Quarterly Schedule of Portfolio Holdings of Registered Management Investment Company (n-q)

January 29 2013 - 9:40AM

Edgar (US Regulatory)

|

OMB APPROVAL

|

|

OMB Number: 3235-0578

Expires: April 30, 2013

Estimated average burden hours per response: 5.6

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-Q

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number

811-03907

The Empire Builder Tax Free Bond Fund

(Exact name of registrant as specified in charter)

|

546 Fifth Avenue, 7

th

Floor New York, New York

|

10036

|

|

(Address of principal executive offices)

|

(Zip code)

|

Frank L. Newbauer, Esq.

Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246

(Name and address of agent for service)

Registrant's telephone number, including area code:

(212) 953-7800

Date of fiscal year end:

February 28, 2013

Date of reporting period:

November 30, 2012

Form N-Q is to be used by management investment companies other than small business investment companies registered on Form N-5 (§§ 239.24 and 274.5 of this chapter), to file reports with the Commission, not later than 60 days after the close of the first and third fiscal quarters, pursuant to Rule 30b1-5 under the Investment Company Act of 1940 (17 CFR 270.30b1-5). The Commission may use the information provided on Form N-Q in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-Q, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-Q unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

|

Item 1.

|

Schedule of Investments.

|

|

THE EMPIRE BUILDER TAX FREE BOND FUND

|

|

|

|

|

|

SCHEDULE OF INVESTMENTS

|

|

|

|

|

|

November 30, 2012

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

MUNICIPAL SECURITIES - 95.1%

|

|

Credit Ratings *

|

|

|

Par Value

|

|

|

Value

|

|

|

New York City and New York City Agencies - 18.1%

|

|

|

Hudson Yards Infrastructure Corp., Revenue, Series A,

|

|

|

|

|

|

|

|

|

|

|

5.75%, due 02/15/2047, Par Call 02/15/2021 @ 100

|

|

A2/A

|

|

|

$

|

1,000,000

|

|

|

$

|

1,208,930

|

|

|

New York City, General Obligation, Series C,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.50%, due 08/01/2014, Par Call 02/01/2013 @ 100

|

|

Aa2/AA

|

|

|

|

3,500,000

|

|

|

|

3,528,035

|

|

|

New York City, General Obligation, Series E-1,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.25%, due 10/15/2028, Par Call 10/15/2018 @ 100

|

|

Aa2/AA

|

|

|

|

2,000,000

|

|

|

|

2,529,800

|

|

|

New York City, Housing Development Corp., Multi-Family Housing Revenue, Series M,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.40%, due 05/01/2014, Non-Callable

|

|

Aa2/AA

|

|

|

|

165,000

|

|

|

|

171,722

|

|

|

4.45%, due 11/01/2014, Non-Callable

|

|

Aa2/AA

|

|

|

|

330,000

|

|

|

|

348,153

|

|

|

4.60%, due 05/01/2015, Non-Callable

|

|

Aa2/AA

|

|

|

|

340,000

|

|

|

|

364,222

|

|

|

4.65%, due 11/01/2015, Non-Callable

|

|

Aa2/AA

|

|

|

|

350,000

|

|

|

|

379,978

|

|

|

6.75%, due 11/01/2033, Par Call 11/01/2018 @ 100

|

|

Aa2/AA

|

|

|

|

1,000,000

|

|

|

|

1,195,500

|

|

|

New York City, Municipal Water Finance Authority, Water & Sewer Systems, Revenue, Series GG,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.00%, due 06/15/2017, Par Call 12/15/2015 @ 100

|

|

Aa2/AA+

|

|

|

|

1,125,000

|

|

|

|

1,270,766

|

|

|

Triborough Bridge & Tunnel Authority, Revenue,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.25%, due 11/15/2022, Continuously Callable @ 100 (NATL-RE)

|

|

A1/A+

|

|

|

|

750,000

|

|

|

|

752,640

|

|

|

5.25%, due 11/15/2023, Continuously Callable @ 100 (NATL-RE)

|

|

A1/A+

|

|

|

|

2,900,000

|

|

|

|

2,910,121

|

|

|

Total New York City and New York City Agencies

|

|

|

|

|

|

|

|

|

|

$

|

14,659,867

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New York State Agencies - 43.7%

