UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of October 2023

Commission File Number: 001-34615

JinkoSolar Holding Co., Ltd.

(Translation of registrant’s name into English)

1 Yingbin Road

Shangrao Economic Development Zone

Jiangxi Province, 334100

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1).

Yes ¨ No x

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7).

Yes ¨ No x

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

JinkoSolar Holding Co., Ltd. |

| |

|

|

| |

By: |

/s/ Mengmeng (Pan) Li |

| |

Name: |

Mengmeng (Pan) Li |

| |

Title: |

Chief Financial Officer |

Date: October 30, 2023

Exhibit 99.1

JinkoSolar Announces Third Quarter

2023 Financial Results

10/30/2023

SHANGRAO, China, Oct. 30,

2023 /PRNewswire/ -- JinkoSolar Holding Co., Ltd. ("JinkoSolar" or the "Company") (NYSE: JKS), one

of the largest and most innovative solar module manufacturers in the world, today announced its unaudited financial results for the third

quarter ended September 30, 2023.

Third Quarter 2023 Business Highlights

| • | Leveraging

our outstanding N-type technology, extensive global operation network, and advanced integrated

capacity structure, module shipments in the third quarter increased 20.4% sequentially and

107.9% year-over-year. |

| • | At

the end of the third quarter, we became the first module manufacturer in the world to have

delivered a total of 190 GW solar modules, covering over 190 countries and regions. |

| • | Demand

for N-type products continued to grow globally. N-type module shipments accounted for more

than 60% of all module shipments globally in the third quarter. N-type modules retained their

competitive premium over P-type modules and the premium continued to exceed the market average. |

| • | The

mass production efficiency of N-type TOPCon cells reached 25.6% and the power output of N-type

modules was 25-30wp higher than that of similar P-type modules. |

| • | We

continued to make progress in sustainability and, recently, scored high in the Ecovadis Ratings,

leading the mainstream PV companies. |

Third Quarter 2023 Operational

and Financial Highlights

| • | Quarterly

shipments were 22,597 MW (21,384 MW for solar modules, and 1,213 MW for cells and wafers),

up 21.4% sequentially, and up 108.2% year-over-year. |

| • | Total

revenues were RMB31.83 billion (US$4.36 billion), up 3.7% sequentially and up 63.1%

year-over-year. |

| • | Gross

profit was RMB6.13 billion (US$840.6 million), up 28.2% sequentially and up 99.7%

year-over-year. |

| • | Gross

margin was 19.3%, compared with 15.6% in Q2 2023 and 15.7% in Q3 2022. |

| • | Net

income attributable to JinkoSolar Holding Co., Ltd.'s ordinary shareholders was RMB1.32

billion (US$181.4 million), compared with RMB1.31 billion in Q2 2023 and RMB549.8

million in Q3 2022. |

| • | Adjusted

net income attributable to JinkoSolar Holding Co., Ltd.'s ordinary shareholders, which

excludes the impact from (i) a change in fair value of the convertible senior notes

(the "Notes"), (ii) a change in fair value of long-term investment and (iii) the

share based compensation expenses, was RMB1.35 billion (US$184.6 million), compared

with RMB1.43 billion in Q2 2023 and RMB427.5 million in Q3 2022. |

| • | Basic

and diluted earnings per ordinary share were RMB6.42 (US$0.88) and RMB4.61 (US$0.63),

respectively. This translates into basic and diluted earnings per ADS of RMB25.66 (US$3.52) and RMB18.46 (US$2.53),

respectively. |

Mr. Xiande Li, JinkoSolar's Chairman

and Chief Executive Officer, commented, "Despite market volatility, we delivered strong results in the third quarter leveraging

our advantages in N-type TOPCon technology, extensive global operation network and advanced integrated capacity structure. Our module

shipments, gross margin and net income all increased significantly year-over-year. Total module shipments were approximately 21.4

GW, an increase of 107.9% year-over-year. The cost of polysilicon decreased sequentially. Our premium high-efficient N-type products

accounted for over 60% of total shipments, and shipments to the U.S. recorded sequential growth. Year-over-year, net income increased

by 140.7% to US$181.4 million, and adjusted net income increased by 215.1% to US$184.6 million, diluted earnings per ordinary

share increased by 188.7% to US$0.63, and gross margin increased from 15.7% to 19.3%.

Since the third quarter, price declines

in the supply chain have stimulated end demand. For the first nine months of 2023, newly-added installations of PV in China reached

128.9 GW, nearly 50% more than full-year installations in 2022. Meanwhile, intensified competition brought by changes in supply and demand,

accelerated technical iteration, high interest rates in some regions, and geopolitical tensions caused some volatility in the global

PV market, and posed challenges on all industry players. We believe that we, as the industry leader, will become even stronger as the

competition intensifies. At the end of the third quarter, we became the first module manufacturer in the world to have delivered a total

of 190 GW solar modules, covering over 190 countries and regions. Our capabilities in global sales, operations and management, together

with continuous R&D accumulation and innovation, help us build an all-round competition barrier. We are confident in our ability

to navigate through cyclical volatility, achieve healthy and sustainable profitability, and increase shareholder value.

By the end of the third quarter, the

mass production efficiency for our N-type TOPCon cells reached 25.6%, and our N-type modules power output was 25-30wp higher than that

of similar P-type modules. Demand for these products continued to increase globally as the levelized cost of energy is lower. N-type

modules still retained a premium over similar P-type modules, and the premium continued to exceed the market average.

