FALSE000002409000000240902023-08-242023-08-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 24, 2023

COMMISSION FILE NUMBER: 000-16509

CITIZENS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Colorado | | 84-0755371 |

(State or other jurisdiction of incorporation) | | (I.R.S. Employer Identification No.) |

11815 Alterra Pkwy, Suite 1500, Austin, TX 78758

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number: (512) 837-7100

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Class A Common Stock | CIA | New York Stock Exchange |

| (Title of each class) | (Trading Symbol) | (Name of each exchange on which registered) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

As previously reported in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the “2022 Form 10-K”), on January 1, 2023, Citizens, Inc. (the “Company”) adopted Accounting Standards Update No. 2018-12, Financial Services-Insurance (Topic 944): Targeted Improvements to the Accounting for Long-Duration Contracts ("LDTI") on a modified retrospective basis with a transition date of January 1, 2021.

The Company is filing this Current Report on Form 8-K ("Current Report") to present certain previously reported financial statements and other related financial information on a basis consistent with LDTI (the "Recast Financial Supplement"). The Recast Financial Supplement, a copy of which is attached hereto as Exhibit 99.1 and incorporated herein by reference, is unaudited and provided by the Company voluntarily, and prior to the availability of the audited financial statements for the year ended December 31, 2023, to assist investors and other readers of the Company’s consolidated financial statements in evaluating LDTI’s impact on the Company’s financial position and results of operations for prior periods. It is possible that the financial statements in future filings with the U.S. Securities and Exchange Commission may differ, perhaps materially, from the information included in the Recast Financial Supplement and as such, investors and other readers should not place undue reliance on this information and should read it in conjunction with the financial information included in the Company’s 2022 Form 10-K. The Company undertakes no obligation to update or revise the information provided in the Recast Financial Supplement as a result of new information or otherwise, except as required by law.

The information in Item 2.02 and Exhibit 99.1 listed in Item 9.01 of this Current Report shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | |

| Exhibit No. | Description of Exhibit |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | CITIZENS, INC. |

| | | | |

| | | By: | /s/ Gerald W. Shields |

| | | | Chief Executive Officer and President |

Date: August 24, 2023

Financial Supplement

Fourth Quarter 2022

Recast for Targeted Improvements to the Accounting for Long-Duration Contracts (LDTI) - Unaudited

Accounting Standards Update No. 2018-12

| | | | | |

| CITIZENS, INC. | Exhibit 99.1 |

| |

2022 NOTES TO FILING

Introductory note

Citizens, Inc., also referred to as “Citizens,” “we,” “our,” “its” or the “Company,” adopted Accounting Standards Update No. 2018-12 (“ASU 2018-12”), Targeted Improvements to the Accounting for Long-Duration Contracts (“LDTI”) on January 1, 2023, on a modified retrospective basis with a transition date of January 1, 2021. This Exhibit 99.1 to the Form 8-K is for informational purposes only and includes unaudited figures. The financial statements and related information included within are those management feels are most important and relevant for the users of the Company’s consolidated financial statements and should be read in conjunction with its Annual Report on Form 10-K for the year ended December 31, 2022, originally filed with the Securities and Exchange Commission (the "SEC") on March 10, 2023 (“2022 Form 10-K”). Certain quarterly information not typically included in the 2022 Form 10-K has been included herein for purposes of additional analysis.

Adoption of New Accounting Standard

Citizens has recast certain information contained in its 2022 Form 10-K to reflect the adoption of LDTI. In the first quarter of 2023, the Company adopted ASU 2018-12 which updated certain requirements for the accounting for long-duration insurance contracts and, in accordance with accounting principles generally accepted in the U.S., the Company is required to restate previously reported prior period balances in future financial statements for comparative purposes. The following is a discussion of the most significant impacts as a result of the adoption of LDTI.

•Cash flow assumptions and measuring liability for future policy benefits – ASU 2018-12 requires the Company to review its cash flow assumptions at least annually and update, when necessary, with the impact recognized in net income in the period of the change. Upon adoption, the Company recorded a charge of $0.1 million to retained earnings, net of tax, primarily from capping net premium ratios for certain policyholder benefit cohorts at 100%, increasing reserves for certain non-premium paying cohorts and flooring certain DAC cohorts at zero.

•Discount rate – The discount rate assumption is prescribed by ASU 2018-12 as an upper-medium (low credit risk) fixed-income yield and is required to be updated every quarter. The change in the liability as a result of updating the discount rate assumption is recognized in other comprehensive income (loss) (“OCI”). Upon adoption, there was a pretax decrease to accumulated other comprehensive income (loss) in the amount of $370.3 million as a result of remeasuring in force contract liabilities using current upper-medium grade fixed income instrument yields. The adjustment largely reflects the difference between discount rates locked-in at contract inception versus current discount rates at transition.

