UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of August 2023

Commission File Number 001-40459

ERO COPPER CORP.

(Translation of registrant's name into English)

625 Howe Street, Suite 1050

Vancouver, British Columbia V6C 2T6

Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☐ Form 40-F ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1).

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7).

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| Ero Copper Corp. |

| | |

| By: | /s/ Deepk Hundal |

| | Name: Deepk Hundal |

| | Title: SVP, General Counsel and Corporate Secretary |

Date: August 3, 2023 | | |

Exhibit Index

| | | | | | | | |

| Exhibit Number | | Description of Document |

| | |

| | |

| | |

| | |

MANAGEMENT’S DISCUSSION

AND ANALYSIS

FOR THE THREE AND SIX MONTHS ENDED

JUNE 30, 2023

1050 – 625 Howe Street, Vancouver, B.C., Canada V6C 2T6

Phone: 604-449-9244 | Website: www.erocopper.com | Email: info@erocopper.com

| | | | | |

| TABLE OF CONTENTS | |

| |

| BUSINESS OVERVIEW | |

| HIGHLIGHTS | |

| REVIEW OF OPERATIONS | |

| The Caraíba Operations | |

| The Xavantina Operations | |

| 2023 GUIDANCE | |

| REVIEW OF FINANCIAL RESULTS | |

| Review of quarterly results | |

| Review of year to date results | |

| Summary of quarterly results for most recent eight quarters | |

| OTHER DISCLOSURES | |

| Liquidity, Capital Resources, and Contractual Obligations | |

| Management of Risks and Uncertainties | |

| Other Financial Information | |

| Accounting Policies, Judgments and Estimates | |

| Capital Expenditures | |

| Alternative Performance (NON-IFRS) Measures | |

| Disclosure Controls and Procedures and Internal Control over Financial Reporting | |

| Notes and Cautionary Statements | |

Ero Copper Corp. June 30, 2023 MD&A

MANAGEMENT’S DISCUSSION AND ANALYSIS

This Management’s Discussion and Analysis (“MD&A”) has been prepared as at August 3, 2023 and should be read in conjunction with the unaudited condensed consolidated interim financial statements of Ero Copper Corp. (“Ero”, the “Company”, or “we”) as at, and for the three and six months ended June 30, 2023, and related notes thereto, which are prepared in accordance with International Accounting Standards (“IAS”) 34, Interim Financial Reporting as permitted by the International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (the “IASB”). All references in this MD&A to “Q2 2023” and “Q2 2022” are to the three months ended June 30, 2023 and June 30, 2022, respectively, and all references in this MD&A to “YTD 2023” and “YTD 2022” are to the six months ended June 30, 2023 and June 30, 2022, respectively. As well, this MD&A should be read in conjunction with the Company’s December 31, 2022 audited consolidated financial statements and MD&A. All dollar amounts are expressed in United States (“US”) dollars and tabular amounts are expressed in thousands of US dollars, unless otherwise indicated. References to “$”, “US$”, “dollars”, or “USD” are to US dollars, references to “C$” are to Canadian dollars, and references to “R$” or “BRL” are to Brazilian Reais.

This MD&A refers to various alternative performance (Non-IFRS) measures, including C1 cash cost of copper produced (per lb), realized copper price (per lb), C1 cash cost of gold produced (per ounce), all-in sustaining cost (“AISC”) of gold produced (per ounce), realized gold price (per ounce), EBITDA, Adjusted EBITDA, Adjusted net income attributable to owners of the Company, Adjusted net income per share attributable to owners of the Company, Net (Cash) Debt, Working Capital and Available Liquidity. Please refer to the section titled "Alternative Performance (Non-IFRS) Measures" for a discussion of non-IFRS measures.

This MD&A contains “forward‐looking statements” that are subject to risk factors set out in a cautionary note contained at the end of this MD&A. The Company cannot assure investors that such statements will prove to be accurate, and actual results and future events may differ materially from those anticipated in such statements. The results for the periods presented are not necessarily indicative of the results that may be expected for any future period. Investors are cautioned not to place undue reliance on such forward-looking statements. All information contained in this MD&A is current and has been approved by the Board of Directors of the Company (the “Board”) as of August 3, 2023, unless otherwise stated.

BUSINESS OVERVIEW

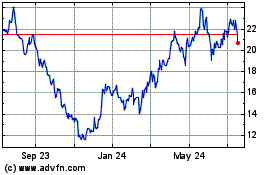

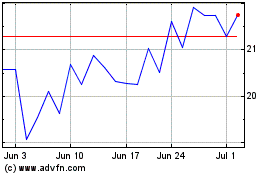

Ero is a high-margin, high-growth, low carbon-intensity copper producer with operations in Brazil and corporate headquarters in Vancouver, B.C. The Company's primary asset is a 99.6% interest in the Brazilian copper mining company, Mineração Caraíba S.A. ("MCSA"), 100% owner of the Company's Caraíba Operations (formerly known as the MCSA Mining Complex), which are located in the Curaçá Valley, Bahia State, Brazil, and the Tucumã Project (formerly known as Boa Esperança), an IOCG-type copper project located in Pará, Brazil. The Company also owns 97.6% of NX Gold S.A. ("NX Gold") which owns the Xavantina Operations (formerly known as the NX Gold Mine), comprised of an operating gold and silver mine located in Mato Grosso, Brazil. Additional information on the Company and its operations, including technical reports on the Caraíba Operations, Xavantina Operations and Tucumã Project, can be found on the Company's website (www.erocopper.com), on SEDAR (www.sedar.com), and on EDGAR (www.sec.gov). The Company’s shares are publicly traded on the Toronto Stock Exchange and the New York Stock Exchange under the symbol “ERO”.

Ero Copper Corp. June 30, 2023 MD&A | Page 1

HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2023 - Q2 | | 2023 - Q1 | | 2022 - Q2 | | 2023 - YTD | | 2022 - YTD | |

Operating Information | | | | | | | | | | | |

| | | | | | | | | | | |

| Copper (Caraíba Operations) | | | | | | | | | | | |

| Ore Processed (tonnes) | | 840,821 | | | 772,548 | | | 801,425 | | | 1,613,369 | | | 1,397,655 | | |

| Grade (% Cu) | | 1.55 | | | 1.33 | | | 1.74 | | | 1.45 | | | 1.76 | | |

| Cu Production (tonnes) | | 12,004 | | | 9,327 | | | 12,734 | | | 21,331 | | | 22,518 | | |

| Cu Production (lbs) | | 26,463,779 | | | 20,563,552 | | | 28,072,691 | | | 47,027,331 | | | 49,642,662 | | |

| Cu Sold in Concentrate (tonnes) | | 11,612 | | | 9,464 | | | 12,948 | | | 21,076 | | | 22,993 | | |

| Cu Sold in Concentrate (lbs) | | 25,599,840 | | | 20,865,486 | | | 28,546,045 | | | 46,465,326 | | | 50,690,999 | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

C1 Cash Cost of Cu Produced (per lb)(1) | | $ | 1.52 | | | $ | 1.70 | | | $ | 1.24 | | | $ | 1.60 | | | $ | 1.27 | | |

| | | | | | | | | | | |

| Gold (Xavantina Operations) | | | | | | | | | | | |

| Ore Processed (tonnes) | | 34,377 | | | 35,763 | | | 57,291 | | | 70,140 | | | 107,281 | | |

| Au Production (oz) | | 12,333 | | | 12,443 | | | 11,122 | | | 24,776 | | | 19,918 | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

C1 Cash Cost of Au Produced (per oz)(1) | | $ | 492 | | | $ | 436 | | | $ | 643 | | | $ | 464 | | | $ | 641 | | |

AISC of Au produced (per oz)(1) | | $ | 1,081 | | | $ | 946 | | | $ | 1,169 | | | $ | 1,013 | | | $ | 1,135 | | |

| | | | | | | | | | | |

| Financial information ($ in millions, except per share amounts) | | | | | | | |

| Revenues | | $ | 104.9 | | | $ | 101.0 | | | $ | 114.9 | | | $ | 205.9 | | | $ | 223.8 | | |

| Gross profit | | 39.4 | | | 40.1 | | | 50.7 | | | 79.5 | | | 111.7 | | |

EBITDA(1) | | 61.9 | | | 52.2 | | | 53.9 | | | 114.1 | | | 132.0 | | |

Adjusted EBITDA(1) | | 49.1 | | | 48.6 | | | 55.8 | | | 97.7 | | | 118.2 | | |

Cash flow from operations | | 55.5 | | | 16.4 | | | 22.4 | | | 71.8 | | | 66.4 | | |

Net income | | 29.9 | | | 24.5 | | | 24.1 | | | 54.4 | | | 76.6 | | |

Net income attributable to owners of the Company | | 29.6 | | | 24.2 | | | 23.8 | | | 53.7 | | | 75.9 | | |

| - Per share (basic) | | 0.32 | | | 0.26 | | | 0.26 | | | 0.58 | | | 0.84 | | |

| - Per share (diluted) | | 0.32 | | | 0.26 | | | 0.26 | | | 0.58 | | | 0.83 | | |

Adjusted net income attributable to owners of the Company(1) | | 22.3 | | | 22.5 | | | 24.4 | | | 44.7 | | | 57.3 | | |

| - Per share (basic) | | 0.24 | | | 0.24 | | | 0.27 | | | 0.48 | | | 0.63 | | |

| - Per share (diluted) | | 0.24 | | | 0.24 | | | 0.27 | | | 0.48 | | | 0.62 | | |

| | | | | | | | | | | |

| Cash, cash equivalents and short-term investments | | 180.4 | | | 236.6 | | | 429.9 | | | 180.4 | | | 429.9 | | |

Working capital(1) | | 140.7 | | | 218.8 | | | 417.7 | | | 140.7 | | | 417.7 | | |

Net debt (cash)(1) | | 246.5 | | | 174.2 | | | (10.2) | | | 246.5 | | | (10.2) | | |

(1) Please refer to the section titled "Alternative Performance (Non-IFRS) Measures" within this MD&A.

