Greystone Housing Impact Investors LP Announces Regular Quarterly Cash Distribution and Supplemental BUCs Distribution

December 13 2023 - 4:15PM

On December 13, 2023, Greystone Housing Impact Investors LP (NYSE:

GHI) (the “Partnership”) announced that the Board of Managers of

Greystone AF Manager LLC (“Greystone Manager”) declared a

distribution to the Partnership’s Beneficial Unit Certificate

(“BUC”) holders of $0.44 per BUC. The distribution consists of a

regular quarterly cash distribution of $0.37 per BUC plus a

supplemental distribution payable in the form of additional BUCs

equal in value to $0.07 per BUC. The supplemental distribution will

be paid at a ratio of 0.00415 BUCs for each issued and outstanding

BUC as of the record date, which represents an amount per BUC based

on the closing price of the BUCs on the New York Stock Exchange on

December 12, 2023 of $16.87 per BUC. No fractional BUCs will be

issued in connection with the supplemental BUCs distribution, as

all fractional BUCs resulting from the distribution will receive

cash for such fraction based on the market value of the BUCs on the

record date. The Partnership expects to issue an aggregate of

approximately 95,000 BUCs for the supplemental BUCs distribution.

The cash distribution and supplemental

distribution will be paid on January 31, 2024 to all BUC holders of

record as of the close of trading on December 29, 2023. The BUCs

will trade ex-distribution as of December 28, 2023.

While the Board has not yet declared any

distributions for subsequent quarters, the Board currently intends

to declare an additional supplemental distribution of $0.07 per BUC

payable in the form of additional BUCs during the first quarter of

2024. Both the current and expected future supplemental

distributions are a result of the Partnership’s expectation of

strong operating results for the full 2023 fiscal year which are

anticipated to permit the Partnership to make distributions to BUC

holders in excess of its regular cash distributions. The payment of

the supplemental distributions in the form of BUCs allows the

Partnership to retain additional capital to fund future investment

opportunities which the Partnership and the Board believe will

accrue to the benefit of BUC holders.

“We are pleased to announce the fourth quarter

2023 distribution which is consistent with the Board’s previously

stated intent,” said Kenneth C. Rogozinski, Chief Executive Officer

of the Partnership. “The payment of the current and future

supplemental distributions in the form of additional BUCs will

allow BUC holders to benefit from our deployment of the retained

capital into accretive investments in a cost-efficient manner.”

Greystone Manager is the general partner of

America First Capital Associates Limited Partnership Two, the

Partnership’s general partner. Distributions to the Partnership’s

BUC holders, including regular and any supplemental distributions,

are determined by Greystone Manager based on a disciplined

evaluation of the Partnership’s current and anticipated operating

results, financial condition and other factors it deems relevant.

Greystone Manager continually evaluates the factors that go into

BUC holder distribution decisions, consistent with the long-term

best interests of the BUC holders and the Partnership.

About Greystone Housing Impact Investors

LP

Greystone Housing Impact Investors LP was formed

in 1998 under the Delaware Revised Uniform Limited Partnership Act

for the primary purpose of acquiring, holding, selling and

otherwise dealing with a portfolio of mortgage revenue bonds which

have been issued to provide construction and/or permanent financing

for affordable multifamily, seniors and student housing properties.

The Partnership is pursuing a business strategy of acquiring

additional mortgage revenue bonds and other investments on a

leveraged basis. The Partnership expects and believes the interest

earned on these mortgage revenue bonds is excludable from gross

income for federal income tax purposes. The Partnership seeks to

achieve its investment growth strategy by investing in additional

mortgage revenue bonds and other investments as permitted by its

Second Amended and Restated Limited Partnership Agreement, dated

December 5, 2022, taking advantage of attractive financing

structures available in the securities market, and entering into

interest rate risk management instruments. Greystone Housing Impact

Investors LP press releases are available at

www.ghiinvestors.com.

Safe Harbor Statement

Certain statements in this press release are

intended to be covered by the safe harbor for “forward-looking

statements” provided by the Private Securities Litigation Reform

Act of 1995. These forward-looking statements generally can be

identified by use of statements that include, but are not limited

to, phrases such as “believe,” “expect,” “future,” “anticipate,”

“intend,” “plan,” “foresee,” “may,” “should,” “will,” “estimates,”

“potential,” “continue,” or other similar words or phrases.

