0000832101false00008321012024-10-292024-10-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The

Securities Exchange Act of 1934

Date of Report: October 29, 2024

(Date of earliest event reported)

IDEX CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-10235 | | 36-3555336 |

| (State or other jurisdiction | | (Commission File Number) | | (IRS Employer |

| of incorporation) | | | | Identification No.) |

3100 Sanders Road, Suite 301

Northbrook, Illinois 60062

(Address of principal executive offices, including zip code)

(847) 498-7070

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $.01 per share | | IEX | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Emerging growth company | ☐ |

| | | | | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Item 2.02 – Results of Operations and Financial Condition.

On October 29, 2024, IDEX Corporation (the “Company”) issued a press release announcing financial results for the period ended September 30, 2024.

A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Current Report furnished pursuant to Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. This information shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except to the extent specifically provided in any such filing.

Item 7.01 – Regulation FD Disclosure.

Q3 2024 Presentation Slides

Presentation slides discussing the Company’s quarterly operating results are attached as Exhibit 99.2 to this Current Report on Form 8-K and are incorporated herein by reference.

The information in this Current Report furnished pursuant to Item 7.01, including Exhibit 99.2, shall not be deemed “filed” for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that Section. This information shall not be incorporated by reference into any filing under the Securities Act or the Exchange Act, except to the extent specifically provided in any such filing.

Item 9.01 – Financial Statements and Exhibits.

(d) Exhibits

99.1 Press release dated October 29, 2024 announcing IDEX Corporation’s quarterly operating results

99.2 Presentation slides of IDEX Corporation’s quarterly operating results

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| IDEX CORPORATION |

| | |

| By: | /s/ ABHISHEK KHANDELWAL |

| | Abhishek Khandelwal |

| | Senior Vice President and Chief Financial Officer |

| October 30, 2024 | | |

For further information: TRADED: NYSE (IEX) EX-99.1

Investor Contact:

Wendy Palacios

Vice President FP&A and Investor Relations

(847) 498-7070

IDEX REPORTS THIRD QUARTER RESULTS

Third Quarter 2024 Highlights

(All comparisons are against the third quarter of 2023 unless otherwise noted)

•Sales of $798 million, up 1% overall and flat organically

•Reported diluted EPS of $1.57, down 43%, and adjusted diluted EPS of $1.90, down 10%

•Operating cash flow of $205 million, down 9%; and 172% of net income, up from 108%

•Free cash flow of $192 million, down 7%; and 133% of adjusted net income, up from 129%

•Completed acquisition of Mott Corporation on September 5, 2024

•Completed a public offering of $500 million principal amount of 4.950% Senior Notes, due September 2029

Full Year 2024 Outlook

•Full year organic sales growth is projected to decline 1% to 2% versus the prior year

•Full year GAAP diluted EPS of $6.65 - $6.70 vs. previous guidance of $6.85 - $6.95. Current guidance includes purchase accounting impacts, such as acquisition-related amortization, from the acquisition of Mott Corporation

•Adjusted diluted EPS of $7.85 - $7.90 vs. previous guidance of $7.80 - $7.90

NORTHBROOK, IL, October 29, 2024 - IDEX Corporation (NYSE: IEX) today announced its financial results for the three-month period ended September 30, 2024.

“We are encouraged by our third quarter performance. The teams within our Fluid & Metering Technologies and Fire & Safety / Diversified Products segments drove organic growth against an uncertain economic backdrop while delivering strong margins through operational execution,” said Eric D. Ashleman, IDEX Corporation Chief Executive Officer and President. “We saw a healthy organic increase in orders within our Health & Science Technologies segment, strengthening our business positioning as we look for signs of extended recovery within the life science and semiconductor sectors.”

“Meanwhile, less than two months since completing our acquisition of Mott, the partnership is off to a fast start. Teams from other IDEX businesses are already collaborating with their Mott colleagues, designing new prototypes together that incorporate Mott’s highly engineered filtration products. Talented IDEX employees have been integrated into Mott leadership since closing, helping initiate a smooth integration,” Ashleman said. “The core advanced technology markets Mott serves, including semiconductor wafer fabrication, transformative energy solutions, medical technologies, and water purification, are advantaged to outperform over the long haul.”

“IDEX remains well-positioned, solving difficult problems with customers on the cutting edge of new technologies. We expect to continue deploying resources across our portfolio with our 8020 mindset toward growth accelerators to position us to drive long-term value creation.”

Consolidated Financial Results

| | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, |

| (Dollars in millions, except per share amounts) | 2024 | | 2023 | | Increase (Decrease) |

| Orders | $ | 780.5 | | $ | 712.3 | | $ | 68.2 |

| Change in organic orders* | | | | | 8 | % |

| Net sales | 798.2 | | 793.4 | | 4.8 |

| Change in organic net sales* | | | | | — | |

| Gross profit | 353.9 | | 349.6 | | 4.3 |

| Adjusted gross profit* | 356.0 | | 350.8 | | 5.2 |

| Net income attributable to IDEX | 119.1 | | 209.1 | | (90.0) |

| Adjusted net income attributable to IDEX* | 144.1 | | 160.6 | | (16.5) |

| Adjusted EBITDA* | 214.3 | | 225.5 | | (11.2) |

| Diluted EPS attributable to IDEX | 1.57 | | 2.75 | | (1.18) |

| Adjusted diluted EPS attributable to IDEX* | 1.90 | | 2.12 | | (0.22) |

| Cash flows from operating activities | 205.3 | | 226.6 | | (21.3) |

| Free cash flow* | 191.6 | | 206.5 | | (14.9) |

| Gross margin | 44.3 | % | | 44.1 | % | | 20 bps |

| Adjusted gross margin* | 44.6 | % | | 44.2 | % | | 40 bps |

| Net income margin | 14.9 | % | | 26.3 | % | | (1,140) bps |

| Adjusted EBITDA margin* | 26.9 | % | | 28.4 | % | | (150) bps |

*These are non-GAAP measures. See the definitions of these non-GAAP measures in the section in this release titled “Non-GAAP Measures of Financial Performance” and reconciliations to their most directly comparable GAAP financial measures in the reconciliation tables at the end of this release. |

•Net sales increased 1% compared to the prior year period as a result of the net impact of acquisitions and divestitures. Organic net sales were flat, reflecting lower volumes in our Health & Science Technologies segment, which were mitigated by price capture across all segments.

•Gross margin of 44.3% increased 20 bps primarily due to strong price/cost, partially offset by higher employee-related costs.

•Net income margin of 14.9% decreased 1,140 bps and reported Diluted EPS of $1.57 decreased $1.18, primarily as a result of the absence of the gain on sale of the Micropump, Inc. (“Micropump”) business, which occurred in the prior year period. Diluted EPS was further impacted by lower operating results as well as a higher effective tax rate. The effective tax rate in the prior year period included one-time benefits that lowered the effective tax rate, partially offset by tax recorded on the gain from the Micropump divestiture.

•Adjusted EBITDA margin of 26.9% decreased 150 bps and Adjusted diluted EPS of $1.90 decreased $0.22 reflecting strong price/cost, which was more than offset by higher employee-related costs and lower volume. Additionally, the current year period included $3.7 million of higher transaction-related expenses in connection with the acquisition of Mott Corporation and its subsidiaries (“Mott").

•Adjusted diluted EPS also reflects an $0.11 impact of a higher effective tax rate as compared to the prior year period as discussed above. The adjusted effective tax rate in the prior year period excludes the gain and associated tax impacts of the Micropump divestiture.

