Certain Van Kampen Closed-End Funds Declare Dividends

July 01 2009 - 12:00PM

Business Wire

The Board of Trustees of each of the Van Kampen closed-end funds

listed below (the �Funds�) today declared the following

dividends.

EX-DATE

�

RECORD DATE

�

REINVEST DATE

�

PAYABLE DATE

7/13/09 7/15/09 7/31/09 7/31/09

Name of

Closed-EndManagement Investment Company �

Ticker

�

Per Share of

NetInvestment Income (monthly)

Advantage Municipal Income Trust II � VKI � $0.0620 California

Value Municipal Income Trust � VCV � $0.0730 Dynamic Credit

Opportunities Fund � VTA � $0.1005 High Income Trust II � VLT �

$0.1175 Massachusetts Value Municipal Income Trust � VMV � $0.0680

Municipal Opportunity Trust � VMO � $0.0710 Municipal Trust � VKQ �

$0.0700 Ohio Quality Municipal Trust � VOQ � $0.0685 Pennsylvania

Value Municipal Income Trust � VPV � $0.0645 Select Sector

Municipal Trust � VKL � $0.0590 Senior Income Trust � VVR � $0.0251

Trust for Insured Municipals � VIM � $0.0655 Trust for Investment

Grade Municipals � VGM � $0.0715 Trust for Investment Grade New

Jersey Municipals � VTJ � $0.0785 Trust for Investment Grade New

York Municipals � VTN � $0.0735

For more information call: 1-800-341-2929.

The amount of dividends paid by each fund may vary from time to

time. Past amounts of dividends are no guarantee of future dividend

payment amounts.

The final determination of the source and tax characteristics of

all distributions in 2009 will be made after the end of the

year.

Investing involves risk and it is possible to lose money on any

investment in the funds.

In order to comply with the requirements of Section 19 of the

Investment Company Act of 1940, each Fund will provide its

shareholders of record on the record date with a Section 19 Notice

disclosing the sources of�its dividend payment when a distribution

includes anything other than net investment income. The Section 19

Notice is not provided for tax reporting purposes but for

informational purposes only. If applicable, this Section 19 Notice

information can be found�on the Funds' website at

www.vankampen.com/rop.

Van Kampen Asset Management, the Funds� investment adviser, is a

wholly owned subsidiary of Van Kampen Investments Inc. (�Van

Kampen�). Van Kampen is one of the nation�s largest investment

management companies, with approximately $78 billion in assets

under management or supervision as of March 31, 2009. With roots in

money management dating back to 1927, Van Kampen has helped nearly

four generations of investors achieve their financial goals. For

more information, visit Van Kampen�s website at

www.vankampen.com

Copyright �2009 Van Kampen Funds Inc.

All Rights Reserved. Member FINRA/SIPC.

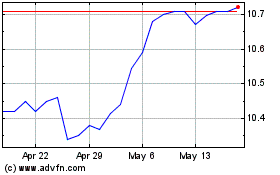

Invesco Trust for Invest... (NYSE:VTN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Invesco Trust for Invest... (NYSE:VTN)

Historical Stock Chart

From Nov 2023 to Nov 2024