|

|

|

Dormitory Authority of the State of New York - 35.9%

|

|

|

Catholic Health System Obligated Group, Non-State Supported Debt, Revenue, Series A,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.00%, due 07/01/2014, Non-Callable

|

|

Baa1/BBB+

|

|

|

$

|

130,000

|

|

|

$

|

131,167

|

|

|

3.00%, due 07/01/2015, Non-Callable

|

|

Baa1/BBB+

|

|

|

|

340,000

|

|

|

|

351,597

|

|

|

3.00%, due 07/01/2016, Non-Callable

|

|

Baa1/BBB+

|

|

|

|

300,000

|

|

|

|

311,976

|

|

|

City University System Consolidated Fifth General Resolution, State Supported Debt, Revenue, Series E,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.125%, due 01/01/2031, Par Call 01/01/2019 @ 100

|

|

NR/AA-

|

|

|

|

1,500,000

|

|

|

|

1,853,085

|

|

|

Department of Education, State Supported Debt, Revenue, Series A,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.00%, due 07/01/2018, Par Call 07/01/2016 @ 100

|

|

NR/AA-

|

|

|

|

1,000,000

|

|

|

|

1,130,600

|

|

|

Department of Health, Veterans Home, Revenue, Series A,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.00%, due 07/01/2013, Non-Callable

|

|

NR/AA-

|

|

|

|

955,000

|

|

|

|

979,190

|

|

|

Hospital for Special Surgery, Non-State Supported Debt, Revenue,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.00%, due 08/15/2038, Par Call 08/15/2019 @ 100 (FHA)

|

|

Aa2/AA+

|

|

|

|

500,000

|

|

|

|

619,410

|

|

|

Memorial Sloan-Kettering Cancer Center, Non-State Supported Debt, Revenue, Series 1,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.00%, due 07/01/2020, Non-Callable

|

|

Aa3/AA-

|

|

|

|

500,000

|

|

|

|

621,580

|

|

|

THE EMPIRE BUILDER TAX FREE BOND FUND

|

|

|

|

|

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

|

|

|

|

|

|

|

|

|

|

MUNICIPAL SECURITIES - 95.1% (Continued)

|

|

Credit Ratings *

|

|

|

Par Value

|

|

|

Value

|

|

|

New York State Agencies - 43.7% (Continued)

|

|

|

Dormitory Authority of the State of New York - 35.9% (Continued)

|

|

|

Mental Health Services Facilities Improvement, State Supported Debt, Revenue, Series A,

|

|

|

|

|

|

|

|

|

|

|

5.00%, due 02/15/2019, Par Call 02/15/2015 @ 100 (AMBAC)

|

|

NR/AA-

|

|

|

$

|

2,500,000

|

|

|

$

|

2,722,775

|

|

|

Mental Health Services Facilities Improvement, State Supported Debt, Revenue, Series F,

|

|

|

|

|

|

|

|

|

|

|

|

|

6.25%, due 02/15/2031, Par Call 08/15/2018 @ 100

|

|

NR/AA-

|

|

|

|

1,500,000

|

|

|

|

1,846,890

|

|

|

Municipal Health Facilities Improvement Program, Non-State Supported Debt, Revenue, Subseries 2-1,

|

|

|

|

|

|

|

|

|

|

|

|

|

5.00%, due 01/15/2018, Non-Callable

|

|

Aa3/AA-

|

|

|

|

2,000,000

|

|

|

|

2,315,380

|

|

|

New York Medical College, Revenue,

|

|

|

|

|

|

|

|

|

|

|

|

|

5.25%, due 07/01/2013, Continuously Callable @ 100 (NATL-RE)

|

|

Baa2/BBB

|

|

|

|

1,015,000

|

|

|

|

1,017,720

|

|

|

North Shore-Long Island Jewish Obligated Group, Non-State Supported Debt, Revenue, Series B,

|

|

|

|

|

|

|

|

|

|

|

|

|

4.25%, due 05/01/2039, Par Call 05/01/2022 @ 100

|

|

A3/A-

|

|

|

|

150,000

|

|

|

|

160,937

|

|

|

School Districts Revenue Bond Financing Program, Non-State Supported Debt, Revenue, Series A,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.00%, due 04/01/2014, Non-Callable (State Aid Withholding)

