FALSE000144123600014412362024-08-062024-08-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 6, 2024

CLEARWATER PAPER CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| DE | 001-34146 | 20-3594554 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | | | | |

| 601 West Riverside, | Suite 1100 | | 99201 |

| Spokane, | WA | |

| (Address of principal executive offices) | | (Zip Code) |

(509) 344-5900

(Registrant’s telephone number, including area code)

Not Applicable

(Former name of former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchanged on which registered |

| Common Stock, par value $0.0001 per share | CLW | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 6, 2024, Clearwater Paper Corporation (the “Company”) announced its results of operations and financial condition for the second quarter ending June 30, 2024. A copy of the press release containing this announcement is furnished as Exhibit 99.1 hereto. In addition, a copy of the Company’s Second Quarter Supplemental Information is furnished as Exhibit 99.2 hereto.

In addition to disclosing financial results calculated in accordance with U.S. generally accepted accounting principles (“GAAP”), the following are disclosed in the attached Adjusted EBITDA which is defined as earnings before interest expense, taxes, depreciation and amortization, other operating credits and charges, net and other non-operating items. Adjusted EBITDA are not a substitute for the GAAP measure of net income or other GAAP measures of operating performance.

The Company discloses Adjusted EBITDA in the attached because it is used as an important supplemental measure of its performance and believes that similarly-titled measures are frequently used by securities analysts, investors and other interested persons in the evaluation of companies in its industry, some of which present similarly-titled measures when reporting their results. The Company uses Adjusted EBITDA to evaluate its performance as compared to other companies in its industry that have different financing and capital structures and/or tax rates. It should be noted that companies calculate similarly-titled measures differently and, therefore, as presented by the Company may not be comparable to similarly-titled measures reported by other companies. In addition, Adjusted EBITDA has material limitations as a performance measure because it excludes interest expense, income tax expense and depreciation and amortization which are necessary to operate the Company's business or which the Company otherwise incurred or experienced in connection with the operation of its business.

The information in Item 2.02, including Exhibits 99.1 and 99.2 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibit Index

| | | | | |

| Exhibit | Description |

| 99.1 | |

| 99.2 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: August 6, 2024

CLEARWATER PAPER CORPORATION

| | | | | |

| By: | /s/ REBECCA A. BARCKLEY |

| Rebecca A. Barckley, Vice President, Corporate Controller (Principal Accounting Officer) |

| |

Exhibit 99.1

Clearwater Paper Reports Second Quarter 2024 Results

SPOKANE, Wash.--(BUSINESS WIRE)--August 6, 2024 --Clearwater Paper Corporation (NYSE:CLW), a premier supplier of bleached paperboard and quality consumer tissue today reported financial results for the second quarter and six months ended June 30, 2024.

SECOND QUARTER HIGHLIGHTS

•Continued strong demand in tissue, improved demand in paperboard

•Completed acquisition of Augusta paperboard manufacturing facility

•Net sales of $586 million, up 12% from the second quarter of last year, primarily driven by incremental sales volume from Augusta

•Net loss of $26 million, or $1.55 per diluted share compared to $30 million income, or $1.75 per diluted share in the second quarter of last year

•Adjusted EBITDA of $35 million, $36 million less than second quarter of last year, driven by the $32 million impact from the planned major maintenance at the Lewiston, Idaho facility

"We completed the acquisition of the Augusta facility in May and our integration is on track. We are pleased with the quality of the assets and are committed to achieving our targeted synergies by the end of 2026,” said Arsen Kitch, president and chief executive officer. “Our tissue business continues to deliver outstanding performance, and we are expecting a gradual recovery in paperboard market demand in the coming quarters.”

STRATEGIC UPDATES

On July 22, 2024, the company announced that it has signed definitive agreements to sell its consumer products division (tissue business) to Sofidel America Corp. for $1.06 billion, subject to customary adjustments. The transaction is subject to regulatory approval other customary closing conditions and is currently expected to close in the fourth quarter of 2024.

“We thoroughly explored strategic options for our tissue business and believe that Sofidel will be well positioned to continue investing in these assets for long-term growth,” said Kitch. "This is a transformational time for Clearwater paper, and we are looking forward to the next chapter of value creation as we continue our strategy to scale and grow our paperboard business.”

OVERALL RESULTS

For the second quarter of 2024, Clearwater Paper reported net sales of $586 million compared to net sales of $525 million for the second quarter of 2023. Clearwater Paper reported a net loss for the second quarter of 2024 of $26 million, or $1.55 per diluted share, compared to net income for the second quarter of 2023 of $30 million, or $1.75 per diluted share. Adjusted EBITDA for the second quarter of 2024 was $35 million, compared to the second quarter of 2023 Adjusted EBITDA of $71 million.

For the first six months of 2024, Clearwater Paper reported net sales of $1.1 billion, a 3% increase compared to net sales of $1 billion for the first six months of 2023. Clearwater Paper reported a net loss for the first six months of 2024 of $9 million, or $0.52 per diluted share, compared to net income for the first six months of 2023 of $54 million, or $3.15 per diluted share. Adjusted EBITDA for the first six months of 2024 was $97 million, compared to the first six months of 2023 Adjusted EBITDA of $137 million.

Pulp and Paperboard Segment

Net sales in the Pulp and Paperboard segment were $334 million for the second quarter of 2024, up 23% compared to second quarter 2023 net sales of $272 million. Segment operating loss for the second quarter of 2024 was $12 million, compared to operating income of $42 million for the second quarter of 2023. Adjusted EBITDA for the segment was $11 million in the second quarter of 2024, compared to $51 million in the second quarter of 2023. The decrease in operating income and Adjusted EBITDA was driven by lower sales prices and the impacts of the company's planned major maintenance outage at its Lewiston, Idaho facility, partially offset by lower wood costs and an insurance recovery

realized in the second quarter of 2024 related to a significant weather event at its Lewiston, Idaho facility which occurred in the first quarter of 2024.

