0000019745falseAugust 3, 2023falseNYSE00000197452023-08-032023-08-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 3, 2023

CHESAPEAKE UTILITIES CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| DE | | 001-11590 | | 51-0064146 |

| (State or other jurisdiction of | | (Commission | | (I.R.S. Employer |

| incorporation or organization) | | File Number) | | Identification No.) |

500 Energy Lane, Dover, DE 19901

(Address of principal executive offices, including Zip Code)

(302) 734-6799

(Registrant's Telephone Number, including Area Code)

(Former name, former address and former fiscal year, if changed since last report.)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock - par value per share $0.4867 | CPK | New York Stock Exchange, Inc. |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 2.02. Results of Operations and Financial Condition.

On August 3, 2023, Chesapeake Utilities Corporation issued a press release announcing its financial results for the quarter and six months ended June 30, 2023. A copy of the press release is attached as Exhibit 99.1 hereto and is incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibit 99.1 - Press Release of Chesapeake Utilities Corporation, dated August 3, 2023.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

|

CHESAPEAKE UTILITIES CORPORATION |

|

| /s/ Beth W. Cooper |

| Beth W. Cooper |

| Executive Vice President, Chief Financial Officer, Treasurer, and Assistant Corporate Secretary |

|

| Date: August 3, 2023 |

FOR IMMEDIATE RELEASE

August 3, 2023

NYSE Symbol: CPK

CHESAPEAKE UTILITIES CORPORATION REPORTS SECOND QUARTER

2023 RESULTS

•Earnings per share ("EPS")* for the second quarter of 2023 was $0.90 compared to $0.96 per share for the second quarter of 2022 which included a non-recurring gain of $0.08 per share; Operating income for the quarter grew 7.1 percent from the prior year quarter to $28.3 million

•Year-to-date EPS was $2.94 compared to $3.04 per share in the prior year

•Customer consumption was significantly impacted by historically warmer temperatures during the quarter and the six months ended June 30, 2023, lowering EPS by approximately $0.09 and $0.38 per share, respectively

•Adjusted gross margin growth of $7.4 million was driven by regulatory initiatives, natural gas organic growth, increased demand for CNG, RNG and LNG services and continued pipeline expansion projects

•Multiple new project updates, including the announcement of two new pipeline projects that will drive future earnings growth

•Reiteration of long-term earnings and capital expenditures guidance, including continued capital expenditure guidance of $200 million to $230 million for 2023

Dover, Delaware — Chesapeake Utilities Corporation (NYSE: CPK) (“Chesapeake Utilities” or the “Company”) today announced financial results for the three and six months ended June 30, 2023.

In the second quarter of 2023, the Company's net income was $16.1 million, compared to $17.1 million reported in the same quarter of 2022. EPS in the quarter was $0.90 per share, compared to $0.96 per share reported in the same prior-year period. Net income in the second quarter of 2022 also included a $1.9 million one-time building sale gain, or EPS of $0.08.

Earnings during the second quarter of 2023 were driven by contributions from the Company's Florida natural gas base rate proceeding, organic growth in the Company's natural gas distribution businesses, increased propane margins and fees, continued pipeline expansion projects, increased demand for compressed natural gas ("CNG"), renewable natural gas ("RNG") and liquefied natural gas ("LNG") services and incremental contributions associated with regulated infrastructure programs. These contributions were partially offset by the continued presence of significantly warmer weather on the Delmarva Peninsula and in Ohio during the second quarter of 2023 as well as higher interest expense associated with the Company's short-term borrowings.

For the first half of 2023, net income was $52.5 million compared to $54.0 million for the same period in 2022. EPS for the first half of 2023 was $2.94 compared to $3.04 per share reported in the same prior-year period.

For the first half of 2023, earnings were impacted by significantly warmer weather in our service territories during which, the Delmarva Peninsula and Ohio experienced temperatures that were more than 20

percent higher than historical averages. The impacts of weather for the first half of 2023 were primarily offset by the factors noted above.

“The Company’s growth on a year-to-date basis continues to be overshadowed by warmer temperatures and the ongoing inflationary environment," commented Jeff Householder, president and CEO. "In the first half of 2023, growth investments, regulatory initiatives and continued expense management, enabled us to reach within $0.10 per share of 2022 year-to-date EPS, despite a cumulative gross weather impact of $0.38 per share," continued Householder. "During the second quarter alone, our adjusted gross margin and operating income grew by 8.1 percent and 7.1 percent, respectively, driven by contributions from the natural gas rate case settlement in Florida and organic residential customer growth that continues to track above industry levels at 5.5 percent and 4.0 percent, respectively for our Delmarva and Florida natural gas distribution businesses.”

“We continue to find ways to drive incremental growth, even in the midst of challenging weather conditions and continued economic pressures. Within this release, we introduced two new pipeline projects – Lake Wales, which was an acquisition, is already contributing to the bottom line and Newberry, which was recently approved by the Florida Public Service Commission. We also recently received approval for our regulatory filing with the Florida PSC for the GUARD program. Demand for new pipeline infrastructure continues to be robust, largely driven by customer growth. Our team remains ever focused on executing on our growth strategy, achieving another record year of performance and driving increased shareholder value,“ concluded Householder.

Capital Investment and Earnings Guidance Update

The Company continues to support its long-term capital expenditures and EPS guidance ranges. The Company's capital expenditures guidance ranges from $900 million to $1.1 billion for the five years ended 2025, while the EPS guidance range is $6.15 to $6.35 per share for 2025. Capital expenditures for the six months ended June 30, 2023 were $91.9 million, and the full year estimate for 2023 continues to range from $200 million to $230 million.

*Unless otherwise noted, EPS information is presented on a diluted basis.

Non-GAAP Financial Measures

**This press release including the tables herein, include references to both Generally Accepted Accounting Principles ("GAAP") and non-GAAP financial measures, including Adjusted Gross Margin. A "non-GAAP financial measure" is generally defined as a numerical measure of a company's historical or future performance that includes or excludes amounts, or that is subject to adjustments, so as to be different from the most directly comparable measure calculated or presented in accordance with GAAP. Our management believes certain non-GAAP financial measures, when considered together with GAAP financial measures, provide information that is useful to investors in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionately positive or negative impact on results in any particular period.

The Company calculates Adjusted Gross Margin by deducting the purchased cost of natural gas, propane and electricity and the cost of labor spent on direct revenue-producing activities from operating revenues. The costs included in Adjusted Gross Margin exclude depreciation and amortization and certain costs presented in operations and maintenance expenses in accordance with regulatory requirements. Adjusted Gross Margin should not be considered an alternative to Gross Margin under US GAAP which is defined as the excess of sales over cost of goods sold. The Company believes that Adjusted Gross Margin, although a non-GAAP measure, is useful and meaningful to investors as a basis for making investment decisions. It provides investors with information that demonstrates the profitability achieved by the Company under allowed rates for regulated energy operations and under the Company's competitive pricing structures for unregulated energy operations. The Company's management uses Adjusted Gross

Margin as one of the financial measures in assessing a business unit’s performance. Other companies may calculate Adjusted Gross Margin in a different manner.