|

|

NR/A+

|

|

|

|

735,000

|

|

|

|

758,491

|

|

|

4.00%, due 10/01/2014, Non-Callable (State Aid Withholding)

|

|

NR/A+

|

|

|

|

500,000

|

|

|

|

531,040

|

|

|

Special Act School Districts Program, Revenue,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.00%, due 07/01/2019, Continuously Callable @ 100 (NATL-RE)

|

|

Baa2/BBB

|

|

|

|

3,540,000

|

|

|

|

3,555,080

|

|

|

St. Lawrence-Lewis BOCES Program, Non-State Supported Debt, Revenue,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.00%, due 08/15/2018, Par Call 08/15/2017 @ 100 (AGM)

|

|

Aa3/AA-

|

|

|

|

100,000

|

|

|

|

110,333

|

|

|

4.125%, due 08/15/2020, Par Call 08/15/2017 @ 100 (AGM)

|

|

Aa3/AA-

|

|

|

|

110,000

|

|

|

|

120,577

|

|

|

4.25%, due 08/15/2021, Par Call 08/15/2017 @ 100 (AGM)

|

|

Aa3/AA-

|

|

|

|

100,000

|

|

|

|

110,220

|

|

|

State Personal Income Tax, Revenue, Series A,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.00%, due 12/15/2029, Par Call 12/15/2022 @ 100

|

|

NR/AAA

|

|

|

|

3,000,000

|

|

|

|

3,761,400

|

|

|

University of Rochester, Non-State Supported Debt, Revenue, Series A-1,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.00%, due 07/01/2019, Par Call 01/01/2017 @ 100

|

|

Aa3/AA-

|

|

|

|

2,305,000

|

|

|

|

2,703,235

|

|

|

Upstate Community Colleges, Revenue, Series B,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.25%, due 07/01/2015, Par Call 07/01/2014 @ 100 (NATL-RE, FGIC, TCRS)

|

|

Aa3/NR

|

|

|

|

3,140,000

|

|

|

|

3,379,990

|

|

|

Total Dormitory Authority of the State of New York

|

|

|

|

|

|

|

|

|

|

|

29,092,673

|

|

|

THE EMPIRE BUILDER TAX FREE BOND FUND

|

|

|

|

|

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

|

|

|

|

|

|

|

|

|

|

MUNICIPAL SECURITIES - 95.1% (Continued)

|

Credit Ratings *

|

|

Par Value

|

|

|

Value

|

|

|

New York State Agencies - 43.7% (Continued)

|

|

|

Other New York State Agencies - 7.8%

|

|

|

New York State Environmental Facilities Corp., United Water New Rochelle, Water Facilities Revenue, Series A,

|

|

|

|

|

|

|

|

|

4.875%, due 09/01/2040, Par Call 09/01/2020 @ 100

|

Baa1/A-

|

|

$

|

1,000,000

|

|

|

$

|

1,096,010

|

|

|

New York State Housing Finance Agency, Revenue, Series A,

|

|

|

|

|

|

|

|

|

|

|

2.00%, due 09/15/2013, Non-Callable

|

NR/AA-

|

|

|

1,500,000

|

|

|

|

1,517,550

|

|

|

5.00%, due 09/15/2013, Non-Callable

|

NR/AA-

|

|

|

2,500,000

|

|

|

|

2,587,400

|

|

|

New York State Urban Development Corp., Service Contract Revenue, Series D,

|

|

|

|

|

|

|

|

|

|

|

5.00%, due 01/01/2015, Non-Callable

|

NR/AA-

|

|

|

1,000,000

|

|

|

|

1,093,300

|

|

|

Total Other New York State Agencies

|

|

|

|

|

|

|

|

6,294,260

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total New York State Agencies

|

|

|

|

|

|

|

$

|

35,386,933

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other New York State Bonds - 33.3%

|

|

|

Addison Central School District, General Obligation,

|

|

|

|

|

|

|

|

|

|

|

5.00%, due 06/01/2019, Non-Callable (State Aid Withholding)