At the end of the third quarter, we

already had over 55 GW of N-type cell production capacity, and by the end of the year, our N-type cell production capacity is expected

to reach about 70 GW, leading the industry, and our integrated project in Shanxi, China has started construction recently.

Phase I and Phase II of a project with a total of 28 GW wafer-cell-module integrated capacity are expected to start production in the

first half of 2024.

Recently, our high-efficiency N-Type

monocrystalline silicon solar cell set a new record with a maximum conversion efficiency of 26.89%, creating another important milestone

in the innovation of our products and solutions. With higher conversion efficiency and lower industrialization cost, we strongly believe

that the TOPCon technology will remain the mainstream technical path in the next 3-5 years. We are confident that we are ahead of the

industry in terms of power output, cost efficiency and product competitiveness.

As a responsible global company, we

continued to make progress in sustainability and, recently, scored high in the Ecovadis Ratings, leading the mainstream PV companies.

We are dedicated to providing clean, high-efficient and reliable solar products and energy storage solutions to more and more countries

and regions, and contributing to global energy transition.

We expect our module shipments to be

approximately 23.0 GW for the fourth quarter of 2023 and are confident that our full-year module shipments will exceed our guidance of

70 to 75 GW, with N-type modules accounting for approximately 60%. We expect our annual production capacity for mono wafers, solar cells

and solar modules to reach 85.0 GW, 90.0 GW and 110.0 GW, respectively, by the end of 2023, with N-type capacity accounting for over

75%. We are confident that we will continue to lead the industry with our advanced technology and premium high-efficient products. "

Third Quarter 2023 Financial Results

Total Revenues

Total revenues in the third quarter

of 2023 were RMB31.83 billion (US$4.36 billion), an increase of 3.7% from RMB30.69 billion in the second quarter

of 2023 and an increase of 63.1% from RMB19.52 billion in the third quarter of 2022. The sequential and year-over-year increases

were mainly attributable to the increases in the shipment of solar modules due to the increasing demand in the global market.

Gross Profit and Gross Margin

Gross profit in the third quarter of

2023 was RMB6.13 billion (US$840.6 million), compared with RMB4.78 billion in the second quarter of 2023 and RMB3.07

billion in the third quarter of 2022.

Gross margin was 19.3% in the third

quarter of 2023, compared with 15.6% in the second quarter of 2023 and 15.7% in the third quarter of 2022. The sequential and year-over-year

increases were mainly due to the decrease in the cost of raw materials.

Income from Operations and Operating

Margin

Income from operations in the third

quarter of 2023 was RMB2.99 billion (US$409.8 million), compared with RMB1.54 billion in the second quarter of 2023

and RMB63.1 million in the third quarter of 2022. The changes were primarily attributable to the increases in our revenues

and gross margin in the third quarter of 2023.

Operating profit margin was 9.4% in

the third quarter of 2023, compared with 5.0% in the second quarter of 2023 and 0.3% in the third quarter of 2022.

Total operating expenses in the third

quarter of 2023 were RMB3.14 billion (US$430.8 million), a decrease of 3.1% from RMB3.24 billion in the second quarter

of 2023 and an increase of 4.5% from RMB3.01 billion in the third quarter of 2022. The sequential and year-over-year changes

were relatively flat.

Total operating expenses accounted for

9.9% of total revenues in the third quarter of 2023, compared to 10.6% in the second quarter of 2023 and 15.4% in the third quarter of

2022. The sequential and year-over-year decreases were mainly due to the increases in the shipment of solar modules and the decreases

in average shipment cost.

Interest Expenses, Net

Net interest expenses in the third quarter

of 2023 were RMB148.2 million (US$20.3 million), a decrease of 28.9% from RMB208.5 million in the second quarter

of 2023 and an increase of 15.1% from RMB128.7 million in the third quarter of 2022. The sequential decrease was mainly due

to the increase in interest income and the year-over-year increase was mainly due to an increase in interest expense.

Subsidy Income

Subsidy income in the third quarter

of 2023 was RMB64.5 million (US$8.8 million), compared with RMB292.4 million in the second quarter of 2023 and RMB225.3

million in the third quarter of 2022. The sequential and year-over-year changes were mainly attributable to the changes in the cash

receipt of subsidies from local governments in China which are non-recurring, not refundable and with no conditions.

Exchange Gain/Loss and Change

in Fair Value of Foreign Exchange Derivatives

The Company recorded a net exchange

loss (including change in fair value of foreign exchange derivatives) of RMB295.8 million (US$40.5 million) in the third

quarter of 2023, compared to a net exchange gain of RMB916.4 million in the second quarter of 2023 and a net exchange

gain of RMB520.3 million in the third quarter of 2022. The sequential and year-over-year changes were mainly attributable to

the exchange rate fluctuation of US dollars against RMB in the third quarter of 2023.

Change in Fair Value of Convertible

Senior Notes

The Company issued US$85.0 million of

4.5% convertible senior notes due 2024 in May 2019 and has elected to measure the Notes at fair value derived by valuation

model, i.e. Binomial Model.