Segment Financial Results

| | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, (a) |

(Dollars in millions) | 2024 | | 2023 | | Increase (Decrease) |

| Fluid & Metering Technologies ("FMT") | | | | | |

| Net sales | $ | 300.8 | | $ | 301.1 | | $ | (0.3) |

| Change in organic net sales* | | | | | 2 | % |

Adjusted EBITDA(b) | 98.5 | | 103.6 | | (5.1) |

| Adjusted EBITDA margin | 32.8 | % | | 34.4 | % | | (160) bps |

| Health & Science Technologies ("HST") | | | | | |

| Net sales | $ | 311.0 | | $ | 313.2 | | $ | (2.2) |

| Change in organic net sales* | | | | | (5 | %) |

Adjusted EBITDA(b) | 82.6 | | 84.4 | | (1.8) |

| Adjusted EBITDA margin | 26.5 | % | | 26.9 | % | | (40) bps |

| Fire & Safety/Diversified Products ("FSDP") | | | | | |

| Net sales | $ | 188.0 | | $ | 180.6 | | $ | 7.4 |

| Change in organic net sales* | | | | | 4 | % |

Adjusted EBITDA(b) | 54.7 | | 52.8 | | 1.9 |

| Adjusted EBITDA margin | 29.1 | % | | 29.3 | % | | (20) bps |

| Corporate Office and Eliminations | | | | | |

| Intersegment sales eliminations | $ | (1.6) | | $ | (1.5) | | $ | (0.1) |

Adjusted EBITDA(b) | (21.5) | | (15.3) | | (6.2) |

*These are non-GAAP measures. See the definitions of these non-GAAP measures in the section in this release titled “Non-GAAP Measures of Financial Performance” and reconciliations to their most directly comparable GAAP financial measures in the reconciliation tables at the end of this release. |

(a) Three month data includes the results of the acquisitions of STC Material Solutions (December 2023) and Mott Corporation (September 2024) in the HST segment. Three month data also includes the results of Micropump (August 2023) and Novotema, SpA (December 2023) in the HST segment and Alfa Valvole, Srl (June 2024) in the FMT segment through the respective dates of disposition. |

(b) Segment Adjusted EBITDA excludes unallocated corporate costs which are included in Corporate and other. |

Fluid & Metering Technologies Segment

•Net sales were relatively flat compared to the prior year period while organic net sales were up 2%. Positive impacts of price capture were offset by the impact of divestitures. Volumes were relatively flat period over period with improvement in the industrial market and strength in our water business, offset by a down agriculture cycle and softness in the energy market.

•Adjusted EBITDA margin for the third quarter 2024 decreased primarily due to higher employee-related costs, higher discretionary spending and unfavorable mix, partially offset by price/cost.

Health & Science Technologies Segment

•Net sales for the third quarter 2024 were relatively flat while organic net sales were down 5%. Net sales were negatively impacted by lower volumes driven by continued broad based market softness. This decrease was partially offset by price capture and the positive net impact of acquisitions and divestitures.

•Adjusted EBITDA margin for the third quarter 2024 decreased primarily due to lower volume and higher employee-related costs, partially offset by price/cost, favorable operational productivity and the net accretive impact of acquisitions and divestitures.

Fire & Safety/Diversified Products Segment

•Both reported and organic net sales for the third quarter 2024 were up 4% and positively impacted by price capture and higher volumes. The benefit of key growth initiatives and strength in the aerospace market was partially offset by the cyclical nature of project sales in our North American dispensing business.

•Adjusted EBITDA margin for the third quarter 2024 decreased due to unfavorable mix. Positive price/cost offset higher employee related costs.

Mott Acquisition

On September 5, 2024, IDEX acquired Mott for cash consideration of $986.2 million, net of cash acquired of $3.1 million. When adjusted for the present value of expected tax benefits of approximately $100 million, the net transaction value is approximately $900 million. This represents approximately 19x Mott’s forecasted full year 2024 EBITDA and a mid-teens multiple based on Mott’s forecasted 2025 EBITDA. The acquisition is expected to be accretive to IDEX’s adjusted earnings per share in fiscal year 2026.

Conference Call to be Broadcast over the Internet

IDEX will broadcast its third quarter earnings conference call over the Internet on Wednesday, October 30, 2024 at 9:30 a.m. CT. Chief Executive Officer and President Eric Ashleman and Senior Vice President and Chief Financial Officer Abhi Khandelwal will discuss the Company’s recent financial performance and respond to questions from the financial analyst community. IDEX invites interested investors to listen to the call and view the accompanying slide presentation, which will be available on its website at www.idexcorp.com. Those who wish to participate should log on several minutes before the discussion begins. After clicking on the presentation icon, investors should follow the instructions to ensure their systems are set up to hear the event and view the presentation slides or download the correct applications at no charge. Investors will also be able to hear a replay of the call by dialing 877.660.6853 (or 201.612.7415 for international participants) using the ID #13742105.

Forward-Looking Statements

This news release contains “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. These statements may relate to, among other things, the Company’s fourth quarter 2024 and full year 2024 outlook including expected sales, expected organic sales, expected earnings per share, expected adjusted earnings per share, estimated net income and estimated adjusted EBITDA and the assumptions underlying these expectations, anticipated future acquisition behavior, resource deployment and focus and organic and inorganic growth, anticipated trends in end markets, anticipated growth initiatives, the anticipated benefits of the Company’s recent acquisitions and integration plans, including the projected EBITDA of Mott and the related impact and timing for such impact on the Company’s earnings, and are indicated by words or phrases such as “anticipates,” “estimates,” “plans,” “guidance,” “expects,” “projects,” “forecasts,” “should,” “could,” “will,” “management believes,” “the Company believes,” “the Company intends” and similar words or phrases. These statements are subject to inherent uncertainties and risks that could cause actual results to differ materially from those anticipated at the date of this news release.

The risks and uncertainties include, but are not limited to, the following: levels of industrial activity and economic conditions in the U.S. and other countries around the world, including uncertainties in the financial markets; pricing pressures, including inflation and rising interest rates, and other competitive factors and levels of capital spending in certain industries; the impact of severe weather events, natural disasters and public health threats; economic and political consequences resulting from terrorist attacks and wars; the Company’s ability to make acquisitions and to integrate and operate acquired businesses on a profitable basis; cybersecurity incidents; the relationship of the U.S. dollar to other currencies and its impact on pricing and cost competitiveness; political and economic conditions in foreign countries in which the Company operates; developments with respect to trade policy and tariffs; interest rates; capacity utilization and the effect this has on costs; labor markets; supply chain conditions; market conditions and material costs; risks related to environmental, social and corporate governance issues, including those related to climate change and sustainability; and developments with respect to contingencies, such as litigation and environmental matters.

Additional factors that could cause actual results to differ materially from those reflected in the forward-looking statements include, but are not limited to, the risks discussed in the “Risk Factors” section included in the Company’s most recent annual report on Form 10-K and the Company’s subsequent quarterly reports filed with the Securities and Exchange Commission (“SEC”) and the other risks discussed in the Company’s filings with the SEC. The forward-looking statements included here are only made as of the date of this news release, and management undertakes no obligation to publicly update them to reflect subsequent events or circumstances, except as may be required by law. Investors are cautioned not to rely unduly on forward-looking statements when evaluating the information presented here.