Ero Copper Corp. June 30, 2023 MD&A | Page 2

Q2 2023 Highlights

Strong Q2 2023 operating and financial performance supports ongoing execution of strategic growth initiatives

•The Caraíba Operations produced 12,004 tonnes of copper in concentrate during the quarter at C1 cash costs(1) of $1.52 per pound of copper produced

◦Higher mined tonnage and copper grades due to planned stope sequencing drove an increase in copper production of nearly 30% quarter-on-quarter and improved C1 cash costs(1) during the period

•The Xavantina Operations delivered quarterly gold production of 12,333 ounces at C1 cash costs(1) and AISC(1) of $492 and $1,081, respectively, per ounce of gold produced

◦Processed gold grades of 13.20 grams per tonne ("gpt") reflect more than an 11% increase quarter-on-quarter and 100% year-on-year

•Financial results reflected meaningfully higher copper production compared to Q1 2023, offsetting lower copper prices and a stronger BRL over the same period

◦Net earnings of $29.9 million

◦Adjusted net income attributable to owners of the Company(1) of $22.3 million ($0.24 per share on a diluted basis)

◦Adjusted EBITDA(1) of $49.1 million

•The Company's strategic growth initiatives, including construction of the Tucumã Project as well as the new external shaft at the Caraíba Operations' Pilar Mine, advanced according to plan, resulting in $126.9 million of capital expenditures during the period, partially funded by cash flows from operations of $55.5 million

•Available liquidity at quarter-end was $330.4 million, including cash and cash equivalents of $124.4 million, short-term investments of $56.0 million, and $150.0 million of undrawn availability under the Company's senior secured revolving credit facility

Reaffirming production and cash cost guidance; increasing capital expenditure guidance by $15 to $20 million to reflect proactive investments at the Caraíba Operations

•The Company is reiterating its full-year copper production guidance of 44,000 to 47,000 tonnes. Copper production is expected to decrease slightly in Q3 2023 before increasing in the last quarter of the year due to planned stope sequencing and commissioning of the new ball mill late in the year

•The Company is reaffirming its 2023 gold production guidance of 50,000 to 53,000 ounces with slightly higher gold production expected in H2 2023 due to increased mill throughput volumes

•After conducting a detailed review of major projects and support infrastructure at the Caraíba Operations during the quarter, including infrastructure related to the Deepening, underground paste fill and tailings, the Company has elected to invest in various upgrades throughout H2 2023. These enhancements aim to bolster the Caraíba Operations' ongoing projects and support expanded life-of-mine operating plans at the Pilar Mine

(1) Please refer to the section titled "Alternative Performance (Non-IFRS) Measures" within this MD&A.

Ero Copper Corp. June 30, 2023 MD&A | Page 3

Continued execution of strategic growth initiatives

•The Company significantly advanced the construction of its Tucumã Project, which remains on schedule, achieving physical completion of approximately 45% as of quarter-end, up from approximately 30% at the end of Q1 2023

◦Mine pre-stripping is advancing as planned with over 5 million tonnes, or approximately 35% of total planned pre-strip volume, completed as of quarter-end. The mine remains on track to reach first sulphide ore in Q4 2023

◦Civil works are also tracking to schedule with foundations for the primary crusher and ball mill completed during the quarter. Electromechanical erection for both areas commenced just after quarter-end, as planned

◦Total project capital estimate remains unchanged at approximately $305 million based on over 95% visibility on planned capital expenditures

◦Workforce training programs, established in partnership with The National Service for Industrial Training, a Brazilian non-profit organization focused on improving the competitiveness of Brazil's manufacturing sector through technical and vocational education, are now well underway with nearly 100% of employees and contractors expected to come from within Brazil, including approximately two-thirds from communities surrounding the Tucumã Project

•At the Caraíba Operations, the Company is focused on advancing its Pilar 3.0 initiative, designed to support sustained annual ore production levels of 3.0 million tonnes. The components of Pilar 3.0 include (i) Project Honeypot, an engineering initiative focused on recovering higher-grade material in the upper levels of the Pilar Mine, (ii) an expansion of the Caraíba mill from 3.0 to 4.2 million tonnes of annual throughput capacity, and (iii) construction of a new external shaft to service the lower levels of the Pilar Mine, including the Deepening Extension Zone

◦Construction of the new external shaft remains on schedule. The 40-meter shaft pre-sink phase of development was completed during the quarter, and the main sinking stage was successfully hoisted into the shaft subsequent to quarter-end. Hoisting of the pre-assembled headframe is currently underway with main shaft sinking expected to commence prior to year-end. Planned capital expenditures under contract or in the final stages of negotiation were approximately 80% at quarter-end with current estimates remaining within 5% of budget

◦The Caraíba mill expansion also remains on schedule with commissioning on track to begin late in the year

Ero Copper Corp. June 30, 2023 MD&A | Page 4

REVIEW OF OPERATIONS

The Caraíba Operations

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Copper | | 2023 - Q2 | | 2023 - Q1 | | 2022 - Q2 | | 2023 - YTD | | 2022 - YTD |

| Ore processed (tonnes) | | 840,821 | | | 772,548 | | | 801,425 | | | 1,613,369 | | | 1,397,655 | |

| Grade (% Cu) | | 1.55 | | | 1.33 | | | 1.74 | | | 1.45 | | | 1.76 | |

| Recovery (%) | | 92.0 | | | 90.8 | | | 91.2 | | | 91.4 | | | 91.6 | |

| | | | | | | | | | |

| Cu Production (tonnes) | | 12,004 | | | 9,327 | | | 12,734 | | | 21,331 | | | 22,518 | |

| Cu Production (lbs) | | 26,463,779 | | | 20,563,552 | | | 28,072,691 | | | 47,027,331 | | | 49,642,662 | |

| | | | | | | | | | |

| Concentrate grade (% Cu) | | 33.8 | | | 33.9 | | | 32.9 | | | 33.9 | | | 33.0 | |

| Concentrate sales (tonnes) | | 35,845 | | | 30,074 | | | 41,919 | | | 65,919 | | | 71,125 | |

| Cu Sold in concentrate (tonnes) | | 11,612 | | | 9,464 | | | 12,948 | | | 21,076 | | | 22,993 | |

| Cu Sold in concentrate (lbs) | | 25,599,840 | | | 20,865,486 | | | 28,546,045 | | | 46,465,326 | | | 50,690,999 | |

| | | | | | | | | | |

| Realized copper price (per lb) | | $ | 3.30 | | | $ | 3.69 | | | $ | 3.26 | | | $ | 3.48 | | | $ | 3.63 | |

| C1 cash cost of copper produced (per lb) | | $ | 1.52 | | | $ | 1.70 | | | $ | 1.24 | | | $ | 1.60 | | | $ | 1.27 | |

Higher mined tonnage and copper grades due to planned stope sequencing drove an increase in copper production at the Caraíba Operations of nearly 30% quarter-on-quarter. Production of 12,004 tonnes of copper in concentrate during the period brought H1 2023 copper production to 21,331 tonnes in concentrate. Higher mined and processed copper grades contributed to lower C1 cash costs of $1.52 per pound of copper produced during the quarter, resulting in weighted average C1 cash costs for H1 2023 of $1.60 per pound of copper produced.

Mined ore production in Q2 2023 included:

•Pilar: 491,632 tonnes grading 1.61% copper (vs. 450,559 tonnes at 1.35% copper in Q1 2023)

•Vermelhos: 226,229 tonnes grading 1.76% copper (vs. 205,963 tonnes at 1.61% copper in Q1 2023)

•Surubim: 183,288 tonnes at 0.79% copper (vs. 103,077 tonnes at 0.68% copper in Q1 2023)

Contributions from the three mines resulted in total ore mined during the period of 901,149 tonnes grading 1.48% copper (vs. 759,599 tonnes grading 1.33% copper in Q1 2023). During Q2 2023, 840,821 tonnes of ore grading 1.55% copper were processed, resulting in production of 12,004 tonnes of copper after average metallurgical recoveries of 92.0%.

The Caraíba Operations are expected to produce 44,000 to 47,000 tonnes of copper in concentrate in 2023. Mill throughput volumes are expected to be slightly lower in Q3 2023 compared to Q2 2023 and higher in Q4 2023 due to the anticipated commissioning of the new ball mill. Combined with expected copper grade variations related to planned stope sequencing, copper production is expected to decrease slightly in Q3 2023 before increasing in the last quarter of the year.

The Company is maintaining its full-year C1 cash cost guidance range for the Caraíba Operations of $1.40 to $1.60 per pound of copper produced. Unit operating costs are expected to be slightly higher in Q3 2023 compared to Q2 2023 and lowest in the last quarter of the year due to anticipated variations in quarterly mined and processed copper grades as well as total copper production.

Ero Copper Corp. June 30, 2023 MD&A | Page 5

Exploration activities during Q2 2023 at the Caraíba Operations continued to focus on advancing the Company's full-year exploration objectives of (i) delineating extensions of nickel mineralization identified within the Umburana system, (ii) drill testing additional regional nickel and copper targets throughout the Curaçá Valley, and (iii) extending high-grade mineralization within the upper levels of the Pilar Mine and at the Vermelhos Mine.