The Company recognized a gain from a

change in fair value of the Notes of RMB295.6 million (US$40.5 million) in the third quarter of 2023, compared to a gain of RMB89.7

million in the second quarter of 2023 and a gain of RMB233.0 million in the third quarter of 2022. The changes were primarily

due to the changes in the Company's stock price in the third quarter of 2023.

Change in Fair Value of Long-term

Investment

The Company invested in certain equity

interests in several solar technology companies engaged in photovoltaic industry chain, which are recorded as long-term investment and

reported at fair value with changes in fair value recognized in earnings. As of September 30, 2023, the Company had RMB956.2

million (US$131.1 million) in long-term investment, compared with RMB1.09 billion as of June 30, 2023.

The Company recognized a loss from change

in fair value of RMB130.3 million (US$17.9 million) in the third quarter of 2023, compared with a gain of RMB2.3 million in

the second quarter of 2023.

Equity in Earnings of Affiliated

Companies

The Company indirectly holds a 20% equity

interest in Sweihan PV Power Company P.J.S.C, a developer and operator of solar power projects in Dubai, and a 9% equity interest

in Xinte Ltd, a domestic silicon material supplier, and both are accounted for using the equity method. The Company recorded equity in

loss of affiliated companies of RMB22.9 million(US$3.1 million) in the third quarter of 2023, compared with gain of RMB63.3

million in the second quarter of 2023 and gain of RMB38.9 million in the third quarter of 2022. The fluctuation of equity

in gain or loss of affiliated companies primarily arose from the net gain or loss incurred by an affiliate company.

Income Tax Expense

The Company recorded an income tax expense

of RMB403.3 million (US$55.3 million) in the third quarter of 2023, compared with RMB341.1 million in the second

quarter of 2023 and RMB150.8 million in the third quarter of 2022.

Non-Controlling Interests

Net income attributable to non-controlling

interests amounted to RMB1.00 billion (US$137.2 million) in the third quarter of 2023, compared with RMB1.11 billion

in the second quarter of 2023 and RMB247.8 million in the third quarter of 2022. The sequential and year-over-year changes

were mainly attributable to the changes in net income of the Company's majority-owned principal operating subsidiary, Jinko Solar Co., Ltd.

("Jiangxi Jinko").

Net Income and Earnings per Share

Net income attributable to the JinkoSolar

Holding Co., Ltd.'s ordinary shareholders was RMB1.32 billion (US$181.4 million) in the third quarter of 2023, compared

with RMB1.31 billion in the second quarter of 2023 and RMB549.8 million in the third quarter of 2022.

Excluding the impact from (i) a change in fair value of the Notes (ii) a change in fair value of the long-term investment and

(iii)the share based compensation expenses, the adjusted net income attributable to JinkoSolar Holding Co., Ltd.'s ordinary shareholders

was RMB1.35 billion (US$184.6 million), compared with RMB1.43 billion in the second quarter of 2023 and RMB427.5

million in the third quarter of 2022.

Basic and diluted earnings per ordinary

share were RMB6.42 (US$0.88) and RMB4.61 (US$0.63), respectively, in the third quarter of 2023, compared to RMB6.39 and RMB5.55,

respectively, in the second quarter of 2023, and RMB2.74 and RMB1.60, respectively, in the third quarter of 2022. As each

ADS represents four ordinary shares, this translates into basic and diluted earnings per ADS of RMB25.66 (US$3.52) and RMB18.46 (US$2.53),

respectively in the third quarter of 2023; basic and diluted earnings per ADS of RMB25.54 and RMB22.20, respectively,

in the second quarter of 2023; and basic and diluted earnings per ADS of RMB10.97 and RMB6.39, respectively, in the third

quarter of 2022.

Financial Position

As of September 30, 2023,

the Company had RMB14.11 billion (US$1.93 billion) in cash and cash equivalents and restricted cash, compared with RMB17.03

billion as of June 30, 2023.

As of September 30, 2023,

the Company's accounts receivables due from third parties were RMB25.78 billion (US$3.53 billion), compared with RMB21.59

billion as of June 30, 2023.

As of September 30, 2023,

the Company's inventories were RMB19.15 billion (US$2.63 billion), compared with RMB20.09 billion as of June 30,

2023.

As of September 30, 2023,

the Company's total interest-bearing debts were RMB30.83 billion (US$4.23 billion), compared with RMB34.31 billion as

of June 30, 2023.

Third Quarter 2023 Operational Highlights

Solar Module, Cell and Wafer Shipments

Total shipments were 22,597 MW in the

third quarter of 2023, including 21,384 MW for solar module shipments and 1,213 MW for cell and wafer shipments.

Operations and Business Outlook Highlights

We are optimistic about global market

demand and the opportunities brought by penetration of N-type technology. We will continue to maintain our leading position in N-type

modules through technology iteration, improvement in mass production capability, and cost optimization. By the end of 2023, we expect

mass-produced N-type cell efficiency to reach 25.8%, and the integrated cost of N-type modules to remain competitive with P-type modules.

The proportion of N-type modules shipments of our total module shipments is expected to reach about 60% in 2023, as we expect there will

be a strong demand for high-efficiency products from a growing number of markets and customers.

As we continue to invest in N-type capacity

expansion overseas in the second half of 2023, we expect to reach an integrated capacity of over 12 GW overseas by the end of 2023, with

the production capacity of N-type accounting for over 75%. We will continuously strengthen and expand our global industrial chain to

provide premium and high-quality products and services to our global clients.

