UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2016

EMPRESA DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A. (EDENOR)

(DISTRIBUTION AND MARKETING COMPANY OF THE NORTH )

(Translation of Registrant's Name Into English)

Argentina

(Jurisdiction of incorporation or organization)

Av. del Libertador 6363,

12th Floor,

City of Buenos Aires (A1428ARG),

Tel: 54-11-4346-5000

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F X Form 40-F

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes No X

(If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .)

|

|

Fourth Quarter 2015

Page 1

|

|

|

Edenor announces fourth quarter 2015 results

|

|

Stock Information:

Ticker: EDN

New York Stock Exchange

Ratio: 20 Class B = 1 ADR

Buenos Aires Stock Exchange |

Investor Relations Contacts:

Leandro Montero

Chief Financial Officer

Verónica Gysin

Planning and Capital Markets Manager |

| |

Tel: +54 (11) 4346 -5231 |

Buenos Aires, Argentina, March 11, 2016. Empresa Distribuidora y Comercializadora Norte S.A. (NYSE: EDN; Buenos Aires Stock Exchange: EDN) (“EDENOR” or “the Company”), Argentina’s largest electricity distributor, today announced its results for the fourth quarter of 2015. All figures are stated in Argentine Pesos and have been prepared in accordance with International Financing Reporting Standards (“IFRS”). Solely for the convenience of the reader, Peso amounts as of and for the quarter ended on December 31, 2015 have been translated into U.S. Dollars at the selling price quoted by Banco de la Nación Argentina of AR$ 13.04 per U.S. Dollar.

HIGHLIGHTS

Resolution N°6/16 of the Ministry of Energy and Mining-Reference Seasonal Tariffs

On January 25, 2016, the Ministry of Energy and Mining issued Resolution N°6, approving the seasonal WEM prices for the period from February 2016 through April 2016. This Resolution tries to recompose the seasonal prices set forth in the Regulatory framework. Energy prices in the spot market were set by CAMMESA, which determined the price charged by generators for energy sold in the spot market of the wholesale electricity market on an hourly basis. Resolution 6, introduced different prices depending on the customers’ categories. Said resolution contemplates a social tariff for residential customers who comply with certain requirements, which establishes a tariff of AR$0 for monthly consumptions below or equal to 150 Kwh and preferential tariffs for customers who, having exceeded the established limit consumption, have achieved a monthly consumption lower than that of the same period in the immediately preceding year (saving). Resolution also establishes tariff benefits due to consumption savings addressed to residential customers.

Resolution N°7/16 of the Ministry of Energy and Mining

By means of Resolution number 7/2016 of the Ministry of Energy and Mining, the ENRE was requested to perform on account of the RTI (Integral Tariff Revision) a VAD adjustment to the tariff schedules of Edenor and Edesur and carry out all necessary steps to achieve the corresponding tariff update prior to December 31, 2016.

Likewise the mentioned resolution resolved to: (i) render the PUREE (Program of Rational use of Electric Energy) ineffective; (ii) revoke Resolution SE 32/2015 as from the date the ENRE resolution implementing the new tariff schedule is in force; (iii) discontinue the application of mechanisms that imply the transfer of funds in the form of Loan Agreements with CAMMESA, which had been entered into between the Company and CAMMESA; (iv) implement the required actions in order to terminate the Trusts created pursuant to the ENRE 347/2012 Resolution.

In compliance with Resolution 7/2016 mentioned above, the ENRE subscribed Resolution N°1/2016 establishing the new tariff structure.

Loans agreements with CAMMESA for Extraordinary Investment Plan

In September 2014, the Energy Secretariat instructed CAMMESA to enter into a Loan and Guarantee Assignment Agreement with the Company in order to provide the necessary financing to cover the Extraordinary Investment Plan as a consequence of the temporary insufficiency of funds received through Resolution 347/12. During 2015, with different Amendments, the Loan Agreement reached AR$ 2,913 million for the whole plan.

|

|

Fourth Quarter 2015

Page 2

|

As of December 31, 2015, the total debt under this loans agreements amounts to AR$ 1,099.8 million, comprised of AR$ 923.6 million principal for the effective disbursements, and AR$ 176.2 million in accrued interest.

