Graco Inc. (NYSE: GGG) today announced results for the

quarter and year ended December 30, 2011.

Summary

$ in millions except per share amounts

Quarter Ended Year Ended

Dec 30, Dec 31, %

Dec 30, Dec 31, %

2011 2010 Change 2011 2010

Change (13 weeks) (14 weeks) (52 weeks)

(53 weeks) Net Sales $ 215.6 $ 197.3 9 % $ 895.3 $

744.1 20 % Net Earnings 30.4 27.0 13 % 142.3 102.8 38 % Diluted Net

Earnings per Common Share $ 0.50 $ 0.44 14 % $ 2.32 $ 1.69 37 %

- Sales for the quarter were 9 percent

higher than the strong fourth quarter last year, which included 14

weeks, compared to 13 weeks in 2011.

- Sales for the year increased 20 percent

from last year.

- Lubrication segment sales for the year

topped $100 million and operating earnings more than doubled from

the previous year.

- For the year, gross margin rate of 56

percent and return on sales of 16 percent were each 2 percentage

points higher than last year.

- General and administrative expenses

include $2 million of acquisition-related costs for the quarter and

$8 million for the year.

“The increase in our revenues for the full year 2011 was very

broad-based, with strong double-digit growth in all geographies and

business segments,” said Patrick J. McHale, Graco’s President and

Chief Executive Officer. “Although year-over-year growth

decelerated somewhat from the third quarter of 2011, Graco reported

revenues that were a record for any fourth quarter in the history

of the Company. In addition, the extra week in the 2010 comparables

belies the underlying growth in the Company’s weekly order rate

experienced in the fourth quarter of 2011. When compared to the

same period of the prior year, weekly order intake in the fourth

quarter continued to grow at a double-digit rate. These strong

results were driven by the Company’s continued investment in new

products and geographic expansion.”

Consolidated Results

For the quarter, sales were 9 percent higher than last year in

the Americas, flat in Europe and 20 percent higher in Asia Pacific.

Translation rates did not have a significant impact on the sales

increase for the quarter. For the year, sales increased 20 percent

(18 percent at consistent translation rates), including increases

of 17 percent in the Americas, 19 percent in Europe (14 percent at

consistent translation rates) and 32 percent in Asia Pacific (27

percent at consistent translation rates). There were 53 weeks in

fiscal 2010, including 14 weeks in the fourth quarter. There were

52 weeks in fiscal 2011, with 13 weeks in the fourth quarter.

Gross profit margin, expressed as a percentage of sales, was 54

percent for the quarter, consistent with last year, and 56 percent

for the year, up 2 percentage points. The rate improvement for the

year is mainly from higher production volumes, pricing and

favorable translation rates, partially offset by higher material

costs.

Total operating expenses for the quarter were flat compared to

last year and increased $30 million for the year. Half of the

increase was in selling, marketing and distribution expenses,

including strategic spending to generate and support growth,

especially in Asia Pacific. General and administrative expenses for

the year increased by $11 million, including $8 million related to

the proposed acquisition of ITW’s finishing businesses. Operating

expenses as a percentage of sales decreased to 32 percent for the

quarter and 31 percent for the year, down 3 and 2 percentage

points, respectively, compared to last year.

The effective income tax rate was 30 percent for the quarter and

32 percent for the year, compared to 26 percent and 31 percent for

the comparable periods last year. In 2010, the effective rate for

the quarter was low because the federal R&D tax credit was not

renewed until the fourth quarter and the full-year benefit was

reflected in that quarter.

Segment Results

Certain measurements of segment operations are summarized

below:

Quarter Ended Year Ended

(13 weeks in 2011, 14 weeks in 2010) (52 weeks in 2011,

53 weeks in 2010) Industrial

Contractor Lubrication

Industrial Contractor

Lubrication Net sales (in millions) $ 125.2 $ 62.1 $ 28.3 $

501.8 $ 290.7 $ 102.7 Net sales percentage change from last year 11

% 1 % 26 % 23 % 13 % 32 % Operating earnings as a percentage of net

sales

2011

33 % 10 % 19 % 35 % 17 % 18 %

2010

31 % 8 % 11 % 31 % 14 % 11 %

Industrial segment sales increased 11 percent for the quarter,

including increases of 7 percent in the Americas, 8 percent in

Europe and 20 percent in Asia Pacific. For the year, sales

increased 23 percent, including increases of 17 percent in the

Americas, 23 percent in Europe (19 percent at consistent

translation rates) and 31 percent in Asia Pacific (27 percent at

consistent translation rates). Higher sales and the leveraging of

expenses led to improvement in operating earnings as a percentage

of sales.