•Deferred policy acquisition costs and similar balances – Deferred policy acquisition costs (“DAC”) and other capitalized costs such as cost of insurance acquired (“COIA”) and unearned revenue are amortized on a constant level or straight-line basis over the expected term of the contracts. Upon adoption, the Company recorded a pretax decrease in the amount of $35.2 million to accumulated other comprehensive income (loss) for the removal of net cumulative adjustments to DAC, COIA and unearned revenue associated with unrealized gains and losses previously recorded in accumulated other comprehensive income (loss).

•Other comprehensive income ("OCI") was reduced by $316.8 million primarily due to the difference in the discount rate used prior to transition and the discount rate at January 1, 2021 and the elimination of the adjustments to DAC, COIA and unearned revenue associated with unrealized gains and losses described above after adjusting the changes for taxes.

Change in Balance Sheet Presentation

The Company revised the presentation of its future policy benefit reserves, annuity reserves, supplemental contracts without life contingency reserves and other policyholders’ funds in the consolidated balance sheet. Previously, annuity reserves were reported under future policy benefit reserves while supplemental contracts without life contingency reserves were reported in other policyholders’ funds in the consolidated balance sheet. The Company revised prior periods’ balance sheets to combine annuity reserves and supplemental contracts without life contingency reserves into the annuities financial statement line item under policyholders’ funds in the updated presentation.

| | | | | |

| CITIZENS, INC. | Exhibit 99.1 |

| |

FORWARD-LOOKING STATEMENTS

This exhibit 99.1 to the Form 8-K (the “Recast Financial Supplement”) contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this Recast Financial Supplement other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans, our expected capital needs, and our objectives for future operations, are forward-looking statements. Forward-looking statements may be identified by words such as “future,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “will,” “would,” “could,” “can,” “may,” and similar terms. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in Part I, Item 1A, "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the Securities and Exchange Commission on March 10, 2023. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this Recast Financial Supplement may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should read this Recast Financial Supplement completely and with the understanding that actual results may be materially different from expectations. All forward-looking statements made in this Recast Financial Supplement are qualified by these cautionary statements. These forward-looking statements are made only as of the date of this Recast Financial Supplement, and we do not undertake any obligation to update or revise any forward-looking statements to reflect the occurrences of events, unanticipated or otherwise, other than as may be required by law.

| | | | | | | | | | | | | | |

CITIZENS, INC. AND CONSOLIDATED SUBSIDIARIES

Consolidated Balance Sheets (Recast for LDTI)

|

As of

(Unaudited, in thousands) | | Dec. 31, 2022 | | Dec. 31, 2021 |

| Assets | | | | |

| Investments: | | | | |

| Fixed maturity securities available-for-sale | | $ | 1,179,619 | | | 1,470,617 | |

| | | | |

| Equity securities | | 11,590 | | | 14,844 | |

| | | | |

| Policy loans | | 78,773 | | | 80,307 | |

| | | | |

| | | | |

| Other long-term investments | | 69,558 | | | 57,399 | |

| Short-term investments | | 1,241 | | | — | |

| Total investments | | 1,340,781 | | | 1,623,167 | |

| Cash and cash equivalents | | 22,973 | | | 27,294 | |

| Accrued investment income | | 17,131 | | | 16,197 | |

| | | | |

| Reinsurance recoverable | | 4,560 | | | 5,539 | |

| Deferred policy acquisition costs | | 162,927 | | | 152,418 | |

| Cost of insurance acquired | | 10,647 | | | 11,268 | |

| | | | |

| | | | |

| Federal income tax receivable | | 601 | | | 762 | |

| Deferred tax asset, net | | — | | | 5,532 | |

| Property and equipment, net | | 12,926 | | | 14,074 | |

| Due premiums | | 11,829 | | | 10,748 | |

| | | | |

| Other assets | | 6,328 | | | 5,739 | |

| Total assets | | $ | 1,590,703 | | | 1,872,738 | |

| | | | |

| Liabilities and Stockholders' Equity | | | | |

| Liabilities: | | | | |

| Policy liabilities: | | | | |

| Future policy benefit reserves: | | | | |

| Life insurance | | $ | 1,198,647 | | | 1,531,711 | |

| Accident and health | | 767 | | | 784 | |

| Future policy benefit reserves | | 1,199,414 | | | 1,532,495 | |

| Policyholders' funds: | | | | |

| Annuities | | 121,422 | | | 109,441 | |

| Dividend accumulations | | 41,663 | | | 37,760 | |

| Premiums paid in advance | | 36,384 | | | 40,690 | |

| Policy claims payable | | 9,884 | | | 14,590 | |

| Other policyholders' funds | | 7,501 | | | 6,740 | |

| Total policyholders' funds | | 216,854 | | | 209,221 | |

| Total policy liabilities | | 1,416,268 | | | 1,741,716 | |

| Commissions payable | | 1,967 | | | 2,285 | |

| Deferred federal income tax liability, net | | 3,653 | | | — | |

| | | | |

| | | | |

| Other liabilities | | 41,025 | | | 28,780 | |

| Total liabilities | | 1,462,913 | | | 1,772,781 | |

| | | | |

| Stockholders' Equity: | | | | |

| | | | |

| Class A common stock | | 268,147 | | | 265,561 | |

| Class B common stock | | 3,184 | | | 3,184 | |

| Accumulated deficit | | 16,309 | | | (9,698) | |

| Accumulated other comprehensive income (loss): | | | | |

| Net unrealized gains (losses) on fixed maturity securities, net of tax | | (137,044) | | | (138,989) | |