As explained before, these loans were discontinued as from February 1, 2016 under the terms of Resolution N°7 of the Ministry of Energy and Mining

CMM (Costs Monitoring Mechanism)

During November 2015 the SE issued Notes 2097 and 2157 which rules the application of percentages of CMM of 6.20% and 9.05% as from May 1st 2015 and November 1st 2015, respectively. At December 31st the company recognized a total of $ 364.9 million due to the mentioned concept.

Fourth Quarter 2015 Operating Figures

|

|

|

|

| In millon of Pesos |

4° Q 2015 |

4° Q 2014 |

% Variation |

| Revenue from sales |

891.0 |

850.2 |

4.8% |

| Electricity power puchase |

(474.1) |

(464.8) |

2.0% |

| Net operating income (loss) |

558.5 |

638.7 |

(12.6%) |

| Net income (loss) |

203.6 |

664.0 |

N/A |

Revenue from sales increased 4.8% to AR$ 891.0 million in the fourth quarter of 2015 compared to AR$ 850.2 million in the fourth quarter of 2014, mainly due to an increase in volume of energy sold in GWh for about 3.7%, a 7.2% growth in revenues related to the application of Resolution 347/12, and higher income from the right of use on poles.

Volume of energy sold increased 3.7% to 5,422 GWh in the fourth quarter of 2015 from 5,227 GWh in the fourth quarter of 2014, basically due to an increase of 7.4% in residential customers, a 4.8% increase in small commercial customers, and a 3.1% growth in industrial and medium commercial customers.

Electricity power purchases increased 2.0% to AR$ 474.1 million in the fourth quarter of 2015 compared to AR$ 464.8 million in the same period of 2014, mainly due to the increase in energy sales described above, partially offset by a reduction in mobile generation.

Net operating income decreased AR$ 80.2 million amounting a gain of AR$ 558.5 million in the fourth quarter of 2015 compared to a gain of AR$ 638.7 million in the same period of 2014. This negative result was due to a 10.3% increase in operating expenses, mainly due to the raise in salaries which represent approximately 76% of the total growth, partially offset by the income obtained through SE Resolution 32/15 and to a CMM (Cost Monitoring Mechanism) adjustment obtained in November 2015, retroactive as from May 2015.

The operating expenses increase is basically explained by higher administrative expenses of AR$ 58.1 million, by an increase of AR$ 40.2 million in transmission and distribution expenses and by greater selling expenses of AR$ 34.9 million.

Net income shows a decrease of AR$ 460.4 million, amounting a gain of AR$ 203.6 million in the fourth quarter of 2015, compared to a gain of AR$ 664.0 million in the same period of 2014, mainly due to the operating results explained above and to a decrease in financial results due to the devaluation of the AR$/US$, partially offset by the sales increase and a reversal of the income tax provision.

|

|

Fourth Quarter 2015

Page 3

|

Adjusted EBITDA

Adjusted EBITDA has increased to a gain of AR$ 647.3 million in the fourth quarter ended December 31, 2015, compared to a loss of AR$ 690.2 million in the same period of 2014.

|

|

|

| In millon of Pesos |

4° Q 2015 |

4° Q 2014 |

| Net operating loss before resolution 32/15 |

(1,021.8) |

(897.6) |

| Depreciation of property, plant and equipment |

77.3 |

64.1 |

| EBITDA |

(944.5) |

(833.5) |

| Resolution 32/15 recognition (1) |

1,580.3 |

- |

| PUREE |

- |

130.7 |

| Commercial Interests |

11.5 |

10.8 |

| Adjusted EBITDA |

647.3 |

(692.0) |

| (1) Includes a dditional income under this resolution, PUREE funds and MMC over SE Resolution 32/15 |