Net sales in the Pulp and Paperboard segment were $578 million for the first six months of 2024, up 5% compared to net sales of $551 million in the first six months of 2023. Segment operating income for the first six months of 2024 was $13 million, compared to $99 million for the first six months of 2023. Adjusted EBITDA for the segment was $45 million in the first six months of 2024, compared to $118 million in the first six months of 2023. The decrease in operating income and Adjusted EBITDA was primarily driven by lower sales prices and the impacts of the company's planned major maintenance outage at its Lewiston Idaho facility, partially offset by lower wood costs.

Pulp and Paperboard Sales Volumes and Prices:

• Paperboard sales volumes were 272,585 tons in the second quarter of 2024, an increase of 46% compared to 186,160 tons in the second quarter of 2023. Paperboard sales volumes were 459,888 tons in the first six months of 2024, an increase of 22.5% compared to 375,558 tons in the first six months of 2023.

• Paperboard average net selling price decreased 14% to $1,216 per ton for the second quarter of 2024, compared to $1,413 per ton in the second quarter of 2023. Paperboard average net selling price decreased 13% to $1,244 per ton for the first six months of 2024, compared to $1,428 per ton in the first six months of 2023.

Consumer Products Segment

Net sales in the Consumer Products segment were $253 million for the second quarter of 2024, flat compared to second quarter 2023 net sales of $254 million. Segment operating income for the second quarter of 2024 was $27 million compared to operating income of $25 million in the second quarter of 2023. Adjusted EBITDA for the segment was $41 million in the second quarter of 2024, compared to $40 million in the second quarter of 2023. The increases in operating income and Adjusted EBITDA were driven by higher volumes and lower input costs partially offset by lower sales prices.

Net sales in the Consumer Products segment were $506 million for the first six months of 2024, up 1% compared to net sales of $502 million in the first six months of 2023. Segment operating income for the first six months of 2024 was $59 million compared to operating income of $29 million in the first six months of 2023. Adjusted EBITDA for the segment was $87 million in the first six months of 2024, compared to $59 million in the first six months of 2023. The increase in operating income and Adjusted EBITDA was driven by higher volumes and lower input costs offset by lower sales prices.

Retail Tissue Sales Volumes and Prices:

• Retail tissue volumes sold were 81,196 tons in the second quarter of 2024, an increase of 3% compared to 78,672 tons in the second quarter of 2023. Retail tissue volumes sold were 161,125 tons in the first six months of 2024, an increase of 4% compared to 155,520 tons in the first six months of 2023.

• Retail tissue average net selling price decreased 3% to $3,104 per ton in the second quarter of 2024, compared to $3,214 per ton in the second quarter of 2023. Retail tissue average net selling price decreased 3% to 3,121 per ton in the first six months of 2024, compared to $3,207 per ton in the first six months of 2023.

COMPANY OUTLOOK

“We remain confident in the long-term fundamentals of the paperboard market and expect gradual demand recovery for the balance of 2024 and into 2025. We currently expect to close the sale of our tissue business in the fourth quarter of 2024, subject to customary closing conditions and regulatory approval. Our plan is to use the proceeds to de-lever our balance sheet and continue executing our strategy to grow and diversify our paperboard product portfolio,” continued Kitch.

WEBCAST INFORMATION

Clearwater Paper Corporation will discuss these results during an earnings conference call that begins at 2:00 p.m. Pacific Time today. A live webcast and accompanying supplemental information will be available on the company's website. A replay of today's conference call will be available on the website beginning at 5:00 p.m. Pacific Time today.

ABOUT CLEARWATER PAPER

Clearwater Paper is a premier supplier of paperboard and private brand tissue. The company’s paperboard operations serve quality-conscious printers and packaging converters, with services that include custom sheeting, slitting, and cutting. The company’s tissue operations serve private brand market retail customers including grocery, club, mass merchants, and discount stores. Clearwater Paper’s employees build shareholder value by developing strong relationships through quality and service. For more information on Clearwater Paper, please visit our website at www.clearwaterpaper.com.

USE OF NON-GAAP MEASURES

In this press release, the company presents certain non-GAAP financial information for the second quarter and first six months of 2024 and 2023, including adjusted income and Adjusted EBITDA. Because these amounts are not in accordance with GAAP, reconciliations to net income as determined in accordance with GAAP are included in the tables at the end of this press release. The company presents these non-GAAP metrics because management believes they assist investors and analysts in comparing the company's performance across reporting periods on a consistent basis by excluding items that the company does not believe are indicative of its core operating performance. In addition, the company uses Adjusted EBITDA: (i) as a factor in evaluating management’s performance when determining incentive compensation, (ii) to evaluate the effectiveness of the company's business strategies, and (iii) because the company's credit agreement and the indentures governing the company's outstanding notes use metrics similar to Adjusted EBITDA to measure the company's compliance with certain covenants.