The Xavantina Operations

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gold | | 2023 - Q2 | | 2023 - Q1 | | 2022 - Q2 | | 2023 - YTD | | 2022 - YTD |

| Ore mined (tonnes) | | 34,525 | | | 35,763 | | | 57,291 | | | 70,288 | | | 107,281 | |

| Ore processed (tonnes) | | 34,377 | | | 35,763 | | | 57,291 | | | 70,140 | | | 107,281 | |

| Head grade (grams per tonne Au) | | 13.20 | | | 11.85 | | | 6.59 | | | 12.51 | | | 6.28 | |

| Recovery (%) | | 84.6 | | | 91.4 | | | 91.6 | | | 87.8 | | | 91.9 | |

| | | | | | | | | | |

| Gold ounces produced (oz) | | 12,333 | | | 12,443 | | | 11,122 | | | 24,776 | | | 19,918 | |

| Silver ounces produced (oz) | | 8,579 | | | 8,194 | | | 7,306 | | | 16,773 | | | 13,348 | |

| | | | | | | | | | |

| Gold sold (oz) | | 10,916 | | | 13,097 | | | 10,448 | | | 24,013 | | | 18,461 | |

| Silver sold (oz) | | 7,319 | | | 8,422 | | | 7,018 | | | 15,741 | | | 12,507 | |

| | | | | | | | | | |

Realized gold price (per oz)(1) | | $ | 1,945 | | | $ | 1,828 | | | $ | 1,865 | | | $ | 1,881 | | | $ | 1,888 | |

| C1 cash cost of gold produced (per oz) | | $ | 492 | | | $ | 436 | | | $ | 643 | | | $ | 464 | | | $ | 641 | |

| AISC of gold produced (per oz) | | $ | 1,081 | | | $ | 946 | | | $ | 1,169 | | | $ | 1,013 | | | $ | 1,135 | |

(1) Realized Au price includes the effect of ounces sold under the stream arrangement with Royal Gold. See "Realized Gold Price" section of "Non-IFRS Measures" for detail.

The Xavantina Operations delivered strong quarterly gold production of 12,333 ounces, bringing H1 2023 gold production to 24,776 ounces. Processed gold grades during the quarter of 13.20 grams per tonne ("gpt") represented an increase of over 11% quarter-on-quarter and 100% year-on-year. Metallurgical recoveries were impacted by elevated in-process inventory at quarter-end as well as elevated carbon content in several high-grade stopes mined and processed during the period.

Q2 2023 C1 cash costs and AISC were $492 and $1,081, respectively, per ounce of gold produced, bringing H1 2023 C1 cash costs and AISC to $464 and $1,013, respectively, per ounce of gold produced.

The Company is reaffirming its 2023 gold production guidance range of 50,000 to 53,000 ounces with slightly higher gold production expected in H2 2023 due to increased mill throughput volumes following the expected commencement of production from the Matinha vein.

The Company is maintaining its full-year C1 cash cost guidance for the Xavantina Operations of $475 to $575 per ounce of gold produced and adjusting its AISC guidance range to $1,000 to $1,100 per ounce of gold produced to reflect the inclusion of sustaining lease payments and other miscellaneous sustaining expenses.

Ero Copper Corp. June 30, 2023 MD&A | Page 6

Exploration activities at the Xavantina Operations during the quarter were focused on testing extensions of the Matinha and Santo Antônio veins at depth as well as drill testing near-mine extensions of the shear zone hosting the Santo Antônio and Matinha veins along strike.

2023 Guidance

The Company is reaffirming its full-year production, cash cost and capital expenditure guidance as detailed in the tables below. The Caraíba Operations are expected to produce 44,000 to 47,000 tonnes of copper in concentrate in 2023. Mill throughput volumes are expected to be slightly lower in Q3 2023 compared to Q2 2023 and higher in Q4 2023 due to the anticipated commissioning of the new ball mill. Combined with expected copper grade variations related to planned stope sequencing, copper production is expected to decrease slightly in Q3 2023 before increasing in the last quarter of the year.

The Company is maintaining its full-year C1 cash cost guidance range for the Caraíba Operations of $1.40 to $1.60 per pound of copper produced. Unit operating costs are expected to be slightly higher in Q3 2023 compared to Q2 2023 and lowest in the last quarter of the year due to anticipated variations in quarterly mined and processed copper grades as well as total copper production.

At the Xavantina Operations, the Company is reaffirming its 2023 gold production guidance range of 50,000 to 53,000 ounces with slightly higher gold production expected in H2 2023 due to increased mill throughput volumes following the expected commencement of production from the Matinha vein.

The Company is maintaining its full-year C1 cash cost guidance for the Xavantina Operations of $475 to $575 per ounce of gold produced and adjusting its AISC guidance range to $1,000 to $1,100 per ounce of gold produced to reflect the inclusion of sustaining lease payments and other miscellaneous sustaining expenses.

2023 Production and Cost Guidance

The Company's cost guidance for 2023 assumes a USD:BRL foreign exchange rate of 5.30, a gold price of $1,725 per ounce and a silver price of $20.00 per ounce.

| | | | | | | | | | | | |

| | | | | | 2023 Guidance |

The Caraíba Operations | | | | | | |

| Copper Production (tonnes) | | | | | | 44,000 - 47,000 |

C1 Cash Cost Guidance (US$/lb)(1) | | | | | | $1.40 - $1.60 |

| | | | | | |

The Xavantina Operations | | | | | | |

| Au Production (ounces) | | | | | | 50,000 - 53,000 |

C1 Cash Cost Guidance (US$/oz)(1) | | | | | | $475 - $575 |

All-in Sustaining Cost (AISC) Guidance (US$/oz)(1) | | | | | | $1,000 - $1,100 |

| | | | | | |

Note: Guidance is based on certain estimates and assumptions, including but not limited to, mineral reserve estimates, grade and continuity of interpreted geological formations and metallurgical performance. Please refer to the Company’s Annual Information Form for the year ended December 31, 2022 (the "AIF") and Management of Risks and Uncertainties in this MD&A for complete risk factors.

(1) Please refer to the section titled "Alternative Performance (Non-IFRS) Measures" within this MD&A.

Ero Copper Corp. June 30, 2023 MD&A | Page 7

2023 Capital Expenditure Guidance

After conducting a detailed review of major projects and support infrastructure at the Caraíba Operations during the quarter, including infrastructure related to the Deepening, underground paste fill and tailings, the Company has elected to invest in various upgrades throughout H2 2023. These enhancements aim to bolster the Caraíba Operations' ongoing projects and support expanded life-of-mine operating plans at the Pilar Mine. As a result, the Company is increasing its full-year capital expenditure guidance by $15 to $20 million.

The Company's capital expenditure guidance for 2023 assumes a USD:BRL foreign exchange rate of 5.30 and has been presented below in USD millions.

| | | | | | | | | | | | | | | | | | |

| | 2023 Guidance | | | | | | | | | | |

Caraíba Operations | | | | | | | | | | | | |

| Growth | | $90 - $105 | | | | | | | | | | |

| Sustaining | | $70 - $80 | | | | | | | | | | |

| Exploration | | $22 - $27 | | | | | | | | | | |

Total, Caraíba Operations | | $182 - $212 | | | | | | | | | | |

| | | | | | | | | | | | |

| Tucumã Project | | | | | | | | | | | | |

| Growth | | $150 - $165 | | | | | | | | | | |

| Sustaining | | $0 | | | | | | | | | | |

| Exploration | | $0 - $1 | | | | | | | | | | |

| Total, Tucumã Project | | $150 - $166 | | | | | | | | | | |

| | | | | | | | | | | | |

| Xavantina Operations | | | | | | | | | | | | |

| Growth | | $4 - $5 | | | | | | | | | | |

| Sustaining | | $12 - $14 | | | | | | | | | | |

| Exploration | | $6 - $7 | | | | | | | | | | |

| Total, Xavantina Operations | | $22 - $26 | | | | | | | | | | |

| | | | | | | | | | | | |

| Other Exploration Projects | | $3 - $5 | | | | | | | | | | |

| | | | | | | | | | | | |

| Company Total | | | | | | | | | | | | |

| Growth | | $244 - $275 | | | | | | | | | | |

| Sustaining | | $82 - $94 | | | | | | | | | | |

| Exploration | | $31 - $40 | | | | | | | | | | |

| Total, Company | | $357 - $409 | | | | | | | | | | |

Ero Copper Corp. June 30, 2023 MD&A | Page 8

REVIEW OF FINANCIAL RESULTS

The following table provides a summary of the financial results of the Company for Q2 2023 and Q2 2022. Tabular amounts are in thousands of US dollars, except share and per share amounts.

| | | | | | | | | | | | | | | | | |

| | | Three months ended June 30, |

| Notes | | 2023 | | 2022 |

| | | | | |

| Revenue | 1 | | $ | 104,929 | | | $ | 114,903 | |

| Cost of sales | 2 | | (65,521) | | | (64,251) | |

| Gross profit | | | 39,408 | | | 50,652 | |

| Expenses | | | | | |

| General and administrative | 3 | | (13,651) | | | (12,471) | |

| Share-based compensation | | | (4,909) | | | 2,333 | |

Income before the undernoted | | | 20,848 | | | 40,514 | |

| Finance income | | | 3,362 | | | 1,544 | |

| Finance expense | 4 | | (5,995) | | | (8,154) | |

Foreign exchange gain (loss) | 5 | | 15,057 | | | (3,303) | |

| | | | | |

| | | | | |

Other income (expenses) | | | 2,442 | | | (1,208) | |

Income before income taxes | | | 35,714 | | | 29,393 | |

Income tax expense | | | | | |

| Current | | | (3,742) | | | (3,111) | |

| Deferred | | | (2,031) | | | (2,172) | |

| 6 | | (5,773) | | | (5,283) | |

Net income for the period | | | $ | 29,941 | | | $ | 24,110 | |

| | | | | |

Other comprehensive gain (loss) | | | | | |

Foreign currency translation gain (loss) | 7 | | 37,987 | | | (59,372) | |

Comprehensive income (loss) | | | $ | 67,928 | | | $ | (35,262) | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Net income (loss) per share attributable to owners of the Company | | | | | |

| Basic | | | $ | 0.32 | | | $ | 0.26 | |

| Diluted | | | $ | 0.32 | | | $ | 0.26 | |

| Weighted average number of common shares outstanding | | | | | |

| Basic | | | 92,685,916 | | | 90,539,647 | |

| Diluted | | | 93,643,447 | | | 91,850,321 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Ero Copper Corp. June 30, 2023 MD&A | Page 9

Notes:

1. Revenues from copper sales in Q2 2023 was $83.9 million (Q2 2022 - $95.7 million) on sale of 25.6 million lbs of copper (Q2 2022 - 28.5 million lbs). The decrease in revenues was primarily attributed to lower copper prices and less copper sold. The decrease in copper production was attributed to lower head grades based on planned stope sequencing.