Operating Expenses

The following table sets forth the main transmission and distribution, selling and administrative expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Transmission and distribution

expenses |

Selling expenses |

Administrative expenses |

Total expenses |

| |

| In millon of Pesos and % |

4° Quarter |

%

Variation |

4° Quarter |

%

Variation |

4° Quarter |

%

Variation |

4° Quarter |

%

Variation |

| |

| |

2015 |

2014 |

2015 |

2014 |

|

2015 |

2014 |

2015 |

2014 |

| Salaries, social security taxes |

506.7 |

417.6 |

20% |

79.2 |

75.5 |

5% |

88.9 |

79.7 |

12% |

674.7 |

572.9 |

18% |

| Pensions Plans |

17.8 |

17.9 |

0% |

4.6 |

3.2 |

41% |

3.1 |

3.3 |

-5% |

25.5 |

24.4 |

5% |

| Communications expenses |

4.4 |

4.6 |

0% |

14.6 |

9.4 |

55% |

1.1 |

0.8 |

38% |

20.1 |

14.9 |

35% |

| Allowance for the impairment of trade and other |

|

|

|

|

|

|

|

|

|

|

|

|

| receivables |

0.0 |

0.0 |

0% |

1.2 |

8.4 |

-85% |

0.0 |

0.0 |

0% |

1.2 |

8.4 |

-85% |

| Supplies consumption |

50.7 |

46.8 |

10% |

0.0 |

0.0 |

0% |

9.8 |

5.0 |

95% |

60.5 |

51.8 |

17% |

| Leases and insurance |

0.1 |

1.1 |

-90% |

0.0 |

0.0 |

0% |

14.3 |

10.3 |

39% |

14.4 |

11.4 |

26% |

| Security service |

12.4 |

9.1 |

40% |

0.2 |

0.0 |

2067% |

7.9 |

4.6 |

71% |

20.4 |

13.7 |

50% |

| Fees and remuneration for services |

96.2 |

175.2 |

-50% |

91.8 |

75.0 |

23% |

90.5 |

55.7 |

63% |

278.5 |

305.9 |

-9% |

| Public relations and marketing |

0.0 |

0.0 |

0% |

0.0 |

0.0 |

0% |

3.5 |

1.6 |

120% |

3.5 |

1.6 |

120% |

| Advertising and sponsorship |

0.0 |

0.0 |

0% |

0.0 |

0.0 |

0% |

1.8 |

0.8 |

120% |

1.8 |

0.8 |

120% |

| Reimbursements to personnel |

0.3 |

0.3 |

-20% |

0.1 |

0.1 |

-9% |

0.2 |

0.3 |

-48% |

0.5 |

0.7 |

-33% |

| Depreciation of property, plant and |

64.2 |

54.7 |

20% |

11.5 |

6.2 |

87% |

1.6 |

3.2 |

-51% |

77.3 |

64.1 |

21% |

| equipment |

|

|

|

|

|

|

|

|

|

|

|

|

| Directors and Supervisory Committee members’ fees |

0.0 |

0.0 |

0% |

0.0 |

0.0 |

0% |

1.0 |

0.8 |

26% |

1.0 |

0.8 |

26% |

| ENRE penalties |

69.1 |

54.8 |

30% |

15.3 |

7.0 |

117% |

0.0 |

0.0 |

0% |

84.4 |

61.8 |

37% |

| Taxes and charges |

0.0 |

0.0 |

0% |

13.2 |

12.0 |

10% |

2.2 |

2.0 |

12% |

15.4 |

14.0 |

10% |

| Other |

0.6 |

0.2 |

190% |

0.2 |

0.1 |

137% |

1.2 |

0.8 |

50% |

1.9 |

1.1 |

82% |

| Total |

822.5 |

782.4 |

5% |

231.8 |

196.9 |

18% |

227.0 |

168.9 |

34% |

1,281.3 |

1,148.2 |

12% |

|

|

Fourth Quarter 2015

Page 4

|

Sales

The following table shows our energy sales by customer´s category (in GWh) and its number of clients:

|

|

|

|

|

|

|

|

|

| In Gwh and % |

Energy sales |

Customers |

| |

4th Quarter 2015 |

4th Quarter 2014 |

% Variation |

At

12/31/2015 |

At

12/31/2014 |

% Variation |

| |

Gwh |

% |

Gwh |

% |

| Residential |

2,267 |

41.8% |

2,111 |

40.4% |

7.4% |

2,467,757 |

2,443,670 |

1.0% |

| Small commercial |

463 |

8.5% |

442 |

8.5% |

4.8% |

325,149 |

317,237 |

2.5% |

| Medium commercial |

459 |

8.5% |

445 |

8.5% |

3.0% |

34,477 |

32,526 |

6.0% |

| Industrial |

934 |

17.2% |

906 |

17.3% |

3.1% |

6,706 |

6,552 |

2.4% |

| Wheeling System |

1,051 |

19.4% |

1,080 |

20.7% |

(2.7%) |

708 |

710 |

(0.3%) |

| Others |

|

|

|

|

|

|

|

|

| Public lighting |

151 |

2.8% |

149 |

2.8% |

1.9% |

22 |

22 |

0.0% |

| Shantytowns and others |

97 |

1.8% |

94 |

1.8% |

3.1% |

410 |

404 |

1.5% |

| Total |

5,422 |

100% |

5,227 |

100% |

3.7% |

2,835,229 |

2,801,121 |

1.2% |

Capital Expenditures

Edenor’s capital expenditures during the fourth quarter of 2015 totaled AR$ 1,175.8 million, compared to AR$ 662.8 million in the fourth quarter of 2014. This increase was mainly due to the increase in costs and key facilities for ensuring the proper provision of the service.

Our capital expenditures in the fourth quarter of 2015 mainly consisted of the following:

· AR$ 23.4 million in new connections;

· AR$ 464.1 million in grid enhancements;

· AR$ 128.9 million in network maintenance and improvements;

· AR$ 0.6 million in legal requirements;

· AR$ 37.5 million in communications and telecontrol;

· AR$ 521.2 million of other investment projects.

For the twelve-month period ended December 31, 2015, our Capital Expenditures totalized to AR$ 2,518.2 million compared to AR$ 1,701.8 million in 2014, including capitalized costs and interests in property, plant and equipment.

|

|

Fourth Quarter 2015

Page 5

|

Energy Losses

In the fourth quarter of 2015 energy losses decreased to 14.5% compared to 13.7% in the same period of 2014.

Indebtedness

The outstanding principal amount of our dollar denominated financial debt is US$ 191.2 million, consisting of US$ 14.8 million principal amount of Senior Notes due on 2017 and US$ 176.4 million principal amount of Senior Notes due on 2022.

|

|

Fourth Quarter 2015

Page 6

|

About EDENOR

Empresa Distribuidora y Comercializadora Norte S.A. (Edenor) is the largest electricity distribution company in Argentina in terms of number of customers and electricity sold (both in GWh and Pesos). Through a concession, Edenor distributes electricity exclusively to the northwestern zone of the greater Buenos Aires metropolitan area and the northern part of the city of Buenos Aires, which has a population of approximately 7 million people and an area of 4,637 sq. km. In 2015, Edenor sold 22,380 GWh of energy and purchased 22,127 GWh, with net sales of approximately AR$ 3.8 billion and net income of AR$ 1,142.4 million.

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management’s current view and estimates of future economic circumstances, industry conditions, Company performance and financial results. The words “anticipates”, “believes”, “estimates”, “expects”, “plans” and similar expressions, as they relate to the Company are intended to identify forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties, including those identified in the documents filed by the Company with the U.S. Securities and Exchange Commission. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

Edenor S.A.

6363 Del Libertador Avenue, 4th Floor

(C1428ARG) Buenos Aires, Argentina

Fax: 5411.4346.5358

investor@edenor.com

www.edenor.com

Conference Call Information

|

There will be a conference call to discuss Edenor’s quarterly results on Friday, March 11, 2016, at 12:00 p.m. Buenos Aires time / 10:00 a.m. New York time. For those interested in participating, please dial + 1(877) 317 - 6776 in the United States or, if outside the United States, +1(412) 317-6776 or 0-800-444-2930 in Argentina. Participants should use conference ID Edenor and dial in five minutes before the call is set to begin. There will also be a live audio webcast of the conference at www.edenor.com in the Investor Relations section. |