FORWARD-LOOKING STATEMENTS

This press release contains certain “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995 as amended, including statements regarding: the acquisition of the paperboard manufacturing facility and associated business in Augusta, Georgia; our expectations regarding tissue performance and paperboard demand; the expected timing and structure of the pending consumer products division (tissue business) sale transaction; the ability of the parties to complete the pending tissue business sale transaction considering the various closing conditions; the company’s paperboard strategy, including its plans to further scale and increase capacity utilization; the company’s plans for the proceeds from the pending tissue business sale transaction, including its plan to meaningfully de-lever its balance sheet; and the company’s expectation that paperboard represents the best opportunity for steady and sustainable value creation. These forward-looking statements are based on management’s current expectations, estimates, assumptions and projections that are subject to change. Our actual results of operations may differ materially from those expressed or implied by the forward-looking statements contained in this press release. Factors that could cause or contribute to such material differences in actual results include, but are not limited to: one or more closing conditions to the pending tissue business sale transaction, including certain regulatory approvals, may not be satisfied or waived, on a timely basis or otherwise; the tissue business sale transaction may not be completed in the time frame expected by the parties, or at all; there may be unexpected costs, charges or expenses resulting from the pending tissue business sale transaction; there may be stockholder litigation in connection with the pending tissue business sale transaction or the acquisition of the Augusta, Georgia paperboard manufacturing facility or other settlements or investigations may affect the timing or occurrence of the pending tissue business sale transaction or result in significant costs of defense, indemnification and liability; our inability to realize the expected benefits of the Augusta, Georgia paperboard manufacturing facility acquisition because of integration difficulties or other challenges; risks relating to the integration of the Augusta, Georgia paperboard manufacturing facility and achievement of anticipated financial results and other benefits of the acquisition; competitive pricing pressures for our products, including as a result of capacity additions, demand reduction and the impact of foreign currency fluctuations on the pricing of products globally; changes in the U.S. and international economies and in general economic conditions in the regions and industries in which we operate; manufacturing or operating disruptions, including equipment malfunctions and damage to our manufacturing facilities; the loss of, changes in prices in regard to, or reduction in, orders from a significant customer; changes in the cost and availability of wood fiber and wood pulp; changes in energy, chemicals, packaging and transportation costs and disruptions in transportation services impacting our ability to receive inputs or ship products to customers; reliance on a limited number of third-party suppliers, vendors and service providers required for the production of our products and our operations; changes in customer product preferences and competitors’ product offerings; cyber-security risks; larger competitors having operational, financial and other advantages; consolidation and vertical integration of converting operations in the paperboard industry; our ability to successfully execute capital

projects and other activities to operate our assets, including effective maintenance, implement our operational efficiencies and realize higher throughput or lower costs; IT system disruptions and IT system implementation failures; labor disruptions; cyclical industry conditions; changes in expenses, required contributions and potential withdrawal costs associated with our pension plans; environmental liabilities or expenditures and climate change; our ability to attract, motivate, train and retain qualified and key personnel; our ability to service our debt obligations and restrictions on our business from debt covenants and terms; changes in our banking relations, or in our customer supply chain financing; negative changes in our credit agency ratings; changes in laws, regulations or industry standards affecting our business; and other risks and uncertainties described from time to time in the company’s public filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2023. The forward-looking statements are made as of the date of this press release and the company does not undertake to update any forward-looking statements based on new developments or changes in the company’s expectations after the date of this press release.

| | | | | | | | | | | | | | | | | |

| Clearwater Paper Corporation |

| Consolidated Statements of Operations |

| (Unaudited) |

| | | | |

| Quarter Ended June 30, | | Six Months Ended June 30, |

| (In millions, except per-share data) | 2024 | 2023 | | 2024 | 2023 |

| Net sales | $ | 586.4 | | $ | 524.6 | | | $ | 1,082.6 | | $ | 1,050.0 | |

| Costs and expenses: | | | | | |

| Cost of sales | 550.8 | | 438.7 | | | 972.5 | | 887.2 | |

| Selling, general and administrative expenses | 38.0 | | 39.1 | | | 74.3 | | 75.1 | |

Other operating (income) charges, net 1 | 17.0 | | (0.4) | | | 25.0 | | 0.6 | |

| Total operating costs and expenses | 605.9 | | 477.3 | | | 1,071.7 | | 962.9 | |

| Income (loss) from operations | (19.5) | | 47.3 | | | 10.9 | | 87.1 | |

| Interest expense, net | (16.0) | | (7.5) | | | (22.6) | | (15.1) | |

| | | | | |

| Other non-operating income | 0.3 | | 0.1 | | | 0.7 | | 0.2 | |

| Total non-operating expense | (15.7) | | (7.4) | | | (21.9) | | (14.9) | |

| Income (loss) before income taxes | (35.2) | | 39.9 | | | (11.0) | | 72.1 | |

| Income tax provision (benefit) | (9.4) | | 10.2 | | | (2.4) | | 18.6 | |

| Net income (loss) | $ | (25.8) | | $ | 29.7 | | | $ | (8.6) | | $ | 53.5 | |

| | | | | |

| Net income (loss) per common share: | | | | | |

| Basic | $ | (1.55) | | $ | 1.76 | | | $ | (0.52) | | $ | 3.18 | |

| Diluted | (1.55) | | 1.75 | | | (0.52) | | 3.15 | |

| | | | | |

| Average shares outstanding (in thousands): | | | |

| Basic | 16,661 | | 16,865 | | | 16,634 | | 16,849 | |

| Diluted | 16,661 | | 16,958 | | | 16,634 | | 17,003 | |

1 Other operating charges, net consist of amounts unrelated to ongoing core operating activities. Please refer to Note 11 within Clearwater Paper's Form 10-Q filed with the SEC for the period ended June 30, 2024 for the detailed breakout of this amount.

| | | | | | | | |

| Clearwater Paper Corporation |

| Condensed Consolidated Balance Sheets |

| (Unaudited) |

| | |

| (In millions) | June 30, 2024 | December 31, 2023 |

| Assets | | |

| Current assets: | | |

| Cash and cash equivalents | $ | 39.6 | | $ | 42.0 | |

| Receivables, net | 255.8 | | 184.5 | |

| Inventories, net | 420.2 | | 319.8 | |

| Other current assets | 18.3 | | 17.9 | |

| Total current assets | 733.9 | | 564.1 | |

| Property, plant and equipment, net | 1,605.1 | | 990.1 | |

| Goodwill and intangible assets, net | 54.1 | | 41.5 | |

| Other assets, net | 85.3 | | 76.1 | |

| Total assets | $ | 2,478.4 | | $ | 1,671.8 | |

| | |

| Liabilities and stockholders' equity | | |

| Current liabilities: | | |

| Current portion of long-term debt | $ | 5.2 | | $ | 0.8 | |

| Accounts payable and accrued liabilities | 418.1 | | 285.1 | |

| Total current liabilities | 423.3 | | 286.0 | |

| Long-term debt | 1,137.9 | | 462.3 | |

| Liability for pension and other postretirement employee benefits | 54.7 | | 55.7 | |