| Treasury stock, at cost | | (22,806) | | | (20,101) | |

| Total stockholders' equity | | 127,790 | | | 99,957 | |

| Total liabilities and stockholders' equity | | $ | 1,590,703 | | | 1,872,738 | |

Exhibit 99.1 | Citizens, Inc. 8-K 1

| | | | | | | | | | | | | | |

CITIZENS, INC. AND CONSOLIDATED SUBSIDIARIES

Consolidated Balance Sheets, Continued

Quarterly Summary (Recast for LDTI)

|

| | | | |

As of (Unaudited, in thousands) | Dec. 31, 2022 | Sep. 30, 2022 | Jun. 30, 2022 | Mar. 31, 2022 |

| Assets | | | | |

| Investments: | | | | |

| Fixed maturity securities available-for-sale | $ | 1,179,619 | | 1,161,048 | | 1,237,004 | | 1,355,410 | |

| | | | |

| Equity securities | 11,590 | | 11,789 | | 12,711 | | 13,902 | |

| | | | |

| Policy loans | 78,773 | | 78,085 | | 78,586 | | 79,345 | |

| | | | |

| | | | |

| Other long-term investments | 69,558 | | 62,717 | | 66,002 | | 63,927 | |

| Short-term investments | 1,241 | | 1,241 | | — | | — | |

| Total investments | 1,340,781 | | 1,314,880 | | 1,394,303 | | 1,512,584 | |

| Cash and cash equivalents | 22,973 | | 21,007 | | 22,407 | | 21,298 | |

| Accrued investment income | 17,131 | | 16,615 | | 16,497 | | 15,755 | |

| | | | |

| Reinsurance recoverable | 4,560 | | 3,485 | | 3,426 | | 3,574 | |

| Deferred policy acquisition costs | 162,927 | | 159,104 | | 156,356 | | 153,640 | |

| Cost of insurance acquired | 10,647 | | 10,822 | | 10,988 | | 11,139 | |

| | | | |

| | | | |

| | | | |

| | | | |

| Tax asset | 601 | | — | | 204 | | 3,851 | |

| Property and equipment, net | 12,926 | | 13,310 | | 13,689 | | 14,088 | |

| Due premiums | 11,829 | | 10,551 | | 9,538 | | 8,971 | |

| | | | |

| Other assets | 6,328 | | 6,572 | | 6,801 | | 5,886 | |

| Total assets | 1,590,703 | | 1,556,346 | | 1,634,209 | | 1,750,786 | |

| | | | |

| Liabilities and Stockholders' Equity | | | | |

| Liabilities: | | | | |

| Policy liabilities: | | | | |

| Future policy benefit reserves: | | | | |

| Life insurance | $ | 1,198,647 | | 1,190,502 | | 1,263,346 | | 1,380,100 | |

| Accident and health | 767 | | 729 | | 745 | | 766 | |

| Future policy benefit reserves | 1,199,414 | | 1,191,231 | | 1,264,091 | | 1,380,866 | |

| Policyholders' funds: | | | | |

| Annuities | 121,422 | | 118,452 | | 114,923 | | 111,751 | |

| Dividend accumulations | 41,663 | | 40,483 | | 39,622 | | 38,575 | |

| Premiums paid in advance | 36,384 | | 38,437 | | 39,636 | | 40,433 | |

| Policy claims payable | 9,884 | | 7,979 | | 8,475 | | 9,659 | |

| Other policyholders' funds | 7,501 | | 7,235 | | 7,286 | | 7,088 | |

| Total policyholders' funds | 216,854 | | 212,586 | | 209,942 | | 207,506 | |

| Total policy liabilities | 1,416,268 | | 1,403,817 | | 1,474,033 | | 1,588,372 | |

| Commissions payable | 1,967 | | 1,772 | | 1,917 | | 1,816 | |

| Deferred federal income tax liability, net | 3,653 | | 1,992 | | — | | — | |

| Current federal income tax payable | — | | 2,254 | | 2,167 | | — | |

| Payable for securities in process of settlement | — | | — | | 3,291 | | 3,815 | |

