GBAB Announces Increase to Monthly Dividend

December 03 2012 - 4:30PM

Business Wire

(NYSE: GBAB) Guggenheim Build America Bonds Managed Duration

Trust (the “Trust”), a closed-end management investment company,

announces that it is increasing its monthly dividend to $0.1348 per

share, effective with its December 2012 dividend. The increased

dividend compares to $0.1322 per share for the Trust’s most recent

dividend. This increased dividend represents a distribution rate of

6.96% based upon the closing market price of $23.25 on November 30,

2012.

The December 2012 dividend will be paid on December 31, 2012 to

shareholders of record as of December 14, 2012 with an ex-dividend

date of December 12, 2012. For additional commentary, news,

portfolio holdings and other regularly updated information, please

visit the Trust’s website at www.guggenheiminvestments.com.

Past performance is not indicative of future performance.

If it is determined that a notification is required, pursuant to

Section 19(a) of the Investment Company Act of 1940, as amended,

such notice will be posted to the Trust’s website after the close

of business three business days prior to the payable date.

Distributions may be comprised of sources other than income, which

may not reflect actual Trust performance.

About Guggenheim Investments

Guggenheim Investments represents the investment management

division of Guggenheim Partners (“Guggenheim”), which consists of

investment managers with approximately $137 billion in combined

total assets*. Collectively, Guggenheim Investments has a long,

distinguished history of serving institutional investors,

ultra-high-net-worth individuals, family offices and financial

intermediaries. Guggenheim Investments offers clients a wide range

of differentiated capabilities built on a proven commitment to

investment excellence. Guggenheim Investments has offices in

Chicago, New York City and Santa Monica, along with a global

network of offices throughout the United States, Europe, and

Asia.

Guggenheim Investments is comprised of several investment

management entities within Guggenheim Partners, which includes

Guggenheim Funds Distributors, LLC and Guggenheim Funds Investment

Advisors, LLC (together, “Guggenheim Funds”). Guggenheim

Funds Investment Advisors, LLC serves as Investment Adviser for

GBAB.

*The total asset figure is as of 09/30/2012 and includes $9.56B

of leverage for Assets Under Management and $0.83B of leverage for

Serviced Assets. Total assets include assets from Security

Investors, LLC, Guggenheim Partners Investment Management, LLC

(“GPIM”, formerly known as Guggenheim Partners Asset Management,

LLC; GPIM assets also include all assets from Guggenheim Investment

Management, LLC which were transferred as of 06/30/2012),

Guggenheim Funds Investment Advisors and its affiliated entities,

and some business units including Guggenheim Real Estate, LLC,

Guggenheim Aviation, GS GAMMA Advisors, LLC, Guggenheim Partners

Europe Limited, Transparent Value Advisors, LLC, and Guggenheim

Partners India Management. Values from some funds are based upon

prior periods.

This information does not represent an offer to sell securities

of the Trust and it is not soliciting an offer to buy securities of

the Trust. There can be no assurance that the Trust will achieve

its investment objective. The net asset value of the Trust will

fluctuate with the value of the underlying securities. It is

important to note that closed-end funds trade on their market

value, not net asset value, and closed-end funds often trade at a

discount to their net asset value. Past performance is not

indicative of future performance. An investment in closed-end funds

is subject to investment risk, including the possible loss of the

entire amount that you invest. Some general risks and

considerations associated with investing in a closed-end fund

include: Investment and Market Risk; Lower Grade Securities Risk;

Equity Securities Risk; Foreign Securities Risk; Interest Rate

Risk; Illiquidity Risk; Derivative Risk; Management Risk;

Anti-Takeover Provisions; Market Disruption Risk and Leverage Risk.

See www.guggenheiminvestments.com for a detailed discussion of

fund-specific risks.

Investors should consider the investment objectives and

policies, risk considerations, charges and expenses of any

investment before they invest. For this and more information

visit www.guggenheiminvestments.com or contact a

securities representative or Guggenheim Investments 2455 Corporate

West Drive, Lisle, IL 60532, 800-345-7999.

NOT FDIC-INSURED | NOT BANK-GUARANTEED | MAY

LOSE VALUEMember FINRA/SIPC (12/12)

Guggenheim Taxable Munic... (NYSE:GBAB)

Historical Stock Chart

From Jun 2024 to Jul 2024

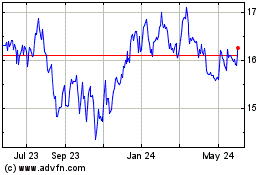

Guggenheim Taxable Munic... (NYSE:GBAB)

Historical Stock Chart

From Jul 2023 to Jul 2024