Fourth Quarter and Full Year 2023

Guidance

The Company's business outlook is based

on management's current views and estimates with respect to market conditions, production capacity, the Company's order book and the

global economic environment. This outlook is subject to uncertainty on final customer demand and sale schedules. Management's views and

estimates are subject to change without notice.

For the fourth quarter of 2023, the

Company expects its module shipments to be around 23 GW.

We are confident to exceed the full

year module shipment target of 70 to 75 GW.

Solar Products Production Capacity

JinkoSolar expects its annual production

capacity for mono wafer, solar cell and solar module to reach 85.0 GW, 90.0 GW and 110.0 GW, respectively, by the end

of 2023.

Recent Business Developments

| • | In August 2023,

JinkoSolar was appointed a co-chair of the Tech, Innovation, and R&D Taskforce of

B20 India. |

| • | In September 2023,

JinkoSolar signed a Memorandum of Understanding with Failte Energy Solutions limited to supply

Tiger Neo modules for a total capacity of 200 MW. |

| • | In September 2023,

JinkoSolar's board of directors declared a cash dividend of US$0.375 per ordinary

share of US$0.00002 each of the Company, or US$1.50 per ADS. |

| • | In October 2023,

Jiangxi Jinko announced that its module shipments exceeded 52 GW for the nine months ended September 30,

2023, with N-type modules accounting for about 57% of these shipments. |

| • | In October 2023,

Jiangxi Jinko published its estimates of certain preliminary unaudited financial results

for the nine months ended September 30, 2023. |

| • | In October 2023,

JinkoSolar announced that its affiliate has signed the largest ever supply agreement with

ACWA Power, to provide 3.8 GW N-type Tiger Neo modules for ACWA Power's two projects, the

1,581MWp Al KAHFAH and the 2,257MWp AR RASS 2, in Saudi Arabia. |

| • | In October 2023,

JinkoSolar announced that its high-efficiency N-Type monocrystalline silicon solar cell sets

new record with maximum conversion efficiency of 26.89%. |

Conference Call Information

JinkoSolar's management will host an

earnings conference call on Monday, October 30, 2023 at 8:30 a.m. U.S. Eastern Time (8:30 p.m. Beijing / Hong

Kong the same day).

Please register in advance of the conference

using the link provided below. Upon registering, you will be provided with participant dial-in numbers, passcode and unique access PIN

by a calendar invite.

Participant Online Registration: https://s1.c-conf.com/diamondpass/10034589-n7xtqc.html

It will automatically direct you to

the registration page of "JinkoSolar Third Quarter 2023 Earnings Conference Call", where you may fill in your details

for RSVP.

In the 10 minutes prior to the call

start time, you may use the conference access information (including dial-in number(s), passcode and unique access PIN) provided in the

calendar invite that you have received following your pre-registration.

A telephone replay of the call will

be available 2 hours after the conclusion of the conference call through 23:59 U.S. Eastern Time, November 6, 2023. The dial-in

details for the replay are as follows:

| International: |

+61

7 3107 6325 |

| U.S.: |

+1

855 883 1031 |

| Passcode: |

10034589 |

Additionally, a live and archived webcast

of the conference call will be available on the Investor Relations section of JinkoSolar's website at http://www.jinkosolar.com.

About JinkoSolar Holding Co., Ltd.

JinkoSolar (NYSE: JKS) is one

of the largest and most innovative solar module manufacturers in the world. JinkoSolar distributes its solar products and sells its

solutions and services to a diversified international utility, commercial and residential customer base in China, the

United States, Japan, Germany, the United Kingdom, Chile, South

Africa, India, Mexico, Brazil, the United Arab Emirates,

Italy, Spain, France, Belgium, Netherlands, Poland, Austria, Switzerland, Greece and

other countries and regions.

JinkoSolar had 14 productions

facilities globally, 24 overseas subsidiaries in Japan, South

Korea, Vietnam, India, Turkey, Germany, Italy, Switzerland, the United

States, Mexico, Brazil, Chile, Australia, Canada, Malaysia, the United Arab

Emirates, Denmark, Indonesia, Nigeria and Saudi Arabia, and global sales teams in China, the

United States, Canada, Brazil, Chile, Mexico, Italy, Germany, Turkey, Spain, Japan,

the United Arab Emirates, Netherlands, Vietnam and India, as of September 30, 2023.

To find out more, please see: www.jinkosolar.com

Currency Convenience Translation

The conversion of Renminbi into U.S. dollars in this release, made

solely for the convenience of the readers, is based on the noon buying rate in the city of New York for cable transfers of Renminbi as

certified for customs purposes by the Federal Reserve Bank of New York as of September 29, 2023, which was RMB7.2960 to US$1.00. No representation

is intended to imply that the Renminbi amounts could have been, or could be, converted, realized, or settled into U.S. dollars at that

rate or any other rate. The percentages stated in this press release are calculated based on Renminbi.

Safe Harbor Statement

This press release contains forward-looking

statements. These statements constitute "forward-looking" statements within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private

Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will,"

"expects," "anticipates," "future," "intends," "plans," "believes," "estimates"

and similar statements. Among other things, the quotations from management in this press release and the Company's operations and business

outlook, contain forward-looking statements. Such statements involve certain risks and uncertainties that could cause actual results

to differ materially from those in the forward-looking statements. Further information regarding these and other risks is included in

JinkoSolar's filings with the U.S. Securities and Exchange Commission, including its annual report on Form 20-F. Except as required

by law, the Company does not undertake any obligation to update any forward-looking statements, whether as a result of new information,

future events or otherwise.