| Other liabilities | 41,025 | | 35,466 | | 29,477 | | 31,307 | |

| | | | |

| Total liabilities | 1,462,913 | | 1,445,301 | | 1,510,885 | | 1,625,310 | |

| | | | |

| Stockholders' Equity: | | | | |

| | | | |

| Class A common stock | 268,147 | | 267,988 | | 267,850 | | 267,442 | |

| Class B common stock | 3,184 | | 3,184 | | 3,184 | | 3,184 | |

| Accumulated deficit | 16,309 | | 2,650 | | (757) | | (3,249) | |

| Accumulated other comprehensive income (loss): | | | | |

| Net unrealized gains (losses) on fixed maturity securities, net of tax | (137,044) | | (140,493) | | (125,552) | | (121,800) | |

| Treasury stock, at cost | (22,806) | | (22,284) | | (21,401) | | (20,101) | |

| Total stockholders' equity | 127,790 | | 111,045 | | 123,324 | | 125,476 | |

| Total liabilities and stockholders' equity | $ | 1,590,703 | | 1,556,346 | | 1,634,209 | | 1,750,786 | |

Exhibit 99.1 | Citizens, Inc. 8-K 2

| | | | | | | | | | | | | | | | |

CITIZENS, INC. AND CONSOLIDATED SUBSIDIARIES

Consolidated Statements of Operations and Comprehensive Income (Loss) (Recast for LDTI)

|

For the Years Ended

(Unaudited, in thousands, except share amounts) | | Dec. 31, 2022 | | Dec. 31, 2021 | | |

| Revenues: | | | | | | |

| Premiums: | | | | | | |

| Life insurance | | $ | 167,586 | | | 169,801 | | | |

| Accident and health insurance | | 1,278 | | | 1,250 | | | |

| Property insurance | | 4,850 | | | 3,677 | | | |

| Net investment income | | 65,426 | | | 61,495 | | | |

| Investment related gains (losses), net | | (10,291) | | | 10,991 | | | |

| | | | | | |

| Other income | | 3,675 | | | 3,332 | | | |

| Total revenues | | 232,524 | | | 250,546 | | | |

| Benefits and Expenses: | | | | | | |

| Insurance benefits paid or provided: | | | | | | |

| Claims and surrenders | | 119,935 | | | 119,735 | | | |

| Increase in future policy benefit reserves | | 5,290 | | | 9,782 | | | |

| Policyholder liability remeasurement (gain) loss | | 2,398 | | | 1,425 | | | |

| Policyholders' dividends | | 6,013 | | | 6,180 | | | |

| Total insurance benefits paid or provided | | 133,636 | | | 137,122 | | | |

| Commissions | | 36,222 | | | 35,463 | | | |

| Other general expenses | | 45,177 | | | 43,370 | | | |

| Capitalization of deferred policy acquisition costs | | (24,899) | | | (22,740) | | | |

| Amortization of deferred policy acquisition costs | | 14,390 | | | 13,445 | | | |

| Amortization of cost of insurance acquired | | 621 | | | 757 | | | |

| Goodwill impairment | | — | | | 12,624 | | | |

| Total benefits and expenses | | 205,147 | | | 220,041 | | | |

| Income (loss) before federal income tax | | 27,377 | | | 30,505 | | | |

| Federal income tax expense (benefit) | | 1,370 | | | (42,201) | | | |

| Net income (loss) | | 26,007 | | | 72,706 | | | |

| Basic Earnings Per Share: | | | | | | |

| Class A common stock | | $ | 0.52 | | | 1.46 | | | |

| Class B common stock | | — | | | 0.73 | | | |

| Diluted Earnings Per Share: | | | | | | |

| Class A common stock | | 0.51 | | | 1.44 | | | |

| Class B common stock | | — | | | 0.72 | | | |

| Other Comprehensive Income (Loss): | | | | | | |

| Unrealized gains (losses) on fixed maturity securities: | | | | | | |

| Unrealized holding gains (losses) arising during period | | (328,673) | | | (41,123) | | | |

| Reclassification adjustment for losses (gains) included in net income (loss) | | 104 | | | (243) | | | |

| Unrealized gains (losses) on fixed maturity securities, net | | (328,569) | | | (41,366) | | | |

| Change in current discount rate for liability for future policy benefits | | 337,776 | | | 92,396 | | | |

| Income tax expense (benefit) on unrealized gains (losses) on fixed maturity securities | | 7,262 | | | 1,449 | | | |

| Other comprehensive income (loss) | | 1,945 | | | 49,581 | | | |

| Total comprehensive income (loss) | | $ | 27,952 | | | 122,287 | | | |

Exhibit 99.1 | Citizens, Inc. 8-K 3

| | | | | | | | | | | | | | | | | | | |

CITIZENS, INC. AND CONSOLIDATED SUBSIDIARIES

Consolidated Statements of Operations and Comprehensive Income (Loss), Continued

Quarterly Summary (Recast for LDTI)

|

For the Three Months Ended (Unaudited, in thousands, except share amounts) | | Dec. 31, 2022 | | Sep. 30, 2022 | | Jun. 30, 2022 | Mar. 31, 2022 | | |