Revenues from gold sales in Q2 2023 was $21.0 million (Q2 2022 - $19.2 million) on sale of 10,916 ounces of gold (Q2 2022 - 10,448 ounces) at an average realized price of $1,945 per ounce (Q2 2022 - $1,865 per ounce). The increase in revenues was primarily attributable to both higher realized gold price and the increase in sales volume, as production and head grades increased significantly compared to the same quarter of the prior year.

2. Cost of sales for Q2 2023 from copper sales was $56.2 million (Q2 2022 - $54.0 million) which primarily comprised of $18.0 million (Q2 2022 - $12.7 million) in depreciation and depletion, $12.7 million (Q2 2022 - $10.6 million) in salaries and benefits, $9.8 million (Q2 2022 - $9.4 million) in materials and consumables, $6.7 million (Q2 2022 - $6.3 million) in maintenance costs, $7.0 million (Q2 2022 - $6.6 million) in contracted services, $2.9 million (Q2 2022 - $2.7 million) in utilities, and $2.3 million (Q2 2022 - $2.6 million) in sales expenses, partially offset by $(3.4) million in change in inventory (Q2 2022 - $2.9 million). The increase in cost of sales in Q2 2023 as compared to Q2 2022 was primarily attributable to a 5% increase in tonnes milled and lower copper head grades, resulting in higher depreciation and depletion and labour costs compared to the same quarter of the prior year.

Cost of sales for Q2 2023 from gold sales was $9.3 million (Q2 2022 - $10.3 million) which primarily comprised of $4.1 million (Q2 2022 - $3.1 million) in depreciation and depletion, $2.2 million (Q2 2022 - $2.2 million) in salaries and benefits, $1.5 million (Q2 2022 - $1.7 million) in contracted services, $1.5 million (Q2 2022 - $2.0 million) in materials and consumables, $0.6 million (Q2 2022 - $0.7 million) in utilities, and $0.5 million (Q2 2022 - $0.7 million) in maintenance costs, partially offset by $(1.6) million in change in inventory (Q2 2022 - $(0.2) million). The increase in cost of sales in Q2 2023 as compared to Q2 2022 is primarily attributable to a 4% increase in gold ounces sold, as well as higher depreciation and depletion attributed to an increase in depreciable asset base.

3. General and administrative expenses for Q2 2023 was primarily comprised of $8.3 million (Q2 2022 - $6.6 million) in salaries and consulting fees, $2.0 million (Q2 2022 - $2.6 million) in office and administration expenses, $1.4 million (Q2 2022 - $1.8 million) in incentive payments, $1.0 million (Q2 2022 - $0.7 million) in other costs, and $0.4 million (Q2 2022 - $0.7 million) in accounting and legal costs. The increase in general and administrative expenses was mainly attributed to an increase in salaries and consulting fees to support overall growth in operations, as well as consulting fees incurred on various operational excellence initiatives that are currently underway.

4. Finance expense for Q2 2023 was $6.0 million (Q2 2022 - $8.2 million) and is primarily comprised of interest on loans and borrowings of $3.9 million (Q2 2022 - $6.0 million), accretion of deferred revenue of $0.8 million (Q2 2022 - $0.9 million), accretion of asset retirement obligations of $0.7 million (Q2 2022 - $0.6 million), lease interest of $0.3 million (Q2 2022 - $0.2 million), and other finance expense of $0.4 million (Q2 2022 - $0.5 million). In addition, $3.2 million (Q2 2022 - $1.2 million) in interest was capitalized to projects in progress. The overall decrease in finance expense was primarily attributable to higher interest capitalized as a result of higher capital expenditures on various projects as compared to the same quarter in the prior year.

5. Foreign exchange gain for Q2 2023 was $15.1 million (Q2 2022 - $3.3 million loss). This amount is primarily comprised of foreign exchange gain on USD denominated debt of $12.1 million (Q2 2022 - $6.5 million loss) in MCSA for which the functional currency is the BRL, realized foreign exchange gain on derivative contracts of $2.8 million (Q2 2022 - $3.0 million loss), and unrealized foreign exchange gain on derivative contracts of $2.1 million (Q2 2022 - $1.4 million loss), partially offset by other foreign exchange losses of $1.9 million (Q2 2022 - $7.6 million gains). The foreign exchange gains were primarily a result of a strengthening of BRL against USD at the end of Q2 2023 as compared to the prior quarter. The foreign exchange gain on unrealized derivative contracts are a result of mark-to-market adjustments at period end.

6. In Q2 2023, the Company recognized $5.8 million in income tax expense (Q2 2022 - $5.3 million). The increase was primarily a result of an increase in income before taxes as compared to the same quarter of the prior year.

7. The foreign currency translation gain is a result of a strengthening of the BRL against the USD during Q2 2023, which strengthened from approximately 5.08 BRL per US dollar at the beginning of Q2 2023 to approximately 4.82 BRL per US dollar by the end of the quarter, when translating the net assets of the Company’s Brazilian subsidiaries to USD for presentation in the Company’s condensed consolidated interim financial statements.

Ero Copper Corp. June 30, 2023 MD&A | Page 10

The following table provides a summary of the financial results of the Company for YTD 2023 and 2022. Tabular amounts are in thousands of US dollars, except share and per share amounts.

| | | | | | | | | | | | | | | | | | | |

| | | Six months ended June 30, |

| Notes | | 2023 | | 2022 | | |

| | | | | | | |

| Revenue | 1 | | $ | 205,885 | | | $ | 223,814 | | | |

| Cost of sales | 2 | | (126,369) | | | (112,163) | | | |

| Gross profit | | | 79,516 | | | 111,651 | | | |

| Expenses | | | | | | | |

| General and administrative | 3 | | (25,867) | | | (23,684) | | | |

| Share-based compensation | | | (9,926) | | | 343 | | | |

Income before the undernoted | | | 43,723 | | | 88,310 | | | |

| Finance income | | | 7,500 | | | 2,257 | | | |

| Finance expense | 4 | | (12,521) | | | (13,650) | | | |

Foreign exchange gain | 5 | | 23,678 | | | 15,406 | | | |

| | | | | | | |

| | | | | | | |

Other income (expenses) | | | 2,500 | | | (1,838) | | | |

Income before income taxes | | | 64,880 | | | 90,485 | | | |

Income tax expense | | | | | | | |

| Current | | | (5,842) | | | (6,170) | | | |

| Deferred | | | (4,597) | | | (7,719) | | | |

| 6 | | (10,439) | | | (13,889) | | | |

Net income for the period | | | $ | 54,441 | | | $ | 76,596 | | | |

| | | | | | | |

Other comprehensive gain | | | | | | | |

Foreign currency translation gain | 7 | | 55,628 | | | 26,562 | | | |

Comprehensive income | | | $ | 110,069 | | | $ | 103,158 | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Net income per share attributable to owners of the Company | | | | | | | |

| Basic | | | $ | 0.58 | | | $ | 0.84 | | | |

| Diluted | | | $ | 0.58 | | | $ | 0.83 | | | |

| Weighted average number of common shares outstanding | | | | | | | |

| Basic | | | 92,491,063 | | | 90,389,661 | | | |

| Diluted | | | 93,429,191 | | | 91,887,665 | | | |

Ero Copper Corp. June 30, 2023 MD&A | Page 11

Notes:

1. Revenues from copper sales in YTD 2023 was $161.2 million (YTD 2022 - $189.4 million), which included the sale of 46.5 million lbs of copper compared to 50.7 million lbs of copper for YTD 2022. The decrease in revenues was primarily attributed to lower copper prices and lower copper sold.

Revenues from gold sales in YTD 2023 was $44.7 million (YTD 2022 - $34.5 million), which included the sale of 24,013 ounces of gold at a realized price of $1,881 per ounce, compared to 18,461 ounces of gold sold at a realized price of $1,888 per ounce in for YTD 2022. The increase in revenues was primarily attributable to higher sales volume compared to the prior year.

2. Cost of sales for YTD 2023 from copper sales was $106.8 million (YTD 2022 - $94.5 million) which primarily consisted of $30.2 million (YTD 2022 - $22.5 million) in depreciation and depletion, $23.9 million (YTD 2022 - $19.8 million) in salaries and benefits, $18.3 million (YTD 2022 - $16.7 million) in materials and consumables, $13.0 million (YTD 2022 - $12.2 million) in contracted services, $13.2 million (YTD 2022 - $11.3 million) in maintenance costs, $5.6 million (YTD 2022 - $5.3 million) in utilities and $4.2 million (YTD 2022 - $4.4 million) in sales expenses. The increase in cost of sales was primarily attributed to a 15% increase in tonnes milled and lower head grades, resulting in higher depletion, depreciation and amortization, as well as an increase in labour and materials costs.