Contractor segment sales increased 1 percent for the quarter and

13 percent for the year. Sales for the quarter increased 8 percent

in the Americas and 5 percent in Asia Pacific (2 percent at

consistent translation rates). In Europe, sales decreased 15

percent compared to a strong fourth quarter of 2010 that included

initial stocking orders of the new handheld product. For the year,

sales increased 13 percent in the Americas, 9 percent in Europe (4

percent at consistent translation rates) and 25 percent in Asia

Pacific (18 percent at consistent translation rates). Higher sales

and the leveraging of expenses led to improvement in operating

earnings as a percentage of sales.

Lubrication segment sales increased 26 percent for the quarter

and 32 percent for the year. Sales for the quarter increased 17

percent in both the Americas and Europe, and 59 percent in Asia

Pacific. For the year, sales increased 25 percent in the Americas,

38 percent in Europe and 57 percent in Asia Pacific. For both the

quarter and the year, higher sales and the leveraging of factory

volumes and operating expenses led to improvement in operating

earnings as a percentage of sales.

Outlook

“We are planning for growth in all business segments and

geographies for the full year 2012, although percentage growth

trends will likely be lower, reflecting difficult comparisons to

our record-level sales in 2011, continued challenges in the

worldwide construction market and the ongoing Eurozone crisis. We

will continue to invest in new products and resources to expand

Graco’s geographic footprint and broaden the served markets and

applications for our products,” said McHale. “While we remain

cautious regarding demand trends in Western Europe, we continue to

see strong growth in the emerging markets of Europe as well as

pockets of strength in certain end-markets, such as automotive,

energy, heavy equipment and industrial lubrication. We also see

sustained opportunities to grow in the United States, while Asia

Pacific remains a bright spot for ongoing double-digit growth in

2012.”

As announced in mid-December, the Federal Trade Commission (FTC)

has filed a complaint to challenge Graco's proposed acquisition of

the finishing businesses of Illinois Tool Works Inc. (NYSE: ITW).

“The decision by the FTC to challenge this acquisition is extremely

disappointing,” said McHale. “We strongly believe that this

acquisition is pro-competitive and will benefit both end users and

our distributor partners. We are confident in our position and will

vigorously fight for approval in court.”

Cautionary Statement Regarding Forward-Looking

Statements

A forward-looking statement is any statement made in this

earnings release and other reports that the Company files

periodically with the Securities and Exchange Commission, as well

as in press releases, analyst briefings, conference calls and the

Company’s Annual Report to shareholders, which reflects the

Company’s current thinking on the acquisition of the finishing

businesses of ITW, market trends and the Company’s future financial

performance at the time it is made. All forecasts and projections

are forward-looking statements. The Company undertakes no

obligation to update these statements in light of new information

or future events.

The Company desires to take advantage of the “safe harbor”

provisions of the Private Securities Litigation Reform Act of 1995

by making cautionary statements concerning any forward-looking

statements made by or on behalf of the Company. The Company cannot

give any assurance that the results forecasted in any

forward-looking statement will actually be achieved. Future results

could differ materially from those expressed, due to the impact of

changes in various factors. These risk factors include, but are not

limited to: economic conditions in the United States and other

major world economies, currency fluctuations, political

instability, changes in laws and regulations, and changes in

product demand. In addition, risk factors related to the Company’s

pending acquisition of the ITW finishing businesses include:

whether and when the required regulatory approvals will be

obtained, whether and when the closing conditions will be satisfied

and whether and when the transaction will close, the ability to

close on committed financing on satisfactory terms, the amount of

debt that the Company will incur to complete the transaction,

completion of purchase price valuation for acquired assets, whether

and when the Company will be able to realize the expected financial

results and accretive effect of the transaction, how customers,

competitors, suppliers and employees will react to the transaction,

and economic changes in global markets. Please refer to Item 1A of,

and Exhibit 99 to, the Company’s Annual Report on Form 10-K for

fiscal year 2010 (and most recent Form 10-Q) for a more

comprehensive discussion of these and other risk factors. These

reports are available on the Company’s website at www.graco.com and the Securities and Exchange

Commission’s website at www.sec.gov.