| Revenues: | | | | | | | | | |

| Premiums: | | | | | | | | | |

| Life insurance | | $ | 46,656 | | | 42,423 | | | 40,761 | | 37,746 | | | |

| Accident and health insurance | | 413 | | | 299 | | | 280 | | 286 | | | |

| Property insurance | | 1,182 | | | 1,153 | | | 1,183 | | 1,332 | | | |

| Net investment income | | 17,443 | | | 16,604 | | | 15,892 | | 15,487 | | | |

| Investment related gains (losses), net | | 298 | | | (4,991) | | | (5,016) | | (582) | | | |

| | | | | | | | | |

| Other income | | 1,265 | | | 688 | | | 634 | | 1,088 | | | |

| Total revenues | | 67,257 | | | 56,176 | | | 53,734 | | 55,357 | | | |

| Benefits and Expenses: | | | | | | | | | |

| Insurance benefits paid or provided: | | | | | | | | | |

| Claims and surrenders | | 33,675 | | | 30,729 | | | 27,097 | | 28,434 | | | |

| Increase in future policy benefit reserves | | 308 | | | 1,138 | | | 3,730 | | 114 | | | |

| Policyholder liability remeasurement (gain) loss | | 1,152 | | | (89) | | | 667 | | 668 | | | |

| Policyholders' dividends | | 1,756 | | | 1,389 | | | 1,515 | | 1,353 | | | |

| Total insurance benefits paid or provided | | 36,891 | | | 33,167 | | | 33,009 | | 30,569 | | | |

| Commissions | | 10,415 | | | 9,210 | | | 8,924 | | 7,673 | | | |

| Other general expenses | | 12,188 | | | 11,559 | | | 10,400 | | 11,030 | | | |

| Capitalization of deferred policy acquisition costs | | (7,562) | | | (6,372) | | | (6,184) | | (4,781) | | | |

| Amortization of deferred policy acquisition costs | | 3,739 | | | 3,624 | | | 3,468 | | 3,559 | | | |

| Amortization of cost of insurance acquired | | 175 | | | 166 | | | 151 | | 129 | | | |

| | | | | | | | | |

| Total benefits and expenses | | 55,846 | | | 51,354 | | | 49,768 | | 48,179 | | | |

| Income (loss) before federal income tax | | 11,411 | | | 4,822 | | | 3,966 | | 7,178 | | | |

| Federal income tax expense (benefit) | | (2,248) | | | 1,415 | | | 1,474 | | 729 | | | |

| Net income (loss) | | 13,659 | | | 3,407 | | | 2,492 | | 6,449 | | | |

| Basic Earnings Per Share: | | | | | | | | | |

| Class A common stock | | $ | 0.27 | | | 0.07 | | | 0.05 | | 0.13 | | | |

| | | | | | | | | |

| Diluted Earnings Per Share: | | | | | | | | | |

| Class A common stock | | 0.27 | | | 0.06 | | | 0.05 | | 0.13 | | | |

| | | | | | | | | |

| Other Comprehensive Income (Loss): | | | | | | | | | |

| Unrealized gains (losses) on fixed maturity securities: | | | | | | | | | |

| Unrealized holding gains (losses) arising during period | | 12,005 | | | (88,382) | | | (119,531) | | (132,765) | | | |

| Reclassification adjustment for losses (gains) included in net income (loss) | | 26 | | | 43 | | | (24) | | 59 | | | |

| Unrealized gains (losses) on fixed maturity securities, net | | 12,031 | | | (88,339) | | | (119,555) | | (132,706) | | | |

| Change in current discount rate for liability for future policy benefits | | (7,482) | | | 73,214 | | | 120,437 | | 151,607 | | | |

| Income tax expense (benefit) on unrealized gains (losses) on fixed maturity securities | | 1,100 | | | (184) | | | 4,634 | | 1,712 | | | |

| Other comprehensive income (loss) | | 3,449 | | | (14,941) | | | (3,752) | | 17,189 | | | |

| Total comprehensive income (loss) | | $ | 17,108 | | | (11,534) | | | (1,260) | | 23,638 | | | |

Exhibit 99.1 | Citizens, Inc. 8-K 4

RELATED INFORMATION

(Recast for LDTI) (Unaudited)

EARNINGS PER SHARE

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended | | | For the Years Ended | | |