For investor and media inquiries,

please contact:

In China:

Ms. Stella Wang

JinkoSolar Holding Co., Ltd.

Tel: +86 21-5180-8777 ext.7806

Email: ir@jinkosolar.com

Mr. Rene Vanguestaine

Christensen

Tel: +86 178 1749 0483

Email: rene.vanguestaine@christensencomms.com

In the U.S.:

Ms. Linda Bergkamp

Christensen, Scottsdale, Arizona

Tel: +1-480-614-3004

Email: linda.bergkamp@christensencomms.com

JINKOSOLAR HOLDING CO., LTD.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except ADS and Share data)

| |

|

For

the quarter ended |

|

|

For

the nine months ended |

|

| |

|

Sep

30, 2022 |

|

|

Jun

30, 2023 |

|

|

Sep

30, 2023 |

|

|

Sep

30, 2022 |

|

|

Sep

30, 2023 |

|

| |

|

RMB'000 |

|

|

RMB'000 |

|

|

RMB'000 |

|

|

USD'000 |

|

|

RMB'000 |

|

|

RMB'000 |

|

|

USD'000 |

|

| Revenues from third parties |

|

|

19,418,227 |

|

|

|

30,635,727 |

|

|

|

31,737,818 |

|

|

|

4,350,030 |

|

|

|

52,876,179 |

|

|

|

85,623,354 |

|

|

|

11,735,657 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues from related parties |

|

|

101,089 |

|

|

|

49,372 |

|

|

|

96,440 |

|

|

|

13,218 |

|

|

|

249,062 |

|

|

|

225,065 |

|

|

|

30,848 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

|

19,519,316 |

|

|

|

30,685,099 |

|

|

|

31,834,258 |

|

|

|

4,363,248 |

|

|

|

53,125,241 |

|

|

|

85,848,419 |

|

|

|

11,766,505 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenues |

|

|

(16,447,649 |

) |

|

|

(25,902,426 |

) |

|

|

(25,701,047 |

) |

|

|

(3,522,622 |

) |

|

|

(45,055,189 |

) |

|

|

(70,891,519 |

) |

|

|

(9,716,491 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

3,071,667 |

|

|

|

4,782,673 |

|

|

|

6,133,211 |

|

|

|

840,626 |

|

|

|

8,070,052 |

|

|

|

14,956,900 |

|

|

|

2,050,014 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling and marketing |

|

|

(1,980,508 |

) |

|

|

(1,665,996 |

) |

|

|

(1,739,184 |

) |

|

|

(238,375 |

) |

|

|

(4,987,519 |

) |

|

|

(4,961,480 |

) |

|

|

(680,027 |

) |

| General and administrative |

|

|

(823,679 |

) |

|

|

(800,148 |

) |

|

|

(1,157,814 |

) |

|

|

(158,692 |

) |

|

|

(2,612,076 |

) |

|

|

(3,042,370 |

) |

|

|

(416,992 |

) |

| Research and development |

|

|

(201,690 |

) |

|

|

(225,574 |

) |

|

|

(218,097 |

) |

|

|

(29,893 |

) |

|

|

(496,370 |

) |

|

|

(632,227 |

) |

|

|

(86,654 |

) |

| Impairment of long-lived assets |

|

|

(2,662 |

) |

|

|

(552,751 |

) |

|

|

(27,912 |

) |

|

|

(3,826 |

) |

|

|

(159,259 |

) |

|

|

(580,662 |

) |

|

|

(79,586 |

) |

| Total operating expenses |

|

|

(3,008,539 |

) |

|

|

(3,244,469 |

) |

|

|

(3,143,007 |

) |

|

|

(430,786 |

) |

|

|

(8,255,224 |

) |

|

|

(9,216,739 |

) |

|

|

(1,263,259 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from operations |

