Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

January 07 2025 - 6:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under the

Securities Exchange Act of 1934

For the month of January, 2025

Commission File Number 001-15216

HDFC BANK LIMITED

(Translation of registrant’s name into English)

HDFC Bank House, Senapati Bapat Marg,

Lower Parel, Mumbai. 400 013, India

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

HDFC BANK LIMITED |

|

|

|

|

(Registrant) |

|

|

|

|

| Date: January 3, 2025 |

|

|

|

By: |

|

/s/ Ajay Agarwal |

|

|

|

|

Name: Ajay Agarwal |

|

|

|

|

Title: Company Secretary & Head – Group

Oversight |

EXHIBIT INDEX

The following documents (bearing the exhibit number listed below) are furnished herewith and are made a part of this report pursuant to the General

Instructions for Form 6-K.

Exhibit No. 99

Description

Disclosure

Exhibit 99

January 3, 2025

New York Stock Exchange

11, Wall Street,

New York,

NY 10005

USA

Dear Sir,

Sub: Disclosure

We wish to inform you that the RBI vide its letters dated January 3, 2025, has given its approval to HDFC Bank Limited (being promoter / sponsor of its

group entities viz HDFC Mutual Fund, HDFC Life Insurance Company Limited, HDFC ERGO General Insurance Company Limited, HDFC Pension Fund Management Limited and others) to acquire “aggregate holding” of up to 9.50% of the share capital or

voting rights in the following banks:

| |

1. |

Kotak Mahindra Bank Limited |

| |

2. |

AU Small Finance Bank Limited |

| |

3. |

Capital Small Finance Bank Limited |

We further wish to inform you that the said approval is valid for a period of one year from the date of RBI’s letter, i.e., till January 2, 2026.

Further HDFC Bank needs to ensure that the “aggregate holding” by its group entities in the above-mentioned banks does not exceed 9.50% of the paid-up share capital or voting rights of the respective

banks, at all times.

Kindly note that as per the Reserve Bank of India (Acquisition and Holding of Shares or Voting Rights in Banking Companies)

Directions, 2023 (“RBI Directions”), ‘aggregate holding’ includes shareholding by the Bank, entities under the same management/ control, mutual funds, trustees, promoter group entities, etc. In view of the same, whilst HDFC Bank

does not intend to invest in these banks, since the “aggregate holding” of HDFC Bank group entities is likely to exceed the prescribed limit of 5%, an application seeking approval of RBI for increase in investment limits was made. Further,

since the RBI Directions is applicable to HDFC Bank, the Bank had made the application to RBI on behalf of the Group, on September 20, 2024.

Please

also note that the above investments by HDFC Bank group entities are in the normal course of business of the respective group entities.

We request you to

bring the above to the notice of all concerned.

Yours faithfully,

For HDFC Bank Limited

Sd/-

Ajay Agarwal

Company Secretary & Head –

Group Oversight

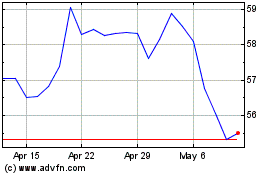

HDFC Bank (NYSE:HDB)

Historical Stock Chart

From Dec 2024 to Jan 2025

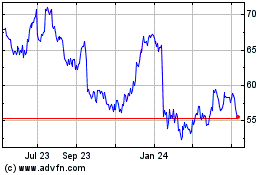

HDFC Bank (NYSE:HDB)

Historical Stock Chart

From Jan 2024 to Jan 2025