(In thousands, except per share amounts) | | Dec. 31, 2022 | | Sep. 30, 2022 | | Jun. 30, 2022 | Mar. 31, 2022 | | | Dec. 31, 2022 | Dec. 31, 2021 | | |

| Net income (loss) | | $ | 13,659 | | | 3,407 | | | 2,492 | | 6,449 | | | | $ | 26,007 | | 72,706 | | | |

| Numerator for Basic Earnings Per Share: | | | | | | | | | | | |

| Net income (loss) allocated to Class A common stock | | $ | 13,659 | | | 3,407 | | | 2,492 | | 6,449 | | | | $ | 26,007 | | 72,481 | | | |

| Net income (loss) allocated to Class B common stock | | — | | | — | | | — | | — | | | | — | | 225 | | | |

| Net income (loss) | | $ | 13,659 | | | 3,407 | | | 2,492 | | 6,449 | | | | $ | 26,007 | | 72,706 | | | |

| Denominator for Basic Earnings Per Share: | | | | | | | | | | | |

| Weighted average shares of Class A outstanding | | 49,946 | | | 50,075 | | | 50,373 | | 50,236 | | | | 50,139 | | 49,664 | | | |

| Weighted average shares of Class B outstanding | | — | | | — | | | — | | — | | | | — | | 308 | | | |

| Total weighted average shares outstanding | | 49,946 | | | 50,075 | | | 50,373 | | 50,236 | | | | 50,139 | | 49,972 | | | |

| Basic earnings (loss) per share of Class A common stock | | $ | 0.27 | | | 0.07 | | | 0.05 | | 0.13 | | | | $ | 0.52 | | 1.46 | | | |

| Basic earnings (loss) per share of Class B common stock | | — | | | — | | | — | | — | | | | — | | 0.73 | | | |

| | | | | | | | | | | | | |

| Numerator for Diluted Earnings Per Share: | | | | | | | | | | | |

| Net income (loss) allocated to Class A common stock | | $ | 13,659 | | | 3,407 | | | 2,492 | | 6,449 | | | | $ | 26,007 | | 72,484 | | | |

| Net income (loss) allocated to Class B common stock | | — | | | — | | | — | | — | | | | — | | 222 | | | |

| Net income (loss) | | $ | 13,659 | | | 3,407 | | | 2,492 | | 6,449 | | | | $ | 26,007 | | 72,706 | | | |

| Denominator for Diluted Earnings Per Share: | | | | | | | | | | | |

| Weighted average shares of Class A outstanding | | 50,674 | | | 50,799 | | | 51,065 | | 50,906 | | | | 50,867 | | 50,337 | | | |

| Weighted average shares of Class B outstanding | | — | | | — | | | — | | — | | | | — | | 308 | | | |

| Total weighted average shares outstanding | | 50,674 | | | 50,799 | | | 51,065 | | 50,906 | | | | 50,867 | | 50,645 | | | |

| Diluted earnings (loss) per share of Class A common stock | | $ | 0.27 | | | 0.06 | | | 0.05 | | 0.13 | | | | $ | 0.51 | | 1.44 | | | |

| Diluted earnings (loss) per share of Class B common stock | | — | | | — | | | — | | — | | | | — | | 0.72 | | | |

Exhibit 99.1 | Citizens, Inc. 8-K 5

SEGMENT AND OTHER OPERATING INFORMATION

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Life Insurance |

| | For the Three Months Ended | | | For the Years Ended |

(In thousands) | | Dec. 31, 2022 | | Sep. 30, 2022 | | Jun. 30, 2022 | Mar. 31, 2022 | | | Dec. 31, 2022 | Dec. 31, 2021 |

| Revenues: | | | | | | | | | | | |

| Premiums | | $ | 36,192 | | | 31,696 | | | 29,834 | | 26,931 | | | | $ | 124,653 | | 126,058 | |

| Net investment income (loss) | | 13,556 | | | 12,806 | | | 12,347 | | 11,971 | | | | 50,680 | | 47,216 | |

| Investment related gains (losses), net | | (182) | | | (4,367) | | | (3,984) | | (293) | | | | (8,826) | | 9,176 | |

| Other income (loss) | | 1,265 | | | 682 | | | 633 | | 1,088 | | | | 3,668 | | 3,362 | |

| Total revenues | | 50,831 | | | 40,817 | | | 38,830 | | 39,697 | | | | 170,175 | | 185,812 | |

| Benefits and expenses: | | | | | | | | | | | |

| Insurance benefits paid or provided: | | | | | | | | | | | |

| Claims and surrenders | | 27,808 | | | 24,742 | | | 21,568 | | 21,458 | | | | 95,576 | | 91,390 | |

| Increase in future policy benefit reserves | | (914) | | | 195 | | | 3,006 | | 1,376 | | | | 3,663 | | 7,262 | |

| Policyholder liability remeasurement (gain) loss | | 1,179 | | | (214) | | | 580 | | 414 | | | | 1,959 | | 1,390 | |

| Policyholders' dividends | | 1,749 | | | 1,382 | | | 1,509 | | 1,350 | | | | 5,990 | | 6,140 | |

| Total insurance benefits paid or provided | | 29,822 | | | 26,105 | | | 26,663 | | 24,598 | | | | 107,188 | | 106,182 | |

| Commissions | | 6,330 | | | 5,103 | | | 4,792 | | 3,806 | | | | 20,031 | | 18,747 | |

| Other general expenses | | 6,127 | | | 6,016 | | | 5,358 | | 5,691 | | | | 23,192 | | 20,846 | |

