Buenaventura Announces Second Quarter 2022 Production and Volume Sold per Metal Results

July 14 2022 - 6:46PM

Business Wire

Compañia de Minas Buenaventura S.A.A. (“Buenaventura” or

“the Company”) (NYSE: BVN; Lima Stock Exchange: BUE.LM), Peru’s

largest publicly-traded precious metals mining company, today

announced 2Q22 results for production and volume sold.

2Q22 Production per Metal(100% basis)

1Q22(Actual) 2Q22(Actual) 6M22(Actual) 2022

UpdatedGuidance (1) Gold (Oz.)

Orcopampa

19,031

17,749

36,780

65k - 70k

Tambomayo

13,867

14,351

28,218

48k - 53k

La Zanja

5,900

4,767

10,667

37k - 45k

Coimolache

19,512

19,930

39,442

80k - 85k

El Brocal

4,350

4,457

8,807

12k - 15k

Silver (Oz.)

Uchucchacua

0

0

0

0

El Brocal

1,059,666

806,123

1,865,789

3.0M - 3.5M

Tambomayo

419,396

433,820

853,216

1.8M - 2.4M

Julcani

661,132

640,557

1,301,689

2.2M - 2.5M

Lead (MT)

El Brocal

2,497

1,306

3,803

5.0k - 6.0k

Uchucchacua

0

0

0

0

Tambomayo

2,509

2,823

5,331

6.0k - 8.0k

Zinc (MT)

El Brocal

8,772

4,146

12,918

16.0k - 20.0k

Uchucchacua

0

0

0

0

Tambomayo

3,543

3,920

7,464

8.0k - 10.0k

Copper (MT)

El Brocal

10,159

10,537

20,696

40.0k - 45.0k

- 2022 outlook projections shown above are considered

forward-looking statements and represent management’s good faith

estimates or expectations of future production results as of July

2022.

2Q22 Comments

Tambomayo:

- 2Q22 gold, lead and zinc production exceeded expectations due

to an increase in grade and metallurgical recovery. 2022 guidance

has subsequently been updated.

- 2Q22 silver production was in line with expectations for the

quarter. 2022 guidance remains unchanged.

Orcopampa:

- 2Q22 gold production exceeded expectations due to an increase

of treated ore and higher gold grades. 2022 guidance has been

updated.

Coimolache:

- Production remained stable during the quarter with higher than

expected gold production due to positive reconciliation of grades

from the Mirador Norte open pit along with improved leaching

permeability. 2022 guidance has been updated.

La Zanja:

- Partial recovery of mining rate at the Pampa Verde open pit

subsequent to Peru’s January through April rainy season.

Inflationary pressure has accelerated Buenaventura’s decision to

put the mine under care and maintenance by 4Q22 in anticipation of

oxides being largely depleted between October and December 2022.

Buenaventura will then continue to focus on Cu-Au sulfide

exploration within La Zanja’s operational footprint. Any residual

gold ounces remaining within the open pit will be recovered once La

Zanja’s Cu_Au project is confirmed. 2022 guidance remains

unchanged.

Julcani:

- 2Q22 silver production was in line with expectations. 2022

guidance remains unchanged.

Uchucchacua:

- Exploration continues at the Uchucchacua mine according to plan

with a focus on tunnels and diamond drilling during 2Q22.

Underground crews are simultaneously in the process of being

assembled in order to resume mine development during 3Q22,

targeting production restart by 2H23.

- Yumpag project continued according to plan with progress

related to construction and permitting during the second quarter.

Production is targeted to begin during the 2H23. Exploration

continued as planned at the Camila and Tomasa orebodies with

positive results which likely will increase reserves and resources

by the end of 2022.

El Brocal:

- Stable production at the underground mine at a rate of 8,000

tpd. 2Q22 copper production was in line with expectations. 2022

guidance remains unchanged.

- Tajo Norte’s silver, zinc and lead production was below

expectations during the quarter due to a change in the mine plan.

2022 guidance was updated.

- Rehabilitation work began in late June within the upper area of

the open pit which required stabilization subsequent to the March

2022 landslide.

- Polymetallic ore derived from the open pit’s low-grade

stockpiles was processed during 2Q22. This will continue during

3Q22 while rehabilitation works progresses at the open pit.

2Q22 Payable Volume Sold

2Q22 Volume Sold per Metal

(100% basis)

1Q22(Actual) 2Q22(Actual) 6M22(Actual)

Gold (Oz.)