Similarly, statements that describe objectives, plans, or goals

also are forward-looking statements. Such forward-looking

statements involve inherent risks and uncertainties, many of which

are difficult to predict and are generally beyond the control of

the Partnership. The Partnership cautions readers that a number of

important factors could cause actual results to differ materially

from those expressed in, implied, or projected by such

forward-looking statements. Risks and uncertainties include, but

are not limited to: defaults on the mortgage loans securing our

mortgage revenue bonds and governmental issuer loans; the

competitive environment in which the Partnership operates; risks

associated with investing in multifamily, student, senior citizen

residential properties and commercial properties; general economic,

geopolitical, and financial conditions, including the current and

future impact of changing interest rates, inflation, and

international conflicts on business operations, employment, and

financial conditions; current financial conditions within the

banking industry, including the effects of recent failures of

financial institutions, liquidity levels, and responses by the

Federal Reserve, Department of the Treasury, and the Federal

Deposit Insurance Corporation to address these issues; uncertain

conditions within the domestic and international macroeconomic

environment, including monetary and fiscal policy and conditions in

the investment, credit, interest rate, and derivatives markets;

adverse reactions in U.S. financial markets related to actions of

foreign central banks or the economic performance of foreign

economies, including in particular China, Japan, the European

Union, and the United Kingdom; the general condition of the real

estate markets in the regions in which we operate, which may be

unfavorably impacted by increases in mortgage interest rates,

slowing economic growth, persistent elevated inflation levels, and

other factors; changes in interest rates and credit spreads, as

well as the success of any hedging strategies the Partnership may

undertake in relation to such changes, and the effect such changes

may have on the relative spreads between the yield on investments

and cost of financing; persistent inflationary trends, spurred by

multiple factors including expansionary monetary and fiscal policy,

higher commodity prices, a tight labor market, and low residential

vacancy rates, which may result in further interest rate increases

and lead to increased market volatility; the Partnership’s ability

to access debt and equity capital to finance its assets; current

maturities of the Partnership’s financing arrangements and the

Partnership’s ability to renew or refinance such financing

arrangements; exercising of redemption rights by the holders of the

Series A Preferred Units; local, regional, national and

international economic and credit market conditions; recapture of

previously issued Low Income Housing Tax Credits in accordance with

Section 42 of the Internal Revenue Code; geographic concentration

of properties related to investments held by the Partnership;

changes in the U.S. corporate tax code and other government

regulations affecting the Partnership’s business; and the other

risks detailed in the Partnership’s SEC filings (including but not

limited to, the Partnership’s Annual Report on Form 10-K, Quarterly

Reports on Form 10-Q, and Current Reports on Form 8-K). Readers are

urged to consider these factors carefully in evaluating the

forward-looking statements.

If any of these risks or uncertainties

materializes or if any of the assumptions underlying such

forward-looking statements proves to be incorrect, the developments

and future events concerning the Partnership set forth in this

press release may differ materially from those expressed or implied

by these forward-looking statements. You are cautioned not to place

undue reliance on these statements, which speak only as of the date

of this document. We anticipate that subsequent events and

developments will cause our expectations and beliefs to change. The

Partnership assumes no obligation to update such forward-looking

statements to reflect events or circumstances after the date of

this document or to reflect the occurrence of unanticipated events,

unless obligated to do so under the federal securities laws.

MEDIA CONTACT:Karen

MarottaGreystone212-896-9149Karen.Marotta@greyco.com

INVESTOR CONTACT:Andy

GrierSenior Vice President402-952-1235

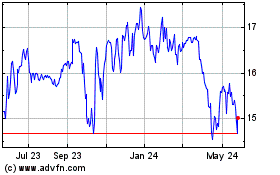

Greystone Housing Impact... (NYSE:GHI)

Historical Stock Chart

From Oct 2024 to Nov 2024

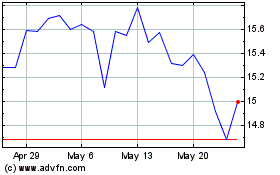

Greystone Housing Impact... (NYSE:GHI)

Historical Stock Chart

From Nov 2023 to Nov 2024