| Capitalization of deferred policy acquisition costs | | (5,737) | | | (4,592) | | | (4,307) | | (3,306) | | | | (17,942) | | (16,174) | |

| Amortization of deferred policy acquisition costs | | 3,109 | | | 3,081 | | | 2,950 | | 3,020 | | | | 12,160 | | 11,536 | |

| Amortization of cost of insurance acquired | | 29 | | | 32 | | | 38 | | 24 | | | | 123 | | 150 | |

| Goodwill impairment | | — | | | — | | | — | | — | | | | — | | 12,624 | |

| Total benefits and expenses | | 39,680 | | | 35,745 | | | 35,494 | | 33,833 | | | | 144,752 | | 153,911 | |

| Income (loss) before federal income tax | | $ | 11,151 | | | 5,072 | | | 3,336 | | 5,864 | | | | $ | 25,423 | | 31,901 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Home Service Insurance |

| | For the Three Months Ended | | | For the Years Ended |

(In thousands) | | Dec. 31, 2022 | | Sep. 30, 2022 | | Jun. 30, 2022 | Mar. 31, 2022 | | | Dec. 31, 2022 | Dec. 31, 2021 |

| Revenues: | | | | | | | | | | | |

| Premiums | | $ | 12,059 | | | 12,179 | | | 12,390 | | 12,433 | | | | $ | 49,061 | | 48,670 | |

| Net investment income (loss) | | 3,578 | | | 3,527 | | | 3,283 | | 3,244 | | | | 13,632 | | 13,224 | |

| Investment related gains (losses), net | | 352 | | | (462) | | | (925) | | (242) | | | | (1,277) | | 618 | |

| Other income (loss) | | — | | | — | | | 1 | | — | | | | 1 | | 7 | |

| Total revenues | | 15,989 | | | 15,244 | | | 14,749 | | 15,435 | | | | 61,417 | | 62,519 | |

| Benefits and expenses: | | | | | | | | | | | |

| Insurance benefits paid or provided: | | | | | | | | | | | |

| Claims and surrenders | | 5,867 | | | 5,987 | | | 5,529 | | 6,976 | | | | 24,359 | | 28,345 | |

| Increase in future policy benefit reserves | | 1,222 | | | 943 | | | 724 | | (1,262) | | | | 1,627 | | 2,520 | |

| Policyholder liability remeasurement (gain) loss | | (27) | | | 125 | | | 87 | | 254 | | | | 439 | | 35 | |

| Policyholders' dividends | | 7 | | | 7 | | | 6 | | 3 | | | | 23 | | 40 | |

| Total insurance benefits paid or provided | | 7,069 | | | 7,062 | | | 6,346 | | 5,971 | | | | 26,448 | | 30,940 | |

| Commissions | | 4,085 | | | 4,107 | | | 4,132 | | 3,867 | | | | 16,191 | | 16,716 | |

| Other general expenses | | 4,351 | | | 4,228 | | | 3,515 | | 4,350 | | | | 16,444 | | 14,739 | |

| Capitalization of deferred policy acquisition costs | | (1,825) | | | (1,780) | | | (1,877) | | (1,475) | | | | (6,957) | | (6,566) | |

| Amortization of deferred policy acquisition costs | | 630 | | | 543 | | | 518 | | 539 | | | | 2,230 | | 1,909 | |

| Amortization of cost of insurance acquired | | 146 | | | 134 | | | 113 | | 105 | | | | 498 | | 607 | |

| Total benefits and expenses | | 14,456 | | | 14,294 | | | 12,747 | | 13,357 | | | | 54,854 | | 58,345 | |

| Income (loss) before federal income tax | | $ | 1,533 | | | 950 | | | 2,002 | | 2,078 | | | | $ | 6,563 | | 4,174 | |

Exhibit 99.1 | Citizens, Inc. 8-K 6

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Other Non-Insurance Enterprises |

| | For the Three Months Ended | | | For the Years Ended |

(In thousands) | | Dec. 31, 2022 | | Sep. 30, 2022 | | Jun. 30, 2022 | Mar. 31, 2022 | | | Dec. 31, 2022 | Dec. 31, 2021 |

| Revenues: | | | | | | | | | | | |

| Premiums | | $ | — | | | — | | | — | | — | | | | $ | — | | — | |

| Net investment income (loss) | | 309 | | | 271 | | | 262 | | 272 | | | | 1,114 | | 1,055 | |

| Investment related gains (losses), net | | 128 | | | (162) | | | (107) | | (47) | | | | (188) | | 1,197 | |

| Other income (loss) | | — | | | 6 | | | — | | — | | | | 6 | | (37) | |

| Total revenues | | 437 | | | 115 | | | 155 | | 225 | | | | 932 | | 2,215 | |

| Benefits and expenses: | | | | | | | | | | | |

| Insurance benefits paid or provided: | | | | | | | | | | | |

| Claims and surrenders | | — | | | — | | | — | | — | | | | — | | — | |

| Increase in future policy benefit reserves | | — | | | — | | | — | | — | | | | — | | — | |