About IDEX

IDEX Corporation (NYSE: IEX) designs and builds engineered products and mission-critical components that make everyday life better. IDEX precision components help craft the microchip powering your

electronics, treat water so it is safe to drink, and protect communities and the environment from sewer overflows. Our optics enable global broadband satellite communications, and our pumps move challenging fluids that range from hot, to viscous, to caustic. IDEX components assist healthcare professionals in saving lives as part of many leading diagnostic machines, including DNA sequencers that help doctors personalize treatment. And our fire and rescue tools, including the industry-leading Hurst Jaws of Life®, are trusted by rescue workers around the world. These are just some of the thousands of products that help IDEX live its purpose – Trusted Solutions, Improving Lives™. Founded in 1988 with three small, entrepreneurial manufacturing companies, IDEX now includes more than 50 diverse businesses around the world. With about 8,800 employees and manufacturing operations in more than 20 countries, IDEX is a diversified, high-performing, global company with approximately $3.3 billion in annual sales.

For further information on IDEX Corporation and its business units, visit the company’s website at www.idexcorp.com.

(Financial reports follow)

IDEX CORPORATION

Condensed Consolidated Statements of Income

(in millions, except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net sales | $ | 798.2 | | | $ | 793.4 | | | $ | 2,405.9 | | | $ | 2,485.0 | |

| Cost of sales | 444.3 | | | 443.8 | | | 1,327.8 | | | 1,374.9 | |

| Gross profit | 353.9 | | | 349.6 | | | 1,078.1 | | | 1,110.1 | |

| Selling, general and administrative expenses | 182.9 | | | 165.9 | | | 560.8 | | | 529.9 | |

| Restructuring expenses and asset impairments | 3.0 | | | 4.1 | | | 5.4 | | | 8.2 | |

| Operating income | 168.0 | | | 179.6 | | | 511.9 | | | 572.0 | |

Gain on sale of business(1) | 0.6 | | | (93.8) | | | (4.0) | | | (93.8) | |

| Other expense (income) – net | 2.7 | | | (2.1) | | | — | | | 5.6 | |

| Interest expense - net | 10.3 | | | 13.7 | | | 27.8 | | | 40.1 | |

| Income before income taxes | 154.4 | | | 261.8 | | | 488.1 | | | 620.1 | |

| Provision for income taxes | 35.5 | | | 52.8 | | | 106.7 | | | 132.8 | |

| Net income | 118.9 | | | 209.0 | | | 381.4 | | | 487.3 | |

| Net loss attributable to noncontrolling interest | 0.2 | | | 0.1 | | | 0.4 | | | 0.2 | |

| Net income attributable to IDEX | $ | 119.1 | | | $ | 209.1 | | | $ | 381.8 | | | $ | 487.5 | |

| | | | | | | |

| Earnings per Common Share: | | | | | | | |

| Basic earnings per common share attributable to IDEX | $ | 1.57 | | | $ | 2.76 | | | $ | 5.03 | | | $ | 6.44 | |

| Diluted earnings per common share attributable to IDEX | $ | 1.57 | | | $ | 2.75 | | | $ | 5.02 | | | $ | 6.42 | |

| | | | | | | |

| Share Data: | | | | | | | |

| Basic weighted average common shares outstanding | 75.7 | | | 75.6 | | | 75.7 | | | 75.6 | |

| Diluted weighted average common shares outstanding | 75.9 | | | 75.9 | | | 75.9 | | | 75.9 | |

(1) Activity recorded during the three months ended September 30, 2024 represents the finalization of the gain on the sale of Alfa Valvole, Srl resulting in a $0.6 million downward adjustment during the third quarter of 2024.

IDEX CORPORATION

Condensed Consolidated Balance Sheets

(in millions)

(unaudited)

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 633.2 | | | $ | 534.3 | |

| Receivables - net | 475.1 | | | 427.8 | |

| Inventories - net | 488.2 | | | 420.8 | |

| Other current assets | 81.3 | | | 63.4 | |

| Total current assets | 1,677.8 | | | 1,446.3 | |

| Property, plant and equipment - net | 468.6 | | | 430.3 | |

| Goodwill | 3,316.0 | | | 2,838.3 | |

| Intangible assets - net | 1,349.4 | | | 1,011.8 | |

| Other noncurrent assets | 155.7 | | | 138.5 | |

| Total assets | $ | 6,967.5 | | | $ | 5,865.2 | |

| | | |

| Liabilities and equity | | | |

| Current liabilities | | | |

| Trade accounts payable | $ | 210.4 | | | $ | 179.7 | |

| Accrued expenses | 301.2 | | | 271.5 | |

| Current portion of long-term borrowings | 0.6 | | | 0.6 | |

| Dividends payable | 52.4 | | | 48.5 | |

| Total current liabilities | 564.6 | | | 500.3 | |

| Long-term borrowings - net | 2,075.1 | | | 1,325.1 | |

| Deferred income taxes | 301.3 | | | 291.9 | |

| Other noncurrent liabilities | 208.2 | | | 206.7 | |

| Total liabilities | 3,149.2 | | | 2,324.0 | |

| Shareholders' equity | | | |

| Preferred stock | — | | | — | |

| Common stock | 0.9 | | | 0.9 | |

| Treasury stock | (1,176.5) | | | (1,187.0) | |

| Additional paid-in capital | 859.9 | | | 839.0 | |

| Retained earnings | 4,159.3 | | | 3,934.3 | |

| Accumulated other comprehensive loss | (24.7) | | | (45.8) | |

| Total shareholders' equity | 3,818.9 | | | 3,541.4 | |

| Noncontrolling interest | (0.6) | | | (0.2) | |

| Total equity | 3,818.3 | | | 3,541.2 | |

| Total liabilities and equity | $ | 6,967.5 | | | $ | 5,865.2 | |

IDEX CORPORATION

Condensed Consolidated Statements of Cash Flows

(in millions)

(unaudited)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2024 | | 2023 |

| Cash flows from operating activities | | | |

| Net income | $ | 381.4 | | | $ | 487.3 | |

| Adjustments to reconcile net income to net cash flows provided by operating activities: | | | |

| Gain on sale of business | (4.0) | | | (93.8) | |

| Credit loss on note receivable from collaborative partner | — | | | 7.7 | |

| Depreciation | 49.9 | | | 41.9 | |

| Amortization of intangible assets | 75.0 | | | 70.6 | |

| Share-based compensation expense | 20.9 | | | 18.9 | |

| Deferred income taxes | 0.4 | | | (1.8) | |

| Changes in (net of the effect from acquisitions/divestitures and foreign currency translation): | | | |

| Receivables - net | (14.5) | | | 11.6 | |

| Inventories - net | (21.6) | | | 24.5 | |

| Other current assets | (4.6) | | | 0.3 | |

| Trade accounts payable | 15.3 | | | (30.2) | |

| Deferred revenue | (4.3) | | | 5.6 | |

| Accrued expenses | (0.5) | | | (34.0) | |

| Other - net | 2.1 | | | 7.1 | |

| Net cash flows provided by operating activities | 495.5 | | | 515.7 | |

| Cash flows from investing activities | | | |

| Capital expenditures | (49.6) | | | (68.3) | |

| Acquisition of businesses, net of cash acquired | (984.5) | | | (110.3) | |

| Proceeds from sale of business, net of cash remitted | 45.1 | | | 110.3 | |

| Purchases of marketable securities | — | | | (24.6) | |

| Proceeds from sale of marketable securities | 4.5 | | | — | |

| Other - net | (7.3) | | | 2.9 | |

| Net cash flows used in investing activities | (991.8) | | | (90.0) | |

| Cash flows from financing activities | | | |

| Borrowings under revolving credit facilities | 279.3 | | | — | |

| Proceeds from issuance of long-term borrowings | 496.7 | | | 100.0 | |

| Payment of long-term borrowings | (25.0) | | | (250.0) | |

| Debt issuance costs | (1.2) | | | — | |

| Cash dividends paid to shareholders | (153.0) | | | (142.3) | |

| Proceeds from share issuances, net of shares withheld for taxes | 10.5 | | | 7.7 | |

| Repurchases of common stock | — | | | (1.1) | |

| Other - net | (0.6) | | | (1.0) | |

| Net cash flows provided by (used in) financing activities | 606.7 | | | (286.7) | |

| Effect of exchange rate changes on cash and cash equivalents | 6.6 | | | (6.5) | |

| Net increase in cash and cash equivalents and restricted cash | 117.0 | | | 132.5 | |

