Current Report Filing (8-k)

September 18 2019 - 5:19PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

September 15, 2019

CONTURA ENERGY, INC.

(Exact Name of Registrant as Specified in

Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

001-38735

|

|

81-3015061

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

340 Martin Luther King Jr. Blvd.

Bristol, Tennessee 37620

|

|

|

(Address of Principal Executive Offices, zip code)

|

|

|

(423) 573-0300

|

|

|

|

(Registrant’s telephone number, including area code)

|

|

|

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

CTRA

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

Growth Company ☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

On September 15, 2019, Contura Energy,

Inc. (“Contura”) entered into a binding term sheet (the “Term Sheet”) with Eagle Specialty Materials,

LLC (“ESM”), an affiliate of FM Coal, LLC, in connection with a proposed acquisition of the Belle Aye and Eagle

Butte Mines (the “Western Mines”) by ESM from the Seller Parties (as defined below) in lieu of Contura making

the acquisition. Subject to certain terms and conditions, Contura had previously agreed to serve as the stalking horse

purchaser of the Western Mines as part of the Chapter 11 bankruptcy auction held by Blackjewel, L.L.C.

(“Blackjewel”) and certain of its subsidiaries and affiliates (collectively with Blackjewel, the “Seller

Parties”). ESM is proposing to acquire the Western Mines from the Seller Parties, and the Term Sheet sets forth the

certain agreements between ESM and Contura that would occur in connection with any closing of ESM’s acquisition of the

Western Mines from the Seller Parties (the closing of ESM’s acquisition of the Western Mines from the Seller Parties,

the “Closing”). The Seller Parties are not party to the Term Sheet and the sale of the Western Mines to ESM is

contingent upon a number of conditions, including ESM reaching agreement with the Seller Parties (and other third parties, as

described below) regarding the terms of such sale and obtaining approval of the United States Bankruptcy Court for the

Southern District of West Virginia. The closing of the transactions under the Term Sheet is conditioned upon, and would occur

concurrently with, the Closing.

Pursuant to the Term Sheet, and subject to the closing conditions

set forth therein, Contura agrees at Closing to make a cash payment of $90,000,000 to ESM and to convey interests in ranches known

as the Belle Ayr Ranch and the Black Thunder Ranch (together, the “Ranches”) to ESM. As soon as reasonably practical,

ESM agrees to arrange to have one or more sureties issue at Closing the reclamation bonds (the “Substitute Reclamation Bonds”),

for the benefit of the Wyoming Department of Environmental Quality (“DEQ”), that are required in connection with the

release by the DEQ at Closing of the collateral previously posted by a Contura affiliate to secure its reclamation obligations

related to the Western Mines, which collateral consists of reclamation bonds and the Ranches (the “Contura Collateral”).

If the Closing occurs, ESM agrees to satisfy the reclamation obligations related to the Western Mines and indemnify Contura in

respect of the Contura Federal Claims (as defined below).

A Contura affiliate holds certain permits related to the Western

Mines and those permits will not transfer at Closing but rather when all applicable approvals for the transfer have been obtained.

Following the Closing and until the earlier of the date of the permit transfers and June 30, 2020, Contura would consent to ESM

operating the Western Mines under the permits subject to and in compliance with a permit operating agreement previously entered

into between a Contura affiliate and Blackjewel. ESM has agreed to use commercially reasonable efforts to have the permits transferred

as promptly as possible.

Other closing conditions include:

|

|

i.

|

Entry into specific agreements with applicable parties such that, among other things:

|

|

|

a.

|

ESM agrees to purchase the Western Mines from the Seller Parties in exchange for a specific amount of cash and the assumption

of certain related liabilities including the reclamation obligations related to the Western Mines;

|

|

|

b.

|

Contura and the Seller Parties agree that the rights and obligations of Contura to purchase the Western Mines are terminated

and Contura agrees at Closing to waive its rights with respect to the deposit Contura previously provided to the Seller Parties

in connection with its agreement to serve as the stalking horse purchaser of the Western Mines;

|

|

|

c.

|

ESM agrees at Closing to pay off certain debts owed by the Seller Parties to Riverstone Credit Parties – Direct L.P.,

and certain related parties and Riverstone and Contura each agree at Closing to release their respective purported first priority

liens on certain of the Seller Parties’ assets;

|

|

|

d.

|

Each of the Bureau of Land Management (the “BLM”) and the State of Wyoming will authorize ESM to conduct mining

operations on the federal or State of Wyoming leases, as applicable, associated with the Western Mines prior to the transfer thereof;

|

|

|

e.

