false

0000026780

0000026780

2025-01-23

2025-01-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 23, 2025

Dana Incorporated

(Exact name of registrant as specified in

its charter)

| Delaware |

|

1-1063 |

|

26-1531856 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification Number) |

| 3939 Technology Drive, Maumee, Ohio 43537 |

| (Address of principal executive offices) (Zip Code) |

| |

| (419) 887-3000 |

| (Registrant’s telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

|

Title of Each

Class |

|

Trading

Symbol |

|

Name of Each Exchange

on which Registered |

| Common Stock, $.01 par value |

|

DAN |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 | Entry into a Material Definitive Agreement. |

On January 23, 2025, Dana Incorporated (the

“Company”) entered into an amendment (the “Amendment”) to that certain Director Appointment and

Nomination Agreement, dated as of January 7, 2022 (the “Agreement”) with Carl C. Icahn and the persons and entities

listed therein (collectively, the “Icahn Group”).

Pursuant to the terms of the Amendment,

the Company has agreed to certain amendments to the Agreement, including the appointment of Mr. Brett Icahn and Mr. Christian Garcia

(together, the “Icahn Designees”) to the board of directors of the

Company (the “Board”) to fill the vacancies created by the resignations

of Mr. Gary Hu and Mr. Steven Miller. The Amendment also revises the term of the standstill under the Agreement to (i) until 30 days

prior to the director nomination deadline for the 2027 Annual Meeting if certain business objectives are met and the Company

nominates both Icahn Designees (or any replacement designees) for re-election at the 2026 Annual Meeting or (ii) until 30 days prior

to the director nomination deadline for the 2026 Annual Meeting if certain business objective are not met. The Icahn Designees will

also be entitled to serve on existing and new committees of the Board, subject to certain conditions.

The foregoing description of the Amendment does

not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment, a copy of which is filed as

Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers. |

The information set forth in Item 1.01 is incorporated

herein by reference.

On January 23, 2025, in connection with

the Amendment, (i) Mr. Gary Hu, a member of the Board, the Audit Committee of the Board (the

“Audit Committee”) and the Nominating and Corporate Governance Committee

of the Board (the “NCG Committee”), and Mr. Steven Miller, a member of

the Board, the Compensation Committee of the Board (the “Compensation

Committee”) and the Technology and Sustainability Committee of the Board (the “Technology

Committee”), each of whom were previously designees under the Agreement, resigned from the Board, effective immediately

and (ii) the Board appointed each of the Icahn Designees to the Board, effective immediately. Mr. Hu and Mr. Miller’s

resignations were not due to any disagreement with the Company.

Each of

the Icahn Designees will receive the same compensation for his services as the Company’s other non-employee directors. Other than

respect to the matters referred to in Item 1.01 of this Current Report on Form 8-K, there are no arrangements or understandings between

the Icahn Designees and any other persons pursuant to which the Icahn Designees were selected as a director, and there are no transactions

in which the Icahn Designees have an interest requiring disclosure under Item 404(a) of Regulation S-K.

Upon their

appointment to the Board, Mr. Icahn joined the Audit Committee and the NCG Committee and Mr. Garcia joined the Compensation Committee

and the Technology Committee.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

| |

DANA

INCORPORATED |

|

| |

|

|

|

| Date: January 23, 2025 |

By: |

/s/ Douglas H. Liedberg |

|

| |

Name: |

Douglas H. Liedberg |

|

| |

Title: |

Senior Vice President, General Counsel and Secretary |

|

EXHIBIT 10.1

Execution Version

Amendment to Director Appointment and

Nomination Agreement

This Amendment, dated as

of January 23, 2025, (this “Amendment”) is entered into by and among the persons

and entities listed on Schedule A (collectively, the “Icahn Group”, and each individually a “member”

of the Icahn Group), and Dana Incorporated, a Delaware corporation (the “Company”), and amends the Director Appointment

and Nomination Agreement, dated as of January 7, 2022, by and among the Icahn Group and the Company (the “Nomination Agreement”).

All capitalized terms that are used but not defined herein shall have the meanings ascribed to such terms in the Nomination Agreement.

WHEREAS, the Icahn Group

and the Company previously entered into the Nomination Agreement in advance of the 2022 annual meeting of the stockholders of the Company

(the “2022 Annual Meeting”); and

WHEREAS, each of the Icahn

Group and the Company wish to amend the Nomination Agreement as set forth herein.

