Form N-CEN - Annual Report for Registered Investment Companies

February 08 2024 - 4:15PM

Edgar (US Regulatory)

Report of Independent Registered Public Accounting

Firm

To

the Board of Trustees and shareholders of DWS Municipal Income Trust:

In planning

and performing our audit of the financial statements of DWS Municipal Income

Trust (the “Fund”) as of and for the year ended November 30, 2023 in accordance

with the standards of the Public Company Accounting Oversight Board (United

States) (PCAOB), we considered the Fund’s internal control over financial

reporting, including controls over safeguarding securities, as a basis for

designing our auditing procedures for the purpose of expressing our opinion on

the financial statements and to comply with the requirements of Form N-CEN, but

not for the purpose of expressing an opinion on the effectiveness of the Fund’s

internal control over financial reporting. Accordingly, we express no such

opinion.

The

management of the Fund is responsible for establishing and maintaining

effective internal control over financial reporting. In fulfilling this

responsibility, estimates and judgments by management are required to assess

the expected benefits and related costs of controls. A company’s internal

control over financial reporting is a process designed to provide reasonable

assurance regarding the reliability of financial reporting and the preparation

of financial statements for external purposes in accordance with U.S. generally

accepted accounting principles. A company’s internal control over financial

reporting includes those policies and procedures that (1) pertain to the

maintenance of records that, in reasonable detail, accurately and fairly

reflect the transactions and dispositions of the assets of the company; (2)

provide reasonable assurance that transactions are recorded as necessary to

permit preparation of financial statements in accordance with U.S. generally

accepted accounting principles, and that receipts and expenditures of the

company are being made only in accordance with authorizations of management and

directors of the company; and (3) provide reasonable assurance regarding

prevention or timely detection of unauthorized acquisition, use or disposition

of a company’s assets that could have a material effect on the financial

statements.

Because of

its inherent limitations, internal control over financial reporting may not

prevent or detect misstatements. Also, projections of any evaluation of

effectiveness to future periods are subject to the risk that controls may

become inadequate because of changes in conditions, or that the degree of

compliance with the policies or procedures may deteriorate.

A deficiency

in internal control over financial reporting exists when the design or

operation of a control does not allow management or employees, in the normal

course of performing their assigned functions, to prevent or detect

misstatements on a timely basis. A material weakness is a deficiency, or a

combination of deficiencies, in internal control over financial reporting, such

that there is a reasonable possibility that a material misstatement of the Fund’s

annual or interim financial statements will not be prevented or detected on a

timely basis.

Our

consideration of the Fund’s internal control over financial reporting was for

the limited purpose described in the first paragraph and would not necessarily

disclose all deficiencies in internal control that might be material weaknesses

under standards established by the PCAOB. However, we noted no deficiencies in

the Fund’s internal control over financial reporting and its operation,

including controls over safeguarding securities, that we consider to be a

material weakness as defined above as of November 30, 2023.

This report is intended solely for the information and

use of management and the Board of Trustees of DWS Municipal Income Trust and

the Securities and Exchange Commission and is not intended to be and should not

be used by anyone other than these specified parties.

/s/ ERNST & YOUNG, LLP

Boston, Massachusetts

January 23, 2024

Item G.1.b.i DWS Municipal

Income Trust

dws Municipal Income Trust

FIRST AMENDMENT TO APPENDIX A OF the

STATEMENT Establishing and Fixing the Rights and Preferences of VARIABLE

Rate MuniFUND Term Preferred Shares

WHEREAS, DWS Municipal Income Trust (the “Trust”)

established a Series of Variable Rate MuniFund Term Preferred Shares designated

as the “Variable Rate MuniFund Term Preferred Shares, Series 2020-1” (the “Series

2020-1 VMTP Shares”) pursuant to the Statement Establishing and Fixing the

Rights and Preferences of Variable Rate MuniFund Term Preferred Shares dated

November 6, 2020 and effective November 10, 2020 (the “VMTP

Statement”) and Appendix A thereto dated November 6, 2020 and

effective November 10, 2020 (the “Appendix”);

WHEREAS, the Appendix provides that the first Early Term

Redemption Date for the Series 2020‑1 VMTP Shares occurs forty-two (42)

months from the Date of Original Issue, or May 10, 2024, and the related Rate

Period Termination Date and Liquidity Account Initial Date occurs six (6)

months prior to such Early Term Redemption Date, or November 10, 2023; and

WHEREAS, the Board of Trustees of the Trust has approved,

and the sole Holder of the Series 2020-1 VMTP Shares has consented to, the

amendment of the Appendix to extend the Early Term Redemption Date for the

Series 2020-1 VMTP Shares and to effect certain other amendments to the VMTP Statement

and Appendix as set forth herein.

Capitalized terms used but not defined herein have the

respective meanings therefor set forth in the VMTP Statement.

Section 1. Amendments.

1. Section 5 of the Appendix is hereby

amended by deleting the second paragraph in such section in its entirety and

replacing it as set forth below:

An “Early Term Redemption Date”

means (i) every forty-two (42) month anniversary of the Date of Original

Issue except for the Term Redemption Date (for the avoidance of doubt, such

date to occur once every forty-two (42) months) and (ii) the Mandatory Tender

Date as described in Section 2.5(a)(iii); provided that (y) notwithstanding

the foregoing, the first Early Term Redemption Date following the Date of

Original Issue shall be May 10, 2027, and (z) an Early Term

Redemption Date shall be deemed not to have occurred with respect to any VMTP

Shares for which an election to retain is made pursuant to Section 2.5(a)(iv)

of the VMTP Statement relating to the Mandatory Tender Event.

