- Generated third quarter net income of $43.1 million and

Adjusted EBITDA1 of $215.3 million

- Achieved quarterly gas processed volumes of 1.49 Bcf/d, up 23%

year-over-year

- Updated the Company’s 2023 Adjusted EBITDA1 Guidance range to

$820 million to $860 million

- 2023 Capital Expenditures expected to be at the top end of the

Company’s Guidance range of $490 million to $540 million

Kinetik Holdings Inc. (NYSE: KNTK) (“Kinetik” or the

“Company”) today reported financial results for the quarter

ended September 30, 2023.

Third Quarter 2023 Results and

Commentary

For the three and nine months ended September 30, 2023, Kinetik

processed natural gas volumes of 1.49 Bcf/d and 1.44 Bcf/d,

respectively, and reported net income including noncontrolling

interest of $43.1 million and $119.1 million, respectively.

Kinetik generated Adjusted EBITDA1 of $215.3 million and $610.8

million for the three and nine months ended September 30, 2023,

respectively, Distributable Cash Flow1 of $148.1 million and $418.8

million for the three and nine months ended September 30, 2023,

respectively, and Free Cash Flow1 of $36.8 million and $(17.0)

million for the three and nine months ended September 30, 2023,

respectively.

“2023 continues to be a seminal year for our Company as we

execute on our capital program that underscores our long-term

strategic vision,” said Jamie Welch, Kinetik’s President &

Chief Executive Officer. “In the third quarter, we achieved

processed gas volumes of 1.49 Bcf/d, representing 23% growth

year-over-year. Adjusted EBITDA1 increased 4% quarter-over-quarter,

despite weather-related challenges in July and August and some

unexpected downstream pipeline outages for multiple days throughout

the quarter.”

“We made significant progress on our 2023 capital program during

the quarter. Construction continued across the state line on our

expansion into Lea County, New Mexico with right-of-way approval

for the route received. The expansion, which is supported by

multi-year agreements with minimum volume commitments, remains

ahead of schedule with expected in-service in the first quarter of

2024. We completed construction of the Delaware Link pipeline in

September and reached commercial in-service on October 1, 2023.

These two projects, coupled with the Permian Highway Pipeline

(“PHP”) expansion nearing completion, enable Kinetik to

offer Delaware Basin producers a highly-competitive, integrated

wellhead-to-Gulf Coast market solution.”

“Looking ahead, we are on track to achieve our 2023 exit rate

guidance of 1.6 Bcf/d of gas processed volumes. We forecast

sequential Adjusted EBITDA1 and volume growth in the fourth quarter

at our Midstream Logistics segment. Within our Pipeline

Transportation segment, the Delaware Link pipeline is in-service,

and we expect the start-up of the PHP expansion in December. As a

result, we have tightened our 2023 Adjusted EBITDA1 Guidance

range.”

“In 2024, we estimate meaningful year-over-year Adjusted EBITDA1

growth combined with a capital expenditures plan of less than $150

million, demonstrating the attractive Free Cash Flow1 potential of

our asset base.”

Financial

a. Achieved quarterly net income of $43.1 million and Adjusted

EBITDA1 of $215.3 million.

b. Declared a dividend of $0.75 per share for the quarter ended

September 30, 2023, or $3.00 per share on an annualized basis. 118

million shares have elected to reinvest the third quarter dividend

into newly issued shares of Class A common stock. As a result,

$23.3 million of third quarter dividends will be paid in cash.2

c. Exited the quarter with a Leverage Ratio1,3 per the Company’s

Revolving Credit Agreement of 4.0x and a Net Debt to Adjusted

EBITDA1,4 Ratio of 4.4x.

d. Generated Free Cash Flow1 of $36.8 million, marking the end

of the Company’s elevated capital intensity of its 2023 growth

Capital Expenditure program.

e. Hedged approximately 25% of its 2024 commodity-linked gross

profit exposure.