Reconciliation of GAAP to Non-GAAP Adjusted Gross Margin

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended June 30, 2023 |

| (in thousands) | | Regulated Energy | | Unregulated Energy | | Other and Eliminations | | Total |

| Operating Revenues | | $ | 101,141 | | | $ | 40,751 | | | $ | (6,299) | | | $ | 135,593 | |

| Cost of Sales: | | | | | | | | |

| Natural gas, propane and electric costs | | (23,886) | | | (18,116) | | | 6,209 | | | (35,793) | |

| Depreciation & amortization | | (13,035) | | | (4,269) | | | 1 | | | (17,303) | |

Operations & maintenance expense (1) | | (9,240) | | | (7,520) | | | (2) | | | (16,762) | |

| Gross Margin (GAAP) | | 54,980 | | | 10,846 | | | (91) | | | 65,735 | |

Operations & maintenance expense (1) | | 9,240 | | | 7,520 | | | 2 | | | 16,762 | |

| Depreciation & amortization | | 13,035 | | | 4,269 | | | (1) | | | 17,303 | |

| Adjusted Gross Margin (Non-GAAP) | | $ | 77,255 | | | $ | 22,635 | | | $ | (90) | | | $ | 99,800 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended June 30, 2022 |

| (in thousands) | | Regulated Energy | | Unregulated Energy | | Other and Eliminations | | Total |

| Operating Revenues | | $ | 92,193 | | | $ | 53,463 | | | $ | (6,186) | | | $ | 139,470 | |

| Cost of Sales: | | | | | | | | |

| Natural gas, propane and electric costs | | (21,573) | | | (31,701) | | | 6,158 | | | (47,116) | |

| Depreciation & amortization | | (13,140) | | | (4,074) | | | (2) | | | (17,216) | |

Operations & maintenance expense (1) | | (8,324) | | | (6,699) | | | (521) | | | (15,544) | |

| Gross Margin (GAAP) | | 49,156 | | | 10,989 | | | (551) | | | 59,594 | |

Operations & maintenance expense (1) | | 8,324 | | | 6,699 | | | 521 | | | 15,544 | |

| Depreciation & amortization | | 13,140 | | | 4,074 | | | 2 | | | 17,216 | |

| Adjusted Gross Margin (Non-GAAP) | | $ | 70,620 | | | $ | 21,762 | | | $ | (28) | | | $ | 92,354 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Six months ended June 30, 2023 |

| (in thousands) | | Regulated Energy | | Unregulated Energy | | Other and Eliminations | | Total |

| Operating Revenues | | $ | 243,411 | | | $ | 123,916 | | | $ | (13,605) | | | $ | 353,722 | |

| Cost of Sales: | | | | | | | | |

| Natural gas, propane and electric costs | | (79,174) | | | (58,687) | | | 13,479 | | | (124,382) | |

| Depreciation & amortization | | (25,987) | | | (8,503) | | | 4 | | | (34,486) | |

Operations & maintenance expense (1) | | (18,527) | | | (15,996) | | | 3 | | | (34,520) | |

| Gross Margin (GAAP) | | 119,723 | | | 40,730 | | | (119) | | | 160,334 | |

Operations & maintenance expense (1) | | 18,527 | | | 15,996 | | | (3) | | | 34,520 | |

| Depreciation & amortization | | 25,987 | | | 8,503 | | | (4) | | | 34,486 | |

| Adjusted Gross Margin (Non-GAAP) | | $ | 164,237 | | | $ | 65,229 | | | $ | (126) | | | $ | 229,340 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Six months ended June 30, 2022 |

| (in thousands) | | Regulated Energy | | Unregulated Energy | | Other and Eliminations | | Total |

| Operating Revenues | | $ | 220,084 | | | $ | 154,754 | | | $ | (12,488) | | | $ | 362,350 | |

| Cost of Sales: | | | | | | | | |

| Natural gas, propane and electric costs | | (67,016) | | | (89,708) | | | 12,427 | | | (144,297) | |

| Depreciation & amortization | | (26,225) | | | (7,954) | | | (14) | | | (34,193) | |

Operations & maintenance expense (1) | | (16,485) | | | (13,756) | | | (944) | | | (31,185) | |

| Gross Margin (GAAP) | | 110,358 | | | 43,336 | | | (1,019) | | | 152,675 | |

Operations & maintenance expense (1) | | 16,485 | | | 13,756 | | | 944 | | | 31,185 | |

| Depreciation & amortization | | 26,225 | | | 7,954 | | | 14 | | | 34,193 | |

| Adjusted Gross Margin (Non-GAAP) | | $ | 153,068 | | | $ | 65,046 | | | $ | (61) | | | $ | 218,053 | |

(1) Operations & maintenance expenses within the Consolidated Statements of Income are presented in accordance with regulatory requirements and to provide comparability within the industry. Operations & maintenance expenses which are deemed to be directly attributable to revenue producing activities have been separately presented above in order to calculate Gross Margin as defined under US GAAP.

Operating Results for the Quarters Ended June 30, 2023 and 2022

Consolidated Results

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | |

| June 30, | | | | |

| (in thousands) | 2023 | | 2022 | | Change | | Percent Change |

| Adjusted gross margin** | $ | 99,800 | | | $ | 92,354 | | | $ | 7,446 | | | 8.1 | % |

| Depreciation, amortization and property taxes | 23,628 | | | 22,854 | | | 774 | | | 3.4 | % |

| Other operating expenses | 47,826 | | | 43,031 | | | 4,795 | | | 11.1 | % |

| Operating income | $ | 28,346 | | | $ | 26,469 | | | $ | 1,877 | | | 7.1 | % |

Operating income for the second quarter of 2023 was $28.3 million, an increase of $1.9 million or 7.1 percent compared to the same period in 2022. Adjusted gross margin in the second quarter of 2023 was positively impacted by contributions from the Company's Florida natural gas base rate proceeding, organic growth in the Company's natural gas distribution businesses, increased propane margins and fees, continued pipeline expansion projects, increased demand for CNG, RNG and LNG services and incremental contributions associated with regulated infrastructure programs. These increases in adjusted gross margin were partially offset by reduced consumption, including the continued effects of warmer temperatures experienced during the second quarter of 2023. Higher operating expenses were largely associated with increased employee costs driven by growth initiatives, the ongoing competitive labor market and higher benefits costs compared to the prior-year period. Operating income was also impacted by higher property taxes during the second quarter of 2023.

Regulated Energy Segment

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | |

| June 30, | | | | |

| (in thousands) | 2023 | | 2022 | | Change | | Percent Change |

| Adjusted gross margin** | $ | 77,255 | | | $ | 70,620 | | | $ | 6,635 | | | 9.4 | % |

| Depreciation, amortization and property taxes | 18,854 | | | 18,380 | | | 474 | | | 2.6 | % |

| Other operating expenses | 29,110 | | | 26,399 | | | 2,711 | | | 10.3 | % |

| Operating income | $ | 29,291 | | | $ | 25,841 | | | $ | 3,450 | | | 13.4 | % |

The key components of the increase in adjusted gross margin** are shown below:

| | | | | |

| (in thousands) | |

Rate changes associated with the Florida natural gas base rate proceeding (1) | $ | 3,873 | |

| Natural gas growth including conversions (excluding service expansions) | 1,844 | |

| Natural gas transmission service expansions | 1,113 | |

| Increased adjusted gross margin from off-system natural gas capacity sales | 637 | |

| Contributions from regulated infrastructure programs | 395 | |

| Changes in customer consumption - primarily related to weather | (1,148) | |

| Other variances | (79) | |

| Quarter-over-quarter increase in adjusted gross margin** | $ | 6,635 | |

(1) Includes adjusted gross margin contributions from permanent base rates that became effective in March 2023.