| Deferred tax liabilities and other long-term obligations | 204.0 | | 199.1 | |

| Total liabilities | 1,819.8 | | 1,003.0 | |

| | |

| Stockholders' equity: | | |

| Common stock | — | | — | |

| Additional paid-in capital | 13.5 | | 14.9 | |

| Retained earnings | 675.8 | | 684.5 | |

| Accumulated other comprehensive loss, net of tax | (30.7) | | (30.7) | |

| Total stockholders' equity | 658.6 | | 668.8 | |

| Total liabilities and stockholders' equity | $ | 2,478.4 | | $ | 1,671.8 | |

| | | | | | | | | | | | | | | | | |

| Clearwater Paper Corporation |

| Consolidated Statements of Cash Flows |

| (Unaudited) |

| Quarter Ended June 30, | | Six Months Ended June 30, |

| (In millions) | 2024 | 2023 | | 2024 | 2023 |

| Operating activities | | | | | |

| Net income (loss) | $ | (25.8) | | $ | 29.7 | | | $ | (8.6) | | $ | 53.5 | |

| Adjustments to reconcile net income (loss) to net cash flows provided by operating activities: | | | | | |

| Depreciation and amortization | 30.9 | | 24.6 | | | 54.1 | | 49.4 | |

| Equity-based compensation expense | 4.7 | | 1.5 | | | 8.1 | | 3.4 | |

| Deferred taxes | (3.5) | | (1.6) | | | (5.1) | | (2.9) | |

| Defined benefit pension and other postretirement employee benefits | (0.8) | | (0.6) | | | (1.7) | | (1.1) | |

| Amortization of deferred debt costs | 0.7 | | 0.3 | | | 1.1 | | 0.6 | |

| Loss on sale or impairment associated with assets | 0.7 | | — | | | 0.8 | | 1.1 | |

| Changes in operating assets and liabilities, excluding the effects of acquired business: | | | | | |

| Increase in accounts receivable | (65.6) | | (7.7) | | | (57.8) | | (14.1) | |

| (Increase) decrease in inventories | 9.2 | | 5.3 | | | 1.0 | | (17.0) | |

| (Increase) decrease in other current assets | 2.3 | | 5.4 | | | — | | 5.8 | |

| Increase (decrease) in accounts payable and accrued liabilities | 69.4 | | (10.7) | | | 89.9 | | (42.5) | |

| Other, net | (1.2) | | (0.1) | | | (1.5) | | 0.6 | |

| Net cash flows provided by operating activities | 21.1 | | 46.0 | | | 80.3 | | 36.9 | |

| Investing activities | | | | | |

| Additions to property, plant and equipment, net | (18.1) | | (12.8) | | | (36.6) | | (34.3) | |

| Acquisition of business | (708.2) | | — | | | (708.2) | | — | |

| Net cash flows used in investing activities | (726.3) | | (12.8) | | | (744.8) | | (34.3) | |

| Financing activities | | | | | |

| Borrowings on long-term debt | 726.7 | | — | | | 723.5 | | 12.0 | |

| Repayments of long-term debt | (30.3) | | (0.2) | | | (50.5) | | (12.5) | |

| Repurchases of common stock | (3.0) | | (8.4) | | | (3.5) | | (10.1) | |

| Payments of debt issuance costs | (4.1) | | — | | | (4.5) | | (0.1) | |

| Other, net | 0.2 | | (0.4) | | | (2.9) | | (4.6) | |

| Net cash flows provided by (used in) financing activities | 689.6 | | (8.9) | | | 662.1 | | (15.3) | |

| | | | | |

| Increase (decrease) in cash, cash equivalents | (15.6) | | 24.3 | | | (2.4) | | (12.7) | |

| Cash and cash equivalents at beginning of period | 55.2 | | 17.4 | | | 42.0 | | 54.4 | |

| Cash and cash equivalents at end of period | $ | 39.6 | | $ | 41.7 | | | $ | 39.6 | | $ | 41.7 | |

| | | | | | | | | | | | | | | | | |

| Clearwater Paper Corporation |

| Segment Information |

| (Unaudited) |

| | | | |

| Quarter Ended June 30, | | Six Months Ended June 30, |

| (In millions) | 2024 | 2023 | | 2024 | 2023 |

| Segment net sales: | | | | | |

| Pulp and Paperboard | $ | 333.6 | | $ | 272.3 | | | $ | 578.1 | | $ | 551.0 | |

| Consumer Products | 252.8 | | 253.6 | | | 505.9 | | 502.0 | |

| Eliminations | — | | (1.3) | | | (1.4) | | (3.0) | |

| Total segment net sales | $ | 586.4 | | $ | 524.6 | | | $ | 1,082.6 | | $ | 1,050.0 | |

| | | | | |

| Operating income (loss): | | | | | |

| Pulp and Paperboard | $ | (12.2) | | $ | 42.0 | | | $ | 13.1 | | $ | 99.1 | |

| Consumer Products | 27.4 | | 25.0 | | | 59.0 | | 29.2 | |

| Corporate and eliminations | (17.7) | | (20.1) | | | (36.2) | | (40.6) | |

Other operating (income) charges, net 1 | (17.0) | | 0.4 | | | (25.0) | | (0.6) | |

| Income (loss) from operations | $ | (19.5) | | $ | 47.3 | | | $ | 10.9 | | $ | 87.1 | |

1 Other operating charges, net consist of amounts unrelated to ongoing core operating activities. Please refer to Note 11 within Clearwater Paper's Form 10-Q filed with the SEC for the period ended June 30, 2024 for the detailed breakout of this amount.