Selected Key Metrics:

Three Months Ended September

30,

Nine Months Ended September

30,

2023

2023

(In thousands, except shares

and ratios)

Net income including noncontrolling

interest5

$

43,131

$

119,098

Adjusted EBITDA1

$

215,324

$

610,825

Distributable Cash Flow1

$

148,053

$

418,794

Dividend Coverage Ratio1,6

1.3x

1.2x

Free Cash Flow1

$

36,805

$

(16,986

)

Leverage Ratio1,3

4.0x

Net Debt to Adjusted EBITDA Ratio1,4

4.4x

Common stock issued and outstanding7

148,608,696

September 30, 2023

June 30, 2023

March 31, 2022

(In thousands)

Net Debt1,8

$

3,629,932

$

3,647,763

$

3,535,016

Strategic

a. Kinetik’s Commercial team continued to expand gathering and

processing services with both new and existing customers around the

Company’s system in the Delaware Basin including new opportunities

in both Texas and New Mexico.

b. Continue to evaluate monetizing the Company’s stake in Gulf

Coast Express pipeline.

Growth Projects

a. Completion of Delaware Link, Kinetik’s 30-inch residue gas

pipeline from its processing complexes to Waha with an initial

throughput capacity of 1 Bcf/d, achieved ahead of schedule.

Commercial in-service started on October 1, 2023.

b. Kinetik’s New Mexico system expansion into Lea County remains

on budget and construction is ahead of schedule with expected

in-service at the beginning of 2024.

c. Construction is nearly complete on the PHP expansion of 550

MMcf/d of incremental capacity, increasing natural gas deliveries

from the Permian to U.S. Gulf Coast markets. The project is

expected to be in-service on December 1, 2023.

Sustainability

a. Kinetik’s ESG rating was upgraded to AA by MSCI.

b. Kinetik was awarded a 2023 New Technology Implementation

Grant by The Texas Commission on Environmental Quality and Texas

Emissions Reduction Plan. The grant supports the implementation of

new technologies that reduce emissions.

Upcoming Tour Dates

Kinetik plans to participate at the following upcoming

conferences and events:

a. Bank of America Global Energy Conference in Houston on

November 14th

b. Bank of America Leveraged Finance Conference in Boca Raton on

November 29th

c. Mizuho Power, Energy & Infrastructure Conference in New

York City on December 5th

d. Wells Fargo Midstream and Utilities Symposium in New York

City on December 6th

e. Goldman Sachs Global Energy Conference in Miami on January

3rd – 5th

f. UBS Global Energy & Utilities Conference in Park City on

January 8th – 10th

g. USCA Midstream Corporate Access Day in Houston on January

23rd

Investor Presentation

An updated investor presentation will be available under Events

and Presentations in the Investors section of the Company’s website

at www.ir.kinetik.com.

Conference Call and

Webcast

Kinetik will host its third quarter 2023 results conference call

on Thursday, November 9, 2023 at 8:00 am Central Standard Time

(9:00 am Eastern Standard Time) to discuss third quarter results.

To access a live webcast of the conference call, please visit the

Investors section of Kinetik’s website at www.ir.kinetik.com. A

replay of the conference call also will be available on the website

following the call.

About Kinetik Holdings

Inc.

Kinetik is a fully integrated, pure-play, Permian-to-Gulf Coast

midstream C-corporation operating in the Delaware Basin. Kinetik is

headquartered in Midland, Texas and has a significant presence in

Houston, Texas. Kinetik provides comprehensive gathering,

transportation, compression, processing and treating services for

companies that produce natural gas, natural gas liquids, crude oil

and water. Kinetik posts announcements, operational updates,

investor information and press releases on its website,

www.kinetik.com.

Forward-looking

statements

This news release includes certain statements that may

constitute “forward-looking statements” for purposes of the federal

securities laws. Forward-looking statements include, but are not

limited to, statements that refer to projections, forecasts or

other characterizations of future events or circumstances,

including any underlying assumptions. The words “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “intends,”

“may,” “might,” “plan,” “seeks,” “possible,” “potential,”

“predict,” “project,” “prospects,” “guidance,” “outlook,” “should,”

“would,” “will,” and similar expressions may identify

forward-looking statements, but the absence of these words does not

mean that a statement is not forward-looking. These statements

include, but are not limited to, statements about the Company’s

future plans, expectations, and objectives for the Company’s

operations, including statements about strategy, synergies,

sustainability initiatives, portfolio monetization opportunities,

expansion projects and future operations, and financial guidance;

the Company’s projected dividend amounts and the timing thereof;

and the Company’s leverage and financial profile. While

forward-looking statements are based on assumptions and analyses

made by us that we believe to be reasonable under the

circumstances, whether actual results and developments will meet

our expectations and predictions depend on a number of risks and

uncertainties which could cause our actual results, performance,

and financial condition to differ materially from our expectations.