The major components of the increase in other operating expenses are as follows: | | | | | |

| (in thousands) | |

| Increased payroll, benefits and other employee-related expenses | $ | 1,305 | |

| Increased facilities expenses, maintenance costs and outside services | 682 | |

| Increased costs related to credit and collections | 345 | |

| Other variances | 379 | |

| Quarter-over-quarter increase in other operating expenses | $ | 2,711 | |

Unregulated Energy Segment

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | | | |

| (in thousands) | 2023 | | 2022 | | Change | | Percent Change |

| Adjusted gross margin** | $ | 22,635 | | | $ | 21,762 | | | $ | 873 | | | 4.0 | % |

| Depreciation, amortization and property taxes | 4,777 | | | 4,466 | | | 311 | | | 7.0 | % |

| Other operating expenses | 18,851 | | | 16,736 | | | 2,115 | | | 12.6 | % |

| Operating income (loss) | $ | (993) | | | $ | 560 | | | $ | (1,553) | | | (277.3) | % |

The major components of the change in adjusted gross margin** are shown below:

| | | | | | | | |

| (in thousands) | | |

| Propane Operations | | |

| Increased propane margins and service fees | | $ | 1,512 | |

| Reduced customer consumption due to conversion of customers to the Company's natural gas system | | (591) | |

| Propane customer consumption - primarily weather related | | (381) | |

| CNG/RNG/LNG Transportation and Infrastructure | | |

| Increased demand for CNG/RNG/LNG Services | | 478 | |

| Aspire Energy | | |

| Reduced customer consumption - primarily weather related | | (45) | |

| Other variances | | (100) | |

| Quarter-over-quarter increase in adjusted gross margin** | | $ | 873 | |

The major components of the increase in other operating expenses are as follows:

| | | | | | | | |

| (in thousands) | | |

| Increased payroll, benefits and other employee-related expenses | | $ | 1,908 | |

| Increased facilities expenses, maintenance costs and outside services | | 291 | |

| Other variances | | (84) | |

| Quarter-over-quarter increase in other operating expenses | | $ | 2,115 | |

Operating Results for the Six Months Ended June 30, 2023 and 2022

Consolidated Results

| | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended

June 30, | | | | |

| (in thousands) | 2023 | | 2022 | | Change | | Percent Change |

| Adjusted gross margin** | $ | 229,340 | | | $ | 218,053 | | | $ | 11,287 | | | 5.2 | % |

| Depreciation, amortization and property taxes | 47,118 | | | 45,418 | | | 1,700 | | | 3.7 | % |

| Other operating expenses | 98,961 | | | 91,301 | | | 7,660 | | | 8.4 | % |

| Operating income | $ | 83,261 | | | $ | 81,334 | | | $ | 1,927 | | | 2.4 | % |

Operating income for the first half of 2023 was $83.3 million, an increase of $1.9 million or 2.4 percent compared to the same period in 2022, despite significantly warmer temperatures in the Company's northern service territories experienced during the first half of 2023. Adjusted gross margin for the first half of 2023 was positively impacted by contributions from the Company's Florida natural gas base rate proceeding, increased propane margins and fees, organic growth in the Company's natural gas distribution businesses, increased demand for CNG, RNG and LNG services, continued pipeline expansion projects and incremental contributions associated with regulated infrastructure programs. These increases in adjusted gross margin were partially offset by reduced consumption experienced during the first half of 2023 largely due to the unprecedented temperatures in our northern service territories primarily during the first quarter. The Company recorded higher employee costs driven by growth initiatives, the ongoing competitive labor market and higher benefits costs compared to the prior-year period, increased costs related to our facilities, maintenance and outside services, and higher property taxes.

Regulated Energy Segment

| | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended | | | | |

| June 30, | | | | |

| (in thousands) | 2023 | | 2022 | | Change | | Percent Change |

| Adjusted gross margin** | $ | 164,237 | | | $ | 153,068 | | | $ | 11,169 | | | 7.3 | % |

| Depreciation, amortization and property taxes | 37,524 | | | 36,631 | | | 893 | | | 2.4 | % |

| Other operating expenses | 59,797 | | | 55,898 | | | 3,899 | | | 7.0 | % |

| Operating income | $ | 66,916 | | | $ | 60,539 | | | $ | 6,377 | | | 10.5 | % |

The key components of the increase in adjusted gross margin** are shown below:

| | | | | |

| (in thousands) | |

Rate changes associated with the Florida natural gas base rate proceeding (1) | $ | 7,970 | |

| Natural gas growth including conversions (excluding service expansions) | 3,366 | |

| Natural gas transmission service expansions | 1,594 | |

| Contributions from regulated infrastructure programs | 1,193 | |

| |

| Changes in customer consumption - primarily related to weather | (3,013) | |

| Eastern Shore contracted rate adjustments | (285) | |

| Other variances | 344 | |

| Period-over-period increase in adjusted gross margin** | $ | 11,169 | |

(1) Includes adjusted gross margin contributions from interim rates and permanent base rates that became effective in March 2023.

The major components of the increase in other operating expenses are as follows: | | | | | |

| (in thousands) | |

| Increased payroll, benefits and other employee-related expenses | $ | 1,598 | |

| Increased facilities expenses, maintenance costs and outside services | 1,064 | |

| Increased costs related to credit and collections | 426 | |

| Other variances | 811 | |

| Period-over-period increase in other operating expenses | $ | 3,899 | |

Unregulated Energy Segment

| | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended | | | | |

| June 30, | | | | |

| (in thousands) | 2023 | | 2022 | | Change | | Percent Change |

| Adjusted gross margin** | $ | 65,229 | | | $ | 65,046 | | | $ | 183 | | | 0.3 | % |

| Depreciation, amortization and property taxes | 9,598 | | | 8,762 | | | 836 | | | 9.5 | % |

| Other operating expenses | 39,379 | | | 35,671 | | | 3,708 | | | 10.4 | % |

| Operating income | $ | 16,252 | | | $ | 20,613 | | | $ | (4,361) | | | (21.2) | % |

The major components of the change in adjusted gross margin** are shown below:

| | | | | | | | |

| (in thousands) | | |

| Propane Operations | | |

| Propane customer consumption - primarily weather related | | $ | (4,924) | |

| Increased propane margins and service fees | | 4,576 | |

| Decreased customer consumption due to conversion of customers to our natural gas system | | (591) | |

| CNG/RNG/LNG Transportation and Infrastructure | | |

| Increased demand for CNG/RNG/LNG Services | | 1,766 | |

| Aspire Energy | | |

| Reduced customer consumption - primarily weather related | | (553) | |

| Other variances | | (91) | |

| Period-over-period increase in adjusted gross margin** | | $ | 183 | |

The major components of the increase in other operating expenses are as follows:

| | | | | | | | |

| (in thousands) | | |

| Increased payroll, benefits and other employee-related expenses | | $ | 2,733 | |

| Increased facilities expenses, maintenance costs and outside services | | 889 | |

| Other variances | | 86 | |

| Period-over-period increase in other operating expenses | | $ | 3,708 | |

Sustainability Initiatives

In May 2023, Chesapeake Utilities published its most recent sustainability report, and the Company continues to remain steadfast in regards to its sustainability commitments, including:

•Maintaining a leading role in the journey to a lower carbon future in its service areas.

•Continuing to promote a diverse and inclusive workplace and further the sustainability of the communities it serves.

•Operating its businesses with integrity and the highest ethical standards.

These commitments guide the Company's mission to deliver energy that makes life better for the people and communities it serves. They impact every aspect of the Company and the relationships it has with its

stakeholders. The Company encourages its investors to review the report, which can be accessed on the Company's website, and welcomes feedback as it continues to enhance its sustainability disclosures.

Forward-Looking Statements

Matters included in this release may include forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those in the forward-looking statements. Please refer to the Safe Harbor for Forward-Looking Statements in the Company’s 2022 Annual Report on Form 10-K and Quarterly Report on Form 10-Q for the second quarter of 2023 for further information on the risks and uncertainties related to the Company’s forward-looking statements.