| | | | | | | | | | | | | | | | | |

| Clearwater Paper Corporation |

| Reconciliation of Non-GAAP Financial Measures |

| Adjusted EBITDA |

| (Unaudited) |

| | | |

| Quarter Ended June 30, | | Six Months Ended June 30, |

| (In millions) | 2024 | 2023 | | 2024 | 2023 |

| Net income (loss) | $ | (25.8) | | $ | 29.7 | | | $ | (8.6) | | $ | 53.5 | |

| Add back: | | | | | |

| Income tax provision (benefit) | (9.4) | | 10.2 | | | (2.4) | | 18.6 | |

| Interest expense, net | 16.0 | | 7.5 | | | 22.6 | | 15.1 | |

| Depreciation and amortization | 30.9 | | 24.6 | | | 54.1 | | 49.4 | |

| Inventory revaluation on acquired business | 6.8 | | — | | | 6.8 | | — | |

Other operating (income) charges, net 1 | 17.0 | | (0.4) | | | 25.0 | | 0.6 | |

| Other non-operating income | (0.3) | | (0.1) | | | (0.7) | | (0.2) | |

| Adjusted EBITDA | $ | 35.3 | | $ | 71.5 | | | $ | 96.8 | | $ | 137.2 | |

| | | | | |

| Pulp and Paperboard segment income (loss) | $ | (12.2) | | $ | 42.0 | | | $ | 13.1 | | $ | 99.1 | |

| Inventory revaluation on acquired business | 6.8 | | — | | | 6.8 | | — | |

| Depreciation and amortization | 16.5 | | 9.3 | | | 24.8 | | 18.5 | |

| Adjusted EBITDA Pulp and Paperboard | $ | 11.1 | | $ | 51.3 | | | $ | 44.8 | | $ | 117.6 | |

| | | | | |

| Consumer Products segment income | $ | 27.4 | | $ | 25.0 | | | $ | 59.0 | | $ | 29.2 | |

| Depreciation and amortization | 14.0 | | 14.7 | | | 28.2 | | 29.7 | |

| Adjusted EBITDA Consumer Products | $ | 41.4 | | $ | 39.7 | | | $ | 87.1 | | $ | 58.9 | |

| | | | | |

| Corporate and other expenses | $ | (17.7) | | $ | (20.1) | | | $ | (36.2) | | $ | (40.6) | |

| Depreciation and amortization | 0.5 | | 0.6 | | | 1.1 | | 1.2 | |

| Adjusted EBITDA Corporate and other | $ | (17.2) | | $ | (19.5) | | | $ | (35.1) | | $ | (39.3) | |

| | | | | |

| Pulp and Paperboard segment | $ | 11.1 | | $ | 51.3 | | | $ | 44.8 | | $ | 117.6 | |

| Consumer Products segment | 41.4 | | 39.7 | | | 87.1 | | 58.9 | |

| Corporate and other | (17.2) | | (19.5) | | | (35.1) | | (39.3) | |

| Adjusted EBITDA | $ | 35.3 | | $ | 71.5 | | | $ | 96.8 | | $ | 137.2 | |

1 Other operating charges, net consist of amounts unrelated to ongoing core operating activities. Please refer to Note 11 within Clearwater Paper's Form 10-Q filed with the SEC for the period ended June 30, 2024 for the detailed breakout of this amount.

| | | | | | | | | | | | | | | | | |

| Clearwater Paper Corporation |

| Reconciliation of Non-GAAP Financial Measures |

| (Unaudited) |

| | | |

| June 30, 2024 | March 31, 2024 | | December 31, 2023 | |

| Calculation of net debt: | | | | | |

| Current portion of long-term debt | $ | 5.2 | | $ | 0.9 | | | $ | 0.8 | | |

| Long-term debt | 1,137.9 | | 442.3 | | | 462.3 | | |

| Add back: | | | | | |

| Unamortized deferred debt costs | 14.2 | | 4.9 | | | 5.1 | | |

| Less: | | | | | |

| Cash and cash equivalents | 39.6 | | 55.2 | | | 42.0 | | |

| Net debt | $ | 1,117.6 | | $ | 392.9 | | | $ | 426.3 | | |

Clearwater Paper Corporation

Investors contact:

Sloan Bohlen

Solebury Strategic Communications

509-344-5906

investorinfo@clearwaterpaper.com

News media:

Jules Joy, Director, Corporate Communications

509-344-5967

Julia.joy@clearwaterpaper.com

CLEARWATER PAPER CORPORATION SECOND QUARTER EARNINGS RELEASE MATERIALS AUGUST 6, 2024 ARSEN KITCH President, Chief Executive Officer and Director SHERRI BAKER Senior Vice President and Chief Financial Officer