In consideration of and reliance

upon the mutual covenants and agreements contained in this Amendment, and for other good and valuable consideration, the receipt and sufficiency

of which is hereby acknowledged, the parties agree as follows:

1. Amendments

to the Nomination Agreement. The Nomination Agreement is hereby amended as follows by:

(a)

Amending and restating Section 1(a)(i) in its entirety as follows:

“On or prior

to the date of this Amendment, each of Gary Hu and Steven Miller has resigned as a member of the Board of Directors of the Company (the

“Board”) and all committees thereof. On or prior to the date of this Amendment, the Board shall take or shall have

taken, effective on the date of this Amendment, all necessary action to appoint each of Brett Icahn and Christian Garcia (collectively,

the “Icahn Designees” and each, an “Icahn Designee”), each with a term expiring at the 2025 annual

meeting of stockholders of the Company (the “2025 Annual Meeting”), to fill the vacancies created by the resignations

of Messrs. Hu and Miller. The Company agrees that the Company’s slate of nominees for election to the Board at the 2025 Annual Meeting

will consist of no more than nine (9) individuals and will include, subject to their willingness and consent to serve, the Icahn Designees

(including any Replacement Designees, as applicable). The Company shall use reasonable best efforts to cause the election of each of the

Icahn Designees at the 2025 Annual Meeting (including by (x) recommending that the Company’s stockholders vote in favor of the election

of each of the Icahn Designees, (y) including each of the Icahn Designees in the Company’s proxy statement and proxy card for the

2025 Annual Meeting, and (z) otherwise supporting each of the Icahn Designees for election in a manner no less rigorous and favorable

than the manner in which the Company supports its other nominees in the aggregate).”

(b)

Amending and restating Section 1(a)(ix) in its entirety as follows:

“that from

and after the date of this Amendment, so long as an Icahn Designee is a member of the Board, without the approval of the Icahn Designees

then on the Board (such approval not to be unreasonably withheld, delayed or conditioned), (w) the Board shall not form an Executive Committee

or any other committee with functions similar to those customarily granted to an Executive Committee; (x) the Board shall not form any

other new committee (other than committees formed with respect to matters for which there are actual conflicts of interest between the

Icahn Designees and the Company) without offering to each of the Icahn Designees the opportunity to be a member of such committee; (y)

the Board shall offer each of the Icahn Designees the opportunity to be a member of any existing committees with functions relating to

the sourcing and identification of Chief Executive Officer candidates, strategic transactions, including mergers and acquisitions, capital

allocation, finance and/or strategy; and (z) the Board shall not increase the size of any committee other than to appoint each of the

Icahn Designees to such committee. Notwithstanding anything to the contrary in this Amendment, any Board consideration of appointment

and employment of named executive officers, mergers and acquisitions of material assets, or dispositions of material assets, or similar

extraordinary transactions, such consideration, and voting with respect thereto shall take place only at the full Board level or in committees

of which both of the Icahn Designees are members (for the avoidance of doubt, nothing in this Amendment changes, amends, or modifies the

authority, duties and obligations of the Compensation Committee of the Board).”

(c)

Amending and restating Section 1(a)(xii) in its entirety as follows:

“The Company acknowledges that for so long as the Icahn Designees are members of the Board, (x) each committee of the Board, including all existing committees as of the date of this Amendment and all committees that may be formed from time to time by the Board, shall include at least one Icahn Designee and (y) the Icahn Designees shall have the same rights as any other director with respect to being permitted to attend (as an observer and without voting rights) any committee meeting regardless of whether such director is a member of such committee, except in cases where privileged matters will be discussed or reviewed (unless the Icahn Designees commit, in writing, on terms reasonably satisfactory to the Company, not to share information relating to such matters with the Icahn Group, including its Affiliates, Associates and representatives), where the matters under consideration involve an actual conflict of interest between the Company and the Icahn Group or its Affiliates or Associates, or where, upon advice of outside counsel to the Company, the Icahn Designees attendance would jeopardize any legal privilege.”

(d)

Amending the introductory paragraph to Section 3(a) as follows:

“From and after the date hereof, until the later of: (x) the earlier of (i) the date that is thirty (30) days prior to the deadline for nomination of director candidates, which shall be no later than January 22, 2027, pursuant to the Company’s Bylaws for the 2027 annual meeting of the Company’s stockholders, and (ii) the date that is thirty (30) days prior to the deadline for nomination of director candidates, which shall be no later than January 23, 2026, pursuant to the Company’s Bylaws for the 2026 annual meeting of the Company’s stockholders if the Objectives (as defined below) have not been met by such date; and (y) such date as no Icahn Designee is on the Board and the Icahn Group has no right to designate a Replacement Designee (including if the Icahn Group has irrevocably waived such right in writing) (the “Standstill Period”),”

(e)

Amending Section 3 by adding the following as a new subsection (c) at the end thereof:

“For the purposes

of this Section 3(a), “Objectives” shall mean that all of the following have occurred and that the Company has provided

the Icahn Group with documentary evidence that such have events occurred: (i) the Company shall have hired a Chief Executive Officer who

is not as of the date of this Amendment, and has not previously been, a member of the Board; (ii) the Company shall have entered into

a definitive agreement with a third party providing for the disposition by the Company of its Off-Highway Drive and Motion System’s

business (the “Off-Highway Business”); and (iii) the Board shall have engaged a financial advisor to advise the Board

with respect to, and shall thereafter have publicly announced a capital allocation plan with respect to, the anticipated net proceeds

from the disposition of the Off-Highway Business; it being understood and agreed that such financial advisor shall be either: (x) Morgan

Stanley; or (y) at the option of the Icahn Group, such other financial advisor as may be recommended by the Icahn Group (provided, however,

that such other financial advisor recommended by the Icahn Group shall (i) be compensated by the Icahn Group, (ii) not have a conflict

with the Company and (iii) enter into a confidentiality agreement with the Company on terms reasonably acceptable to the Company).”

(f)

Amending Section 3 by adding the following as a new subsection (d) at the end thereof:

“Notwithstanding

anything else contained herein and for the avoidance of doubt:

(1) if (i) the Objectives have been met and (ii) the Company delivers a notice to the Icahn Group pursuant to Section 1(a)(vii) that the

Company does not intend to renominate one or more of the Icahn Designees for re-election at

the 2026 annual meeting of the Company’s

stockholders, then the Standstill Period in Section 3(a) shall immediately terminate on the date on which there is no Icahn Designee on

the Board and the Icahn Group has no right to designate a Replacement Designee (including if the Icahn Group has irrevocably waived such

right in writing); or

(2) if (i) the Objectives

have been met and (ii) either (A) the Company delivers a notice to the Icahn Group pursuant to Section 1(a)(vii) that the Company intends

to renominate both of the Icahn Designees for re-election at the 2026 annual meeting of the Company’s stockholders (provided that,

at such time, both Icahn Designees are members of the Board and the Icahn Group satisfies the applicable ownership requirements set forth

in Section 1(c)) or (B) the Company’s failure to deliver such a notice occurs after any time at which none of the Icahn Designees

are on the Board and the Icahn Group has no right to designate a Replacement Designee (including if the Icahn Group has irrevocably waived

such right in writing), then, in either case, the Standstill Period in Section 3(a) shall be the later of the (x) the date that is thirty

(30) days prior to the deadline for nomination of director candidates, which shall be no later than January 22, 2027, pursuant to the

Company’s Bylaws for the 2027 annual meeting of the Company’s stockholders and (y) such date as no Icahn Designee is on the

Board and the Icahn Group has no right to designate a Replacement Designee (including if the Icahn Group has irrevocably waived such right

in writing).”

(g)

Amending Section 9 by replacing the first sentence of the section with the following sentence:

“This Agreement

shall remain in effect until the termination of the Standstill Period, at which time it will terminate and be of no further force or effect.”

2.

Public Filings. The parties agree that following the execution and delivery of this Amendment by the parties, (a) the Company

will file with the SEC a Current Report on Form 8-K in respect of this Amendment, and, prior to the filing thereof, the Company shall

provide the Icahn Group and its counsel a reasonable opportunity to review and comment on such Form 8-K, and (b) the Icahn Group will

file with the SEC an amendment to the Icahn Schedule 13D in respect of this Amendment, and prior to the filing thereof, the Icahn Group

shall provide the Company and its counsel a reasonable opportunity to review and comment on such amendment. Other than as set forth herein,

neither party shall issue a press release relating to this Amendment.

3.

Entire Agreement; Amendment. This Amendment, the Nomination Agreement and the Confidentiality Agreement contain the entire

understanding of the parties with respect to the subject matter hereof and may be amended only by an agreement in writing executed by

the parties hereto.

4.

Reference to the Nomination Agreement. From and after the date of this Amendment, each reference in the Nomination Agreement

to “this Nomination Agreement,” “hereunder,” “hereof,” “herein,” or words of similar meaning

referring to the Nomination

Agreement, mean and are a reference to the

Nomination Agreement as amended by this Amendment. Except as expressly amended by the terms of this Amendment, all other terms of the

Nomination Agreement remain unchanged and in full force and effect.

5.

Counterparts. This Amendment may be executed (including by PDF) in two or more counterparts which together shall constitute

a single agreement.

6.

Successors and Assigns. This Amendment shall not be assignable by any of the parties to this Amendment. This Amendment,

however, shall be binding on successors of the parties hereto.

7.

No Third Party Beneficiaries. This Amendment is solely for the benefit of the parties hereto and is not enforceable by any

other persons.