Conference Call

Chesapeake Utilities (NYSE: CPK) will host a conference call on Friday, August 4, 2023 at 8:30 a.m. Eastern Time to discuss the Company’s financial results for the three and six months ended June 30, 2023. To listen to the Company’s conference call via live webcast, please visit the Events & Presentations section of the Investors page on www.chpk.com. For investors and analysts that wish to participate by phone for the question and answer portion of the call, please use the following dial-in information:

Toll-free: 800.343.5172

International: 203.518.9848

Conference ID: CPKQ223

A replay of the presentation will be made available on the previously noted website following the conclusion of the call.

About Chesapeake Utilities Corporation

Chesapeake Utilities Corporation is a diversified energy delivery company, listed on the New York Stock Exchange. Chesapeake Utilities Corporation offers sustainable energy solutions through its natural gas transmission and distribution, electricity generation and distribution, propane gas distribution, mobile compressed natural gas utility services and solutions, and other businesses.

Please note that Chesapeake Utilities Corporation is not affiliated with Chesapeake Energy, an oil and natural gas exploration company headquartered in Oklahoma City, Oklahoma.

For more information, contact:

Beth W. Cooper

Executive Vice President, Chief Financial Officer, Treasurer and Assistant Corporate Secretary

302.734.6022

Michael Galtman

Senior Vice President and Chief Accounting Officer

302.217.7036

Financial Summary

(in thousands, except per-share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Adjusted Gross Margin | | | | | | | |

| Regulated Energy segment | $ | 77,255 | | | $ | 70,620 | | | $ | 164,237 | | | $ | 153,068 | |

| Unregulated Energy segment | 22,635 | | | 21,762 | | | 65,229 | | | 65,046 | |

| Other businesses and eliminations | (90) | | | (28) | | | (126) | | | (61) | |

| Total Adjusted Gross Margin** | $ | 99,800 | | | $ | 92,354 | | | $ | 229,340 | | | $ | 218,053 | |

| | | | | | | |

| Operating Income (Loss) | | | | | | | |

| Regulated Energy segment | $ | 29,291 | | | $ | 25,841 | | | $ | 66,916 | | | $ | 60,539 | |

| Unregulated Energy segment | (993) | | | 560 | | | 16,252 | | | 20,613 | |

| Other businesses and eliminations | 48 | | | 68 | | | 93 | | | 182 | |

| Total Operating Income | 28,346 | | | 26,469 | | | 83,261 | | | 81,334 | |

| Other income, net | 831 | | | 2,584 | | | 1,107 | | | 3,498 | |

| Interest charges | 6,964 | | | 5,825 | | | 14,196 | | | 11,164 | |

| Income Before Income Taxes | 22,213 | | | 23,228 | | | 70,172 | | | 73,668 | |

| Income taxes | 6,080 | | | 6,177 | | | 17,695 | | | 19,683 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net Income | $ | 16,133 | | | $ | 17,051 | | | $ | 52,477 | | | $ | 53,985 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Earnings Per Share of Common Stock | | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic | $ | 0.91 | | $ | 0.96 | | $ | 2.95 | | $ | 3.05 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Diluted | $ | 0.90 | | $ | 0.96 | | $ | 2.94 | | $ | 3.04 |

Financial Summary Highlights

Key variances between the second quarter of 2022 and the second quarter of 2023 included:

| | | | | | | | | | | | | | | | | | | | |

| (in thousands, except per share data) | | Pre-tax

Income | | Net

Income | | Earnings

Per Share |

| Second Quarter of 2022 Reported Results | | $ | 23,228 | | | $ | 17,051 | | | $ | 0.96 | |

| | | | | | |

| Adjusting for Non-recurring Items: | | | | | | |

| Absence of gain from sales of assets | | (1,902) | | | (1,382) | | | (0.08) | |

| | (1,902) | | | (1,382) | | | (0.08) | |

| | | | | | |

| Increased (Decreased) Adjusted Gross Margins: | | | | | | |

| Contribution from rates associated with Florida natural gas base rate proceeding* | | 3,873 | | | 2,813 | | | 0.16 | |

| Natural gas growth including conversions (excluding service expansions) | | 1,844 | | | 1,339 | | | 0.08 | |

| Increased propane margins and service fees | | 1,512 | | | 1,098 | | | 0.06 | |

| Natural gas transmission service expansions* | | 1,113 | | | 809 | | | 0.05 | |

| Increased adjusted gross margin from off-system natural gas capacity sales | | 637 | | | 463 | | | 0.03 | |

| Increased margins related to demand for CNG/RNG/LNG services* | | 478 | | | 347 | | | 0.02 | |

| Contributions from regulated infrastructure programs* | | 395 | | | 287 | | | 0.02 | |

| Customer consumption - primarily resulting from weather | | (2,165) | | | (1,572) | | | (0.09) | |

| | 7,687 | | | 5,584 | | | 0.33 | |

| | | | | | |

| (Increased) Operating Expenses (Excluding Natural Gas, Propane, and Electric Costs): | | | | | | |

| Increased payroll, benefits and other employee-related expenses | | (3,124) | | | (2,269) | | | (0.13) | |

| Increased facilities expenses, maintenance costs and outside services | | (1,008) | | | (732) | | | (0.04) | |

| Depreciation, amortization and property taxes | | (774) | | | (562) | | | (0.03) | |

| | (4,906) | | | (3,563) | | | (0.20) | |

| | | | | | |

| Interest charges | | (1,139) | | | (827) | | | (0.05) | |

| Net other changes | | (755) | | | (730) | | | (0.06) | |

| | (1,894) | | | (1,557) | | | (0.11) | |

| Second Quarter of 2023 Reported Results | | $ | 22,213 | | | $ | 16,133 | | | $ | 0.90 | |

* Refer to Major Projects and Initiatives Table for additional information.

Key variances between the six months ended June 30, 2022 and the six months ended June 30, 2023 included:

| | | | | | | | | | | | | | | | | | | | |

| (in thousands, except per share data) | | Pre-tax

Income | | Net

Income | | Earnings

Per Share |

| Six months ended June 30, 2022 Reported Results | | $ | 73,668 | | | $ | 53,985 | | | $ | 3.04 | |

| | | | | | |

| Adjusting for Non-recurring Items: | | | | | | |

| Absence of gain from sales of assets | | (1,902) | | | (1,423) | | | (0.08) | |

| One-time benefit associated with reduction in state tax rate | | — | | | 1,284 | | | 0.07 | |

| | (1,902) | | | (139) | | | (0.01) | |

| | | | | | |

| Increased (Decreased) Adjusted Gross Margins: | | | | | | |

| Customer consumption - primarily resulting from weather | | (9,081) | | | (6,792) | | | (0.38) | |

| Contribution from rates associated with Florida natural gas base rate proceeding* | | 7,970 | | | 5,962 | | | 0.33 | |

| Increased propane margins and service fees | | 4,576 | | | 3,423 | | | 0.19 | |

| Natural gas growth including conversions (excluding service expansions) | | 3,366 | | | 2,518 | | | 0.14 | |

| Increased margins related to demand for CNG/RNG/LNG services* | | 1,766 | | | 1,321 | | | 0.07 | |

| Natural gas transmission service expansions* | | 1,594 | | | 1,192 | | | 0.07 | |

| Contributions from regulated infrastructure programs* | | 1,193 | | | 892 | | | 0.05 | |

| Eastern Shore contracted rate adjustments | | (285) | | | (213) | | | (0.01) | |

| | 11,099 | | | 8,303 | | | 0.46 | |

| | | | | | |

| Increased Operating Expenses (Excluding Natural Gas, Propane, and Electric Costs): | | | | | | |

| Increased payroll, benefits and other employee-related expenses | | (4,267) | | | (3,191) | | | (0.18) | |

| Increased facilities expenses, maintenance costs and outside services | | (2,069) | | | (1,548) | | | (0.09) | |

| Depreciation, amortization and property taxes | | (1,700) | | | (1,272) | | | (0.07) | |

| | (8,036) | | | (6,011) | | | (0.34) | |

| | | | | | |

| Interest charges | | (3,032) | | | (2,268) | | | (0.13) | |

| Changes in Other income, net | | (489) | | | (366) | | | (0.02) | |

| Net other changes | | (1,136) | | | (1,027) | | | (0.06) | |

| | (4,657) | | | (3,661) | | | (0.21) | |

| Six months ended June 30, 2023 Reported Results | | $ | 70,172 | | | $ | 52,477 | | | $ | 2.94 | |

* Refer to Major Projects and Initiatives Table for additional information.