Conference Call

Graco management will hold a conference call, including slides

via webcast, with analysts and institutional investors on Tuesday,

January 31, 2012, at 11:00 a.m. ET, to discuss Graco’s fourth

quarter and year-end results.

A real-time Webcast of the conference call will be broadcast

live over the Internet. Individuals wanting to listen and view

slides can access the call at the Company’s website at www.graco.com. Listeners should go to the website

at least 15 minutes prior to the live conference call to install

any necessary audio software.

For those unable to listen to the live event, a replay will be

available soon after the conference call at Graco’s website, or by

telephone beginning at approximately 2:00 p.m. ET on January 31,

2012, by dialing 800-406-7325, Conference ID #4502375, if calling

within the U.S. or Canada. The dial-in number for international

participants is 303-590-3030, with the same Conference ID #. The

replay by telephone will be available through February 4, 2012.

Graco Inc. supplies technology and expertise for the management

of fluids in both industrial and commercial applications. It

designs, manufactures and markets systems and equipment to move,

measure, control, dispense and spray fluid materials. A recognized

leader in its specialties, Minneapolis-based Graco serves customers

around the world in the manufacturing, processing, construction and

maintenance industries. For additional information about Graco

Inc., please visit us at www.graco.com.

GRACO INC. AND SUBSIDIARIES Consolidated

Statement of Earnings (Unaudited)

Quarter Ended Year Ended Dec 30, Dec

31, Dec 30, Dec 31, 2011 2010 2011 2010

Net Sales $ 215,594

$ 197,293 $ 895,283 $ 744,065 Cost of products sold 98,581

89,621 395,078 340,620

Gross Profit 117,013 107,672 500,205 403,445 Product

development 10,846 9,490 41,554 37,699 Selling, marketing and

distribution 37,538 40,816 151,276 135,903 General and

administrative 21,241 19,563

87,861 76,702

Operating Earnings 47,388

37,803 219,514 153,141 Interest expense 3,658 1,025 9,131 4,184

Other expense (income), net 6 270

655 417

Earnings Before Income

Taxes 43,724 36,508 209,728 148,540 Income taxes 13,300

9,500 67,400 45,700

Net Earnings $ 30,424 $ 27,008 $

142,328 $ 102,840

Net Earnings per Common

Share Basic $ 0.51 $ 0.45 $ 2.36 $ 1.71 Diluted $ 0.50 $ 0.44 $

2.32 $ 1.69

Weighted Average Number of Shares Basic

59,723 59,944 60,286 60,209 Diluted 60,635 60,700 61,370 60,803

Segment Information (Unaudited) Quarter

Ended Year Ended Dec 30, Dec 31, Dec 30, Dec 31, 2011 2010 2011

2010

Net Sales Industrial $ 125,205 $ 113,080 $ 501,841 $

409,569 Contractor 62,068 61,647 290,732 256,588 Lubrication

28,321 22,566 102,710

77,908

Total $ 215,594 $ 197,293 $

895,283 $ 744,065

Operating Earnings

Industrial $ 40,698 $ 35,032 $ 173,694 $ 126,266 Contractor 6,342

5,113 50,581 36,952 Lubrication 5,276 2,571 18,928 8,897

Unallocated corporate (expense) (4,928 ) (4,913 )

(23,689 ) (18,974 )

