Schwab Reports Monthly Activity Highlights

December 14 2022 - 8:45AM

Business Wire

The Charles Schwab Corporation released its Monthly Activity

Report today. Company highlights for the month of November 2022

include:

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20221214005359/en/

- Core net new assets brought to the company by new and existing

clients totaled $33.1 billion. Net new assets excluding mutual fund

clearing totaled $35.0 billion.

- Total client assets were $7.32 trillion as of month-end

November, down 8% from November 2021 and up 5% compared to October

2022.

- Client cash as a percentage of assets was 11.5% as of month-end

November, compared with 10.5% in November 2021 and 12.2% in October

2022.

Commentary from the CFO

Peter Crawford, Managing Director and Chief Financial Officer,

provides perspectives on recent account activity, the

reclassification of certain investment securities, and client cash

sorting trends at: https://www.aboutschwab.com/cfo-commentary.

About Charles Schwab

The Charles Schwab Corporation (NYSE: SCHW) is a leading

provider of financial services, with 33.6 million active brokerage

accounts, 2.3 million corporate retirement plan participants, 1.7

million banking accounts, and $7.32 trillion in client assets as of

November 30, 2022. Through its operating subsidiaries, the company

provides a full range of wealth management, securities brokerage,

banking, asset management, custody, and financial advisory services

to individual investors and independent investment advisors. Its

broker-dealer subsidiaries, Charles Schwab & Co., Inc., TD

Ameritrade, Inc., and TD Ameritrade Clearing, Inc., (members SIPC,

https://www.sipc.org), and their affiliates offer a complete range

of investment services and products including an extensive

selection of mutual funds; financial planning and investment

advice; retirement plan and equity compensation plan services;

referrals to independent, fee-based investment advisors; and

custodial, operational and trading support for independent,

fee-based investment advisors through Schwab Advisor Services. Its

primary banking subsidiary, Charles Schwab Bank, SSB (member FDIC

and an Equal Housing Lender), provides banking and lending services

and products. More information is available at

https://www.aboutschwab.com.

TD Ameritrade, Inc. and TD Ameritrade Clearing, Inc. are

separate but affiliated companies and subsidiaries of TD Ameritrade

Holding Corporation. TD Ameritrade Holding Corporation is a wholly

owned subsidiary of The Charles Schwab Corporation. TD Ameritrade

is a trademark jointly owned by TD Ameritrade IP Company, Inc. and

The Toronto-Dominion Bank.

The Charles Schwab Corporation Monthly Activity Report For

November 2022

2021

2022

Change Nov Dec

Jan Feb Mar

Apr May Jun

Jul Aug Sep

Oct Nov Mo.

Yr. Market Indices (at month

end) Dow Jones Industrial Average®

34,484

36,338

35,132

33,893

34,678

32,977

32,990

30,775

32,845

31,510

28,726

32,733

34,590

6

%

-

Nasdaq Composite®

15,538

15,645

14,240

13,751

14,221

12,335

12,081

11,029

12,391

11,816

10,576

10,988

11,468

4

%

(26

%)

Standard & Poor’s® 500

4,567

4,766

4,516

4,374

4,530

4,132

4,132

3,785

4,130

3,955

3,586

3,872

4,080

5

%

(11

%)

Client Assets (in billions of dollars) Beginning Client

Assets

7,982.3

7,918.3

8,138.0

7,803.8

7,686.6

7,862.1

7,284.4

7,301.7

6,832.5

7,304.8

7,127.6

6,644.2

7,004.6

Net New Assets (1)

31.4

80.3

33.6

40.6

46.3

(9.2

)

32.8

19.8

31.5

43.3

39.8

42.0

33.1

(21

%)

5

%

Net Market (Losses) Gains

(95.4

)

139.4

(367.8

)

(157.8

)

129.2

(568.5

)

(15.5

)

(489.0

)

440.8

(220.5

)

(523.2

)

318.4

282.9

Total Client Assets (at month end)

7,918.3

8,138.0

7,803.8

7,686.6

7,862.1

7,284.4

7,301.7

6,832.5

7,304.8

7,127.6

6,644.2

7,004.6

7,320.6

5

%

(8

%)

Core Net New Assets (2)

45.1

80.3

33.6

40.6

46.3

(9.2

)

32.8

40.6

31.5

43.3

39.8

42.0

33.1

(21

%)

(27

%)

Receiving Ongoing Advisory Services (at month end) Investor

Services

543.1

559.2

541.9

533.7

538.9

509.3

513.0

483.8

514.8

499.2

466.6

487.3

514.0

5

%

(5

%)

Advisor Services (3)

3,374.3

3,505.2

3,382.4

3,342.5

3,404.6

3,190.5

3,213.8

3,040.4

3,222.5

3,150.5

2,950.9

3,106.0

3,270.5

5

%

(3

%)

Client Accounts (at month end, in thousands) Active

Brokerage Accounts (4)

32,942

33,165

33,308

33,421

33,577

33,759

33,822

33,896

33,934

33,984

33,875

33,896

33,636

(1

%)