Recently Completed and Ongoing Major Projects and Initiatives

The Company constantly pursues and develops additional projects and initiatives to serve existing and new customers, further grow its businesses and earnings, and increase shareholder value. The following table includes the major projects and initiatives recently completed and currently underway. Major projects and initiatives that have generated consistent year-over-year adjusted gross margin contributions are removed from the table at the beginning of the next calendar year. The discussion of the Company's major projects accompanying this table, includes those projects which began generating adjusted gross margin in the current year, or those which are expected to contribute adjusted gross margin beginning in future years. A comprehensive discussion of all projects reflected below can be found in the Company's second quarter 2023 Quarterly Report on Form 10-Q. The Company's practice is to add new projects and initiatives to this table once negotiations or details are substantially final and/or the associated earnings can be estimated.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Gross Margin |

| Three Months Ended | | Six Months Ended | | Year Ended | | Estimate for |

| June 30, | | June 30, | | December 31, | | Fiscal |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 | | 2022 | | 2023 | | 2024 |

| Pipeline Expansions: | | | | | | | | | | | | | |

| Guernsey Power Station | $ | 369 | | | $ | 368 | | | $ | 734 | | | $ | 631 | | | $ | 1,377 | | | $ | 1,486 | | | $ | 1,482 | |

| Southern Expansion | — | | | — | | | — | | | — | | | — | | | 586 | | | 2,344 | |

| Winter Haven Expansion | 163 | | | 28 | | | 302 | | | 61 | | | 260 | | | 576 | | | 626 | |

| Beachside Pipeline Expansion | 603 | | | — | | | 603 | | | — | | | — | | | 1,825 | | | 2,451 | |

| North Ocean City Connector | — | | | — | | | — | | | — | | | — | | | — | | | 200 | |

| St. Cloud / Twin Lakes Expansion | — | | | — | | | — | | | — | | | — | | | 268 | | | 584 | |

| Clean Energy (1) | 269 | | | — | | | 516 | | | — | | | 126 | | | 1,009 | | | 1,009 | |

| Wildlight | 67 | | | — | | | 93 | | | — | | | — | | | 528 | | | 2,000 | |

| Lake Wales | 38 | | | — | | | 38 | | | — | | | — | | | 265 | | | 454 | |

| Newberry | — | | | — | | | — | | | — | | | — | | | TBD | | TBD |

| Total Pipeline Expansions | 1,509 | | | 396 | | | 2,286 | | | 692 | | | 1,763 | | | 6,543 | | | 11,150 | |

| | | | | | | | | | | | | |

| CNG/RNG/LNG Transportation and Infrastructure | 2,905 | | | 2,427 | | | 6,426 | | | 4,660 | | | 11,100 | | | 12,558 | | | 12,280 | |

| | | | | | | | | | | | | |

| Regulatory Initiatives: | | | | | | | | | | | | | |

| Florida GUARD program | — | | | — | | | — | | | — | | | — | | | 37 | | | 1,412 | |

| Capital Cost Surcharge Programs | 703 | | | 497 | | | 1,423 | | | 1,014 | | | 2,001 | | | 2,811 | | | 3,558 | |

Florida Rate Case Proceeding (2) | 3,873 | | | — | | | 7,970 | | | — | | | 2,474 | | | 16,289 | | | 17,153 | |

| Electric Storm Protection Plan | 436 | | | — | | | 642 | | | — | | | 486 | | | 960 | | | 2,433 | |

| Total Regulatory Initiatives | 5,012 | | | 497 | | | 10,035 | | | 1,014 | | | 4,961 | | | 20,097 | | | 24,556 | |

| | | | | | | | | | | | | |

| Total | $ | 9,426 | | | $ | 3,320 | | | $ | 18,747 | | | $ | 6,366 | | | $ | 17,824 | | | $ | 39,198 | | | $ | 47,986 | |

(1) Includes adjusted gross margin generated from interim services.

(2) Includes adjusted gross margin during 2023 comprised of both interim rates and permanent base rates which became effective in March 2023.

Detailed Discussion of Major Projects and Initiatives

Pipeline Expansions

Southern Expansion

Eastern Shore plans to install a new natural gas driven compressor skid unit at its existing Bridgeville, Delaware compressor station that will provide 7,300 Dts/d of incremental firm transportation pipeline capacity. The Company obtained FERC approval for this project in December 2022 and it is currently estimated to go into service in the fourth quarter of 2023.

Beachside Pipeline Expansion

In June 2021, Peninsula Pipeline and an unrelated party, Florida City Gas, entered into a Transportation Service Agreement for an incremental 10,176 Dts/d of firm service in Indian River County, Florida, to support Florida City Gas’ growth along the Indian River's barrier island. As part of this agreement, Peninsula Pipeline constructed approximately 11.3 miles of pipeline from its existing pipeline in the Sebastian, Florida area east under the Intercoastal Waterway and southward on the barrier island. Construction is complete and the project went into service in April 2023.

North Ocean City Connector

During the second quarter of 2022, the Company began construction of an extension of service into North Ocean City, Maryland. The Company's Delaware natural gas division and its subsidiary, Sandpiper Energy, Inc. installed approximately 5.7 miles of pipeline across southern Sussex County, Delaware to Fenwick Island, Delaware and Worcester County, Maryland. The project reinforces the Company's existing system in Ocean City, Maryland and enables incremental growth along the pipeline. Construction of this project was completed in the second quarter of 2023. Adjusted gross margin in connection with this project is expected to be recognized contingent upon the completion and approval of the Company's next rate case in Maryland.

St. Cloud / Twin Lakes Expansion

In July 2022, Peninsula Pipeline filed a petition with the Public Service Commission ("PSC") for the State of Florida for approval of its Transportation Service Agreement with the Company's Florida subsidiary, Florida Public Utilities ("FPU"), for an additional 2,400 Dts/day of firm service in the St. Cloud, Florida area. As part of this agreement, Peninsula Pipeline will construct a pipeline extension and regulator station for FPU. The extension will be used to support new incremental load due to growth in the area, including providing service, most immediately, to the residential development Twin Lakes. The expansion will also improve reliability and provide operational benefits to FPU’s existing distribution system in the area, supporting future growth. Construction is forecasted to be complete in the third quarter of 2023.