Cash and cash equivalents at beginning of year(1) | 534.3 | | | 430.2 | |

Cash and cash equivalents and restricted cash at end of period(1) | $ | 651.3 | | | $ | 562.7 | |

(1) Includes $18.1 million of restricted cash at September 30, 2024. The restricted cash has been included in Other current assets in the Condensed Consolidated Balance Sheets. There was no restricted cash as of September 30, 2023, December 31, 2023, or December 31, 2022.

IDEX CORPORATION

Company and Segment Financial Information

(in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Fluid & Metering Technologies | | | | | | | |

| Depreciation | $ | 4.3 | | $ | 3.1 | | $ | 12.9 | | $ | 10.3 |

| Amortization of intangible assets | 5.2 | | 5.6 | | 15.7 | | 17.3 |

| Restructuring expenses and asset impairments | 1.0 | | 1.7 | | 1.6 | | 2.4 |

| Health & Science Technologies | | | | | | | |

| Depreciation | $ | 10.6 | | $ | 9.0 | | $ | 29.5 | | $ | 24.1 |

| Amortization of intangible assets | 19.7 | | 16.7 | | 54.6 | | 48.5 |

| Restructuring expenses and asset impairments | 1.7 | | 1.5 | | 3.3 | | 4.5 |

| Fire & Safety/Diversified Products | | | | | | | |

| Depreciation | $ | 2.2 | | $ | 2.3 | | $ | 6.7 | | $ | 6.7 |

| Amortization of intangible assets | 1.6 | | 1.5 | | 4.7 | | 4.8 |

| Restructuring expenses and asset impairments | 0.1 | | 0.4 | | 0.2 | | 0.8 |

| Corporate Office and Eliminations | | | | | | | |

| Depreciation | $ | 0.3 | | $ | 0.3 | | $ | 0.8 | | $ | 0.8 |

| Restructuring expenses and asset impairments | 0.2 | | 0.5 | | 0.3 | | 0.5 |

| Total IDEX | | | | | | | |

| Depreciation | $ | 17.4 | | $ | 14.7 | | $ | 49.9 | | $ | 41.9 |

| Amortization of intangible assets | 26.5 | | 23.8 | | 75.0 | | 70.6 |

| Restructuring expenses and asset impairments | 3.0 | | 4.1 | | 5.4 | | 8.2 |

Non-GAAP Measures of Financial Performance

The Company prepares its public financial statements in conformity with accounting principles generally accepted in the United States of America (GAAP). The Company supplements certain GAAP financial performance metrics with non-GAAP financial performance metrics. Management believes these non-GAAP financial performance metrics provide investors with greater insight, transparency and a more comprehensive understanding of the financial information used by management in its financial and operational decision making because certain of these adjusted metrics exclude items not reflective of ongoing operations, as identified in the reconciliations below. Reconciliations of non-GAAP financial performance metrics to their most directly comparable GAAP financial performance metrics are defined and presented below and should not be considered a substitute for, nor superior to, the financial data prepared in accordance with GAAP. Due to rounding, numbers presented throughout this and other documents may not add up or recalculate precisely. The Company has not provided a reconciliation of Mott’s expected EBITDA for fiscal year 2024 or fiscal year 2025 because it is unable to quantify certain amounts that would be required to be included in Mott’s contribution to net income without unreasonable efforts. In addition, the Company believes such reconciliation would imply a degree of precision that would be confusing or misleading to investors.

All table footnotes can be found at the end of this Non-GAAP Measures section. There were no adjustments to GAAP financial performance metrics other than the items noted below.

•Organic orders and net sales are calculated excluding amounts from acquired or divested businesses during the first twelve months of ownership or prior to divestiture and excluding the impact of foreign currency translation.

•Adjusted gross profit is calculated as gross profit plus fair value inventory step-up charges.

•Adjusted gross margin is calculated as adjusted gross profit divided by net sales.

•Adjusted net income attributable to IDEX is calculated as net income attributable to IDEX plus fair value inventory step-up charges, plus restructuring expenses and asset impairments, less the gain on sale of a business, plus the credit loss on a note receivable from a collaborative partner, plus acquisition-related intangible asset amortization, all net of the statutory tax expense or benefit.

•Adjusted diluted EPS attributable to IDEX is calculated as adjusted net income attributable to IDEX divided by the diluted weighted average shares outstanding.

•Consolidated Adjusted EBITDA is calculated as consolidated earnings before interest expense - net, taxes, depreciation and amortization, or consolidated EBITDA, less the gain on sale of a business, plus fair value inventory step-up charges, plus restructuring expenses and asset impairments, plus the credit loss on a note receivable from a collaborative partner.

•Consolidated Adjusted EBITDA margin is calculated as Consolidated Adjusted EBITDA divided by net sales.

•Free cash flow is calculated as cash flows from operating activities less capital expenditures. Free cash flow conversion is calculated as free cash flow divided by adjusted net income attributable to IDEX.

Table 1: Reconciliations of the Change in Net Sales to Organic Net Sales

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| FMT | | HST | | FSDP | | IDEX |

| Three Months Ended September 30, 2024 |

| Change in net sales | — | % | | (1 | %) | | 4 | % | | 1 | % |

| Less: | | | | | | | |

Net impact from acquisitions/divestitures(1) | (3 | %) | | 4 | % | | — | % | | 1 | % |

| Impact from foreign currency | 1 | % | | — | % | | — | % | | — | % |

| Change in organic net sales | 2 | % | | (5 | %) | | 4 | % | | — | % |

| | | | | | | |

| Nine Months Ended September 30, 2024 |

| Change in net sales | (1 | %) | | (8 | %) | | 2 | % | | (3 | %) |

| Less: | | | | | | | |

Net impact from acquisitions/divestitures(1) | (1 | %) | | 2 | % | | — | % | | — | % |

| Impact from foreign currency | — | % | | — | % | | — | % | | — | % |

| Change in organic net sales | — | % | | (10 | %) | | 2 | % | | (3 | %) |

Table 2: Reconciliations of Reported-to-Adjusted Gross Profit and Gross Margin (dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Gross profit | $ | 353.9 | | | $ | 349.6 | | | $ | 1,078.1 | | | $ | 1,110.1 | |

| Fair value inventory step-up charge | 2.1 | | | 1.2 | | | 4.6 | | | 1.2 | |

| Adjusted gross profit | $ | 356.0 | | | $ | 350.8 | | | $ | 1,082.7 | | | $ | 1,111.3 | |