Cost of sales for YTD 2023 from gold sales was $19.5 million (YTD 2022- $17.6 million) which primarily comprised of $8.0 million (YTD 2022 - $5.3 million) in depreciation and depletion, $4.3 million (YTD 2022 - $4.4 million) in salaries and benefits, $2.8 million (YTD 2022 - $3.2 million) in contracted services, $3.0 million (YTD 2022 - $3.3 million) in materials and consumables, $1.1 million (YTD 2022 - $1.3 million) in utilities, and $0.9 million (YTD 2022 - $1.3 million) in maintenance costs. The increase in cost of sales was primarily attributed to overall inflationary pressure on costs.

3. General and administrative expenses for YTD 2023 was primarily comprised of $15.4 million (YTD 2022 - $12.5 million) with respect to salaries and consulting fees, $4.2 million (YTD 2022 - $4.7 million) in office and administrative expenses, $2.8 million (YTD 2022 - $3.4 million) in incentive payments, $1.9 million (YTD 2022 - $1.7 million) in other general and administrative expenses, and $1.0 million (YTD 2022 - $1.1 million) in accounting and legal fees. The increase in general and administrative expenses in YTD 2023 was primarily attributable to increases in salaries, consulting fees and administrative activities to support overall growth in operations, as well as consulting fees incurred on various operational excellence initiatives that are currently underway.

4. Finance expense for YTD 2023 was $12.5 million (YTD 2022 - $13.7 million) and was primarily comprised of interest on loans at the corporate head office of $8.4 million (YTD 2022 - $10.0 million), accretion of deferred revenue of $1.6 million (YTD 2022 - $1.7 million), accretion of the asset retirement obligations of $1.3 million (YTD 2022 - $1.1 million), lease interest of $0.6 million (YTD 2022 - $0.3 million), and other finance expense of $0.6 million (YTD 2022 - $0.5 million). In addition, $5.6 million (YTD 2022 - $2.3 million) in interest was capitalized to projects in progress. The overall decrease in finance expense was primarily attributable to higher interest capitalized as a result of higher capital expenditures on various projects as compared to the prior year.

5. Foreign exchange gain for YTD 2023 was $23.7 million (YTD 2022 - $15.4 million gain). This amount was primarily comprised of a foreign exchange gain on USD denominated debt of $17.5 million (YTD 2022 - $4.8 million gain) in MCSA for which the functional currency is the BRL, a foreign exchange gain on unrealized derivative contracts of $5.3 million (YTD 2022 - $23.3 million), and realized foreign exchange gain on derivative contracts of $3.8 million (YTD 2022 - $7.6 million loss), partially offset by other foreign exchange losses of $2.8 million (YTD 2022 - $5.1 million losses). The fluctuation in foreign exchange gains/losses were primarily a result of increased volatility of the USD/BRL foreign exchange rates. During YTD 2023, the BRL strengthened 8.7% against the USD. The foreign exchange gains/losses on unrealized derivative contracts are a result of mark-to-market calculations at period end and may not represent the amount that will ultimately be realized, which will depend on future changes to the USD/BRL foreign exchange rates.

6. In YTD 2023, the Company recognized a $10.4 million income tax expense (YTD 2022 - income tax expense of $13.9 million), The decrease was primarily as a result of a decrease in income before income taxes, partially offset by increase in non-deductible expenses and increase in withholding tax on intercompany interest and dividends.

7. The foreign currency translation income is a result of the strengthening of the BRL against the USD during YTD 2023 when translating the net assets of the Company’s Brazilian subsidiaries to USD for presentation in the Company’s condensed consolidated interim financial statements.

Ero Copper Corp. June 30, 2023 MD&A | Page 12

SUMMARY OF QUARTERLY RESULTS

The following table presents selected financial information for each of the most recent eight quarters. Tabular amounts are in millions of US Dollars, except share and per share amounts.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Selected Financial Information | | Jun. 30,(1) | | Mar. 31,(2) | | Dec. 31,(3) | | Sep. 30,(4) | | Jun. 30,(5) | | Mar. 31,(6) | | Dec. 31,(7) | | Sep. 30,(8) |

| 2023 | | 2023 | | 2022 | | 2022 | | 2022 | | 2022 | | 2021 | | 2021 |

| Revenue | | $ | 104.9 | | | $ | 101.0 | | | $ | 116.7 | | | $ | 85.9 | | | $ | 114.9 | | | $ | 108.9 | | | $ | 134.9 | | | $ | 111.8 | |

Cost of sales | | $ | (65.5) | | | $ | (60.8) | | | $ | (64.0) | | | $ | (63.1) | | | $ | (64.3) | | | $ | (47.9) | | | $ | (50.5) | | | $ | (43.8) | |

Gross profit | | $ | 39.4 | | | $ | 40.1 | | | $ | 52.7 | | | $ | 22.8 | | | $ | 50.7 | | | $ | 61.0 | | | $ | 84.4 | | | $ | 68.0 | |

Net income for period | | $ | 29.9 | | | $ | 24.5 | | | $ | 22.5 | | | $ | 4.0 | | | $ | 24.1 | | | $ | 52.5 | | | $ | 60.2 | | | $ | 26.4 | |

Income per share attributable to the owners of the Company | | | | | | | | | | | | | | | | |

| - Basic | | $ | 0.32 | | | $ | 0.26 | | | $ | 0.24 | | | $ | 0.04 | | | $ | 0.26 | | | $ | 0.58 | | | $ | 0.67 | | | $ | 0.29 | |

| - Diluted | | $ | 0.32 | | | $ | 0.26 | | | $ | 0.24 | | | $ | 0.04 | | | $ | 0.26 | | | $ | 0.57 | | | $ | 0.65 | | | $ | 0.28 | |

| Weighted average number of common shares outstanding | | | | | | | | | | | | | | | | |

| - Basic | | 92,685,916 | | | 92,294,045 | | | 91,522,358 | | | 90,845,229 | | | 90,539,647 | | | 90,238,008 | | | 89,637,768 | | | 88,449,567 | |

| - Diluted | | 93,643,447 | | | 93,218,281 | | | 92,551,916 | | | 91,797,437 | | | 91,850,321 | | | 92,050,104 | | | 91,727,452 | | | 93,255,615 | |

Notes:

1.During Q2 2023, the Company recognized net income of $29.9 million compared to $24.5 million in the preceding quarter. The increase was primarily attributable to an increase in foreign exchange gain and the recognition of an unrealized gain in copper derivative contracts.

2.During Q1 2023, the Company recognized net income of $24.5 million compared to $22.5 million in the preceding quarter. The increase was primarily attributable to an increase in foreign exchange gain, a reduction in general and administrative expenses, and a reduction in finance expense. In the prior quarter, the Company recognized a $3.3 million expected credit loss provision.

3.During Q4 2022, the Company recognized net income of $22.5 million compared to $4.0 million in the preceding quarter. The increase was primarily attributable to a $29.9 million increase in gross profit as a result of 13% increase in copper production, partially offset by higher share-based payment expenses and a $3.3 million expected credit loss provision recognized in relation to payment arrangement with one of the Company's customers in Brazil, Paranapanema S/A ("PMA").

4.During Q3 2022, the Company recognized net income of $4.0 million compared to $24.1 million in the preceding quarter. The decrease was primarily attributable to a $27.9 million decrease in gross profit as a result of 12% lower production, reduced copper and gold realized prices, and provisional pricing adjustments on copper concentrate sold in the prior quarter.

5.During Q2 2022, the Company recognized net income of $24.1 million compared to $52.5 million in the preceding quarter. The decrease was primarily attributable to volatility in foreign exchange gains or losses driven by the strengthening of the BRL against the USD in the quarter, which resulted in $3.3 million of foreign exchange losses compared to $18.7 million of foreign exchange gains in the preceding quarter and a $10.3 million decrease in gross profit as a result of reduced copper and gold realized prices and overall inflationary pressure on cost of sales. The increase in copper produced and sold was mostly offset by a provisional pricing adjustment.

Ero Copper Corp. June 30, 2023 MD&A | Page 13

6.During Q1 2022, the Company recognized net income of $52.5 million compared to $60.2 million in the preceding quarter. The decrease was primarily attributable to a $23.4 million decrease in gross profit as a result of reduced copper and gold sales volume, and overall inflationary pressure on cost of sales. Production and throughput for the quarter was adversely impacted by employee absenteeism due to COVID-19 and the seasonal influenza virus. The decrease in gross profit was partially offset by foreign exchange gains driven by the strengthening of the BRL against the USD in the quarter, which resulted in $18.7 million of foreign exchange gains compared to $4.4 million of foreign exchange losses in the preceding quarter.

7.During Q4 2021, the Company recognized net income of $60.2 million compared to $26.4 million in the preceding quarter. The increase was primarily attributable to a $16.4 million increase in gross profit as a result of increased copper sales volume, as well as a $15.2 million decrease in foreign exchange losses as the BRL depreciation against the USD was relatively less than the preceding quarter.

8.During Q3 2021, the Company recognized net income of $26.4 million compared to $84.0 million in the preceding quarter, a decrease of $57.6 million primarily due to volatility in foreign exchange gains or losses driven by the weakening of the BRL against the USD in the quarter, resulting in $19.6 million of foreign exchange losses compared to foreign exchange gains of $30.7 million in the preceding quarter.