Wildlight Expansion

In August 2022, Peninsula Pipeline and FPU filed a joint petition with the Florida PSC for approval of its Transportation Service Agreement associated with the Wildlight planned community located in Nassau County, Florida. The project enables the Company to meet the significant growing demand for service in Yulee, Florida. The agreement allows the Company to build the project during the construction and build-out of the community, and charge the reservation rate as each phase of the project goes into service. Construction of the pipeline facilities will occur in two separate phases. Phase one consists of three extensions with associated facilities, and a gas injection interconnect with associated facilities. Phase two will consist of two additional pipeline extensions. Various phases of the project commenced in the first quarter of 2023, with construction on the overall project continuing through 2025.

Lake Wales

In February 2023, Peninsula Pipeline filed a petition with the Florida PSC for approval of its Transportation Service Agreement with the Company's Florida natural gas division, FPU for an additional 9,000 Dt/d of firm service in the Lake Wales, Florida area. The PSC approved the petition in April 2023.

Approval of the agreement enabled Peninsula Pipeline to complete the acquisition of an existing pipeline in May 2023 that is being utilized to serve the Company's current natural gas customers as well as new customers.

Newberry

In April 2023, Peninsula Pipeline filed a petition with the Florida PSC for approval of its Transportation Service Agreement with FPU for an additional 8,000 Dt/d of firm service in the Newberry, Florida area. In July 2023, the Florida PSC approved the Company's recommendation to proceed with this project. Peninsula Pipeline will construct a pipeline extension which will be used by FPU to support the development of a natural gas distribution system to provide gas service to the City of Newberry.

CNG/RNG/LNG Transportation and Infrastructure

The Company has made a commitment to meet customer demand for CNG, RNG and LNG in the markets we serve. This has included making investments within Marlin Gas Services to be able to transport these products through its virtual pipeline fleet to customers. To date, the Company has also made an infrastructure investment in Ohio, enabling RNG to fuel a third-party landfill fleet and to transport RNG to end use customers off its pipeline system. Similarly, the Company announced in March 2022, the opening of a high-capacity CNG truck and tube trailer fueling station in Port Wentworth, Georgia. As one of the largest public access CNG stations on the East Coast, it will offer a RNG option to customers in the near future. The Company constructed the station in partnership with Atlanta Gas Light, a subsidiary of Southern Company Gas.

The Company is also involved in various other projects, all at various stages and all with different opportunities to participate across the energy value chain. In many of these projects, Marlin will play a key role in ensuring the RNG is transported to one of the Company’s many pipeline systems where it will be injected. The Company includes its RNG transportation services and infrastructure related adjusted gross margin from across the organization in combination with CNG and LNG projects.

As new projects are finalized, we will provide additional detail on those projects at that time.

Discussed below is a current project in which we are in the construction phase:

Full Circle Dairy

In February 2023, the Company announced plans to construct, own and operate a dairy manure RNG facility at Full Circle Dairy in Madison County, Florida. The project consists of a facility converting dairy manure to RNG and transportation assets to bring the gas to market. The first injection of RNG is projected to occur in the first half of 2024.

Regulatory Initiatives

Florida Gas Utility Access and Replacement Directive ("GUARD") Program

In February 2023, FPU filed a petition with the Florida PSC for approval of the GUARD program. GUARD is a ten-year program to enhance the safety, reliability, and accessibility of portions of the Company's natural gas distribution system. The Company has identified various categories of projects to be included in GUARD, which include the relocation of mains and service lines located in rear easements and other difficult to access areas to the front of the street, the replacement of problematic distribution mains, service lines, and M&R equipment and system reliability projects. In August 2023, the Florida PSC approved the GUARD program, with the exception of reliability projects with an approximate value of $10 million. The remainder of the program was approved as filed, which included $205 million of capital expenditures projected to be spent over a 10-year period.

Other Major Factors Influencing Adjusted Gross Margin

Weather and Consumption

For the first half of 2023, lower consumption driven by weather experienced primarily during the first quarter resulted in a $9.1 million decrease in adjusted gross margin compared to the same period in 2022. The impact to adjusted gross margin was largely the result of unprecedented temperatures in the Company's northern service territories that were more than 20 percent higher than historical averages. Assuming normal temperatures, as detailed below, adjusted gross margin would have been higher by $10.3 million. The following table summarizes HDD and CDD variances from the 10-year average HDD/CDD ("Normal") for the three and six months ended June 30, 2023 and 2022.

HDD and CDD Information | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | Six Months Ended | | |

| June 30, | | | | June 30, | | |

| 2023 | | 2022 | | Variance | | 2023 | | 2022 | | Variance |

| Delmarva | | | | | | | | | | | |

| Actual HDD | 276 | | | 394 | | | (118) | | | 2,050 | | | 2,575 | | | (525) | |

| 10-Year Average HDD ("Normal") | 408 | | | 412 | | | (4) | | | 2,693 | | | 2,667 | | | 26 | |

| Variance from Normal | (132) | | | (18) | | | | | (643) | | | (92) | | | |

| | | | | | | | | | | |

Florida | | | | | | | | | | | |

| Actual HDD | 26 | | | 37 | | | (11) | | | 370 | | | 534 | | | (164) | |

| 10-Year Average HDD ("Normal") | 44 | | | 45 | | | (1) | | | 549 | | | 542 | | | 7 | |

| Variance from Normal | (18) | | | (8) | | | | | (179) | | | (8) | | | |

| | | | | | | | | | | |

| Ohio | | | | | | | | | | | |

| Actual HDD | 678 | | | 604 | | | 74 | | | 3,062 | | | 3,530 | | | (468) | |

| 10-Year Average HDD ("Normal") | 631 | | | 630 | | | 1 | | | 3,596 | | | 3,542 | | | 54 | |

| Variance from Normal | 47 | | | (26) | | | | | (534) | | | (12) | | | |

| | | | | | | | | | | |

Florida | | | | | | | | | | | |

| Actual CDD | 937 | | | 988 | | | (51) | | | 1,260 | | | 1,183 | | | 77 | |

| 10-Year Average CDD ("Normal") | 952 | | | 945 | | | 7 | | | 1,144 | | | 1,142 | | | 2 | |

| Variance from Normal | (15) | | | 43 | | | | | 116 | | | 41 | | | |

Natural Gas Distribution Growth

The average number of residential customers served on the Delmarva Peninsula increased by approximately 5.5 percent and 5.7 percent, respectively, for the three and six months ended June 30, 2023, while Florida customers increased by 4.0 percent and 4.2 percent, respectively, for the three and six month periods. On the Delmarva Peninsula, a larger percentage of the adjusted gross margin growth was generated from residential growth given the expansion of gas into new housing communities and conversions to natural gas as our distribution infrastructure continues to build out. In Florida, as new communities continue to build out due to population growth and infrastructure is added to support the growth, there is increased load from both residential customers as well as new commercial and industrial customers. The details are provided in the following table:

| | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Gross Margin** |

| Three Months Ended June 30, 2023 | | Six Months Ended June 30, 2023 |

| (in thousands) | Delmarva Peninsula | | Florida | | Delmarva | | Florida |

| Customer growth: | | | | | | | |

| Residential | $ | 476 | | | $ | 347 | | | $ | 1,086 | | | $ | 663 | |

| Commercial and industrial | 241 | | | 780 | | | 453 | | | 1,164 | |

Total customer growth (1) | $ | 717 | | | $ | 1,127 | | | $ | 1,539 | | | $ | 1,827 | |

(1) Customer growth amounts for Florida include the effects of revised rates associated with the Company's natural gas base rate proceeding.