|

|

63,128 |

|

|

|

1,538,204 |

|

|

|

2,990,204 |

|

|

|

409,840 |

|

|

|

(185,172 |

) |

|

|

5,740,161 |

|

|

|

786,755 |

|

| Interest expenses, net |

|

|

(128,749 |

) |

|

|

(208,453 |

) |

|

|

(148,171 |

) |

|

|

(20,309 |

) |

|

|

(378,987 |

) |

|

|

(412,015 |

) |

|

|

(56,471 |

) |

| Subsidy income |

|

|

225,336 |

|

|

|

292,376 |

|

|

|

64,461 |

|

|

|

8,835 |

|

|

|

995,386 |

|

|

|

620,879 |

|

|

|

85,099 |

|

| Exchange gain/(loss) |

|

|

650,466 |

|

|

|

1,358,867 |

|

|

|

(253,303 |

) |

|

|

(34,718 |

) |

|

|

1,046,064 |

|

|

|

976,517 |

|

|

|

133,843 |

|

| Change in fair value of foreign exchange derivatives |

|

|

(130,196 |

) |

|

|

(442,492 |

) |

|

|

(42,474 |

) |

|

|

(5,822 |

) |

|

|

(223,701 |

) |

|

|

(429,628 |

) |

|

|

(58,885 |

) |

| Change in fair value of Long-term Investment |

|

|

|

|

|

|

2,278 |

|

|

|

(130,311 |

) |

|

|

(17,861 |

) |

|

|

- |

|

|

|

312,391 |

|

|

|

42,817 |

|

| Change in fair value of convertible senior notes |

|

|

232,961 |

|

|

|

89,747 |

|

|

|

295,602 |

|

|

|

40,516 |

|

|

|

(408,877 |

) |

|

|

123,914 |

|

|

|

16,984 |

|

| Other income/(loss), net |

|

|

(888 |

) |

|

|

58,971 |

|

|

|

(25,190 |

) |

|

|

(3,453 |

) |

|

|

11,544 |

|

|

|

36,905 |

|

|

|

5,059 |

|

| Income before income taxes |

|

|

909,504 |

|

|

|

2,689,498 |

|

|

|

2,750,818 |

|

|

|

377,028 |

|

|

|

850,070 |

|

|

|

6,969,124 |

|

|

|

955,201 |

|

| Income tax expenses |

|

|

(150,775 |

) |

|

|

(341,144 |

) |

|

|

(403,305 |

) |

|

|

(55,278 |

) |

|

|

(339,887 |

) |

|

|

(1,059,453 |

) |

|

|

(145,210 |

) |

| Equity in earnings of affiliated companies |

|

|

38,904 |

|

|

|

63,281 |

|

|

|

(22,937 |

) |

|

|

(3,144 |

) |

|

|

45,233 |

|

|

|

220,299 |

|

|

|

30,194 |

|

| Net income |

|

|

797,633 |

|

|

|

2,411,635 |

|

|

|

2,324,576 |

|

|

|

318,606 |

|

|

|

555,416 |

|

|

|

6,129,970 |

|

|

|

840,185 |

|

| Less: Net income attributable to non-controlling interests |

|

|

(247,811 |

) |

|

|

(1,105,533 |

) |

|

|

(1,001,203 |

) |

|

|

(137,226 |

) |

|

|

(599,932 |

) |

|

|

(2,711,842 |

) |

|

|

(371,689 |

) |

| Net income attributable to JinkoSolar Holding Co.,

Ltd.'s ordinary shareholders |

|

|

549,822 |

|

|

|

1,306,102 |

|

|

|

1,323,373 |

|

|

|

181,380 |

|

|

|

(44,516 |

) |

|

|

3,418,128 |

|

|

|

468,496 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to JinkoSolar Holding Co., Ltd.'s

ordinary shareholders per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

2.74 |

|

|

|

6.39 |

|

|

|

6.42 |

|

|

|

0.88 |

|

|

|

(0.23 |

) |

|

|

16.73 |

|

|

|

2.29 |

|

| Diluted |

|

|

1.60 |

|

|

|

5.55 |

|

|

|

4.61 |

|

|

|

0.63 |

|

|

|

(0.23 |

) |

|

|

14.85 |

|

|

|

2.04 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to JinkoSolar Holding Co., Ltd.'s

ordinary shareholders per ADS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

10.97 |

|

|

|

25.54 |

|

|

|

25.66 |

|

|

|

3.52 |

|

|

|

(0.90 |

) |

|

|

66.93 |

|

|

|

9.17 |

|

| Diluted |

|

|

6.39 |

|

|

|

22.20 |

|

|

|

18.46 |

|

|

|

2.53 |

|

|

|

(0.90 |

) |

|

|

59.38 |

|

|

|

8.14 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average ordinary shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

200,494,033 |

|

|

|

204,566,514 |

|

|

|

206,286,879 |

|

|

|

206,286,879 |

|

|

|

196,930,951 |

|

|

|

204,273,709 |

|

|

|

204,273,709 |

|

| Diluted |

|

|

219,038,845 |

|

|

|

223,654,851 |

|

|

|

223,182,957 |

|

|

|

223,182,957 |

|

|

|

196,930,951 |

|

|

|

223,117,023 |

|

|

|

223,117,023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average ADS outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

50,123,508 |

|

|

|

51,141,628 |

|

|

|

51,571,720 |

|

|

|

51,571,720 |

|

|

|

49,232,738 |

|

|

|

51,068,427 |

|

|

|

51,068,427 |

|

| Diluted |

|

|

54,759,711 |

|

|

|

55,913,713 |

|

|

|

55,795,739 |

|

|

|

55,795,739 |

|

|

|

49,232,738 |

|

|

|

55,779,256 |

|

|

|

55,779,256 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

797,633 |

|

|

|

2,411,635 |

|

|

|

2,324,576 |

|

|

|

318,606 |

|

|

|

555,416 |

|

|

|

6,129,970 |

|

|

|

840,185 |

|

| Other comprehensive income/(loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| -Unrealized loss on available-for-sale securities |