For additional information on the Company please access: www.edenor.com; www.cnv.gob.ar

|

|

Fourth Quarter 2015

Page 7

|

Condensed Interim Statements of Financial Position as of December 31, 2015 and December 31, 2014

|

|

|

|

|

|

| In million of US Dollars and Argentine Pesos |

12.31.15 |

|

12.31.15 |

|

12.31.14 |

| |

US$ |

|

AR$ |

|

AR$ |

| |

| ASSETS |

|

|

|

|

|

| |

| Non-current assets |

|

|

|

|

|

| Property, plant and equipment |

681.4 |

|

8,885.8 |

|

6,652.5 |

| Interest in joint ventures |

0.0 |

|

0.4 |

|

0.4 |

| Deferred tax asset |

3.8 |

|

50.0 |

|

87.2 |

| Other receivables |

11.8 |

|

153.8 |

|

249.2 |

| Financial assets at fair value through profit |

|

|

|

|

|

| or loss |

1.8 |

|

23.6 |

|

- |

| Total non-current assets |

698.9 |

|

9,113.6 |

|

6,989.3 |

| |

| Current assets |

|

|

|

|

|

| Inventories |

10.3 |

|

134.9 |

|

74.0 |

| Other receivables |

82.8 |

|

1,079.9 |

|

250.3 |

| Trade receivables |

73.9 |

|

963.0 |

|

882.9 |

| Financial assets at fair value through profit |

|

|

|

|

|

| or loss |

119.7 |

|

1,560.4 |

|

254.4 |

| Derivative financial instruments |

0.0 |

|

0.2 |

|

- |

| Cash and cash equivalents |

9.9 |

|

129.0 |

|

179.1 |

| Total current assets |

296.6 |

|

3,867.3 |

|

1,640.8 |

| |

| |

| TOTAL ASSETS |

995.5 |

|

12,980.9 |

|

8,630.1 |

Financial tables have been converted into U.S. dollars at a rate of AR$ 13.04 per dollar, the selling rate as of December 31, 2015, solely for the convenience of the reader.

|

|

Fourth Quarter 2015

Page 8

|

Condensed Interim Statements of Financial Position as of December 31, 2015 and December 31, 2014