See Part II, Item 1A. Risk Factors in our Annual Report on Form

10-K for the year ended December 31, 2022. Any forward-looking

statement made by us in this news release speaks only as of the

date on which it is made. Factors or events that could cause our

actual results to differ may emerge from time to time, and it is

not possible for us to predict all of them. We undertake no

obligation to publicly update any forward-looking statement whether

as a result of new information, future development, or otherwise,

except as may be required by law.

Additional information

Additional information follows, including a reconciliation of

Adjusted EBITDA, Distributable Cash Flow, Free Cash Flow, and Net

Debt (non-GAAP financial measures) to the GAAP measures.

Non-GAAP financial

measures

Kinetik’s financial information includes information prepared in

conformity with generally accepted accounting principles (GAAP) as

well as non-GAAP financial information. It is management’s intent

to provide non-GAAP financial information to enhance understanding

of our consolidated financial information as prepared in according

with GAAP. Adjusted EBITDA, Distributable Cash Flow, Free Cash

Flow, Dividend Coverage Ratio, Net Debt and Leverage Ratio are

non-GAAP measures. This non-GAAP information should be considered

by the reader in addition to, but not instead of, the financial

statements prepared in accordance with GAAP and reconciliations

from these results should be carefully evaluated. See

“Reconciliation of GAAP to Non-GAAP Measures” elsewhere in this

news release.

- A non-GAAP financial measure. See “Non-GAAP Financial Measures”

and “Reconciliation of GAAP to Non-GAAP Measures” for further

details.

- Estimated dividends reinvested and dividends paid in cash as of

November 1, 2023. Final numbers are subject to change.

- Leverage Ratio is total debt less cash and cash equivalents

divided by last twelve months Adjusted EBITDA, calculated in the

Company’s credit agreement. The calculation includes Qualified

Project and Acquisition EBITDA Adjustments that pertain to the

funding of the Permian Highway Pipeline expansion project, Delaware

Link project, first quarter 2023 midstream infrastructure asset

acquisition, and other qualified growth capital projects at the

Midstream Logistics segment.

- Net Debt to Adjusted EBITDA Ratio is defined as Net Debt

divided by last twelve months Adjusted EBITDA.

- Net income including noncontrolling interest for the three and

nine months ended September 30, 2022 was $49.4 million and $202.3

million, respectively.

- Dividend Coverage Ratio is Distributable Cash Flow divided by

total declared dividends.

- Issued and outstanding shares of 148,608,696 is the sum of

54,519,658 shares of Class A common stock and 94,089,038 shares of

Class C common stock.

- Net Debt is defined as total long-term debt, excluding deferred

financing costs, less cash and cash equivalents.

Notes Regarding Presentation of Financial

Information

The following addresses the results of our operations for the

three and nine months ended September 30, 2023, as compared to our

results of operations for the three and nine months ended September

30, 2022. As the business combination between BCP Raptor Holdco,

LP, Kinetik’s predecessor for accounting purposes (“BCP”)

and Altus Midstream LP (“Altus”) (the “Transaction”)

was determined to be a reverse merger, BCP was considered the

accounting acquirer and Altus was considered the legal acquirer.

Therefore, BCP’s net assets, carrying at historical value, were

presented as the predecessor to the Company’s historical financial

statements and the comparable period presented herein reflects the

results of operations of BCP for the three and nine months ended

September 30, 2022 and Altus’ results of operations from February

22, 2022, the closing date of the Transaction, through September

30, 2022. Kinetik’s financial results on and after February 22,

2022 reflect the results of the combined company.