LIQUIDITY, CAPITAL RESOURCES, AND CONTRACTUAL OBLIGATIONS

Liquidity

As at June 30, 2023, the Company held cash and cash equivalents of $124.4 million which were primarily comprised of cash held with reputable financial institutions and are invested in highly liquid short-term investments with maturities of three months or less. In addition, the Company held short-term investments of $56.0 million with reputable financial institutions with maturities greater than three months and less than one year. The funds are not exposed to liquidity risk and there are no restrictions on the ability of the Company to use these funds to meet its obligations.

Cash and cash equivalents have decreased by $53.3 million since December 31, 2022. The Company’s cash flows from operating, investing, and financing activities during 2023 are summarized as follows:

•Cash used in investing activities of $121.1 million, including:

◦$204.2 million of additions to mineral property, plant and equipment;

◦$9.0 million of additions to exploration and evaluation assets; and

◦$40.0 million of short-term investment purchases;

net of:

◦$132.1 million in proceeds from short-term investments and interest received;

•Cash used in financing activities of $5.6 million, primarily consists of:

◦$13.5 million of interest paid on loans and borrowings;

◦$5.5 million of lease payments; and

◦$3.8 million of principal repayments on loans and borrowings;

net of:

◦$11.8 million of new loans and borrowings, net of finance costs; and

◦$8.3 million of proceeds from exercise of stock options.

Partially offset by:

•Cash from operating activities of $71.8 million, primarily consists of:

Ero Copper Corp. June 30, 2023 MD&A | Page 14

◦$114.1 million of EBITDA (see Non-IFRS Measures);

◦$2.4 million of additional advances from the NX Gold Precious Metal Purchase Agreement; and

◦$2.0 million of derivative contract settlements;

net of:

◦$13.3 million of net change in non-cash working capital items;

◦$5.3 million of unrealized gain on foreign exchange hedges; and

◦$1.5 million of income taxes paid.

As at June 30, 2023, the Company had working capital of $140.7 million and available liquidity of $330.4 million.

Capital Resources

The Company’s primary sources of capital are comprised of cash from operations, cash and cash equivalents on hand and short-term investments. The Company continuously monitors its liquidity position and capital structure and, based on changes in operations and economic conditions, may adjust such structure by issuing new common shares or new debt as necessary. Taking into consideration cash flow from existing operations, management believes that the Company has sufficient working capital and financial resources to maintain its planned operations and activities for the foreseeable future.

At June 30, 2023, the Company had available liquidity of $330.4 million, including $124.4 million in cash and cash equivalents, $56.0 million in short-term investments and $150.0 million of undrawn availability under its senior secured revolving credit facility.

In January 2023, the senior credit facility was amended to increase its limit from $75.0 million to $150.0 million with maturity extended from March 2025 to December 2026 ("Amended Senior Credit Facility"). The Amended Senior Credit Facility bears interest on a sliding scale of SOFR plus an applicable margin of 2.00% to 4.00% depending on the Company's consolidated leverage ratio. Commitment fees for the undrawn portion of the Amended Senior Credit Facility is also based on a sliding scale ranging from 0.45% to 0.90%.

In relation to its loans and borrowings, the Company is required to comply with certain financial covenants. As of the date of the condensed consolidated interim financial statements, the Company is in compliance with these covenants. The loan agreements also contain covenants that could restrict the ability of the Company and its subsidiaries, MCSA, Ero Gold, and NX Gold, to, among other things, incur additional indebtedness needed to fund its respective operations, pay dividends or make other distributions, make investments, create liens, sell or transfer assets or enter into transactions with affiliates. There are no other restrictions or externally imposed capital requirements of the Company.

Contractual Obligations and Commitments

The Company has a precious metals purchase agreement with RGLD Gold AG ("Royal Gold"), a wholly-owned subsidiary of Royal Gold, Inc., whereby the Company is obligated to sell a portion of its gold production from the Xavantina Operations at contract prices.

Ero Copper Corp. June 30, 2023 MD&A | Page 15

Refer to the "Liquidity Risk" section for further information on the Company's contractual obligations and commitments.

MANAGEMENT OF RISKS AND UNCERTAINTIES

The Company thoroughly examines the various financial instruments and risks to which it is exposed and assesses the impact and likelihood of those risks. These risks may include credit risk, liquidity risk, currency risk, commodity price risk and interest rate risk. Where material, these risks are reviewed and monitored by the Board.

Credit risk

Credit risk is the risk of financial loss to the Company if a customer or counterparty to a financial instrument fails to meet its contractual obligations and arises principally from the Company’s receivables from customers. The carrying amount of the financial assets below represents the maximum credit risk exposure as at June 30, 2023 and December 31, 2022:

| | | | | | | | | | | |

| June 30, 2023 | | December 31, 2022 |

| Cash and cash equivalents | $ | 124,382 | | | $ | 177,702 | |

| Short-term investments | 56,011 | | | 139,700 | |

| Accounts receivable | 12,779 | | | 10,289 | |

| Note receivable | 18,756 | | | 20,630 | |

| Deposits and other non-current assets | 7,276 | | | 3,985 | |

| $ | 219,204 | | | $ | 352,306 | |

The Company invests cash and cash equivalents and short-term investments with financial institutions that are financially sound based on their credit rating.

The Company’s exposure to credit risk associated with accounts receivable is influenced mainly by the individual characteristics of each customer. On November 30, 2022, one of the Company's customers in Brazil, Paranapanema S/A ("PMA"), filed for bankruptcy protection due to working capital difficulties after an operational incident in June which resulted in one of their plants being shutdown for 38 days. Preceding the announcement, the Company agreed to restructure PMA's outstanding accounts receivable balance of $23.9 million into a note receivable, guaranteed by certain assets of PMA, with payment terms of 24 monthly installments beginning in February 2023. The loan bears an annual interest rate equivalent to Brazil's CDI rate of approx. 13%. At June 30, 2023, the gross carrying amount of accounts and note receivable has been reduced by a credit loss provision of $2.7 million (December 31, 2022 - $3.3 million.

Liquidity risk

Liquidity risk is the risk associated with the difficulties that the Company may have meeting the obligations associated with financial liabilities that are settled with cash payments or with another financial asset. The Company's approach to liquidity management is to ensure as much as possible that sufficient liquidity exists to meet their maturity obligations on the expiration dates, under normal and stressful conditions, without causing unacceptable losses or with risk of undermining the normal operation of the Company.

Ero Copper Corp. June 30, 2023 MD&A | Page 16

The table below shows the Company's maturity of non-derivative financial liabilities on June 30, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-derivative financial liabilities | | Carrying

value | | Contractual cash flows | | Up to

12 months | | 1 - 2

years | | 3 - 5

years | | More than

5 years |

| Loans and borrowings (including interest) | | $ | 426,923 | | | $ | 608,972 | | | $ | 34,699 | | | $ | 35,690 | | | $ | 86,583 | | | $ | 452,000 | |

| Accounts payable and accrued liabilities | | 94,221 | | | 94,221 | | | 94,221 | | | — | | | — | | | — | |

| Other non-current liabilities | | 9,755 | | | 22,199 | | | — | | | 10,580 | | | 10,951 | | | 668 | |

| Leases | | 14,875 | | | 14,855 | | | 9,123 | | | 3,809 | | | 1,729 | | | 193 | |

| Total | | $ | 545,774 | | | $ | 740,247 | | | $ | 138,043 | | | $ | 50,079 | | | $ | 99,263 | | | $ | 452,861 | |

As at June 30, 2023, the Company has made commitments for capital expenditures through contracts and purchase orders amounting to $197.1 million, which are expected to be incurred over a six-year period. In the normal course of operations, the Company may also enter into long-term contracts which can be cancelled with certain agreed customary notice periods without material penalties.

The Company also has derivative financial asset for foreign exchange collar contracts and copper derivative contracts whose notional amounts and maturity information are disclosed below under foreign exchange currency risk, interest rate risk, and price risk.

Foreign exchange currency risk

The Company’s subsidiaries in Brazil are exposed to exchange risks primarily related to the US dollar. In order to minimize currency mismatches, the Company monitors its cash flow projections considering future sales expectations indexed to US dollar variation in relation to the cash requirement to settle the existing financings.

The Company's exposure to foreign exchange currency risk at June 30, 2023 relates to $19.9 million (December 31, 2022 – $11.7 million) in loans and borrowings of MCSA denominated in US dollars and Euros. In addition, the Company is also exposed to foreign exchange currency risk at June 30, 2023 on $210.1 million of intercompany loan balances (December 31, 2022 - $148.2 million) which have contractual repayment terms. Strengthening (weakening) in the Brazilian Real against the US dollar at June 30, 2023 by 10% and 20%, would have increased (decreased) pre-tax net income by $22.9 million and $45.8 million, respectively (June 30, 2022 – $6.5 million and $13.0 million. This analysis is based on the foreign currency exchange variation rate that the Company considered to be reasonably possible at the end of the period. The analysis assumes that all other variables, especially interest rates, are held constant.

The Company may use derivatives, including forward contracts, collars and swap contracts, to manage market risks. At June 30, 2023, the Company has entered into foreign exchange collar contracts at zero cost for notional amounts of $90.0 million (December 31, 2022 - notional amount of $270.0 million) with an average floor rate of 5.30 BRL to US Dollar and an average cap rate of 6.31 BRL to US Dollar. The maturity dates of these contracts are from July 2023 to December 2023 and are financially settled on a net basis. As of June 30, 2023 the Company had contracts with three different

Ero Copper Corp. June 30, 2023 MD&A | Page 17

counterparties and the fair value of these contracts was a net asset of $9.0 million (December 31, 2022 - asset of $3.2 million), included in other current assets in the statement of financial position. The fair value of foreign exchange contracts was determined based on option pricing models, forward foreign exchange rates and information provided by the counter party.