|

|

|

|

|

|

| In million of US Dollars and Argentine Pesos |

12.31.15 |

|

12.31.15 |

|

12.31.14 |

| |

US$ |

|

AR$ |

|

AR$ |

| EQUITY |

|

|

|

|

|

| |

| Share capital |

68.8 |

|

897.0 |

|

897.0 |

| Adjustment to share capital |

30.5 |

|

397.7 |

|

397.7 |

| Additional paid-in capital |

0.3 |

|

3.5 |

|

3.5 |

| Treasury stock |

0.7 |

|

9.4 |

|

9.4 |

| Adjustment to treasury stock |

0.8 |

|

10.3 |

|

10.3 |

| Other comprehensive loss |

(3.2) |

|

(42.3) |

|

(39.9) |

| Accumulated losses |

19.1 |

|

249.3 |

|

(893.1) |

| TOTAL EQUITY |

117.0 |

|

1,525.1 |

|

385.0 |

| |

| LIABILITIES |

|

|

|

|

|

| Non-current liabilities |

|

|

|

|

|

| |

| Trade payables |

17.3 |

|

225.0 |

|

231.1 |

| Other payables |

183.4 |

|

2,391.9 |

|

1,644.6 |

| Borrow ings |

188.7 |

|

2,461.0 |

|

1,598.4 |

| Deferred revenue |

11.8 |

|

153.8 |

|

109.1 |

| Salaries and social security payable |

6.1 |

|

80.0 |

|

62.9 |

| Benefit plans |

15.7 |

|

204.4 |

|

150.4 |

| Tax liabilities |

0.1 |

|

1.9 |

|

3.2 |

| Provisions |

19.9 |

|

259.6 |

|

112.1 |

| Total non-current liabilities |

443.1 |

|

5,777.6 |

|

3,911.7 |

| |

| Current liabilities |

|

|

|

|

|

| Trade payables |

343.2 |

|

4,475.4 |

|

3,299.9 |

| Other payables |

11.6 |

|

151.7 |

|

187.1 |

| Borrow ings |

3.7 |

|

48.8 |

|

34.0 |

| Derivative financial instruments |

- |

|

- |

|

5.9 |

| Deferred revenue |

0.1 |

|

0.8 |

|

0.8 |

| Salaries and social security payable |

56.2 |

|

733.1 |

|

610.6 |

| Benefit plans |

2.2 |

|

28.3 |

|

10.6 |

| Tax liabilities |

13.0 |

|

169.7 |

|

160.5 |

| Provisions |

5.4 |

|

70.5 |

|

24.1 |

| Total current liabilities |

435.5 |

|

5,678.3 |

|

4,333.4 |

| TOTAL LIABILITIES |

878.5 |

|

11,455.9 |

|

8,245.1 |

| |

|

|

- |

|

- |

| TOTAL LIABILITIES AND EQUITY |

995.5 |

|

12,980.9 |

|

8,630.1 |

Financial tables have been converted into U.S. dollars at a rate of AR$ 13.04 per dollar, the selling rate as of December 31, 2015, solely for the convenience of the reader.

|

|

Fourth Quarter 2015

Page 9

|

Condensed Interim Statements of Comprehensive Income (Loss) for the twelve-month

periods ended December 31, 2015 and 2014

|

|

|

|

|

|

| In millon of US Dollars and Argentine Pesos |

12.31.2015 |

|

12.31.2015 |

|

12.31.2014 |

| |

US$ |

|

AR$ |

|

AR$ |

| |

| Continuing operations |

|

|

|

|

|

| Revenue from sales |

291.6 |

|

3,802.2 |

|

3,598.4 |

| Electric power purchases |

(155.1) |

|

(2,022.0) |

|

(1,878.1) |

| Subtotal |

136.5 |

|

1,780.2 |

|

1,720.3 |

| Transmission and distribution expenses |

(241.8) |

|

(3,153.7) |

|

(2,825.1) |

| Gross loss |

(105.3) |

|

(1,373.5) |

|

(1,104.8) |

| Selling expenses |

(63.9) |

|

(832.8) |

|

(657.9) |

| Administrative expenses |

(54.1) |

|

(706.1) |

|

(496.8) |

| Other operating expense, net |

(32.4) |

|

(422.5) |

|

(265.5) |

| Operating loss before higher costs recognition and SE Resolution |

|

|

|

|

|

| 32/15 |

(255.7) |

|

(3,334.9) |

|

(2,524.9) |

| Income recognition on account of the RTI - SE Resolution 32/15 |

385.4 |

|

5,025.1 |

|

- |

| Higher costs recognition - SE Resolution 250/13 and subsequents Notes |

42.3 |

|

551.5 |

|

2,271.9 |

| Operating (loss) profit |

171.9 |

|

2,241.7 |

|

(253.0) |

| Financial income |

7.4 |

|

96.2 |

|

235.5 |

| Financial expenses |

(34.5) |

|

(450.0) |

|

(592.0) |

| Other financial expense |

(43.1) |

|

(561.7) |

|

(324.6) |

| Net financial expense (income) |

(70.2) |

|

(915.5) |

|

(681.1) |

| (Loss) Profit before taxes |

101.7 |

|

1,326.2 |

|

(934.1) |

| |

| Income tax |

(14.1) |

|

(183.7) |

|

154.4 |

| (Loss) Profit for the period from continuing operations |

87.6 |

|

1,142.4 |

|

(779.7) |

| |

| Basic and diluted (loss) earnings per share: |

|

|

|

|

|

| Basic and diluted (loss) earnings per share from continuing operations |

0.10 |

|

1.27 |

|

(0.87) |

| |

Financial tables have been converted into U.S. dollars at a rate of AR$ 13.04 per dollar, the selling rate as of December 31, 2015, solely for the convenience of the reader.