|

|

1,638 |

|

|

|

58 |

|

|

|

- |

|

|

|

- |

|

|

|

1,638 |

|

|

|

(973 |

) |

|

|

(133 |

) |

| -Foreign currency translation adjustments |

|

|

185,181 |

|

|

|

282,017 |

|

|

|

(31,771 |

) |

|

|

(4,354 |

) |

|

|

372,219 |

|

|

|

192,274 |

|

|

|

26,353 |

|

| -Change in the instrument-specific credit risk |

|

|

48,293 |

|

|

|

20,227 |

|

|

|

5,245 |

|

|

|

719 |

|

|

|

106,423 |

|

|

|

70,690 |

|

|

|

9,689 |

|

| Comprehensive income |

|

|

1,032,745 |

|

|

|

2,713,937 |

|

|

|

2,298,050 |

|

|

|

314,971 |

|

|

|

1,035,696 |

|

|

|

6,391,961 |

|

|

|

876,094 |

|

| Less: Comprehensive income attributable to non-controlling

interests |

|

|

(339,109 |

) |

|

|

(1,168,875 |

) |

|

|

(992,475 |

) |

|

|

(136,030 |

) |

|

|

(751,880 |

) |

|

|

(2,747,573 |

) |

|

|

(376,586 |

) |

| Comprehensive income attributable to JinkoSolar Holding

Co., Ltd.'s ordinary shareholders |

|

|

693,636 |

|

|

|

1,545,062 |

|

|

|

1,305,575 |

|

|

|

178,941 |

|

|

|

283,816 |

|

|

|

3,644,388 |

|

|

|

499,508 |

|

JINKOSOLAR HOLDING CO., LTD.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

| |

|

Dec 31, 2022 |

|

|

Sep 30, 2023 |

|

| |

|

RMB'000 |

|

|

RMB'000 |

|

|

USD'000 |

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

10,243,500 |

|

|

|

13,563,594 |

|

|

|

1,859,045 |

|

| Restricted cash |

|

|

1,027,454 |

|

|

|

547,369 |

|

|

|

75,023 |

|

| Restricted short-term investments |

|

|

8,945,271 |

|

|

|

7,799,555 |

|

|

|

1,069,018 |

|

| Short-term investments |

|

|

- |

|

|

|

51,922 |

|

|

|

7,117 |

|

| Accounts receivable, net - related parties |

|

|

139,714 |

|

|

|

148,826 |

|

|

|

20,398 |

|

| Accounts receivable, net - third parties |

|

|

16,674,876 |

|

|

|

25,779,992 |

|

|

|

3,533,442 |

|

| Notes receivable, net - related parties |

|

|

282,824 |

|

|

|

1,850 |

|

|

|

254 |

|

| Notes receivable, net - third parties |

|

|

6,697,096 |

|

|

|

3,960,907 |

|

|

|

542,887 |

|

| Advances to suppliers, net - related parties |

|

|

56,860 |

|

|

|

78,208 |

|

|

|

10,719 |

|

| Advances to suppliers, net - third parties |

|

|

3,271,284 |

|

|

|

3,903,922 |

|

|

|

535,077 |

|

| Inventories, net |

|

|

17,450,284 |

|

|

|

19,153,303 |

|

|

|

2,625,179 |

|

| Forward contract receivables |

|

|

119,625 |

|

|

|

30,717 |

|

|

|

4,210 |

|

| Prepayments and other current assets, net - related parties |

|

|

23,105 |

|

|

|

29,518 |

|

|

|

4,046 |

|

| Prepayments and other current assets, net |

|

|

3,290,902 |

|

|

|

3,533,424 |

|

|

|

484,296 |

|

| Held-for-sale assets |

|

|

- |

|

|

|

2,231,004 |

|

|

|

305,785 |

|

| Available-for-sale securities |

|

|

104,499 |

|

|

|

- |

|

|

|

- |

|

| Total current assets |

|

|

68,327,294 |

|

|

|

80,814,111 |

|

|

|

11,076,496 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Non-current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

| Restricted cash |

|

|

1,378,680 |

|

|

|

1,575,353 |

|

|

|

215,920 |

|

| Long-term investments |

|

|

1,711,072 |

|

|

|

2,302,860 |

|

|

|

315,634 |

|

| Property, plant and equipment, net |

|

|

32,290,088 |

|

|

|

36,025,775 |

|

|

|

4,937,743 |

|

| Land use rights, net |

|

|

1,431,424 |

|

|

|

1,613,337 |

|

|

|

221,126 |

|

| Intangible assets, net |

|

|

79,600 |

|

|

|

186,794 |

|

|

|

25,602 |

|

| Financing lease right-of-use assets, net |

|

|

558,407 |

|

|

|

336,096 |

|

|

|

46,066 |

|

| Operating lease right-of-use assets, net |

|

|

396,966 |

|

|

|

377,985 |

|

|

|

51,807 |

|

| Deferred tax assets |

|

|

704,244 |

|

|

|

703,856 |

|

|

|

96,471 |

|

| Advances to suppliers to be utilised beyond one year |

|

|

310,375 |

|

|

|

669,897 |

|

|

|

91,817 |

|

| Other assets, net - related parties |

|

|

52,363 |

|

|

|

55,451 |

|

|

|

7,600 |

|

| Other assets, net - third parties |

|

|

1,421,669 |

|

|

|

2,636,924 |

|

|

|

361,421 |

|

| Available-for-sale securities Non current |

|

|

- |

|

|

|

50,000 |

|

|

|

6,853 |

|

| Total non-current assets |

|

|

40,334,888 |

|

|

|

46,534,328 |

|

|

|

6,378,060 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

|

108,662,182 |

|

|

|

127,348,439 |

|

|

|

17,454,556 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Accounts payable - third parties |

