Form 8-K - Current report

September 25 2023 - 5:13PM

Edgar (US Regulatory)

false0001711291200 W Hubbard Street8th FloorChicagoIL00017112912023-09-252023-09-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_______________________________________________________________________

FORM 8-K

__________________________________________________________________________

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): September 25, 2023

________________________________________________________________________

CURO GROUP HOLDINGS CORP

(Exact Name of Registrant as Specified in Its Charter)

________________________________________________________________________

| | | | | | | | |

| Delaware | 001-38315 | 90-0934597 |

| (State or other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

200 W Hubbard Street, 8th Floor, Chicago, IL | 60654 |

| (Address of Principal Executive Offices) | (Zip Code) |

(312) 470-2000

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

________________________________________________________________________

Check the appropriate box below if the Form8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common stock | CURO | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule12b-2of the Securities Exchange Act of 1934(§240.12b-2of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 7.01 Regulation FD Disclosure

CURO Group Holdings Corp. (the “Company”) has prepared updated information for use in connection with upcoming investor meetings, which includes certain projections, forecasts and assumptions about various matters such as future financial and operational performance. A copy of the investor presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated into this Item 7.01 by reference. A copy of the investor presentation will be available at https://ir.curo.com/.

The information furnished pursuant to this Current Report on Form 8-K shall not be considered “filed” under the Securities Exchange Act of 1934, as amended, nor shall it be incorporated by reference into future filings by the Company under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, as amended, unless the Company expressly sets forth in such future filing that such information is to be considered “filed” or incorporated by reference therein. The furnishing of the information in this Current Report on Form 8-K is not intended to, and does not, constitute a determination or admission by the Company that the information herein is material or complete, or that investors should consider this information before making an investment decision with respect to any security of the Company.

ITEM 9.01 Financial Statements and Exhibits

(d). Exhibits

| | | | | |

| Exhibit Number | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized on this 25th day of September, 2023.

CURO Group Holdings Corp.

By: /s/ Ismail Dawood

Ismail Dawood

Chief Financial Officer

Investor Presentation September 2023

Disclaimer IMPORTANT: You must read the following information before continuing to the rest of the presentation, which is being provided to you for informational purposes only. FORWARD-LOOKING STATEMENTS This presentation contains forward-looking statements. These forward-looking statements include projections, estimates and assumptions about various matters such as our future operational performance, including the updated third quarter information presented on slide 12. In addition, words such as “estimate,” “believe,” “forecast,” “predict,” “project,” “intend,” “should” and variations of such words and similar expressions are intended to identify forward-looking statements. Our ability to achieve these forward-looking statements is based on certain assumptions, judgments and other factors, both within and outside of our control, that could cause actual results to differ materially from those in the forward-looking statements, including, risks relating to the uncertainty of projected financial information and forecasts, our level of indebtedness; our dependence on third-party lenders to provide the cash we need to fund our indebtedness and our ability to affordably access third-party financing; the impact of regulations on our business; the effects of competition on our business; our ability to attract and retain customers; global economic, market, financial, political or public health conditions or events; our ability to integrate acquired businesses; our ability to protect our proprietary technology and analytics; disruption of our information technology systems; improper disclosure of customer personal data, as well as other factors discussed in our filings with the Securities and Exchange Commission. The foregoing factors, as well as other existing risk factors and new risk factors that emerge from time to time, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual future results. Furthermore, the Company undertakes no obligation to update, amend or clarify forward-looking statements. NON-GAAP FINANCIAL MEASURES In addition to the financial information prepared in conformity with U.S. GAAP, we provide certain “non-GAAP financial measures,” which are intended as a supplemental measure of our performance that are not required by, or presented in accordance with, GAAP. We present these non-GAAP financial measures because we believe that, when viewed with our GAAP results and the accompanying reconciliation, such measures provide useful information for comparing our performance over various reporting periods as they remove from our operating results the impact of items that we believe do not reflect our core operating performance. These non-GAAP financial measures are not substitutes for any GAAP financial measure and there are limitations to using them. Although we believe that these non-GAAP financial measures can make an evaluation of our operating performance more consistent because they remove items that do not reflect our core operations, other companies in our industry may define their own non-GAAP financial measures differently or use different measures. As a result, it may be difficult to use any non-GAAP financial measure to compare the performance of other companies to our performance. The non-GAAP financial measures presented in these slides should not be considered as measures of the income generated by our business or discretionary cash available to us to invest in the growth of our business. Our management compensates for these limitations by reference to GAAP results and using these non-GAAP financial measures as supplemental measures. 2