The change in fair value of foreign exchange collar contracts was a gain of $5.3 million for the three and six months ended June 30, 2023 (a gain of $23.3 million for the three and six months ended June 30, 2022) and has been recognized in foreign exchange gain (loss). In addition, during the three and six months ended June 30, 2023, the Company recognized a realized gain of $3.8 million (realized loss of $7.6 million for the three and six months ended June 30, 2022) related to the settlement of foreign currency forward collar contracts.

Interest rate risk

The Company is principally exposed to the variation in interest rates on loans and borrowings with variable rates of interest. Management reduces interest rate risk exposure by entering into loans and borrowings with fixed rates of interest or by entering into derivative instruments that fix the ultimate interest rate paid.

The Company is principally exposed to interest rate risk through Brazilian Real denominated bank loans of $2.8 million. Based on the Company’s net exposure at June 30, 2023, a 1% change in the variable rates would not materially impact its pre-tax annual net income.

Price risk

The Company may use derivatives, including forward contracts, collars and swap contracts, to manage commodity price risks.

At June 30, 2023, the Company has provisionally priced sales that are exposed to commodity price changes. Based on the Company’s net exposure at June 30, 2023, a 10% change in the price of copper would have changed $2.4 million. At June 30, 2023, the Company has entered into copper derivative contracts at zero-cost on 3,000 tonnes of copper per month from July 2023 to January 2024. These copper derivative contracts establish a floor price of $3.50 per pound of copper and a cap price of $4.76 per pound on total hedged volumes of 18,000 tonnes of copper, representing approximately 75% of estimated production volumes over the period. As of June 30, 2023, the fair value of these contracts was a net asset of $2.2 million (December 31, 2022 - liability of $0.6 million). The fair value of copper collar contracts was determined based on option pricing models, forward copper price and information provided by the counter party.

During the three and six months ended June 30, 2023, the Company recognized an unrealized gain of $2.7 million (2022 - $nil) and a realized loss of $1.8 million in relation to its copper hedge derivatives in other income or loss.

For a discussion of additional risks applicable to the Company and its business and operations, including risks related to the Company’s foreign operations, the environment and legal proceedings, see “Risk Factors” in the Company’s AIF.

OTHER FINANCIAL INFORMATION

Ero Copper Corp. June 30, 2023 MD&A | Page 18

Off-Balance Sheet Arrangements

As at June 30, 2023, the Company had no material off-balance sheet arrangements.

Outstanding Share Data

As of August 3, 2023, the Company had 93,211,871 common shares issued and outstanding.

ACCOUNTING POLICIES, JUDGMENTS AND ESTIMATES

Critical Accounting Judgments and Estimates

The preparation of condensed consolidated interim financial statements in conformity with IFRS requires management to make judgments, estimates and assumptions about future events that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Although these estimates are based on management’s best knowledge of the amount, events or actions, actual results may differ from these estimates.

The Company’s significant accounting policies and accounting estimates are contained in the Company’s consolidated financial statements for the year ended December 31, 2022. Certain of these policies, such as derivative instruments, deferred revenue, depreciation of property, plant and equipment and mining interests, provision for rehabilitation and closure costs, and income tax estimates including tax uncertainties involve critical accounting estimates. Certain of these estimates are dependent on mineral reserves and resource estimates and require management of the Company to make subjective or complex judgments about matters that are inherently uncertain, and because of the likelihood that materially different amounts could be reported under different conditions or using different assumptions. Actual results may differ from these estimates.

Management continuously reviews its estimates, judgments and assumptions on an ongoing basis using the most current information available. Revisions to estimates are recognized prospectively.

Ero Copper Corp. June 30, 2023 MD&A | Page 19

Capital Expenditures

The following table presents capital expenditures at the Company’s operations.

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | 2023 - Q2 | 2023 - Q1 | | | 2023 - YTD | | | |

Caraíba Operations | | | | | | | | | |

| Growth | | $ | 35,450 | | $ | 24,702 | | | | $ | 60,152 | | | | |

| Sustaining | | 28,788 | | 20,862 | | | | 49,650 | | | | |

| Exploration | | 8,580 | | 5,196 | | | | 13,776 | | | | |

| Deposit on Projects | | 6,962 | | 3,659 | | | | 10,621 | | | | |

Total, Caraíba Operations | | $ | 79,780 | | $ | 54,419 | | | | $ | 134,199 | | | | |

| | | | | | | | | |

Tucumã Project | | | | | | | | | |

| Growth | | 23,870 | | 11,782 | | | | 35,652 | | | | |

| | | | | | | | | |

| Exploration | | 48 | | 638 | | | | 686 | | | | |

| Deposit on Projects | | 15,430 | | 14,100 | | | | 29,530 | | | | |

Total, Tucumã Project | | $ | 39,348 | | $ | 26,520 | | | | $ | 65,868 | | | | |

| | | | | | | | | |

Xavantina Operations | | | | | | | | | |

| Growth | | 1,490 | | 987 | | | | 2,477 | | | | |

| Sustaining | | 3,366 | | 3,013 | | | | 6,379 | | | | |

| Exploration | | 2,449 | | 1,905 | | | | 4,354 | | | | |

| | | | | | | | | |

Total, Xavantina Operations | | $ | 7,305 | | $ | 5,905 | | | | $ | 13,210 | | | | |

| | | | | | | | | |

| Corporate and Other | | | | | | | | | |

| | | | | | | | | |

| Sustaining | | 222 | | 178 | | | | 400 | | | | |

| Exploration | | 1,800 | | 1,837 | | | | 3,637 | | | | |

| Deposit on Projects | | 81 | | — | | | | 81 | | | | |

| Total, Corporate and Other | | $ | 2,103 | | $ | 2,015 | | | | $ | 4,118 | | | | |

| | | | | | | | | |

| Consolidated | | | | | | | | | |

| Growth | | 60,810 | | 37,471 | | | | $ | 98,281 | | | | |

| Sustaining | | 32,376 | | 24,053 | | | | 56,429 | | | | |

| Exploration | | 12,877 | | 9,576 | | | | 22,453 | | | | |

| Deposit on Projects | | 22,473 | | 17,759 | | | | 40,232 | | | | |

| Total, Consolidated | | $ | 128,536 | | $ | 88,859 | | | | $ | 217,395 | | | | |

| | | | | | | | | |

Ero Copper Corp. June 30, 2023 MD&A | Page 20

ALTERNATIVE PERFORMANCE (NON-IFRS) MEASURES

The Company utilizes certain alternative performance (non-IFRS) measures to monitor its performance, including C1 cash cost of copper produced (per lb), realized copper price (per lb), C1 cash cost of gold produced (per ounce), AISC of gold produced (per ounce), realized gold price (per ounce), EBITDA, adjusted EBITDA, adjusted net income attributable to owners of the Company, adjusted net income per share, net (cash) debt, working capital and available liquidity. These performance measures have no standardized meaning prescribed within generally accepted accounting principles under IFRS and, therefore, amounts presented may not be comparable to similar measures presented by other mining companies. These non-IFRS measures are intended to provide supplemental information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. The tables below provide reconciliations of these non-IFRS measures to the most directly comparable IFRS measures as contained in the Company’s financial statements.

Unless otherwise noted, the non-IFRS measures presented below have been calculated on a consistent basis for the periods presented.

C1 Cash Cost of Copper Produced (per lb)

C1 cash cost of copper produced (per lb) is a non-IFRS performance measure used by the Company to manage and evaluate the operating performance of its copper mining segment and is calculated as C1 cash costs divided by total pounds of copper produced during the period. C1 cash costs includes total cost of production, transportation, treatment and refining charges, and certain tax credits relating to sales invoiced to the Company's Brazilian customer on sales, net of by-product credits and incentive payments. C1 cash cost of copper produced per pound is widely reported in the mining industry as benchmarks for performance but does not have a standardized meaning and is disclosed in supplement to IFRS measures.

The following table provides a reconciliation of C1 cash cost of copper produced per pound to cost of production, its most directly comparable IFRS measure.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation: | | 2023 - Q2 | | 2023 - Q1 | | 2022 - Q2 | | 2023 - YTD | | 2022 - YTD |

Cost of production | | $ | 37,767 | | | $ | 36,285 | | | $ | 38,015 | | | $ | 74,052 | | | $ | 67,178 | |

Add (less): | | | | | | | | | | |

| Transportation costs & other | | 1,733 | | | 1,339 | | | 2,579 | | | 3,072 | | | 4,448 | |

| Treatment, refining, and other | | 4,248 | | | 2,527 | | | 3,893 | | | 6,775 | | | 5,939 | |

| By-product credits | | (3,704) | | | (2,810) | | | (6,438) | | | (6,514) | | | (11,250) | |

| Incentive payments | | (1,129) | | | (1,237) | | | (1,016) | | | (2,366) | | | (1,920) | |

Net change in inventory | | 1,323 | | | (1,185) | | | (1,907) | | | 138 | | | (1,330) | |

Foreign exchange translation and other | | (13) | | | 15 | | | (178) | | | 2 | | | 208 | |

| C1 cash costs | | $ | 40,225 | | | $ | 34,934 | | | $ | 34,948 | | | $ | 75,159 | | | $ | 63,273 | |

