Silver Miners on the Upswing as Investors Turn to Riskier Plays

February 09 2012 - 8:20AM

Marketwired

Silver stocks have been on an impressive run in 2012. The Global X

Silver Miners ETF (SIL) is up nearly 19 percent year to date --

keeping up with the metal's 20 percent gains in 2012 -- as a steady

uptick in the broader market has pushed investors into riskier

trading avenues. The Paragon Report examines investing

opportunities in the Silver Industry and provides equity research

on First Majestic Silver Corporation (NYSE: AG) (TSX: FR) and Coeur

d'Alene Mines Corporation (NYSE: CDE) (TSX: CDM). Access to the

full company reports can be found at:

www.paragonreport.com/AG

www.paragonreport.com/CDE

With the S&P on the upswing, silver mining stocks have the

ability to keep up with -- or exceed -- the performance of silver

prices. According to The Silver Institute's most recent Silver

Investment Market Update, "the investment characteristics of silver

mining stocks are different from those of the metal, but in a

rising market they can often outperform the silver price and hence

may potentially offer healthier returns." The Silver Institute

argues that investors in silver miners not only benefit from rises

in silver prices, but also from a "stream of dividends."

The Paragon Report provides investors with an excellent first

step in their due diligence by providing daily trading ideas, and

consolidating the public information available on them. For more

investment research on the silver industry register with us free at

www.paragonreport.com and get exclusive access to our numerous

stock reports and industry newsletters.

Investments in silver miners are not without risks. The Silver

Institute argues that miners "sometimes face significant technical

challenges in accurately quantifying their ore reserves, then

mining and processing the ore profitably."

First Majestic Silver Corp. engages in the production,

development, exploration, and acquisition of mineral properties

with a focus on silver in Mexico. In January the company reported

an 8 percent rise in silver production for 2011, helped in part by

higher grades of ore, and said it expects higher output in 2012.

The company also said in a press release that it expects production

to rise to 8.9 to 9.4 million ounces of equivalent silver in 2012,

compared with 7.6 million ounces of silver equivalent produced in

2011.

The Paragon Report has not been compensated by any of the

above-mentioned publicly traded companies. Paragon Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at http://www.paragonreport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

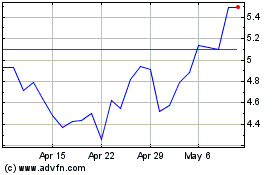

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Jun 2024 to Jul 2024

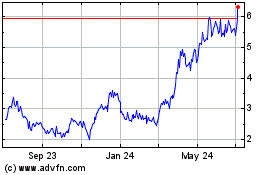

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Jul 2023 to Jul 2024