2. The definition of “Applicable Spread” contained

in Section 9 of the Appendix is hereby amended and restated in its

entirety, effective beginning with the Rate Period for the Series 2020-1 VMTP

Shares commencing on November 16, 2023, to read as set forth below:

“Applicable Spread” means,

with respect to any Rate Period for the Series 2020-1 VMTP Shares, the

percentage per annum equal to the sum of

(i) the

percentage per annum set forth opposite the applicable credit rating most

recently assigned to the Series 2020-1 VMTP Shares by the Rating Agency in the

table below on the Rate Determination Date for such Rate Period, plus

(ii) the Spread Adjustment.

|

|

|

|

|

|

|

AAA

to AA-

|

1.27%

|

|

|

A+

***

|

1.62%

|

|

|

A

***

|

2.02%

|

|

|

A-

|

2.17%

|

|

|

BBB+

|

2.52%

|

|

|

BBB

|

2.77%

|

|

|

BBB-

|

3.27%

|

|

|

Non-investment

Grade/Not Rated

|

4.57%

|

|

*And/or the

equivalent long-term ratings of any other Rating Agency then rating the VMTP

Shares utilizing the highest of the ratings of the Rating Agencies then rating

the VMTP Shares, unless the lowest applicable credit rating is below A3

(in the case of Moody's) or A- (in the case of Fitch or S&P) or, in which

case, the lowest rating shall be used.

**Unless an

Increased Rate Period is in effect and is continuing, in which case the

Increased Rate shall be the Index Rate for such Increased Rate Period plus

2.00% plus the Applicable Spread.

***During an

Applicable Spread Transition Period, the percentage shall be 1.62% during such

Applicable Spread Transition Period, and thereafter shall be 2.02% until the

Fitch rating on the Series 2020-1 VMTP Shares (and/or the equivalent ratings of

Moody’s, S&P, and/or an Other Rating Agency then rating the Series 2020-1

VMTP Shares at the request of the Fund) changes, at which point the percentage

shall be in accordance with the table above.

3. The definition of “Optional Redemption Premium”

contained in Section 9 of the Appendix is hereby amended and restated in

its entirety to read as set forth below:

“Optional Redemption Premium”

means with respect to each Series 2020-1 VMTP Share to be redeemed an amount

equal to:

(A) if the Optional

Redemption Date for such Series 2020-1 VMTP Share occurs prior to November 10,

2025, the product of (i) the Applicable Spread for such VMTP Share in effect on

such Optional Redemption Date and (ii) the Liquidation Preference of such VMTP

Share and (iii) a fraction, the numerator of which is the number of calendar

days from and including the date of redemption to and including November 10,

2025 and the denominator of which is the actual number of calendar days from

and including November 10, 2023 to and including November 10, 2025; or

(B) if

the Optional Redemption Date for such Series 2020-1 VMTP Share either occurs on

or after November 10, 2025, none.

4. Section 10 of the Appendix is hereby

amended by deleting the words “Not Applicable” in such section and replacing them

in their entirety as set forth below:

The second paragraph of Section

2.6(a)(iv) of the VMTP Statement shall be amended to read in its entirety as

follows:

If the Mandatory Tender

Redemption Date occurs pursuant to this Section 2.6(a)(iv) and such

date is prior to November 10, 2025, then the Optional Redemption Premium shall

be payable on such Mandatory Tender Redemption Date in addition to the

Mandatory Tender Redemption Price.

Section 2. Additional Provisions.

Except as specifically set forth in Section 1

hereof, the Appendix and the VMTPS Statement remain unmodified and continue in

full force and effect.

This Amendment shall be effective as of November 10,

2023.

[Signature page follows.]

IN WITNESS WHEREOF, DWS Municipal

Income Trust has caused this Amendment to be signed on November 9, 2023 in

its name and on its behalf by a duly authorized officer. The Declaration of

Trust of the Trust is on file with the Secretary of the Commonwealth of

Massachusetts, and the said officer of the Trust has executed this Amendment as

an officer and not individually, and the obligations and rights set forth in

this Amendment are not binding upon any such officer, or the trustees of the

Trust or any shareholder of the Trust, individually, but are binding only upon

the assets and property of the Trust.

|

|

DWS MUNICIPAL INCOME TRUST

By: /s/ John Millette

____________________________

Name: John Millette

Title: Vice President and Secretary

|

|

|

|

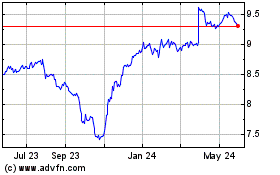

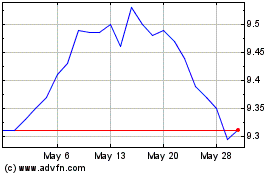

DWS Municipal Income (NYSE:KTF)

Historical Stock Chart

From Feb 2025 to Mar 2025

DWS Municipal Income (NYSE:KTF)

Historical Stock Chart

From Mar 2024 to Mar 2025