Capital Investment Growth and Capital Structure Updates

The Company's capital expenditures were $91.9 million for the six months ended June 30, 2023. The following table shows a range of the forecasted 2023 capital expenditures by segment and by business line:

| | | | | | | | | | | |

| 2023 |

| (in thousands) | Low | | High |

| Regulated Energy: | | | |

| Natural gas distribution | $ | 89,000 | | | $ | 100,000 | |

| Natural gas transmission | 50,000 | | | 60,000 | |

| Electric distribution | 13,000 | | | 15,000 | |

| Total Regulated Energy | 152,000 | | | 175,000 | |

| Unregulated Energy: | | | |

| Propane distribution | 15,000 | | | 16,000 | |

| Energy transmission | 8,000 | | | 9,000 | |

| Other unregulated energy | 23,000 | | | 27,000 | |

| Total Unregulated Energy | 46,000 | | | 52,000 | |

| Other: | | | |

| Corporate and other businesses | 2,000 | | | 3,000 | |

| Total 2023 Forecasted Capital Expenditures | $ | 200,000 | | | $ | 230,000 | |

The capital expenditure projection is subject to continuous review and modification. Actual capital requirements may vary from the above estimates due to a number of factors, including changing economic conditions, supply chain disruptions, capital delays that are greater than currently anticipated, customer growth in existing areas, regulation, new growth or acquisition opportunities and availability of capital. Historically, actual capital expenditures have typically lagged behind the forecasted amounts.

The Company's target ratio of equity to total capitalization, including short-term borrowings, is between 50 and 60 percent. The Company's equity to total capitalization ratio, including short-term borrowings, was approximately 53 percent as of June 30, 2023.

Chesapeake Utilities Corporation and Subsidiaries

Condensed Consolidated Statements of Income (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 30, | | June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| (in thousands, except shares and per share data) | | | | | | | | |

| Operating Revenues | | | | | | | | |

| Regulated Energy | | $ | 101,141 | | | $ | 92,193 | | | $ | 243,411 | | | $ | 220,084 | |

| Unregulated Energy and other | | 34,452 | | | 47,277 | | | 110,311 | | | 142,266 | |

| Total Operating Revenues | | 135,593 | | | 139,470 | | | 353,722 | | | 362,350 | |

| Operating Expenses | | | | | | | | |

| Natural gas and electricity costs | | 23,886 | | | 21,573 | | | 79,174 | | | 67,016 | |

| Propane and natural gas costs | | 11,907 | | | 25,543 | | | 45,208 | | | 77,279 | |

| Operations | | 42,163 | | | 38,002 | | | 86,930 | | | 80,796 | |

| Maintenance | | 5,258 | | | 4,507 | | | 10,362 | | | 8,772 | |

| Depreciation and amortization | | 17,303 | | | 17,216 | | | 34,486 | | | 34,193 | |

| Other taxes | | 6,730 | | | 6,160 | | | 14,301 | | | 12,960 | |

| Total operating expenses | | 107,247 | | | 113,001 | | | 270,461 | | | 281,016 | |

| Operating Income | | 28,346 | | | 26,469 | | | 83,261 | | | 81,334 | |

| Other income, net | | 831 | | | 2,584 | | | 1,107 | | | 3,498 | |

| Interest charges | | 6,964 | | | 5,825 | | | 14,196 | | | 11,164 | |

| Income Before Income Taxes | | 22,213 | | | 23,228 | | | 70,172 | | | 73,668 | |

| Income Taxes | | 6,080 | | | 6,177 | | | 17,695 | | | 19,683 | |

| Net Income | | $ | 16,133 | | | $ | 17,051 | | | $ | 52,477 | | | $ | 53,985 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Weighted Average Common Shares Outstanding: | | | | | | | | |

| Basic | | 17,794,320 | | | 17,730,833 | | | 17,777,203 | | | 17,704,592 | |

| Diluted | | 17,852,024 | | | 17,809,871 | | | 17,841,954 | | | 17,785,629 | |

| | | | | | | | |

| Earnings Per Share of Common Stock: | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Basic | | $ | 0.91 | | | $ | 0.96 | | | $ | 2.95 | | | $ | 3.05 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Diluted | | $ | 0.90 | | | $ | 0.96 | | | $ | 2.94 | | | $ | 3.04 | |

Chesapeake Utilities Corporation and Subsidiaries

Consolidated Balance Sheets (Unaudited)

| | | | | | | | | | | | | | |

| Assets | | June 30,

2023 | | December 31,

2022 |

| (in thousands, except shares and per share data) | | | | |

| Property, Plant and Equipment | | | | |

| Regulated Energy | | $ | 1,868,763 | | | $ | 1,802,999 | |

| Unregulated Energy | | 402,352 | | | 393,215 | |

| Other businesses and eliminations | | 29,213 | | | 29,890 | |

| Total property, plant and equipment | | 2,300,328 | | | 2,226,104 | |

| Less: Accumulated depreciation and amortization | | (489,724) | | | (462,926) | |

| Plus: Construction work in progress | | 60,578 | | | 47,295 | |

| Net property, plant and equipment | | 1,871,182 | | | 1,810,473 | |

| Current Assets | | | | |

| Cash and cash equivalents | | 4,169 | | | 6,204 | |

| Trade and other receivables | | 48,091 | | | 65,758 | |

| Less: Allowance for credit losses | | (2,692) | | | (2,877) | |

| Trade and other receivables, net | | 45,399 | | | 62,881 | |

| Accrued revenue | | 15,875 | | | 29,206 | |

| Propane inventory, at average cost | | 6,492 | | | 9,365 | |

| Other inventory, at average cost | | 17,873 | | | 16,896 | |

| Regulatory assets | | 26,343 | | | 41,439 | |

| Storage gas prepayments | | 3,208 | | | 6,364 | |

| Income taxes receivable | | 1,276 | | | 2,541 | |

| Prepaid expenses | | 12,496 | | | 15,865 | |

| Derivative assets, at fair value | | 1,704 | | | 2,787 | |

| Other current assets | | 1,934 | | | 428 | |

| Total current assets | | 136,769 | | | 193,976 | |

| Deferred Charges and Other Assets | | | | |

| Goodwill | | 46,213 | | | 46,213 | |

| Other intangible assets, net | | 16,965 | | | 17,859 | |

| Investments, at fair value | | 11,693 | | | 10,576 | |

| Derivative assets, at fair value | | 140 | | | 982 | |

| Operating lease right-of-use assets | | 13,432 | | | 14,421 | |

| Regulatory assets | | 95,985 | | | 108,214 | |

| Receivables and other deferred charges | | 12,111 | | | 12,323 | |

| Total deferred charges and other assets | | 196,539 | | | 210,588 | |

| Total Assets | | $ | 2,204,490 | | | $ | 2,215,037 | |

Chesapeake Utilities Corporation and Subsidiaries

Consolidated Balance Sheets (Unaudited) | | | | | | | | | | | | | | |

| Capitalization and Liabilities | | June 30,

2023 | | December 31,

2022 |

| (in thousands, except shares and per share data) | | | | |

| Capitalization | | | | |

| Stockholders’ equity | | | | |

| Preferred stock, par value $0.01 per share (authorized 2,000,000 shares), no shares issued and outstanding | | $ | — | | | $ | — | |

| Common stock, par value $0.4867 per share (authorized 50,000,000 shares) | | 8,662 | | | 8,635 | |