| Policyholder liability remeasurement (gain) loss | | — | | | — | | | — | | — | | | | — | | — | |

| Policyholders' dividends | | — | | | — | | | — | | — | | | | — | | — | |

| Total insurance benefits paid or provided | | — | | | — | | | — | | — | | | | — | | — | |

| Commissions | | — | | | — | | | — | | — | | | | — | | — | |

| Other general expenses | | 1,710 | | | 1,315 | | | 1,527 | | 989 | | | | 5,541 | | 7,785 | |

| Capitalization of deferred policy acquisition costs | | — | | | — | | | — | | — | | | | — | | — | |

| Amortization of deferred policy acquisition costs | | — | | | — | | | — | | — | | | | — | | — | |

| Amortization of cost of insurance acquired | | — | | | — | | | — | | — | | | | — | | — | |

| Total benefits and expenses | | 1,710 | | | 1,315 | | | 1,527 | | 989 | | | | 5,541 | | 7,785 | |

| Income (loss) before federal income tax | | $ | (1,273) | | | (1,200) | | | (1,372) | | (764) | | | | $ | (4,609) | | (5,570) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Consolidated |

| | For the Three Months Ended | | | For the Years Ended |

(In thousands) | | Dec. 31, 2022 | | Sep. 30, 2022 | | Jun. 30, 2022 | Mar. 31, 2022 | | | Dec. 31, 2022 | Dec. 31, 2021 |

| Revenues: | | | | | | | | | | | |

| Premiums | | $ | 48,251 | | | 43,875 | | | 42,224 | | 39,364 | | | | $ | 173,714 | | 174,728 | |

| Net investment income (loss) | | 17,443 | | | 16,604 | | | 15,892 | | 15,487 | | | | 65,426 | | 61,495 | |

| Investment related gains (losses), net | | 298 | | | (4,991) | | | (5,016) | | (582) | | | | (10,291) | | 10,991 | |

| Other income (loss) | | 1,265 | | | 688 | | | 634 | | 1,088 | | | | 3,675 | | 3,332 | |

| Total revenues | | 67,257 | | | 56,176 | | | 53,734 | | 55,357 | | | | 232,524 | | 250,546 | |

| Benefits and expenses: | | | | | | | | | | | |

| Insurance benefits paid or provided: | | | | | | | | | | | |

| Claims and surrenders | | 33,675 | | | 30,729 | | | 27,097 | | 28,434 | | | | 119,935 | | 119,735 | |

| Increase in future policy benefit reserves | | 308 | | | 1,138 | | | 3,730 | | 114 | | | | 5,290 | | 9,782 | |

| Policyholder liability remeasurement (gain) loss | | 1,152 | | | (89) | | | 667 | | 668 | | | | 2,398 | | 1,425 | |

| Policyholders' dividends | | 1,756 | | | 1,389 | | | 1,515 | | 1,353 | | | | 6,013 | | 6,180 | |

| Total insurance benefits paid or provided | | 36,891 | | | 33,167 | | | 33,009 | | 30,569 | | | | 133,636 | | 137,122 | |

| Commissions | | 10,415 | | | 9,210 | | | 8,924 | | 7,673 | | | | 36,222 | | 35,463 | |

| Other general expenses | | 12,188 | | | 11,559 | | | 10,400 | | 11,030 | | | | 45,177 | | 43,370 | |

| Capitalization of deferred policy acquisition costs | | (7,562) | | | (6,372) | | | (6,184) | | (4,781) | | | | (24,899) | | (22,740) | |

| Amortization of deferred policy acquisition costs | | 3,739 | | | 3,624 | | | 3,468 | | 3,559 | | | | 14,390 | | 13,445 | |

| Amortization of cost of insurance acquired | | 175 | | | 166 | | | 151 | | 129 | | | | 621 | | 757 | |

| Goodwill impairment | | — | | | — | | | — | | — | | | | — | | 12,624 | |

| Total benefits and expenses | | 55,846 | | | 51,354 | | | 49,768 | | 48,179 | | | | 205,147 | | 220,041 | |

| Income (loss) before federal income tax | | $ | 11,411 | | | 4,822 | | | 3,966 | | 7,178 | | | | $ | 27,377 | | 30,505 | |

Exhibit 99.1 | Citizens, Inc. 8-K 7

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

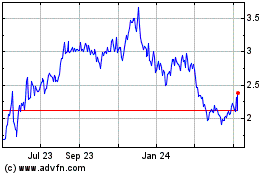

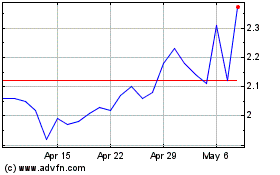

Citizens (NYSE:CIA)

Historical Stock Chart

From Apr 2024 to May 2024

Citizens (NYSE:CIA)

Historical Stock Chart

From May 2023 to May 2024