Orcopampa

19,307

17,719

37,026

Tambomayo

12,181

12,917

25,098

La Zanja

5,773

4,452

10,225

Coimolache

20,586

20,551

41,137

El Brocal

2,907

2,590

5,496

Silver (Oz.)

Uchucchacua

18,730

139,688

158,418

El Brocal

852,933

650,260

1,503,193

Tambomayo

351,077

376,313

727,390

Julcani

636,303

605,634

1,241,937

Lead (MT)

El Brocal

2,239

1,071

3,310

Uchucchacua

0

18

18

Tambomayo

2,275

2,629

4,904

Zinc (MT)

El Brocal

7,256

3,370

10,626

Uchucchacua

0

0

0

Tambomayo

2,922

3,262

6,184

Copper (MT)

El Brocal

9,697

10,311

20,008

Realized Metal Prices*

1Q22(Actual) 2Q22(Actual) 6M22(Actual)

Gold (Oz)

1,896

1,825

1,861

Silver (Oz)

24.10

22.71

23.42

Lead (MT)

2,363

2,180

2,280

Zinc (MT)

4,105

4,489

4,257

Copper (MT)

9,950

9,073

9,498

*Buenaventura consolidated figures.

Appendix

1. 2Q22 Production per

Metal

1Q22 (Actual)

2Q22 (Actual)

6M22 (Actual)

Silver (Oz.)

Orcopampa

7,856

7,334

15,190

La Zanja

23,363

30,318

53,682

Coimolache

77,195

75,504

152,699

Lead (MT)

Julcani

99

124

224

2. 2Q22 Volume Sold per

Metal

1Q22 (Actual)

2Q22 (Actual)

6M22 (Actual)

Silver (Oz.)

Orcopampa

6,928

12,411

19,339

La Zanja

21,818

29,273

51,090

Coimolache

96,634

84,859

181,494

Lead (MT)

Julcani

76

93

168

Company Description

Compañía de Minas Buenaventura S.A.A. is Peru’s largest,

publicly traded precious and base metals Company and a major holder

of mining rights in Peru. The Company is engaged in the

exploration, mining development, processing and trade of gold,

silver and other base metals via wholly-owned mines and through its

participation in joint venture projects. Buenaventura currently

operates several mines in Peru (Orcopampa*, Uchucchacua*, Julcani*,

Tambomayo*, La Zanja*, El Brocal and Coimolache).

The Company owns 19.58% of Sociedad Minera Cerro Verde, an

important Peruvian copper producer (a partnership with

Freeport-McMorRan Inc. and Sumitomo Corporation).

For a printed version of the Company’s 2021 Form 20-F, please

contact the persons indicated above, or download a PDF format file

from the Company’s web site.

(*) Operations wholly owned by Buenaventura

Note on Forward-Looking Statements

This press release may contain forward-looking information (as

defined in the U.S. Private Securities Litigation Reform Act of

1995) that involve risks and uncertainties, including those

concerning Cerro Verde’s costs and expenses, results of

exploration, the continued improving efficiency of operations,

prevailing market prices of gold, silver, copper and other metals

mined, the success of joint ventures, estimates of future

explorations, development and production, subsidiaries’ plans for

capital expenditures, estimates of reserves and Peruvian political,

economic, social and legal developments. These forward-looking

statements reflect the Company’s view with respect to Cerro Verde’s

future financial performance. Actual results could differ

materially from those projected in the forward-looking statements

as a result of a variety of factors discussed elsewhere in this

Press Release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220714005880/en/

Contacts in Lima: Daniel Dominguez, Chief Financial

Officer (511) 419 2540

Gabriel Salas, Head of Investor Relations (511) 419

2591 / Gabriel.salas@buenaventura.pe

Contacts in NY: Barbara Cano (646) 452 2334

barbara@inspirgroup.com

Company Website: www.buenaventura.com.pe/ir

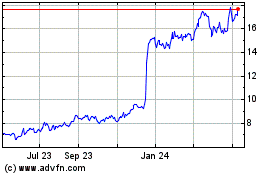

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Dec 2024 to Jan 2025

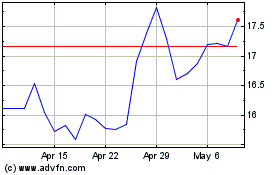

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Jan 2024 to Jan 2025