Ero Copper Corp. June 30, 2023 MD&A | Page 21

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2023 - Q2 | | 2023 - Q1 | | 2022 - Q2 | | 2023 - YTD | | 2022 - YTD |

| Costs | | | | | | | | | | |

Mining | | $ | 25,794 | | | $ | 23,210 | | | $ | 23,933 | | | $ | 49,004 | | | $ | 44,059 | |

| Processing | | 7,643 | | | 6,554 | | | 7,988 | | | 14,197 | | | 14,435 | |

| Indirect | | 6,244 | | | 5,453 | | | 5,572 | | | 11,697 | | | 10,090 | |

| Production costs | | 39,681 | | | 35,217 | | | 37,493 | | | 74,898 | | | 68,584 | |

| By-product credits | | (3,704) | | | (2,810) | | | (6,438) | | | (6,514) | | | (11,250) | |

| Treatment, refining and other | | 4,248 | | | 2,527 | | | 3,893 | | | 6,775 | | | 5,939 | |

| C1 cash costs | | $ | 40,225 | | | $ | 34,934 | | | $ | 34,948 | | | $ | 75,159 | | | $ | 63,273 | |

| | | | | | | | | | |

| Costs per pound | | | | | | | | | | |

| Payable copper produced (lb, 000) | | 26,464 | | | 20,564 | | | 28,073 | | | 47,027 | | | 49,643 | |

| | | | | | | | | | |

| Mining | | $ | 0.97 | | | $ | 1.13 | | | $ | 0.85 | | | $ | 1.04 | | | $ | 0.89 | |

| Processing | | $ | 0.29 | | | $ | 0.32 | | | $ | 0.28 | | | $ | 0.30 | | | $ | 0.29 | |

| Indirect | | $ | 0.24 | | | $ | 0.27 | | | $ | 0.20 | | | $ | 0.25 | | | $ | 0.20 | |

| By-product credits | | $ | (0.14) | | | $ | (0.14) | | | $ | (0.23) | | | $ | (0.14) | | | $ | (0.23) | |

| Treatment, refining and other | | $ | 0.16 | | | $ | 0.12 | | | $ | 0.14 | | | $ | 0.15 | | | $ | 0.12 | |

| C1 cash costs of copper produced (per lb) | | $ | 1.52 | | | $ | 1.70 | | | $ | 1.24 | | | $ | 1.60 | | | $ | 1.27 | |

Realized Copper Price (per lb)

Realized Copper Price (per lb) is a non-IFRS ratio that is calculated as gross copper revenue divided by pounds of copper sold during the period. Management believes measuring Realized Copper Price (per lb) enables investors to better understand performance based on the realized copper sales in each reporting period. The following table provides a calculation of Realized Copper Price (per lb) and a reconciliation to copper segment .

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation: | | 2023 - Q2 | | 2023 - Q1 | | 2022 - Q2 | | 2023 - YTD | | 2022 - YTD |

| Copper revenue ($000s) | | $ | 83,929 | | | $ | 77,301 | | | $ | 95,654 | | | $ | 161,230 | | | $ | 189,350 | |

| less: by-product credits | | (3,704) | | | (2,810) | | | (6,438) | | | (6,514) | | | (11,250) | |

| Net copper revenue | | 80,225 | | | 74,491 | | | 89,216 | | | 154,716 | | | 178,100 | |

| add: treatment, refining and other | | 4,248 | | | 2,527 | | | 3,893 | | | 6,775 | | | 5,939 | |

| Gross copper revenue | | 84,473 | | | 77,018 | | | 93,109 | | | 161,491 | | | 184,039 | |

| Cu Sold in concentrate (lbs) | | 25,600 | | | 20,865 | | | 28,546 | | | 46,465 | | | 50,691 | |

| Realized copper price (per lb) | | $ | 3.30 | | | $ | 3.69 | | | $ | 3.26 | | | $ | 3.48 | | | $ | 3.63 | |

Ero Copper Corp. June 30, 2023 MD&A | Page 22

C1 Cash Cost of Gold produced (per ounce) and AISC of Gold produced (per ounce)

C1 cash cost of gold produced (per ounce) is a non-IFRS performance measure used by the Company to manage and evaluate the operating performance of its gold mining segment and is calculated as C1 cash costs divided by total ounces of gold produced during the period. C1 cash cost includes total cost of production, net of by-product credits and incentive payments. C1 cash cost of gold produced per ounce is widely reported in the mining industry as benchmarks for performance but does not have a standardized meaning and is disclosed in supplemental to IFRS measures.

AISC of gold produced (per ounce) is an extension of C1 cash cost of gold produced (per ounce) discussed above and is also a key performance measure used by management to evaluate operating performance of its gold mining segment. AISC of gold produced (per ounce) is calculated as AISC divided by total ounces of gold produced during the period. AISC includes C1 cash costs, site general and administrative costs, accretion of mine closure and rehabilitation provision, sustaining capital expenditures, sustaining leases, and royalties and production taxes. AISC of gold produced (per ounce) is widely reported in the mining industry as benchmarks for performance but does not have a standardized meaning and is disclosed in supplement to IFRS measures.

The following table provides a reconciliation of C1 cash cost of gold produced per ounce and AISC of gold produced per ounce to cost of production, its most directly comparable IFRS measure.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Reconciliation: | | 2023 - Q2 | | 2023 - Q1 | | 2022 - Q2 | | 2023 - YTD | | 2022 - YTD |

Cost of production | | $ | 5,657 | | | $ | 6,107 | | | $ | 7,225 | | | $ | 11,764 | | | $ | 12,617 | |

Add (less): | | | | | | | | | | |

| Incentive payments | | (311) | | | (407) | | | (188) | | | (718) | | | (773) | |

| Net change in inventory | | 936 | | | (352) | | | (73) | | | 584 | | | 654 | |

| By-product credits | | (163) | | | (176) | | | (145) | | | (339) | | | (269) | |

Smelting and refining | | 63 | | | 76 | | | 62 | | | 139 | | | 104 | |

Foreign exchange translation and other | | (119) | | | 176 | | | 265 | | | 57 | | | 429 | |

| C1 cash costs | | $ | 6,063 | | | $ | 5,424 | | | $ | 7,146 | | | $ | 11,487 | | | $ | 12,762 | |

| Site general and administrative | | 1,338 | | | 1,232 | | | 882 | | | 2,570 | | | 1,441 | |

| Accretion of mine closure and rehabilitation provision | | 111 | | | 105 | | | 112 | | | 216 | | | 224 | |

| Sustaining capital expenditure | | 3,530 | | | 3,013 | | | 3,690 | | | 6,543 | | | 5,986 | |

| Sustaining lease payments | | 1,740 | | | 1,660 | | | 894 | | | 3,400 | | | 1,716 | |

| Royalties and production taxes | | 556 | | | 338 | | | 277 | | | 894 | | | 481 | |

| AISC | | $ | 13,338 | | | $ | 11,772 | | | $ | 13,001 | | | $ | 25,110 | | | $ | 22,610 | |

| | | | | | | | | | |

Ero Copper Corp. June 30, 2023 MD&A | Page 23

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2023 - Q2 | | 2023 - Q1 | | 2022 - Q2 | | 2023 - YTD | | 2022 - YTD |

| Costs | | | | | | | | | | |

Mining | | $ | 3,017 | | | $ | 2,567 | | | $ | 3,929 | | | $ | 5,584 | | | $ | 7,147 | |

| Processing | | 2,048 | | | 1,905 | | | 2,285 | | | 3,953 | | | 3,983 | |

| Indirect | | 1,098 | | | 1,052 | | | 1,015 | | | 2,150 | | | 1,797 | |

| Production costs | | 6,163 | | | 5,524 | | | 7,229 | | | 11,687 | | | 12,927 | |

Smelting and refining costs | | 63 | | | 76 | | | 62 | | | 139 | | | 104 | |

| By-product credits | | (163) | | | (176) | | | (145) | | | (339) | | | (269) | |

| C1 cash costs | | $ | 6,063 | | | $ | 5,424 | | | $ | 7,146 | | | $ | 11,487 | | | $ | 12,762 | |

| Site general and administrative | | 1,338 | | | 1,232 | | | 882 | | | 2,570 | | | 1,441 | |

| Accretion of mine closure and rehabilitation provision | | 111 | | | 105 | | | 112 | | | 216 | | | 224 | |

| Sustaining capital expenditure | | 3,530 | | | 3,013 | | | 3,690 | | | 6,543 | | | 5,986 | |

| Sustaining leases | | 1,740 | | | 1,660 | | | 894 | | | 3,400 | | | 1,716 | |

| Royalties and production taxes | | 556 | | | 338 | | | 277 | | | 894 | | | 481 | |

| AISC | | $ | 13,338 | | | $ | 11,772 | | | $ | 13,001 | | | $ | 25,110 | | | $ | 22,610 | |

| | | | | | | | | | |

| Costs per ounce | | | | | | | | | | |

| Payable gold produced (ounces) | | 12,333 | | | 12,443 | | | 11,122 | | | 24,776 | | | 19,918 | |

| | | | | | | | | | |

| Mining | | $ | 245 | | | $ | 206 | | | $ | 353 | | | $ | 225 | | | $ | 359 | |

| Processing | | $ | 166 | | | $ | 153 | | | $ | 205 | | | $ | 160 | | | $ | 200 | |

| Indirect | | $ | 89 | | | $ | 85 | | | $ | 91 | | | $ | 87 | | | $ | 90 | |

| Smelting and refining | | $ | 5 | | | $ | 6 | | | $ | 6 | | | $ | 6 | | | $ | 5 | |

| By-product credits | | $ | (13) | | | $ | (14) | | | $ | (12) | | | $ | (14) | | | $ | (13) | |

| C1 cash costs of gold produced (per ounce) | | $ | 492 | | | $ | 436 | | | $ | 643 | | | $ | 464 | | | $ | 641 | |