|

|

10,378,076 |

|

|

|

14,158,209 |

|

|

|

1,940,544 |

|

| Notes payable - related parties |

|

|

419,500 |

|

|

|

401,500 |

|

|

|

55,030 |

|

| Notes payable - third parties |

|

|

20,204,323 |

|

|

|

22,579,090 |

|

|

|

3,094,722 |

|

| Accrued payroll and welfare expenses |

|

|

2,035,931 |

|

|

|

2,382,141 |

|

|

|

326,500 |

|

| Advances from related parties |

|

|

3,829 |

|

|

|

884 |

|

|

|

121 |

|

| Advances from third parties |

|

|

9,220,267 |

|

|

|

7,936,887 |

|

|

|

1,087,841 |

|

| Income tax payable |

|

|

737,735 |

|

|

|

395,570 |

|

|

|

54,217 |

|

| Other payables and accruals |

|

|

9,214,384 |

|

|

|

10,902,493 |

|

|

|

1,494,312 |

|

| Other payables due to related parties |

|

|

5,964 |

|

|

|

16,069 |

|

|

|

2,202 |

|

| Forward contract payables |

|

|

63,137 |

|

|

|

96,138 |

|

|

|

13,177 |

|

| Convertible senior notes - current |

|

|

- |

|

|

|

635,956 |

|

|

|

87,165 |

|

| Financing lease liabilities - current |

|

|

168,381 |

|

|

|

78,277 |

|

|

|

10,728 |

|

| Operating lease liabilities - current |

|

|

65,489 |

|

|

|

72,177 |

|

|

|

9,893 |

|

| Short-term

borrowings from third parties, including current portion of long-term bank borrowings |

|

|

12,419,170 |

|

|

|

12,151,300 |

|

|

|

1,665,474 |

|

| Held-for-sale liabilities |

|

|

- |

|

|

|

1,459,435 |

|

|

|

200,032 |

|

| Total current liabilities |

|

|

64,936,186 |

|

|

|

73,325,829 |

|

|

|

10,050,141 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Non-current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Long-term borrowings |

|

|

13,022,795 |

|

|

|

13,047,106 |

|

|

|

1,788,255 |

|

| Convertible senior notes |

|

|

1,070,699 |

|

|

|

4,533,415 |

|

|

|

621,356 |

|

| Accrued warranty costs - non current |

|

|

1,422,276 |

|

|

|

1,988,279 |

|

|

|

272,516 |

|

| Financing lease liabilities |

|

|

69,881 |

|

|

|

- |

|

|

|

- |

|

| Operating lease liabilities |

|

|

339,885 |

|

|

|

316,188 |

|

|

|

43,337 |

|

| Deferred tax liability |

|

|

194,808 |

|

|

|

202,391 |

|

|

|

27,740 |

|

| Long-term Payables |

|

|

601,759 |

|

|

|

844,819 |

|

|

|

115,792 |

|

| Guarantee

liabilities to related parties - non current |

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Total non-current liabilities |

|

|

16,722,103 |

|

|

|

20,932,198 |

|

|

|

2,868,996 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

81,658,289 |

|

|

|

94,258,027 |

|

|

|

12,919,137 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

| Ordinary shares (US$0.00002 par value, 500,000,000 shares authorized 204,135,029 and 209,232,719 shares issued as of December 31, 2022 and September 30, 2023, respectively) |

|

|

28 |

|

|

|

29 |

|

|

|

4 |

|

| Additional paid-in capital |

|

|

9,912,931 |

|

|

|

10,569,527 |

|

|

|

1,448,674 |

|

| Accumulated other comprehensive income |

|

|

217,563 |

|

|

|

390,766 |

|

|

|

53,559 |

|

| Treasury stock, at cost; 2,945,840 ordinary shares as of December 31, 2022 and September 30, 2023 |

|

|

(43,170 |

) |

|

|

(43,170 |

) |

|

|

(5,917 |

) |

| Modification of non-controlling interests |

|

|

|

|

|

|

|

|

|

|

|

|

| Accumulated retained earnings |

|

|

6,249,883 |

|

|

|

9,112,599 |

|

|

|

1,248,986 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total JinkoSolar Holding Co., Ltd. shareholders' equity |

|

|

16,337,235 |

|

|

|

20,029,751 |

|

|

|

2,745,306 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Non-controlling interests |

|

|

10,666,658 |

|

|

|

13,060,661 |

|

|

|

1,790,113 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total shareholders' equity |

|

|

27,003,893 |

|

|

|

33,090,412 |

|

|

|

4,535,419 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and shareholders' equity |

|

|

108,662,182 |

|

|

|

127,348,439 |

|

|

|

17,454,556 |

|

|  | View original content: https://www.prnewswire.com/news-releases/jinkosolar-announces-third-quarter-2023-financial-results-301971257.html |

SOURCE JinkoSolar Holding Co., Ltd.

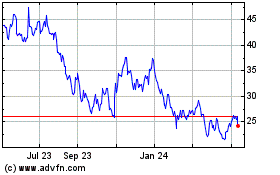

Jinkosolar (NYSE:JKS)

Historical Stock Chart

From Mar 2024 to Apr 2024

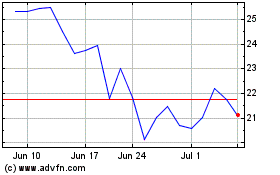

Jinkosolar (NYSE:JKS)

Historical Stock Chart

From Apr 2023 to Apr 2024