Key Management 3 Doug Clark Chief Executive Officer Izzy Dawood Chief Financial Officer Gary Fulk Chief Operating Officer ▪ Joined CURO in 2021 through the acquisition of Heights Finance ▪ Formerly CEO of Heights Finance, joined CURO as President of North America Direct Lending and was subsequently named CEO ▪ Nearly 20 years of consumer finance experience driving organizational growth, including leadership roles at Heights Finance and Axcess Financial ▪ Joined CURO in 2023 ▪ 20+ years of experience building and leading financial teams, including CFO roles at Santander Consumer and Paysafe, a global payments platform, and leadership roles at BNY Mellon ▪ Joined CURO in 2021 through the acquisition of Heights Finance ▪ 28+ years of consumer finance experience including Heights Finance and OneMain Financial where he held numerous leadership and operational roles Shu Chen Chief Credit Risk Officer ▪ Joined CURO in 2023, and oversees risk and analytics ▪ 10+ years of experience in credit, fraud, risk monitoring, loss forecasting and marketing analytics, including prior role as Chief Risk and Analytics officer of CNG Holdings

4 Company Overview ▪ Omni-channel consumer finance company serving consumers in the U.S. and Canada ▪ Operates in almost 500 branches across 13 states in the U.S. and nearly 150 branches in Canada – eight provinces with retail locations and eight provinces and one territory online ▪ Secured and unsecured installment and open-end loan products to non-prime consumers as well as credit insurance and other ancillary financial products 4

Strategic Transformation 5 Acquisition of First Heritage Credit Expands <36% APR lending capabilities, adding new strategic geographies Sale of Legacy U.S. Direct Lending Business Accelerates transition from and reduces exposure to high APR loan products Acquisition of Heights Entrance into the <36% APR loan market Refinanced and upsized Warehouse Facilities for Heights ($425M) and First Heritage ($225M) as part of the acquisitions Issued C$526.5M Flexiti Securitization Facility; refinanced and upsized C$535M Flexiti Warehouse Facility Refinanced Senior Notes and upsized issue to $1B 2021 2022 2023 Issued $150M Sr Term Loan and executed uptier exchange on $1B Senior Notes Executed new C$110M Warehouse Facility in Canada CURO started as a U.S. short-term lender, but through investments and M&A, has repositioned the business to align with go-forward strategy of offering longer term, higher balance and lower risk credit products Sale of Flexiti Completes transformation allowing us to focus exclusively on our Direct Lending business

U.S. DIRECT LENDING Secured and unsecured installment loan products to non-prime consumers as well as credit insurance and other ancillary financial products in almost 500 branches across 13 states Direct Lending by Geography 6 CANADA DIRECT LENDING Non-prime open-end loans and payment protection insurance in nearly 150 branches across eight provinces and online in nine provinces

Direct Lending (U.S.) Overview 7 Overview: • Gross AR >$700M • Almost 500 branches across 13 states • Non-Prime, both secured and unsecured • Ongoing shift to larger, lower rate loans decreases regulatory risk Loan Characteristics1 < 36% APR > 36% APR % of Portfolio 51% 49% Avg Original Balance ~$6,600 ~$2,000 Avg Term 42 24 Avg FICO 632 612 Avg Yield2 ~36% ~61% % Secured 38% 12% 1 As of 6/30/23, all values are rounded and exclude insurance and other ancillary fees 2 Avg Yield = (Revenue / Average Receivables) and includes approximately 6% of ancillary insurance yield

Direct Lending (Canada) Overview 8 Open-end Loan Characteristics1,2 Avg Original Balance ~C$3,500 Avg Term n/a2 Avg Credit Vision Score 627 Avg Yield3 ~58% 1 As of 6/30/23, all values are rounded 2 Our primary product in Canada is an open-ended product 3 Avg Yield = (Revenue / Average Receivables) and includes approximately 13% of ancillary insurance yield Overview: • Gross AR ~$500M • Nearly 150 branches in eight provinces with retail locations and eight provinces and one territory online • Open-End Loans and single-pay loans • Omni-channel solution (online and branch) • Typical customer: 33% homeowners, average net income of ~C$36,000, and nine years in current job