|

|

Fourth Quarter 2015

Page 10

|

Condensed Interim Statements of Cash Flows

for the twelve-month periods ended December 31, 2015 and 2014

| |

|

|

|

|

|

| In millon of US Dollars and Argentine Pesos |

31.12.2015 |

|

31.12.2015 |

|

31.12.2014 |

| |

US$ |

|

AR$ |

|

AR$ |

| |

| |

| Cash flows from operating activities |

|

|

|

|

|

| (Loss) Profit for the period |

87.6 |

|

1,142.4 |

|

(779.7) |

| Adjustments to reconcile net (loss) profit to net cash flows |

|

|

|

|

|

| provided by operating activities: |

|

|

|

|

|

| Depreciation of property, plant and equipment |

21.6 |

|

281.4 |

|

237.6 |

| Loss on disposals of property, plant and equipment |

0.3 |

|

3.5 |

|

1.0 |

| Net accrued interest |

25.6 |

|

333.7 |

|

341.0 |

| Exchange differences |

68.6 |

|

894.8 |

|

427.9 |

| Income tax |

14.1 |

|

183.7 |

|

(154.4) |

| Allowance for the impairment of trade and other receivables, net of |

1.8 |

|

24.1 |

|

19.7 |

| recovery |

|

|

|

|

|

| Adjustment to present value of receivables |

(0.4) |

|

(5.4) |

|

(8.1) |

| Provision for contingencies |

17.4 |

|

226.4 |

|

75.4 |

| Other expenses - FOCEDE |

4.6 |

|

59.6 |

|

97.7 |

| Changes in fair value of financial assets |

(24.8) |

|

(323.6) |

|

(67.6) |

| Accrual of benefit plans |

6.8 |

|

89.3 |

|

51.4 |

| Higher costs recognition - SE Resolution 250/13 and subsequents |

(42.3) |

|

(551.5) |

|

(2,271.9) |

| Notes |

|

|

|

|

|

| Higher costs recognition - SE Resolution 32/15 of the SE. |

(38.0) |

|

(495.5) |

|

- |

| Net gain from the repurchase of Corporate Notes |

- |

|

- |

|

(44.4) |

| |

| Income from non-reimbursable customer |

(0.1) |

|

(0.8) |

|

- |

| contributions |

|

|

|

|

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

| Increase in trade receivables |

(3.1) |

|

(40.6) |

|

(55.3) |

| Increase in other receivables |

(26.7) |

|

(348.0) |

|

(134.7) |

| Increase (Decrease) in inventories |

(4.7) |

|

(60.9) |

|

9.9 |

| Increase (Decrease) in deferred revenue |

3.5 |

|

45.5 |

|

76.2 |

| Decrease in trade payables |

50.7 |

|

660.8 |

|

(528.4) |

| Increase in salaries and social security taxes payable |

10.7 |

|

139.7 |

|

226.7 |

| Decrease in benefit plans |

(1.6) |

|

(21.2) |

|

(11.0) |

| (Decrease) Increase in tax liabilities |

(10.8) |

|

(141.0) |

|

(28.7) |

| |

| Increase in other payables |

(4.8) |

|

(62.1) |

|

162.3 |

| Funds obtained from the program for the rational use of electric |

2.0 |

|

25.6 |

|

482.9 |

| power (PUREE) (SE Resolution No. 1037/07) |

|

|

|

|

|

| Net decrease in provisions |

(2.5) |

|

(32.6) |

|

(33.0) |

| |

| Subtotal before variations of debts with Cammesa |

155.5 |

|

2,027.5 |

|

(1,907.5) |

| Increase in account payable and loans with Cammesa |

91.2 |

|

1,189.6 |

|

3,455.5 |

| |

| Net cash flows provided by operating activities |

246.7 |

|

3,217.0 |

|

1,548.0 |

| |

Financial tables have been converted into U.S. dollars at a rate of AR$ 13.04 per dollar, the selling rate as of December 31, 2015, solely for the convenience of the reader.

|

|

Fourth Quarter 2015

Page 11

|

Condensed Interim Statements of Cash Flows

for the twelve-month periods ended December 31, 2015 and 2014

(Continued)