|

A1/NR

|

|

$

|

1,425,000

|

|

|

$

|

1,723,465

|

|

|

Ausable Valley Central School District, General Obligation,

|

|

|

|

|

|

|

|

|

|

|

2.50%, due 06/15/2013, Non-Callable (State Aid Withholding)

|

NR/A

|

|

|

380,000

|

|

|

|

383,576

|

|

|

Caledonia-Mumford Central School District, General Obligation,

|

|

|

|

|

|

|

|

|

|

|

4.00%, due 06/15/2013, Non-Callable (State Aid Withholding)

|

NR/A+

|

|

|

455,000

|

|

|

|

462,967

|

|

|

Chili, Public Improvement, General Obligation,

|

|

|

|

|

|

|

|

|

|

|

3.00%, due 12/15/2012, Non-Callable

|

Aa3/NR

|

|

|

315,000

|

|

|

|

315,316

|

|

|

Cobleskill-Richmondville Central School District, General Obligation,

|

|

|

|

|

|

|

|

|

|

|

3.25%, due 01/15/2013, Non-Callable (Assured GTY State Aid Withholding)

|

Aa3/NR

|

|

|

700,000

|

|

|

|

702,201

|

|

|

Dansville Central School District, General Obligation,

|

|

|

|

|

|

|

|

|

|

|

2.00%, due 06/15/2013, Non-Callable (State Aid Withholding)

|

NR/AA-

|

|

|

275,000

|

|

|

|

276,922

|

|

|

East Moriches Union Free School District, General Obligation,

|

|

|

|

|

|

|

|

|

|

|

3.00%, due 07/01/2018, Non-Callable (AGM State Aid Withholding)

|

NR/AA-

|

|

|

525,000

|

|

|

|

564,029

|

|

|

3.00%, due 07/01/2019, Non-Callable (AGM State Aid Withholding)

|

NR/AA-

|

|

|

385,000

|

|

|

|

414,999

|

|

|

3.00%, due 07/01/2020, Non-Callable (AGM State Aid Withholding)

|

NR/AA-

|

|

|

460,000

|

|

|

|

492,471

|

|

|

Elmira City School District, General Obligation,

|

|

|

|

|

|

|

|

|

|

|

5.00%, due 06/15/2013, Non-Callable (State Aid Withholding)

|

NR/A

|

|

|

1,000,000

|

|

|

|

1,023,150

|

|

|

THE EMPIRE BUILDER TAX FREE BOND FUND

|

|

|

|

|

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

|

|

|

|

|

|

|

|

|

|

MUNICIPAL SECURITIES - 95.1% (Continued)

|

|

Credit Ratings *

|

|

|

Par Value

|

|

|

Value

|

|

|

Other New York State Bonds - 33.3% (Continued)

|

|

|

Erie County IDA, City School District of Buffalo Project, School Facility Revenue, Series A,

|

|

|

|

|

|

|

|

|

|

|

5.75%, due 05/01/2025, Par Call 05/01/2017 @ 100 (AGM)

|

|

Aa3/AA-

|

|

|

$

|

2,000,000

|

|

|

$

|

2,381,739

|

|

|

Freeport, Public Improvement, General Obligation, Series A,

|

|

|

|

|

|

|

|

|

|

|

|

|

3.00%, due 03/15/2013, Non-Callable (AGM)

|

|

Aa3/NR

|

|

|

|

1,005,000

|

|

|

|

1,011,935

|

|

|

Freeport, Public Improvement, General Obligation, Series B,

|

|

|

|

|

|

|

|

|

|

|

|

|

2.00%, due 06/01/2013, Non-Callable (AGM)

|

|

Aa3/NR

|

|

|

|

655,000

|

|

|

|

659,664

|

|

|

Genesee Valley Central School District at Angelica Belmont, General Obligation,

|

|

|

|

|

|

|

|

|

|

|

|

|

3.00%, due 06/15/2014, Non-Callable (AGM State Aid Withholding)

|

|

NR/AA-

|

|

|

|

300,000

|

|

|

|

310,002

|

|

|

4.00%, due 06/15/2015, Non-Callable (AGM State Aid Withholding)