2

%

Banking Accounts

1,608

1,614

1,628

1,641

1,641

1,652

1,658

1,669

1,680

1,690

1,696

1,706

1,705

-

6

%

Corporate Retirement Plan Participants

2,198

2,200

2,216

2,235

2,246

2,261

2,275

2,275

2,267

2,285

2,305

2,322

2,336

1

%

6

%

Client Activity New Brokerage Accounts (in thousands)

448

473

426

356

420

386

323

305

278

332

287

298

303

2

%

(32

%)

Client Cash as a Percentage of Client Assets (5)

10.5

%

10.9

%

11.3

%

11.5

%

11.4

%

11.9

%

12.0

%

12.8

%

12.0

%

12.1

%

12.9

%

12.2

%

11.5

%

(70) bp 100 bp Derivative Trades as a Percentage of Total Trades

23.4

%

23.0

%

22.4

%

24.0

%

22.4

%

21.9

%

22.6

%

22.3

%

24.2

%

23.3

%

23.6

%

24.1

%

24.6

%

50 bp 120 bp

Selected Average Balances (in millions of

dollars) Average Interest-Earning Assets (6)

584,362

605,709

622,997

629,042

644,768

636,668

620,157

614,100

605,751

586,154

568,351

552,631

527,019

(5

%)

(10

%)

Average Margin Balances

87,311

88,328

86,737

84,354

81,526

83,762

78,841

74,577

72,177

72,855

73,224

69,188

66,011

(5

%)

(24

%)

Average Bank Deposit Account Balances (7)

153,877

154,918

157,706

153,824

155,657

152,653

154,669

155,306

154,542

148,427

141,198

136,036

130,479

(4

%)

(15

%)

Mutual Fund and Exchange-Traded Fund Net Buys (Sells)

(8,9) (in millions of dollars) Equities

13,099

11,519

7,384

9,371

14,177

(786

)

1,889

(1,586

)

5,589

10,465

(2,662

)

3,984

3,777

Hybrid

308

(1,207

)

(367

)

(478

)

(497

)

(529

)

(1,718

)

(1,054

)

(2,041

)

(783

)

(938

)

(1,380

)

(2,052

)

Bonds

4,097

5,600

1,804

(1,973

)

(7,851

)

(6,933

)

(6,121

)

(5,631

)

729

(141

)

(5,801

)

(7,218

)

(3,721

)

Net Buy (Sell) Activity (in millions of dollars) Mutual

Funds (8)

189

(2,859

)

(4,961

)

(6,318

)

(11,888

)

(16,657

)

(20,761

)

(16,258

)

(8,674

)

(7,117

)

(15,200

)

(18,473

)

(17,143

)

Exchange-Traded Funds (9)

17,315

18,771

13,782

13,238

17,717

8,409

14,811

7,987

12,951

16,658

5,799

13,859

15,147

Money Market Funds

(1,725

)

(144

)

(1,984

)

(1,086

)

(1,344

)

(3,430

)

7,106

11,544

13,711

19,702

17,018

21,542

16,929

Note: Certain supplemental details related to the information above

can be found at:

https://www.aboutschwab.com/financial-reports.

(1)

June 2022 includes an outflow of $20.8 billion from a mutual fund

clearing services client. November 2021 includes an outflow of

$13.7 billion from a mutual fund clearing services client.

(2)

Net new assets before significant one-time inflows or outflows,

such as acquisitions/divestitures or extraordinary flows (generally

greater than $10 billion) relating to a specific client. These

flows may span multiple reporting periods.

(3)

Excludes Retirement Business Services.

(4)

November 2022 includes the company-initiated closure of

approximately 350 thousand low-balance accounts. September 2022

includes the company-initiated closure of approximately 152

thousand low-balance accounts.

(5)

Schwab One®, certain cash equivalents, bank deposits, third-party

bank deposit accounts, and money market fund balances as a

percentage of total client assets.

(6)

Represents average total interest-earning assets on the company's

balance sheet. November 2022 includes the impact of transferring

certain investment securities from the available for sale category

to the held-to-maturity category.

(7)

Represents average TD Ameritrade clients’ uninvested cash sweep

account balances held in deposit accounts at third-party financial

institutions.

(8)

Represents the principal value of client mutual fund transactions

handled by Schwab, including transactions in proprietary funds.

Includes institutional funds available only to Investment Managers.

Excludes money market fund transactions.

(9)

Represents the principal value of client ETF transactions handled

by Schwab, including transactions in proprietary ETFs.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221214005359/en/

MEDIA: Mayura Hooper Charles Schwab Phone:

415-667-1525

INVESTORS/ANALYSTS: Jeff Edwards Charles Schwab Phone:

415-667-1524

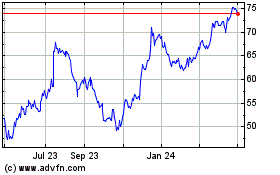

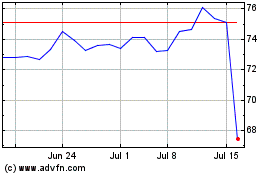

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2024 to May 2024

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From May 2023 to May 2024