| | | | | | | |

| Net sales | $ | 798.2 | | | $ | 793.4 | | | $ | 2,405.9 | | | $ | 2,485.0 | |

| | | | | | | |

| Gross margin | 44.3 | % | | 44.1 | % | | 44.8 | % | | 44.7 | % |

| Adjusted gross margin | 44.6 | % | | 44.2 | % | | 45.0 | % | | 44.7 | % |

Table 3: Reconciliations of Reported-to-Adjusted Net Income Attributable to IDEX and Diluted EPS Attributable to IDEX (in millions, other than per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Reported net income attributable to IDEX | | $ | 119.1 | | | $ | 209.1 | | | $ | 381.8 | | | $ | 487.5 | |

| Fair value inventory step-up charge | | 2.1 | | | 1.2 | | | 4.6 | | | 1.2 | |

| Tax impact on fair value inventory step-up charge | | (0.5) | | | (0.3) | | | (1.0) | | | (0.3) | |

| Restructuring expenses and asset impairments | | 3.0 | | | 4.1 | | | 5.4 | | | 8.2 | |

| Tax impact on restructuring expenses and asset impairments | | (0.7) | | | (0.9) | | | (1.3) | | | (1.8) | |

Gain on sale of business(2) | | 0.6 | | | (93.8) | | | (4.0) | | | (93.8) | |

| Tax impact on gain of sale of business | | — | | | 22.7 | | | — | | | 22.7 | |

Credit loss on note receivable from collaborative partner(3) | | — | | | — | | | — | | | 7.7 | |

| Tax impact on credit loss on note receivable from collaborative partner | | — | | | — | | | — | | | (1.6) | |

| Acquisition-related intangible asset amortization | | 26.5 | | | 23.8 | | | 75.0 | | | 70.6 | |

| Tax impact on acquisition-related intangible asset amortization | | (6.0) | | | (5.3) | | | (17.1) | | | (15.8) | |

| Adjusted net income attributable to IDEX | | $ | 144.1 | | | $ | 160.6 | | | $ | 443.4 | | | $ | 484.6 | |

| | | | | | | | |

| Reported diluted EPS attributable to IDEX | | $ | 1.57 | | | $ | 2.75 | | | $ | 5.02 | | | $ | 6.42 | |

| Fair value inventory step-up charge | | 0.03 | | | 0.02 | | | 0.06 | | | 0.02 | |

| Tax impact on fair value inventory step-up charge | | — | | | — | | | (0.01) | | | — | |

| Restructuring expenses and asset impairments | | 0.04 | | | 0.06 | | | 0.07 | | | 0.11 | |

| Tax impact on restructuring expenses and asset impairments | | (0.01) | | | (0.01) | | | (0.02) | | | (0.03) | |

Gain on sale of business(2) | | 0.01 | | | (1.24) | | | (0.05) | | | (1.24) | |

| Tax impact on gain of sale of business | | — | | | 0.30 | | | — | | | 0.30 | |

Credit loss on note receivable from collaborative partner(3) | | — | | | — | | | — | | | 0.10 | |

| Tax impact on credit loss on note receivable from collaborative partner | | — | | | — | | | — | | | (0.02) | |

| Acquisition-related intangible asset amortization | | 0.35 | | | 0.31 | | | 0.99 | | | 0.93 | |

| Tax impact on acquisition-related intangible asset amortization | | (0.09) | | | (0.07) | | | (0.22) | | | (0.21) | |

| Adjusted diluted EPS attributable to IDEX | | $ | 1.90 | | | $ | 2.12 | | | $ | 5.84 | | | $ | 6.38 | |

| | | | | | | | |

| Diluted weighted average shares outstanding | | 75.9 | | | 75.9 | | | 75.9 | | | 75.9 | |

Table 4: Reconciliations of Net Income to Adjusted EBITDA (dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Reported net income | $ | 118.9 | | $ | 209.0 | | $ | 381.4 | | $ | 487.3 |

| Provision for income taxes | 35.5 | | 52.8 | | 106.7 | | 132.8 |

| Interest expense - net | 10.3 | | 13.7 | | 27.8 | | 40.1 |

Gain on sale of business(2) | 0.6 | | (93.8) | | (4.0) | | (93.8) |

| Depreciation | 17.4 | | 14.7 | | 49.9 | | 41.9 |

| Amortization | 26.5 | | 23.8 | | 75.0 | | 70.6 |

| Fair value inventory step-up charges | 2.1 | | 1.2 | | 4.6 | | 1.2 |

| Restructuring expenses and asset impairments | 3.0 | | 4.1 | | 5.4 | | 8.2 |

Credit loss on note receivable from collaborative partner(3) | — | | — | | — | | 7.7 |

| Adjusted EBITDA | $ | 214.3 | | $ | 225.5 | | $ | 646.8 | | $ | 696.0 |

| | | | | | | |

| Adjusted EBITDA Components: | | | | | | | |

| FMT | $ | 98.5 | | $ | 103.6 | | $ | 311.6 | | $ | 323.9 |

| HST | 82.6 | | 84.4 | | 248.2 | | 278.8 |

| FSDP | 54.7 | | 52.8 | | 159.9 | | 157.0 |

| Corporate and other | (21.5) | | (15.3) | | (72.9) | | (63.7) |

| Total Adjusted EBITDA | $ | 214.3 | | $ | 225.5 | | $ | 646.8 | | $ | 696.0 |

| | | | | | | |

| Net sales | $ | 798.2 | | $ | 793.4 | | $ | 2,405.9 | | $ | 2,485.0 |

| | | | | | | |

| Net income margin | 14.9 | % | | 26.3 | % | | 15.9 | % | | 19.6 | % |

| Adjusted EBITDA margin | 26.9 | % | | 28.4 | % | | 26.9 | % | | 28.0 | % |

Table 5: Reconciliations of Cash Flows from Operating Activities to Free Cash Flow (dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cash flows from operating activities | $ | 205.3 | | | $ | 226.6 | | | $ | 495.5 | | | $ | 515.7 | |

| Less: Capital expenditures | 13.7 | | | 20.1 | | | 49.6 | | | 68.3 | |

| Free cash flow | $ | 191.6 | | | $ | 206.5 | | | $ | 445.9 | | | $ | 447.4 | |

| | | | | | | |

| Reported net income attributable to IDEX | $ | 119.1 | | | $ | 209.1 | | | $ | 381.8 | | | $ | 487.5 | |

| Adjusted net income attributable to IDEX | 144.1 | | | 160.6 | | | 443.4 | | | 484.6 | |

| | | | | | | |

| Operating cash flow conversion | 172 | % | | 108 | % | | 130 | % | | 106 | % |

| Free cash flow conversion | 133 | % | | 129 | % | | 101 | % | | 92 | % |

Table 6: Reconciliation of Estimated 2024 Change in Net Sales to Change in Organic Net Sales

| | | | | | | | | | | | | | | | | | | | | | | |

| Guidance |

| Fourth Quarter 2024 | | Full Year 2024 |

| Low End | | High End | | Low End | | High End |

| Change in net sales | 10 | % | | 11 | % | | — | % | | 1 | % |

| Less: | | | | | | | |

| Net impact from acquisitions/divestitures | 6 | % | | 6 | % | | 2 | % | | 2 | % |