Cautionary Statement Regarding Forward Looking Statements This presentation of supplemental information contains, in addition to historical information, certain “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995 as amended, including statements regarding: the recent acquisition of the paperboard manufacturing facility and associated business in Augusta, Georgia; the expected impact, benefits and opportunities resulting from the Augusta acquisition; the Company’s intention to focus on growth in paperboard; order patterns; product demand and industry trends; production targets; impact of inflation of raw material and energy; assumptions for Q3 2024 and full year 2024, including maintenance outage impacts, operational factors, interest, capital, lower input costs, depreciation and amortization and income tax; our capital allocation priorities; our strategy, including achieving target leverage ratio and maintaining liquidity; expectations regarding the paperboard and tissue markets; inventory management; our financial flexibility; and repurchases under existing share buyback authorization. These forward-looking statements are based on management’s current expectations, estimates, assumptions and projections that are subject to change. Our actual results of operations may differ materially from those expressed or implied by the forward-looking statements contained in this presentation. Important factors that could cause or contribute to such differences include the risks and uncertainties described from time to time in the Company's public filings with the Securities and Exchange Commission, including but not limited to the following: our inability to realize the expected benefits of the Augusta, Georgia paperboard manufacturing facility acquisition because of integration difficulties or other challenges; risks relating to the integration of the Augusta, Georgia paperboard manufacturing facility and achievement of anticipated financial results and other benefits of the acquisition; competitive pricing pressures for our products, including as a result of capacity additions, demand reduction and the impact of foreign currency fluctuations on the pricing of products globally; the loss of, changes in prices in regard to, or reduction in, orders from a significant customer; changes in the cost and availability of wood fiber and wood pulp; changes in energy, chemicals, packaging and freight costs and disruptions in transportation services impacting our ability to receive inputs or ship products to customers; changes in customer product preferences and competitors' product offerings; larger competitors having operational, financial and other advantages; consolidation and vertical integration of converting operations in the paperboard industry; changes in the U.S. and international economies and in general economic conditions in the regions and industries in which we operate; manufacturing or operating disruptions, including equipment malfunctions and damage to our manufacturing facilities; cyber-security risks; our ability to successfully execute capital projects and other activities to operate our assets, including effective maintenance, implement our operational efficiencies and realize higher throughput or lower costs; IT system disruptions and IT system implementation failures; labor disruptions; cyclical industry conditions; changes in expenses, required contributions and potential withdrawal costs associated with our pension plans; environmental liabilities or expenditures and climate change; reliance on a limited number of third-party suppliers, vendors and service providers required for the production of our products and our operations; our ability to attract, motivate, train and retain qualified and key personnel; our ability to service our debt obligations and restrictions on our business from debt covenants and terms; changes in our banking relations, or in our customer supply chain financing; negative changes in our credit agency ratings; and changes in laws, regulations or industry standards affecting our business. Forward-looking statements contained in this presentation present management’s views only as of the date of this presentation. We undertake no obligation to publicly update forward-looking statements or to retract future revisions of management's views based on events or circumstances occurring after the date of this presentation. Non-GAAP Financial Measures This presentation includes certain financial measures that are not calculated in accordance with GAAP, including Adjusted EBITDA, free cash flow and net debt. The Company’s management believes that the presentation of these financial measures provides useful information to investors because these measures are regularly used by management in assessing the Company’s performance. These financial measures should be considered in addition to results prepared in accordance with GAAP but should not be considered substitutes for or superior to GAAP results. In addition, these non-GAAP financial measures may not be comparable to similarly-titled measures utilized by other companies, since such other companies may not calculate such measure in the same manner as we do. A reconciliation of these measures (Adjusted EBITDA, free cash flow and net debt) to the most relevant GAAP measure is available in the appendix of this presentation. FORWARD LOOKING STATEMENTS © Clearwater Paper Corporation 2024 2

Overall • Net sales $586 million, up 12% versus Q2 2023 • Net loss $26 million compared to net income $30 million in Q2 2023 • Adjusted EBITDA $35 million compared to $72 million in Q2 2023 Pulp and Paperboard • SBS prices down 14% versus Q2 2023, 5% lower versus Q1 2024 • Completed acquisition of Augusta paperboard facility; on track with integration • $32 million impact from the planned major maintenance at Lewiston pulp and paperboard facility Consumer Products • Tissue prices down 3% versus Q2 2023, 1% lower than Q1 2024 • Demand for private branded products remained strong • Strong operational performance and reduced input costs Capital Structure • Continued to maintain strong financial flexibility • Repurchased $3 million of stock to offset dilution, with $3 million remaining authorized under our stock repurchase program Q2 2024 BUSINESS HIGHLIGHTS © Clearwater Paper Corporation 2024 3

Industry (SBS) • Shipments increased in Q2 2024 versus Q1 2024 based on AF&PA data • Shipments (in tons) improved 0.9% from Q1 2024 • Production declined 6% from Q1 2024, inventory levels dropped 16% • Operating rates were flat at about 84% in Q2 2024 and Q1 2024 • RISI projecting gradual demand recovery into 2025 Clearwater Paper • Price down 14% in Q2 2024 versus Q2 2023, down 5% versus Q1 2024 • Completed planned major maintenance at our Lewiston, ID facility in Q3 2024; Q2 2024 impact of $32M • On track with integration of Augusta paperboard facility BUSINESS UPDATE – PULP AND PAPERBOARD IMPROVING DEMAND AND STEADY CAPACITY UTILIZATION © Clearwater Paper Corporation 2024 4

Industry • Consumers continue to shift to private brands with economic uncertainty and inflation • Private brand market share increased to 38%1 • Over 95% capacity utilization YTD May 2024 based on RISI data Clearwater Paper • Strong demand with Q2 2024 shipments of 13.3 million cases compared to 12.8 million cases in Q2 2023 and 13.1 million in Q1 2024 • Solid operational performance continued • Outstanding service levels with high on-time performance rates • Lower input costs in pulp, energy and freight as compared to Q2 2023, with increased pulp costs between Q1 2024 and Q2 2024 BUSINESS UPDATE – CONSUMER PRODUCTS SHIPMENTS STRENGTHENED; DEMAND REMAINED STRONG © Clearwater Paper Corporation 2024 5 1 Circana panel data for dollar share as of June 2024

© Clearwater Paper Corporation 2024 FINANCIAL PERFORMANCE ($ IN MILLIONS, EXCEPT PER SHARE AMOUNTS) 6 2024 2023 2024 2023 Net sales 586.4$ 524.6$ 1,082.6$ 1,050.0$ Cost of sales 550.8 438.7 972.5 887.2 Selling, general and adminstrative 38.0 39.1 74.3 75.1 Other operating charges, net 17.0 (0.4) 25.0 0.6 Income (loss) from operations (19.5) 47.3 10.9 87.1 Non-operating expense (15.7) (7.4) (21.9) (14.9) Income tax (benefit) provision (9.4) 10.2 (2.4) 18.6 Net income (loss) (25.8)$ 29.7$ (8.6)$ 53.5$ Diluted income (loss) per share (1.55)$ 1.75$ (0.52)$ 3.15$ Adjusted EBITDA 35.3$ 71.5$ 96.8$ 137.2$ June 30, June 30, Quarter Ended Year to date