|

|

|

|

|

|

| In million of US Dollars and Argentine Pesos |

31.12.2015 |

|

31.12.2015 |

|

31.12.2014 |

| |

US$ |

|

AR$ |

|

AR$ |

| |

| Cash flows from investing activities |

|

|

|

|

|

| |

| Acquisitions of property, plant and equipment |

(160.7) |

|

(2,095.5) |

|

(1,400.1) |

| |

| Net (payment for) collection of purchase / sale of financial assets at |

(77.6) |

|

(1,012.0) |

|

(64.6) |

| fair value |

|

|

|

|

|

| Collection of receivables from sale of subsidiaries - SIESA |

0.3 |

|

4.3 |

|

3.0 |

| Net cash flows used in investing activities |

(238.0) |

|

(3,103.3) |

|

(1,461.8) |

| |

| |

| Cash flows from financing activities |

|

|

|

|

|

| Payment of principal on loans |

- |

|

- |

|

(0.4) |

| Payment of interest on loans |

(13.3) |

|

(172.9) |

|

(155.3) |

| Net cash flows used in financing activities |

(13.3) |

|

(172.9) |

|

(155.7) |

| |

| Net (decrease) / increase in cash and cash equivalents |

(4.5) |

|

(59.2) |

|

(69.5) |

| |

| |

| Cash and cash equivalents at the beginning of year |

13.7 |

|

179.1 |

|

243.5 |

| Exchange differences in cash and cash equivalents |

0.7 |

|

9.1 |

|

5.1 |

| Net (decrease) / increase in cash and cash equivalents |

(4.5) |

|

(59.2) |

|

(69.5) |

| Cash and cash equivalents at the end of period |

9.9 |

|

129.0 |

|

179.1 |

| |

Financial tables have been converted into U.S. dollars at a rate of AR$ 13.04 per dollar, the selling rate as of December 31, 2015, solely for the convenience of the reader.

|

|

Fourth Quarter 2015

Page 12

|

Condensed Interim Statements of Cash Flows

for the twelve-month periods ended December 31, 2015 and 2014

(Continued)

|

|

|

|

|

|

| In millon of US Dollars and Argentine Pesos |

31.12.2015 |

|

31.12.2015 |

|

31.12.2014 |

| |

US$ |

|

AR$ |

|

AR$ |

| |

| Supplemental cash flows information |

|

|

|

|

|

| |

| Non-cash operating, investing and financing activities |

|

|

|

|

|

| |

| Financial costs capitalized in property, plant and equipment |

(19.6) |

|

(255.9) |

|

(123.9) |

| |

| Acquisitions of property, plant and equipment through increased |

(12.8) |

|

(166.8) |

|

(144.8) |

| trade payables |

|

|

|

|

|

| Decrease from offsetting of PUREE-related liability against |

|

|

|

|

|

| receivables (SE Resolution 250/13, subsequent Notes and SE |

0.8 |

|

10.6 |

|

(574.0) |

| Resolution 32/15) |

|

|

|

|

|

| Decrease from offsetting of liability with CAMMESA for electricity |

|

|

|

|

|

| purchases against receivables (SE Resolution 250/13, subsequent |

12.1 |

|

158.1 |

|

(2,218.4) |

| Notes and SE Resolution 32/15) |

|

|

|

|

|

| Decrease from offset of other liabilities with CAMMESA for loans for |

|

|

|

|

|

| consumption (Mutuums) granted for higher salary costs (SE |

(38.0) |

|

(495.5) |

|

- |

| Resolution 32/15) |

|

|

|

|

|

| Decrease in financial assets at fair value from repurchase of |

- |

|

- |

|

91.6 |

| Corporate Bonds |

|

|

|

|

|

| Acquisitions of property, plant and equipment through increased |

- |

|

- |

|

(33) |

| FOTAE debt |

|

|

|

|

|

| |

Financial tables have been converted into U.S. dollars at a rate of AR$ 13.04 per dollar, the selling rate as of December 31, 2015, solely for the convenience of the reader.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Empresa Distribuidora y Comercializadora Norte S.A. |

| |

|

|

| |

|

|

| |

By: |

/s/ Leandro Montero |

| |

Leandro Montero |

| |

Chief Financial Officer |

Date: March 11, 2016

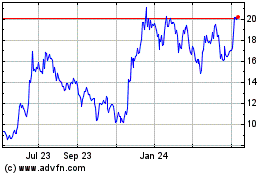

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Jun 2024 to Jul 2024

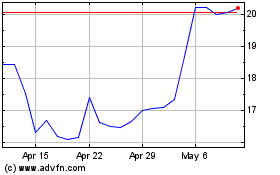

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Jul 2023 to Jul 2024