|

|

NR/AA-

|

|

|

|

295,000

|

|

|

|

316,500

|

|

|

Geneva City School District, General Obligation,

|

|

|

|

|

|

|

|

|

|

|

|

|

2.00%, due 06/15/2013, Non-Callable (State Aid Withholding)

|

|

A1/NR

|

|

|

|

300,000

|

|

|

|

302,337

|

|

|

3.00%, due 06/15/2014, Non-Callable (State Aid Withholding)

|

|

A1/NR

|

|

|

|

1,090,000

|

|

|

|

1,126,003

|

|

|

Greene County, Public Improvement, General Obligation,

|

|

|

|

|

|

|

|

|

|

|

|

|

3.00%, due 03/15/2013, Non-Callable

|

|

Aa3/NR

|

|

|

|

790,000

|

|

|

|

795,427

|

|

|

Hannibal Central School District, General Obligation, Series A,

|

|

|

|

|

|

|

|

|

|

|

|

|

2.00%, due 07/01/2013, Non-Callable (AGM State Aid Withholding)

|

|

NR/AA-

|

|

|

|

460,000

|

|

|

|

463,620

|

|

|

Hempstead Town, Adelphi University Project, Revenue,

|

|

|

|

|

|

|

|

|

|

|

|

|

3.00%, due 06/01/2013, Non-Callable

|

|

NR/A

|

|

|

|

565,000

|

|

|

|

569,803

|

|

|

Hempstead Town, Local Development Corp., Revenue, Series 2011,

|

|

|

|

|

|

|

|

|

|

|

|

|

4.625%, due 07/01/2036, Par Call 07/01/2021 @ 100

|

|

A3/A

|

|

|

|

250,000

|

|

|

|

273,185

|

|

|

Hornell City School District, General Obligation,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.00%, due 06/15/2013, Non-Callable (State Aid Withholding)

|

|

A1/NR

|

|

|

|

750,000

|

|

|

|

758,595

|

|

|

Ithaca City, General Obligation, Series B,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.00%, due 08/01/2015, Non-Callable

|

|

Aa2/NR

|

|

|

|

250,000

|

|

|

|

264,965

|

|

|

Ithaca City, General Obligation, Series A,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.00%, due 01/15/2016, Non-Callable

|

|

Aa2/NR

|

|

|

|

750,000

|

|

|

|

800,115

|

|

|

Jamestown City School District, General Obligation,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.00%, due 11/01/2019, Non-Callable (State Aid Withholding)

|

|

A1/NR

|

|

|

|

1,310,000

|

|

|

|

1,492,692

|

|

|

Johnson City Central School District, General Obligation,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.00%, due 06/15/2022, Non-Callable (AGM State Aid Witholding)

|

|

NR/AA-

|

|

|

|

335,000

|

|

|

|

413,283

|

|

|

5.00%, due 06/15/2026, Par Call 06/15/2022 @ 100 (AGM State Aid Withholding)

|

|

NR/AA-

|

|

|

|

400,000

|

|

|

|

488,864

|

|

|

THE EMPIRE BUILDER TAX FREE BOND FUND

|

|

|

|

|

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

|

|

|

|

|

|

|

|

|

|

MUNICIPAL SECURITIES - 95.1% (Continued)

|

|

Credit Ratings *

|

|

|

Par Value

|

|

|

Value

|

|

|

Other New York State Bonds - 33.3% (Continued)

|

|

|

Long Island Power Authority, Electric System General Revenue, Series A,

|

|

|

|

|

|

|

|

|

|

|

6.00%, due 05/01/2033, Par Call 05/01/2019 @ 100

|

|

A3/A-

|

|

|

$

|

500,000

|

|

|

$

|

622,735

|

|

|

Mechanicville City School District, General Obligation,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.00%, due 06/15/2013, Non-Callable (State Aid Withholding)

|

|

NR/A+

|

|

|

|

250,000

|

|

|

|

253,063

|

|

|

Metropolitan Transportation Authority, Transportation Revenue, Series 2008C,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.50%, due 11/15/2028, Par Call 11/15/2018 @ 100

|

|

A2/A

|

|

|

|

1,500,000

|

|

|

|

1,938,839

|

|

|

Newburgh City School District, General Obligation,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.50%, due 06/15/2013, Non-Callable (AGM State Aid Withholding)