| Impact from foreign currency | 1 | % | | 1 | % | | — | % | | — | % |

| Change in organic net sales | 3 | % | | 4 | % | | (2 | %) | | (1 | %) |

Table 7: Reconciliation of Estimated 2024 Diluted EPS Attributable to IDEX to Adjusted Diluted EPS Attributable to IDEX

| | | | | | | | | | | | | | |

| | Guidance |

| | Fourth Quarter 2024 | | Full Year 2024 |

| Estimated diluted EPS attributable to IDEX | | $1.64 - $1.69 | | $6.65 - $6.70 |

| Fair value inventory step-up charge | | 0.05 | | 0.12 |

| Tax impact on fair value inventory step-up charge | | (0.01) | | (0.03) |

| Restructuring expenses and asset impairments | | — | | 0.08 |

| Tax impact on restructuring expenses and asset impairments | | — | | (0.02) |

| Gain on sale of business | | — | | (0.05) |

| Tax impact on gain of sale of business | | — | | — |

| Acquisition-related intangible asset amortization | | 0.43 | | 1.42 |

| Tax impact on acquisition-related intangible asset amortization | | (0.10) | | (0.32) |

| Estimated adjusted diluted EPS attributable to IDEX | | $2.01 - $2.06 | | $7.85 - $7.90 |

Table 8: Reconciliation of Estimated 2024 Net Income to Adjusted EBITDA (dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Guidance |

| Fourth Quarter 2024 | | Full Year 2024 |

| Low End | | High End | | Low End | | High End |

Estimated Reported net income | $ | 123.1 | | $ | 127.4 | | $ | 504.5 | | $ | 508.8 |

| Provision for income taxes | 38.0 | | 39.4 | | 144.7 | | 146.1 |

| Interest expense - net | 18.2 | | 18.2 | | 46.0 | | 46.0 |

| Gain on sale of business | — | | — | | (4.0) | | (4.0) |

| Depreciation | 19.3 | | 19.3 | | 69.2 | | 69.2 |

| Amortization of intangible assets | 32.6 | | 32.6 | | 107.6 | | 107.6 |

| Fair value inventory step-up charge | 4.2 | | 4.2 | | 8.8 | | 8.8 |

| Restructuring expenses and asset impairments | 0.4 | | 0.4 | | 5.8 | | 5.8 |

Estimated Adjusted EBITDA | $ | 235.8 | | $ | 241.5 | | $ | 882.6 | | $ | 888.3 |

| | | | | | | |

Estimated Net sales | $ | 874.3 | | $ | 882.3 | | $ | 3,280.2 | | $ | 3,288.2 |

| | | | | | | |

Estimated Net income margin | 14.1% | | 14.4% | | 15.4% | | 15.5% |

Estimated Adjusted EBITDA margin | 27.0% | | 27.4% | | 26.9% | | 27.0% |

(1) Represents the sales from acquired or divested businesses during the first 12 months of ownership or prior to divestiture.

(2) Activity recorded during the three months ended September 30, 2024 represents the finalization of the gain on the sale of Alfa Valvole, Srl resulting in a $0.6 million downward adjustment during the third quarter of 2024.

(3) Represents a reserve on an investment with a collaborative partner recorded in Other expense (income) – net during the nine months ended September 30, 2023. During the fourth quarter of 2023, the Company converted the promissory note receivable from the collaborative partner to equity, resulting in a cost method investment with zero value.

Click Here to Edit Title October 30, 2024 Third Quarter 2024 Earnings

Click Here to Edit Titleautionary Statement 2 Cautionary Statement Under the Private Securities Litigation Reform Act; Non-GAAP Measures This presentation contains “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. These statements may relate to, among other things, the Company’s fourth quarter 2024 and full year 2024 outlook including expected sales, expected organic sales, expected earnings per share, expected adjusted earnings per share, estimated net income and estimated adjusted EBITDA and the assumptions underlying these expectations, anticipated future acquisition behavior, resource deployment and focus and organic and inorganic growth, anticipated trends in end markets, anticipated growth initiatives, the anticipated benefits of the Company’s recent acquisitions and integration plans, including the projected EBITDA of Mott and the related impact and timing for such impact on the Company’s earnings, and are indicated by words or phrases such as “anticipates,” “estimates,” “plans,” “guidance,” “expects,” “projects,” “forecasts,” “should,” “could,” “will,” “management believes,” “the Company believes,” “the Company intends” and similar words or phrases. These statements are subject to inherent uncertainties and risks that could cause actual results to differ materially from those anticipated at the date of this presentation. The risks and uncertainties include, but are not limited to, the following: levels of industrial activity and economic conditions in the U.S. and other countries around the world, including uncertainties in the financial markets; pricing pressures, including inflation and rising interest rates, and other competitive factors and levels of capital spending in certain industries; the impact of severe weather events, natural disasters and public health threats; economic and political consequences resulting from terrorist attacks and wars; the Company’s ability to make acquisitions and to integrate and operate acquired businesses on a profitable basis; cybersecurity incidents; the relationship of the U.S. dollar to other currencies and its impact on pricing and cost competitiveness; political and economic conditions in foreign countries in which the Company operates; developments with respect to trade policy and tariffs; interest rates; capacity utilization and the effect this has on costs; labor markets; supply chain conditions; market conditions and material costs; risks related to environmental, social and corporate governance issues, including those related to climate change and sustainability; and developments with respect to contingencies, such as litigation and environmental matters. Additional factors that could cause actual results to differ materially from those reflected in the forward-looking statements include, but are not limited to, the risks discussed in the “Risk Factors” section included in the Company’s most recent annual report on Form 10-K and the Company’s subsequent quarterly reports filed with the Securities and Exchange Commission (“SEC”) and the other risks discussed in the Company’s filings with the SEC. The forward-looking statements included here are only made as of the date of this presentation, and management undertakes no obligation to publicly update them to reflect subsequent events or circumstances, except as may be required by law. Investors are cautioned not to rely unduly on forward-looking statements when evaluating the information presented here. This presentation contains non-GAAP financial information. Reconciliations of non-GAAP measures are included either in this presentation or our earnings release which is available on our website.

Click Here to Edit TitleIDEX Ov rview 3 • Monitoring for inflection in industrial project activity and signs of sustained recovery in Life Sciences and Semi-con markets • Drive Mott integration alongside recent HST acquisitions and deploy resources against best growth synergies • Continue to drive 8020 and operational excellence to promote optimum productivity and flowthrough Looking Ahead • FMT growth with stable day-to-day orders…Still delays in long term commitments • FSDP record sales with strong Fire & Safety and BAND-IT growth • HST strong orders growth and backlog build led by Life Sciences • Completed Mott acquisition and swiftly executing integration plans Third Quarter Results

Click Here to Edit Title Pulsimeter flow controls for wastewater management Diverse and Specialized Portfolio Intelligent Water Envirosight inspection and monitoring solutions Trebor Recirculation DI water heaters ADS sewer and stormwater management systems

Click Here to Edit TitleStrategic Value Creation Acquisition 5 New green hydrogen components facility opening Gas filters production and inspection clean room Mott

Click Here to Edit TitleQ3 2024 Financial Performance 6 ($ in millions excl. EPS) $793 $798 Q3'23 Q3'24 Sales Flat Organic* *This presentation contains non-GAAP financial information. Reconciliations of non-GAAP measures are included either in this presentation or in our Q3 ‘24 earnings release. 28.4% 26.9% Q3'23 Q3'24 Adj. EBITDA Margin* -150 bps $2.12 $1.90 Q3'23 Q3'24 Adj. EPS* -10% $206 $192 Q3'23 Q3'24 Free Cash Flow* -7% Performance in line with expectations coupled with strong Free Cash Flow Organic* FX M&A YoY∆ Sales Growth 0% 0% 1% 1%