© Clearwater Paper Corporation 2024 SEGMENT PROFIT AND LOSS AND ADJUSTED EBITDA ($ IN MILLIONS) 2024 2023 2024 2023 Net Sales Pulp and Paperboard 333.6$ 272.3$ 578.1$ 551.0$ Consumer Products 252.8 253.6 505.9 502.0 Eliminations - (1.3) (1.4) (3.0) 586.4$ 524.6$ 1,082.6$ 1,050.0$ Operating Income Pulp and Paperboard (12.2)$ 42.0$ 13.1$ 99.1$ Consumer Products 27.4 25.0 59.0 29.2 Corporate and other (17.7) (20.1) (36.2) (40.6) Other operating charges, net (17.0) 0.4 (25.0) (0.6) (19.5)$ 47.3$ 10.9$ 87.1$ Adjusted EBITDA Pulp and Paperboard 11.1$ 51.3$ 44.8$ 117.6$ Consumer Products 41.4 39.7 87.1 58.9 Corporate and other (17.2) (19.5) (35.1) (39.3) 35.3$ 71.5$ 96.8$ 137.2$ June 30, June 30, Quarter Ended Year to Date 7

PULP AND PAPERBOARD Q2 2024 RESULTS Q2 2023 VS. Q2 2024 ADJUSTED EBITDA ($ IN MILLIONS) © Clearwater Paper Corporation 2024 8 Lower pricing Planned major maintenance offset by insurance recovery and lower input costs Higher sales volume offset by lower production from outage

CONSUMER PRODUCTS Q2 2024 RESULTS Q2 2023 VS. Q2 2024 ADJUSTED EBITDA ($ IN MILLIONS) © Clearwater Paper Corporation 2024 9 Lower pulp and freight costs Lower index based pricing and higher mix of conventional products Higher production and sales volume

© Clearwater Paper Corporation 2024 CAPITAL STRUCTURE AND ALLOCATION Capital structure summary • Ample liquidity • No material near-term debt maturities • Corporate/Issuer ratings: Ba2/BB- Capital allocation • Repurchased 64,000 shares at an average price of $46.95 per share in Q2 2024 • $730M additional debt to fund closing of Augusta acquisition on May 1 • Reduced net debt by $30 million post Augusta acquisition • Leverage ratio as of June 2024 is 3.58x $0 $5 $5 $95 $275 $360 $0 $395 2024 2025 2026 2027 2028 2029 2030 2031 Scheduled Debt Maturity Profile ($ in millions)2 Liquidity Profile ($ in millions)1 ABL Availability $278.2 Less Utilization (93.7) Plus Unrestricted Cash 39.6 Liquidity $224.1 1. ABL availability based on borrowing base calculations and consolidated balance sheet as of June 30, 2024, maximum capacity is $275 million 2. This chart excludes finance leases as of June 30, 2024. 10

OUTLOOK FOR Q3’24 AND 2024 OVERALL ASSUMPTIONS © Clearwater Paper Corporation 2024 Q3 2024: $58 to $68 million1 of adjusted EBITDA • Increasing paperboard demand and production volumes • Lower maintenance outage cost impact • Continued strong performance in tissue, partly offset by higher pulp costs FY 2024 operational assumptions vs. FY 20232 • Maintaining tissue margin improvement achieved in 2023 • $69 - $74 million planned major maintenance outage at Lewiston and Augusta sites • $40 - $50 million lower paperboard pricing partly offset by lower input costs • $55 - $70 million improved paperboard demand and contribution from Augusta 2024 other assumptions • Interest expense: $63 to $67 million • Depreciation and amortization expense: $120 to $125 million • CAPEX: $115 to $125 million, inclusive of Augusta • Taxes: effective rate ~25 to 26% 11 1 As there is uncertainty in connection with calculating the adjustments necessary to prepare reconciliations from Adjusted EBITDA to the comparable GAAP financial measure, the Company is unable to reconcile the Adjusted EBITDA projections without unreasonable efforts. Therefore, no reconciliation is being provided at this time. These items could result in significant adjustments from the most comparable GAAP measure. 2 Does not contemplate CPD divestiture

APPENDIX © Clearwater Paper Corporation 2024 12

PULP AND PAPERBOARD SEQUENTIAL QUARTER RESULTS Q1 2024 VS. Q2 2024 ADJUSTED EBITDA © Clearwater Paper Corporation 2024 13 ($ IN MILLIONS) Lower pricing Planned major outage offset by insurance recovery and lower input costs Higher sales volume offset by lower production from outage

CONSUMER PRODUCTS SEQUENTIAL QUARTER RESULTS Q1 2024 VS. Q2 2024 ADJUSTED EBITDA ($ IN MILLIONS) © Clearwater Paper Corporation 2024 14 Lower index driven pricing Higher pulp costs offset by lower mill costs Lower production

KEY SEGMENT INFORMATION Q2’2022 Q3’2022 Q4’2022 Q1’2023 Q2’2023 Q3’2023 Q4’2023 Q1’2024 Q2’2024 Pulp and Paperboard Sales ($ millions) $295.8 $300.8 $273.5 $278.8 $272.3 $261.4 $251.3 $244.5 $333.6 Adjusted EBITDA ($ millions) $61.2 $73.0 $26.7 $66.2 $51.3 $53.1 $36.8 $33.7 $11.1 Paperboard shipments (short tons) 215.9 208.3 189.0 189.4 186.2 187.9 188.0 187.3 272.6 Paperboard sales price ($/short ton) $1,332 $1,405 $1,429 $1,441 $1,413 $1,350 $1,297 $1,284 $1,216 Consumer Products Sales ($ millions) $232.1 $240.9 $254.1 $248.3 $253.6 $259.3 $262.0 $253.1 $252.8 Adjusted EBITDA ($ millions) $19.1 $21.2 $17.6 $19.2 $39.7 $45.8 $45.7 $45.7 $41.4 Shipments Retail (short tons in thousands) 76.6 76.9 80.8 76.8 78.7 80.5 81.5 79.9 81.2 Non-Retail (short tons in thousands) 2.6 2.3 2.2 1.0 0.1 1.4 2.3 2.3 0.4 Converted Products (cases in millions) 12.6 12.6 13.0 12.7 12.8 13.0 13.5 13.1 13.3 Sales Price ($ per short ton) Retail $2,984 $3,082 $3,095 $3,201 $3,214 $3,198 $3,187 $3,138 $3,104 Production Converted Products (cases in millions) 12.1 12.9 12.3 12.7 12.6 12.9 13.0 13.3 13.2 © Clearwater Paper Corporation 2024 15