|

|

Aa3/AA-

|

|

|

|

625,000

|

|

|

|

631,350

|

|

|

North Syracuse Central School District, General Obligation, Series B,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.00%, due 06/15/2019, Non-Callable (State Aid Withholding)

|

|

Aa3/NR

|

|

|

|

350,000

|

|

|

|

429,811

|

|

|

5.00%, due 06/15/2021, Non-Callable (State Aid Withholding)

|

|

Aa3/NR

|

|

|

|

300,000

|

|

|

|

375,039

|

|

|

Otego-Unadilla Central School District, General Obligation,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.00%, due 06/15/2019, Non-Callable (AGM State Aid Withholding)

|

|

NR/AA-

|

|

|

|

250,000

|

|

|

|

270,965

|

|

|

4.00%, due 06/15/2020, Non-Callable (AGM State Aid Withholding)

|

|

NR/AA-

|

|

|

|

250,000

|

|

|

|

287,988

|

|

|

Peru Central School District, General Obligation,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.00%, due 06/15/2013, Non-Callable (State Aid Withholding)

|

|

Aa3/A+

|

|

|

|

380,000

|

|

|

|

382,918

|

|

|

Ravena-Coeymans-Selkirk Central School District, General Obligation,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.00%, due 06/15/2013, Non-Callable (State Aid Withholding)

|

|

Aa3/NR

|

|

|

|

500,000

|

|

|

|

503,895

|

|

|

Schuylerville Central School District, General Obligation,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.00%, due 06/15/2013, Non-Callable (State Aid Withholding)

|

|

NR/A+

|

|

|

|

250,000

|

|

|

|

253,063

|

|

|

Sodus Central School District, General Obligation,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.00%, due 06/15/2013, Non-Callable (State Aid Withholding)

|

|

NR/A+

|

|

|

|

485,000

|

|

|

|

488,647

|

|

|

South Seneca Central School District, General Obligation,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.25%, due 06/15/2013, Non-Callable (State Aid Withholding)

|

|

A1/NR

|

|

|

|

500,000

|

|

|

|

509,175

|

|

|

Sullivan West Central School District, General Obligation,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.00%, due 06/15/2013, Non-Callable (AGM State Aid Withholding)

|

|

Aa3/AA-

|

|

|

|

350,000

|

|

|

|

354,568

|

|

|

Wappingers Central School District, General Obligation,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.00%, due 12/15/2012, Non-Callable (AGM State Aid Withholding)

|

|

Aa3/NR

|

|

|

|

500,000

|

|

|

|

500,878

|

|

|

THE EMPIRE BUILDER TAX FREE BOND FUND

|

|

|

|

|

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

|

|

|

|

|

|

|

|

|

|

MUNICIPAL SECURITIES - 95.1% (Continued)

|

Credit Ratings *

|

|

Par Value

|

|

|

Value

|

|

|

Other New York State Bonds - 33.3% (Continued)

|

|

|

Warsaw Central School District, General Obligation,

|

|

|

|

|

|

|

|

|

2.625%, due 06/15/2013, Non-Callable (State Aid Withholding)

|

Aa3/A+

|

|

$

|

375,000

|

|

|

$

|

378,855

|

|

|

Total Other New York State Bonds

|

|

|

|

|

|

|

$

|

26,969,614

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investments at Value - 95.1%

(Cost $72,478,446)

|

|

|

|

|

|

$

|

77,016,414

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Assets in Excess of Liabilities - 4.9%

|

|

|

|

|

|

|

3,970,981

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Assets - 100.0%

|

|

|

|

|

|

$

|

80,987,395

|

|

|

*

|

Credit

Ratings assigned by Moody's Investors Service, Inc. ("Moody's") and Standard & Poor's Corp. ("Standard

& Poor's") (Unaudited).

|

|

Definitions

|

|

AGM

|

Insured as to principal and interest by the Assured Guaranty Municipal Corp.

|

|

AMBAC

|

Insured as to principal and interest by the American Municipal Bond Insurance Corp.

|

|

BOCES

|

Board of Cooperative Educational Services

|

|

FGIC

|

Insured as to principal and interest by the Financial Guaranty Insurance Co.