Unless otherwise noted or the context requires otherwise,

references herein to Kinetik Holdings Inc. or “the Company” with

respect to time periods prior to February 22, 2022 include BCP and

its consolidated subsidiaries and do not include Altus and its

consolidated subsidiaries, while references herein to Kinetik

Holdings Inc. with respect to time periods from and after February

22, 2022 include Altus and its consolidated subsidiaries.

The Company completed a two-for-one Stock Split on June 8, 2022.

All corresponding per-share and share amounts for periods prior to

June 8, 2022 have been retroactively restated to reflect the

two-for-one Stock Split.

KINETIK HOLDINGS INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2023

2022

2023

2022(1)

(In thousands, except per

share data)

Operating revenues:

Service revenue

$

104,349

$

107,597

$

310,325

$

290,122

Product revenue

221,280

213,803

586,534

618,382

Other revenue

4,672

3,776

10,685

9,493

Total operating revenues

330,301

325,176

907,544

917,997

Operating costs and expenses:

Costs of sales (exclusive of depreciation

and amortization shown separately below) (2)

147,756

145,208

374,100

418,197

Operating expenses

42,925

35,845

118,804

100,996

Ad valorem taxes

5,607

5,903

14,954

15,936

General and administrative expenses

22,751

23,468

73,131

72,180

Depreciation and amortization expenses

69,935

65,005

208,271

192,609

Loss on disposal of assets

2,927

3,946

15,166

12,602

Total operating costs and expenses

291,901

279,375

804,426

812,520

Operating income

38,400

45,801

103,118

105,477

Other income (expense):

Interest and other income

289

—

1,625

250

Gain on redemption of mandatorily

redeemable Preferred Units

—

—

—

9,580

Loss on debt extinguishment

—

—

—

(27,975

)

Gain on embedded derivative

—

488

—

89,050

Interest expense

(45,009

)

(40,464

)

(130,443

)

(92,585

)

Equity in earnings of unconsolidated

affiliates

50,754

45,003

146,828

120,706

Total other income, net

6,034

5,027

18,010

99,026

Income before income taxes

44,434

50,828

121,128

204,503

Income tax expense

1,303

1,406

2,030

2,244

Net income including noncontrolling

interest

43,131

49,422

119,098

202,259

Net income attributable to Preferred Unit

limited partners

—

708

—

115,203

Net income attributable to common

shareholders

43,131

48,714

119,098

87,056

Net income attributable to Common Unit

limited partners

27,551

33,778

77,068

61,817

Net income attributable to Class A Common

Stock Shareholders

$

15,580

$

14,936

$

42,030

$

25,239

Net income attributable to Class A Common

Shareholders per share

Basic

$

0.21

$

1.04

$

0.58

$

1.24

Diluted

$

0.21

$

1.04

$

0.57

$

1.24

Weighted-average shares(3)

Basic

53,340

41,816

50,464

40,042

Diluted

53,463

41,855

50,719

40,075

(1) The results of the legacy Altus

business are not included in the Company’s consolidated financials

prior to February 22, 2022. Refer to Note 1 – Description of the

Organization and Summary of Significant accounting Policies in the

Notes to the Condensed Consolidated Financial Statements of the

Company’s Form 10-Q filed on November 9, 2023 for further

information.

(2) Cost of sales (exclusive of

depreciation and amortization) is net of gas service revenues

totaling $38.6 million, $17.1 million, $107.1 million and $51.1

million for the three and nine months ended September 30, 2023 and

2022, respectively, for certain volumes where we act as

principal.

(3) Share amounts have been retroactively

restated to reflect the Company’s two-for-one stock split, which

was effected on June 8, 2022. Refer to Note 10 – Equity and

Warrants in the Notes to the Condensed Consolidated Financial

Statements of the Company’s Form 10-Q filed on November 9, 2023 for

further information.

KINETIK HOLDINGS INC.