8.

Fees and Expenses. Neither the Company, on the one hand, nor the Icahn Group, on the other hand, will be responsible for

any fees or expenses of the other in connection with this Amendment.

9.

Interpretation and Construction. Each of the parties hereto acknowledges that it has been represented by counsel of its

choice throughout all negotiations that have preceded the execution of this Amendment, and that it has executed the same with the advice

of said independent counsel. Each party and its counsel cooperated and participated in the drafting and preparation of this Amendment

and the documents referred to herein, and any and all drafts relating thereto exchanged among the parties shall be deemed the work product

of all of the parties and may not be construed against any party by reason of its drafting or preparation. Accordingly, any rule of law

or any legal decision that would require interpretation of any ambiguities in this Amendment against any party that drafted or prepared

it is of no application and is hereby expressly waived by each of the parties hereto, and any controversy over interpretations of this

Amendment shall be decided without regards to events of drafting or preparation. The section headings contained in this Amendment are

for reference purposes only and shall not affect in any way the meaning or interpretation of this Amendment. Unless context otherwise

requires, references herein to Exhibits, Sections or Schedules mean the Exhibits, Sections or Schedules attached to this Amendment. The

term “including” shall be deemed to mean “including without limitation” in all instances. In all instances, the

term “or” shall not be deemed to be exclusive.

[Signature pages follow]

IN WITNESS WHEREOF, each

of the parties hereto has executed this Amendment, or caused the same to be executed by its duly authorized representative as of the

date first above written.

| |

THE COMPANY: |

|

| |

|

|

| |

DANA INCORPORATED |

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Douglas H. Liedberg |

|

| |

|

Name: |

Douglas H. Liedberg |

|

| |

|

Title: |

Senior Vice President,

General Counsel & Secretary |

|

[Signature Page to Amendment to Director Appointment

and Nomination Agreement]

| |

Icahn Group: |

|

| |

|

|

| |

ICAHN PARTNERS LP

ICAHN ONSHORE LP

ICAHN PARTNERS MASTER FUND LP

ICAHN OFFSHORE LP

ICAHN CAPITAL LP

|

|

| |

|

|

|

|

| |

By: |

/s/ Jesse Lynn |

|

| |

|

Name: |

Jesse Lynn |

|

| |

|

Title: |

Chief Operating Officer |

|

| |

|

|

| |

IPH GP LLC

By: Icahn Enterprises Holdings L.P., its sole member

By: Icahn Enterprises G.P. Inc., its general partner

ICAHN ENTERPRISES HOLDINGS L.P.

By: Icahn Enterprises G.P. Inc., its general partner

ICAHN ENTERPRISES G.P. INC.

|

|

| |

|

|

|

|

| |

By: |

/s/ Ted Papapostolou |

|

| |

|

Name: |

Ted Papapostolou |

|

| |

|

Title: |

Chief Financial Officer |

|

| |

BECKTON CORP. |

|

| |

|

|

|

|

| |

By: |

/s/ Ted Papapostolou |

|

| |

|

Name: |

Ted Papapostolou |

|

| |

|

Title: |

Senior Vice President |

|

| |

/s/ Carl C. Icahn |

|

| |

CARL C. ICAHN |

|

| |

|

|

|

|

| |

/s/ Brett Icahn |

|

| |

BRETT ICAHN |

|

| |

|

|

|

|

| |

/s/ Steven Miller |

|

| |

STEVEN MILLER |

|

| |

|

|

|

|

| |

/s/ Christian Garcia |

|

| |

CHRISTIAN GARCIA |

|

| |

|

|

|

|

[Signature Page to Amendment to Director Appointment

and Nomination Agreement]

Schedule

a

CARL C. ICAHN

BRETT ICAHN

CHRISTIAN GARCIA

ICAHN PARTNERS LP

ICAHN PARTNERS MASTER FUND LP

ICAHN ENTERPRISES G.P. INC.

ICAHN ENTERPRISES HOLDINGS L.P.

IPH GP LLC

ICAHN CAPITAL LP

ICAHN ONSHORE LP

ICAHN OFFSHORE LP

BECKTON CORP.

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

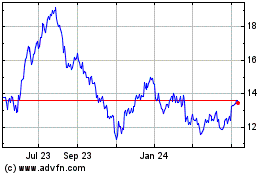

Dana (NYSE:DAN)

Historical Stock Chart

From Dec 2024 to Jan 2025

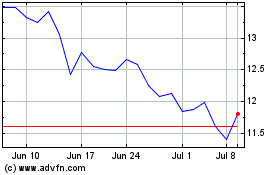

Dana (NYSE:DAN)

Historical Stock Chart

From Jan 2024 to Jan 2025