Total $ 47,388 $

37,803 $ 219,514 $ 153,141

GRACO INC. AND SUBSIDIARIES Consolidated Balance Sheets

(Unaudited) (In thousands) Dec 30,

Dec 31, 2011 2010

ASSETS Current Assets Cash and cash

equivalents $ 303,150 $ 9,591 Accounts receivable, less allowances

of $5,500 and $5,600 150,912 124,593 Inventories 105,347 91,620

Deferred income taxes 17,674 18,647 Other current assets

5,887 7,957 Total current assets 582,970

252,408 Property, Plant and Equipment Cost 358,235 344,854

Accumulated depreciation (219,987 ) (210,669 )

Property, plant and equipment, net 138,248 134,185 Goodwill

93,400 91,740 Other Intangible Assets, net 18,118 28,338 Deferred

Income Taxes 29,752 14,696 Other Assets 11,821

9,107 Total Assets $ 874,309 $ 530,474

LIABILITIES AND SHAREHOLDERS' EQUITY Current Liabilities

Notes payable to banks $ 8,658 $ 8,183 Trade accounts payable

27,402 19,669 Salaries and incentives 32,181 34,907 Dividends

payable 13,445 12,610 Other current liabilities 49,596

44,385 Total current liabilities 131,282

119,754 Long-term Debt 300,000 70,255 Retirement Benefits

and Deferred Compensation 120,287 76,351 Shareholders'

Equity Common stock 59,747 60,048 Additional paid-in-capital

242,007 212,073 Retained earnings 97,467 44,436 Accumulated other

comprehensive income (loss) (76,481 ) (52,443 ) Total

shareholders' equity 322,740 264,114

Total Liabilities and Shareholders' Equity $ 874,309 $

530,474

GRACO INC. AND

SUBSIDIARIES Consolidated Statements of Cash Flows

(Unaudited) (In thousands) Year Ended Dec

30, Dec 31, 2011 2010

Cash Flows From Operating

Activities Net Earnings $ 142,328 $ 102,840 Adjustments to

reconcile net earnings to net cash provided by operating activities

Depreciation and amortization 32,483 33,973 Deferred income taxes

(1,814 ) (4,248 ) Share-based compensation 10,994 10,024 Excess tax

benefit related to share-based payment arrangements (2,195 ) (1,988

) Change in Accounts receivable (26,767 ) (23,285 ) Inventories

(13,440 ) (32,997 ) Trade accounts payable 5,974 1,670 Salaries and

incentives (3,469 ) 20,453 Retirement benefits and deferred

compensation 7,228 (1,428 ) Other accrued liabilities 8,148 (18 )

Other 2,574 (3,873 )

Net cash provided by

operating activities 162,044 101,123

Cash Flows From Investing Activities Property, plant

and equipment additions (23,854 ) (16,620 ) Proceeds from sale of

property, plant and equipment 426 257 Acquisition of business

(2,139 ) - Investment in life insurance (1,499 ) (1,499 )

Capitalized software and other intangible asset additions

(931 ) (907 )

Net cash used in investing activities

(27,997 ) (18,769 )

Cash Flows From Financing

Activities Borrowings on short-term lines of credit 18,221

10,584 Payments on short-term lines of credit (17,724 ) (13,789 )

Borrowings on long-term notes and line of credit 402,175 140,540

Payments on long-term line of credit (172,430 ) (156,545 ) Payments

of debt issuance costs (1,131 ) - Excess tax benefit related to

share-based payment arrangements 2,195 1,988 Common stock issued

22,231 12,794 Common stock repurchased (43,250 ) (24,218 ) Cash

dividends paid (50,646 ) (48,146 )

Net cash

provided by (used in) financing activities 159,641

(76,792 ) Effect of exchange rate changes on cash

(129 ) (1,383 ) Net increase (decrease) in cash and

cash equivalents 293,559 4,179 Cash and cash equivalents: Beginning

of year 9,591 5,412 End of year $

303,150 $ 9,591

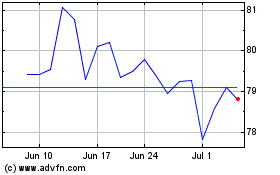

Graco (NYSE:GGG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Graco (NYSE:GGG)

Historical Stock Chart

From Jul 2023 to Jul 2024