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES

Three Months Ended

September 30,

Nine Months Ended

September 30,

2023

2022

2023

2022(1)

(In thousands)

Net Income Including Noncontrolling

Interests to Adjusted EBITDA

Net income including noncontrolling

interest

$

43,131

$

49,422

$

119,098

$

202,259

Add back:

Interest expense

45,009

40,464

130,443

92,585

Income tax expense

1,303

1,406

2,030

2,244

Depreciation and amortization

69,935

65,005

208,271

192,609

Amortization of contract costs

1,655

448

4,965

1,344

Proportionate EMI EBITDA

78,585

78,357

224,933

190,438

Share-based compensation

12,502

12,661

43,340

30,966

Loss on disposal of assets

2,927

3,946

15,166

12,602

Loss on debt extinguishment

—

—

—

27,975

Unrealized loss on derivatives

8,259

—

616

—

Integration Costs

21

2,338

985

10,012

Transaction Costs

378

62

648

6,412

Other one-time cost or amortization

2,662

3,752

7,545

10,969

Warrant valuation adjustment

4

—

—

—

Deduct:

Interest income

293

—

314

—

Warrant valuation adjustment

—

—

73

—

Gain on redemption of mandatorily

redeemable Preferred Units

—

—

—

9,580

Gain on embedded derivative

—

488

—

89,050

Equity income from EMI's

50,754

45,003

146,828

120,706

Adjusted EBITDA(2) (non-GAAP)

$

215,324

$

212,370

$

610,825

$

561,079

Distributable Cash Flow(3)

Adjusted EBITDA (non-GAAP)

$

215,324

$

212,370

$

610,825

$

561,079

Proportionate EMI EBITDA

(78,585

)

(78,357

)

(224,933

)

(190,438

)

Cash distributions received from EMI's

(operating)

69,661

68,242

205,891

185,786

Interest expense

(45,009

)

(40,464

)

(130,443

)

(92,585

)

Unrealized gain on interest rate

derivatives

(7,835

)

—

(27,481

)

—

Maintenance capital expenditures

(5,503

)

(4,053

)

(15,065

)

(7,492

)

Distributions paid to preferred unit

limited partners

—

—

—

(8,787

)

Distributable cash flow

(non-GAAP)

$

148,053

$

157,738

$

418,794

$

447,563

Free Cash Flow(4)

Distributable cash flow (non-GAAP)

$

148,053

$

157,738

$

418,794

$

447,563

Cash interest adjustment

12,378

16,854

(7,953

)

15,993

Realized gain on interest rate swaps

4,665

—

7,082

—

Growth capital expenditures

(81,250

)

(89,812

)

(245,812

)

(166,318

)

Investments in EMI's

(48,008

)

(53,524

)

(202,729

)

(56,199

)

Cash distributions received from EMI's

(investing)

—

—

5,793

—

Contributions in aid of construction

967

2,752

7,839

14,344

Free cash flow (non-GAAP)

$

36,805

$

34,008

$

(16,986

)

$

255,383

KINETIK HOLDINGS INC.

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES (CONTINUED)

Nine Months Ended

September 30,

2023

2022(1)

(In thousands)

Reconciliation of net cash provided by

operating activities to Adjusted EBITDA

Net cash provided by operating

activities

$

405,585

$

453,244

Net changes in operating assets and

liabilities

24,604

(12,810

)

Interest expense

130,443

92,585

Amortization of deferred financing

costs

(4,601

)

(8,053

)

Contingent liabilities remeasurement

—

839

Current income tax expense

355

362

Cash distributions received from EMI's

(205,891

)

(185,786

)

Proportionate EMI EBITDA

224,933

190,438

Derivative fair value adjustment and

settlement

25,917

2,867

Unrealized loss on derivatives

616

—

Interest income

(314

)

—

Integration Costs

985

10,012

Transaction Costs

648

6,412

Other one-time cost or amortization

7,545

10,969

Adjusted EBITDA(2) (non-GAAP)

$

610,825

$

561,079

Distributable Cash Flow(3)

Adjusted EBITDA (non-GAAP)

$

610,825

$

561,079

Proportionate EMI EBITDA

(224,933

)

(190,438

)

Cash distributions received from EMI's

(operating)

205,891

185,786

Interest expense

(130,443

)

(92,585

)

Unrealized gain on interest rate

derivatives

(27,481

)

—

Maintenance capital expenditures

(15,065

)

(7,492

)

Distributions paid to preferred unit

limited partners

—

(8,787

)

Distributable cash flow

(non-GAAP)

$

418,794

$

447,563

Free Cash Flow(4)

Distributable cash flow (non-GAAP)

$

418,794

$

447,563

Cash interest adjustment

(7,953

)

15,993

Realized gain on interest rate swaps

7,082

—

Growth capital expenditures

(245,812

)

(166,318

)

Investments in EMI's

(202,729

)

(56,199

)

Cash distributions received from EMI's

(investing)

5,793

—

Contributions in aid of construction

7,839

14,344

Free cash flow (non-GAAP)

$

(16,986

)

$

255,383

KINETIK HOLDINGS INC.

