Dynatrace Launches Proposed Public Offering by Selling Stockholders

February 07 2023 - 4:27PM

Business Wire

Software intelligence company, Dynatrace, Inc. (NYSE: DT),

announced today the commencement of an underwritten public offering

of 15,000,000 shares of common stock by certain selling

stockholders of Dynatrace. Such selling stockholders will also

grant the underwriter a 30-day option to purchase up to an

additional 2,250,000 shares of Dynatrace’s common stock. Dynatrace

will not receive any of the proceeds from the sale of the shares

being offered by the selling stockholders but will bear the costs

associated with the registration of such shares, other than

underwriting discounts and commissions and other similar

expenses.

BofA Securities is acting as the sole underwriter for the

offering.

BofA Securities may offer the shares of common stock from time

to time in one or more transactions on the New York Stock Exchange,

in the over-the-counter market, through negotiated transactions or

otherwise at market prices prevailing at the time of sale, at

prices related to prevailing market prices or at negotiated prices.

The offering is subject to market and other conditions, and there

can be no assurance as to whether or when the offering may be

completed or as to the actual size or terms of the offering.

A registration statement on Form S-3 relating to these

securities has been filed with the Securities and Exchange

Commission (the “SEC”) and became effective when filed on August 3,

2020. The proposed offering will be made only by means of a

prospectus and prospectus supplement. A copy of the preliminary

prospectus supplement relating to this offering may be obtained,

when available, by visiting the SEC’s website at www.sec.gov or by

contacting the offices of BofA Securities, NC1-004-03-43, 200 North

College Street, 3rd floor, Charlotte NC 28255-0001, Attn:

Prospectus Department, Email: dg.prospectus_requests@bofa.com. The

final terms of the offering will be disclosed in a final prospectus

supplement to be filed with the SEC.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy these securities, nor shall there

be any offer or sale of these securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such state or jurisdiction.

About Dynatrace

Dynatrace exists to make the world’s software work perfectly.

Our unified software intelligence platform combines broad and deep

observability and continuous runtime application security with the

most advanced AIOps to provide answers and intelligent automation

from data at an enormous scale. This enables innovators to

modernize and automate cloud operations, deliver software faster

and more securely, and ensure flawless digital experiences. That is

why the world’s largest organizations trust Dynatrace® to

accelerate digital transformation.

Forward Looking Statements

This press release contains forward looking statements,

including among other things, statements concerning the completion

of the public offering, and other statements identified by words

such as “could,” “expects,” “intends,” “may,” “plans,” “potential,”

“should,” “will,” “would,” or similar expressions and the negatives

of those terms. Forward-looking statements are not promises or

guarantees of future performance, and are subject to a variety of

risks and uncertainties, many of which are beyond Dynatrace’s

control. Actual results may differ materially from those described

in the forward-looking statements and will be affected by a variety

of risks and factors that are beyond our control including, without

limitation, market risks and uncertainties and the satisfaction of

customary closing conditions for an offering of securities, and

other risks set forth under the heading “Risk Factors” in

Dynatrace’s Annual Report on Form 10-K and its Quarterly Reports on

Form 10-Q, the preliminary prospectus related to the public

offering and in subsequent filings made by Dynatrace with the SEC.

Forward-looking statements speak only as of the date hereof, and,

except as required by law, Dynatrace undertakes no obligation to

update or revise these forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230205005067/en/

Investor Contact: Noelle Faris VP, Investor Relations

Noelle.Faris@dynatrace.com

Media Relations: Jerome Stewart VP, Communications

Jerome.Stewart@dynatrace.com

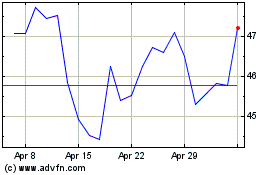

Dynatrace (NYSE:DT)

Historical Stock Chart

From Aug 2024 to Sep 2024

Dynatrace (NYSE:DT)

Historical Stock Chart

From Sep 2023 to Sep 2024