| Additional paid-in capital | | 380,830 | | | 380,036 | |

| Retained earnings | | 477,795 | | | 445,509 | |

| Accumulated other comprehensive income (loss) | | (3,059) | | | (1,379) | |

| Deferred compensation obligation | | 9,001 | | | 7,060 | |

| Treasury stock | | (9,001) | | | (7,060) | |

| Total stockholders’ equity | | 864,228 | | | 832,801 | |

| Long-term debt, net of current maturities | | 645,742 | | | 578,388 | |

| Total capitalization | | 1,509,970 | | | 1,411,189 | |

| Current Liabilities | | | | |

| Current portion of long-term debt | | 19,994 | | | 21,483 | |

| Short-term borrowing | | 95,807 | | | 202,157 | |

| Accounts payable | | 44,173 | | | 61,496 | |

| Customer deposits and refunds | | 38,468 | | | 37,152 | |

| Accrued interest | | 3,429 | | | 3,349 | |

| Dividends payable | | 10,500 | | | 9,492 | |

| Accrued compensation | | 9,772 | | | 14,660 | |

| Regulatory liabilities | | 12,894 | | | 5,031 | |

| | | | |

| Derivative liabilities, at fair value | | 2,178 | | | 585 | |

| Other accrued liabilities | | 17,942 | | | 13,618 | |

| Total current liabilities | | 255,157 | | | 369,023 | |

| Deferred Credits and Other Liabilities | | | | |

| Deferred income taxes | | 261,215 | | | 256,167 | |

| Regulatory liabilities | | 144,275 | | | 142,989 | |

| Environmental liabilities | | 2,512 | | | 3,272 | |

| Other pension and benefit costs | | 17,890 | | | 16,965 | |

| Derivative liabilities, at fair value | | 474 | | | 1,630 | |

| Operating lease - liabilities | | 11,585 | | | 12,392 | |

| Deferred investment tax credits and other liabilities | | 1,412 | | | 1,410 | |

| Total deferred credits and other liabilities | | 439,363 | | | 434,825 | |

Environmental and other commitments and contingencies (1) | | | | |

| Total Capitalization and Liabilities | | $ | 2,204,490 | | | $ | 2,215,037 | |

(1) Refer to Note 6 and 7 in the Company's Quarterly Report on Form 10-Q for further information.

Chesapeake Utilities Corporation and Subsidiaries

Distribution Utility Statistical Data (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended June 30, 2023 | | For the Three Months Ended June 30, 2022 |

| | Delmarva NG Distribution | | Florida Natural Gas Distribution (1) | | FPU Electric Distribution | | Delmarva NG Distribution | | Florida Natural Gas Distribution (1) | | FPU Electric Distribution |

Operating Revenues

(in thousands) | | | | | | | | |

| Residential | | $ | 16,878 | | | $ | 12,188 | | | $ | 11,023 | | | $ | 16,434 | | | $ | 10,605 | | | $ | 8,675 | |

| Commercial and Industrial | | 11,093 | | | 28,740 | | | 12,253 | | | 11,231 | | | 23,678 | | | 9,154 | |

Other (2) | | (3,858) | | | (162) | | | (242) | | | (4,254) | | | 1,153 | | | 2,476 | |

| Total Operating Revenues | | $ | 24,113 | | | $ | 40,766 | | | $ | 23,034 | | | $ | 23,411 | | | $ | 35,436 | | | $ | 20,305 | |

| | | | | | | | | | | | |

| Volumes (in Dts for natural gas and MWHs for electric) | | | | | | | |

| Residential | | 765,193 | | | 472,147 | | | 66,835 | | | 870,629 | | | 470,767 | | | 71,262 | |

| Commercial and Industrial | | 2,220,105 | | | 10,054,518 | | | 74,086 | | | 2,343,989 | | | 9,179,992 | | | 76,327 | |

| Other | | 63,787 | | | — | | | — | | | 70,395 | | | 814,475 | | | 1,979 | |

| Total | | 3,049,085 | | | 10,526,665 | | | 140,921 | | | 3,285,013 | | | 10,465,234 | | | 149,568 | |

| | | | | | | | | | | | |

| Average Customers | | | | | | | | | | |

| Residential | | 97,333 | | | 88,188 | | | 25,755 | | | 92,226 | | | 84,773 | | | 25,517 | |

| Commercial and Industrial | | 8,249 | | | 8,405 | | | 7,378 | | | 8,118 | | | 8,322 | | | 7,347 | |

| Other | | 22 | | | 6 | | | — | | | 4 | | | 6 | | | — | |

| Total | | 105,604 | | | 96,599 | | | 33,133 | | | 100,348 | | | 93,101 | | | 32,864 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Six Months Ended June 30, 2023 | | For the Six Months Ended June 30, 2022 |

| | Delmarva NG Distribution | | Florida Natural Gas Distribution (1) | | FPU Electric Distribution | | Delmarva NG Distribution | | Florida Natural Gas Distribution (1) | | FPU Electric Distribution |

Operating Revenues

(in thousands) | | | | | | | | |

| Residential | | $ | 58,898 | | | $ | 28,684 | | | $ | 22,380 | | | $ | 54,088 | | | $ | 25,796 | | | $ | 17,596 | |

| Commercial and Industrial | | 32,518 | | | 54,479 | | | 23,994 | | | 30,179 | | | 49,754 | | | 17,755 | |

Other (2) | | (6,911) | | | 3,961 | | | (603) | | | (4,907) | | | 172 | | | 4,043 | |

| Total Operating Revenues | | $ | 84,505 | | | $ | 87,124 | | | $ | 45,771 | | | $ | 79,360 | | | $ | 75,722 | | | $ | 39,394 | |

| | | | | | | | | | | | |

| Volumes (in Dts for natural gas and MWHs for electric) | | | | | | | |

| Residential | | 3,056,513 | | | 1,225,903 | | | 135,352 | | | 3,362,821 | | | 1,240,117 | | | 143,824 | |

| Commercial and Industrial | | 5,607,936 | | | 20,362,474 | | | 142,789 | | | 5,772,719 | | | 19,851,428 | | | 148,968 | |

| Other | | 151,323 | | | 627,934 | | | — | | | 162,284 | | | 1,669,484 | | | 3,970 | |

| Total | | 8,815,772 | | | 22,216,311 | | | 278,141 | | | 9,297,824 | | | 22,761,029 | | | 296,762 | |

| | | | | | | | | | | | |

| Average Customers | | | | | | | | | | |

| Residential | | 96,922 | | | 87,757 | | | 25,686 | | | 91,731 | | | 84,219 | | | 25,458 | |

| Commercial and Industrial | | 8,260 | | | 8,407 | | | 7,369 | | | 8,140 | | | 8,296 | | | 7,334 | |

| Other | | 23 | | | 6 | | | — | | | 4 | | | 6 | | | — | |

| Total | | 105,205 | | | 96,170 | | | 33,055 | | | 99,875 | | | 92,521 | | | 32,792 | |

| | | | | | | | | | | | |

(1) In accordance with the Florida PSC approval of our natural gas base rate proceeding, effective March 1, 2023, our natural gas distribution businesses in Florida (FPU, FPU-Indiantown division, FPU-Fort Meade division and Chesapeake Utilities CFG division, collectively, "Florida natural gas distribution businesses") have been consolidated for rate-making purposes and amounts above are now being presented on a consolidated basis consistent with the final rate order.

(2) Operating Revenues from "Other" sources include unbilled revenue, under (over) recoveries of fuel cost, conservation revenue, other miscellaneous charges, fees for billing services provided to third parties and adjustments for pass-through taxes.

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

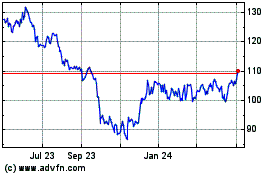

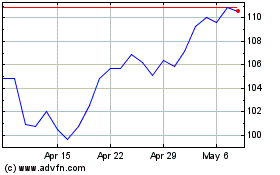

Chesapeake Utilities (NYSE:CPK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chesapeake Utilities (NYSE:CPK)

Historical Stock Chart

From Apr 2023 to Apr 2024