|

|

FHA

|

Insured as to principal and interest by the Federal Housing Administration

|

|

GTY

|

Guaranty

|

|

IDA

|

Industrial Development Agency

|

|

NATL-RE

|

Reinsured as to principal and interest by the National Public Finance Guarantee Corp.

|

|

TCRS

|

Transferable Custodial Receipts

|

|

State Aid Withholding

|

Upon default, the State Comptroller is authorized to withhold the next State Aid payment due to the school district and to make the State Aid payment directly to the Paying Agent for the benefit of the school district's bondholders and noteholders.

|

|

Description of Moody's Ratings

|

|

Aaa

|

Issuers or issues rated 'Aaa' demonstrate the strongest creditworthiness relative to other U.S. municipal or tax-exempt issuers or issues.

|

|

Aa

|

Issuers or issues rated 'Aa' demonstrate very strong creditworthiness relative to other U.S. municipal or tax-exempt issuers or issues.

|

|

A

|

Issuers or issues rated 'A' demonstrate above-average creditworthiness relative to other U.S. municipal or tax-exempt issuers or issues.

|

|

Baa

|

Issuers or issues rated 'Baa' demonstrate average creditworthiness relative to other U.S. municipal or tax-exempt issuers or issues.

|

|

NR

|

Not Rated. In the opinion of the Adviser, instrument judged to be of comparable investment quality to rated securities which may be purchased by the Fund.

|

|

|

|

Moody's applies numerical modifiers 1, 2 and 3 in each generic rating classification below Aaa. The modifier 1 indicates that the obligation ranks in the higher end of its generic rating category; the modifier 2 indicates a mid-range ranking; and the modifier 3 indicates a ranking in the lower end of that generic rating category.

|

|

|

|

Description of Standard & Poor's Ratings

|

|

AAA

|

An obligation rated 'AAA' has the highest rating assigned by Standard & Poor's. The obligor's capacity to meet its financial commitment on the obligation is extremely strong.

|

|

AA

|

An obligation rated 'AA' differs from the highest-rated obligations only to a small degree. The obligor's capacity to meet its financial commitment on the obligation is very strong.

|

|

THE EMPIRE BUILDER TAX FREE BOND FUND

|

|

SCHEDULE OF INVESTMENTS (Continued)

|

|

Description of Standard & Poor's Ratings (Continued)

|

|

A

|

An obligation rated 'A' is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligations in higher-rated categories. However, the obligor's capacity to meet its financial commitment on the obligation is still strong.

|

|

BBB

|

An obligation rated 'BBB' exhibits adequate protection parameters. However, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity of the obligor to meet its financial commitment on the obligation.

|

|

NR

|

Not Rated. In the opinion of

the

Adviser, instrument judged to be of comparable investment quality to rated securities which may be purchased by the Fund.

|

|

|

|

Standard & Poor's ratings may be modified by the addition of a plus or minus sign to show relative standing within the major rating categories.

|

|

See accompanying notes to Schedule of Investments.

|

THE EMPIRE BUILDER TAX FREE BOND FUND

NOTES TO SCHEDULE OF INVESTMENTS

November 30, 2012 (Unaudited)

1. Securities Valuation

The Empire Builder Tax Free Bond Fund’s (the “Fund”) tax-exempt securities are generally valued using prices provided by an independent pricing service approved by the Fund’s Board of Trustees (the “Board”). The independent pricing service uses information with respect to transactions in bonds, quotations from bond dealers, market transactions in comparable securities and various relationships between securities in determining these prices. The methods used by the independent pricing service and the quality of valuations so established are reviewed by Glickenhaus & Co. (the Fund’s investment adviser) under the general supervision of the Board.

Securities for which quotations are not readily available are stated at fair value using procedures approved by the Board and will be classified as Level 2 or 3 within the fair value hierarchy (see below), depending on the inputs used. Short-term debt securities having remaining maturities of sixty days or less are stated at amortized cost, which approximates market value. Investments in registered investment companies are reported at their respective net asset values as reported by those companies.