|

Campbell County in Wyoming (“Campbell County”) and the State of Wyoming agree to release at Closing all claims

against Contura on account of royalties, taxes or other amounts relating to the Western Mines, the DEQ agrees at Closing to release

the Contura Collateral, Contura agrees at Closing to make a $13,500,000 payment to Campbell County and ESM agrees to make certain

specified payments;

|

|

|

f.

|

The sureties issuing the Substitute Reclamation Bonds agree that Contura will have no liability in respect thereof or the obligations

secured thereby;

|

|

|

g.

|

The United States Department of Interior’s Office of Surface Mining, Reclamation and Enforcement agrees not to take actions

against Contura or related persons related to the bonds and/or permits for the Western Mines, including not linking Contura or

related persons to the Applicant Violator System for claims or violations under the permits;

|

|

|

ii.

|

Performance by the parties to the agreements above of their obligations thereunder that are to be performed on or before Closing,

and the actions that are to occur under those agreements on or before Closing shall have occurred or shall be occurring simultaneously

with Closing;

|

|

|

iii.

|

Approval by the United States Bankruptcy Court for the Southern District of West Virginia of the Term Sheet and the other specific

agreements contemplated therein;

|

|

|

iv.

|

Approval by the Contura board of directors of the Term Sheet and the transactions contemplated thereby and receipt by Contura

of all necessary amendments and/or waivers to its existing credit facilities to permit and/or facilitate the transactions contemplated

by the Term Sheet;

|

|

|

v.

|

Receipt by Contura of evidence of the discharge of its liabilities in respect of certain royalties, and interest thereon, generated

by the Western Mines, which Blackjewel allegedly is obligated to, but failed to, pay, and which is alleged by BLM to be owed by

Contura; and

|

|

|

vi.

|

Submission by ESM to the Department of Justice (the “DOJ”) of a proposed term sheet or settlement agreement between

ESM and certain federal agencies that is recommended for approval by the Civil Division of the DOJ (the “Proposed Settlement”)

pursuant to which, among other things, (a) ESM agrees to make certain payments necessary to cure the unpaid prepetition claims

against Blackjewel with respect to the federal leases associated with the Western Mines (the “Contura Federal Claims”)

and (b) all relevant federal agencies agree for the benefit of Contura to release all claims against Contura or its affiliates

on account of royalties, taxes or other amounts owing in respect of or relating to the Western Mines (and if the Proposed Settlement

is approved by the DOJ, ESM will cause the parties thereto to enter into an agreement in respect thereof).

|

The Term Sheet will terminate if the Closing has not occurred

on or before September 27, 2019 (unless extended by the parties) or if the term sheet or definitive agreement, as applicable, for

the acquisition by ESM of the Western Mines terminates in accordance with its terms and without a breach by ESM.

As noted, the closing of the transactions under the Term Sheet

is subject to numerous conditions, many of which require the agreement or consent of third parties and/or are otherwise outside

of the control of Contura and ESM. Therefore there can be no assurance that those conditions will be satisfied and/or waived and

therefore no assurance that the transactions described in the Term Sheet will be consummated.

Item

7.01 REGULATION FD DISCLOSURE.

Attached hereto as Exhibit 99.1 is a copy of the press release

issued by Contura, dated September 18, 2019, announcing the entry by Contura into the Term Sheet.

The information in this Item 7.01, including Exhibit 99.1 attached

hereto, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (“Exchange Act”), or otherwise subject to the liabilities of that Section, and shall not be

incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended,

or the Exchange Act, except as otherwise expressly stated in such filing.

Item

9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits

Signatures

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: September 18, 2019

|

|

Contura Energy, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Mark M. Manno

|

|

|

|

|

Name:

|

Mark M. Manno

|

|

|

|

|

Title:

|

Executive Vice President, Chief Administrative & Legal Officer and Secretary

|

|

EXHIBIT INDEX

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

Exhibit 99.1

|

Press Release issued by Contura Energy, Inc., dated September 18, 2019

|

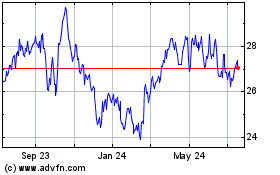

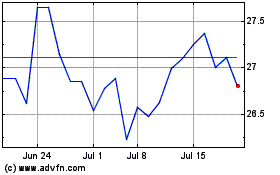

Coterra Energy (NYSE:CTRA)

Historical Stock Chart

From Aug 2024 to Sep 2024

Coterra Energy (NYSE:CTRA)

Historical Stock Chart

From Sep 2023 to Sep 2024