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES (CONTINUED)

September 30,

June 30,

March 31,

2023

2023

2023

(In thousands)

Net Debt(5)

Long-term debt, net

$

3,606,962

$

3,625,799

$

3,511,648

Plus: Debt issuance costs, net

23,038

24,201

25,352

Total long-term debt

3,630,000

3,650,000

3,537,000

Less: Cash and cash equivalents

68

2,237

1,984

Net debt (non-GAAP)

$

3,629,932

$

3,647,763

$

3,535,016

(1) The results of the legacy Altus

business are not included in the Company’s consolidated financials

prior to February 22, 2022.

(2) Adjusted EBITDA is defined as net

income including noncontrolling interests adjusted for interest,

taxes, depreciation and amortization, impairment charges, asset

write-offs, the proportionate EBITDA from our equity method

investments, equity in earnings from investments recorded using the

equity method, share-based compensation expense, noncash increases

and decreases related to trading and hedging agreements,

extraordinary losses and unusual or non-recurring charges. Adjusted

EBITDA provides a basis for comparison of our business operations

between current, past and future periods by excluding items that we

do not believe are indicative of our core operating performance.

Adjusted EBITDA should not be considered as an alternative to the

GAAP measure of net income including noncontrolling interests or

any other measure of financial performance presented in accordance

with GAAP.

(3) Distributable Cash Flow is defined as

Adjusted EBITDA, adjusted for the proportionate EBITDA from our

equity method investments, operating cash distributions received

from our equity method investments, interest expense, net of

amounts capitalized, distributions to preferred unitholders and

maintenance capital expenditures. Distributable Cash Flow should

not be considered as an alternative to the GAAP measure of net

income including noncontrolling interests or any other measure of

financial performance presented in accordance with GAAP. We believe

that Distributable Cash Flow is a useful measure to compare cash

generation performance from period to period and to compare the

cash generation performance for specific periods to the amount of

cash dividends we make.

(4) Free Cash Flow is defined as

Distributable Cash Flow adjusted for growth capital expenditures,

investments in EMI’s, investing cash distributions received from

our equity method investments, cash interest and contributions in

aid of construction. Free Cash flow should not be considered as an

alternative to the GAAP measure of net income including

noncontrolling interests or any other measure of financial

performance presented in accordance with GAAP. We believe that Free

Cash Flow is a useful performance measure to compare cash

generation performance from period to period and to compare the

cash generation performance for specific periods to the amount of

cash dividends that we make.

(5) Net Debt is defined as total long-term

debt, excluding deferred financing costs, less cash and cash

equivalents. Net Debt illustrates our total debt position less cash

on hand that could be utilized to pay down debt at the balance

sheet date. Net Debt should not be considered as an alternative to

the GAAP measure of total long-term debt, or any other measure of

financial performance presented in accordance with GAAP.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231108682371/en/

Kinetik Investors: (713) 487-4832 Maddie Wagner (713) 574-4743

Alex Durkee Website: www.kinetik.com

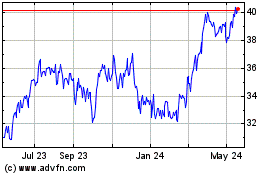

Kinetik (NYSE:KNTK)

Historical Stock Chart

From Oct 2024 to Nov 2024

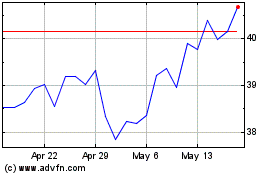

Kinetik (NYSE:KNTK)

Historical Stock Chart

From Nov 2023 to Nov 2024