Executed on Key Strategic Priorities 9 New Money Term Loan Transaction type First Lien Senior Secured Term Loan Term Loan $150M1 Cost of Capital 18.0% interest per annum Maturity August 2027 Cost of Capital Details 6.0% cash and 12.0% PIK option3 in the first year and 9.0% / 9.0%, respectively, thereafter Canada SPV Facility Facility Size C$110M1 (or ~$83M USD2) Cost of Capital CDOR + 8.00% Maturity November 2025 Accordion Feature Up to C$30M Sale of Flexiti 1 Figures denote gross amounts 2 Converted to USD using a 03/31/23 rate of 0.74, as presented in our Q1-23 earnings presentation 3 At CURO’s option Allows CURO to focus exclusively on its Direct Lending business in the U.S. and Canada

Credit Quality Improving Highlights: • In the U.S., Direct Lending net charge-offs ("NCOs") declined sequentially • In Canada, 2Q23 NCOs reflect a full period of the change in charge-off policy, while 1Q23 NCOs were artificially low due to this change in policy. Excluding the change in policy during 1Q23, NCOs in Canada decreased on a sequential basis ($ Millions) * Direct Lending NCOs by Geography 10 * Legacy U.S. Direct Lending business was sold and First Heritage Credit was acquired 1 1Q23 NCOs excluding policy change. Reported 1Q23 Direct Lending NCOs and NCO % were $47M and 15.6%, respectively in the U.S. and $10M and 8.0%, respectively in Canada, including the change in charge-off policy 1 1* 1

Delinquency Rates Remain Relatively Stable ($ Millions) 11 Canada U.S. Total Direct Lending 1 1 Implemented change in charge-off policy in Canada during 1Q23

Updated 3Q23 Outlook Ex-Flexiti Strengthen our Foundation Execute with Excellence Grow Responsibly Continue to maintain adequate liquidity and capacity for growth EOP Receivables: $1.23-1.28B Revenue: $165-170MM Net Charge-off: 17.0-19.5% Operating Expenses: $90-100M Note: There have been no material changes vs our prior published targets other than the removal of Flexiti from our 3Q23 outlook Updated 3Q 2023 targets to reflect the removal of Flexiti, our Canada POS Lending Segment, on August 31, 2023 12

Appendix

14 More than Half of Debt is Fixed Rate 57% 43% Fixed1 vs Variable of Funded Debt Fixed Variable (Millions, rounded) Fixed / Variable Maturity Date Effective Interest Rate Borrowing Capacity Outstanding as of 06/30/23 Corporate Debt: 1.0L Term Loan Fixed Aug-27 18.0% n/a $167.5 1.5L Senior Notes Fixed Aug-28 7.5% n/a $682.3 2.0L Senior Notes Fixed Aug-28 7.5% n/a $317.7 Funding Debt: Heights SPV Variable Jul-25 1-Mo SOFR + 4.71% $425.0 $387.2 First Heritage SPV Variable Jul-25 1-Mo SOFR + 4.25% $225.0 $159.5 CDL SPV I Variable Aug-26 3-Mo CDOR + 6.00% $302.9(2) $251.9 CDL SPV II Variable Nov-25 3-Mo CDOR + 8.00% $83.3(2) $72.2 1 As of quarter ended 6/30/23, excluding Flexiti 2 CDL SPV I and CDL SPV II borrowing capacity are denominated in CAD but were converted to USD using a 06/30/23 rate of ~0.76

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

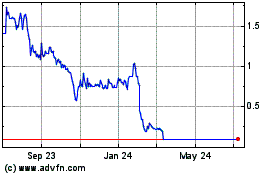

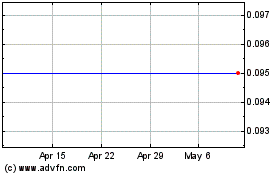

CURO (NYSE:CURO)

Historical Stock Chart

From Apr 2024 to May 2024

CURO (NYSE:CURO)

Historical Stock Chart

From May 2023 to May 2024