Accounting principles generally accepted in the United States (“GAAP”) establish a single authoritative definition of fair value, set out a framework for measuring fair value and require additional disclosures about fair value measurements.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical securities

Level 2 – other significant observable inputs

Level 3 – significant unobservable inputs

Municipal securities are valued using various inputs, including benchmark yields, reported trades, broker dealer quotes, issuer spreads, benchmark securities, bids, offers, reference data and industry and market events and are typically classified as Level 2. The inputs or methodology used are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the inputs used to value the Fund’s investments as of November 30, 2012, by security type:

|

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total

|

|

|

Municipal Securities

|

|

$

|

-

|

|

|

$

|

77,016,414

|

|

|

$

|

-

|

|

|

$

|

77,016,414

|

|

As of November 30, 2012, the Fund did not have any transfers in and out of any Level. The Fund did not have any assets or liabilities that were measured at fair value on a recurring basis using significant unobservable inputs (Level 3) as of November 30, 2012. It is the Fund’s policy to recognize transfers into and out of any Level at the end of the reporting period.

2. Investment Transactions

Investment transactions are accounted for on trade date. Gains and losses on securities sold are determined on a specific identification basis.

THE EMPIRE BUILDER TAX FREE BOND FUND

NOTES TO SCHEDULE OF INVESTMENTS (Continued)

3. Federal Income Tax Information

As of November 30, 2012, the cost, gross unrealized appreciation and gross unrealized depreciation of securities for federal income tax purposes were as follows:

|

|

|

|

Tax Unrealized

|

|

|

Tax Unrealized

|

|

|

Net Unrealized

|

|

|

Tax Cost

|

|

|

Appreciation

|

|

|

Depreciation

|

|

|

Appreciation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

72,460,248

|

|

|

$

|

4,556,583

|

|

|

$

|

(417

|

)

|

|

$

|

4,556,166

|

|

The difference between the federal income tax cost of portfolio investments and the Schedule of Investments cost is primarily due to differing methods in the amortization of market discount on fixed income securities.

4.

Concentration of Credit Risk

The Fund invests primarily in debt instruments of municipal issuers in New York State. The issuers’ abilities to meet their obligations may be affected by economic developments in New York State or its region, as well as recent disruptions in the credit markets and the economy, generally. The issuers of municipal securities, including issuers of New York Tax Exempt Bonds, have been under stress relating to recent disruptions in the credit markets and the economy generally. These disruptions could have a significant negative effect on an issuer’s ability to make payments of principal and/or interest.

|

Item 2.

|

Controls and Procedures.

|

(a) Based on their evaluation of the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940) as of a date within 90 days of the filing date of this report, the registrant’s principal executive officer and principal financial officer have concluded that such disclosure controls and procedures are reasonably designed and are operating effectively to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to them by others within those entities, particularly during the period in which this report is being prepared, and that such information is recorded, processed, summarized, and reported on a timely basis.

(b) There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) that occurred during the registrant’s last fiscal quarter that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

File as exhibits as part of this Form a separate certification for each principal executive officer and principal financial officer of the registrant as required by Rule 30a-2(a) under the Act (17 CFR 270.30a-2(a)): Attached hereto

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant)

The Empire Builder Tax Free Bond Fund

|

By (Signature and Title)*

|

/s/ Seth M. Glickenhaus

|

|

|

|

|

Seth M. Glickenhaus, Chairman and President

|

|

|

|

|

|

|

|

Date

|

January 28, 2013

|

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

By (Signature and Title)*

|

/s/ Seth M. Glickenhaus

|

|

|

|

|

Seth M. Glickenhaus, Chairman and President

|

|

|

|

|

|

|

|

Date

|

January 28, 2013

|

|

|

|

|

|

|

|

|

By (Signature and Title)*

|

/s/ Mark J. Seger

|

|

|

|

|

Mark J. Seger, Treasurer

|

|

|

|

|

|

|

|

Date

|

January 28, 2013

|

|

|

*

Print the name and title of each signing officer under his or her signature.

Guggenheim Taxable Munic... (NYSE:GBAB)

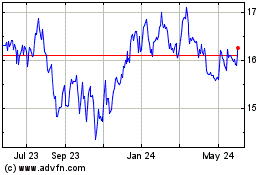

Historical Stock Chart

From Jun 2024 to Jul 2024

Guggenheim Taxable Munic... (NYSE:GBAB)

Historical Stock Chart

From Jul 2023 to Jul 2024