Ferguson plc: Notice of Cancellation and Replacement of UK Listing in Connection with New Corporate Structure to Achieve a U.S. Domicile

July 02 2024 - 6:45AM

Business Wire

As previously announced, to effect a new corporate structure to

domicile the Ferguson plc group’s ultimate parent company in the

United States, Ferguson plc (the “Company”) entered into a merger

agreement (the “Merger Agreement”), dated as of February 29, 2024,

by and among the Company, Ferguson Enterprises Inc., a newly

incorporated corporation under the laws of Delaware (“New TopCo”),

and Ferguson (Jersey) 2 Limited, a newly formed Jersey incorporated

private limited company and direct, wholly owned subsidiary of New

TopCo (“Merger Sub”). The Merger Agreement provides for the merger

(the “Merger”) of Merger Sub with and into the Company, with the

Company surviving the Merger as a direct, wholly owned subsidiary

of New TopCo and Merger Sub ceasing to exist, on the terms and

subject to the conditions of the Merger Agreement.

At the extraordinary general meeting on May 30, 2024 (the

“Special Meeting”), shareholders of the Company voted to approve

the implementation of the Merger with 99.56% of votes cast in

favour. Following receipt of such shareholder approval, and subject

to the satisfaction of any outstanding conditions precedent listed

in the Merger Agreement, it is anticipated that the Merger and the

other transactions contemplated by the Merger Agreement will be

consummated on August 1, 2024 (the “Effective Date”).

Cancellation and Replacement of Ferguson’s UK Listing

Subject to the consummation of the Merger and the implementation

date of the Proposed Reforms (as defined below), with effect from

3:00 a.m. Eastern Time / 8:00 a.m. UK Time on the Effective Date,

it is currently anticipated that: (i) the Company’s listing on the

standard segment of the Official List (the “Official List”) of the

Financial Conduct Authority (“FCA”) and its admission to trading on

the London Stock Exchange plc’s Main Market for listed securities

(“LSE”) will be cancelled; and (ii) New TopCo’s common stock will

be admitted to the standard segment of the Official List and to

trading on the LSE.

The Company notes the proposed reforms to the Listing Rules (the

“Proposed Reforms”) as outlined in FCA consultation paper CP23/31

(‘Primary Markets Effectiveness Review: Feedback to CP23/10 and

detailed proposals for listing rules reforms’). The FCA has

confirmed to the Company that: (i) if the Proposed Reforms are

implemented in their current form after the Effective Date, New

TopCo will be admitted to the standard segment of the Official List

on the Effective Date, and upon the subsequent implementation of

the Proposed Reforms, New TopCo will be mapped onto to the new

“equity shares (international commercial companies secondary

listing)” segment of the Official List; and (ii) if the Proposed

Reforms are implemented in their current form on or before the

Effective Date, New TopCo will be admitted to the “equity shares

(international commercial companies secondary listing)” segment of

the Official List on the Effective Date. The Company will notify

shareholders once it is clear which Official List listing segment

it will be admitted to on the Effective Date.

In addition, subject to the consummation of the Merger, it is

anticipated that on the Effective Date, the Company’s ordinary

shares will cease trading on the New York Stock Exchange (“NYSE”)

and New TopCo’s common stock will commence trading on the NYSE.

On completion of the Merger, New TopCo’s common stock is

expected to trade on the NYSE and the LSE under the symbol “FERG”,

the same symbol that currently attaches to the Company’s ordinary

shares.

Important Information for Investors and Shareholders

THIS ANNOUNCEMENT AND THE INFORMATION HEREIN IS NOT FOR RELEASE,

PUBLICATION OR DISTRIBUTION TO PERSONS, IN WHOLE OR IN PART,

DIRECTLY OR INDIRECTLY, IN OR INTO OR FROM ANY JURISDICTION IN

WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BREACH ANY

APPLICABLE LAW.

This announcement does not constitute an offer to sell or the

solicitation of an offer to buy or exchange any securities or a

solicitation of any vote or approval in any jurisdiction. It does

not constitute a prospectus or prospectus equivalent document. No

offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act of 1933.

Cautionary Note Regarding Forward-Looking Statements

Certain information in this announcement is forward-looking

within the meaning of the Private Securities Litigation Reform Act

of 1995, including statements relating to the process and timetable

for the Merger and the cancellation and replacement of the

Company’s UK and US listings. Forward-looking statements cover all

matters which are not historical facts and speak only as of the

date on which they are made. Forward-looking statements can be

identified by the use of forward-looking terminology, such as

“anticipates,” “will,” or, in each case, their negative or other

variations or comparable terminology. Many factors could cause

actual results to differ materially from those in such

forward-looking statements, including, but not limited to: the

Merger may be delayed, cancelled, suspended or terminated; the

conditions to the completion of the Merger may not be satisfied;

weakness in the economy, market trends, uncertainty and other

conditions in the markets in which we operate, and other factors

beyond our control, including disruption in the financial markets

and any macroeconomic or other consequences of political unrest,

disputes or war; failure to rapidly identify or effectively respond

to direct and/or end customers’ wants, expectations or trends,

including costs and potential problems associated with new or

upgraded information technology systems or our ability to timely

deploy new omni-channel capabilities; unsuccessful execution of our

operational strategies; changes in, interpretations of, or

compliance with tax laws in the United States, the United Kingdom,

Switzerland or Canada; adverse impacts caused by a public health

crisis; and other risks and uncertainties set forth under the

heading “Risk Factors” in the definitive proxy statement filed by

the Company with the Securities and Exchange Commission (“SEC”) on

April 18, 2024, and in other filings we or New TopCo make with the

SEC in the future. Forward-looking statements regarding past trends

or activities should not be taken as a representation that such

trends or activities will continue in the future. Other than in

accordance with our legal or regulatory obligations, we undertake

no obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise.

About Ferguson

Ferguson plc (NYSE: FERG; LSE: FERG) is a leading value-added

distributor in North America providing expertise, solutions and

products from infrastructure, plumbing and appliances to HVAC,

fire, fabrication and more. We exist to make our customers’ complex

projects simple, successful and sustainable. Ferguson is

headquartered in the U.K., with its operations and associates

solely focused on North America and managed from Newport News,

Virginia. For more information, please visit

corporate.ferguson.com or follow us on LinkedIn

linkedin.com/company/ferguson-enterprises.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240702697675/en/

For further information please contact:

Investor Inquiries Brian Lantz Vice President, IR and

Communications +1 224 285 2410

Pete Kennedy Director, Investor Relations +1 757 603 0111

Media Inquiries Christine Dwyer Senior Director,

Communications and Public Relations +1 757 469 5813

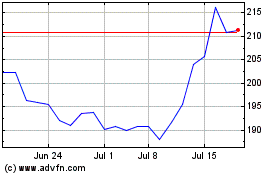

Ferguson (NYSE:FERG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Ferguson (NYSE:FERG)

Historical Stock Chart

From Jul 2023 to Jul 2024