrastructure team has

made a number of investments behind this theme globally, including

recent investments in or partnerships with Caruna, Finland’s

largest electricity distribution company, NextEra Energy, the

world’s largest generator of energy from the wind and sun,

Virescent Infrastructure, a newly created platform to acquire

renewable energy assets in India, and First Gen, one of the

Philippines’ largest independent power producers.

KKR first established its Global Infrastructure strategy in 2008

and has since been one of the most active infrastructure investors

around the world with a team of more than 50 dedicated investment

professionals. The firm currently manages over $27 billion in

infrastructure assets and has made over 40 infrastructure

investments across a range of sub-sectors and geographies.

About KKR

KKR is a leading global investment firm that offers alternative

asset management and capital markets and insurance solutions. KKR

aims to generate attractive investment returns by following a

patient and disciplined investment approach, employing world-class

people and supporting growth in its portfolio companies and

communities. KKR sponsors investment funds that invest in private

equity, credit and real assets and has strategic partners that

manage hedge funds. KKR’s insurance subsidiaries offer retirement,

life and reinsurance products under the management of The Global

Atlantic Financial Group. References to KKR’s investments may

include the activities of its sponsored funds and insurance

subsidiaries. For additional information about KKR & Co. Inc.

(NYSE: KKR), please visit KKR’s website at www.kkr.com and on

Twitter @KKR_Co.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210412005123/en/

Cara Major or Miles Radcliffe-Trenner media@kkr.com

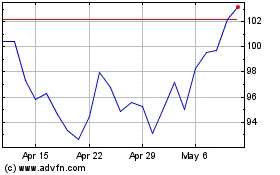

KKR (NYSE:KKR)

Historical Stock Chart

From Oct 2024 to Nov 2024

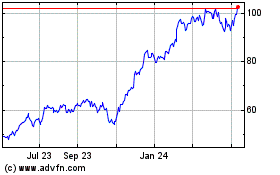

KKR (NYSE:KKR)

Historical Stock Chart

From Nov 2023 to Nov 2024