Current Report Filing (8-k)

July 20 2022 - 5:25PM

Edgar (US Regulatory)

HECLA MINING CO/DE/ false 0000719413 0000719413 2022-07-20 2022-07-20 0000719413 hl:CommonStockParValue025PerShareMember 2022-07-20 2022-07-20 0000719413 hl:SeriesBCumulativeConvertiblePreferredStockParValue025PerShareMember 2022-07-20 2022-07-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 20, 2022

HECLA MINING COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-8491 |

|

77-0664171 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

6500 North Mineral Drive, Suite 200

Coeur d’Alene, Idaho 83815-9408

(Address of principal executive offices) (Zip Code)

(208) 769-4100

Registrant’s telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.25 per share |

|

HL |

|

New York Stock Exchange |

| Series B Cumulative Convertible Preferred Stock, par value $0.25 per share |

|

HL-PB |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

On July 20, 2022, representatives of Hecla Mining Company (“Hecla”) are scheduled to make a presentation (the “Presentation”) in Coeur d’Alene, Idaho to certain analysts. As part of the Presentation, Phillips S. Baker, Jr., President and Chief Executive Officer of Hecla, will discuss Hecla’s pending acquisition of Alexco Resource Corp. (“Alexco”). The Presentation will include the slides attached as Exhibit 99.1 (the “Acquisition Slides”).

As previously announced, on July 4, 2022, Hecla entered into an Arrangement Agreement (the “Alexco Agreement”) with Alexco. Under the terms of the Alexco Agreement, Hecla will acquire all of the outstanding shares of Alexco, and Alexco’s shareholders will receive 0.116 of a share of Hecla common stock per Alexco share, representing total consideration with a value of US$0.47 per Alexco share (based on the companies’ 5-day volume weighted average price on the New York Stock Exchange (“NYSE”) and NYSE American on July 1, 2022). As part of the Alexco Agreement, Hecla has agreed to:

| |

• |

|

provide a loan to Alexco in the amount of up to $30 million to bridge Alexco’s operations from signing to closing; and |

| |

• |

|

subscribe for and purchase 8,984,100 Alexco common shares at CDN$0.50 per share, having an aggregate value of US$3,593,640. Following such purchase, Hecla and its affiliates will own 9.9% of the outstanding Alexco shares. |

Concurrently with entering into the Alexco Agreement, Hecla entered into a Stream Termination Agreement (the “WPM Agreement” and together with the Alexco Agreement, the “Agreements”) with Wheaton Precious Metals Corp. (“WPM”). Under the WPM Agreement, after the closing of the Alexco acquisition, Hecla will issue shares of its common stock valued at US$135 million based on Hecla’s 5-day volume-weighted average price immediately prior to the closing in exchange for the termination of WPM’s silver streaming interest in Alexco’s Keno Hill silver mine located in the Yukon Territory, Canada.

In accordance with General Instruction B.2 of Form 8-K, the information in Item 7.01 and Exhibit 99.1 is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any of the Company’s filings or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 - Financial Statements and Exhibits

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

HECLA MINING COMPANY |

|

|

|

|

|

|

|

|

By: |

|

/s/ David C. Sienko |

|

|

|

|

|

|

David C. Sienko |

|

|

|

|

|

|

Vice President and General Counsel |

|

|

|

|

| Dated: July 20, 2022 |

|

|

|

|

|

|

3

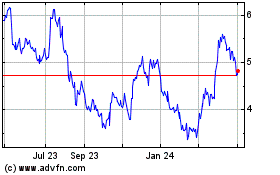

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Jul 2023 to Jul 2024