RECONCILIATION OF ADJUSTED EBITDA ($ IN MILLIONS) March 31, 2024 2023 2024 2024 2023 Net income (loss) $ (25.8) $ 29.7 $ 17.2 $ (8.6) $ 53.5 Income tax (benefit) provision (9.4) 10.2 7.0 (2.4) 18.6 Interest expense, net 16.0 7.5 6.5 22.6 15.1 Depreciation and amortization expense 30.9 24.6 23.2 54.1 49.4 Inventory revaluation on acquired business 6.8 - - 6.8 - Other operating charges, net 17.0 (0.4) 7.9 25.0 0.6 Other non-operating expense (0.3) (0.1) (0.3) (0.7) (0.2) Adjusted EBITDA $ 36.3 $ 71.5 $ 61.5 $ 96.8 $ 137.2 Pulp and Paperboard segment income $ (12.2) $ 42.0 $ 25.3 $ 13.1 $ 99.1 Depreciation and amortization 16.5 9.3 8.4 24.8 18.5 Inventory revaluation on acquired business 6.8 - - 6.8 - Adjusted EBITDA Paperboard segment $ 11.1 $ 51.3 $ 33.7 $ 44.8 $ 117.6 Consumer Products segment income $ 27.4 $ 25.0 $ 31.5 $ 59.0 $ 29.2 Depreciation and amortization 14.0 14.7 14.2 28.2 29.7 Adjusted EBITDA Consumer Products segment $ 41.4 $ 39.7 $ 45.7 $ 87.1 $ 58.9 Corporate and other expense $ (17.7) $ (20.1) $ (18.5) $ (36.2) $ (40.6) Depreciation and amortization 0.5 0.6 0.6 1.1 1.2 Adjusted EBITDA Corporate and other $ (17.2) $ (19.5) $ (17.9) $ (35.1) $ (39.3) Pulp and Paperboard segment $ 11.1 $ 51.3 $ 33.7 $ 44.8 $ 117.6 Consumer Products segment 41.4 39.7 45.7 87.1 58.9 Corporate and other (17.2) (19.5) (17.9) (35.1) (39.3) Adjusted EBITDA $ 35.3 $ 71.5 $ 61.5 $ 96.8 $ 137.2 June 30, June 30, Six Months EndedQuarter Ended © Clearwater Paper Corporation 2024 16

ADDITIONAL RECONCILIATIONS Net Debt Jun 30 ‘22 Sep 30 ‘22 Dec 31 ‘22 Mar 31 ’23 Jun 30 ‘23 Sep 30 ‘23 Dec 31 ‘23 Mar 31‘24 Jun 30’24 Cash $69.5 $50.8 $53.7 $16.7 $41.7 $110.2 $42.0 $55.2 $39.6 Current debt 1.0 1.0 0.9 0.9 0.9 0.9 0.8 0.9 5.2 Long term debt 589.9 564.9 564.9 564.9 564.8 564.6 462.3 442.3 1,137.9 add: Deferred debt costs 3.8 3.6 3.4 3.2 3.0 3.0 5.1 4.9 14.2 Subtotal 594.7 569.5 569.2 569.0 568.7 568.5 468.3 448.1 1,157.3 Net debt $525.2 $518.7 $515.5 $552.3 $527.0 $458.3 $426.3 $392.9 $1,117.6 Free Cash Flow Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Cash from operations $78.5 $13.3 $17.4 $(9.1) $46.0 $88.2 $65.6 $59.2 $21.1 Additions to property, plant and equipment, net (5.4) (6.7) (13.5) (21.5) (12.8) (14.2) (25.2) (18.5) (18.1) Free cash flow $73.1 $6.6 $3.9 $(30.6) $33.2 $74.0 $40.4 $40.7 $3.0 ($ IN MILLIONS) © Clearwater Paper Corporation 2024 17

v3.24.2.u1

Cover

|

Aug. 06, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 06, 2024

|

| Entity Registrant Name |

CLEARWATER PAPER CORPORATION

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-34146

|

| Entity Tax Identification Number |

20-3594554

|

| Entity Address, Address Line One |

601 West Riverside,

|

| Entity Address, Address Line Two |

Suite 1100

|

| Entity Address, Postal Zip Code |

99201

|

| Entity Address, State or Province |

WA

|

| Entity Address, City or Town |

Spokane,

|

| City Area Code |

509

|

| Local Phone Number |

344-5900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

CLW

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001441236

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

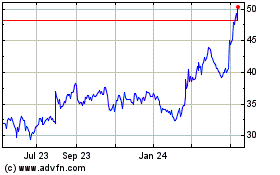

ClearWater Paper (NYSE:CLW)

Historical Stock Chart

From Nov 2024 to Dec 2024

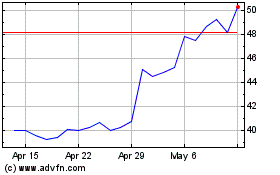

ClearWater Paper (NYSE:CLW)

Historical Stock Chart

From Dec 2023 to Dec 2024