Click Here to Edit TitleQ3 2024 Adjusted EBITDA Walk 7 ($ in millions) *This presentation contains non-GAAP financial information. Reconciliations of non-GAAP measures are included either in this presentation or in our Q3 ‘24 earnings release. Price & Productivity partially offsetting volume headwinds, M&A spend and employee related costs 3Q’23 Act Adj. EBITDA Volume Flow Thru Price / Productivity / Inflation Mix Resource Investment / Discretionary Acq / Div / FX 3Q’24 ACT Adj. EBITDA Flow thru @ PY GM%* 44.2% Organic flow thru** Unfavorable **Excludes Acquisition, Divestiture, FX Total flow through Unfavorable ***Total flow through is calculated as change in Adjusted EBITDA divided by change in Net Sales

Click Here to Edit TitleQ3 2024: Fluid & Met ring Technologies $301 $301 Q3'23 Q3'24 Sales +2% Organic* *This presentation contains non-GAAP financial information. Reconciliations of non-GAAP measures are included either in this presentation or in our Q3 ‘24 earnings release. 34.4% 32.8% Q3'23 Q3'24 Adj. EBITDA Margin* -160 bps $294 $290 Q3'23 Q3'24 Orders Flat% Organic* Organic* FX M&A YoY∆ Sales Growth 2% 1% -3% 0% Highlights • Municipal Water remains healthy • Energy market softness • Ag down cycle • Higher employee/discretionary costs and unfavorable mix partially offset by price/cost Key Markets Health 2024 Water Solutions & Services Diversified Industrials Agriculture Energy ($ in millions) Positive catalysts Stable / moderate lift Flat / no signs of bounce back / cyclically down Strong Industrial and Water performance partially offset by Ag and Energy 8

Click Here to Edit TitleQ3 2024: Health & Science Technologies 9 Sales -5% Organic* *This presentation contains non-GAAP financial information. Reconciliations of non-GAAP measures are included either in this presentation or in our Q3 ‘24 earnings release. Adj. EBITDA Margin* -40 bps Orders +20% Organic* Organic* FX M&A YoY∆ Sales Growth -5% 0% 4% -1% 2024 Industrials Semiconductor Life Sciences Analytical Instrumentation ($ in millions) Strong orders across the portfolio…swift initiation of Mott integration $313 $311 Q3'23 Q3'24 26.9% 26.5% Q3'23 Q4'24 $265 $330 Q3'23 Q3'24 Highlights • Life Sciences & Analytical Instrumentation steady • Semiconductor delayed inflection • Industrials projects continued delays • Lower volumes and higher employee costs partially offset by price/cost, productivity and acq./div. Key Markets Health Positive catalysts Stable / moderate lift Flat / no signs of bounce back / cyclically down

Click Here to Edit TitleQ3 2024: Fire & Safety / Diversified Products 10 Sales +4% Organic* *This presentation contains non-GAAP financial information. Reconciliations of non-GAAP measures are included either in this presentation or in our Q3 ‘24 earnings release. Adj. EBITDA Margin* -20 bps Orders +4% Organic* Organic* FX M&A YoY∆ Sales Growth 4% 0% 0% 4% Highlights • Fire NA OEM continued production ramp • BAND-IT Aero strength • Dispensing NA headwind partially offset by Emerging markets • Unfavorable mix, higher employee-related costs partially offset by price/cost Key Markets Health 2024 Fire & Rescue Aero & Defense Dispensing Auto ($ in millions) Positive catalysts Stable / moderate lift Flat / no signs of bounce back / cyclically down Record sales despite cyclical downturn in North America Dispensing $181 $188 Q3'23 Q3'24 29.3% 29.1% Q3'23 Q3'24 $155 $163 Q3'23 Q4'24

Click Here to Edit Title2024 Guidance Summary 11 *This presentation contains non-GAAP financial information. Reconciliations of non-GAAP measures are included either in this presentation or in our Q3 ‘24 earnings release. Reconciliations of the Company’s Free Cash Flow as a percentage of Adjusted Net Income guidance to the most directly comparable GAAP financial measures cannot be provided without unreasonable efforts and are not provided herein because of the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. Fourth Quarter Full Year Current Guidance Current Guidance Revenue % vs Prior Year Organic* 3% – 4% (2%) - (1%) EBITDA % Adjusted* ~27% ~27% Earnings Per Share Reported* $1.64 - $1.69 $6.65 - $6.70 Earnings Per Share Adjusted* $2.01 - $2.06 $7.85 - $7.90 Other Modeling Items: FX Impact on Sales ~1% -a) ~0% Acquisition/Divesture Impact on Sales ~6% ~2% Depreciation $ ~$19 Million ~$69 Million Amortization $ ~$33 Million ~$108 Million Net Interest $ ~$18 Million ~$46 Million Capital Expenditures $70+ Million Tax Rate ~23% ~22% Free Cash Flow % of Adjusted Net Income* 100%+ Corporate Costs ~$22 Million ~$95 Million (a) – Based on 9/30/2024 FX Rate Earnings per share estimates exclude all future acquisitions and any future restructuring expenses

Click Here to Edit TitleIDEX Value Drivers ORGANIC GROWTH INORGANIC GROWTH MARGIN EXPANSION • Leading market entitlement • Pricing Execution • Growth Bets Prioritization • Strong funnel of M&A opportunities • Fast growing companies • Disciplined capital deployment • Leading the IDEX Op Model • 80/20 • Leverage

Click Here to Edit Title Non-GAAP Reconciliations

Table 1: Reconciliations of the Change in Net Sales to Organic Net Sales FMT HST FSDP IDEX Three Months Ended September 30, 2024 Change in net sales —% (1%) 4% 1% Less: Net impact from acquisitions/divestitures(1) (3%) 4% —% 1% Impact from foreign currency 1% —% —% —% Change in organic net sales 2% (5%) 4% —% Nine Months Ended September 30, 2024 Change in net sales (1%) (8%) 2% (3%) Less: Net impact from acquisitions/divestitures(1) (1%) 2% —% —% Impact from foreign currency —% —% —% —% Change in organic net sales —% (10%) 2% (3%) Table 2: Reconciliations of Reported-to-Adjusted Gross Profit and Gross Margin (dollars in millions) Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Gross profit $ 353.9 $ 349.6 $ 1,078.1 $ 1,110.1 Fair value inventory step-up charge 2.1 1.2 4.6 1.2 Adjusted gross profit $ 356.0 $ 350.8 $ 1,082.7 $ 1,111.3 Net sales $ 798.2 $ 793.4 $ 2,405.9 $ 2,485.0 Gross margin 44.3% 44.1% 44.8% 44.7% Adjusted gross margin 44.6% 44.2% 45.0% 44.7%

Table 3: Reconciliations of Reported-to-Adjusted Net Income Attributable to IDEX and Diluted EPS Attributable to IDEX (in millions, other than per share amounts) Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Reported net income attributable to IDEX $ 119.1 $ 209.1 $ 381.8 $ 487.5 Fair value inventory step-up charge 2.1 1.2 4.6 1.2 Tax impact on fair value inventory step-up charge (0.5) (0.3) (1.0) (0.3) Restructuring expenses and asset impairments 3.0 4.1 5.4 8.2 Tax impact on restructuring expenses and asset impairments (0.7) (0.9) (1.3) (1.8) Gain on sale of business(2) 0.6 (93.8) (4.0) (93.8) Tax impact on gain of sale of business — 22.7 — 22.7 Credit loss on note receivable from collaborative partner(3) — — — 7.7 Tax impact on credit loss on note receivable from collaborative partner — — — (1.6) Acquisition-related intangible asset amortization 26.5 23.8 75.0 70.6 Tax impact on acquisition-related intangible asset amortization (6.0) (5.3) (17.1) (15.8) Adjusted net income attributable to IDEX $ 144.1 $ 160.6 $ 443.4 $ 484.6 Reported diluted EPS attributable to IDEX $ 1.57 $ 2.75 $ 5.02 $ 6.42 Fair value inventory step-up charge 0.03 0.02 0.06 0.02 Tax impact on fair value inventory step-up charge — — (0.01) — Restructuring expenses and asset impairments 0.04 0.06 0.07 0.11 Tax impact on restructuring expenses and asset impairments (0.01) (0.01) (0.02) (0.03) Gain on sale of business(2) 0.01 (1.24) (0.05) (1.24) Tax impact on gain of sale of business — 0.30 — 0.30 Credit loss on note receivable from collaborative partner(3) — — — 0.10 Tax impact on credit loss on note receivable from collaborative partner — — — (0.02) Acquisition-related intangible asset amortization 0.35 0.31 0.99 0.93 Tax impact on acquisition-related intangible asset amortization (0.09) (0.07) (0.22) (0.21) Adjusted diluted EPS attributable to IDEX $ 1.90 $ 2.12 $ 5.84 $ 6.38 Diluted weighted average shares outstanding 75.9 75.9 75.9 75.9

Table 4: Reconciliations of Net Income to Adjusted EBITDA (dollars in millions) Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Reported net income $ 118.9 $ 209.0 $ 381.4 $ 487.3 Provision for income taxes 35.5 52.8 106.7 132.8 Interest expense - net 10.3 13.7 27.8 40.1 Gain on sale of business(2) 0.6 (93.8) (4.0) (93.8) Depreciation 17.4 14.7 49.9 41.9 Amortization 26.5 23.8 75.0 70.6 Fair value inventory step-up charges 2.1 1.2 4.6 1.2 Restructuring expenses and asset impairments 3.0 4.1 5.4 8.2 Credit loss on note receivable from collaborative partner(3) — — — 7.7 Adjusted EBITDA $ 214.3 $ 225.5 $ 646.8 $ 696.0 Adjusted EBITDA Components: FMT $ 98.5 $ 103.6 $ 311.6 $ 323.9 HST 82.6 84.4 248.2 278.8 FSDP 54.7 52.8 159.9 157.0 Corporate and other (21.5) (15.3) (72.9) (63.7) Total Adjusted EBITDA $ 214.3 $ 225.5 $ 646.8 $ 696.0 Net sales $ 798.2 $ 793.4 $ 2,405.9 $ 2,485.0 Net income margin 14.9% 26.3% 15.9% 19.6% Adjusted EBITDA margin 26.9% 28.4% 26.9% 28.0%

Table 5: Reconciliations of Cash Flows from Operating Activities to Free Cash Flow (dollars in millions) Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Cash flows from operating activities $ 205.3 $ 226.6 $ 495.5 $ 515.7 Less: Capital expenditures 13.7 20.1 49.6 68.3 Free cash flow $ 191.6 $ 206.5 $ 445.9 $ 447.4 Reported net income attributable to IDEX $ 119.1 $ 209.1 $ 381.8 $ 487.5 Adjusted net income attributable to IDEX 144.1 160.6 443.4 484.6 Operating cash flow conversion 172% 108% 130% 106% Free cash flow conversion 133% 129% 101% 92% Table 6: Reconciliation of Estimated 2024 Change in Net Sales to Change in Organic Net Sales Guidance Fourth Quarter 2024 Full Year 2024 Low End High End Low End High End Change in net sales 10% 11% —% 1% Less: Net impact from acquisitions/divestitures 6% 6% 2% 2% Impact from foreign currency 1% 1% —% —% Change in organic net sales 3% 4% (2%) (1%) Table 7: Reconciliation of Estimated 2024 Diluted EPS Attributable to IDEX to Adjusted Diluted EPS Attributable to IDEX Guidance Fourth Quarter 2024 Full Year 2024 Estimated diluted EPS attributable to IDEX $1.64 - $1.69 $6.65 - $6.70 Fair value inventory step-up charge 0.05 0.12 Tax impact on fair value inventory step-up charge (0.01) (0.03) Restructuring expenses and asset impairments — 0.08 Tax impact on restructuring expenses and asset impairments — (0.02) Gain on sale of business — (0.05) Tax impact on gain of sale of business — — Acquisition-related intangible asset amortization 0.43 1.42 Tax impact on acquisition-related intangible asset amortization (0.10) (0.32) Estimated adjusted diluted EPS attributable to IDEX $2.01 - $2.06 $7.85 - $7.90

Table 8: Reconciliation of Estimated 2024 Net Income to Adjusted EBITDA (dollars in millions) Guidance Fourth Quarter 2024 Full Year 2024 Low End High End Low End High End Estimated Reported net income $ 123.1 $ 127.4 $ 504.5 $ 508.8 Provision for income taxes 38.0 39.4 144.7 146.1 Interest expense - net 18.2 18.2 46.0 46.0 Gain on sale of business — — (4.0) (4.0) Depreciation 19.3 19.3 69.2 69.2 Amortization of intangible assets 32.6 32.6 107.6 107.6 Fair value inventory step-up charge 4.2 4.2 8.8 8.8 Restructuring expenses and asset impairments 0.4 0.4 5.8 5.8 Estimated Adjusted EBITDA $ 235.8 $ 241.5 $ 882.6 $ 888.3 Estimated Net sales $ 874.3 $ 882.3 $ 3,280.2 $ 3,288.2 Estimated Net income margin 14.1 % 14.4 % 15.4 % 15.5 % Estimated Adjusted EBITDA margin 27.0 % 27.4 % 26.9 % 27.0 % (1) Represents the sales from acquired or divested businesses during the first 12 months of ownership or prior to divestiture. (2) Activity recorded during the three months ended September 30, 2024 represents the finalization of the gain on the sale of Alfa Valvole, Srl resulting in a $0.6 million downward adjustment during the third quarter of 2024. (3) Represents a reserve on an investment with a collaborative partner recorded in Other expense (income) – net during the nine months ended September 30, 2023. During the fourth quarter of 2023, the Company converted the promissory note receivable from the collaborative partner to equity, resulting in a cost method investment with zero value.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

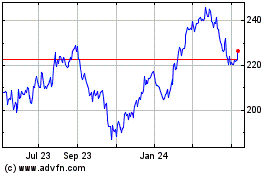

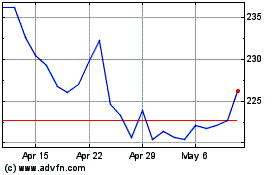

IDEX (NYSE:IEX)

Historical Stock Chart

From Oct 2024 to Nov 2024

IDEX (NYSE:IEX)

Historical Stock Chart

From Nov 2023 to Nov 2024